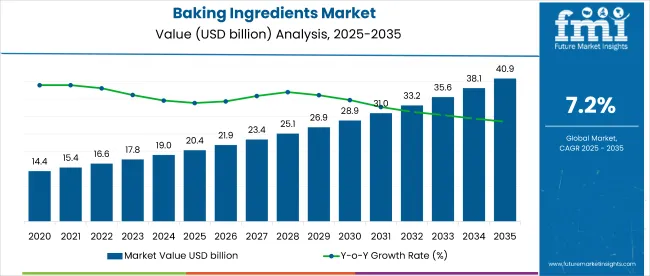

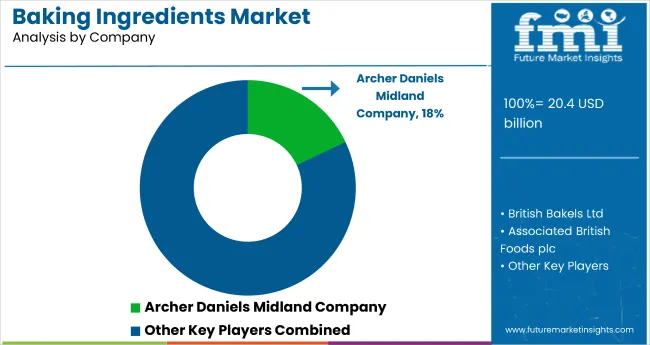

The global baking ingredients market is projected to grow from USD 20.4 billion in 2025 to USD 41.1 billion by 2035, registering a CAGR of 7.2%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 20.4 billion |

| Industry Value (2035F) | USD 41.1 billion |

| CAGR (2025 to 2035) | 7.2% |

The market expansion is being driven by growing consumer demand for convenience foods, clean-label products, and specialty bakery items. Health-conscious consumers are increasingly opting for organic, gluten-free, and sugar-free baked goods, prompting manufacturers to innovate with functional and fortified baking ingredients. Rapid urbanization, evolving dietary preferences, and rising disposable incomes in emerging economies are further accelerating market growth.

The market holds a significant position within its parent markets. It accounts for 100% of the bakery products market in terms of input reliance. Within the food ingredients market, it represents around 13%, owing to its widespread use in baked goods. In the processed food market, baking ingredients contribute nearly 7%, driven by the popularity of ready-to-eat and convenience bakery items. Within the food additives segment, it holds close to 4%, particularly due to leavening agents, emulsifiers, and preservatives. In the broader health & wellness food market, its share is modest, contributing around 2.5%.

Government regulations impacting the market focus on food safety, labeling, and quality standards. Agencies such as the Food Safety and Standards Authority of India (FSSAI), the USA Food and Drug Administration (FDA), and the European Food Safety Authority (EFSA) enforce strict norms on ingredient usage, nutritional disclosures, and allergen declarations.

Regulations like FSS (Packaging and Labelling) Regulations, 2011, and EU Regulation (EC) No. 1169/2011 on food information to consumers, are driving the adoption of clean-label and health-forward ingredients. These frameworks promote transparency and safety, encouraging manufacturers to use natural, non-GMO, and nutritionally beneficial baking ingredients to meet evolving consumer expectations and regulatory compliance.

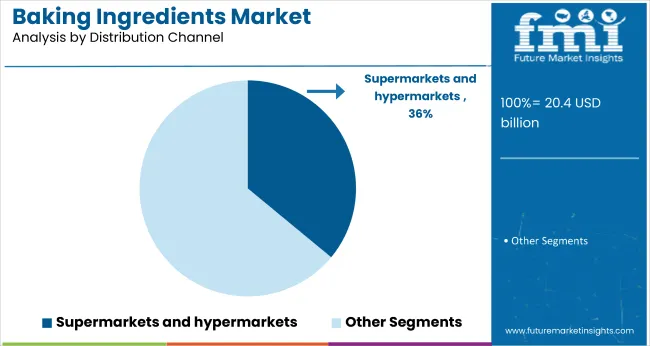

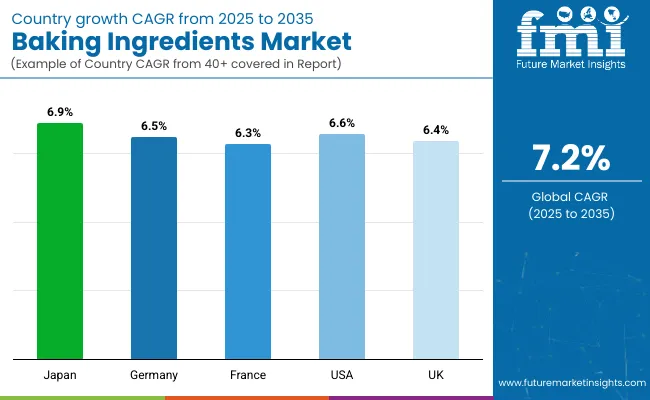

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6.9% from 2025 to 2035. Supermarkets & hypermarkets will lead the distribution channel segment with a 36% share, while bread will dominate the application segment with a 40% share. The UK and Germany markets are expected to grow steadily at CAGRs of 6.4% and 6.5%, respectively, while the USA and France are anticipated to expand at 6.6% and 6.5%, respectively.

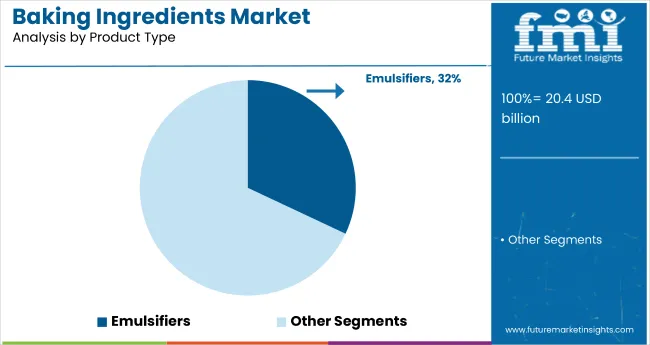

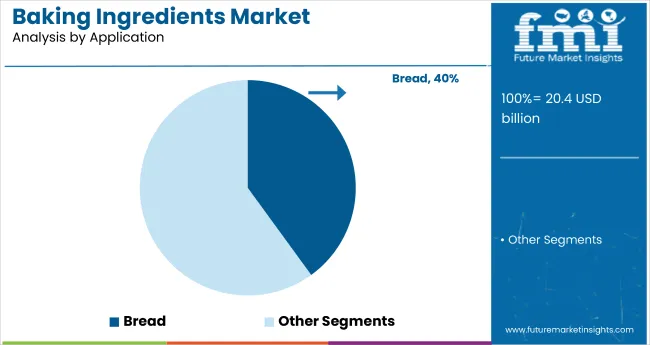

The market is segmented by product type, application, distribution channel, and region. By product type, the market includes emulsifiers, leavening agents, enzymes, baking powder & mixes, colours & flavours, and preservatives. In terms of application, the market is segmented into bread, biscuits & cookies, and cakes & pastries. Based on distribution channel, the market is classified into supermarkets & hypermarkets, specialty stores, convenience stores, and online retailing. Regionally, the market is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Emulsifiers are projected to dominate the product type segment with a 32% market share in 2025, driven by their role in enhancing texture, improving dough stability, and extending shelf life in baked goods.

Bread is projected to lead the application segment, capturing 40% of the global market share in 2025, driven by its staple status, high consumption, and rising demand for healthier bread varieties.

Supermarkets and hypermarkets are projected to lead the distribution channel segment with a 36% market share in 2025, supported by wide product availability, strong in-store promotions, and growing consumer preference for one-stop shopping experiences.

The global baking ingredients market is witnessing steady growth, fueled by rising consumer demand for convenience foods, premium baked goods, and clean-label formulations. Baking ingredients enhance product texture, flavor, and shelf life, playing a vital role in industrial and artisanal bakery production.

Recent Trends in the Baking Ingredients Market

Challenges in the Baking Ingredients Market

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

| Germany | 6.5% |

| France | 6.3% |

| USA | 6.6% |

| UK | 6.4% |

Japan demand is driven by the fusion of traditional and functional baking with high consumer interest in low-sugar and plant-based options. Germany and France show consistent demand growth, supported by clean-label regulations and artisanal baking traditions. Developed economies such as the USA (6.6% CAGR), UK (6.4%), and Japan (6.9%) are expected to expand at a stable 0.94-1.01x of the global growth rate.

Japan leads the market among the top five countries, driven by demand for functional, low-sugar, and premiumized products. The USA follows, with growth fueled by gluten-free, keto, and clean-label trends across industrial bakeries. Germany and France maintain strong market positions due to their focus on organic certification, enzyme-based improvers, and artisanal formats.

The UK records the slowest growth, shaped by demand for vegan, allergen-free, and bakery solutions. While Japan and the USA drive innovation, European markets emphasize clean-label reformulations, heritage baking, and plant-based alternatives, reflecting regional preferences and regulatory alignment with health and sustainability goals.

The report includes detailed analysis of over 40+ countries; five leading OECD markets are outlined below.

The Japan baking ingredients market is forecasted to grow at a CAGR of 6.9% from 2025 to 2035. Demand is rising due to the increasing use of low-calorie sweeteners, functional fibers, and enzyme-based emulsifiers in baked goods. Growth is reinforced by aging demographics, wellness preferences, and adoption of premium, value-added products.

The baking ingredients market in Germany is growing at a CAGR of 6.5% during the forecast period, slightly below the global average. The market is supported by the country’s emphasis on clean-label and organic certification. Germany continues to lead in sustainable sourcing of flour, fats, and leavening agents.

The French baking ingredients revenue is projected to expand at a CAGR of 6.3% from 2025 to 2035. Growth is led by artisanal baking formats, clean-label preferences, and reformulated ingredient systems to reduce fat and sugar content. France continues to innovate in heritage recipes with healthier alternatives and specialty fats.

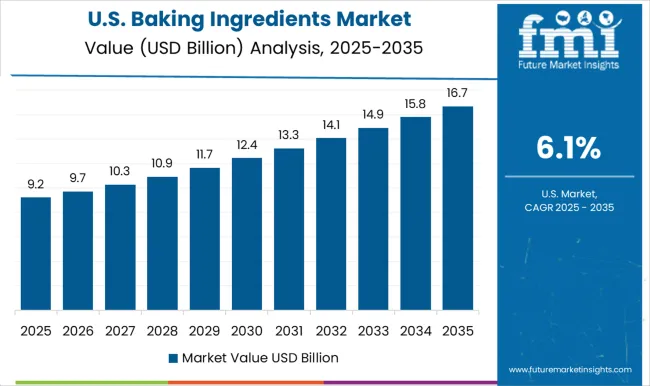

The USA baking ingredients market is anticipated to expand at a CAGR of 6.6% from 2025 to 2035, closely tracking the global pace at 0.97x. Market demand is fueled by the rapid adoption of gluten-free, keto-friendly, and clean-label baking solutions.

The UK baking ingredients revenue is forecasted to grow at a CAGR of 6.4% from 2025 to 2035, marking the slowest rate among the top five OECD markets at 0.94x the global average. Growth is shaped by allergen-free labeling, plant-based trends, and the rise of artisanal and sourdough baking.

The market is moderately consolidated, led by major players such as AAK AB, Associated British Foods plc, British Bakels Ltd, Archer Daniels Midland Company, and Cargill Inc. These companies offer a broad range of high-performance ingredients catering to artisanal, industrial, and retail bakeries worldwide.

AAK AB is known for its specialty fats and oils, while Associated British Foods plc provides yeast, enzymes, and functional flour blends. British Bakels Ltd focuses on innovative bakery mixes and emulsifiers. ADM and Cargill Inc. deliver large-scale, functional ingredients including sweeteners, stabilizers, and proteins.

Other key players such as E.I. du Pont de Nemours and Co., BASF SE, and Kerry Group Plc. contribute with enzyme systems, clean-label solutions, and plant-based substitutes. Ajinomoto Corporation Inc., Dawn Food Products, and Lonza Group AG continue to innovate in texture-enhancing additives, shelf-life extenders, and nutritional fortification for the evolving global bakery landscape.

Recent Baking Ingredients Industry News

In June 2023, Ardent Mills launched Egg Replace™ and Ancient Grains Plus™ to address supply challenges, support customer innovation, and meet rising demand for functional, high-quality baking ingredient solutions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 20.4 billion |

| Projected Market Size (2035) | USD 41.1 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Type Analyzed | Emulsifiers, Leavening Agents, Enzymes, Baking Powder & Mixes, Colours & Flavours, and Preservatives. |

| Application Analyzed | Bread, Biscuits & Cookies, and Cakes & Pastries |

| Distribution Channel Analyzed | Supermarkets & Hypermarkets, Specialty Stores, Convenience Stores, and Online Retailing |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | AAK AB, Associated British Foods plc, British Bakels Ltd, Archer Daniels Midland Company, Cargill Inc., E. I. du Pont de Nemours and Co., BASF SE, Kerry Group Plc., Ajinomoto Corporation Inc., Dawn Food Products, Lonza Group AG |

| Additional Attributes | Dollar sales by product type, category-wise market share, distribution channel trends, regional demand analysis, consumer behavior, competitive benchmarking |

The global baking ingredients market is estimated to be valued at USD 20.4 billion in 2025.

The market size for the baking ingredients market is projected to reach USD 40.9 billion by 2035.

The baking ingredients market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in baking ingredients market are emulsifiers, leavening agents, enzymes, baking powder & mixes, colours & flavours and preservatives.

In terms of application, bread segment to command 47.2% share in the baking ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Baking and Cooking Paper Market Size and Share Forecast Outlook 2025 to 2035

Baking Molds And Trays Market Size and Share Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Baking Soda Substitute Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Market Share Breakdown of the Baking and Cooking Paper Market

Baking Paper Market

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Bean Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Milk Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Malt Ingredients Market Analysis by Raw Material, Product Type, Grade, End-use, and Region through 2035

Aroma Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pulse Ingredients Market Analysis – Size, Share, and Forecast 2025 to 2035

Smoke Ingredients for Food Market Analysis - Size, Share & Forecast 2025 to 2035

Bakery Ingredients Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Biotin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Savory Ingredients Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA