The global market for fluoropolymers in healthcare is set to grow steadily as demand for advanced, durable, and biocompatible materials rises across medical applications. Fluoropolymers, known for their excellent chemical resistance, low friction, and high thermal stability, are used in a variety of healthcare applications including medical tubing, catheters, gaskets, implants, and surgical devices.

As the healthcare sector increasingly prioritizes materials that meet stringent regulatory standards and support patient safety, fluoropolymers are emerging as a critical component in modern medical devices and equipment. Additionally, ongoing innovation in material formulation and the expansion of healthcare infrastructure in emerging markets are expected to drive growth in this sector. With a strong focus on quality, performance, and compliance, the fluoropolymers in healthcare market is poised for steady expansion through 2035.

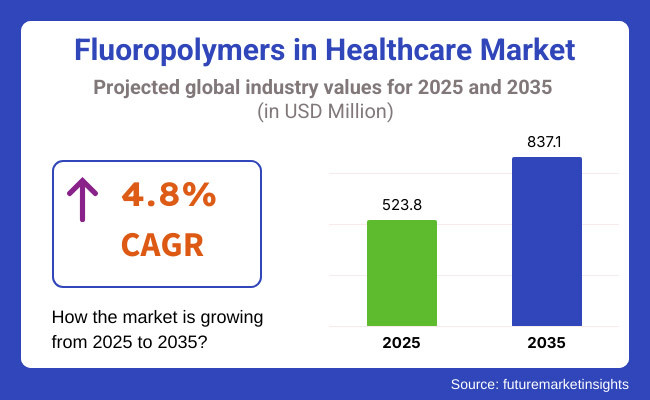

In 2025, the global fluoropolymers in healthcare market is estimated at approximately USD 523.8 Million. By 2035, it is projected to grow to around USD 837.1 Million, reflecting a compound annual growth rate (CAGR) of 4.8%. This growth reflects increasing demand for durable, biocompatible materials in critical healthcare applications.

North America has been a dominant market for fluoropolymers for healthcare owing to its highly regulated medical device manufacturing facilities. Demand for advanced fluoropolymer materials in high-performance applications like minimally invasive surgical instruments and long-term implants has remained steady in the United States and Canada.

Another significant market is Europe, which has a focus on healthcare quality, innovation and regulatory compliance. Besides, nations such as Germany, the UK and France are best in embracing fluoropolymers for application in advanced surgical tools, diagnostic devices, and pharmaceutical processing equipment.

The market for fluoropolymers is the fastest-growing in the healthcare sector in the Asia-Pacific region, owing to rapid industrialization, growing healthcare infrastructure, and an increasing demand for high performing, superior quality medical-grade materials.

China, Japan, & India are major players as they invest more and more in the medical equipment market facing growing patient bases in need of sophisticated health care solutions. The increasing healthcare standards and the trend toward widespread adoption of high-performance materials by regional manufacturers are anticipated to drive United States market share.

Challenges

High Production Costs, Regulatory Compliance, and Environmental Concerns

The fluoropolymers in healthcare market also encounters several challenges, primarily driven by the high cost of production, which is based on both synthesis and processing of fluoropolymers. These include polytetrafluoroethylene (PTFE), perfluoroalkoxy alkane (PFA) and fluorinated ethylene propylene (FEP), which are costly relative to conventional polymers due to the specialized manufacturing techniques.

Regulatory compliance is another difficulty because fluoropolymers that are used in medical devices must comply with FDA, CE Mark and ISO medical device regulations such as biocompatibility, sterilization, and safety. Moreover, environmental regulations and PFAS contamination are driving scrutiny to use sustainable fluoropolymer to mitigate environmental and public health concerns.

Opportunities

Growth in Medical Implants, AI-Driven Material Innovations, and Sustainable Fluoropolymers

Despite these challenges, fluoropolymers in healthcare market has a thriving growth paradigm steered by the increasing demand for high-end medical coatings, bio inert implants, and trifecta that includes AI-optimized polymer formulations. The global market is being driven by increasing prevalence of fluoropolymers in medical implants, catheters, surgical tubing, and drug delivery systems owing to their chemical resistance, non-stickiness, and biocompatibility.

Moreover, AI-driven material science is fine-tuning fluoropolymer formulations to boost their durability, flexibility, and antimicrobial resistance. The focus on sustainable, low-emission fluoropolymers is also opening doors for next-generation medical applications.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, CE, and ISO standards for biocompatibility and medical-grade fluoropolymers. |

| Consumer Trends | Demand for biocompatible fluoropolymer coatings in catheters, implants, and surgical instruments. |

| Industry Adoption | High usage in drug delivery systems, medical tubing, and high-precision surgical devices. |

| Supply Chain and Sourcing | Dependence on fluoropolymer resin producers, specialized medical coating manufacturers, and PTFE suppliers. |

| Market Competition | Dominated by fluoropolymer manufacturers, medical device companies, and specialty chemical firms. |

| Market Growth Drivers | Growth fueled by increasing demand for non-stick, chemical-resistant, and durable medical materials. |

| Sustainability and Environmental Impact | Moderate adoption of low-waste fluoropolymer production and eco-friendly sterilization techniques. |

| Integration of Smart Technologies | Early adoption of AI-assisted material testing, precision medical coatings, and antimicrobial polymer engineering. |

| Advancements in Medical Materials | Development of high-performance fluoropolymers for minimally invasive surgery and drug-coated stents. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter PFAS regulations, sustainability mandates, and AI-driven material safety testing protocols. |

| Consumer Trends | Growth in AI-optimized fluoropolymer formulations, antimicrobial fluoropolymer surfaces, and smart biomaterials. |

| Industry Adoption | Expansion into AI-driven polymer engineering, robotic-assisted surgical applications, and regenerative medicine. |

| Supply Chain and Sourcing | Shift toward eco-friendly fluoropolymers, circular economy sourcing, and AI-enhanced polymer lifecycle tracking. |

| Market Competition | Entry of biotech-driven material developers, AI-assisted polymer synthesis firms, and nanotechnology-based healthcare innovators. |

| Market Growth Drivers | Accelerated by biodegradable fluoropolymers, AI-powered material simulations, and personalized medicine applications. |

| Sustainability and Environmental Impact | Large-scale shift toward PFAS-free fluoropolymers, carbon-neutral medical materials, and AI-driven sustainability tracking. |

| Integration of Smart Technologies | Expansion into self-healing fluoropolymer surfaces, IoT-enabled biomaterial monitoring, and blockchain-based polymer safety tracking. |

| Advancements in Medical Materials | Evolution toward AI-designed fluoropolymer implants, biodegradable fluoropolymers, and nanotechnology-driven medical coatings. |

Due to the rising requirement for biocompatible and chemically resistant materials in medical applications, the fluoropolymers in healthcare market in the USA is growing at a slow and steady pace. Growing usage of PTFE, FEP, and PVDF fluoropolymers in medical tubing, catheters, and surgical tools is contributing to market growth. Plus, the growth of the industry is further supported by the advancements in implantable medical devices and drug delivery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

United Kingdom fluoropolymers in healthcare market forecast to grow during the forecast period with increasing investments in advanced medical coatings, antimicrobial surfaces, and flexible medical devices.

The demand for fluoropolymer-based materials is being driven by the growing emphasis on MIS (minimal invasive surgeries) and everlasting medical implants. This is further being driven by stringent regulations mandating biocompatible and serializable materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Focused on advanced polymer-based solutions that provide high performance in medical devices, drug containers, and protective coatings drives the growth of fluoropolymers in healthcare market throughout the Europe region.

Market demand is driven by the presence of leading medical device manufacturers and regulatory compliance with EU MDR (Medical Device Regulation). Additionally, developments in PTFE-based membranes in filtration and sterilization are influencing the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Nanotechnology-based coatings, biocompatible non-stick medical device components, and fluoropolymer films are some of the major trends that propel moderate growth in Japan fluoropolymers in healthcare market.

The high-precision surgical tools and advanced drug delivery systems that the country is focusing on would skyrocket the demand for fluoropolymers. Furthermore, applied research in highly pure fluoropolymers for pharmaceutical packaging is helping foster long-term growth in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The fluoropolymers in healthcare market in South Korea is growing on account of the rising use of PTFE based coatings in medical devices, diagnostic instruments, and biopharmaceutical applications. The demand for the market is further propelled by the growing biotech and medical research sector of the country, and various government initiatives supporting medical polymer innovations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Fluoropolymers, for instance, are crucial components in medical tubing, surgical instruments, and pharmaceutical packaging and hospital disposables and are used to increase the performance, durability and safety of these items.

As a result, the increasing demand for high purity, contamination-resistant, and heat-resistant materials designed for use in healthcare applications have driven manufacturers to develop advanced fluoropolymer formulations for multiple stringent regulatory standards. Based on Product Type, FEP and Based on Application, the market segments are: Medical Devices, Hospital Disposables, and Pharma packaging).

Based on Type, the market is segmented into PTFE (Polytetrafluoroethylene), Silicon, and Others; and its PTFE (Polytetrafluoroethylene) segment is expected to hold the largest market share in Patients'

Experience through the use of Medical Polymers in Strings in the coming time, owing to their extensive usage in catheters, guidewires, vascular grafts, and medical tubing due to their non-stick properties, chemical inertness and resistance to high temperatures. Due to its properties, PTFE is an important component of many minimally invasive surgical techniques, implantable medical devices and diagnostic modalities where it provides lubricity, and biocompatibility.

There is a growing market of PTFE-based components in medical application that will still increase with the increasing development of minimally invasive surgery (MIS), cardiovascular implants, and bioelectronics. They are also making PTFE-dominated technology like the ceramic-particle based PTFE coatings, reinforced PTFE membranes, etc. or hybrid PTFE composites to provide better performance and patient safety.

Fluorinated Ethylene Propylene (FEP) is also showcasing resilient demand, notably in fluid handling systems, pharmaceutical processing, and disposable medical tubing. Its properties of high purity, chemical resistance, and flexibility make FEP particularly suitable for single use biopharmaceutical processing equipment and IV tubing, and chemical resistant coatings.

As disposable medical devices and biopharmaceutical processing are gaining popularity, the requirement for FEP-based fluoropolymers are increasing in aseptic fluid transfer, drug delivery systems and contamination-free medical packages.

Fluoropolymers play a key role in high-performance precision-engineered medical tools and implants, leading to Medical Devices making the largest product segment in the overall Fluoropolymers in Healthcare Market. Fluoropolymers guarantee low friction, excellent electrical insulation, and resistance to aggressive sterilization procedures, which makes them essential in catheter catheters, endoscopic instruments, surgical robots, and artificial heart valves.

As the prevalence of chronic disease grows, the demand for minimally invasive procedures continues to rise and investments in advanced medical technologies increase, manufacturers are incorporating fluoropolymer coatings, tubing and structural components into next-generation medical devices. Demand for high-performance fluoropolymer solutions continues to grow with the expansion of robotic surgery, smart implants, and wearables.

Moreover, the pharma packaging category is gaining traction with the increasing usage of fluoropolymers in drug storage, biopharmaceutical processing, and vaccine packaging. With their chemical stability and moisture resistance, as well as protective properties against contamination, Fluoropolymer-based vials, seals, and liners help ensure drug safety and long shelf life.

As global vaccine production, biologics manufacturing, and regulatory compliance for pharmaceutical packaging grows demand for fluoropolymer-based sterile and tamper-proof packaging solutions. To enhance barrier protection and stability, manufacturers are concentrating on PCTFE (Polychlorotrifluoroethylene) films, FEP-coated pharmaceutical containers, and PVDF (Polyvinylidene Fluoride) drug delivery systems.

The fluoropolymers in healthcare market growth by application would not have been possible if the biocompatible materials haven't found a way into non-reactive medical coatings as well. The Companies are targeting AI-based polymer innovation, fluoropolymer processing, and sustainable medical-grade fluoropolymers to improve durability, resistance to toxins, and patient safety.

Competitors in the market consist of key players such as manufacturers of fluoropolymers, medical device companies, and vendors of specialty materials that are constantly focusing on innovations in medical fluoropolymers, AI-based material analysis, and polymer solutions meeting regulatory requirements.

Market Share Analysis by Key Players & Fluoropolymer Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| The Chemours Company | 18-22% |

| Daikin Industries Ltd. | 12-16% |

| Solvay S.A. | 10-14% |

| 3M Company (Dyneon LLC) | 8-12% |

| AGC Inc. (Asahi Glass Co.) | 5-9% |

| Other Fluoropolymer Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Chemours Company | Develops AI-optimized medical-grade PTFE, fluoropolymer coatings for catheters, and high-purity fluorinated polymers for surgical tools. |

| Daikin Industries Ltd. | Specializes in biocompatible fluoropolymer medical tubing, AI-driven polymer stability analysis, and fluorinated elastomers for medical implants. |

| Solvay S.A. | Provides ultra-pure PVDF and PFA fluoropolymers for healthcare applications, AI-enhanced polymer performance tracking, and regulatory-compliant coatings. |

| 3M Company (Dyneon LLC) | Focuses on fluoropolymer-based antimicrobial coatings, AI-powered surface optimization, and long-lasting PTFE medical membranes. |

| AGC Inc. (Asahi Glass Co.) | Offers AI-driven fluoropolymer synthesis, medical-grade ETFE and FEP materials, and chemically inert fluoropolymer coatings for implants. |

Key Market Insights

The Chemours Company (18-22%)

Chemours leads the fluoropolymers in healthcare market, offering AI-driven PTFE innovation, next-generation fluoropolymer-based medical coatings, and chemically resistant surgical tools.

Daikin Industries Ltd. (12-16%)

Daikin specializes in biocompatible fluoropolymer medical components, ensuring AI-powered durability analysis, advanced fluoropolymer processing, and high-performance elastomers.

Solvay S.A. (10-14%)

Solvay provides PVDF and PFA fluoropolymers for drug delivery systems and medical devices, optimizing AI-assisted performance tracking and high-purity medical polymer development.

3M Company (Dyneon LLC) (8-12%)

3M focuses on fluoropolymer-based antimicrobial medical coatings, integrating AI-powered surface treatment advancements and long-lasting PTFE membrane technology.

AGC Inc. (Asahi Glass Co.) (5-9%)

AGC develops AI-enhanced ETFE and FEP fluoropolymers, ensuring chemically inert, regulatory-compliant medical fluoropolymer coatings and implant-grade polymers.

Other Key Players (30-40% Combined)

Several specialty material manufacturers, medical device companies, and polymer engineering firms contribute to next-generation fluoropolymer innovations, AI-powered polymer stability improvements, and advanced biocompatible fluoropolymer solutions. These include:

The overall market size for the fluoropolymers in healthcare market was USD 523.8 Million in 2025.

The fluoropolymers in healthcare market is expected to reach USD 837.1 Million in 2035.

Growth is driven by the rising demand for biocompatible materials, increasing use in medical tubing and catheters, and advancements in fluoropolymer coatings for medical devices.

The top 5 countries driving the development of the fluoropolymers in healthcare market are the USA, Germany, China, Japan, and India.

PTFE and Medical Devices are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Oceania Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: Oceania Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: Oceania Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Invar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA