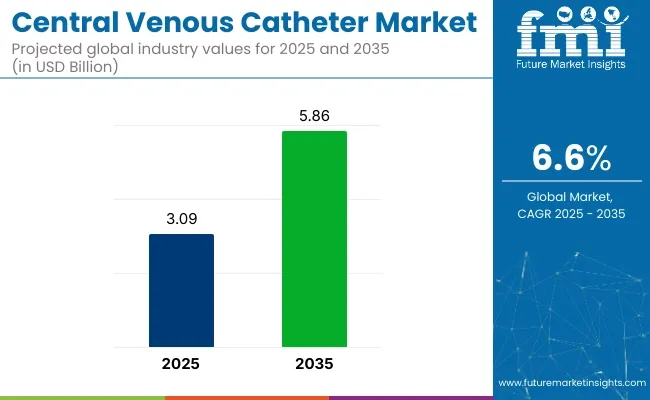

The central venous catheter market is projected to reach USD 3.09 billion in 2025 and is anticipated to grow to USD 5.86 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.6% throughout the forecast period. Central venous catheters (CVCs) are essential medical devices used for administering fluids, medications, and nutrients, as well as for monitoring and obtaining blood samples.

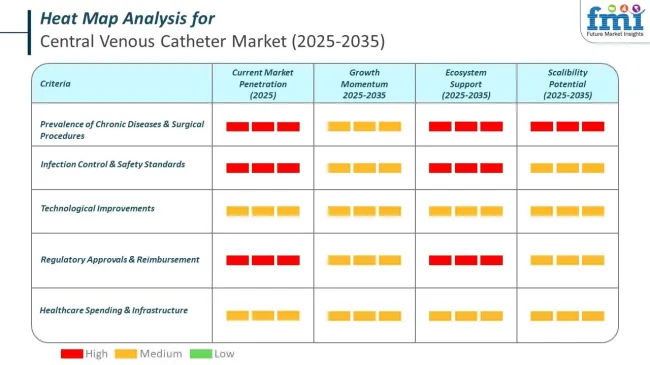

The growing prevalence of chronic diseases, the rise in critical care procedures, and the increasing demand for advanced healthcare solutions are driving the expansion of the central venous catheter market.

A significant driver for market growth is the increasing number of patients requiring long-term intravenous (IV) therapy. As chronic conditions such as cancer, diabetes, and renal failure become more prevalent, the need for reliable and durable central venous catheters for long-term medication delivery is increasing. Moreover, the rise in surgeries and critical care procedures, particularly in intensive care units, is further boosting demand for CVCs, as these devices are critical for administering medications and fluids during and after procedures.

Recent developments in the market highlight advancements in CVC technology aimed at reducing the risk of infections and improving patient outcomes. The introduction of antimicrobial-coated catheters and innovations in catheter materials to enhance biocompatibility and reduce complications have made central venous catheters safer and more efficient.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 3.09 billion |

| Market Size in 2035 | USD 5.86 billion |

| CAGR (2025 to 2035) | 6.6% |

On December 10, 2024, Teleflex Incorporated announced the launch of its new Pressure Injectable Arrowg+ard Blue Plus™ MSB Procedure Kit in Europe, the Middle East, and Africa (EMEA). This comprehensive kit is designed to enhance clinician convenience and confidence during the placement of Centrally-Inserted Central Catheters (CVCs) while adhering to maximal sterile barrier precautions.

The kit includes a pressure injectable CVC impregnated with Arrowg+ard Blue Plus™ protection, the Arrow™ GlideWheel™ Advancer for improved control, a new dilator that reduces penetration force by 48% to 72%, a kink-resistant nitinol guidewire, and other critical components. This was officially announced in the company's press release.

As the central venous catheter market continues to expand, technological advancements, the rising number of chronic disease cases, and the growing demand for specialized healthcare solutions will contribute to long-term growth.

The integration of digital health with central venous catheter systems creates a connected care continuum that boosts safety and efficiency. Smart catheters embed micro- and fiber-optic sensors to monitor flow, pressure, temperature, and early biofilm or thrombus formation, and they wirelessly alert clinicians to dislodgement, occlusion, or infection risk. Digital platforms manage logistics via RFID/barcode inventory tracking, cloud dashboards for dwell time and maintenance, and automated compliance. Outpatient and home-based care is enabled by EHR-linked registries and remote tools that deliver status updates and allow virtual site inspection.

Patient Engagement and Remote Support in Central Venous Catheter Access

The shift to patient-centered CVC care requires systematic measurement of satisfaction, comfort, and quality of life, combined with shared decision-making and robust post-discharge support. According to recent literature, patient-reported outcome and experience measures (PROMs/PREMs) are essential to capture how CVC use affects daily functioning and perceived value of care, yet validated, device-specific quality-of-life instruments are still lacking. Shared decision-making improves alignment of vascular access choice with patient values when clinicians integrate access selection into broader care planning. Home transition success depends on education, structured surveillance, and remote support to avoid gaps in care.

The above table presents the expected CAGR for the global central venous catheter market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 7.3%, followed by a slightly lower growth rate of 7.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.3% |

| H2 (2024 to 2034) | 7.0% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 6.1% |

The above table presents the expected CAGR for the global central venous catheter market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 7.3%, followed by a slightly lower growth rate of 7.0% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.6% in the first half and decrease moderately at 6.1% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

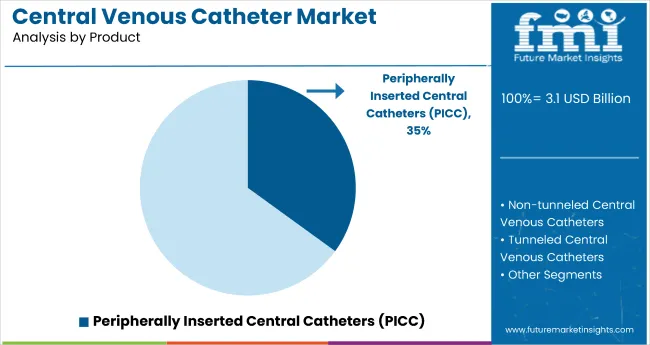

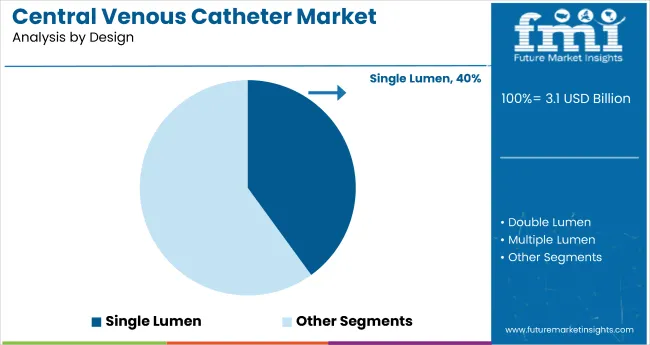

In the central venous catheter market, PICC lines dominate at 40%, reflecting their role in long-term infusion therapy. Double lumen designs lead with 45%, providing superior versatility for multiple drug administration. Polyurethane maintains 60% share due to structural integrity and patient comfort benefits. Hospitals account for 70%, driven by complex procedures and high patient dependency on vascular access solutions.

The peripherally inserted central catheters (PICC) category, commanding 40% of the central venous catheter market in 2025, is regarded as the most reliable option for extended intravenous therapies. These catheters are used for chemotherapy, antibiotic administration, and parenteral nutrition, offering safer placement through peripheral veins. Their acceptance has been reinforced by cost efficiency and reduced mechanical complications. Increased adoption for home-based care and outpatient infusion therapy is shaping demand, while antimicrobial coatings and enhanced material quality are viewed as critical features for infection prevention and device longevity. PICC lines are expected to remain the preferred choice among clinicians due to their adaptability in complex care protocols and patient-centric treatment models.

Double lumen catheters, representing 45% of the central venous catheter market, are considered indispensable for treatments requiring simultaneous infusion of incompatible solutions. Their design is valued for minimizing cross-contamination risks and ensuring consistent medication delivery. Clinical dependence on double lumen configurations has intensified as combination therapy becomes a standard approach in oncology and intensive care settings. Manufacturers are focusing on lumen geometry improvements and material upgrades to deliver better flow efficiency and reduce catheter-associated complications. With high procedural demand in emergency and chronic care, double lumen devices are projected to maintain a dominant role, reflecting their functional superiority over single-lumen alternatives.

Polyurethane accounts for 60% of the central venous catheter market by composition in 2025, supported by its mechanical strength and biocompatibility. This material is preferred for maintaining structural stability while providing flexibility for patient comfort during prolonged usage. Its chemical resistance to multiple infusion drugs adds a layer of reliability in critical care scenarios. Market growth for polyurethane-based catheters is further influenced by developments such as antimicrobial surfaces and heparin bonding, designed to minimize infection risks and extend device lifespan. Healthcare facilities are increasingly standardizing polyurethane as the primary choice over silicone and Teflon because of its proven balance between durability and clinical safety.

Hospitals, securing a 70% share of the central venous catheter market, remain the core setting for catheter utilization due to complex treatment requirements. High-acuity environments such as critical care units and oncology departments rely on these devices for life-sustaining therapies and multiple infusion needs. The role of hospitals in adopting advanced vascular access products has been reinforced by strict infection control measures and the availability of skilled professionals. Continued investment in catheter technology and patient safety protocols positions hospitals as a decisive force shaping procurement patterns and usage trends across regions. Their dominance reflects the growing burden of chronic illnesses and intensive treatment demands globally.

Effective healthcare faces several obstacles due to the rising global prevalence of diseases including cancer, acute infections, and trauma. Healthcare professionals are becoming more likely to employ PICC to provide proper patient care in emergency situations as well as inpatient hospital settings. One of the most prevalent causes for PICC lines is cancer, as patients with this condition frequently need long-term intravenous access and treatment.

The most recent statistics from 2021 by the International Agency for Research on Cancer (IARC) estimates there were 10 million cancer-related deaths, approximately 19.3 million newly diagnosed cancer cases approximately among the global population. Patients receiving haemodialysis for chronic renal diseases, including but not limited to End Stage Renal Disease (ESRD), must have a central venous access catheter (CVC) inserted into a large venous vessel prior to, or will commence after starting haemodialysis.

Sepsis is considered to be an interventional regulatory infection resulting in organ dysfunction or dysfunction of another organ system, and most often minimally requires intravenous broad-spectrum antibiotics administered with a central venous catheter, which can be a peripherally inserted central catheter (PICC) line.

Approximately 30 million people are diagnosed every year with sepsis according to the World Health Organization (WHO). Similarly, patients who cannot sustain appropriate nutritional intake orally may require long-term parenteral nutrition therapy, as in via a PICC line. Malnourishment is the cause of many deaths around the world yearly, for all populations, and stunted 149 million children under 5 years of age due to malnourishment.

The manufacturers of central venous catheters are constantly developing new, superior, and innovative products. These manufacturers have a tremendous opportunity to address the infection potential of vascular access devices and promote patient safety.

Furthermore, from the manufacturer’s perspective, the introduction of antimicrobial-coated central venous catheters provides differentiation and a competitive advantage to catheters in the marketplace. Both infection prevention and patient safety have become a greater higher priority to providers of vascular access devices, making current antimicrobial technology a more appealing proposition as a differentiator.

Central venous catheters are utilized routinely in the treatment of patients, suffering from malignancies in chemotherapy, parenteral nutrition, hemodialysis or critically ill. This population and conditions treated is increasing due to an older population and lifestyle, quality of medical care. The increase in the census of this older population will substantially increase the usage of catheters in practice.

Many complex medical treatment and intervention like central venous catheters are predominately on older adults. When considering the intervention, of treatment, in some small percentage of l-life threatening diseases like cancer, prolonged or continuous intervention or treatment with central venous catheters is warranted.

Central venous catheter manufacturing companies introduce innovative, technically advanced products into the market. These kinds of products create better opportunities for the companies by reducing infections associated with vascular access devices, thereby improving patient safety.

Catheters treated with antimicrobial agents can significantly lower the incidence of CRBSIs. Antimicrobial drugs, such as minocycline, silver, or chlorhexidine, when applied to the catheter's surface, prevent colonizing germs from growing and from infecting others. Antimicrobial-coated catheters should, in theory, improve patient safety, improve clinical outcomes, and save healthcare expenditures related to infection control because to the decreased frequency of CRBSIs they provide.

Therefore, the number of patients that are exposed to treatments using a central venous catheter means a bigger market size and demand. The aging population contributes as a significant force of demand within the market for central venous catheters. Advanced age subjects are very often exposed to complicated medical treatments and interventions that may involve the application of a central venous catheter.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 48.5% in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within tier 1 include Medtronic Plc., Becton, Dickinson and Company, Fresenius Medical Care AG & Co. KGaA, B. Braun Melsungen AG among others.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 21.2% market share. These are characterized by a strong presence overseas and strong market knowledge.

These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Cook Group, Smiths Medical, Teleflex Incorporated, Integer Holdings Corporation, Vygon S.A., Lepu Medical Technology, Argon Medical Devices, Inc., Merit Medical Systems, Inc., AngioDynamics, Inc. among others.

Finally, Tier 3 companies, such as Biomerics, Medical Components, Inc., KIMAL PLC, Heka s.r.l. among others are essential for the market.

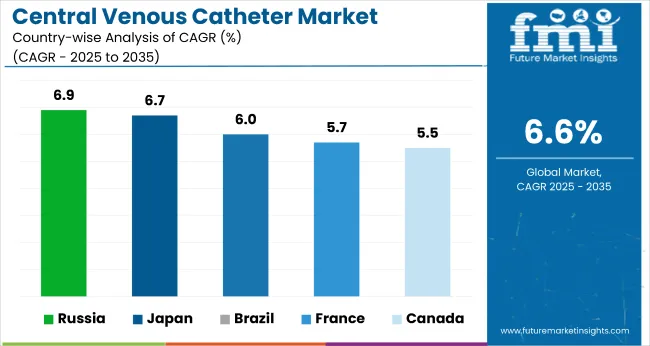

The section below covers the industry analysis for the central venous catheter market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 94.4% through 2035. In Asia Pacific, South Korea is projected to witness a CAGR of 6.0% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Canada | 5.5% |

| Brazil | 6.0% |

| France | 5.7% |

| Russia | 6.9% |

| Japan | 6.7% |

| South Korea | 6.1% |

| Spain | 6.3% |

USA central venous catheter market is poised to exhibit a CAGR of 6.8% between 2025 to 2035. Currently, it holds the highest share in the North American market, and the trend is expected to continue during the forecast period.

Surgeons and anesthesiologists often use CVCs to deliver vital drugs, blood products, or nutrition directly into the bloodstream. The CVC is an important modality in treating complicated cases that may involve emergency surgery or intensive care, as it allows the administration of large volumes rapidly with precision.

Interventional radiologists use CVCs during minimal invasion procedures for the insertion of ports used in chemotherapy or for long-term medication, among other treatment modes such as dialysis. Most surgeons, anesthesiologists, and interventional radiologists prefer CVC because they have options of single-lumen, double-lumen, or multi-lumen catheters depending on the clinical needs.

East Asia, spearheaded by China currently holds around 51.2% share of the East Asia central venous catheter industry. East Asia’s market is anticipated to grow at a CAGR of 7.5% throughout the forecast period.

Distribution and collaboration arrangements in China also continue to be one of the major drivers of demand in the CVC market. Local distributors and healthcare providers in China come together with partnerships to provide international manufacturers with greater access to the rapidly growing healthcare market. This enables the companies to overcome regulatory hurdles with greater efficiency, builds logistics, and opens up the various hospital networks of China.

Besides, such agreements allow product localization, matching products with Chinese healthcare standards and requirements. In return, the products of CVC are gaining access to various regions within China, particularly in Tier II and III cities. Growing efforts to enhance the healthcare infrastructure and access to these regions are further enticing the demand for CVCs mainly due to the rise in chronic disease cases. Strategic partnerships have thus become the major driving force for product penetration and market share in the changing healthcare landscape of China.

UK is expected to have a strong foothold when it comes to technology innovation. In 2024 the country is projected to account for almost 15.5% of the European central venous catheter market.

The primary factor boosting the growth of the Central Venous Catheter market in the UK is the increase in the number of healthcare services toward home-based and outpatient care approaches. Growing efforts toward a reduction of hospital admissions, along with management for long-term care of patients with chronic diseases like cancer, renal failure, and cardiovascular diseases, have made the application of CVC highly useful. These devices facilitate continuous medication, parenteral nutrition, and dialysis treatments without prolonged hospitalization.

The major factors contributing to the growth of the CVC market in the UK include increasing preference for outpatient care, technological advancements, and favorable government policies for treatment at home. With a greater number of patients being treated out of non-hospital environments, safe and effective CVCs will also see increased demand, thereby acting as one of the key drivers of market growth in the near future.

Substantial investments in the central venous catheter market are increasingly focused on acquisitions and expansion to drive growth and strengthen market presence. Companies are prioritizing the acquisition of innovative technologies and products to enhance their offerings, while also pursuing strategic partnerships to expand their global footprint.

Recent Industry Developments in Central Venous Catheter Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.09 billion |

| Projected Market Size (2035) | USD 5.86 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value; Million units of catheters for volume |

| Product Types Analyzed (Segment 1) | Peripherally Inserted Central Catheters (PICC), Implanted Port, Tunneled Central Venous Catheters, Non-Tunneled Central Venous Catheters |

| Design Types Covered (Segment 2) | Single Lumen, Double Lumen, Multiple Lumen |

| Composition Types Covered (Segment 3) | Polyurethane, Teflon, Silicone Rubber |

| End Users Covered (Segment 4) | Hospitals, Ambulatory Surgical Centers, Specialized Clinics, Cancer Research Institutes |

| Regions Covered | North America; Latin America; Europe; Asia-Pacific; Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Japan, United Kingdom, South Korea |

| Key Players Influencing the Market | Becton Dickinson, Teleflex, B. Braun Melsungen, AngioDynamics, Medtronic, Smiths Medical, Cook Group, Vygon, Argon Medical, KIMAL, Lepu Medical, Merit Medical, Fresenius Medical Care, Medical Components, Integer Holdings, Biomerics, Heka |

| Additional Attributes | Dollar sales by product type, PICC adoption trends, hospital demand drivers, innovation in catheter materials, regulatory impact on infection control |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of product type, the industry is divided into peripherally inserted central catheters (PICC), implanted port, tunneled central venous catheters and non-tunneled central venous catheters.

In terms of design, the industry is segregated into single lumen, double lumen, and multiple lumen.

In terms of Composition, the industry is segregated into polyurethane, Teflon and silicone rubber.

The industry is classified by end user as hospitals, ambulatory surgical centers, specialized clinics and cancer research institutes.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa have been covered in the report.

The global central venous catheter industry is projected to witness CAGR of 6.6% between 2025 and 2035.

The global central venous catheter industry stood at USD 2.9 billion in 2024.

The global central venous catheter industry is anticipated to reach USD 5.86 billion by 2035 end.

China is set to record the highest CAGR of 8.5% in the assessment period.

The key players operating in the global central venous catheter industry include Becton, Dickinson and Company, Teleflex Incorporated, B. Braun Melsungen AG, AngioDynamics, Inc., Medtronic Plc., Smiths Medical (ICU Medical Inc.), Cook Group, Vygon S.A., Argon Medical Devices, Inc., KIMAL PLC, Lepu Medical Technology (Beijing) Co., Ltd. (Comed B.V.), Merit Medical Systems, Inc., Fresenius Medical Care AG & Co. KGaA, Medical Components, Inc., Integer Holdings Corporation, Biomerics, Heka s.r.l.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Peripherally Inserted Central Catheter Analysis by Product Type by Indication and by End User through 2035

Demand for Peripherally Inserted Central Catheter in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Peripherally Inserted Central Catheter in Japan Size and Share Forecast Outlook 2025 to 2035

Central Tube Optical Cable Market Size and Share Forecast Outlook 2025 to 2035

Central Dialysis Fluid Delivery System (CDDS) Market Size and Share Forecast Outlook 2025 to 2035

Central Computing Architecture Vehicle OS Market Forecast and Outlook 2025 to 2035

Central Reinforced Tape Market Size and Share Forecast Outlook 2025 to 2035

Venous Stents Market Size and Share Forecast Outlook 2025 to 2035

Central Monitoring Station Market Size and Share Forecast Outlook 2025 to 2035

Venous Thromboembolism Treatment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Centralized Workstation Market Size and Share Forecast Outlook 2025 to 2035

Catheter Market Insights by Product, Indication, End-user, and Region 2025 to 2035

Central Lab Market Growth – Industry Trends & Forecast 2025 to 2035

Catheter-Directed Thrombolysis Market Growth - Trends & Forecast 2025 to 2035

Catheter Tip Syringe Market Size, Share & Demand Outlook 2025 to 2035

Catheter Associated Urinary Tract Infections (UTI) Treatment Market - Demand & Forecast 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

Central Nervous System (CNS) Lymphoma Treatment Market Analysis by Treatment, End User, and Region: Forecast for 2025 to 2035

Central Pain Syndrome Management Market – Size, Share & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA