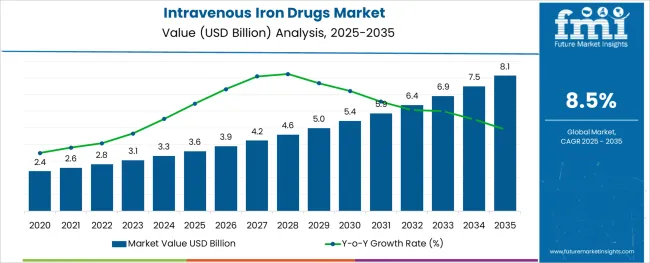

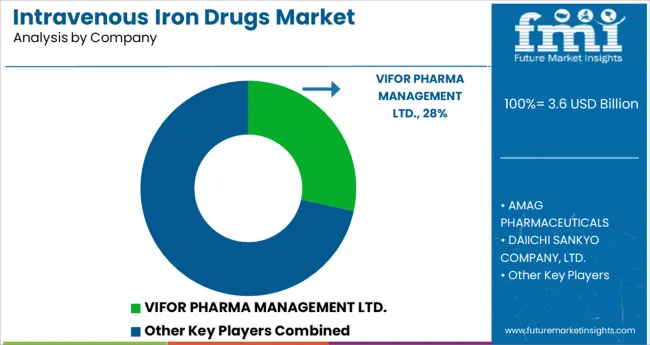

The Intravenous Iron Drugs Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

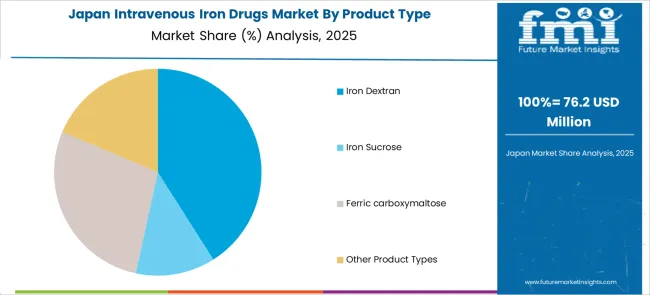

The market is segmented by Product Type and Indication and region. By Product Type, the market is divided into Iron Dextran, Iron Sucrose, Ferric carboxymaltose, and Other Product Types. In terms of Indication, the market is classified into Chronic Kidney Disease, Inflammatory Bowel Disease, Cancer, and Other Applications.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

As per the Intravenous Iron Drugs market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Intravenous Iron Drugs Market increased at around 8.1% CAGR, wherein, the region North America held a significant share in the global market.

Iron is a component of haemoglobin, which transports oxygen in the blood and also allows for the creation of red blood cells. Anaemia is a diagnosed condition in which an individual is lacking in the body's iron needs.

Anaemia symptoms include weariness and loss of energy, unusually quick heartbeat when exercising, difficulties concentrating, pale skin and dizziness, sleeplessness, and cramping.

According to a recent survey done by the Vitamin and Mineral Nutrition Information System (VMNIS), around 40% of mothers and children in poor nations are anaemic. As a result, the market is expected to grow at a CAGR of 8.5% over the next ten years.

Anaemia is one of the most frequent blood illnesses nowadays. Anaemia affects an estimated 3 million people in the United States, according to the National Heart, Lung, and Blood Institute.

The rising incidence of target illnesses such as rheumatoid arthritis, autoimmune diseases, renal issues, cancer, liver disorders, thyroid diseases, and inflammatory bowel disease is a significant factor driving the expansion of the intravenous iron medication market.

As per National Kidney Foundation, the two primary causes of CKD are diabetes and hypertension. Also, according to the report, the chronic renal disease affects approximately 10% of the worldwide population, with over 2 million people needing dialysis on a daily basis.

The bulk of all these people is often observed in nations such as Italy, the United States, Germany, Japan, and Brazil.

A significant number of people who have the disease are unaware of it until severe symptoms appear. The frequency of chronic kidney disease is expected to rise in developing economies such as India and China, implying an increase in the elderly population in the future years.

With the increasing incidence of these disorders, there is a greater demand for intravenous iron medicines.

One of the biggest disadvantages of oral iron medications is the possibility of significant side effects. Digestive issues such as stomach pains, constipation, lack of appetite, nausea, and vomiting are common side effects of oral iron medications.

Convulsions, shallow or quick breathing, exhaustion or weakness, fatigue, pale complexion, and bluish skin or fingernails can all result from an overdose of oral iron medications.

Intravenous iron medications, on the other hand, have been demonstrated to promote iron intake by the body, allowing Erythropoiesis-stimulating Agents (ESAs) to act more effectively in lowering anemic conditions.

Other benefits of intravenous iron medications include heart health preservation and the potential to be utilized by dialysis patients, particularly those undergoing hemodialysis. These negative effects are thus expected to assist the changeover to intravenous iron medications, boosting their use during the projection period.

The market in Asia Pacific is expected to swell at a significant pace of 8.6% from 2025 to 2035. This may be ascribed to the availability of prominent players in the Asia Pacific, as well as the strengthening of healthcare infrastructure with the growing government efforts. Furthermore, the prevalence of IDA in rising economies such as China and India has aided industry expansion.

Besides, the market in Europe is anticipated to increase significantly throughout the forecast year as a result of the growing research and commercialization of new products, the acceptance of advanced medications, and the region's rising incidence of malignancy.

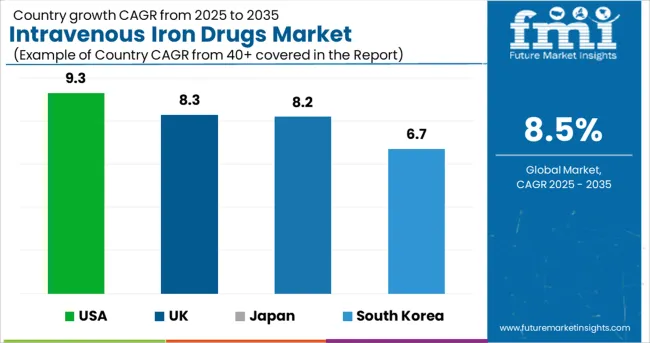

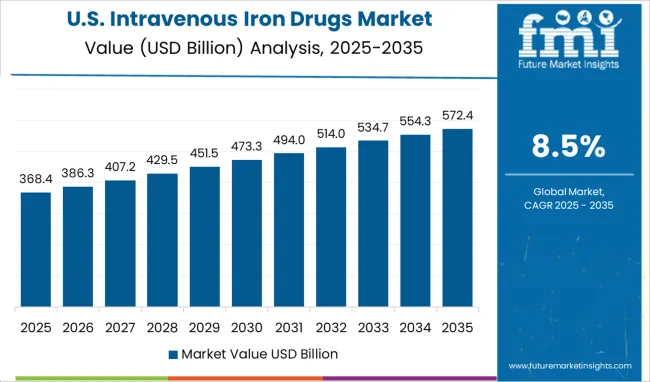

The United States dominated the North American Intravenous Iron Drugs Market, which is expected to reach USD 8.1 billion by 2035 and will increase at a CAGR of 9.3% CAGR during the forecast period. The reimbursement and technological advancement facilities are advantageous factors for market growth in the United States.

The growing geriatric population is a key driver of market expansion in the country. According to USA Census Bureau projections, the number of Americans aged 65 and up is expected to grow from 2.4 million in 2020 to nearly 95 million by 2060. Furthermore, the share of people aged 65 and up is expected to rise from 16% to 23%.

Its dominance is also due to the region's rising rates of cancer, chronic renal disease, and gastrointestinal ailments. Furthermore, an increase in awareness of women's health and a surge in the frequency of celiac disease are the other factors boosting the market in the country.

The market for intravenous iron drugs in the United Kingdom stood at USD 3.3 million in 2024. The market in the country is projected to swell at a CAGR of 8.2% during the forecast period to reach a valuation of USD 278 million by 2035. The market in the country is expected to register an absolute dollar opportunity of USD 3.6 million from 2025 to 2035.

The market in Japan is likely to expand with an absolute dollar opportunity of USD 128 million from 2025 to 2035. The market in the country is expected to reach a valuation of USD 233 million by 2035 growing at a CAGR of 8.2% during the forecast period.

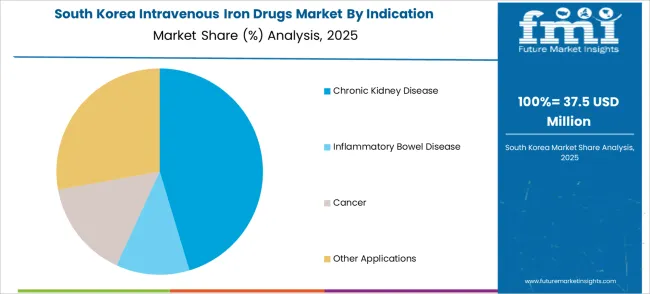

In South Korea, the market is projected to reach a valuation of USD 127 million by 2035, growing from USD 66 million in 2025. With an absolute dollar opportunity of USD 61 million, the market in the country is expected to register a CAGR of 6.7% during the forecast period.

In 2024, the market for intravenous iron drugs led the market for intravenous medicines for chronic kidney disease, accounting for 30% of the total in 2024.

This large market may be due to the fact that chronic kidney disease (CKD) and intravenous iron therapies are intensively used by CKD patients. IDA is a prevalent complication in CKD patients. It is uncommon in the early stages of renal illness; nevertheless, it happens as the disease progresses and kidney function declines.

Anaemia is caused by a decrease in the amount of Red Blood Cells (RBCs) in CKD patients. The growth in CKD cases has resulted in a large increase in the number of IDA patients. The conventional therapy for people with dialysis and non-dialysis-related CKD is intravenous iron. Dialysis is used to treat anaemia and end-stage renal failure.

Due to the increasing incidence of cancer and the consequent increase in the number of IDA cases, the market revenue through cancer application is expected to grow at the fastest CAGR throughout the projection period.

IDA affects a considerable proportion of cancer patients. Blood cancer, bone cancer, cervical cancer, colon cancer, and prostate cancer are all common cancers associated with anaemia. According to the NCBI, lung and breast cancers have the highest rate of anaemia among solid tumours.

Hematologic cancers, such as leukaemia, lymphoma, and multiple myeloma, create abnormal blood cells, which weaken the immune system and cause anaemia. Chemotherapy and radiation therapy are two cancer therapies that cause anaemia in individuals.

Some of the key players in the global Intravenous Iron Drugs market include Vifor Pharma Management Ltd.; AMAG Pharmaceuticals; Daiichi Sankyo Company, Ltd.; Sanofi S.A.; Pharmacosmos A/S; Shield Therapeutics Plc; AbbVie Inc., Vifor Pharma Management Ltd.; AMAG Pharmaceuticals; Daiichi Sankyo Company, Ltd.; Sanofi S.A.; Pharmacosmos A/S; and Shield Therapeutics Plc among others.

Some of the recent developments in the Intravenous Iron Drugs Market are:

The global intravenous iron drugs market is estimated to be valued at USD 3.6 billion in 2025.

It is projected to reach USD 8.1 billion by 2035.

The market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types are iron dextran, iron sucrose, ferric carboxymaltose and other product types.

chronic kidney disease segment is expected to dominate with a 47.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intravenous Hydration Therapy Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Solution Compounders Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Line Connectors Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Packaging Market Size and Share Forecast Outlook 2025 to 2035

Intravenous Pegloticase Market Insights - Growth, Demand & Forecast 2025 to 2035

Market Share Insights of Leading Intravenous Packaging Providers

Peripheral Intravenous Catheter Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA