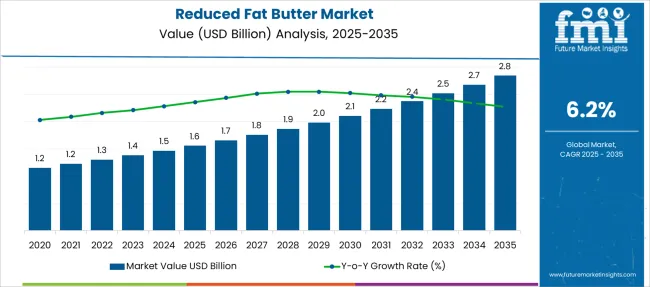

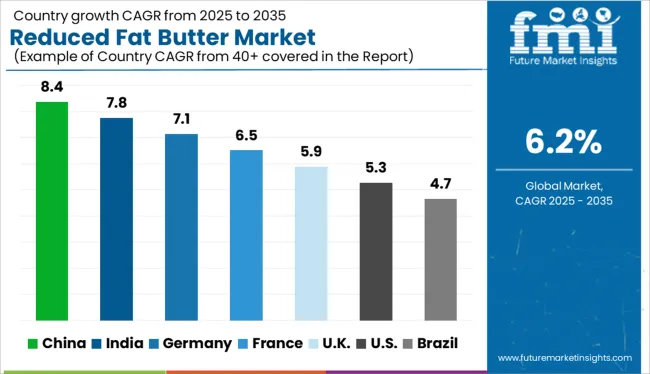

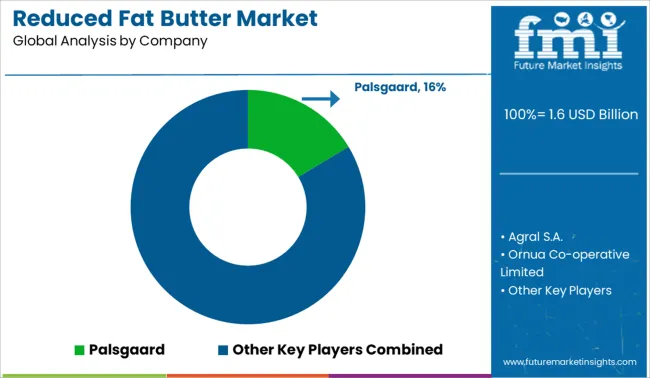

The Reduced Fat Butter Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Reduced Fat Butter Market Estimated Value in (2025 E) | USD 1.6 billion |

| Reduced Fat Butter Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The reduced fat butter market is experiencing a steady expansion, supported by the global emphasis on healthier food choices and balanced fat consumption. This trend is being reinforced by the growing adoption of low-calorie diets and the increasing awareness of cardiovascular health among consumers. As regulatory bodies and public health campaigns promote the reduction of saturated fat intake, reduced fat butter has gained widespread appeal as a practical alternative to traditional full-fat variants.

Manufacturers are increasingly leveraging advanced emulsification and flavor-enhancement technologies to develop low-fat formulations without compromising on taste or texture, which has improved consumer acceptance. The market outlook remains positive as product innovation, clean-label trends, and functional ingredient integrations continue to reshape consumer expectations.

Moreover, rising lactose intolerance and the growing demand for plant-based and hybrid fat spreads are also expected to influence future product development within this category With supportive government nutrition policies and increased retail shelf presence, reduced fat butter is anticipated to remain a key component of evolving health-focused dairy portfolios.

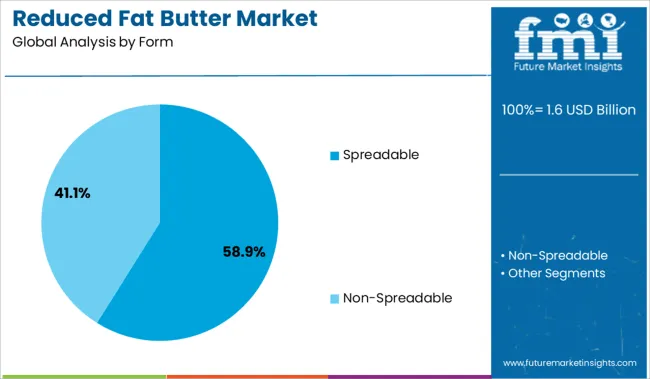

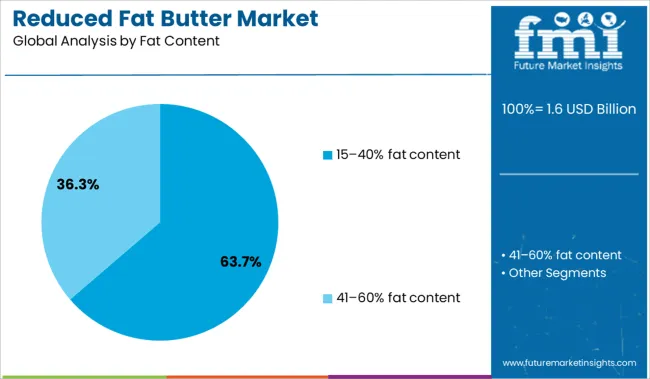

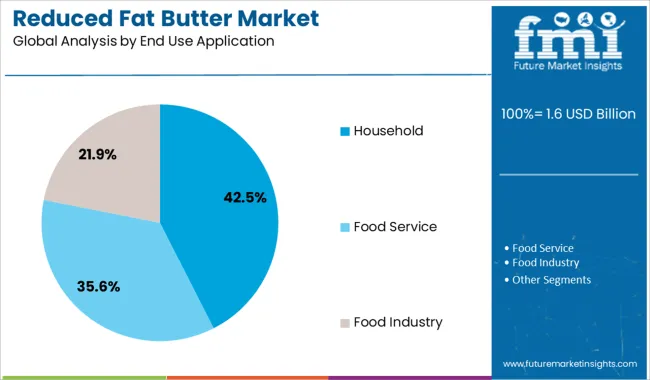

The market is segmented by Form, Fat Content, End Use Application, and Packaging and region. By Form, the market is divided into Spreadable and Non-Spreadable. In terms of Fat Content, the market is classified into 15–40% fat content and 41–60% fat content. Based on End Use Application, the market is segmented into Household, Food Service, and Food Industry. By Packaging, the market is divided into Plastic Tubs, Carton Packs, and Bulb. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spreadable form segment is projected to account for 58.9% of the reduced fat butter market revenue share in 2025, reflecting its strong consumer preference and widespread use across households and foodservice channels. This leading position is being supported by its convenience, ready-to-use texture, and compatibility with refrigeration and room temperature storage.

Spreadable variants are formulated to remain soft and easy to apply directly from the container, meeting modern consumer expectations for functionality and ease of use. Technological advancements in fat structuring and emulsification processes have allowed spreadable reduced fat butter to maintain a creamy consistency while delivering lower fat content.

This segment has also benefited from its versatility in culinary applications including sandwiches, baking, and light sautéing, which makes it a preferred choice for health-conscious consumers Furthermore, increased penetration of single-serve and resealable packaging formats has boosted its adoption in both domestic and institutional settings, reinforcing its leading share in the global market.

The 15 to 40% fat content category is estimated to represent 63.7% of the reduced fat butter market revenue in 2025, making it the dominant fat content range in this segment. The growth of this range is attributed to its balance between palatability and health appeal, offering sufficient creaminess while significantly reducing saturated fat intake. Regulatory benchmarks and nutritional guidelines in several regions favor products within this fat range, which has led manufacturers to align their formulations accordingly.

The segment has gained traction among health-aware consumers seeking alternatives to traditional butter without compromising on taste or mouthfeel. Improvements in processing technology have enabled better texture and spreadability even at lower fat levels, enhancing consumer satisfaction.

The widespread availability of reduced fat butter with 15 to 40% fat content across supermarkets, online platforms, and specialty health stores has also supported its market leadership As food labeling and front-of-pack nutrition scores gain influence, this fat range is expected to retain its competitive edge in both developed and emerging markets.

The household segment is forecast to hold 42.5% of the revenue share in the reduced fat butter market by 2025, driven by the rising trend of home-based meal preparation and conscious nutrition management. The shift toward healthier eating habits has led families and individuals to adopt reduced fat alternatives for daily consumption, particularly in breakfast and baking routines. Marketing campaigns emphasizing wellness and natural ingredients have played a role in reinforcing the appeal of reduced fat butter among household consumers.

The segment’s growth has also been supported by greater availability of branded low-fat variants in retail stores, often positioned alongside functional dairy categories. Increased consumer access to health information through digital platforms has further influenced household preferences in favor of low-fat spreads.

The convenience of use, availability in various pack sizes, and affordability have made reduced fat butter an accessible and sustainable choice for regular home use As culinary experimentation and personalized diets continue to shape consumer behaviors, the household segment is expected to sustain strong demand over the forecast period.

Reduced-fat butter is made by cutting the fat level to 40% while maintaining the same flavor and texture as ordinary butter. It contains plant stanols and sterols, which restrict the absorption of harmful cholesterol and help to prevent heart disease.

Reduced fat butter had a CAGR of 5.5% between 2020 and 2024. The period marked heavy investment in research and developmental activities by reduced fat butter market key players.

There has been a considerable increase in the number of consumers that lay special emphasis on healthy eating habits. Consumer inclination towards products that minimize intake of trans-fats and saturated fats to boost body immunity has increased multifold, which in turn increases the reduced fat butter market size.

They are more aware of what goes into producing food products and carefully choose products that provide health benefits in addition to good taste. Companies are investing in developing butter substitutes that have low-fat content, due to which organic reduced-fat butter is in high demand.

Consumers are on the lookout for products that keep their cholesterol levels in check to avoid any heart ailments. Owing to this reason, demand for reduced-fat butter which does not contain dietary cholesterol and can be used in wide end-use applications like baking cakes, crusts deserts, and vegetables for daily consumption is expected to surge. This enhances the demand for reduced-fat butter in hotels, restaurants, and catering.

The increase of the reduced butter market share is fueled by a surge in various health conditions like obesity, cardiovascular illnesses, diabetes, and the numerous health benefits due to increased intake of reduced fat butter.

Many fast-food outlets are endorsing and frequently incorporating reduced-fat butter on their menus, which has heightened the awareness amongst consumers, further accelerating the expansion of the reduced-fat butter market.

In recent years, the scientific consensus behind food product claims has become more important for enticing customers, and as a result, positive recommendations from the medical community, such as The Dietary Guidelines Committee, have helped the reduced fat butter market flourish.

The World Health Organization claims that the total fat intake should be no more than 30% of the total calories and that the intake of saturated fat should not go beyond 10% of the total calories. This is expected to create many opportunities for the reduced-fat butter market globally.

People have now understood the advantages of consuming a low-fat diet and avoiding the excess energy that gets converted to fat depositions in the body. These factors are expected to positively impact the sales of reduced-fat butter during the assessment period.

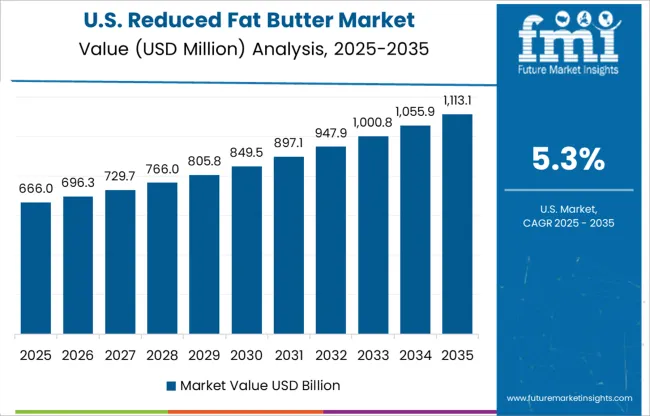

North America is one of the promising regions in the global reduced fat butter market. Due to high consumer spending capacity and emphasis on maintaining a healthy lifestyle by people in countries like the USA, and Canada. Changes in dietary habits like reduction in the consumption of unhealthy fats to boost immunity against infections are expected to increase the sales of reduced-fat butter.

According to FMI, the USA reduced fat butter market is expected to reach a value of about USD 1.6 Million in 2025 which is approximately 24% of the global reduced butter market.

Asia Pacific is expected to generate many opportunities for a reduced fat butter market during the assessment year due to rising awareness of healthy food alternatives among people. Traditionally consumption of fresh butter in households is high.

Top retailers in the reduced-fat butter market are focusing on developing products with low-fat content, and low price points to make them accessible to everyone. As per FMI, the Indian reduced-fat butter market is expected to account for USD 121.5 Million in 2025 which is approximately 17% of the global reduced-butter market.

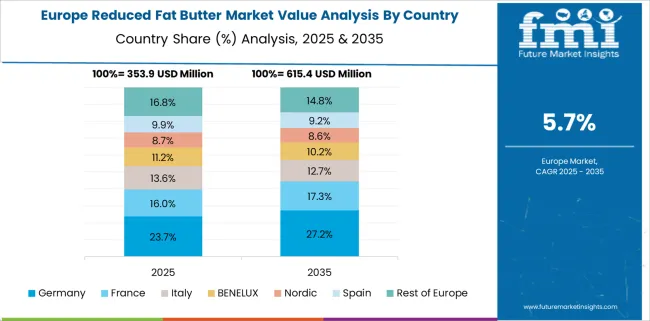

Consumers are increasingly preferring low-fat butter in making daily food products due to rising cases of cardiovascular disease, obesity, and other health-related problems In Europe. They are adopting healthy lifestyles to remain fit.

To satisfy the European reduced-fat butter market need companies are offering a wide variety of butter that are plant-based, vegan, and have significantly low-fat content. Owing to these factors, the demand from regional markets like the United Kingdom, and Germany is expected to surge in the near future.

Carton Packs account for 55% of the total reduced butter market. Different pack sizes ranging from 20gm to 1000 gm are easily available in the market. Consumer inclination towards healthy snacking habits and emphasis on ingredients that are used to produce final products is also expected to register steady growth in the reduced fat butter market share during the forecast period.

Consumers are emphasizing labeling and packaging and are well-informed before making a final purchase. Packaging also plays an important role to maintain the quality of products in transit by prohibiting any reaction with the outer environment. Reduced fat butter market key players are focusing on branding and tamper seals to avoid any mishandling of products.

From 2025 to 2025, the online distribution channel is predicted to grow at a rate of 5.5% and account for 40% of sales. Top companies in the reduced fat butter market are collaborating with online marketplaces such as Amazon and Big Basket.

Their products are displayed on various online portals and company websites to increase product visibility to boost sales of the reduced fat butter market. The online sales channel has made it easy for consumers to choose from reduced fat butter of different brands in different pack sizes and price ranges and choose one suitable for their needs.

Reduced Fat Butter manufacturers are exploring new technologies that fulfill rising consumer demand for healthy food. Key manufacturers are developing new varieties of butter with varying levels of fat content.

Some of the major key players in the reduced fat butter market are Palsgaard Agral S.A., Ornua Co-operative Limited, Upfield, Finlandia Cheese, Inc., Saputo Dairy Australia Pty Ltd., Kerry Gold, Land O'Lakes, Arla Foods, Lam Soon Group, Aurivo Co-operative Society Ltd., Rockview Farms.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Million. Sq. M. for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; and the Middle East & Africa |

| Key Countries Covered | USA, Brazil, Mexico, Germany, United Kingdom, China, India, Japan, Australia, and GCC Countries |

| Key Segments Covered | Form, Fat Content, End-Use Application, Packaging, Sales Channel, and Region |

| Key Companies Profiled | Palsgaard; Agral S.A.; Ornua Co-operative Limited; Upfield; Finlandia Cheese, Inc.; Saputo Dairy Australia Pty Ltd.; Kerry gold; Land O'Lakes; Arla Foods; Lam Soon Group; Aurivo Co-operative Society Ltd.; Rockview Farms |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global reduced fat butter market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the reduced fat butter market is projected to reach USD 2.8 billion by 2035.

The reduced fat butter market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in reduced fat butter market are spreadable and non-spreadable.

In terms of fat content, 15–40% fat content segment to command 63.7% share in the reduced fat butter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reduced Lactose Whey Market Size and Share Forecast Outlook 2025 to 2035

Reduced Salt Packaged Foods Market - Health-Conscious Eating Trends 2025 to 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Reduced Fat Cheese Market Size, Growth, and Forecast for 2025 to 2035

Reduced Fat Dairy Market Analysis by Ice cream, Yogurt, Skim milk and Others through 2035

Reduced Fat Cheeses Market

Direct Reduced Iron Market Growth – Trends & Forecast 2024-2034

Cholesterol Reduced Butter Market

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Filled Milk Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA