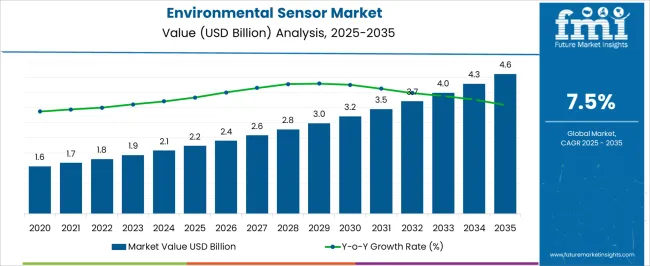

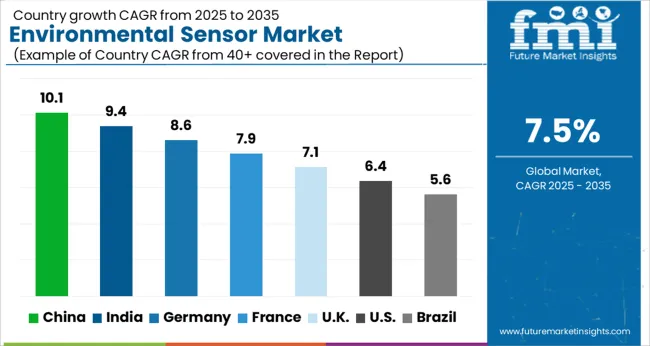

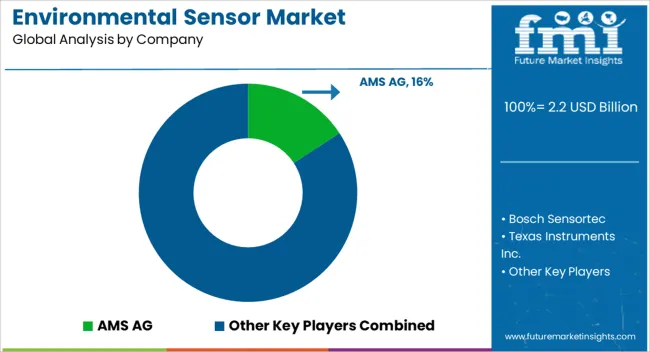

The Environmental Sensor Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Environmental Sensor Market Estimated Value in (2025 E) | USD 2.2 billion |

| Environmental Sensor Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The environmental sensor market is witnessing robust growth as industries, governments, and enterprises intensify efforts to monitor air quality, temperature, humidity, and pollutant levels in real time. Increasing awareness around environmental sustainability, coupled with tightening global emission and safety regulations, is driving large-scale sensor deployments across smart cities, manufacturing plants, data centers, and agricultural facilities.

The integration of IoT platforms and cloud-based analytics is enabling continuous, accurate environmental monitoring with minimal manual intervention. Companies are investing in embedded sensor solutions that provide remote diagnostics, alert systems, and long-term trend analysis to support decision-making.

Further, the miniaturization of sensors and advancement in MEMS and semiconductor technology are expanding the applicability of these devices into more compact, mobile, and wearable systems. As industries aim to achieve carbon neutrality and meet ESG goals, environmental sensors are being positioned as critical tools in optimizing energy use, reducing operational risks, and complying with regulatory frameworks, ensuring sustained demand across all major end-use sectors.

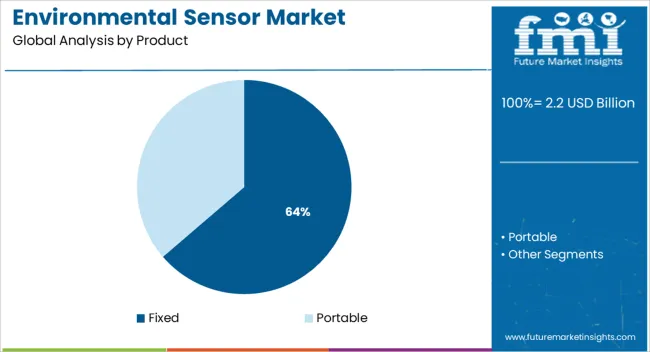

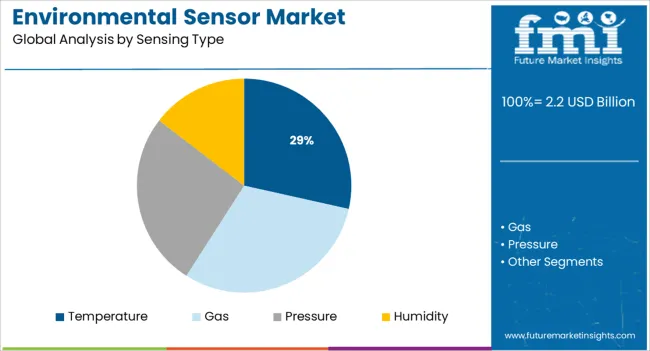

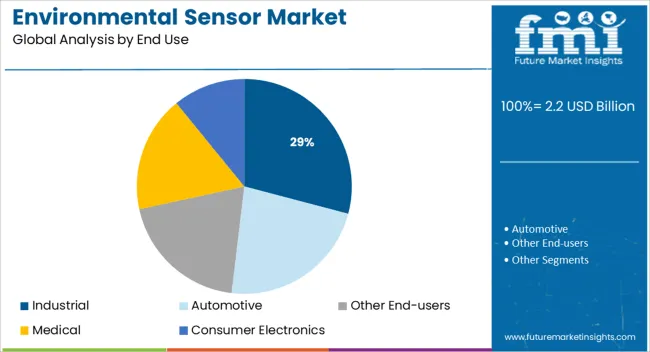

The market is segmented by Product, Sensing Type, and End Use and region. By Product, the market is divided into Fixed and Portable. In terms of Sensing Type, the market is classified into Temperature, Gas, Pressure, and Humidity. Based on End Use, the market is segmented into Industrial, Automotive, Other End-users, Medical, and Consumer Electronics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed product segment is projected to account for 63.7% of total market revenue in 2025, establishing it as the dominant product category. This leading share is supported by the widespread installation of stationary environmental sensors across commercial buildings, factories, transportation hubs, and public infrastructure.

Fixed sensors offer continuous monitoring capabilities and stable data output which are essential for compliance with emission norms and occupational safety standards. Their ability to integrate seamlessly with centralized monitoring systems and deliver long-term operational reliability has made them the preferred choice for permanent installations.

Additionally, fixed sensors are better suited for supporting automated ventilation systems, energy optimization platforms, and risk mitigation programs where uninterrupted monitoring is critical. The adoption has also been driven by government-funded environmental surveillance initiatives and infrastructure modernization programs that prioritize fixed sensor installations for real-time and scalable environmental intelligence.

Temperature sensing is expected to hold 28.5% of total revenue share in 2025 when categorized by sensing type, positioning it as the leading function within environmental sensors. This dominance is attributed to the cross-industry requirement for thermal monitoring in sectors such as agriculture, healthcare, electronics, and industrial automation.

Temperature sensors play a key role in ensuring process efficiency, asset protection, and regulatory compliance by preventing overheating, product spoilage, or unsafe operating conditions. The integration of temperature sensing into HVAC systems, food storage units, and data centers has further reinforced demand.

Technological advancements in precision sensing, combined with low power consumption and compact form factors, have allowed manufacturers to deliver highly reliable and scalable solutions. Temperature sensors also serve as foundational components in multi-sensor arrays, enhancing their utility in comprehensive environmental monitoring systems across both urban and remote environments.

The industrial segment is projected to command 29.1% of total market revenue in 2025 by end use, maintaining its position as the largest consumer of environmental sensors. This growth has been supported by the increased need for continuous environmental monitoring in production environments, energy utilities, chemical plants, and heavy manufacturing.

Industrial operations require real-time data to ensure worker safety, prevent equipment failures, and maintain air and temperature standards within operational thresholds. The adoption of Industry 4.0 practices has further encouraged the integration of sensors into machinery and facility infrastructure, enabling predictive maintenance and environmental diagnostics.

Furthermore, emission monitoring and compliance with environmental health and safety (EHS) standards have become business imperatives across industrial facilities globally. As a result, robust sensor networks capable of monitoring temperature, gas concentration, humidity, and particulate matter are being embedded into both greenfield and retrofit industrial applications, making this segment a key driver of market expansion.

As per the Environmental Sensor Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Environmental Sensor Market increased at around 9.3% CAGR. With an absolute dollar opportunity of USD 4.6 Billion, the market is projected to cross USD 3.5 Billion mark by 2035.

There is a rising potential for environmental sensors with the launch and increased use of smart devices, as well as improvements in IoT and cloud-based services. These sensors can detect environmental conditions in both indoor and outdoor settings. Sensors are packaged together and engineered to offer detailed, precise, and real data outputs, which are necessary for many IoT systems. Smart homes, smart offices and buildings, and HVAC are among the key applications of the environmental sensor market. Indoor environmental monitoring and personal weather data are two examples of mobile and fixed applications.

Environmental sensors monitors and keeps a track of soil and water pollution as public awareness of environmental concerns caused by harmful gas emissions from various industries have grown. Various governments throughout the world have enacted stringent rules and laws encouraging the usage of environmental surveillance systems, which is driving the market for environmental sensors. Over the projected period, advanced technologies in the designing and engineering of individual sensors are anticipated to propel the market. Growing demand from the industrial as well as the agricultural sector is expected to push the growth of the market.

Measuring variables across time is an important aspect of monitoring and a significant problem. Continuous monitoring is necessary as data gaps make it difficult to analyze the full range of environmental resource variability. In addition, infrequent but large events can have a considerable impact on the state of environmental resources. As a result, long-term surveillance becomes critical. However, constant monitoring and operation of sensors might diminish their efficiency and performance, reducing their lifespan.

Environmental sensor specifications change depending on the application and technology employed. Environmental sensors, for example, must meet strict size and power consumption standards in consumer electronics applications. Integrating different sensors with consumer devices, such as smartphones, is extremely difficult in such instances. In addition, as the sector or vertical changes, the sensor's specifications alter as well. For example, gas sensors parameters in the automobile industry vary from those in the oil and gas business; as a result, gas sensor performance requirements in advanced applications become a challenging factor.

North America accounts for the largest market for environmental sensors. Growing enterprises and strict environmental legislation are driving the environment sensors regional market growth.

The United States is expected to account for the largest market share of USD 4.6 Billion by the end of 2035. The United States is the most advanced country in terms of technology and sensors are increasingly being incorporated to monitor environmental impacts. Growing enterprises and strict environmental legislation are driving the market for environmental sensors in the country. Government initiatives are the key factors for the environmental sensors market which helps in spreading awareness.

For example, in July 2024, the Environmental Protection Agency (EPA) announced that it will allocate USD 50 Milion from the American Rescue Plan (ARP) to strengthen air quality index monitoring in communities around the country. This funding for improved air quality monitoring follows the Agency's announcement of USD 50 Million for environmentalist initiatives under the ARP, bringing the total amount of EPA financing assigned by Congress to address pollution-related health disparities and the COVID–19 pandemic to USD 100 Million.

Recently, the Environmental Protection Agency has taken steps to significantly improve the quality of air by planning and developing federal policies that, when completely executed, will result in large reductions in air pollutants. The accompanying air quality gains will enhance the United States' health, lifespan, and standard of living.

The Fixed Sensor product segment is expected to account for the largest market with a CAGR of 7.2% during 2025 to 2035. Fixed or portable sensor deployments can offer highly detailed information, capturing the impacts of urban variables. This level of ground-level detail complements satellite data, which is especially useful in metropolitan areas. Ambient urban sensor platforms are expected to arise as a result of smart city technology deployments. Also, a number of sensing devices are being used to monitor water quality. Fixed sensing could be used by researchers to make observations and can also be linked to public water utility control systems. Only one water source can be monitored with portable sensor modules.

The market for humidity sensors is forecasted to grow at a CAGR of over 7% during 2025 to 2035. Humidity in the environment has an impact on not only crop development and animal husbandry, but also on human health. A humidity sensor can be used to monitor the humidity in the surroundings.

A wall-mounted humidity and temperature sensor are commonly used for indoor humidity monitoring. This sensor is compact, has adequate ventilation, and accurately measures data. It can be observed indefinitely without the need for maintenance. A solar screen humidity sensor is ideal for outdoor environmental monitoring since it has a high degree of safety and is resilient to rain and snow degradation. It performs well in windy conditions, making it perfect for usage in fields and farms. Once deployed, the data can be seen remotely in real-time, allowing farmers to manage their crops more efficiently.

Some of the key companies in the environmental sensor market include ABB Ltd., Delphi Automotive PLC, Freescale Semiconductor Ltd., Honeywell International Inc., Omron Corporation, STMicroelectronics, N.V., Robert Bosch GmbH, and Schneider Electric SE. Environmental sensor market leaders are increasing production by collaborating, inventing, and acquiring small businesses, and investing in a technically advanced product portfolio all around the world.

Some of the recent developments of the Environmental Sensor Market are:

Similar recent developments related to companies in Environmental Sensor Market are tracked by the team at Future Market Insights, which are available in the full report.

The global environmental sensor market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the environmental sensor market is projected to reach USD 4.6 billion by 2035.

The environmental sensor market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in environmental sensor market are fixed and portable.

In terms of sensing type, temperature segment to command 28.5% share in the environmental sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA