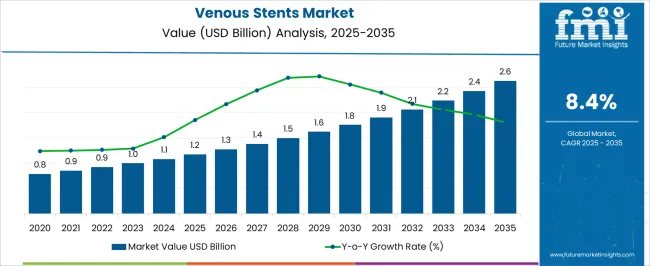

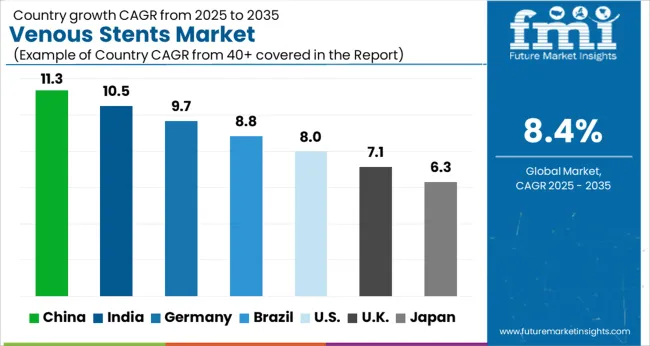

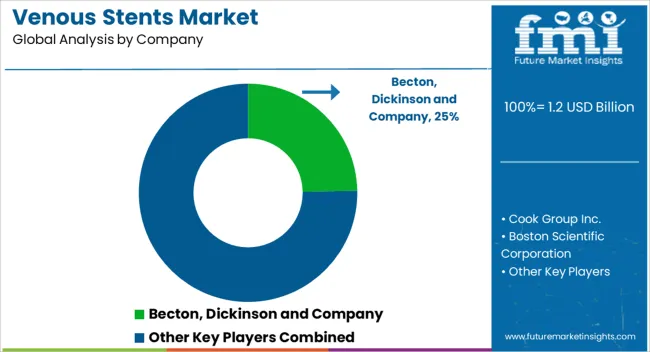

The Venous Stents Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Venous Stents Market Estimated Value in (2025 E) | USD 1.2 billion |

| Venous Stents Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The venous stents market is expanding steadily due to rising cases of venous disorders, advancements in minimally invasive procedures, and growing adoption of stent technologies in vascular treatment. Increased prevalence of conditions such as deep vein thrombosis and post thrombotic syndrome has heightened the demand for effective and durable treatment solutions.

Technological innovations in stent material and design are improving long term patency, biocompatibility, and patient outcomes, which is accelerating adoption among healthcare providers. Favorable reimbursement policies in several regions and rising awareness about venous disease management are further driving growth.

With the integration of advanced imaging techniques and improved interventional procedures, the market outlook remains positive as hospitals and specialty clinics increasingly prioritize minimally invasive solutions to enhance patient recovery and reduce healthcare burden.

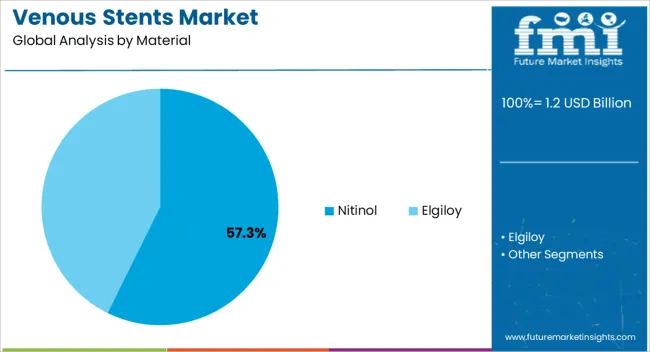

The nitinol material segment is projected to account for 57.30% of the total market revenue by 2025, positioning it as the leading material. This dominance is attributed to the alloy’s exceptional flexibility, biocompatibility, and resistance to fatigue, which are critical for venous applications.

Nitinol’s shape memory properties ensure adaptability to dynamic vascular conditions, providing long term durability and reduced risk of restenosis.

These attributes have reinforced its widespread adoption in venous stent procedures, establishing it as the preferred choice within the material category.

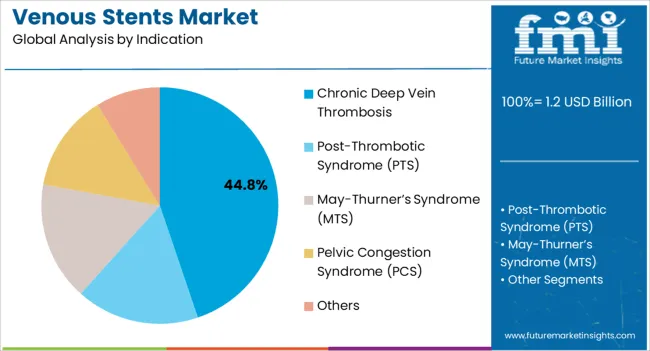

The chronic deep vein thrombosis indication segment is expected to hold 44.80% of market revenue by 2025, making it the dominant indication. This growth is driven by the rising prevalence of chronic venous obstructions and the need for long lasting solutions that restore venous flow.

Increasing patient awareness, coupled with improved diagnostic and interventional practices, has fueled demand for stent implantation in chronic cases.

The ability of venous stents to alleviate symptoms such as swelling and pain while reducing the risk of long term complications has further reinforced adoption in this indication segment.

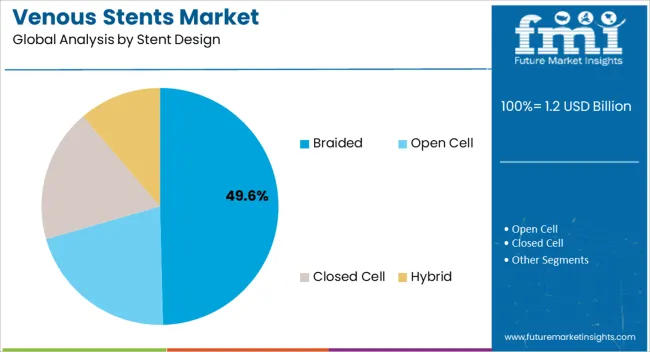

The braided stent design segment is projected to contribute 49.60% of total market revenue by 2025, positioning it as the most prominent design type. This is attributed to its superior flexibility, ease of deployment, and ability to conform effectively to complex venous anatomies.

Braided stents provide strong radial support while maintaining vessel patency, which is vital in treating venous obstructions. Their compatibility with advanced delivery systems and capacity to reduce migration risks have further enhanced clinical acceptance.

As physicians continue to seek reliable and adaptable solutions, braided stents are anticipated to remain the preferred design within the venous stents market.

The global sales of the venous stents are anticipated to rise at a CAGR of 8.4% between 2025 and 2035, owing to prevalence of venous diseases, adoption of minimally invasive procedures, growing ageing population, and increasing awareness about venous stents usage.

The global market holds around 8.5% share of the overall global stents market with a value of around USD 1.2 Billion, in 2025.

The market for venous stents is increasing due to the rising prevalence of various diseases related to the venous, such as chronic venous insufficiency, deep vein thrombosis, phlebitis, varicose and spider veins, and venous stenosis. Such aforementioned disorders require venous stents for treatment purposes, and thus, the rising prevalence of venous disorders among people is driving the market.

Similarly, rising key player’s product development strategies like flexible venous stents with high radial strength are also expanding the market growth. Significant advancement has been made in the design and development of venous stents, including innovations in stent materials, design, and delivery systems. This has resulted in the development of more effective and safer stents, which will boost the demand.

Owing to the above-mentioned factors, the global market is expected to grow at a prominent pace, and reach a valuation of around USD 2.6 Billion during the year 2035.

Global cases of chronic cardiovascular diseases are increasing, owing to the world's growing senior population, as older people are more prone to heart-related problems.

According to the WHO in 2020, annually almost 17.9 million deaths happen due to cardiovascular diseases (CVDs) worldwide. Consequently, as the prevalence of CVD among people increases, so does the demand for cardiovascular surgery, which is promoting market expansion.

Obesity is also a substantial global risk factor for a number of heart ailments. The excessive or incorrect deposition of fat within the arterial wall brought on by obesity can lead to coronary heart disease and other health issues. As a result, the increased obesity rate may demand several venous surgeries which indirectly aid the market growth.

According to published article on proximal deep vein thrombosis (DVT) in medical critical care patients in 2025, around 13% to 31% patients are receiving medical critical care due to deep vein thrombosis. As per the article, 5.7% was the prevalence, while at around 10.1% was the incidence proportion for DVT.

The significant growth in patient base which is raising the demand for vein stent surgery is also aiding the market growth.

For instance, according to published article on rising incidences study of post-thrombotic syndrome of upper extremity vein thrombosis in the Journal of Vascular Surgery: Venous and Lymphatic Disorders in 2025, venous thrombosis of upper extremity (UEVT) is responsible to cause PTS of upper extremity (UE-PTS) at about 14.1%. Hence, the market will boost by the increasing chronic symptomatic venous disease cases.

The restraints of the venous stents market include the high cost of venous stent procedures, lack of skilled professionals, and the risk of complications associated with venous stent implantation. The high cost of venous stent procedures is a major restraint for the growth of the venous stent market, as it limits the adoption of these procedures in developing countries. The lack of skilled professionals is also a challenge for the growth of the venous stent market, as it limits the availability of these procedures in certain regions. The risk of complications associated with venous stent implantation, such as stent migration, stent fracture, and stent thrombosis, is also a restraint for the growth of the venous stent market. The venous stent market is highly competitive, with many players operating in the development, manufacturing, and commercialization of venous stents.

The recall of numerous venous devices from the market is another factor hindering the market growth. Recently, recalls of many product was motivated by recent documentation of unanticipated unfavorable patient effects.

For instance, 7,000 venture catheters were recalled by vascular solutions Inc. in 2020 because the catheter tip contained excess material that could have split during operations and led to blood clots.

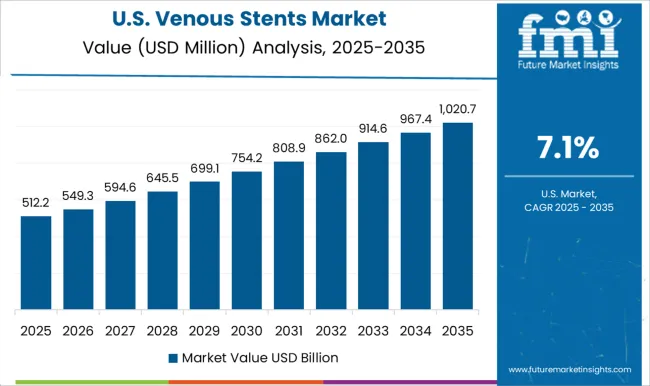

The USA led the global market with value share of around 32.8% in 2025 due to rising prevalence of deep vein thrombosis.

Annually 900,000 individuals are affected by Deep vein thrombosis (DVT) or pulmonary embolism (PE) affects in the United States, according to the Centre for Disease Control and Prevention in June 2025.

Therefore, the demand for venous stents is increasing as a result of the rising number of DVT procedures performed nationwide.

The growing healthcare expenditure in theUSA is driving demand for venous stents as more patients seek treatment for venous diseases.

According to the Centers for Medicare and Medicaid Services, healthcare expenditure in the USA is projected to reach USD 6.2 Trillion by 2035, up from USD 3.6 Trillion in 2020.

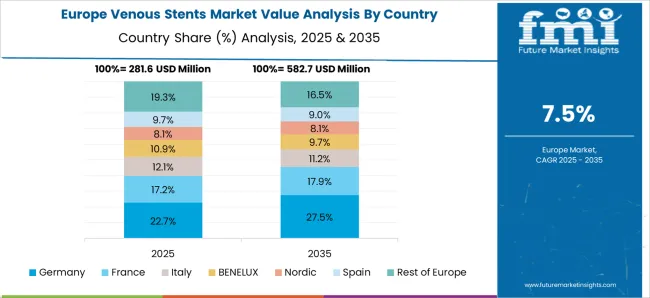

Germany held market share of around 4.4% in the global market 2025 and it is expected to expand further due to high prevalence of venous diseases.

The venous stents market in Germany is primarily driven by the increasing incidence of venous diseases and disorders. These conditions often require medical intervention, including the use of venous stents, to prevent serious complications such as pulmonary embolism or venous ulcers.

According to published article on venous diseases epidemiologic study in Germany on 19,104 workers in the Vascular Health and Risk Management journal 2024, active venous therapy is clearly indicated in 22.3% of the adult working population in Germany.

China holds a market share of 6.3% in 2025 in the global market. Increased interventional cardiology and peripheral vascular operations, as well as rising acceptance of technology developments in an effort to minimize treatment duration for high-risk patients, are the primary growth factors for this market.

According to the Cetas healthcare system in Beijing, around 45% of peripheral treatments, 50% of PAD operations, and 30% atherectomy procedures were performed between 2020 and 2025.

Chinese regulatory approvals also confirm the quality and smooth market penetration for stents. For example, National Medical Products Administration (NMPA) regulatory services include strategy, registration, type testing, product technical requirement, and check clinical evaluation report.

India held a market share of around 3.6% in the global market 2025. The venous stents market in India is expected to grow significantly in the coming years, driven by the increasing availability of venous stents from global manufacturers. Many international companies are expanding their presence in India, either through partnerships or acquisitions of local companies, to tap into the growing demand for medical devices.

Nitinol material is holding the market share of 89.5% in the global market 2025 because of its benefits over other materials and availability of reimbursement.

Nitinol stents are a type of self-expanding stent made from a nickel-titanium alloy that can withstand the high pressures and forces in the veins. The use of Nitinol stents has become increasingly popular in the treatment of venous diseases due to their flexibility, durability, and ability to maintain the shape of the vein after implantation. Such advantages of the product in surgical procedures are expected to drive the adoption of Nitinol stents.

Chronic Deep Vein Thrombosis (DVT) has a market share of 41.6% in the global market 2025. The prevalence of chronic DVT is increasing due to factors such as aging, obesity, sedentary lifestyles, and an increase in the number of patients undergoing surgery or cancer treatment.

For example, according to Centers for Disease Control and Prevention data 2025, every year, Chronic DVT or pulmonary embolism affects nearly 900,000 people in America, while causes death of more than 60,000 individuals.

Open cell stent design has a market share of 88.1% in the global market 2025. In recent years, stents have been used more frequently in the treatment of venous disorders. Open-cell stents are made up of a mesh-like structure that allows for greater flexibility and conformability to the shape of the vein. This type of stent design has larger and more widely spaced struts compared to closed-cell stents, which can improve blood flow and reduce the risk of stent migration or fracture.

One of the advantages of open-cell stent design is that it allows for better coverage of longer lesions or areas of the vein with irregular shapes. Open-cell stents can also be compressed to a smaller profile for easier delivery through narrow or tortuous vessels.

Introducer size (F) 9 has a market share of 45.4% in the global market 2025. Introducer size 9 is an important in the venous stents market. An introducer is a device that is used to insert a stent into a blood vessel. The size of the introducer is an important consideration in venous stenting procedures, as it can impact the safety and efficacy of the procedure.

Introducer size 9 refers to an introducer with an outer diameter of 9 French (3 millimeters), which is a common size used in venous stenting procedures. Its advantage is like introducer size 9 is large enough to accommodate larger stents, which can be necessary in cases where the stenosis (narrowing) in the vein is severe.

Hospitals held a market share of 34.9% in the global market 2025. Hospitals are important end users for venous stents procedures because of availability of skilled healthcare professionals, and easy adoption of advanced technology in the hospital.

Rising incidence of chronic diseases being a major factor driving this growth. While there are no specific search results for hospital trends and drivers in the venous stents market, it can be inferred that the increasing prevalence of chronic diseases and the aging population are likely to drive demand for venous stents in hospitals. The development of new and innovative venous stents is also expected to further drive market growth.

The key players in the market are actively working to improve their positions through product approvals, partnerships, acquisitions, launches, collaborations, and agreements with both existing and up-and-coming market participants. A manufacturer's chances of capturing a sizable market share significantly increases by acquisitions and partnerships.

A few examples of strategies acquired by the key players

Similarly, recent developments related to companies manufacturing venous stents have been tracked by the team at Future Market Insights. These are available in the full report.

| Attribute | Details |

|---|---|

| Historical Data Available for | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Market Analysis | USD Million for Value, and Units for Volume |

| Key Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan & Baltic Countries and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, the United kingdom, Germany, Italy, Russia, Spain, France, Benelux, Nordics, Poland, Hungary, Romania, Czech Republic, India, Thailand, Indonesia, Malaysia, Philippines, Vietnam, Japan, China, South Korea, Australia & New Zealand, Kingdom of Saudi Arabia, Northern Africa, Türkiye, GCC Countries and South Africa |

| Key Market Segments Covered | Material, Indication, Stent Design, Introducer Size, End User, and Region |

| Key Companies Profiled | Becton, Dickinson and Company; Cook Group Inc.; Boston Scientific Corporation; Medtronic; Koninklijke Philips N.V. (Vesper Medical Inc.); Optimed Medizinische Instrumente GmbH; plus medica GmbH & Co. KG; Abbott Laboratories, Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global venous stents market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the venous stents market is projected to reach USD 2.6 billion by 2035.

The venous stents market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in venous stents market are nitinol and elgiloy.

In terms of indication, chronic deep vein thrombosis segment to command 44.8% share in the venous stents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Venous Thromboembolism Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Venous Device Market

Venous Reservoirs Market

Endovenous Laser Therapy Market Size and Share Forecast Outlook 2025 to 2035

Veno-Venous Extracorporeal Life Support (VV ECLS) Devices Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Hydration Therapy Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Iron Drugs Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Packaging Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Pegloticase Market Insights - Growth, Demand & Forecast 2025 to 2035

Market Share Insights of Leading Intravenous Packaging Providers

Arteriovenous Fistula Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Central Venous Catheter (CVC) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Enteral Stents Market

Coronary Stents Market Insights – Trends, Growth & Forecast 2025-2035

Nephrology Stents and Catheters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA