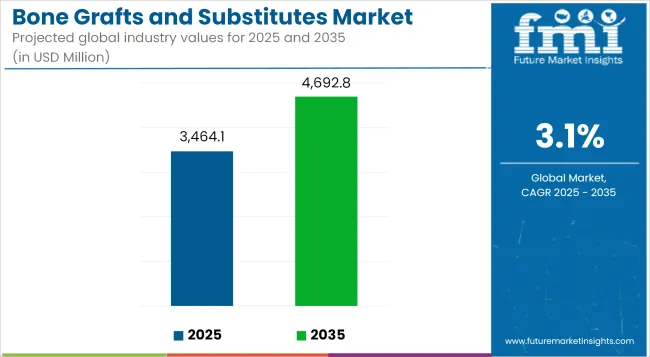

The bone grafts and substitutes market is estimated to reach USD 3,464.1 million in 2025. It is estimated that revenue will increase at a CAGR of 3.1% between 2025 and 2035. The market is anticipated to reach USD 4,692.8 million by 2035.

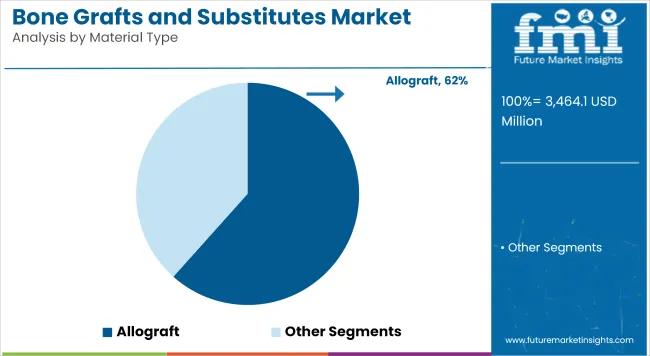

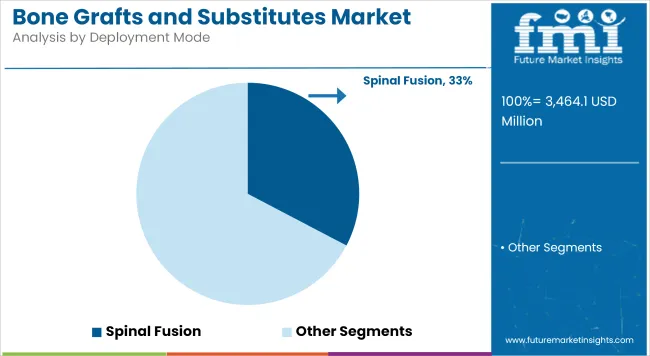

The bone graft and substitute are used to repair, regenerate, or replace damaged bone in medical procedures. Grafts are used in joint reconstruction, trauma repair etc. Among all the application spinal fusion dominated the market. Allograft are the most widely use material type.

The rising prevalence of degenerative diseases in young population is the fueling the adoption of bone grafts. The main cause for it has been found to be sedentary lifestyle. The trend of personalized medicine has also revolutionized the bone graft market. Biocompatible graft with dimension specific to patient requirement are demanded.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 3,320.6 million |

| Estimated Size, 2025 | USD 3,464.1 million |

| Projected Size, 2035 | USD 4,692.8 million |

| Value-based CAGR (2025 to 2035) | 3.1% |

Degenerative disc disease were traditionally only associated with the aging population. But are now being diagnosed in younger individuals. Sedentary lifestyles is the main cause. Degenerative disease accelerate the wear and tear on bones joints. Surgical interventions like joint reconstruction are required to address this challenge. Advances in diagnostic imaging have also led to earlier identification and treatment further driving the demand for bone grafts and substitutes.

With increased participation in high-impact sports fractures, ligament tears, and joint damage, have become more common. Similarly, rising trauma cases from vehicular accidents, industrial mishaps have also increased. Bone graft substitutes to stabilize and reconstruct damaged bone are required. Technological advancements in synthetic grafts, demineralized bone matrices (DBMs), and biologics have improved patient outcomes. They offer better biocompatibility and faster healing.

Complex cases, for example, large bone defects or spinal deformities, demand anatomical and physiological needs. Advanced technologies such as 3D imaging, computer-aided design (CAD), and 3D printing allow custom grafts to be designed and fabricated, thereby improving surgical precision and patient outcome.

Despite these drivers and opportunities, market challenges are prominent, especially a high cost advanced bone graft substitute. Products in the form of BMPs and tissue-engineered scaffolds involve elaborate biotechnology processing, strict quality controls, as well as investment in R&D, which puts a high tag on production cost. Overcoming cost challenges, as well as improving accessibility will be critical in maximizing the scope of this market.

The below table presents the expected CAGR for the global bone grafts and substitutes market over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.1%, followed by a slightly lower growth rate of 3.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.1% |

| H2(2024 to 2034) | 3.5% |

| H1(2025 to 2035) | 3.1% |

| H2(2025 to 2035) | 2.8% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.1% in the first half and remain relatively moderate at 2.8% in the second half. In the first half (H1) the market witnessed a decrease of 100 BPS while in the second half (H2), the market witnessed a decrease of 70 BPS.

A description of the leading segments in the industry is provided in this section. The material type segment held 61.2% of the value share in 2025. Based on the deployment mode, spinal fusion held 32.7% of the market in 2025.

| Material Type | Value Share (2025) |

|---|---|

| Allograft | 61.6% |

The allograft has several exclusive advantages in the application in orthopedics and dentistry. Allografts are made from human donors. As a result, they provide a natural bone matrix that closely matches the structural and biochemical characteristics of bone. They are thus highly effective for bone regeneration.

Allografts obviate the need for a second surgical site as is needed with autografts. This advantage has made them the preferred choice. There have been advancement in the demineralization and sterilization techniques. These advancement ensure that allografts are biocompatible.

Due to the increased occurrence of fractures demand for bone grafts is increasing. They support the regeneration of damaged tissue. Allografts are becoming increasingly important in dental implants where they aid in the restoration of bone structure.

These applications highlight the significant contribution of allografts to these expanding medical fields. Additionally, the aging population around the globe and increased rates of sport-related injuries and accidents have further spurred the demand for an effective bone graft solution.

| Deployment Mode | Value Share (2025) |

|---|---|

| Spinal Fusion | 32.7% |

Spinal fusion procedures are widely performed to treat various spinal conditions. These condition ranges from degenerative disc disease to spinal stenosis. Rise in the elderly population is main contributor to increasing prevalence. Aging leads to wear and tear in the spine. Due to which older adults more prone to degenerative spinal issues. The growing incidence of lifestyle-related disorders increases need for spinal fusion surgeries. Because such condition exacerbate spinal problems.

Technological advancements in bone graft substitutes have further fueled market growth in this segment. Synthetic bone grafts, demineralized bone matrices (DBMs), and other innovations within the market have improved surgical outcomes.

Biocompatible product offering reduced infection risks and faster recovery times are the main factor which drives the product adoption. These advanced materials are often used in spinal fusion procedures to promote bone healing ensuring long-term stability of the spine.

Rising Prevalence of Early-Onset Degenerative Conditions has driven the Industry Growth

Osteoarthritis, degenerative disc disease, and spinal stenosis have been conventionally perceived to afflict populations of advanced years; today, lifestyle and environmental as well as genetic factors combine in various negative ways to create diagnoses even among much younger populations.

The modern sedentary lifestyle is one important contributor. It has brought on the prevalence of an earlier onset of musculoskeletal issues, such as spinal disorders, due to long hours sitting, poor postures, and lack of physical activities. Long-term sitting creates high pressure on intervertebral discs leading to herniated discs with chronic lower back pain. The degeneration can require surgical intervention in the form of spinal fusion, which requires bone grafts to stabilize the spine and encourage the healing process.

Another factor that accelerates degenerative conditions is obesity. Excess body weight increases stress on weight-bearing joints, such as the knees and hips, accelerating the breakdown of cartilage and bone. As more people globally become obese, the number of joint reconstruction surgeries is being performed at an earlier age, thereby boosting demand for bone graft substitutes in knee and hip replacement surgeries.

Sports or physically demanding occupations leads to early degeneration among younger groups. For instance, athletes have a higher tendency to get cartilage wear and ligament injuries which if not treated appropriately will lead to early osteoarthritis. Likewise, laborious professions mostly face overuse and destruction of the joints which sometimes require surgical treatments with the help of bone graft materials.

Growing Sports and Recreational Activities fuels Bone Grafts and Substitutes Industry Growth

Growing sports and recreational activities has led to higher rate of fractures, ligament tears, and joint damage. More complex injuries, including those with bone loss or non-union fractures that cannot heal without medical intervention, will also be expected from high-impact sports and extreme physical activities.

For example, most athletes experiencing severe fractures or structural damages need to be taken through the bone grafting procedure to have their bones take their natural course and time to heal to regain functionality again.

An increase in trauma cases because of vehicle accidents, industrial accidents, and natural calamities is also considered a driving force for bone grafts. These result in severe defects or loss-defective bones of load-bearing bones like the femur, tibia, and pelvis, which need immediate stabilization and reconstruction.

Indications like open fractures, comminuted fractures, and non-union conditions require the need for bone graft substitutes such as DBMs, synthetic grafts, and BMPs. These materials not only offer quickened recoveries but also reduce infection rates, making them indispensable during trauma.

Growth of the market is further supported by the technological advancements in bone graft materials. Inventions such as bioactive ceramics, calcium phosphate-based substitutes, and hybrid grafts offer better biocompatibility, better integration, and faster healing times. The increasing incidence of sports injuries coupled with technological advancements acts as a catalyst for the growth of the bone graft and substitute market.

Personalized and Patient-Specific Solutions Offers an Untapped Opportunity for Market Growth

The bone graft and substitute market has been growing with the ever-increasing need for personalized, patient-specific solutions as healthcare strives to move to personalized medicine to improve both surgical outcomes and patient satisfaction.

Personalized solutions may be particularly essential in cases involving complex fractures, congenital bone defects, spinal deformities, or oncology-related bone loss. The anatomy in many of these applications is so challenging that standard off-the-shelf bone grafts cannot adequately match the specific bone anatomy. Personalized grafts meets anatomical and physiological needs of specific patient.

New generations of high-resolution imaging techniques allow surgeons to make highly accurate digital models of the patient's bone structure. Using that information grafts are fabricated to exactly match the anatomy of the patient. These customized grafts improve implant fit and stability, decrease surgical time, and enhance the healing process by providing a scaffold that closely replicates the patient's natural bone.

These tailored bone grafts are highly prized in the repair of large bone defects due to traumatic incidents or cancer resection, where failure because of a lack of perfect fit has been known to produce complications. For spinal fusion surgeries, customized grafts can model singular curvatures or fix deformities with greatly enhanced long-term stability and patient mobility. Thus, investing in personalized solutions makes companies better poised to drive innovation.

High Manufacturing and Development Cost Hinder the Market Growth

High costs prevent enhanced bone graft substitutes from being accepted in general. Synthetic grafts, DBMs, and biologics such as BMPs are costlier than traditional autografts or allografts. The price disparity presents a challenge to the cost-sensitive healthcare market.

BMPs and tissue-engineered scaffolds involve state-of-the-art biotechnology manufacturing processes, and quality control needs to be rigorously performed. Advanced recombinant DNA technology increases the production costs of BMPs. Bioactive ceramics or composite synthetic grafts are developed to mimic both the mechanical and biological properties of natural bone. The research and development of such a product needs quite substantial investment.

Other than manufacturing, clinical trials, regulatory approvals, and post-marketing surveillance also add to the cost. Extensive testing to prove the safety, efficacy, and long-term outcomes of products from the companies requires much time and cost. The cost is many times passed on to healthcare providers and ultimately to patients.

The high cost of advanced grafts also impacts surgeons' preferences. In cost-conscious healthcare settings, surgeons may opt for more affordable options. Addressing this challenge requires efforts to reduce production costs through technological advancements and economies of scale.

Companies can also focus on improving reimbursement frameworks by providing compelling clinical and economic evidence to healthcare payers. Introducing tiered pricing models for cost-sensitive markets can help market growth.

The bone grafts and substitutes industry recorded a CAGR of 2.2% between 2020 and 2024. According to the industry, bone grafts and substitutes generated USD 3,360.5 million in 2024, up from USD 3,012.4 million in 2020.

Autografts represented the gold standard in bone grafting. While excellent biocompatibility and integration are usually involved, they also involve some kind of donor site morbidity, limited supply, and increased surgical time. This gave rise to the development of allografts as a substitute to reduce the need for secondary surgeries, but these introduced risks such as disease transmission and immune rejection.

Thus, synthetic bone graft substitutes and biologics have recently characterized the market. Due to customizability, availability, and decreased risks of infection, various synthetic materials being tried and popularizing their use in clinics include hydroxyapatite, beta-tricalcium phosphate, and bioactive glasses. In this way, demineralized bone matrices and BMPs are highly sought-after biologics since they aid in osteoinduction and the formation of osteogenesis.

Minimally invasive techniques in surgical procedures are based on advanced bone graft substitutes, ensuring shorter convalescence and therefore improved patient outcomes. Further, the new development of 3D printing and tissue engineering enables patient-specific grafts to be made, thereby enhancing the precision of surgery and improving the rate of success.

Looking ahead, the market is poised to gain from ongoing innovation in regenerative medicine. Lateral innovations combining nanotechnology with stem cell-based therapies and bioengineered scaffolds hold great promise for enhancing the performance of grafts and patient outcomes.

Companies in the Tier 1 sector account for 52.0% of the global market, ranking them as the dominant players in the industry. Tier 1 players’ offer a wide range of product and have established industry presence. Having financial resources enables them to enhance their research and development efforts and expand into new markets.

A strong brand recognition and a loyal customer base provide them with a competitive advantage. Prominent companies within Tier 1 include Medtronic, Stryker Corporation, DePuy Synthes Inc., Johnson & Johnson, NuVasive Inc., and others

Tier 2 players dominate the industry with a 34.8% market share. Tier 2 firms have a strong focus on a specific Product and a substantial presence in the industry, but they have less influence than Tier 1 firms. The players are more competitive when it comes to pricing and target niche markets. New Product and services will also be introduced into the industry by Tier 2 companies. Tier 2 companies include Smith & Nephew, Baxter, Zimmer Biomet, Orthofix Holdings Inc., and others.

Compared to Tiers 1 and 2, Tier 3 companies have smaller revenue spouts and less influence. Those in Tier 3 have smaller work force and limited presence across the globe. Prominent players in the tier 3 category are Allosource, TBF Tissue Engineering, SeaSpine, MedBone Biomaterial and others.

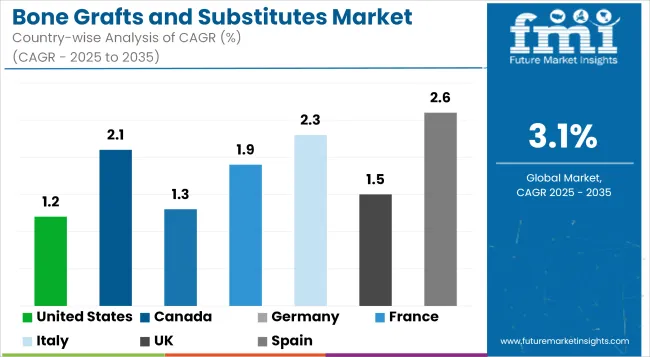

The section below covers the industry analysis for the bone grafts and substitutes for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA), is provided.

The United States is anticipated to remain at the forefront in North America through 2035. India is projected to witness a CAGR of 5.1% from 2025 to 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.2% |

| Canada | 2.1% |

| Germany | 1.3% |

| France | 1.9% |

| Italy | 2.3% |

| UK | 1.5% |

| Spain | 2.6% |

| China | 4.9% |

The United States has one of the largest aging populations in the world, and this demographic is most susceptible to degenerative spine conditions. These conditions often involve surgical interventions, such as spinal fusion, leading to the necessity for bone grafts and substitutes. Lifestyle factors, such as obesity and sedentary behavior, widespread in the USA, also cause an increase in spinal disorders and further the need for corrective procedures.

Advanced medical technologies in the United States are adopted extensively. The incorporation of innovative synthetic bone grafts, demineralized bone matrices (DBMs), and biologics like bone morphogenetic proteins (BMPs) into surgery has helped alter the appearance of surgical results and made surgery more efficient as well as reduces the recovery period.

These same technologies are similarly frequently used during spinal surgeries since there is significant demand for appropriate bone healing as well as a solid structural reconstruction.

The United States healthcare system also catalyzes the expansion of the market. It provides strong reimbursement policies for spinal surgeries, rendering this kind of operation affordable for a patient and consequently resulting in increased demand for grafting solutions.

Germany is a world leader in the advanced solutions of spinal and orthopedic surgeries. The country has a very strong medical R&D ecosystem, which helps in developing and commercializing the state-of-the-art bone graft substitutes like synthetic grafts, demineralized bone matrices (DBMs), and bioactive materials.

Germany is among the most advanced and well-funded healthcare systems in Europe, making the innovative use of surgical products and techniques possible among the majority. The healthcare sector has focused more on orthopedic reconstruction surgeries.

Due to the rising incidence of bone degenerative conditions. Especially among the aging population of Germany. The population of elderly individuals in Germany is high leading to growing burden of osteoporosis, arthritis, etc. Such conditions necessitate a huge requirement for bone grafts and substitutes in surgeries like spinal fusion and joint reconstruction.

Attention to precision medicine and patient-specific solutions in the country further increases the market.

The demographic of elderly populations in Japan ranks the highest proportion globally. A change in demographic trends has therefore increased the level of degenerative bone diseases within that region. Hence, the incidence of surgical intervention, such as spinal fusion also increased. Consequentially, the demand for bone graft and substitutes is therefore experiencing a steady upward trend within that country.

Japan is embracing minimally invasive surgical approaches. These methods are applied for spinal and joint reconstruction. To this end, there is an absolute need for good-quality bone graft substitutes. The benefits provided by minimally invasive surgeries range from shorter periods of recovery time and less post-operative pain, and thus, become very attractive options for elderly patients.

The Japanese healthcare system is highly focused on precision treatments using the integration of innovative medical technologies. The country has adopted synthetic grafts, demineralized bone matrices (DBMs), and recombinant growth factors. These innovative products enhance surgical efficiency. These advancements are in line with Japan's commitment to providing high-quality healthcare.

Key players are focusing on developing bioactive synthetic grafts that have enhanced bone-forming capabilities. These products will cater to a wide range of orthopedic and spine procedural needs. There is also a shift toward improving product ease of use. Reducing environmental impact is active trend in the market. With next-generation antibiotic-eluting bone graft substitutes being introduced. Many companies are working on obtaining regulatory clearances for their products.

The trend indicates increasing competition in offering tailored solutions that provide both functional benefits and superior performance. The key therapeutic area are bone injury management and musculoskeletal system applications.

Recent Industry Developments in the Bone Grafts and Substitutes Market

In terms of material type, the industry is segmented into allograft and synthetic

In terms of deployment mode, the industry is bifurcated into craniomaxillofacial, dental, foot & ankle, joint reconstruction, long bone and spinal fusion

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, the Middle East, and Africa have been covered in the report.

Bone grafts and substitutes market is expected to increase at a CAGR of 3.1% between 2025 and 2035.

The allograft segment is expected to occupy 61.6% market share in 2025.

The market for bone grafts and substitutes is expected to reach USD 4,692.8 million by 2035.

The United States is forecast to see a CAGR of 1.2% during the assessment period.

The key players in the bone grafts and substitutes industry include Allosource, DePuySynthes Inc., Baxter, NuVasive Inc., Smith & Nephew, Medtronic, Orthofix Holdings Inc., TBF Tissue Engineering, Stryker Corporation, OrthoFix Medical Inc., MedBone Biomaterial, SeaSpine and Others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2015 to 2032

Table 2: Global Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 4: North America Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 5: North America Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 6: North America Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 8: Latin America Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 9: Latin America Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 11: Europe Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 12: Europe Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 13: East Asia Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 14: East Asia Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 15: East Asia Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 16: South Asia Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 17: South Asia Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 18: South Asia Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 20: Oceania Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 21: Oceania Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 23: MEA Market Value (US$ Million) Forecast by Material Type, 2015 to 2032

Table 24: MEA Market Value (US$ Million) Forecast by Deployment Mode, 2015 to 2032

Figure 1: Global Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2015 to 2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 10: Global Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 13: Global Market Attractiveness by Material Type, 2022 to 2032

Figure 14: Global Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 15: Global Market Attractiveness by Region, 2022 to 2032

Figure 16: North America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 17: North America Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 18: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 22: North America Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 25: North America Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 28: North America Market Attractiveness by Material Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 30: North America Market Attractiveness by Country, 2022 to 2032

Figure 31: Latin America Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 32: Latin America Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 33: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 40: Latin America Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 43: Latin America Market Attractiveness by Material Type, 2022 to 2032

Figure 44: Latin America Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 46: Europe Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 47: Europe Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 48: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 52: Europe Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 55: Europe Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 58: Europe Market Attractiveness by Material Type, 2022 to 2032

Figure 59: Europe Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 60: Europe Market Attractiveness by Country, 2022 to 2032

Figure 61: East Asia Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 62: East Asia Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 63: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 64: East Asia Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 65: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 66: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 67: East Asia Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 68: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 69: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 70: East Asia Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 71: East Asia Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 72: East Asia Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 73: East Asia Market Attractiveness by Material Type, 2022 to 2032

Figure 74: East Asia Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 75: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 76: South Asia Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 77: South Asia Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 78: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: South Asia Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 80: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: South Asia Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 83: South Asia Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 84: South Asia Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 85: South Asia Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 88: South Asia Market Attractiveness by Material Type, 2022 to 2032

Figure 89: South Asia Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 90: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: Oceania Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 92: Oceania Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 93: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 97: Oceania Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 100: Oceania Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 103: Oceania Market Attractiveness by Material Type, 2022 to 2032

Figure 104: Oceania Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 105: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 106: MEA Market Value (US$ Million) by Material Type, 2022 to 2032

Figure 107: MEA Market Value (US$ Million) by Deployment Mode, 2022 to 2032

Figure 108: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2015 to 2032

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ Million) Analysis by Material Type, 2015 to 2032

Figure 113: MEA Market Value Share (%) and BPS Analysis by Material Type, 2022 to 2032

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2022 to 2032

Figure 115: MEA Market Value (US$ Million) Analysis by Deployment Mode, 2015 to 2032

Figure 116: MEA Market Value Share (%) and BPS Analysis by Deployment Mode, 2022 to 2032

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Deployment Mode, 2022 to 2032

Figure 118: MEA Market Attractiveness by Material Type, 2022 to 2032

Figure 119: MEA Market Attractiveness by Deployment Mode, 2022 to 2032

Figure 120: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Bone Metabolism Test Market Size and Share Forecast Outlook 2025 to 2035

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometer Devices Market Size and Share Forecast Outlook 2025 to 2035

Bone Densitometers Analysis by Product Type, by Technology and by End User through 2035

Bone Growth Stimulators Market is segmented by product type, application and end user from 2025 to 2035

Bone Graft Fixation System Market – Growth & Demand 2025 to 2035

Bone Regeneration Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Fixation Plates Market Trends - Growth, Demand & Forecast 2025 to 2035

Bone Marrow Transplant Market is segmented by transplant type, disease indication, and end user from 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Screw System Market Growth – Demand, Trends & Industry Forecast 2024-2034

Bone Distractors Market

Bone Cement Mixers Market

Bone Conduction Hearing Devices Market

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Metastatic Bone Tumor Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA