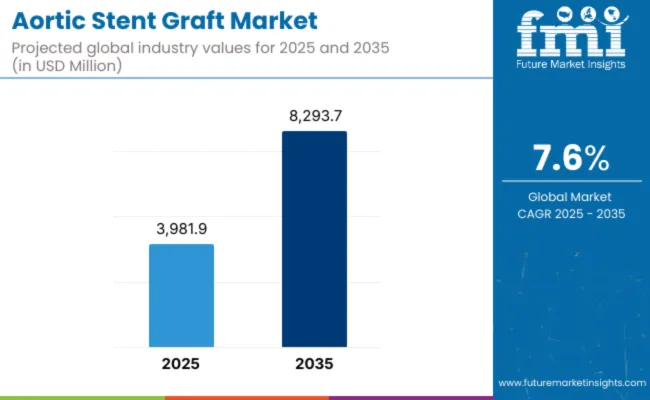

Global revenue for the aortic stent grafts market is set to rise from USD 3,981.9 million in 2025 to about USD 8,293.7 million by 2035 at a 7.6% CAGR, as endovascular aneurysm repair (EVAR) and thoracic EVAR (TEVAR) displace open surgery, driven by the rise in ageing populations. The growing incidence of abdominal and thoracic aortic aneurysms, wider screening in people aged 65 and above, and expanding reimbursement for complex anatomies are all contributing to increased procedure volumes.

Device makers are rolling out low-profile, polymer-sealing, and branched/fenestrated stent-grafts that accommodate short necks, tortuous iliacs, and visceral-branch involvement-anatomies once deemed inoperable. Clinical data presented at VIVA 2024 showed that polymer-sealed endografts reduced Type I endoleaks by 41% compared to legacy designs, supporting the rapid adoption of these premium devices in hospitals.

Regulation is steering innovation toward durability and customisation. The EU MDR now demands ten-year clinical follow-up, prompting firms to pair stent grafts with AI-driven sizing software and on-graft radiopaque markers that simplify long-term surveillance. In the United States, the FDA’s IDE “early feasibility” pathway has shortened first-in-human timelines for branched thoraco-abdominal systems, thereby accelerating the flow of the pipeline.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,981.9 million |

| Industry Value (2035F) | USD 8,293.7 million |

| CAGR (2025 to 2035) | 7.6% |

North America remains the largest market, driven by AAA screening programs and center-of-excellence networks. Europe leads in complex F-/B-EVAR volumes. The Asia Pacific will log the fastest growth (>9 percent CAGR) as China’s Volume-Based Procurement lists domestic endografts and India scales up its National Aneurysm Screening. Supply-chain localisation is also intensifying- Japanese and Australian vascular societies now encourage “region-ready” graft designs built on home-grown nitinol and PET fabrics to hedge geopolitical risk.

Reflecting the sector’s upbeat outlook, Dr John Liddicoat, newly appointed CEO of Endologix, remarked in January 2025, “I’m excited to join Endologix and expand our impact, improving outcomes for patients with vascular disease worldwide by delivering life-changing vascular solutions.”

With screening uptake on the rise, device portfolios shifting to increasingly versatile configurations, and regulatory frameworks rewarding safer, less invasive therapies, the aortic-stent-graft market is poised for a decade-long, innovation-led expansion.

The aortic stent graft industry is undergoing a major transformation driven by breakthroughs in engineering, imaging, and personalized medicine. As demand rises for less invasive vascular interventions, manufacturers are focusing on stent grafts that are smarter, thinner, and more adaptable to diverse patient anatomies.

Today's innovations are making aortic procedures safer and more predictable, even in complex cases such as tortuous vessels, tight bifurcations, or short landing zones. These developments are significantly improving patient outcomes and lowering long-term complication rates.

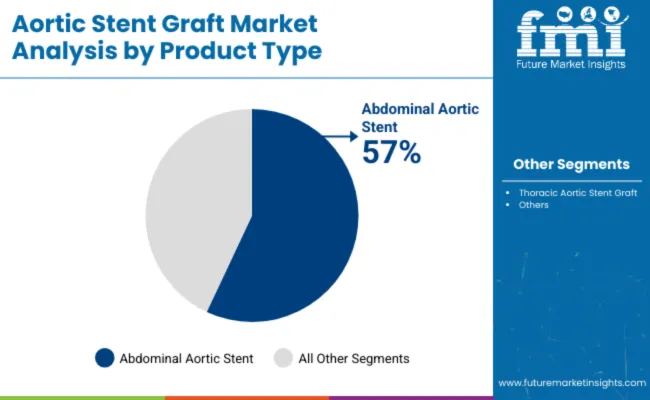

Abdominal aortic stent grafts will likely dominate the aortic stent grafts market with 57% market share in 2025, driven primarily by the increasing incidence of Abdominal Aortic Aneurysms (AAA), especially among the ageing population.

Endovascular aneurysm repair (EVAR), a minimally invasive procedure utilizing abdominal stent grafts, significantly reduces patient recovery time and complications compared to traditional open surgeries. The rising prevalence of risk factors like hypertension, smoking, and obesity among the elderly continues to bolster market growth.

Technological advancements further propel this segment, including fenestrated and branched stent grafts designed to accommodate anatomically complex aneurysms. According to the Centers for Disease Control and Prevention (CDC), AAAs predominantly affect men over 65, with growing screening programs enhancing early detection rates.

Market adoption is strongest in North America and Europe, facilitated by advanced healthcare infrastructure, favorable reimbursement frameworks, and high awareness. In the Asia Pacific region, expanding healthcare access, increased investments in advanced vascular surgery techniques, and broader insurance coverage are expected to sustain significant growth.

The thoracic aortic stent graft segment is also anticipated to experience notable growth due tothe increasing prevalence and awareness of thoracic aortic aneurysms (TAA) and dissections, conditions with high mortality if left untreated. Thoracic endovascular aortic repair (TEVAR), which employs advanced thoracic stent grafts, offers a minimally invasive alternative to traditional open-chest surgery, significantly contributing to market expansion.

Recent developments, including low-profile delivery systems, hybrid devices, and enhanced graft materials, are substantially expanding the treatable patient population, particularly those with complex aortic arch disease.

North America leads due to high incidence rates and robust clinical infrastructure. Europe follows closely, driven by well-defined reimbursement structures. Meanwhile, regions like Latin America and Asia-Pacific represent emerging growth opportunities as healthcare facilities enhance capabilities, and awareness programs increase early diagnosis and intervention.

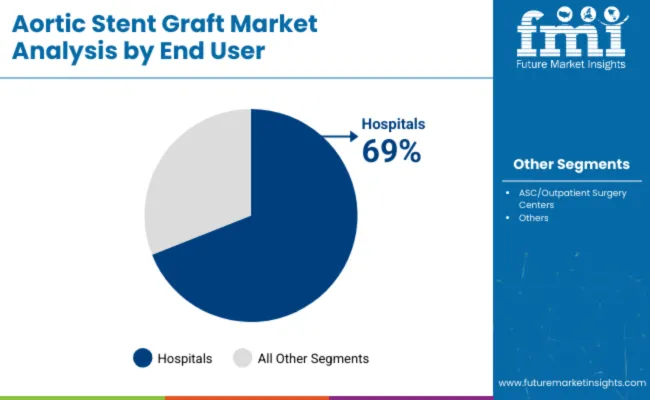

Hospitals constitute the largest end-user segment, accounting for approximately 69% of the market share by 2025. This dominance is primarily due to the presence of sophisticated imaging technologies, hybrid operating rooms, and specialized vascular surgery units within hospital settings. Such infrastructure facilitates complex EVAR and TEVAR procedures, encouraging patient preference for hospital-based interventions.

The growing incidence of aortic aneurysms and rising patient awareness of minimally invasive surgical benefits further amplify hospital demand. Additionally, the increased prevalence of critical emergency cases necessitating immediate, high-level intervention ensures continuous growth in this segment.

Prominent healthcare institutions across North America and Europe, such as the Mayo Clinic and the Cleveland Clinic, set global standards, underscoring the central role hospitals play in aortic aneurysm management. In the Asia-Pacific region, government investments in healthcare facilities and surgeon training programs are rapidly increasing hospital-based interventions, despite cost challenges in lower-income regions.

In contrast, Ambulatory Surgical Centers (ASCs) are gaining traction, with an anticipated market share of around 31% by 2025, driven by a growing preference for outpatient endovascular procedures. Innovations in stent graft technology and procedural efficiency have enabled certain endovascular aortic repair (EVAR) interventions to be performed in ambulatory surgical centers (ASCs), significantly reducing healthcare costs, minimizing hospital stays, and lowering infection risks.

Favorable reimbursement policies in developed regions, particularly North America and Europe, encourage outpatient procedures, boosting ASC utilization. Furthermore, same-day discharge and convenience enhance patient appeal.

Although complex TEVAR procedures remain predominantly hospital-based due to specialized imaging and surgical support requirements, ongoing advancements in minimally invasive techniques are gradually enabling more complex procedures within ASC environments. Leading players, such as Medtronic and Gore Medical, are actively refining their devices to cater to the outpatient market, ensuring continued growth for ASCs in the coming decade.

North America is expected to dominate the aortic stent graft market due to its advanced healthcare infrastructure, high prevalence of aortic disease, and favorable reimbursement policies that enable patients to access advanced treatments. The region also witnesses a growing use of endovascular aneurysm repair (EVAR) procedures, which are less invasive than open surgery, thereby reducing recovery time and the risks associated with the procedure.

Market leaders are investing aggressively in clinical trials and regulatory clearances to introduce advanced stent graft technology that features improved flexibility, durability, and sealability.

Further, the expanding occurrence of both hypertension and obesity, both highly associated with augmented risks of an aortic aneurysm, is accelerating demand for productive treatment options. Cardiovascular research efforts and policy backing of using AI-powered imaging diagnostic techniques, furthered through government policies supporting research, also continue to stimulate disease detection as well as the development of therapy planning, pushing overall market size growth. Continuous advances in technologies coupled with enabling healthcare policies guarantee that North America will lead the market for aortic stent grafts.

Europe maintains its leadership in the market for aortic stent grafts due to technological advancements, an expanding elderly population base, and government investment in cardiovascular research. Major players in the industry, including Germany, France, and the UK, are spearheading the growth in stent graft adoption due to high stakes in clinical research trials and new product development, which leads to further treatment improvements.

Strict regulatory policies in Europe ensure the quality and safety of products, thereby increasing consumer confidence in stent technology advancements. The growing knowledge among patients and physicians about minimally invasive interventions is also boosting the market growth. As an increasing number of hospitals and specialty clinics incorporate endovascular aneurysm repair (EVAR) into their practices, demand for next-generation stent grafts will rise, thereby contributing to overall market growth.

Asia Pacific aortic stent grafts market is estimated to see the highest growth rate as a result of increasing investments in healthcare, increased access to novel treatments, and greater awareness regarding aortic disorders. China, Japan, and India are significant contributors to the growth in the region, driven by escalating demand for less invasive treatments and a rising incidence of cardiovascular conditions.

The area is also supported by the growth in medical tourism, which attracts patients seeking affordable yet high-quality treatment options. Governments are also actively implementing policies to establish cardiovascular care facilities, facilitating early diagnosis and improved treatment outcomes. Furthermore, increasing presence of multinational healthcare companies is also driving faster adoption of newer stent graft technologies, resulting in additional expansion prospects in the region.

High Costs of Stent Grafts and Regulatory Barriers Limiting the Market Growth

The high cost of stent grafts is a significant issue in the aortic stent grafts market, making it inaccessible, particularly in developing countries with limited healthcare budgets. Stent graft interventions, including endovascular aneurysm repair (EVAR), need costly medical devices, sophisticated imaging equipment, and specialized surgical skills, resulting in high total treatment costs.

Furthermore, the cost burden is increased even more in some nations through restricted reimbursement schemes, thus subjecting patients to hardship in purchasing such life-sustaining operations. Smaller health facilities would also be hindered by resource constraints in procuring more sophisticated stent graft technology. Consequently, although minimally invasive aortic repairs have its advantages, elevated costs are an essential impediment to broader market uptake and expansion.

Advancements in Materials Science, Including Bioresorbable Stents, Present Lucrative Growth Prospects

Materials science developments, particularly the creation of bioresorbable stents, are generating high-value growth prospects for the aortic stent graft market. Bioresorbable stents are engineered to break down over time, providing structural integrity while minimizing long-term issues such as graft migration or restenosis.

The development of polymeric and nanomaterial-based stents is enhancing their versatility, strength, and biocompatibility, ultimately improving patient outcomes. These new-generation stents also reduce the incidence of secondary interventions, which is a desirable factor for both patients and physicians. With further development in biodegradable materials, firms investing in bioresorbable stent technologies are bound to have an upper hand in the emerging market.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | FDA and CE approvals focused on safety and efficacy of stent grafts. There is a growing emphasis on post-market surveillance and device longevity. |

| Technological Advancements | EVAR and thoracic endovascular aneurysm repair (TEVAR) techniques improved outcomes. Limited use of patient-specific grafts. |

| Consumer Demand | High demand for minimally invasive procedures due to aging populations and rising aortic aneurysm cases. |

| Market Growth Drivers | Epidemiological growth of aortic aneurysm, improved imaging technology, and awareness about EVAR interventions. |

| Efforts towards sustainability | Improving the biocompatibility of materials while minimizing procedural waste. |

| Supply Chain Dynamics | Dependence on large US and European manufacturers. Production cost and supply chain linkage during the COVID-19 crisis |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter long-term performance monitoring and safety regulations. Expansion of AI-assisted compliance tracking for stent graft durability. |

| Technological Advancements | Development of bioresorbable, drug-eluting, and AI-assisted stent grafts. 3D printing enables the creation of fully customized, patient-specific devices. |

| Consumer Demand | Increased demand for personalized and precision-medicine-based aortic repair solutions. Greater focus on long-term durability and reduced complications. |

| Market Growth Drivers | Growth of surgical planning through artificial intelligence, robot-assisted procedures, and advanced biomaterials, enhancing the durability of the graft. |

| Efforts towards sustainability | Use of biodegradable and environmentally friendly stent material.Green manufacturing processes minimize the carbon footprint involved in device production |

| Supply Chain Dynamics | Diversification of manufacturing hubs. Localized production and 3D-printed grafts enhance supply chain resilience and cost efficiency. |

The US aortic stent graft market is witnessing considerable growth due to the prevalence of high incidences of aortic aneurysms and a strong preference for minimally invasive procedures. Increasing use of complex endovascular aneurysm repair techniques has also been instrumental in boosting market growth. The presence of renowned medical device players and high healthcare spending also contributes to the robust development of the market.

Market Growth Factors

Market Forecast

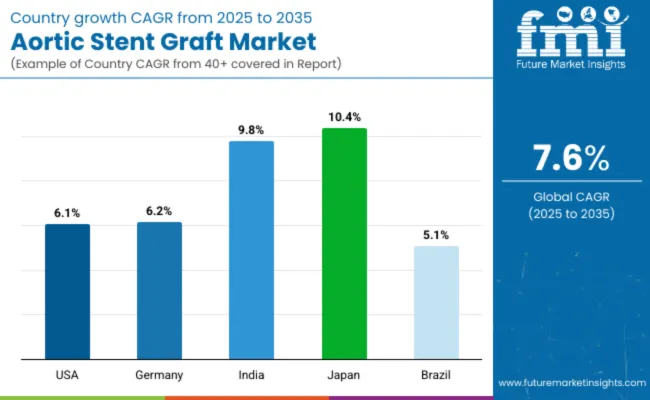

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The established healthcare infrastructure, along with a preventive approach towards cardiovascular disease in this country, would further expand the market for aortic stent grafts in the country. Moreover, early detection and treatment of aortic aneurysms are strongly emphasized in this country, which encourages the use of stent graft technologies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

The Indian market is growing at a rapid pace, driven by the expansion of advanced healthcare infrastructure and increasing awareness of cardiovascular disease. The increased occurrence of aortic aneurysms, combined with the need for minimal interventions, propels the market forward.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.8% |

Japan's market for aortic stent grafts operates in a high-tech field of healthcare technology, which has seen a dent in the acceptance of minimally invasive therapies. The country also experiences a substantial burden due to the prevalence of aortic aneurysms and the aging population, thereby leading to the demand for effective therapies.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.4% |

Due to the balanced stage of the healthcare system and the rising awareness of cardiovascular health, the Brazilian aortic stent graft market is experiencing growth. Another factor contributing to market growth is the rising prevalence of aortic aneurysms as well as the growing demand for minimally invasive procedures.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.1% |

The global aortic stent graft market is very competitive, with the presence of key global players and regional manufacturers stimulating innovation and growth in this market. The number of cases of aortic aneurysms is on the increase, with advances in minimally invasive surgical techniques and a large part of the world's population now considered elderly, leading to technological advancements in aortic stent graft solutions.

Companies invest heavily in developing novel materials, enhancing durability, and precision-engineered designs to stay competitive; it is the well-established players and emerging ones that characterize the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic | 33.5% |

| Cardinal Health, | 22.3% |

| Cook Medical Inc. | 15.3% |

| Becton, Dickinson and Company | 14.0% |

| CryoLife, Inc. (Artivion Inc.) | 5.1% |

| Other Companies (combined) | 9.8% |

| Company Name | Key Offerings/Activities (2024) |

|---|---|

| W. L. Gore & Associates Inc. | Has a wide range of aortic stent grafts focused on innovative designs and materials aimed at optimizing patient outcomes |

| Medtronic Plc | Provides advanced endovascular stent graft systems used to treat aortic aneurysms and promotes minimally invasive treatment. |

| Cook Group Inc. | Excels at creating tailored stent graft solutions specific to each patient's anatomy, increasing procedural success rates. |

| Endologix LLC | The company is dedicated to the creation of new endovascular stent grafts intended to enhance durability and long-term performance. |

| Terumo Corporation | Terumo Corporation supplies a range of aortic stent graft products, focusing on accuracy and reliability in endovascular procedures. |

Key Company Insights

Medtronic Plc (33.5%)

Medtronic Plc, which is a technical leader in their field and offers access to innovative endovascular stent graft systems that enable minimally invasive surgery and are ideal to support the treatment of aortic aneurysm with better recovery times and fewer complications.

Cardinal Health (22.3%)

Cardinal Health is recognized for making a significant impact in the cardiovascular care industry through its range of medical devices and healthcare solutions used to treat aortic and vascular diseases. The company is crucial in providing stent graft technology and other key medical products to healthcare professionals. Cardinal Health is also focused on digital health solutions and patient compliance programs, which drive treatment success and improve patient outcomes.

Cook Medical (15.3%)

Cook Medical is a global medical devices company involved in designing personalized stent graft solutions specifically for individual patient anatomies to enhance procedural success rates and patient satisfaction.

Becton, Dickinson and Company (14.0%)

BD is one of the leaders in aortic stent graft manufacturers that support minimally invasive cardiovascular interventions using a diverse range of medical devices and vascular access solutions. BD focuses on developing next-generation stent graft delivery systems and driving advancements in endovascular repair technology to help enhance patient care

CryoLife, Inc. (Artivion Inc.) (5.1%)

CryoLife, Inc. operates in the aortic stent grafts segment, focusing on with cardiovascular and aortic repair products. The company has gained popularity for its synthetic and biological graft technologies, such as stent grafts for aneurysms and dissections of the aorta. The company deals with developing novel implantable devices that improve surgical performance and increase survival rates for patients.

Beyond the leading companies, several other manufacturers make significant contributions to the market, enhancing product diversity and driving technological advancements. These include:

These companies focus on expanding the reach of advanced endovascular treatments, offering competitive pricing and cutting-edge aortic stent graft solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3,981.9 million |

| Projected Market Size (2035) | USD 8,293.7 million |

| CAGR (2025 to 2035) | 7.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand procedures for volume |

| Product Types Analyzed (Segment 1) | Abdominal Aortic Stent Graft, Thoracic Aortic Stent Graft |

| End Users Analyzed (Segment 2) | Hospitals, ASC/Outpatient Surgery Centers |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Aortic Stent Grafts Market | Medtronic, Cardinal Health, Cook Medical Inc., Becton, Dickinson and Company, CryoLife, Inc. (Artivion Inc.), ENDOLOGIX, INC., Terumo Corporation Inc., Lombard Medical, Inc., W.L. Gore & Associates Inc., MicroPort Scientific Corporation, Others |

| Additional Attributes | Dollar sales by product type (abdominal vs thoracic), Procedure volume trends by region, Hospital vs ASC adoption, Innovation in endovascular surgery, Regulatory advancements in vascular grafts, Regional market share shifts based on device type and patient demographics |

| Customization and Pricing | Customization and Pricing Available on Request |

Abdominal Aortic Stent Graft and Thoracic Aortic Stent Graft

Hospitals and ASC/Outpatient Surgery Centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global aortic stent grafts industry is projected to witness CAGR of 7.6% between 2025 and 2035.

The global aortic stent grafts market stood at USD 3,715.4 million in 2024.

The global aortic stent grafts market is anticipated to reach USD 8,293.7 million by 2035 end.

India is expected to show a CAGR of 9.8% in the assessment period.

The key players operating in the global aortic stent grafts industry are Medtronic, Cardinal Health, Cook Medical Inc., Becton, Dickinson and Company, CryoLife, Inc. (Artivion Inc.), ENDOLOGIX, INC., Terumo Corporation Inc., Lombard Medical, Inc., W.L. Gore & Associates Inc., MicroPort Scientific Corporation and Others

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aortic Endografts Industry Analysis by Product, Procedure, Material, End Users and Regions 2025 to 2035

Intra-Aortic Balloon Pump (IABP) Market Size and Share Forecast Outlook 2025 to 2035

Thoracic Aortic Aneurysm Market Size and Share Forecast Outlook 2025 to 2035

Abdominal Aortic Aneurysm Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Stent Graft Balloon Catheter Market Insights - Growth & Forecast 2025 to 2035

Existent Gum Steam Generator Market

Gel Stent Market Size and Share Forecast Outlook 2025 to 2035

Persistent Epithelial Defect Management Market Size and Share Forecast Outlook 2025 to 2035

Venous Stents Market Size and Share Forecast Outlook 2025 to 2035

Enteral Stents Market

Ureteral Stent Market Size and Share Forecast Outlook 2025 to 2035

Branched Stent Graft Market Size and Share Forecast Outlook 2025 to 2035

Coronary Stents Market Insights – Trends, Growth & Forecast 2025-2035

Nephrology Stents and Catheters Market

Non-Vascular Stents Market Growth - Trends & Forecast 2025 to 2035

Neurovascular Stent Retrievers Market Size and Share Forecast Outlook 2025 to 2035

Bioabsorbable Stents Market Growth – Trends & Forecast 2025 to 2035

Advanced Persistent Threat Protection Market

Nephroureteral Stent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA