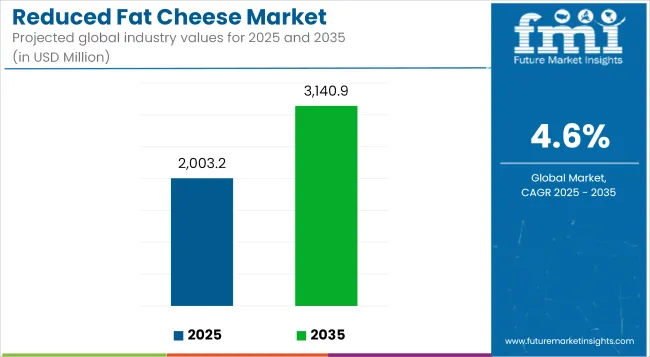

The market size for reduced fat cheese is projected to expand significantly over the forecast period, from USD 2,003.2 million in 2025 to USD 3,140.9 million in 2035, at a CAGR of 4.6%, particularly across health-focused dairy applications.

Consumers are displaying a clear preference for dairy products that align with weight management and heart-health concerns, prompting steady reformulations by manufacturers to offer lower fat alternatives without compromising texture or flavor. This shift has been particularly visible in urban grocery and supermarket formats, where shelf space for light and reduced-fat cheese SKUs has been expanding.

Health-driven snacking, dairy reformulations, and the rise in lactose intolerance are converging as market drivers. A gradual substitution of full-fat cheese in consumer diets, especially in ready-to-eat segments and fast-casual dining, has pushed producers to prioritize innovation in flavor masking and texture optimization.

However, sensory limitations in taste and the higher production costs of reduced-fat variants continue to restrain faster mainstreaming. The retail segment has maintained momentum due to its wide product assortment, whereas foodservice demand is steadily building, particularly in premium casual dining and wellness-focused cafés. Key trends such as plant-blend formulations, reduced sodium variants, and clean-label claims are shaping consumer engagement, while manufacturers are investing in R&D and specialty ingredients to differentiate offerings.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 2,003.2 million |

| Projected Global Industry Value (2035F) | USD 3,140.9 million |

| Value-based CAGR (2025 to 2035) | 4.6% |

By 2025, product lines dominated by cheddar and mozzarella formats are expected to account for over half of global revenue, attributed to their versatility in everyday meals and processed food categories. Cheddar is anticipated to retain a 29.4% share in 2025. The supermarket segment, supported by strong merchandising strategies and in-store promotions, will continue to be the primary revenue contributor, projected at 45.7% market share in 2025.

Looking ahead to 2035, the market is expected to show incremental gains from value-added innovation, including functional claims and regional cheese varieties with reduced fat content. Expansion into Asian and Latin American urban centers will also shape the long-term trajectory of this market.

Market share: Functional reduced fat cheese formats hold an estimated 6.3% share of total reduced fat cheese sales in 2025, projected to reach 11.5% by 2030.

The medical nutrition sector is emerging as a strategically important but underexplored channel for reduced fat cheese manufacturers. Within clinical and specialized diets-especially for patients managing cardiovascular disease, obesity, and diabetes-the integration of high-protein, low-fat dairy formats is gaining clinical validation.

Organizations such as the European Society for Clinical Nutrition and Metabolism (ESPEN) have underscored the potential of dairy protein in malnutrition recovery, opening pathways for medically tailored cheese SKUs with optimized lipid profiles. Companies like Arla Foods Ingredients and Lactalis Ingredients are leveraging whey-based blends to formulate enriched, reduced-fat cheeses with added minerals and prebiotics targeting institutional use in hospitals and care homes.

These medically positioned products, often distributed through hospital procurement channels or long-term care foodservice, are benefiting from rising demand for palatable high-protein options for aging populations. Innovation in enzyme-modified cheese to mimic full-fat taste and texture, while meeting macronutrient thresholds for clinical use, has become a focal R&D theme.

With regulatory convergence in Europe and North America on health claims for fat reduction and heart health, the segment’s marketability is set to expand. Strategic partnerships with health systems and dietitians will be crucial to scale penetration.

Market share: Private label reduced fat cheese is expected to account for 21.6% of global market revenue in 2025, with projected gains toward 27.3% by 2030.

Private label brands have emerged as significant challengers to national brands in the reduced fat cheese segment, particularly in cost-sensitive markets such as Eastern Europe and Southeast Asia. Retailers are increasingly using their store brands to introduce clean-label, affordable reduced fat cheese options, strategically priced 15-25% lower than branded equivalents.

Aldi Süd, Lidl, and Tesco have expanded their "light" cheese SKUs in this category, frequently highlighting nutritional transparency, locally sourced dairy, and simplified ingredient lists. The price-sensitive consumer segment-motivated by health but constrained by economic pressures-has shifted preference toward these private labels, especially in bulk-buy formats such as shredded or sliced reduced-fat cheese.

Unlike earlier iterations of generic offerings, today’s private labels actively invest in sensory quality and packaging appeal. Retailers are also utilizing in-store data analytics to adjust SKU assortments by region and season, tailoring offerings to urban health-conscious shoppers.

Growth is being reinforced by direct collaboration with regional dairy cooperatives and contract manufacturers that specialize in low-fat milk solids and stabilizer systems. In markets with active nutritional labelling regulations, such as under the EU’s Nutri-Score framework, private label reduced fat cheese SKUs have begun outperforming branded products in shopper perception surveys.

Consumer shift towards low carb low fat products bolstering the growth

The increasing popularity of low-carb, low-fat diets among consumers has been one of the main reasons behind the growth of the reduced fat cheese market. As more and more health-conscious individuals look for dairy products that fit their personal menu, the needs for reduced fat cheese options that are lower in calories and carbohydrates have been increased dramatically.

The industry is meeting this need by introducing inventions that are using original technologies and that involve products that are low in fats but keep the same taste and texture throughout cheese, further increasing the sector's growth. The ketogenic and paleo diet movements have caused a big impact particularly since they are about getting the right amount of fats from things like the reduced fat cheese that presents these ideas.

Food manufacturers that are targeting the potential segment of reduced fat cheese products by changing the product offering according to the new dietary regulation of consumers, benefit from this, and expand their business.

Versatile Application attracting Dairy and Snack product manufacturers

The multifunctionality of reduced fat cheese has made it equally interesting for dairy and snacks to the manufacturers. By making the change to process less or no fat is put in cheese, the number of food types that can be made with it and the processes in which it is utilized also increase. This versatility has promoted product innovation in various food categories as producers aim to win market shares by introducing healthier cheese options that still deliver taste and texture.

In addition, reduced fat cheese can serve as a topping, filling, or ingredient in a number of different dishes, such as pizza, sandwiches, and dips, as well as in cheese-flavored snacks and spreads. This flexibility has turned reduced fat cheese into an important resource for those food manufacturers who want to offer products matching the changing trends of health-targeted consumers.

Cheese Snack Customization

The trend of personalized and custom food options has also spilled over into the reduced fat cheese market. Customers are becoming more and more interested in looking for cheese snacks that are specifically tailored for their diet and flavor preferences. In response, the manufacturers are now providing personal reduced fat cheese snack packs, subscription services, and curated cheese samplers which are not only allowing consumers to find new reduced fat cheese varieties but also create their unique cheese snack experiences.

This provisioning of customization backs the increasing need for supposed products that go with people's lifestyles and taste preferences. By giving customers the option to personalize their snacks with their favourite reduced fat cheese, the producers not only build a brand allegiance but also satisfy the need for health-conscious consumers to have their say in the matter.

Fortification of Probiotics and Vitamins Attracting the Consumers

Besides decreasing fat content, a few of the manufacturers of reduced fat cheese are also raising the bar by enriching them with probiotics, vitamins, and other functional ingredients. This way, the company's products cater to a much bigger audience, to those individuals who search for not only lower-fat cheese options but also ones that come with additional health benefits.

For instance, the introduction of probiotics may catch the attention of the consumers who are interested in gut health while the added vitamin in the reduced fat cheese can be a source to those who want to increase their dairy intake through fortification.

The differentiation of product lines is achieved through the receipt of intended and miscellaneous nutritional effects from cheese and through the fortification of these germs. So, the reduced fat cheese manufacturers by this extension of the health benefits they provide, prove their interest in both the market demand for healthy cheese and the consumers' new interest in health-promoting foods and drinks.

New Innovations in Flavor (such as smoked, herb-infused, or spicy) Creating a diversity

Previously the image of reduced fat cheese was not that of a healthy alternative but rather of a cut option, but now producers are rapidly bringing on the market various innovative flavors that appeal to the consumers' tastes. with traditional cheese flavors so smoky, herbed, spicy, and bold they push aside the notion that indulgent options can't be healthy.

By expanding with more exotic and tasteful alternatives of reduced-fat cheese, producers are also seeking to widen their consumer base thus achieving overall growth in the sector. The changing lexicon of health-prioritizing consumers is reflected by the mixing of flavor innovation with the disallowing of redundancies in curiosity regarding taste. On the contrary, less grease cheese makers are not only paralleled to the more entertaining cultural aspects but also to wider leisure and generation areas.

Consumer perception of processed food affecting the growth

The rise of minimally processed and "clean label" foods has had an important effect on the reduced fat cheese market. Consumers who are health-cantered are becoming much less comfortable with products made with a great number of ingredients and thus scrutinize the lists of ingredients and the production processes of cheese they are buying.

This has created both challenges and opportunities for manufacturers of reduced fat cheese.Because consumers might see reduced fat cheese as more artificial than ones like traditional, producers then have to promote the use of biodiversity-friendly materials, eco-friendly design and open procurement avenues. In contrast, the trend of clean labels gives reduced fat cheese manufacturers the opportunity to market themselves as less processed and better for you.

Manufacturers that will clearly settle consumer doubts through clean and plainly labelled formulations along with the marketing strategies will be the ones to ride the wave of the escalating interest in healthier cheese options. Through cutting-edge taste, and full-sided health benefits, the cheese brands now increase their appeal to a much broader range of consumer tastes which leads to the strength of the whole market being increased.

Tier 1 companies comprise industry leaders with revenue of above USD 30 million capturing a significant share of 50% to 60% in the global business landscape. High production capacity and a wide product portfolio characterize these leaders. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Kraft Heinz Company, Sargento Foods Inc., Cabot Creamery Cooperative, Tillamook County Creamery Association, Organic Valley and few others.

Tier 2 companies include mid-size players with revenue of USD 10 to 30 million having a presence in specific regions and highly influencing the local commerce. These are characterized by a strong presence overseas and strong business knowledge. These players in the arena have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Saputo Inc., Lactalis Group, Arla Foods, Bel Group, Schuman Cheese and few others.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche economies having revenue below USD 10 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized ecosystem, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

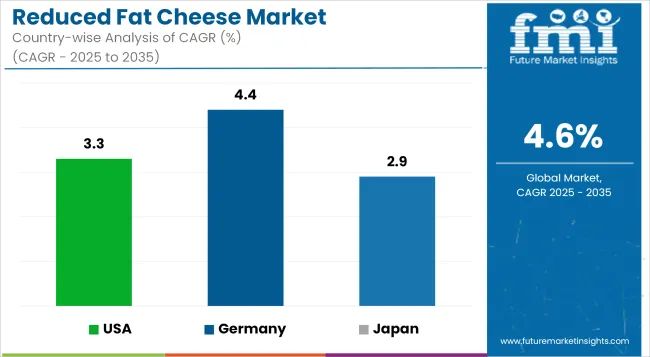

The following table shows the estimated growth rates of the top three countries. USA, Germany, and Japan that are set to exhibit high consumption, recording CAGRs of 3.3%, 4.4%, and 2.9% respectively, through 2035.

| Countries | CAGR |

|---|---|

| USA | 3.3% |

| Germany | 4.4% |

| Japan | 2.9% |

The United States is the largest consumer of reduced fat cheese globally, supported by the health and wellness trends across the country. Guilt-free cheese based goods and snacks have been the real target of the American consumer in search of lower-fat dairy options, which was noted by the welcoming of products like reduced fat cheddar, mozzarella, and cottage cheese manufactured with "good for you" additives.

The growing keto and low-carb diet trends have cultivated the acceptance of reduced fat cheese in America, as people who are health-oriented are getting to know the benefits of eating more good fats instead of bad ones. The positive consumer mind set in healthy indulgence is the dynamic for serial growth in the reduced fat cheese sector of the United States market.

Germany has become a key consumer market for reduced fat cheese in Europe, with increasing preference among the citizens for dairy products with fewer calories. More and more German folks are getting aware of their caloric intake and thus, they are looking to buy cheese with calorie-favourable characteristics.

The trio of those who eat cheese these days is talking about the reduced fat varieties available on the market: cheddar, mozzarella, and cottage cheese as they are popular among calorie-counting consumers who would like to have less fat and calories.

Producers in Germany have reacted to this by broadening their range of alternatives with lower fat options, while at the same time featuring the products as suitable for people on calorie-restricted diets. As the trend for healthy food selections grows in that country, the reduced fat cheese sector is likely to hold its place firmly in the German market.

Japan has been identified as a prominent consumer of the reduced fat cheese market fuelled by the nation that holds a growing health consciousness and a welcoming attitude to innovative dairy products. Japanese consumers are on the mission of searching for cheese options that incorporate not only low-fat and low-calorie contents but also provide nutrients that are good for you.

Probiotic fortified, reduced fat cheese, and additional vitamins makes the products taste better and the customers feel they are making healthier decisions. The companies are innovating thanks to the knowledge of their reduced-fat cheese products that support the functionality of the human body, such as, the immune system, and promoting a balanced diet. As the trend of healthy dairy and dairy products is catching on in Japan, the market for reduced fat cheese is set to flourish and will be well-equipped to take advantage of this situation.

The reduced fat cheese market shows heightened competition because established dairy corporations and upcoming start-ups strive after expanding their customer base as consumers expand their demand for these products. Leadership positions in the market belong to Kraft alongside Sargento together with Cabot Creamery while they utilize their brand success and nationwide distribution outlets to build market dominance.

The market sees specialized manufacturers offering artisanal reduced fat cheeses aimed at meeting contemporary consumer tastes. The rising competition in the industry has produced remarkable innovation because manufacturers use different flavors along with beneficial ingredients while maintaining sustainable production practices to stand apart.

The competitive drive to create health-focused appealing reduced fat cheese products made consumers more attracted to these options thus expanding market growth. Future market challenges in the crowded reduced fat cheese segment will be solved by brands who excel at product innovation, marketing and distribution strategies.

The industry valuation reported by FMI in 2025 is USD 2,003.2 million.

Expected business valuation in 2035 is USD 3,140.9 million.

The CAGR for last 4 years is about 4.2%.

The projected CAGR between 2025 to 2035 is 4.6%

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reduced Fat Cheeses Market

Reduced Fat Butter Market Size and Share Forecast Outlook 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Low-Fat Cheese Nutrition Market Insights - Size & Trends 2025 to 2035

Cheese Packaging Market Forecast and Outlook 2025 to 2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Cheese Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cheese Color Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Cheese Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA