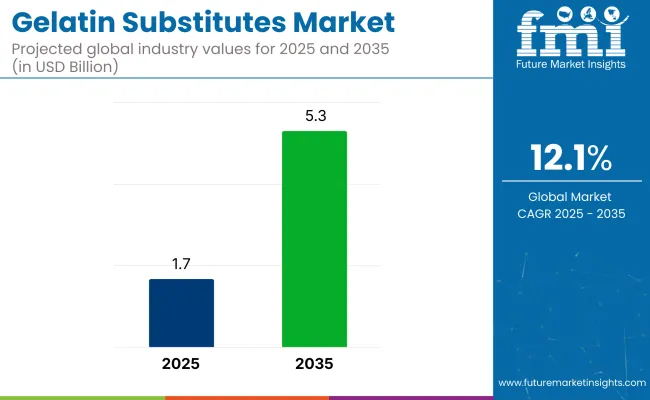

The gelatin substitutes market is projected to reach a valuation of USD 1.7 billion in 2025 and is expected to grow to approximately USD 5.3 billion by 2035, reflecting a CAGR of 12.1% over the forecast period.

Growth is being driven by demand shifts away from animal-derived gelatin in pharmaceuticals, food production, and cosmetics. Regulatory trends, dietary shifts, and ingredient have contributed to the expanding footprint of plant-based alternatives such as agar-agar, pectin, carrageenan, and konjac. Major food and nutraceutical companies are responding to a new baseline of expectations around transparency, vegan compliance, and allergen-free product development, further advancing market uptake.

The industry is estimated to account for nearly 12.4% of the functional food ingredients market due to its integration in dietary supplements and clean-label reformulations. Within the food hydrocolloids market, it contributes around 9.6%, supported by demand for thermal-stable gelling agents. In the plant-based ingredients space, its share stands at approximately 7.1%, as consumers seek animal-free options.

It comprises nearly 5.3% of the pharmaceutical excipients market, driven by its use in non-gelatin capsules. In the nutraceutical ingredients market, its contribution is close to 10.8%, with growth fueled by its role in vegan soft gels and skin-health formulations. These shares reflect both technical applicability and cross-sector adoption in health-forward product development and encapsulation processes.

A key factor accelerating this transition is the growing alignment of functional food needs with wellness-driven product positioning. The rising demand for functional foods that contribute to gut health, joint health, and skin care has aligned well with plant-derived products that offer structural and physiological benefits without animal-origin concerns. Supply-side investments in microbial fermentation and precision extraction have increased the quality and versatility of these ingredients, enabling them to meet technical benchmarks in applications where traditional gelatin was previously irreplaceable.

Consumer-facing companies are leveraging these substitutes to support clean-label claims and non-GMO verification, strengthening product appeal in developed and emerging economies alike. These developments have unlocked cycles across dietary supplements, dairy-free confections, and encapsulated skincare actives.

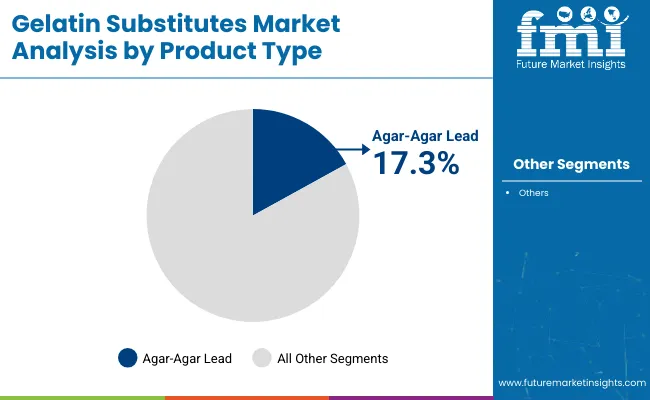

Agar-agar leads product adoption and is mainly distributed as unflavored powders packed in resealable pouches. The food industry drives use, with bulk orders flowing through B2B and HoReCa channels as plant-based gels replace animal-derived gelatin across culinary and industrial applications.

Agar-agar is projected to lead the gelatin substitutes market by product type in 2025, accounting for an estimated 17.3% of total revenue share in 2025. Its dominance is supported by superior gelling strength, clean flavor profile, and thermal stability, which make it highly adaptable across multiple food applications such as desserts, confectionery, and dairy-free formulations.

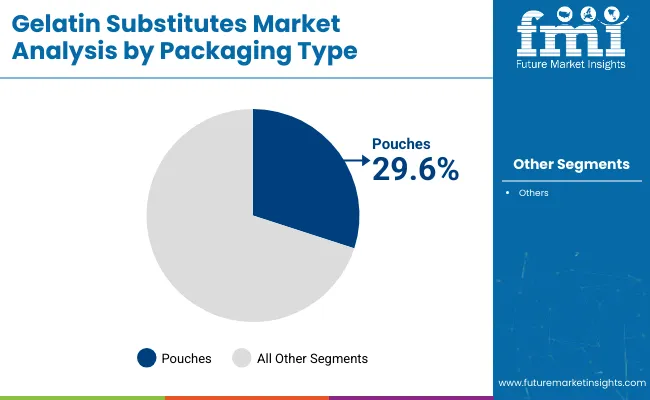

Pouches are expected to lead the gelatin substitutes market by packaging type in 2025, capturing an estimated 29.6% share of total sales. Their dominance stems from growing demand in both retail and foodservice channels for resealable, lightweight, and cost-efficient formats.

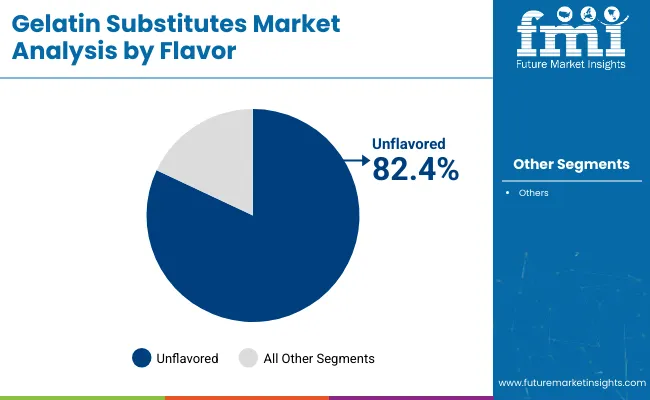

Unflavored gelatin substitutes are projected to dominate the market by flavor in 2025, accounting for approximately 82.4% of total segment revenue. Their leading share is attributed to broad applicability across both savory and sweet product categories without altering the original taste profile.

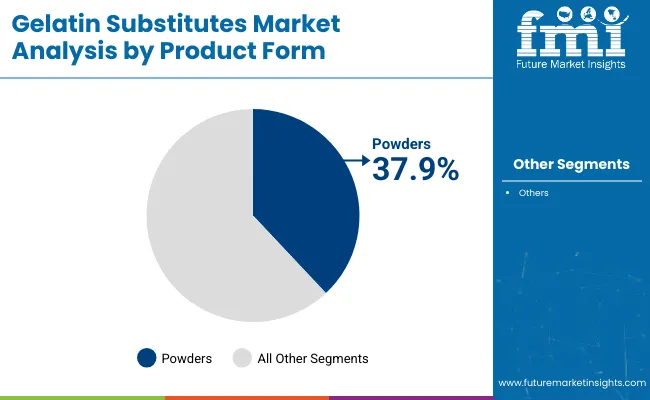

Powders are projected to lead the gelatin substitutes market by product form in 2025, holding an estimated 37.9% share of total revenue. Their dominance stems from formulation flexibility, longer shelf life, and ease of incorporation across multiple applications in food, pharmaceuticals, and nutraceuticals.

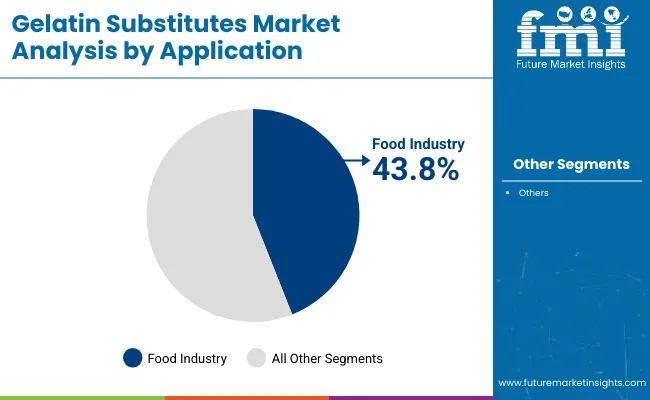

The food industry is expected to command about 43.8% of gelatin substitutes revenue in 2025, giving it the largest share among all application categories.

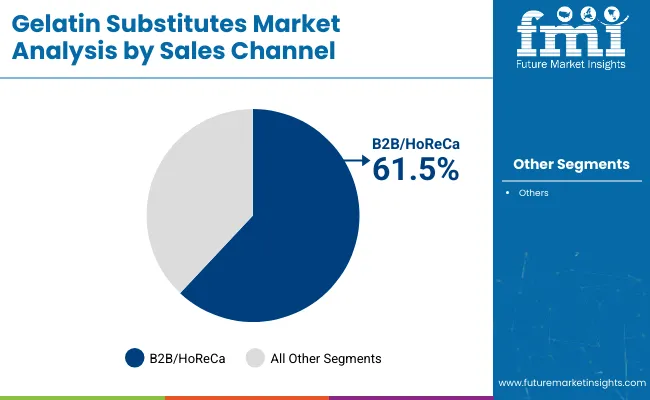

The B2B/HoReCa channel is projected to account for 61.5% of total gelatin substitutes sales in 2025, making it the dominant sales channel. This lead is attributed to strong demand from food manufacturers, nutraceutical producers, and pharmaceutical companies requiring consistent volumes of functional gelling agents for large-scale production.

Production scalability for plant-based gelling agents has advanced through fermentation technologies and seaweed sourcing, enabling cost-effective, high-performance alternatives. Regulatory harmonization and label mandates have accelerated reformulations, with vegan certifications and functional claims driving consumer trust and adoption.

Plant-Derived Capacity Surges

Industrial output for plant-origin gelling agents has been scaled swiftly as precision-fermentation and algal extraction lines reached commercial throughput in 2024 to 2025. Capital allocation has been prioritized toward modular reactors that lower unit energy, while upstream agreements with seaweed cooperatives allowed raw-material certainty.

Powder flow and hydration performance have been standardized through micronization protocols, permitting interchangeability with legacy animal gelatin in confectionery and encapsulation applications. Cost parity is being approached because co-product valorization offsets processing expense. Cold-chain vulnerabilities have been mitigated by heat-stable gels, enabling broader geographic penetration.

Regulatory Alignment and Preference Shifts

Global labeling standards are being harmonized, pushing gelatin alternatives toward universal vegan, halal, and kosher certifications. Food-safety authorities have updated positive lists to include refined agar and pectin grades, reducing dossier submission times for new ingredient launches.

Retailers have mandated front-of-pack disclosures that flag animal content; reformulation programs have accelerated as brand-owner risk teams seek allergen reduction and ethical compliance. Clinical evidence linking soluble fiber from pectin to gut-microbiome benefits has been referenced in structure-function claims, whereas carrageenan viscosity has been employed to lower sugar in beverages without texture loss.

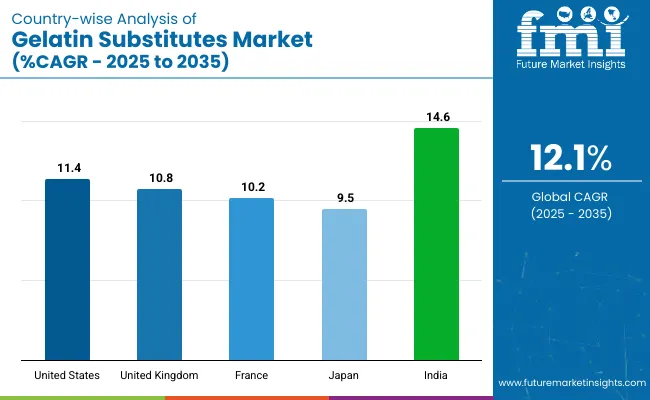

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 11.4% |

| United Kingdom | 10.8% |

| France | 10.2% |

| Japan | 9.5% |

| India | 14.6% |

India, part of the BRICS group, is projected to grow the fastest in the gelatin substitutes market with a 14.6% CAGR, driven by vegetarian dietary norms, increasing agar-agar use in sweets and capsules, and state-supported seaweed farming. The United States, an OECD member, follows with 11.4% CAGR, where growth is fueled by vegan soft gels, precision-fermentation advances, and wide retail and e-commerce distribution.

The United Kingdom, also in the OECD, is expanding at 10.8%, shaped by allergen-labeling regulations that have led to the adoption of carrageenan and pectin in desserts and beverages. France, at 10.2%, leverages its pâtisserie tradition with rising use of agar and pectin in clean-label gourmet applications, supported by Brittany’s seaweed supply. Japan records the slowest growth at 9.5%, with demand linked to elderly-focused texture-modified foods and kanten-based sweets rooted in traditional culinary use, reflecting a stable but slower trend within the OECD grouping.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The USA gelatin substitutes market is estimated to grow at 11.4% CAGR during the forecast period. Demand acceleration is being observed as plant-based confectionery and gummy supplement lines continue to replace animal gelatin for allergen-reduction and vegan-label compliance. Food formulators have adopted precision-fermented agar and carrageenan blends that maintain clarity in dairy-free desserts, while beverage processors employ pectin to stabilize low-sugar juice drinks.

HoReCa distributors have shifted to pouches and bulk powders that hydrate rapidly in industrial mixers, reducing preparation time in large commissaries. Retail adoption is supported by clean-label claims, and omnichannel grocery platforms have expanded shelf presence for unflavoured gelatin alternatives. Co-product valorization from algal extraction has narrowed cost gaps, encouraging nationwide rollouts by private-label snack brands.

The United Kingdom’s gelatin substitutes sector is forecast to advance at 10.8% CAGR through 2035. Growth is underpinned by plant-forward reformulations initiated after the 2024 allergen-labelling update that required clearer disclosure of bovine components. Supermarket own-brand desserts now rely on agar-agar and xanthan gum to achieve heat-stable textures compatible with chilled-chain lapses between distribution hubs and convenience stores.

Craft brewing has integrated carrageenan finings to meet vegan standards sought by taproom patrons, while functional beverage firms deploy pectin to create pulp-suspension in reduced-sugar smoothies. Contract manufacturers in the Midlands have expanded micronization capacity to produce high-flow powders for nutraceutical capsules targeting joint-health and collagen-boost claims.

France’s gelatin substitutes landscape is projected to register a 10.2% CAGR from 2025 to 2035. Domestic pâtisserie brands have moved toward pectin-rich fruit jellies and agar mousses to comply with consumer preference for plant-origin ingredients in premium pastries. Nutritional supplement firms clustered around Lyon have shifted capsule shells to pullulan-agar composites, leveraging local seaweed supplies from Brittany. Texture-focused culinary schools promote agar textbook formulations, accelerating chef-led in fine-dining chains.

The dairy-alternative boom in Provence, centered on almond-based yogurts, uses carrageenan to achieve spoonable viscosity without animal inputs. Institutional catering contracts stipulate halal compliance, steering public-sector kitchens toward gelatin substitutes for gelatinous terrines and aspic dishes.

India’s gelatin substitutes arena is anticipated to expand at 14.6% CAGR over the assessment horizon. Vegetarian dietary norms and widespread religious restrictions on bovine and porcine derivatives underpin robust uptake of agar-agar and guar gum in confectionery, dairy sweets, and pharmaceutical capsules. Government-backed seaweed farming clusters in Tamil Nadu supply local processors with raw Gracilaria, lowering material costs for agar producers.

Ayurvedic nutraceutical brands rely on plant-based soft gels to meet clean-label aspirations among urban millennials. Quick-service restaurants employ xanthan-stabilized sauces that maintain viscosity despite high ambient temperatures, ensuring consistent mouthfeel in takeaway meals. E-pharmacy portals have expanded distribution of vegan capsules for immunity and joint-care remedies.

Japan’s gelatin substitutes segment is expected to progress at 9.5% CAGR through 2035. Confectionery firms have adopted high-purity agar to sustain the traditional wagashi sector while meeting the rising tourism demand for vegan sweets. Precision-cut kanten sticks produced in Nagano reduce hydration time in ready-mix dessert kits.

Beverage conglomerates have incorporated carrageenan in zero-added-sugar coffee beverages to maintain stable foam during shelf life. Pharmaceutical excipient suppliers near Osaka cast pullulan-agar capsule shells that accommodate temperature-sensitive probiotics. Demographic aging has increased consumption of texture-modified foods, with pectin and guar gum enabling easy-to-swallow gels in hospitals and nursing facilities.

The gelatin substitutes industry is shaped by established ingredient providers and emerging formulators addressing the demand for plant-based gelling agents in food, nutraceutical, and pharmaceutical applications. Key players such as NOW Foods and Gelita anchor the market with diversified product lines serving retail and B2B channels. The Agar Company (B&V SRL) and Java Biocolloid (Hakiki Group) focus on high-purity agar sourced from red algae, supplying dessert and dairy-alternative manufacturers.

Special Ingredients Ltd. and Great American Spice Company cater to culinary professionals with customizable blends for bakery and confectionery. Niblack Foods, Inc. and Kelco Co., Inc. offer wholesale solutions aligned with clean-label and vegan trends. Ingredion Incorporated and Tate and Lyle Plc drive through texture-modifying systems and scalable hydrocolloid platforms. In Asia, Marine Hydrocolloids plays a leading role in agar-strip exports, supported by seaweed cultivation along India’s southern coast.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.7 billion |

| Projected Market Size (2035) | USD 5.3 billion |

| CAGR (2025 to 2035) | 12.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Type Analyzed (Segment 1) | Agar-Agar, Carrageen, Pectin, Cornstarch, Xanthan Gum, Guar Gum, Arrowroot, Instant Clear Gel, Kudzu, and Others. |

| Packaging Type Analyzed (Segment 2) | Bag, Bottle, Box, Pouch, and Others. |

| Flavor Analyzed (Segment 3) | Unflavored And Flavored (Apple, Berry, Coffee, Grape, Raspberry, Strawberry, Vanilla, and Watermelon). |

| Applications Analyzed (Segment 4) | Food Industry (Baking Products, Chocolate And Confectionery, Dairy & Desserts, and Others), Pharmaceutical Industry, Cosmetics and Personal Care Industry, Dietary Supplements, Microbiology And Plant Propagation, and Others. |

| Product form Analyzed (Segment 5) | Capsules, Gummies, Powders, Soft Gels, And Others. |

| Sales Channel Analyzed (Segment 6) | B2B / HoReCa and B2C (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Discount Stores, Food Specialty Stores, Independent Small Groceries, Online Retail, And Other Retail Formats). |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | NOW Foods, Gelita, The Agar Company (B&V SRL), Java Biocolloid (Hakiki Group), Special Ingredients Ltd., Great American Spice Company, Niblack Foods, Inc., Kelco Co., Inc., Ingredion Incorporated, Tate and Lyle Plc, and Marine Hydrocolloids. |

| Additional Attributes | Dollar sales, growth rate, regional demand, segment share, sourcing trends, pricing benchmarks, B2B vs B2C split, regulatory updates, product form demand, packaging preference, top buyers, competitor share, retail vs bulk share. |

The industry is segmented into agar-agar, carrageen, pectin, cornstarch, xanthan gum, guar gum, arrowroot, instant clear gel, kudzu, and others.

The industry is segmented into bag, bottle, box, pouch, and others.

The industry finds unflavored and flavored (apple, berry, coffee, grape, raspberry, strawberry, vanilla, and watermelon).

The industry is divided into capsules, gummies, powders, soft gels, and others.

The industry finds applications in food industry (baking products, chocolate and confectionery, dairy & desserts, and others), pharmaceutical industry, cosmetics and personal care industry, dietary supplements, microbiology and plant propagation, and others.

The industry is segmented into B2B / HoReCa and B2C (hypermarkets/supermarkets, convenience stores, mom and pop stores, discount stores, food specialty stores, independent small groceries, online retail, and other retail formats).

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 1.7 billion in 2025.

It is forecasted to reach USD 5.3 billion by 2035.

The industry is anticipated to grow at a CAGR of 12.1% during this period.

Unflavored are projected to lead the market with an 82.4% share in 2025.

Asia Pacific particularly India, is expected to be the key growth region with a projected growth rate of 14.6%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Market Trends - Food, Pharma & Nutritional Growth 2025 to 2035

Gelatin Hydrolysates Market

Hard Gelatin Capsules Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Fish Gelatin Market

Bovine Gelatin Market

Dura Substitutes Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Bone Grafts and Substitutes Market Overview - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA