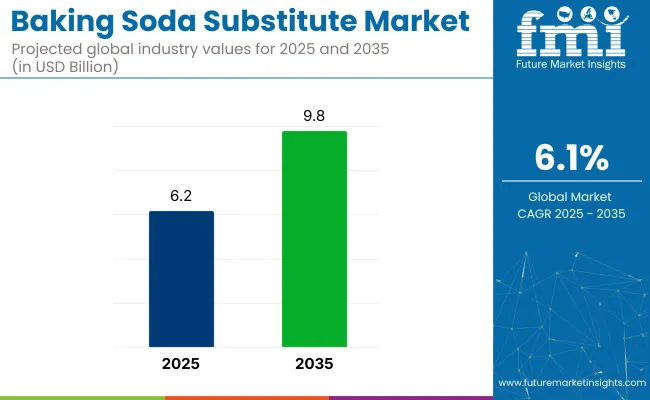

The baking soda substitute market is projected to reach a valuation of USD 6.2 billion in 2025 and is expected to grow to USD 9.8 billion by 2035. This expansion reflects a steady CAGR of 6.1% between 2025 and 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.2 billion |

| Market Value (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 6.1% |

This share is expected to expand gradually due to increasing preference among both industrial and household bakers for sodium-free or low-sodium substitutes to conventional baking soda. As health risks associated with excess sodium intake become more evident, demand is shifting toward ingredients that perform leavening functions without the adverse nutritional impact.

The baking soda substitutes market holds an estimated 5-7% share within the global leavening agents market, reflecting its niche but growing relevance as demand for non-sodium and clean-label alternatives increases. Within the broader bakery ingredients market, its share remains limited, around 1-2%, as traditional baking soda still dominates usage.

In the food additives market, spanning preservatives, emulsifiers, and leavening agents, product account for less than 0.5%. Their share in the clean-label ingredients segment is around 2-3%, driven by consumer interest in recognizable, non-chemical-sounding components. Within the food ingredients market, their presence is minimal, estimated at under 0.1%, but the segment is gradually expanding due to health concerns around sodium and synthetic food chemicals.

Consumer awareness regarding the side effects of overconsumption of sodium bicarbonate, such as hypokalemia, hypernatremia, kidney strain, and cardiovascular complications, has grown considerably in the last five years. This has driven food producers and end-users to explore viable alternatives. The use of potassium-based and ammonium-based compounds has gained traction, especially among consumers managing high blood pressure or other cardiovascular conditions.

The segment of health-conscious consumers seeking clean-label bakery products has remained instrumental in shaping product innovation and ingredient reformulation. In Aug, 2022 WASHINGTON, Agriculture Secretary Tom Vilsack announced details of the USA Department of Agriculture’s USD 300 million investment, including with American Rescue Plan funds, in a new organic transition initiative that will help build new and better markets and streams of income for farmers and producers.

The baking soda substitute market is segmented by form into powder and liquid. By product type, segmentation includes baking powder, potassium bicarbonate, yeast, eggs, and other. By end use application, the categories are household, foodservice, and food industry.

By sales channel, the market is divided into offline including supermarkets/hypermarkets, departmental stores, convenience store, and other sales channel, and online including company website and e-commerce platform. By region, the market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

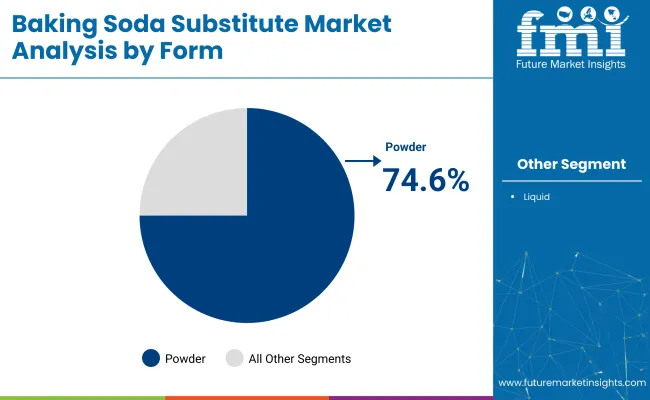

The powder segment is expected to dominate the market by form, accounting for 74.6% of the market share in 2025. This dominance is attributed to the widespread use of powdered leavening agents such as baking powder and potassium bicarbonate across commercial and household baking applications.

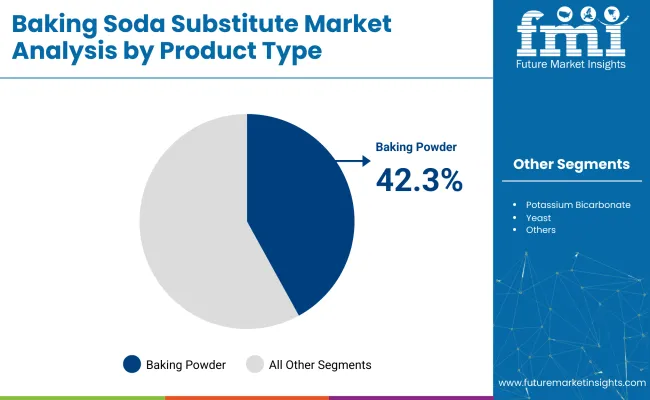

Baking powder is expected to lead the market by product type, capturing a projected market share of around 42.3% Share in 2025. This leading position is driven by its functional similarity to baking soda, ease of use in both home and industrial baking, and consistent leavening effect across a wide range of recipes.

The food industry segment is expected to account for the largest share in the market, holding approximately 51.8% of total demand by end-use application. This dominance is being driven by the extensive use of leavening agents in large-scale production of bakery goods, snacks, and ready-to-eat products.

Offline sales channels are expected to lead the market, capturing approximately 64.7% of total market share in 2025.

The market is growing due to rising health awareness, dietary restrictions, and clean-label trends, with consumers seeking allergen-free, organic, and functional alternatives. E-commerce growth and sustainability-driven innovations further fuel demand for diverse, eco-friendly substitutes in both home and commercial baking.

Rising Health Awareness Among Dietary Restrictions

The market is witnessing strong growth due to increasing consumer preference for natural, allergen-free, and clean-label ingredients. As health awareness rises, particularly among those with dietary restrictions such as gluten intolerance, allergies, or vegan lifestyles, substitutes like potassium bicarbonate, baking powder, egg whites, and yogurt are gaining popularity

Growing Demand for Baking Ingredients

The market is ripe with opportunities driven by evolving consumer lifestyles and sustainability trends. As more individuals shift toward clean-label, plant-based, and health-conscious diets, there is a growing demand for baking ingredients that align with these values.

This opens up space for innovation in functional substitutes that offer enhanced nutritional benefits, such as calcium-enriched or low-sodium alternatives. Companies can leverage these trends to introduce differentiated products tailored to specific dietary needs, including gluten-free, keto, or vegan-friendly baking mixes.

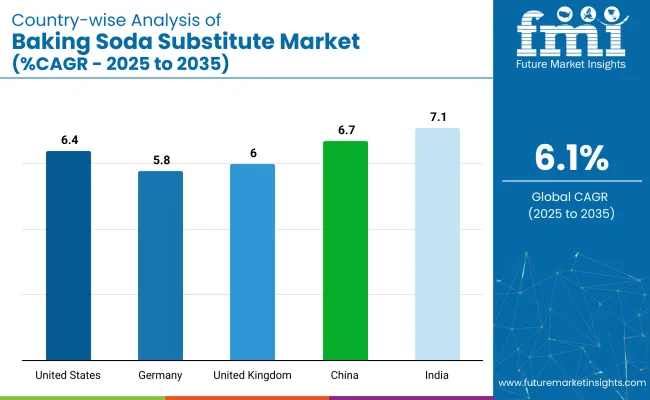

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

| Germany | 5.8% |

| United Kingdom | 6.0% |

| China | 6.7% |

| India | 7.1% |

The baking soda substitute market, projected to grow at a global CAGR of 6.1% from 2025 to 2035, is experiencing varying growth rates across key countries. The United States, with a CAGR of 6.4%, is leading the growth due to its strong demand for products in food, healthcare, and cleaning sectors.

Germany follows closely with a 5.8% CAGR, reflecting steady growth driven by the expanding demand in the food and pharmaceutical industries. The United Kingdom is exhibiting a 6.0% CAGR, supported by stable consumer demand and increasing adoption in health and wellness applications.

China, with a 6.7% CAGR, is seeing the highest growth in the market, driven by growing consumer awareness and a rising demand for eco-friendly and chemical-free alternatives in both food and household products. India, exhibiting a 7.1% CAGR, represents the fastest-growing market, with an emerging trend towards natural and sustainable products, fueled by an expanding middle class and rising disposable incomes.

The report includes a detailed analysis of over 40 countries, with the top five countries highlighted for reference.

The USA baking soda substitute market is estimated to grow at a CAGR of 6.4% between 2025 and 2035.The growing demand for natural, health-conscious, and multi-purpose alternatives to traditional products is driving the market. Consumers are becoming more inclined towards sustainable, eco-friendly solutions for cleaning, personal care, and even baking.

The rise in awareness about the potential health concerns associated with excessive sodium bicarbonate consumption is also influencing this trend. As organic products gain momentum in the USA, many people are opting for product derived from natural and plant-based ingredients.

Demand for baking soda substitute in China is likely to grow at a CAGR of 6.7% during the forecast period. A key driver behind this growth is the rising consumer interest in health and wellness products, particularly among the younger demographic.

The growing middle class in China is also shifting towards premium, health-conscious, and organic alternatives to traditional chemicals used in daily activities, including baking, cleaning, and personal care. The Chinese government’s policies promoting a healthier lifestyle and environmental consciousness are pushing consumers toward safer and more natural products.

Sales of baking soda substitute in India is projected to grow at a CAGR of 7.1% from 2025 to 2035. As the Indian population becomes more urbanized and the middle class expands, there is a growing shift towards healthier lifestyles and natural products. Indian consumers are increasingly seeking alternatives that offer health benefits, particularly with concerns over synthetic chemicals in everyday products.

This trend is not only seen in the food and beverage industry but also in personal care, cleaning, and wellness products. The rapid growth of online shopping platforms is making these substitutes more accessible to a wider consumer base. India’s growing awareness of environmental sustainability is contributing to the shift towards eco-friendly alternatives.

The Germany baking soda substitute market is estimated to grow at a CAGR of 5.8% during the forecast period. Germany has long been a leader in sustainability and eco-conscious consumer behavior, making it an ideal market for the growth of baking soda substitutes.

As consumers become more mindful of their health and the environment, the demand for natural and chemical-free alternatives to traditional products is on the rise. The German government’s strict environmental regulations, including those on the use of hazardous chemicals in household products, are also spurring the use of safer substitutes.

Demand for baking soda substitute in the United Kingdom is set to record a CAGR of 6% during the forecast period with a growing emphasis on sustainability, health, and wellness, UK consumers are increasingly opting for natural alternatives to traditional baking soda. This is especially true in sectors such as food, cosmetics, and household cleaning, where demand for eco-friendly and non-toxic products has surged.

The popularity of plant-based and organic diets in the UK is driving the need for baking soda substitutes in food preparation. The rise of online shopping and e-commerce platforms has also played a crucial role in providing easier access to these products.

The market is propelled by established industry leaders and emerging innovators in the sector. Key players such as Bob’s Red Mill Natural Foods, Cargill, Inc., and Archer Daniels Midland Co. are at the forefront with a diverse range of natural and allergen-free ingredients that cater to health-conscious consumers.

Companies like Weikfield Products Co. Pvt. Ltd and Corbion N.V. are enhancing product formulations with clean-label options, while AB Mauri and LesaffreetCompagnie focus on providing scalable, functional substitutes for the food and baking industries.

Innovations in organic and low-sodium alternatives by Koninklijke DSM N.V. and Lallem and Inc. align with growing consumer preferences for health-forward baking solutions. Kudos Blends Limited and Associated British Foods PLC (ABF) continue to meet the demand for versatile and eco-friendly substitutes in both commercial and home baking applications.

Recent Baking Soda Substitute Industry News

In March 2025, ADM group acquired Indicia Worldwide to transform the Global Marketing activation model, enabling and enhancing sustainable ROI for clients

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 6.2 billion |

| Projected Market Size (2035) | USD 9.8 billion |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and volume in kilo tons |

| Form Analyzed (Segment 1) | Powder And Liquid. |

| Product Type Analyzed (Segment 2) | Baking Powder, Potassium Bicarbonate, Yeast, Eggs, And Other. |

| End Use Application Analyzed (Segment 3) | Household, Foodservice, And Food Industry. |

| Sales Channel Analyzed (Segment 4) | Offline (Supermarkets/Hypermarkets, Departmental Stores, Convenience Store, And Other Sales Channel) And Online (Company Website And E-Commerce Platform). |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | BHS Specialty Chemical Products, Bob’s Red Mill Natural Foods, Archer Daniels Midland Co., Cargill, Inc., Weikfield Products Co. Pvt. Ltd., Corbion N.V., AB Mauri, Koninklijke DSM N.V., Lesaffre et Compagnie, Lallem and Inc., Kudos Blends Limited, and Associated British Foods PLC (ABF). |

| Additional Attributes | Dollar sales, market share, growth trends, consumer preferences, competitive landscape, regional demand, pricing strategies, and the impact of health-conscious trends on product formulation. |

The industry is segmented into powder and liquid.

The industry is segmented into baking powder, potassium bicarbonate, yeast, eggs, and other.

The industry finds applications in household, foodservice, and food industry.

The industry is segmented into offline (supermarkets/hypermarkets, departmental stores, convenience store, and other sales channel) and online (company website and e-commerce platform).

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 6.2 billion in 2025.

It is forecasted to reach USD 9.8 billion by 2035.

The industry is anticipated to grow at a CAGR of 6.1% during this period.

Powder forms are projected to lead the market with a 74.6% share in 2025.

Asia Pacific, particularly the India, is expected to be the key growth region with a projected growth rate of 7.1%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baking and Cooking Paper Market Size and Share Forecast Outlook 2025 to 2035

Baking Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Baking Molds And Trays Market Size and Share Forecast Outlook 2025 to 2035

Baking Tools Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of the Baking and Cooking Paper Market

Baking Paper Market

Home Baking Ingredients Market Growth - Consumer Trends 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soda Ash Market Size and Share Forecast Outlook 2025 to 2035

Soda Maker Market Size and Share Forecast Outlook 2025 to 2035

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Craft Soda Market Analysis by Flavor, Packaging, Distribution Channel, and Region Forecast Through 2035

Prebiotic Soda Market Analysis by Type, Packaging, Flavor and Distribution Channel Through 2035

Low- and No-calorie Soda Market Analysis by Product Type and Region through 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Dura Substitutes Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Sugar Substitute Market Trends - Low-Calorie Sweeteners & Demand 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Gelatin Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA