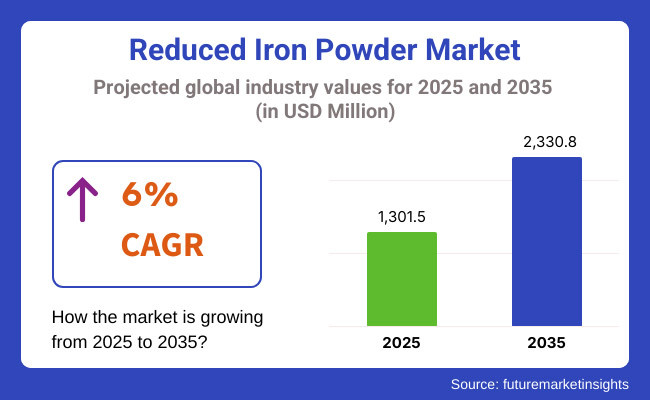

The international reduced iron powder market stood at USD 1,167.8 million in 2023. Reduced iron powder demand went up by 5.5% annually in 2024 and will be USD 1,301.5 million in 2025. Overall sales will rise at a 6% CAGR from 2025 to 2035 and will eventually be USD 2,330.8 million in 2035.

Increasing demand for lower iron powder for use in food, pharmaceuticals, and industry is one of the most powerful market drivers. Lower iron powder has broad use for food fortification due to the ultra-high bioavailability of iron required to avert iron deficiency worldwide. Increasing demand for dietary supplements is also driving the market with one of the most powerful ingredients of all supplements being lower iron powder.

The global reduced iron powder industry is expected to expand exponentially in the near future due to enhanced technology in production, its widespread application in other industries, and greater demand for pure iron powders. Reduced iron powder, produced through reduction of iron ore with reducing agents such as hydrogen or carbon monoxide, finds application in the automobile, electrical, food fortification, and environmental pollution treatment industries.

Reduced iron powder is applied to sintered products in industry applications, which are utilized by the automobile and machinery industries and help further support the market growth. Day-to-day increasing process and growing requirement of special parts used by the automobile and machinery industries are dominating the reduced iron powder market

Growing demand for sustainability and iron availability is compelling industries to adopt newer and cleaner technologies in manufacturing processes. Industries are making sustainability a business in manufacturing processes, including energy consumption reduction and recycling. Additionally, innovation in reducing formulation of iron powder to attain maximum availability in food and dietary supplement foods is compelling the market to grow.

Following is the six-month gap of CAGR of base year (2024) and current year (2025) of the global reduced iron powder market, respectively. The report explains differences in performance with significant differences and patterns in revenue attainment, thus providing the stakeholders a comprehensive idea of the growth pattern in the year. January to June is the first half year, i.e., H1. July to December is the second half, or H2.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.6% |

| H2 (2024 to 2034) | 5.8% |

| H1 (2025 to 2035) | 5.9% |

| H2 (2025 to 2035) | 6.1% |

The company will be expanding at a rate of 5.9% CAGR in the first half (H1) of the period 2025 to 2035, while in the second half (H2) of the same period, it will be expanding at a rate of 6.1%. to the period that follows, H1 2025 to H2 2035, CAGR gains to 5.9% in the initial half and slightly higher at 6.1% in the latter half. The sector added 20 BPS in the initial half (H1) and additional 30 BPS loss suffered by the company in the latter half (H2).

Increased demand for reduced iron powder is due to technological progress, increasing industrial applications, and pursuit of reduction of micronutrient deficiency across the world. Industries never in pursuit of anything but something better to produce and exhaust, there is going to be greater demand for high-quality reduced iron powders and hence diversification and growth.

Tier 1 World Leaders - High Volume Production Capacity and Inventions, They are the global leaders in the production of reduced iron powder with a highest capacity of production, cutting-edge technology, and extensive distribution networks around the globe. Höganäs AB (Sweden), it is a top metal powder manufacturer, and Höganäs AB is a global leader in metallurgical, automotive, and fortifying food with high-purity reduced iron powder.

It has a reputation for continuous R&D, which produces quality output and continuity. Rio Tinto Metal Powders (Canada), Being a worldwide leader in iron and steel powders, Rio Tinto is a manufacturer of premium reduced iron powder used extensively in industrial, chemical, and food sectors. With vertically integrated raw material access and process-excellence focused manufacturing, Rio Tinto is a market leader in Europe and North America.

Tier 2 Regional Key Players - Dominant Competitors with Customized Solutions, They have sufficient regional reach, providing customized solutions and specialty products for diversified industry and nutritional needs. Industrial Metal Powders (India), Being one of the world's top producers of high-purity iron powder, Industrial Metal Powders trades food-grade, pharma, and industrial-grade iron powders to the Middle East and Asian regions. Sundram Group (India): Being experienced in metal powder manufacturing, Sundram Group sells welding, metallurgical, and chemical industry-grade reduced iron powder at competitive prices.

Tier 3 Emerging Innovators - Niche Suppliers and Specialty Producers, These companies specialize in specialty use, special iron powder products, and changing industrial requirements. Yingkou Maolin Powder Products (China), Emerging producer of low iron powder, fine powders for chemical, water treatment, and specialty industrial uses.

American Elements is (USA), Pre-eminent supplier of high-purity low iron powders, American Elements is an industry-leading provider of research solutions, new materials, and pioneering technical applications. Sky Spring Nanomaterials is new Nano-powder Technology Company, Sky Spring manufactures ultra-low iron powders for advanced production and R&D application.

Growing Demand for Supplemented Foods & Supplements

Shift: Iron deficiency anemia is the universal nutritional disorder and involves more than 1.6 billion people, as estimated by the World Health Organization (WHO). Governments are initiating compulsory fortification programs for foods to manage iron deficiency, primarily in the third world where anemia prevails. Iron fortification programs in wheat flour, rice, and milk have been initiated by India, South Africa, and Bangladesh.

But among the biggest challenges is that most iron powders, which are widely used in the strengthening, spoil food flavor, taste, and texture, and as such, their acceptors are humans. Bioavailability of some iron compounds is an issue since there exist certain types of iron, whose assimilation, human bodies can't manage, and as a result, become ineffective for healing anemia.

Strategic Response: To meet such requirements, industry giants in food business such as Höganäs AB and BASF have introduced ultra-high purity microencapsulated reduced iron powders which will not be expected to impart any flavor, taste, or texture to foods while enriching the latter with the former.

It makes food fortification possible of foods such as plain foods - flour, milk derivatives, or breakfast cereals with iron in order to get it done easily without watering anything down from their qualities. Accompanying this is the development by companies such as Industrial Metal Powders (IMP) of capacity to produce low iron powder that is food fortification specifically targeted.

This is consistent with national food fortification programs in countries such as India, China, and most of the countries in Africa where anemia ranks among the largest health concerns. In developed North American and European economies, firms are launching vegetable and organic-based iron supplements in a bid to remain attuned to rising demand for vegan-friendly and clean-label dietary supplements.

Grown Demand for Sustainable Agriculture & Animal Nutrition

Shift: Rising Demand for Iron-Fortified Animal Feed and Agro-Applications. Animal nutrition and sustainable agriculture are new thrust fields for food security and environmental sustainability worldwide. Iron deficiency in animals is becoming more of a usual occurrence, and hence anemia, growth stunting, and reduced reproduction efficiency have been made self-evident.

Soil nutrient loss due to indiscriminate use of farm land has raised demands for iron-based fertilizers to boost farm yields. Farmers now utilize the use of iron powder as a viable and cost-effective way of providing necessary micronutrients to soil and animal feed.

Strategic Response: High-purity reduced iron powders are of considerable interest to leading producers such as Rio Tinto and Höganäs AB since they can be utilized in fertilizers and animal feed. Iron powders address the nutritional iron requirements of plant and animal iron deficiency and correlate closely with healthy animals and other crops.

Organic farming practices go mainstream in US and European markets. Industrial Metal Powders (IMP) and Reade Advanced Materials offer micro-fortified iron powders as non-toxic to toxic to soil nutrient levels and pH values when used as an ingredient in fertilizer.

Additive Manufacturing & 3D Printing Growth

Shift: Increased use of additive manufacturing (AM) and 3D printing is creating gargantuan demand for metals powders such as high-fineness reduced iron powder and high-purity reduced iron powder in the market. The entire industry of 3D printing on its own merit as the top driving force which is transforming the aerospace, automobile, and health sectors.

The market trend among producers is toward more-strength light metal parts that are applied in the automotive, aerospace, and implantable medicine sectors. Demand for spherical reduced iron powder is stimulated by application of engineered-to-order, complex-geometry pieces with more mechanical strength in manufacturing higher-flowing, higher-sintered, and higher-density products.

Strategic Response: Among them are Höganäs AB, Sandvik, and JFE Steel Corporation, who consume plenty of gas and water atomization technology in the manufacture of spherical low-carbon iron powders with enhanced 3D printability, surface texture, and mechanical characteristics.

Höganäs AB has been developing its portfolio of high-performance iron powders to serve the automotive sector, which is being asked more and more to use light, 3D-printed metal components for maximum fuel economy and lowest emissions.

Automotive production companies such as BMW and Tesla are also applying metal additive manufacturing in the shape of micron-scale metal powders to produce engine, brake, and structural components. Orthopedic prosthetics and implants made of specially formulated compounds of powdered iron with reduced size are more sought after as they are extremely strong as well as extremely biocompatible and therefore iron-based powders are printed 3D with increased demand from the medical field.

Demand for Reduced Iron Powder for Water Purification

Shift: Global concern about water pollution, metal poisoning, and strict regulation restraint on industrial effluent are triggering the use of iron-based technology for water purification. Mining, textile, and pharma industries are being compelled to adopt effective water treatment technology cautiously toward the disposal of hazardous waste by regulation.

Powdered reduced iron in zero-valent form (ZVI) is picking up pace these days as an exceptionally effective reagent for treating and decontaminating groundwater against toxic heavy metals like arsenic, lead, and chromium.

Strategic Response: Reade Advanced Materials and BASF are also formulating nano-zero-valent iron (nZVI) for industrial wastewater treatment to enhance it in removing arsenic, lead, and hexavalent chromium contaminants.

Low iron powder manufacturers are collaborating with water treatment firms to ensure more efficient dosing of iron in remediation products in an effort to achieve total adsorption of contaminants as well as secondary wastes in reduced quantities. Hybrid and bio-based iron powders are being sold by firms through the combination of nano-iron with carbonaceous materials in a bid to sell them in industrial applications.

Eco-Friendly & Sustainable Solutions Drive Market Expansion

Shift: Escalating sustainability and carbon footprint concerns are mounting marketplace demands on businesses to buy sustainable material, i.e., reduced amount of iron powders from recyclable origin. The role of the iron powder industry is also massive in managing industrial waste by recycling scrap metal as reusable raw material to be reused.

Strategic Response: Höganäs AB also showcased recycling-based high-purity iron powders as part of a strategy to reduce environmental issues. Their CSR practice includes carbon-free production processes and environmentally friendly manufacturing operations.

Rio Tinto employed low-emission production processes to facilitate regulation compliance in an effort to reduce CO₂ emissions while providing high-quality iron powder for industrial applications on a massive scale. Iron powder water treatment technologies are also researched by companies that are keen on offering environmentally friendly solutions to areas with severe water pollution problems.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of reduced iron powder through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 6.8% |

| Germany | 4.2% |

| China | 2.5% |

| Japan | 5.9% |

| India | 3.1% |

Metallurgy, additive manufacturing (3D printing), and chemical processing are expected to grow in demand which is contributing to the expansion of the powder market in USA iron. Reduced iron powder is used in many applications, and its growing applications in powder metallurgy, soft magnetic composites and iron-fortified food products make it a widely used substance in the aerospace, automotive, and healthcare industries.

Further, the transition to high purity, low-carbon footprint iron powders is driving consumption of atomized and chemically reduced iron powders for precision manufacturing application. Metal injection molding (MIM), which uses fine-grain reduced iron powder to create key components, is also contributing to the success of the USA market.

Government-endorsed efforts to recycle sustainable materials and utilize iron powder in water purification systems have resulted in investments in hydrogen-reduced iron powder with improved chemical stability and energy efficiency.

The growth of sustainable metallurgy in Europe: EU is imposing strict compliance regulations to enhance the demand for the sustainable metallurgy, which in turn is enabling the market players to studying the sustainable metallurgy clearly, thereby proving beneficial for the suppliers in the long run. High purity, reduced iron powders are in high demand due to the expansion of 3D metal printing, high-performance steel manufacturing and powdered metal-based catalytic reactions.

As energy-efficient and minimalist metal solutions gain traction among consumers, manufacturers are focusing on innovations such as high-grade atomization, ultra-fine iron powders and carbonyl iron powder applications to cater to stringent industry demands in Germany.

Demand for cost-efficient metal powders in automotive parts, industrial machinery, and construction materials is driving the growth of China's reduced iron powder industry. The rising powder metallurgy, high-strength sintered components, and chemical catalyst applications increase the demand for commercially attractive, high bulk density, iron powder formulations.

China is steering eye towards high surface area reduced iron powders to use in catalyst production, iron based fortification as well as for battery electrodes with the help from government backed industrial expansion programs.

The reduced iron powder market in Japan, which was heavily influenced by such country's focusing on precision metallurgy, high-performance electronics, and lightweight sintered materials. High purity, ultra-fine iron powders for automotive transmission components, electromagnetic shielding, and compact sintered metals are preferred by manufacturers across Japan.

On the other hand, the upcoming developments in Japan on nanoparticle-based iron powder synthesis and superalloy compositions will result in increased demand for high-performance, oxidation-resistant reduced iron powders.

The growth of the India reduced iron powder market can be attributed to rising industrial manufacturing investment, growing usage of iron-fortified food products, and expansion of powder metallurgy applications. Applications of reduced iron powder are steadily increasing in welding, water treatment, and in sintered structural components.

Supported by government policies and initiatives to encourage industrial infrastructure growth and sustainable metallurgy practices, Indian manufacturers are investing in production capabilities to offer low-cost, local, and high-purity grade iron powder.

| Segment | Value Share (2025) |

|---|---|

| Powder Metallurgy & Industrial Applications (By Application) | 73.4% |

The powder metallurgy and industrial applications segment held the largest market share as it has high demand for reduced iron powder for sintered metal parts, magnetic materials, and structural components. However, for high-performance metal injection molding (MIM) and 3D printing applications, manufacturers need high-purity, finely milled iron powder.

Due to a growing need for lightweight, high-strength components, there is an ongoing shift in the market to engineering a new class of iron powder through chemical reduction techniques that provides improved flowability and compaction properties.

This segment is poised for growth in North America and Asia-Pacific, where advanced metal powder applications are being adopted, with a projected value share of 73.4% by 2025.

| Segment | Value Share (2025) |

|---|---|

| Nutritional Fortification, Chemical Catalysis & Water Treatment (By Application) | 26.6% |

In parallel, the consumer demand for iron-fortified foods, environmentally benign techniques for water purification, and use as industrial catalysts are further driving the market into food fortification, chemical processing, and sustainable waste water treatment applications.

The most noted itself for its potential, from reduced iron powder in bio-compatible formulations, iron-enhanced nutrient blends, and catalytic filtration media has only extended the demand. With health and environmental agencies advocating safe and effective iron-based solutions, demand for food-grade, high-surface-area, and oxidation-resistant iron powders are expected to increase.

Demand for industrial sustainability and food safety regulation will especially drive the segment, which is expected to obtain a 26.6% of value share in 2025, while demand in Asia-Pacific, and Europe is attracting considerable attention in the market.

Real-time market scenario analysis identifies the top players in the reduced iron powder market and provides insights into new production strategies and applications. They are investing in state-of-the-art sintering technologies, nano-structured iron powders and high performance alloy formulations.

Ubiquitous manufacturing companies like Höganäs AB, Rio Tinto Metal Powders, BASF, JFE Steel, and Industrial Metal Powders (IMP) have a strong foothold and are recognized for their prowess in high purity iron powder manufacturing, advanced compaction technology and global distribution networks. Rising demand for powder metallurgy solutions is driving companies to expand operations in Asia-Pacific and Europe.

Key approaches include automotive and aerospace company collaborations, nation-wide iron powder fortification in food safety measures, ultra-fine, high-density iron powder for catalytic development. Manufacturers are also prioritizing sustainable metal recycling and low-emission iron powder production.

For instance:

The market includes elemental iron and various iron compounds, catering to diverse industrial needs.

Iron products are widely used in the food and beverage industry, animal feed, agriculture, and the pharmaceutical sector.

These products are available through both online and offline distribution channels, ensuring accessibility for consumers and businesses.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global reduced iron powder industry is projected to reach USD 1,301.5 million in 2025.

The industry is forecasted to grow at a CAGR of 6.0% from 2025 to 2035.

Asia-Pacific is expected to dominate due to strong demand for powder metallurgy and industrial applications.

Key players include BASF; Yara; Nutrien; Compass Minerals; DowDuPont; AkzoNobel; Spectrum Chemical; Ashland;IMP.

Key drivers include increasing use in additive manufacturing, expanding applications in industrial catalysis, and advancements in sintered metal technology.

Table 1: Global Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Volume (MT) Forecast by Product Type, 2017 to 2033

Table 5: Global Value (US$ Million) Forecast by Application, 2017 to 2033

Table 6: Global Volume (MT) Forecast by Application, 2017 to 2033

Table 7: Global Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 8: Global Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 9: North America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Volume (MT) Forecast by Country, 2017 to 2033

Table 11: North America Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: North America Volume (MT) Forecast by Product Type, 2017 to 2033

Table 13: North America Value (US$ Million) Forecast by Application, 2017 to 2033

Table 14: North America Volume (MT) Forecast by Application, 2017 to 2033

Table 15: North America Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 16: North America Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Volume (MT) Forecast by Country, 2017 to 2033

Table 19: Latin America Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Volume (MT) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Value (US$ Million) Forecast by Application, 2017 to 2033

Table 22: Latin America Volume (MT) Forecast by Application, 2017 to 2033

Table 23: Latin America Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 24: Latin America Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 25: Europe Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Volume (MT) Forecast by Country, 2017 to 2033

Table 27: Europe Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Volume (MT) Forecast by Product Type, 2017 to 2033

Table 29: Europe Value (US$ Million) Forecast by Application, 2017 to 2033

Table 30: Europe Volume (MT) Forecast by Application, 2017 to 2033

Table 31: Europe Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 32: Europe Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 33: East Asia Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: East Asia Volume (MT) Forecast by Country, 2017 to 2033

Table 35: East Asia Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: East Asia Volume (MT) Forecast by Product Type, 2017 to 2033

Table 37: East Asia Value (US$ Million) Forecast by Application, 2017 to 2033

Table 38: East Asia Volume (MT) Forecast by Application, 2017 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 40: East Asia Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 41: South Asia Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: South Asia Volume (MT) Forecast by Country, 2017 to 2033

Table 43: South Asia Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: South Asia Volume (MT) Forecast by Product Type, 2017 to 2033

Table 45: South Asia Value (US$ Million) Forecast by Application, 2017 to 2033

Table 46: South Asia Volume (MT) Forecast by Application, 2017 to 2033

Table 47: South Asia Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 48: South Asia Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 49: Oceania Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Oceania Volume (MT) Forecast by Country, 2017 to 2033

Table 51: Oceania Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: Oceania Volume (MT) Forecast by Product Type, 2017 to 2033

Table 53: Oceania Value (US$ Million) Forecast by Application, 2017 to 2033

Table 54: Oceania Volume (MT) Forecast by Application, 2017 to 2033

Table 55: Oceania Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 56: Oceania Volume (MT) Forecast by Distribution channel, 2017 to 2033

Table 57: MEA Value (US$ Million) Forecast by Country, 2017 to 2033

Table 58: MEA Volume (MT) Forecast by Country, 2017 to 2033

Table 59: MEA Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 60: MEA Volume (MT) Forecast by Product Type, 2017 to 2033

Table 61: MEA Value (US$ Million) Forecast by Application, 2017 to 2033

Table 62: MEA Volume (MT) Forecast by Application, 2017 to 2033

Table 63: MEA Value (US$ Million) Forecast by Distribution channel, 2017 to 2033

Table 64: MEA Volume (MT) Forecast by Distribution channel, 2017 to 2033

Figure 1: Global Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Volume (MT) Analysis by Region, 2017 to 2033

Figure 7: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 11: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 14: Global Volume (MT) Analysis by Application, 2017 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 18: Global Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 19: Global Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 20: Global Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 21: Global Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Attractiveness by Application, 2023 to 2033

Figure 23: Global Attractiveness by Distribution channel, 2023 to 2033

Figure 24: Global Attractiveness by Region, 2023 to 2033

Figure 25: North America Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 28: North America Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Volume (MT) Analysis by Country, 2017 to 2033

Figure 31: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 38: North America Volume (MT) Analysis by Application, 2017 to 2033

Figure 39: North America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 42: North America Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 43: North America Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 44: North America Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 45: North America Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Attractiveness by Application, 2023 to 2033

Figure 47: North America Attractiveness by Distribution channel, 2023 to 2033

Figure 48: North America Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 52: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Volume (MT) Analysis by Country, 2017 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 62: Latin America Volume (MT) Analysis by Application, 2017 to 2033

Figure 63: Latin America Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 66: Latin America Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 67: Latin America Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 68: Latin America Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 69: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Attractiveness by Distribution channel, 2023 to 2033

Figure 72: Latin America Attractiveness by Country, 2023 to 2033

Figure 73: Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 76: Europe Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Volume (MT) Analysis by Country, 2017 to 2033

Figure 79: Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 86: Europe Volume (MT) Analysis by Application, 2017 to 2033

Figure 87: Europe Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 90: Europe Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 91: Europe Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 92: Europe Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 93: Europe Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Attractiveness by Application, 2023 to 2033

Figure 95: Europe Attractiveness by Distribution channel, 2023 to 2033

Figure 96: Europe Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: East Asia Value (US$ Million) by Application, 2023 to 2033

Figure 99: East Asia Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 100: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: East Asia Volume (MT) Analysis by Country, 2017 to 2033

Figure 103: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 106: East Asia Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 107: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: East Asia Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 110: East Asia Volume (MT) Analysis by Application, 2017 to 2033

Figure 111: East Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: East Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: East Asia Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 114: East Asia Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 115: East Asia Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 116: East Asia Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 117: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 118: East Asia Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Attractiveness by Distribution channel, 2023 to 2033

Figure 120: East Asia Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 124: South Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: South Asia Volume (MT) Analysis by Country, 2017 to 2033

Figure 127: South Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 130: South Asia Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 131: South Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 134: South Asia Volume (MT) Analysis by Application, 2017 to 2033

Figure 135: South Asia Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 138: South Asia Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 139: South Asia Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 140: South Asia Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 141: South Asia Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia Attractiveness by Application, 2023 to 2033

Figure 143: South Asia Attractiveness by Distribution channel, 2023 to 2033

Figure 144: South Asia Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Oceania Value (US$ Million) by Application, 2023 to 2033

Figure 147: Oceania Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 148: Oceania Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Oceania Volume (MT) Analysis by Country, 2017 to 2033

Figure 151: Oceania Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 154: Oceania Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 155: Oceania Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Oceania Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Oceania Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 158: Oceania Volume (MT) Analysis by Application, 2017 to 2033

Figure 159: Oceania Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: Oceania Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: Oceania Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 162: Oceania Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 163: Oceania Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 164: Oceania Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 165: Oceania Attractiveness by Product Type, 2023 to 2033

Figure 166: Oceania Attractiveness by Application, 2023 to 2033

Figure 167: Oceania Attractiveness by Distribution channel, 2023 to 2033

Figure 168: Oceania Attractiveness by Country, 2023 to 2033

Figure 169: MEA Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: MEA Value (US$ Million) by Application, 2023 to 2033

Figure 171: MEA Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 172: MEA Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 174: MEA Volume (MT) Analysis by Country, 2017 to 2033

Figure 175: MEA Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 178: MEA Volume (MT) Analysis by Product Type, 2017 to 2033

Figure 179: MEA Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: MEA Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: MEA Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 182: MEA Volume (MT) Analysis by Application, 2017 to 2033

Figure 183: MEA Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: MEA Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: MEA Value (US$ Million) Analysis by Distribution channel, 2017 to 2033

Figure 186: MEA Volume (MT) Analysis by Distribution channel, 2017 to 2033

Figure 187: MEA Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 188: MEA Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 189: MEA Attractiveness by Product Type, 2023 to 2033

Figure 190: MEA Attractiveness by Application, 2023 to 2033

Figure 191: MEA Attractiveness by Distribution channel, 2023 to 2033

Figure 192: MEA Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reduced Fat Butter Market Size and Share Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Cheese Market Size, Growth, and Forecast for 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Reduced Fat Cheeses Market

Direct Reduced Iron Market Growth – Trends & Forecast 2024-2034

Cholesterol Reduced Butter Market

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA