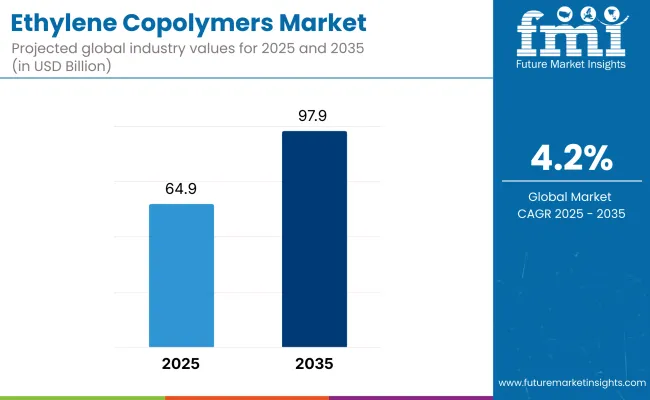

The global ethylene copolymers market is estimated at USD 64.9 billion in 2025. Demand is expected to grow at a CAGR of 4.2%, attaining a value of USD 97.9 billion by 2035. Growth has been attributed to rising consumption in packaging, automotive, and photovoltaic applications. The segment has been shaped by precise product formulation needs, where flexibility, heat resistance, and sealing properties are crucial.

In 2024, Borealis AG reported strong growth in its ethylene vinyl acetate (EVA) product line due to higher demand from solar panel manufacturers. The CEO of Borealis noted during a Q1 2024 earnings call that “ethylene copolymers are instrumental in enabling encapsulant performance in PV modules, especially amid growing solar capacity additions across Asia.” Similar developments were observed in the packaging sector. ExxonMobil, in its 2024 investor briefing, confirmed expanded capacity for polyethylene-based copolymers in Texas. These materials were used for recyclable flexible packaging with enhanced optical and mechanical properties.

The automotive industry continued to adopt ethylene copolymers for under-the-hood applications. DuPont announced in a May 2024 press release that new grades of its ethylene-acrylate copolymers had been developed for vibration dampening components and cable insulation. According to the company’s materials engineering head, “these formulations meet elevated thermal resistance standards and enable miniaturization of engine parts without compromising reliability.”

In pharmaceuticals and adhesives, medical-grade ethylene copolymers have witnessed increased uptake. In March 2025, Mitsui Chemicals confirmed supply contracts for its EVA compounds with sterile packaging producers in Japan and South Korea. The move follows a reported 12% annual rise in demand for pharmaceutical blister packaging in East Asia in 2024, driven by aging populations and increased access to care.

Advanced reactor technologies and catalyst systems have enhanced copolymer purity and molecular distribution. LyondellBasell disclosed in 2024 that its proprietary ACE catalyst platform had reduced the gel content in EVA materials by 40%, streamlining film production for both packaging and solar applications. These improvements are enabling compliance with stringent regulatory and performance standards.

Regional expansion has been supported by investments in localized production. In 2024, SABIC inaugurated a new copolymer plant in Jubail Industrial City, targeting regional automotive and electrical markets. Although volatility in raw material costs and regulatory shifts in plastic usage pose challenges, continuous R&D and integration of circular economy principles are mitigating risks.

Ethylene copolymers mainly have a share in hot melt adhesives used in Packaging, Woodworking and Textiles. Ethylene Vinyl Acetate (EVA) and Ethylene Butyl Acrylate (EBA) are the most common copolymers in hot melt adhesives because they are known for having good adhesive ability, flexibility and energy-efficient bonding.

This is also driving the growth of this segment further owing to the e-commerce boom and rising demand for eco-friendly packaging solutions. Some companies, such as Henkel, 3M, and Arkema, are at the forefront of this development of bio-based and low-VOC hot melt adhesives to comply with more stringent regulatory standards.

The Asia-Pacific region is witnessing heightened industry proliferation in particular in China and India on account of the boisterous consumer goods as well as logistics industries. The use of ethylene copolymers as modifiers for asphalt are increasing, as the importance of long-lasting roads and better pavement performance continues to grow. Tar playground EP (ethylene propylene) and EVA (ethanol-vinyl acetate) copolymer is used to facilitate heat resistance and improve flexibility and anti-crack.

One of the primary drivers pushing modified asphalt demand higher are booming global infrastructure initiatives, particularly in North America, Europe and developing Asian economies.

High-performance road construction have been intensively invested over the past years by many countries like USA, Germany, and China, while dozens of government continue pursuing sustainable and resilient infrastructure solutions across the globe.

Leading manufacturers such as ExxonMobil, Dow Inc. and BASF are working on advanced polymer-modified asphalt to meet growing durability and environmental requirements.

Ethylene Vinyl Acetate (EVA) accounts for the major industry share among ethylene copolymers owing to its provide excellent flexibility, elastic properties, impact resistance and thermal stability. It has wide applications, used in hot melt adhesives, foam materials, PV encapsulation, flexible packaging etc.

As the demand of solar energy industry beats rising, EVA has been proven to have significant impact on its overall consumption, EVA has eventually become a major material in photovoltaic module encapsulation, EVA is propellant for making fill side of photovoltaic modules sustainable and efficient.

Many of the top solar companies - names like First Solar, Trina Solar and Jinko Solar - use EVA-based encapsulants. In the shoe and automotive industries EVA is used as a low density, shock absorbing materials, Nike and Adidas provide said EVA in these types of performance footwear. EVA demand in the Asia-Pacific region, a hub for solar and vehicles manufacturing, is seen quickening. EBA (Ethylene Butyl Acrylate) also finds growing applications in wire and cable insulation, polymer modification and also used in thermo-adhesive films. It is ideally suited to protective coatings and high performance sealants due to the low temperature flexibility, chemical resistance and compliance with environmental regulations.

Key industries in North America and Europe, such as automotive, electronics and aerospace, require high-performance advanced materials, including EBA. Companies including Arkema and Dow Inc. are developing EBA-based materials for high-voltage insulation and specialty adhesives. As advancing polymer technology continues to contribute to the emergence of more applications for the use of EBA, the market itself continues to steadily expand.

For plastic manufacturers, production efficiency is critical and they rate it high, while packaging companies, industrial users and R&D teams assign a medium, adjusting for a balance between throughput and quality. For industrial users, they are under intense margin pressure, and therefore cost competitiveness is particularly important, while for the other two user groups it is of medium importance.

Performance is critical, and the high marks among plastic manufacturers and R&D groups reflect consistent performance in end-use applications. Stakeholders do rank environmental impact as a moderate concern, and R&D do regard environmental impact as a lower priority issue due to their need for innovation.

Lastly, innovation and R&D potential is rated quite differently, as R&D teams see it as being more valuable. Ultimately, the table clearly shows that technical performance, efficiency, and innovation are the driving factors when making decisions in the ethylene copolymer industry.

The ethylene copolymers industry has undergone gradual growth between the periods of 2020 and 2024 primarily under the application areas of the packaging, automotive, and adhesives sectors. The flexible packaging trend gave rise to increased usage of lightweight materials in cars along with the expansion of the solar industry and led to industry growth.

Regulatory pressures for single-use plastics have also forced the use of recyclable and bio-based ethylene copolymers. Manufacturers, on the other hand, faced challenges such as supply chain disruption, rising raw material prices, and general uncertainty. From 2025 to 2035, the world will witness a boom in innovation for sustainable, high-performance copolymers. Bio-based ethylene copolymer development and recyclable formulations will adhere to more stringent environmental regulations. The major end-applications of these niche copolymers will be the automotive and electrical sectors, which will call for enhanced heat and chemical resistance.

Smart packaging is also a possible industry, which will need spectacular barrier properties. In addition, digitalization and AI-guided manufacturing will streamline the production process for cost-efficient and eco-friendly supply chains for ethylene copolymers globally.

Comparative Market Trends 2020 to 2024 VS 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Standards of emissions and industrial safety regulations. | Tighter sustainability regulations driving the need for bio-based and recyclable ethylene copolymers to minimize environmental footprint. |

| Manufacturing of high-performance copolymers of ethylene for automotive and packaging applications. | Advanced polymerization techniques allow enhanced mechanical properties and better recyclability. |

| Strong demand exists in adhesives, packaging films, and coatings. | Increasing applications in renewable energy, medical devices, and sustainable packaging. |

| Increasing trends towards recyclable and low-VOC formulations. | Circular economy projects foster development in biodegradable and upcycled forms of ethylene copolymers. |

| Price volatility based on reliance on petrochemical feedstock. | Guiding development to bio-based sources of ethylene is intended to provide stability in supply and cost-effectiveness. |

| Expansion of flexible packaging, automotive, and construction incidences. | Industry growth is being driven by innovation in lightweight materials, electric vehicle parts, and high-barrier packs. |

The ethylene copolymer industry is also sensitive with regard to volatility in price fluctuation of raw materials due to key feedstocks such as ethylene, vinyl acetate monomer (VAM), and acrylic monomers are highly replaceable and respond to the fluctuations in price of crude oil, supply chain disruptions, and geopolitical factors.

Prices for these materials soar, raising production costs for manufacturers, who can either raise prices or bear margin erosion. It was very competitive and EVA or EAA gets replaced in cost-sensitive applications by alternative materials like LDPE and other copolymers.

At the same time, new elastomers and olefin block copolymers are invading those segments with which you compete in markets for footwear, packaging and adhesives.

Regulatory and environmental risks continue to intensify, specifically for single-use plastics and non-recyclable materials. Tighter regulation of packaging sustainability and food-contact safety can necessitate reformulation or redirect demand to bio-sourced alternatives like EVA from sugarcane.

Demand is also influenced by cyclicality, with segments such as solar panel encapsulants and footwear experiencing booms or busts based on (political) policy changes, economic slowdowns or altering consumer preferences.

A surge in overcapacity, especially in the event of new plants coming online in areas such as Asia, can force prices down and increase competition. Producers need to prioritize cost efficiency, diversification, and innovation in high-performance or environmentally friendly copolymer grades to shield these threats.

The pricing for ethylene copolymers is predominantly cost-plus, with pricing changes to reflect the movements of feedstock prices. If EVA and other copolymers are supplied, many supply contracts are also based on indexation models, where EVA and related copolymers follow ethylene and VAM price movements and can pass through the cost.

But in competitive markets, it’s possible that producers will not be able to pass through fully price increases when raw material costs increase. These are specialty grades where value-based pricing comes into effect (e.g., high-VA EVA for solar encapsulants or EAA in premium packaging adhesives), which is justified due to superior performance.

There is segmentation, where large industrial buyers are negotiating bulk discounting, while smaller customers or niche applications are paying higher per-unit prices.

Furthermore, in response to competitive pricing pressures, we see market-based adjustments, where suppliers seek to respond to, and keep pace with, price decreases to retain share in commodity-type segments.

Promotional strategies, like multi-annual contracts and bundled pricing for specialty applications, stabilize revenues. As sustainability trends increase, some bio-based copolymers may demand a premium; however, their adoption will rely on regulatory incentives and cost competitiveness.

In the long term, raw material trends pricing will be driven still by capacity expansions and shifts to growth applications (e.g., renewable energy, flexible packaging, and automotive materials).

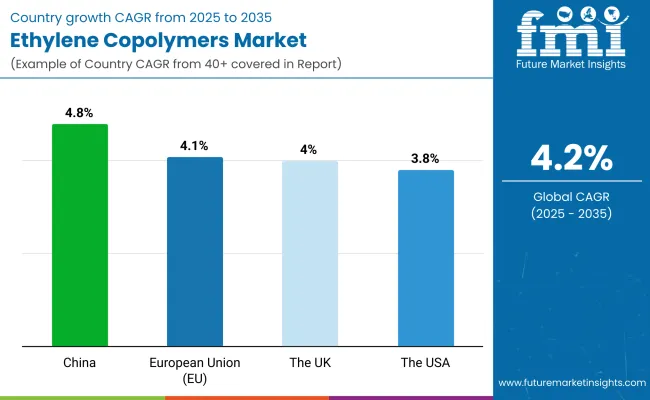

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 3.8% |

| The UK | 4.0% |

| European Union (EU) | 4.1% |

| China | 4.8% |

The United States' ethylene copolymers industry is riding a wave of growth, fueled by demand from the automotive and packaging sectors. The USA industry is spurred by developments in lightweight and high-performance materials, and substantial R&D investment in sustainable polymer technologies.

FMI opines that the USA industry will register a 3.8% CAGR over the study period (2025 to 2035).

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Flexible Packaging Growth | Growing demand for long-term and sustainable packaging solutions propels growth in laminates, wraps, and films, as consumers opt for green alternatives. |

| Automotive Demand | Demand for light polymers to save weight and enhance fuel efficiency is paramount, especially with the growing use of electric vehicles. |

| Polymer Technology Growth | New co-polymer combinations, based on renewable energy and biodegradable raw materials, are enhancing polymer performance while lowering environmental footprint. |

| Regulatory Drive for Sustainability | Government efforts to suppress plastic waste and support environmentally sustainable materials are drawing companies towards sustainable polymer solutions. |

The UK is observing increased demand for ethylene copolymers owing to the increasing spurt in the sustainability culture in packaging, adhesives, and coatings. Government initiatives in favor of the circular economy and the transition towards high-performance plastics also propel the industry.

FMI views that the industry in the UK will grow at a 4.0% CAGR from 2025 to 2035.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Sustainable Packaging Initiatives | Ban on single-use plastics has raised demand for biodegradable and bio-based copolymers to develop sustainable packaging solutions. |

| Construction Sector Growth | Growing application of copolymers as roofing membranes, insulation, and hardness and weatherability-dependent protective coating. |

| Adhesives & Sealants Demand | The demand for copolymer solutions is greatest if there is a requirement for enduring bonding to industries and consumers. |

| Pharmaceutical use | Ethylene copolymers are notably applied in developing drug-delivery systems, tubing for medical application, and device packaging of medications. |

European Union ethylene copolymers industry is growing on the back of environmental policy, industrialization, and heightened development of high-performance polymers. Government schemes such as the EU Green Deal also favor the use of recyclable, bio-based, and sustainable copolymers.

FMI is of the belief that the European Union industry will register a 4.1% CAGR throughout the period of research (2025 to 2035).

Growth Drivers in the European Union

| Key Drivers | Details |

|---|---|

| EU Green Deal Policies | The EU pledge to sustainability makes the use of recyclable and bio-based copolymers a priority in order to harmonize with environmental objectives at the regional level. |

| Growth in Automobile Manufacturing | Use in emission reduction, electric, and hybrid necessitates lighter products, elevating the requirement for ethylene copolymers. |

| Growth in Medical Use | More demand for pharma packaging and medical devices has been created in ethylene copolymers due to non-toxicity and chemical resistance. |

| Investment in Bio-Based Polymers | Investment in production of bio-based copolymers is propelled by the need for sustainable alternatives to replace traditional ethylene products. |

| Infrastructure & Construction Growth | Growing application of ethylene copolymers for waterproofing, corrosion-resistant coatings, and thermal insulation in infrastructure development is rising steadily. |

China also dominates the international ethylene copolymers industry owing to increased industrialization, urbanization, and expenditure on renewable power, electric transport, and packaged consumer goods. Use of ethylene copolymers for packaging is particularly on the uptrend with elevated online shopping trends.

FMI predicts that China's industry is likely to increase at a 4.8% CAGR through the prediction period (2025 to 2035).

Development Drivers in China

| Key Drivers | Details |

|---|---|

| Boom in Packaging Industry | With increasing online shopping, packaging products, including ethylene copolymers, are in high demand online. |

| Technological Advances in Renewable Power | Packaging ethylene copolymers for solar panel packaging owing to China's investment in renewable power is driving the industry. |

| Sustainable Material Use | China encourages the utilization of renewable-based ethylene copolymers and green manufacturing technologies as part of its green efforts. |

| Environmental Recycling Technologies | China is leading in the use of green recycling technologies for ethylene copolymers towards enhancing material sustainability. |

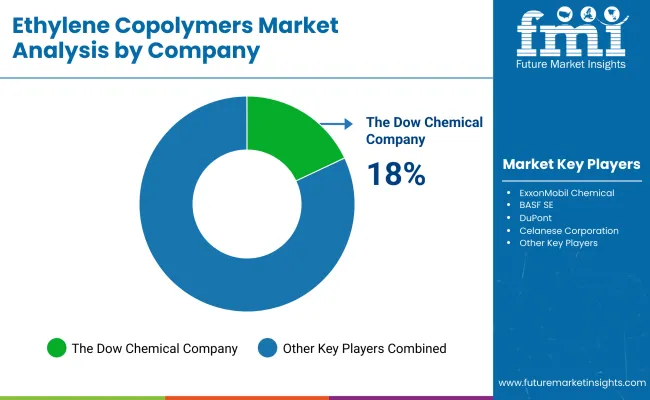

Ethylene copolymer production has a strong concentration and is chiefly controlled by innovative Tier 1 companies running state-of-the-art manufacturing facilities alongside vast production capacities.

Backed by R&D on new materials, the top manufacturers prioritize the production of high-performance goods for various sectors, including packaging, automotive, and construction. They take advantage of their global footprint to approach diverse customer and industrial needs effectively.

The strategy of renewable, research, and development investment enables their product range to be extended even further, thus strengthening their market influence. In addition, they are the role models for the industry, therefore, other companies and sectors emulate their model in strategic decisions and capitalize on their success.

The ethylene copolymers market is intensely competitive and is driven by technological advancements, sustainability initiatives, and multiple applications in various industries.

The prime companies focus on research as well as development, global distribution networks, and strategic collaboration to sustain their market position. The demand for high-performance, recyclable, and bio-based copolymers is enhancing innovation, especially in packaging and automotive applications and in adhesives and coatings.

The Dow Chemical Company, ExxonMobil Chemical, Mitsui Chemicals, and SABIC SK Nexlene Company are prominent players that analyze wide product portfolios with strong supply chain capabilities. Dow excels in high-performance ethylene copolymers for packaging, adhesives, and automotive applications, while ExxonMobil Chemical is known for an advanced polymer technology and worldwide market reach.

Companies that invest in bio-based alternatives, circular economy solutions, and enhanced performance of products will be more favorably placed for sustainable success as sustainability issues and regulatory compliance continue to play a major role in determining the market dynamics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The Dow Chemical Company | 18-22% |

| ExxonMobil Chemical | 14-18% |

| BASF SE | 12-16% |

| DuPont | 10-14% |

| Celanese Corporation | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Dow Chemical Company | Offers a diverse range of ethylene copolymers used in packaging, automotive, and adhesives, with a strong R&D-driven approach. |

| ExxonMobil Chemical | Focuses on high-performance ethylene copolymers for packaging and automotive applications, emphasizing technological advancements. |

| BASF SE | Specializes in high-quality ethylene copolymers, integrating sustainability initiatives for eco-friendly solutions. |

| DuPont | Produces advanced copolymers used in coatings, adhesives, and specialty applications, with a strong focus on innovation. |

| Celanese Corporation | Provides performance-oriented ethylene copolymers for industrial and consumer applications, focusing on durability and flexibility. |

Key Company Insights

The Dow Chemical Company (18-22%)

As the market leader in ethylene copolymers, investing heavily in high-performance applications positions Dow well in individual proprietary formulations for the packaging, adhesives, and automotive market sectors.

ExxonMobil Chemical (14-18%)

With superior technologically advanced copolymers, the company has prioritized global expansion in addition to premium solutions for different applications.

BASF SE (12-16%)

BASF is a leader in terms of sustainable polymer solutions, which includes supplying green materials in its ethylene copolymer production.

DuPont (10-14%)

DuPont specializes in coatings, adhesives, and engineering materials where the application is specialized and performance based.

Celanese Corporation (8-12%)

Celanese manufactures multipurpose, flexible, copolymers for an industrial and consumer audience. This architecture focuses on durability and flexibility.

Other Key Players (30-40% Combined)

The market is expected to generate USD 64.9 billion in revenue by 2025.

The market is projected to reach USD 97.9 billion by 2035, growing at a CAGR of 4.2% from 2025 to 2035.

Key manufacturers in the market include DuPont, Celanese Corporation, The Dow Chemical Company, BASF SE, Sipchem, USI Corporation, LyondellBasell Industries N.V., Wacker Chemie AG, ExxonMobil Chemical Company, and Lanxess AG.

Asia-Pacific, particularly China and India, is expected to be a key growth region due to rising demand in packaging, automotive, and construction industries.

Ethylene vinyl acetate (EVA) is the most widely used product segment due to its versatility, flexibility, and extensive application in packaging, footwear, and solar panel encapsulation.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Volume (Tons) Forecast by Application, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Volume (Tons) Forecast by Type, 2018 to 2033

Table 7: Global Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: North America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Volume (Tons) Forecast by Type, 2018 to 2033

Table 15: North America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Latin America Volume (Tons) Forecast by Application, 2018 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Latin America Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Latin America Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Western Europe Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Western Europe Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: Western Europe Volume (Tons) Forecast by Type, 2018 to 2033

Table 31: Western Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Eastern Europe Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: Eastern Europe Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Eastern Europe Volume (Tons) Forecast by Type, 2018 to 2033

Table 39: Eastern Europe Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: South Asia and Pacific Volume (Tons) Forecast by Application, 2018 to 2033

Table 45: South Asia and Pacific Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: South Asia and Pacific Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: South Asia and Pacific Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Value (US$ Million) Forecast by Application, 2018 to 2033

Table 52: East Asia Volume (Tons) Forecast by Application, 2018 to 2033

Table 53: East Asia Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: East Asia Volume (Tons) Forecast by Type, 2018 to 2033

Table 55: East Asia Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Volume (Tons) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: Middle East and Africa Volume (Tons) Forecast by Application, 2018 to 2033

Table 61: Middle East and Africa Value (US$ Million) Forecast by Type, 2018 to 2033

Table 62: Middle East and Africa Volume (Tons) Forecast by Type, 2018 to 2033

Table 63: Middle East and Africa Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 10: Global Volume (Tons) Analysis by Application, 2018 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 14: Global Volume (Tons) Analysis by Type, 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Attractiveness by Application, 2023 to 2033

Figure 22: Global Attractiveness by Type, 2023 to 2033

Figure 23: Global Attractiveness by End Use, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Application, 2023 to 2033

Figure 26: North America Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 34: North America Volume (Tons) Analysis by Application, 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 38: North America Volume (Tons) Analysis by Type, 2018 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Attractiveness by Application, 2023 to 2033

Figure 46: North America Attractiveness by Type, 2023 to 2033

Figure 47: North America Attractiveness by End Use, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Type, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 58: Latin America Volume (Tons) Analysis by Application, 2018 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 62: Latin America Volume (Tons) Analysis by Type, 2018 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Attractiveness by Application, 2023 to 2033

Figure 70: Latin America Attractiveness by Type, 2023 to 2033

Figure 71: Latin America Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Value (US$ Million) by Application, 2023 to 2033

Figure 74: Western Europe Value (US$ Million) by Type, 2023 to 2033

Figure 75: Western Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 82: Western Europe Volume (Tons) Analysis by Application, 2018 to 2033

Figure 83: Western Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 84: Western Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 85: Western Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 86: Western Europe Volume (Tons) Analysis by Type, 2018 to 2033

Figure 87: Western Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 88: Western Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 89: Western Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Attractiveness by Application, 2023 to 2033

Figure 94: Western Europe Attractiveness by Type, 2023 to 2033

Figure 95: Western Europe Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Value (US$ Million) by Application, 2023 to 2033

Figure 98: Eastern Europe Value (US$ Million) by Type, 2023 to 2033

Figure 99: Eastern Europe Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 106: Eastern Europe Volume (Tons) Analysis by Application, 2018 to 2033

Figure 107: Eastern Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 108: Eastern Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 109: Eastern Europe Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Volume (Tons) Analysis by Type, 2018 to 2033

Figure 111: Eastern Europe Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 112: Eastern Europe Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 113: Eastern Europe Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Attractiveness by Application, 2023 to 2033

Figure 118: Eastern Europe Attractiveness by Type, 2023 to 2033

Figure 119: Eastern Europe Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Value (US$ Million) by Application, 2023 to 2033

Figure 122: South Asia and Pacific Value (US$ Million) by Type, 2023 to 2033

Figure 123: South Asia and Pacific Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 130: South Asia and Pacific Volume (Tons) Analysis by Application, 2018 to 2033

Figure 131: South Asia and Pacific Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 132: South Asia and Pacific Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 133: South Asia and Pacific Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 134: South Asia and Pacific Volume (Tons) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Attractiveness by Application, 2023 to 2033

Figure 142: South Asia and Pacific Attractiveness by Type, 2023 to 2033

Figure 143: South Asia and Pacific Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 146: East Asia Value (US$ Million) by Type, 2023 to 2033

Figure 147: East Asia Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 154: East Asia Volume (Tons) Analysis by Application, 2018 to 2033

Figure 155: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: East Asia Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 158: East Asia Volume (Tons) Analysis by Type, 2018 to 2033

Figure 159: East Asia Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 160: East Asia Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 161: East Asia Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Attractiveness by Application, 2023 to 2033

Figure 166: East Asia Attractiveness by Type, 2023 to 2033

Figure 167: East Asia Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Value (US$ Million) by Application, 2023 to 2033

Figure 170: Middle East and Africa Value (US$ Million) by Type, 2023 to 2033

Figure 171: Middle East and Africa Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 178: Middle East and Africa Volume (Tons) Analysis by Application, 2018 to 2033

Figure 179: Middle East and Africa Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 180: Middle East and Africa Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 181: Middle East and Africa Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 182: Middle East and Africa Volume (Tons) Analysis by Type, 2018 to 2033

Figure 183: Middle East and Africa Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 184: Middle East and Africa Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 185: Middle East and Africa Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Attractiveness by Application, 2023 to 2033

Figure 190: Middle East and Africa Attractiveness by Type, 2023 to 2033

Figure 191: Middle East and Africa Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ethylene Carbonate Market Forecast and Outlook 2025 to 2035

Ethylene Tetrafluoroethylene (ETFE) Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Ethyleneamines Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Dichloride Market Growth – Trends & Forecast 2025 to 2035

Ethylene Amines Market Growth - Trends & Forecast 2024 to 2034

Ethylene Glycol Market Growth - Trends & Forecast 2024 to 2034

Methylene Diphenyl Di-isocyanate Market

Diethylenetriamine (DETA) Market

Triethylenediamine Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Monoethylene Glycol MEG Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Terephthalate Market Growth - Trends & Forecast 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Polyethylene Mailers Market Insights - Growth & Trends Forecast 2025 to 2035

Competitive Breakdown of Polyethylene Corrugated Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA