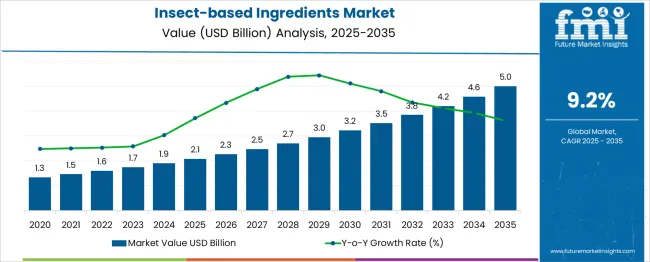

The Insect-based Ingredients Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 2.1 billion to USD 3.2 billion, reflecting consistent adoption across food, feed, and nutraceutical applications. Year-on-year analysis indicates a steady rise, with the market reaching USD 2.3 billion in 2026 and USD 2.5 billion in 2027, driven by the rising demand for alternative protein sources and functional ingredients offering high nutritional value.

By 2028, the market is projected to reach USD 2.7 billion, advancing to USD 3.0 billion in 2029 and USD 3.2 billion by 2030. Growth is anticipated to be fueled by technological advancements in large-scale insect farming and regulatory approvals in key regions for insect-derived proteins and oils. Expanding product innovation in snacks, pet foods, and aquafeeds will further accelerate adoption. These trends indicate that insect-based ingredients will play a critical role in addressing global protein demand while providing sustainable and efficient solutions for both human and animal nutrition markets in the coming decade.

| Metric | Value |

|---|---|

| Insect-based Ingredients Market Estimated Value in (2025 E) | USD 2.1 billion |

| Insect-based Ingredients Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The insect-based ingredients market holds a growing yet specialized share across several protein and ingredient-focused sectors. In the alternative protein market, its share is approximately 8–10%, driven by rising demand for sustainable, high-protein sources alongside plant and lab-grown proteins. Within the animal feed and nutrition market, it contributes around 3–4%, as insect meal is increasingly used as a protein-rich feed for poultry, aquaculture, and livestock.

In the food ingredients market, its share remains small at 1–2%, since adoption in mainstream human food products is still limited to niche and health-focused segments. The nutraceuticals and functional foods market sees about 2–3%, with insect-derived powders and oils incorporated into protein bars, supplements, and fortified products. In the pet food ingredients market, its share is higher at 6–7%, as insects provide a hypoallergenic and digestible protein source in premium and specialty pet foods.

Growth is fueled by the need for sustainable protein alternatives, regulatory approvals, and advancements in insect farming technologies. Increasing awareness of the nutritional benefits of insect proteins, such as essential amino acids, healthy fats, and minerals, is driving their integration across feed, food, and health applications. As consumer acceptance improves, the insect-based ingredients market is positioned to expand significantly within these parent markets.

The insect based ingredients market is undergoing significant transformation as sustainability priorities, resource efficiency, and evolving consumer preferences converge to redefine the food and ingredients industry. Increasing concerns over the environmental impact of conventional animal protein sources have positioned insect based ingredients as a viable, scalable alternative.

Technological advancements in insect farming, improved processing techniques, and heightened awareness of nutritional benefits are driving adoption across various end use sectors. The market is further supported by regulatory approvals and growing acceptance of alternative proteins in mainstream diets.

Future growth is anticipated to be fueled by investments in scalable production systems, product innovation, and broader retail penetration. Enhanced supply chain integration and efforts to educate consumers on health and sustainability benefits are paving the path for sustained expansion and deeper market penetration.

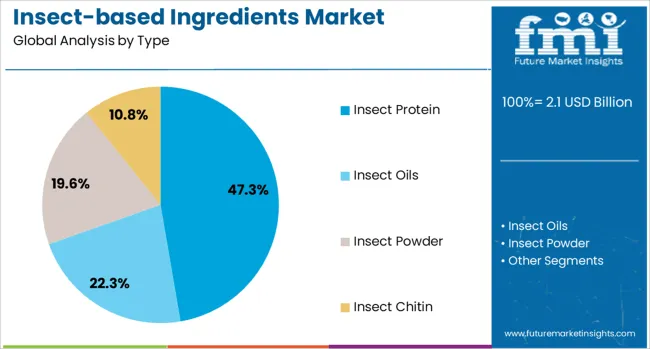

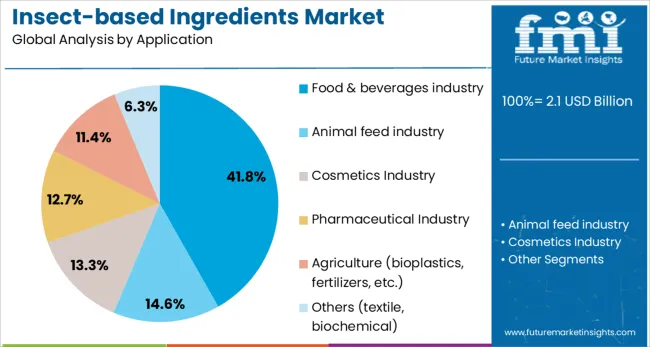

The insect-based ingredients market is segmented by type, application, and geographic regions. The insect-based ingredients market is divided into Insect Protein, Insect Oils, Insect Powder, and Insect Chitin. In terms of application, the insect-based ingredients market is classified into the Food & beverages industry, Animal feed industry, Cosmetics Industry, Pharmaceutical Industry, Agriculture (bioplastics, fertilizers, etc.), and Others (textile, biochemical).

Regionally, the insect-based ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, insect protein is projected to hold 47.3% of the total market revenue in 2025, establishing itself as the dominant type segment. This leadership has been supported by its high protein content, favorable amino acid profile, and lower environmental footprint compared to traditional animal proteins.

Manufacturing investments in efficient farming and processing facilities have increased output capacity while reducing costs, reinforcing the competitiveness of insect protein. Growing interest from food manufacturers in incorporating insect protein into snacks, bars, and meat substitutes has enhanced demand, while regulatory clarity in key markets has accelerated commercialization.

The ability of insect protein to align with both health and sustainability trends has strengthened its position as the preferred type within the insect-based ingredients market.

Segmented by application, the food and beverages industry is expected to account for 41.8% of the market revenue in 2025, retaining its leadership among application areas. This dominance has been driven by rising consumer demand for nutrient dense, sustainable food options and the willingness of brands to innovate with alternative ingredients.

Product launches featuring insect-based flours, powders, and proteins in bakery, snacks, and beverage formulations have grown steadily, normalizing their presence in mainstream retail channels. The food and beverages industry has leveraged insects as a compelling narrative of sustainable consumption, aligning with broader trends in health, wellness, and environmental responsibility.

Improvements in taste, texture, and visual appeal of insect-enriched products have enhanced consumer acceptance, further solidifying this segment’s leading share in the market.

The insect-based ingredients market in 2024 and 2025 gained traction due to high protein density and its role as an alternative protein source for human and animal nutrition. Adoption was visible in sports supplements, bakery snacks, and feed formulations, driven by superior amino acid profiles and digestibility.

However, regulatory uncertainties and compliance costs restricted widespread market penetration, especially in Europe and Asia. Emerging trends centered on powdered formats, which improved integration into mainstream packaged foods and beverages. This approach created a strong opportunity for broader acceptance and expansion into consumer-driven product segments.

In 2024 and 2025, insect-based ingredients gained recognition for their superior protein content compared to conventional sources. Cricket powder and black soldier fly meal were widely used in dietary supplements and specialty nutrition bars to meet demand for high-quality protein in compact servings.

Their amino acid profile and digestibility positioned them as viable alternatives for sports nutrition and functional foods. Feed manufacturers also adopted insect meals for poultry and aquaculture, ensuring better protein conversion efficiency. This nutritional advantage placed insect-based ingredients in a strong position to serve both human and animal nutrition markets, fueling interest in further product development and inclusion.

The years 2024 and 2025 highlighted growing opportunities for incorporating insect-derived powders into everyday food products. Product developers launched bakery mixes, snack bars, and fortified beverages featuring cricket and mealworm protein blends. Early adoption in high-protein snacks showed encouraging consumer response, particularly in markets seeking sustainable yet functional protein sources.

These formats allowed companies to minimize the visual perception barrier often associated with whole insects, enhancing appeal. Expanding distribution through grocery retail and e-commerce platforms offers strong prospects for scaling these innovations. Mainstream integration of insect ingredients into recognizable product categories remains a clear opportunity for market penetration.

In 2024 and 2025 it was observed that inconsistent or evolving regulations significantly constrained insect‑based ingredient deployment. In various regions, including parts of Europe and Asia, approval for insect-derived powders or extracts in human food and feed was delayed or limited. A UK-based edible insect venture was reported to cease operations after regulatory ambiguity blocked product launches.

Similarly, in some EU markets only limited species were cleared for feed use. That regulatory uncertainty was noted to suppress entry into human food segments and restricted sourcing flexibility for ingredient suppliers. Unless clarity in approvals improves, expansion remains constrained by compliance and licensing challenges.

Throughout 2024 and 2025 it was noted that insect‑derived powders were increasingly incorporated into food and beverage formulations. Manufacturers launched cricket and black soldier fly flour variants tailored for bakery, snack, and protein bar applications. In Italy, the first cricket flour was authorized for human use, and powder‑based blends grew in visibility across health‑oriented outlets.

Product developers widely accepted that ingredient form as easier to blend and mask in recipes compared with whole insects. This trend presents a tangible opportunity for ingredient producers to scale through food and beverage innovation focused on powder formats.

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

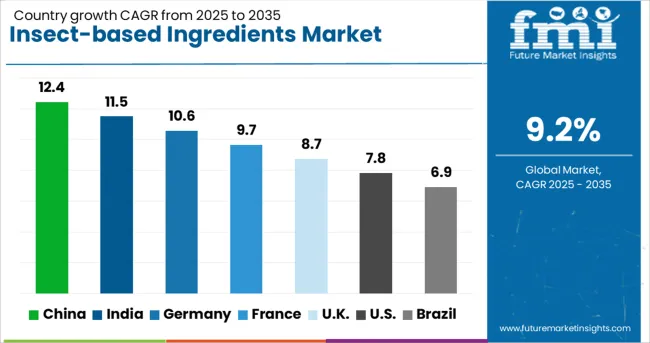

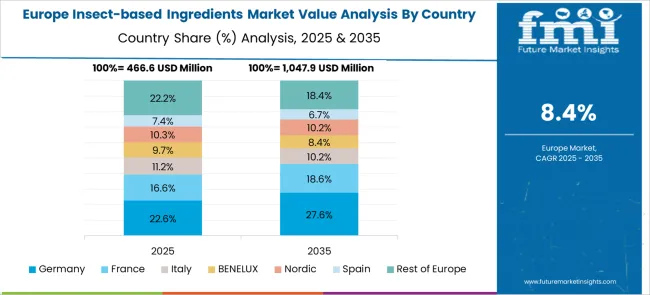

The global insect-based ingredients market is expected to grow at a CAGR of 9.2% from 2025 to 2035. China leads with 12.4%, followed by India at 11.5% and Germany at 10.6%. France records 9.7%, while the United Kingdom posts 8.7%. Growth is driven by increasing demand for alternative proteins, rising adoption in animal feed and food sectors, and sustainability-focused regulations. China and India dominate due to large-scale production capacities and feed industry integration. Germany emphasizes high-quality insect protein for aquaculture and pet food, while France and the UK prioritize premium insect-based food products and functional nutrition formulations.

China is projected to grow at 12.4%, supported by strong integration of insect protein in animal feed and pet food segments. Black soldier fly larvae dominate production for aquaculture and poultry applications. Manufacturers invest in automated farming systems to ensure scalability and cost efficiency. Expanding regulatory support for alternative proteins strengthens the country’s export capacity.

India is forecast to grow at 11.5%, driven by increasing use of insect protein in poultry feed and emerging applications in nutritional supplements. Cricket-based powders dominate health-oriented food formulations. Manufacturers focus on low-cost insect farming techniques to cater to local market affordability. Rising interest in functional snacks and protein bars accelerates industry expansion.

Germany is expected to grow at 10.6%, supported by demand for sustainable animal feed and premium pet food solutions. Insect meal enriched with essential amino acids dominates aquaculture and livestock sectors. Manufacturers invest in high-standard processing facilities to meet EU food safety norms. Development of organic-certified insect protein strengthens its application in premium markets.

France is projected to grow at 9.7%, driven by increased adoption in gourmet food and sports nutrition products. Edible insect powders dominate premium food innovations, including protein bars and bakery products. Manufacturers introduce flavored insect-based snacks to appeal to mainstream consumers. EU-backed research projects encourage development of novel insect protein applications in functional foods.

The UK is forecast to grow at 8.7%, driven by demand for alternative proteins in health-focused diets and pet food formulations. Mealworm protein dominates high-protein bars and baked goods. Manufacturers partner with health food brands for co-branded insect protein products. Online subscription models for insect-based snacks gain traction among eco-conscious consumers.

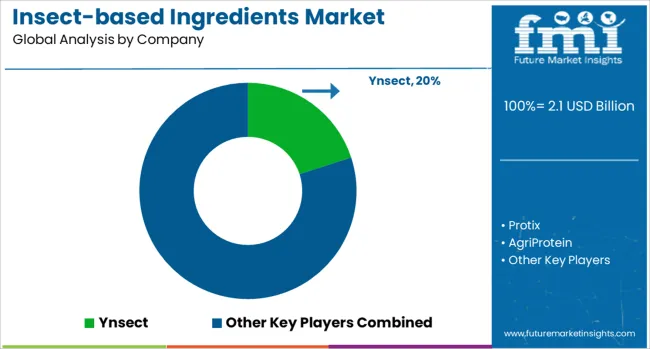

The insect-based ingredients market is moderately consolidated, with Ynsect recognized as a leading player holding a significant share through its large-scale vertical farming systems and advanced mealworm-based protein solutions. The company’s offerings cater to aquaculture, pet food, and fertilizer applications, supported by a strong R&D pipeline for human-grade protein products. Key players include Protix, AgriProtein, EnviroFlight, and Entomo Farms — all focusing on black soldier fly larvae and mealworm-based products for animal feed, food processing, and agricultural uses.

These companies emphasize high-protein, nutrient-dense ingredients designed to replace traditional protein sources while reducing environmental impact. Emerging players such as Six Foods, Bugsolutely, and Beta Hatch Source are targeting niche applications, introducing insect-based flours, snacks, and specialty food products for the human nutrition market. These brands leverage health and sustainability trends to attract environmentally conscious consumers.

Market growth is being driven by rising demand for sustainable protein alternatives, expansion of the aquafeed and pet food sectors, and growing regulatory approvals for insect-based products in Europe, North America, and Asia-Pacific. Leading players are investing in automation, scalable farming technologies, and integrated supply chains to ensure consistent quality and volume. Future opportunities lie in developing premium insect-derived oils, chitin for bioplastics, and fortified functional food ingredients, which are expected to further diversify the market landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Type | Insect Protein, Insect Oils, Insect Powder, and Insect Chitin |

| Application | Food & beverages industry, Animal feed industry, Cosmetics Industry, Pharmaceutical Industry, Agriculture (bioplastics, fertilizers, etc.), and Others (textile, biochemical) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ynsect, Protix, AgriProtein, EnviroFlight, Entomo Farms, Six Foods, Bugsolutely, AgriProtein, and Beta Hatch Source |

| Additional Attributes | Dollar sales by ingredient type (protein powders, oils, flours), Dollar sales by application (food, feed, cosmetics), regional demand trends, competitive landscape, consumer preference for high-protein sustainable options, integration with functional foods, innovations in AI-enabled farming and clean-label processing. |

The global insect-based ingredients market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the insect-based ingredients market is projected to reach USD 5.0 billion by 2035.

The insect-based ingredients market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in insect-based ingredients market are insect protein, _crude protein, _insect meal, _isolated protein, insect oils, _fatty acids, _omega-3 and omega-6 fatty acids, insect powder, _dried insect powder, _protein powder and insect chitin.

In terms of application, food & beverages industry segment to command 41.8% share in the insect-based ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Examining Savory Ingredients Market Share & Industry Leaders

Energy Ingredients Market Analysis by Product Type and Application Through 2035

Perfume Ingredients Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA