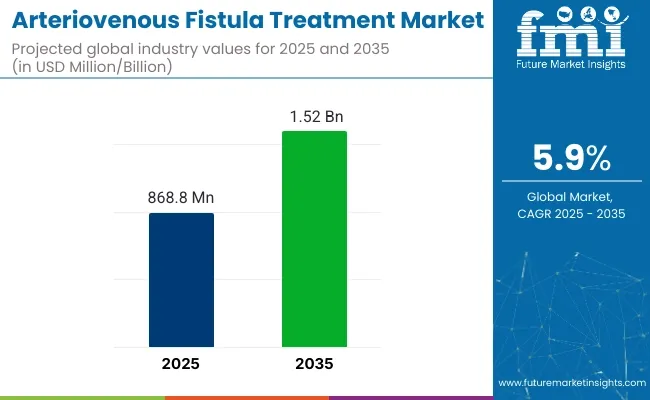

The global arteriovenous fistula (AVF) treatment market is projected to reach approximately USD 868.8 million in 2025 and expand to around USD 1.52 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.9% during the forecast period. This growth is primarily driven by the increasing prevalence of end-stage renal disease (ESRD), advancements in surgical techniques, and the rising demand for durable and reliable vascular access solutions for hemodialysis.

Recent developments in the AVF treatment market underscore significant technological advancements and procedural innovations. Minimally invasive techniques, such as ultrasound-guided cannulation and robotic-assisted surgeries, are enhancing the precision and success rates of AVF creation and maintenance.

Additionally, the integration of drug-eluting devices and bioresorbable materials is improving the long-term patency of AVFs, reducing the incidence of complications like stenosis and thrombosis. These innovations are contributing to better patient outcomes and increasing the adoption of AVF as the preferred method for vascular access in hemodialysis.

On May 6, 2024, Medtronic announced 60-month results from its IN.PACT AV Access trial during Charing Cross 2024. The study demonstrated sustained long-term patency benefits of the IN.PACT AV drug-coated balloon for arteriovenous fistula interventions compared to standard angioplasty.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 868.8 Million |

| Market Size in 2035 | USD 1.52 Billion |

| CAGR (2025 to 2035) | 5.9% |

The market's growth is also supported by favorable reimbursement policies, increased awareness among healthcare providers about the benefits of AVF, and the establishment of specialized dialysis centers. Furthermore, the aging global population and the rising incidence of diabetes and hypertension are contributing to the higher prevalence of ESRD, thereby expanding the patient pool requiring AVF treatments.

As the AVF treatment market continues to evolve, ongoing research and development efforts are expected to lead to the introduction of more specialized and efficient products. These advancements will cater to the diverse needs of healthcare providers and patients, further driving the market's growth and enhancing the quality of care for individuals undergoing hemodialysis.

The global arteriovenous fistula treatment market is expected to witness substantial growth from 2025 to 2035. Key segments driving this growth include peripheral arteriovenous fistulas and transcatheter embolization. These segments are driven by the increasing prevalence of chronic kidney disease, rising demand for dialysis procedures, and advancements in minimally invasive treatment options. Leading companies such as Medtronic and Cook Medical are innovating to provide advanced treatment solutions for arteriovenous fistulas.

Peripheral arteriovenous fistulas are expected to account for 68.2% of the market share in 2025. This segment's dominance is driven by the high prevalence of peripheral arteriovenous fistulas, which are often created for dialysis access in patients with end-stage renal disease (ESRD).

Peripheral fistulas are preferred over other types due to their better long-term patency, reduced risk of complications, and favorable outcomes in dialysis patients. These fistulas, typically created in the forearm, allow for efficient and reliable dialysis treatment, which is crucial for ESRD management.

The preference for peripheral arteriovenous fistulas is further supported by advancements in surgical techniques and improvements in patient outcomes, leading to a greater adoption of this treatment. Key players like Medtronic and Terumo Corporation are developing innovative devices and technologies to enhance the success rate of peripheral fistula procedures. The ongoing rise in the number of patients with ESRD is expected to contribute significantly to the growth of this segment in the coming years, driving its dominance in the arteriovenous fistula treatment market.

Transcatheter embolization is projected to hold 56.3% of the treatment type market share in 2025. This growth is attributed to the increasing preference for minimally invasive procedures in treating arteriovenous fistulas. Transcatheter embolization is a less invasive technique used to close or occlude arteriovenous fistulas, offering a number of benefits, including shorter recovery times, reduced risk of complications, and less post-procedure discomfort compared to traditional surgical methods.

Transcatheter embolization is particularly beneficial for patients who may not be ideal candidates for surgery due to other health conditions. The growing adoption of this technique in clinical practice, along with the development of advanced embolization devices by companies like Cook Medical and Boston Scientific, is further propelling the growth of this segment.

As healthcare providers increasingly prioritize patient safety, comfort, and faster recovery, the demand for transcatheter embolization treatments is expected to grow, making it a significant contributor to the overall arteriovenous fistula treatment market.

Limited Awareness about AVF Maintenance and Postoperative Care is Emerging as the Significant Barrier for Market Growth

The AVF treatment market also encounters a number of real-life issues that adversely affect both the patients and medical professionals. The majority of the patients suffer from access failure, infection, or stenosis, which is usually followed by multiple procedures and increased healthcare expenditures. In cases of patients who have conditions such as diabetes or hypertension, AVF maturation becomes more complicated, and treatment success becomes difficult to attain.

Above all that, strict new regulations on new vascular access devices and sluggish reimbursement authorizations slow the delivery of improved therapies. In certain regions, a lack of qualified vascular specialists can leave patients unable to see AVF procedures in a timely fashion, jeopardizing their health in severe ways.

Another prime problem is that proper AVF care and postoperative care are not well-known. Most patients are faced with complications because they simply lack the knowledge. Filling this knowledge gap through enhanced patient education might be the single greatest step to enhance long-term results.

The Introduction of Nanotechnology-Based Coatings Emerging as The Significant Opportunity for Manufacturers

The fast-changing panorama of AVF treatment is opening avenues for better patient care. Increasingly, there are more talks among physicians and scientists around targeted treatment methods through patient-specific vascular grafts and machine learning-based fistula monitoring for improving outcomes. New advancements in endovascular therapy, such as creating percutaneous AVFs, are fast-tracking the procedures toward long-term success.

Dialysis chambers in most emerging countries increase their capacity to catch up with the demands, while doctors invest more in telemedicine to monitor their AVF patients. Meanwhile, researchers are working on bioengineered vascular grafts that have better compatibility with the body and even encourage natural healing.

There are also all kinds of cooperation among medical device companies and healthcare professionals pushed by innovation to bring new AVF management solutions and better to the market. Amazing changes such as nanotube coatings for grafts to reduce the risk of infection and clot formation are now making AVF procedures safer and more efficient for patients all around the world.

Growth in Bioengineered and Drug-Eluting Vascular Grafts

Physicians and scientists taking bold measures towards improving AVF therapy beyond bioengineered, drug-eluting vascular grafts as extending life of AVFs and reducing complications such as stenosis. Engineers are also designing tissue-engineered vascular grafts from bioresorbable or synthetic materials along with cells isolated from the patient's body. In this way, reduce clotting and infection risk, while the body constructs the vessel.

It also coats drugs in grafts like sirolimus and paclitaxel that can inhibit abnormal tissue formation, which accounted for most of the AVF failures. Besides, biodegradable stents and scaffold-based systems give temporary support yet will lose themselves over time and risk lowering long-term levels.

Thus, these advances point towards better AVF success rates, fewer repeat procedures, and better dialysis. As more people are in need of hemodialysis, these products of the new generation will keep people better while reducing treatment costs.

Advancements in Robotic-Assisted Vascular Surgery

Robotic-assisted surgery is changing the face of AVF procedures by rendering them more precise with less complication and long-term improvement. With robotic systems, the surgeons have the dexterity and precision to operate on tissues with less trauma, allowing for faster recovery for the patients.

AI-driven robotic systems go further by offering real-time imaging and navigation, allowing surgeons to locate blood vessels more precisely and facilitate improved intraoperative decision-making. Such accuracy decreases the fallibility of the AVFs should stenosis and thrombosis arise as complications.

An increasing utility of robots in the vascular access procedure, with the concurrent growth of robotic technology, assures safer surgeries, better patient outcomes, and lesser repeat interventions. This transformation is an exciting breakthrough in improving the care of hemodialysis patients globally.

Market Outlook

This long-term hemodialysis access solution demand increases with the rapidly growing incidence of end-stage renal disease (ESRD). This accounts for consistent growth in the United States market for the treatment of AVFs. Technical improvements in bioengineered vascular grafts, drug-eluting grafts, and robotic-assisted laparoscopic surgeries improve the durability of AVFs, hence reducing their failure rate.

Additional market expansion is warranted by positive reimbursement policies and healthcare expenditure. Growing geriatric populations and high rates of prevalence of diabetes and hypertension provide further demand for AVF-related interventions. A growing rate of AMI intervention innovations is due to the participation of key players, research and development efforts, and regulatory approvals.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

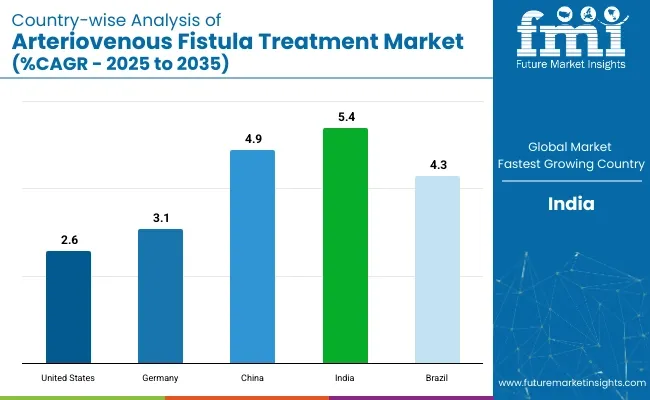

| United States | 2.6% |

Market Outlook

Germany's market for arteriovenous fistula or AVF treatment is thriving, thanks to its well-structured healthcare system together with the rising prevalence of end-stage renal disease or ESRD and acceptance of novel vascular access solutions, all pushing demand. Increased emphasis on medical innovation within the jurisdiction has spurred the development of bioengineered grafts and robotic-assisted vascular intervention.

The magnanimous reimbursement schemes under statutory health insurance are consistently driving the market growth as well. The area of research collaboration among research institutes and medical device players is further escalating technological leaps. The rapidly aging population and the significant proportion of patients suffering from hypertension and diabetes are driving demand for AVF procedures.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.1% |

Market Outlook

The rapid growth of China's AVF treatment market is driven by rising ESRD and diabetes incidence which drives demand for advanced vascular access solutions. The Chinese government healthcare reforms that widen insurance coverage help access hemodialysis and the AVF procedure. Local players and global companies are investing in advanced technologies, such as drug-coated grafts and AI-powered robotic systems.

Market growth is also propelled by the increasing aging population and rapid urbanization. However, the gaps in urban versus rural health care quality persist. Increased investment in AVF technology and infrastructure will help with AVF accessibility and treatment efficacy.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.9% |

Market Outlook

There's a growing market for treatment of arteriovenous fistula (AVF) in India, which is mainly because of escalating numbers of patients suffering from End-Stage Renal Disease (ESRD) and an increasing population in need of dialysis. Government initiatives such as Ayushman Bharat are enhancing availability of services, bringing improvement in acceptance of AVF. Awareness and affordability of treatment are still major challenges in rural areas.

The expanding number of private health providers and foreign capital investment in nephrology care are factors driving the market. Bioengineered graft advancement as well as minimally invasive AVF surgery are increasing momentum while the introduction of new vascular access solutions is likely going to be facilitated by improved regulations.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.4% |

Market Outlook

The Brazilian AVF treatment market is expanding due to increasing ESRD burden and government programs to provide greater access for dialysis. Advance vascular access solution utilization is increasing due to private healthcare sector growth and an increasing investment in nephrology care.

Economic volatility and unequal access to healthcare among these obstacles, the increasing use of bioengineered and drug-eluting vascular grafts has positively impacted the outcome of AVF. Medical education and collaboration of local companies with international healthcare organizations are further fostering the development of robotic-assisted vascular techniques that could improve AVF patency rates and long-term dialysis outcomes.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.3% |

The market for arteriovenous fistula (AVF) treatment is growing swiftly with the increasing number of individuals in need of long-term dialysis from end-stage renal disease (ESRD). The need for good vascular access has boosted the demand, prompting businesses to innovate in areas such as stent grafts, balloon angioplasty, and bioengineered solutions.

The medical device makers, biotech companies, and healthcare professionals are working proactively towards defining the market through innovative technologies, advancing patient results, and success of the treatments.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 868.8 million |

| Projected Market Size (2035) | USD 1.52 billion |

| CAGR (2025 to 2035) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for dollar sales |

| Fistula Types Analyzed (Segment 1) | Arteriovenous Fistulas, Dural, Peripheral, Pial or Cerebral, Other Fistula Types |

| Treatment Types Analyzed (Segment 2) | Drugs, Transcatheter Embolization, Ultrasound-guided Compression, Surgery |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

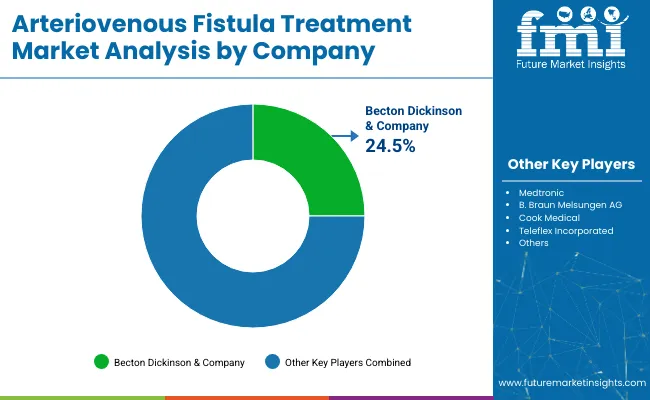

| Key Players influencing the Arteriovenous Fistula Treatment Market | Becton Dickinson & Company, Medtronic, B. Braun Melsungen AG, Cook Medical, Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA, NxStage Medical Inc., Poly Medicure Limited, Shire plc, Mayo Clinic, Proteon Therapeutics |

| Additional Attributes | dollar sales, CAGR trends, fistula type segmentation, treatment type adoption, competitor dollar sales & market share, regional growth patterns |

Arteriovenous Fistulas, Dural, Peripheral, Pial or Cerebral and Other Fistula Types

Drugs, Transcatheter Embolization, Ultrasound-guided Compression and Surgery

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global arteriovenous fistula treatment industry is projected to witness CAGR of 5.9% between 2025 and 2035.

The global Arteriovenous Fistula Treatment industry stood at USD 820.5 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 1,521.29 million by 2035 end.

India is expected to show a CAGR of 5.4% in the assessment period.

The key players operating in the global Arteriovenous Fistula Treatment industry are Becton Dickinson & Company, Medtronic, B. Braun Melsungen Ag, Cook Medical, Teleflex Incorporated, Fresenius Medical Care AG & Co. KGaA and others.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 4: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 5: North America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 6: North America Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 7: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 8: Latin America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 9: Latin America Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 10: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 11: Western Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 12: Western Europe Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 13: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 14: Eastern Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 15: Eastern Europe Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 16: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 17: South Asia and Pacific Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 18: South Asia and Pacific Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 19: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 20: East Asia Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 21: East Asia Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Table 22: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 23: Middle East and Africa Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 24: Middle East and Africa Market Value (USD Million) Forecast by Treatment Type, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Type, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 4: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 7: Global Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 10: Global Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 13: Global Market Attractiveness by Type, 2025 to 2035

Figure 14: Global Market Attractiveness by Treatment Type, 2025 to 2035

Figure 15: Global Market Attractiveness by Region, 2025 to 2035

Figure 16: North America Market Value (USD Million) by Type, 2025 to 2035

Figure 17: North America Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 18: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 19: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 22: North America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 25: North America Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 26: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 27: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 28: North America Market Attractiveness by Type, 2025 to 2035

Figure 29: North America Market Attractiveness by Treatment Type, 2025 to 2035

Figure 30: North America Market Attractiveness by Country, 2025 to 2035

Figure 31: Latin America Market Value (USD Million) by Type, 2025 to 2035

Figure 32: Latin America Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 33: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 34: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 37: Latin America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 40: Latin America Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 43: Latin America Market Attractiveness by Type, 2025 to 2035

Figure 44: Latin America Market Attractiveness by Treatment Type, 2025 to 2035

Figure 45: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 46: Western Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 47: Western Europe Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 48: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 49: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 52: Western Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 55: Western Europe Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 58: Western Europe Market Attractiveness by Type, 2025 to 2035

Figure 59: Western Europe Market Attractiveness by Treatment Type, 2025 to 2035

Figure 60: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 61: Eastern Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 62: Eastern Europe Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 63: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 64: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 67: Eastern Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 70: Eastern Europe Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 73: Eastern Europe Market Attractiveness by Type, 2025 to 2035

Figure 74: Eastern Europe Market Attractiveness by Treatment Type, 2025 to 2035

Figure 75: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 76: South Asia and Pacific Market Value (USD Million) by Type, 2025 to 2035

Figure 77: South Asia and Pacific Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 78: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 79: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 82: South Asia and Pacific Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 85: South Asia and Pacific Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2025 to 2035

Figure 89: South Asia and Pacific Market Attractiveness by Treatment Type, 2025 to 2035

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 91: East Asia Market Value (USD Million) by Type, 2025 to 2035

Figure 92: East Asia Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 93: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 94: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 97: East Asia Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 100: East Asia Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 103: East Asia Market Attractiveness by Type, 2025 to 2035

Figure 104: East Asia Market Attractiveness by Treatment Type, 2025 to 2035

Figure 105: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 106: Middle East and Africa Market Value (USD Million) by Type, 2025 to 2035

Figure 107: Middle East and Africa Market Value (USD Million) by Treatment Type, 2025 to 2035

Figure 108: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 109: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 112: Middle East and Africa Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 115: Middle East and Africa Market Value (USD Million) Analysis by Treatment Type, 2020 to 2035

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Treatment Type, 2025 to 2035

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Treatment Type, 2025 to 2035

Figure 118: Middle East and Africa Market Attractiveness by Type, 2025 to 2035

Figure 119: Middle East and Africa Market Attractiveness by Treatment Type, 2025 to 2035

Figure 120: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA