The environmental remediation technology market size in 2025 stands at USD 142.6 billion, with a CAGR of 8% CAGR during the forecast period. Demand is projected to see a worldwide industry of USD 308.5 billion in 2035. Increased enforcement of environmental standards and global determination towards sustainable development are fueling the demand for clean groundwater, sediment, and soil solutions, with high-technology products as a key growth driver.

Industrialization across developing economies has led to mounting pollution of water resources and land properties. Governments, thus, have been ramping up cleanup through public-private initiatives and promoting the adoption of technologies with diminishing environmental impacts.

This has tremendously boosted industry demand for efficient and eco-friendly chemical treatment, bioremediation, and thermal desorption technology. The energy and mining sectors are the largest contributors to land degradation and pollution, making them the leading adopters of environmental remediation technologies. Companies are increasingly adopting remedy strategies in both post-operational and operational stages of projects. This trend is in response to ESG compliance becoming an international issue.

Aside from this, advancements in remote sensing, site investigation based on AI, and in-situ remediation technology are reshaping the industry paradigm. These technologies allow for faster evaluation, treatment focused on targeted remediation, and low-cost operations with minimum ecological disturbance. The utilization of nanotechnology, particularly in the degradation and containment of pollutants, is also becoming a significant differentiator in premium remediation systems.

As urban regeneration programs grow in older industrial regions, demand for land restoration and contamination risk reduction is anticipated to remain strong during the forecast period. Europe and North America are still industry leaders in terms of regulatory acumen and investment capacity, and Asia-Pacific is gaining momentum with growing environmental awareness and urbanization.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 142.6 billion |

| Industry Value (2035F) | USD 308.5 billion |

| CAGR (2025 to 2035) | 8% |

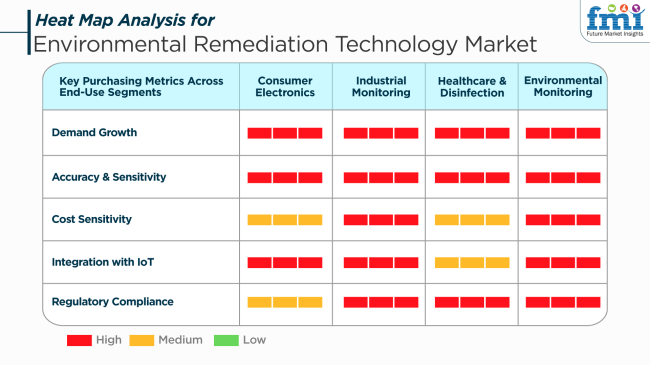

he industry exhibits extreme variability in buying needs among large end-use industries. In consumer electronics, remediation is used in manufacturing waste management and electronic waste recovery. Such technologies are in high demand, particularly with growing end-of-life product management regulation stringency.

Companies desire high sensitivity in detecting contamination to allow compliance with operations. Industrial applications have a very strong demand for accurate technologies that are able to detect pollutants in air, earth, and water environments.

There is strong integration with IoT systems, which gives instantaneous data feedback and allows for immediate intervention and predictive maintenance, which is very crucial for facilities under strict environmental laws. In the healthcare and disinfection industry, demand is slowly increasing for technologies that can treat hazardous biological waste and create contamination-free surroundings.

Key Purchasing Metrics Across End-Use Segments

There are stringent regulatory compliance needs and extreme sensitivity that guide buying decisions. In contrast, industry has extremely high growth, especially in the public as well as municipal industries, where early warning systems and pollutant trend analysis are essential to long-term sustainability and policy development.

From 2020 to 2024, there existed a uniform growth of the industry for environmental remediation technology owing to increasing environmental consciousness and strict regulations on pollution control.

The demand for soil and groundwater contamination technologies, particularly industrial and urban areas, led to an enhancement of remediation technologies in the form of bioremediation, chemical treatment, and thermal desorption. The oil and gas sector continued to be a strong industry driver with emphasis on environmental regulations as well as the cleanup of polluted areas.

During 2025 to 2035, the industry will transform through technological advancements and increasing demand for sustainability. New contaminants such as per- and polyfluoroalkyl substances (PFAS) are expected to be the driving forces behind the creation of innovative remediation technologies.

Additionally, the convergence of digital technologies, including data analytics and remote sensing, is likely to render remediation processes more effective and efficient. The Asia-Pacific industry is likely to be a major driver of industry growth, fueled by rapid industrialization and increasing environmental awareness.

Comparative Market Shift Analysis

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Soil and groundwater remediation, industrial site cleanup | Advanced treatment of emerging pollutants, incorporation of digital technology |

| Bioremediation, chemical treatment, thermal desorption | Emergence of nanotechnology-based solutions, real-time monitoring systems |

| Compliance with regulation, industrial control of pollution | Sustainability projects, public health issues, innovation in technology |

| North America and European dominance | Rapid development in Asia-Pacific and Latin America |

| Conventional remediation materials and processes | Focus on environmental-friendly and sustainable materials |

| Beginning steps towards sustainability | Sustained emphasis on environmental stewardship and circular economy |

The environmental remediation technology industry faces a number of risks that can affect its scalability and stability in the coming decade. The most notable among these is the tremendous capital intensity of advanced remediation solutions. Small- and medium-scale firms often do not have the capital strength to secure funding, particularly where government subsidies or economic incentives are limited or intermittent.

Regulatory complexities and evolving regimes of compliance across jurisdictions represent yet another gargantuan challenge. While environmental rules become increasingly dynamic, corporations need to continue remodeling their technologies in response to changing needs, which may result in time lags for implementation and a higher development cost.

Lastly, the industry is susceptible to technological obsolescence. The rapid rate of innovation in nanotechnology, robotics, and AI can render previous systems uncompetitive or non-compliant. Companies that fail to invest in R&D as well as lack strategic thinking can face issues of industry relevance. In response to these threats, companies are likely to emphasize adaptive development strategies, collaborative innovation, and adaptive regulatory engagement in global industries.

Thermal desorption dominates the industry, accounting for a 16% share of the industry, while Excavation or Dredging will account for about 14.5%. These technologies are widely applied due to their effectiveness in the removal of hazardous contaminants from soil and groundwater.

Thermal desorption is most acceptable because it treats volatile and semi-volatile organic compound contaminants like petroleum hydrocarbons, solvents, and pesticides. It applies heat to vaporize the pollutants and collects the vapor for downstream treatment or disposal.

Advanced in situ and ex-situ thermal systems developed by companies like TerraTherm (Cascade Environmental) and TPS Technologies can deal with complex contaminant scenarios. For example, the technology of In Situ Thermal Desorption (ISTD) developed by TerraTherm has successfully been used to destroy deeply embedded contaminants from Superfund and brownfield sites with minimal excavation.

On the other hand, excavation or dredging is a much more straightforward process where contaminated soil or sediment is physically removed from the site. This method remains a choice when contaminants are found at shallow depths or when immediate risk mitigation is warranted.

Excavation or dredging is the method of choice for cleaning up heavy metals, PCBs, and industrial waste close to water bodies and manufacturing sites. Clean Harbors and Veolia are major providers of dredging and excavation services on a large scale, especially for municipal and industrial remediation projects. For example, Veolia has undertaken dredging programs at historically industrial sites on the Rhône River in France for the containment and removal of persistent organic pollutants.

Both technologies contribute significantly to government-sponsored cleanups, brownfield redevelopment in the private sector, and compliance-driven remediation projects. Strict regulatory requirements and a growing awareness of organizational and environmental health sustain their use and, thus, the growth of remediation technology industries.

In 2025, the industry will be significantly influenced in terms of application for oil and gas and waste disposal sites. Among all applications, the oil and gas segment is projected to dominate by command with a share of 28.0%, whereas the waste disposal sites come in second place with 18.5%.

The oil and gas industry has been a prime user of remediation technology since drilling creates many chances for soils and groundwater to be contaminated through the production process, accidental spills, or pipelines that leak. Remediation technologies used extensively in the oil and gas sector consist of thermal Desorption, biological remediation, and chemical oxidation.

Some companies, including Schlumberger and Halliburton, have added remediation of oil-contaminated sites to their portfolios of environmental services. For example, in mass oil sites, Schlumberger's environmental service division provides great time monitoring and remediation that allows for effective management of the hydrocarbon-affected areas. Thermal and in-situ chemical oxidation have been applied in large-scale remediation by Shell in the past, specifically in the rehabilitation of old oil fields and refineries being decommissioned.

At the same time, waste disposal sites pose a major environmental threat and so would account for a large share of the industry in this segment. Technologies are employed for sites such as soil vapor extraction, excavation, and containment systems, which are a means to control the adverse effects of leachate and gas emissions.

Among the key service providers involved in the remediation of waste disposal sites, especially where toxic heavy metals and industrial waste are present, are Veolia and Clean Harbors. One of the examples is Veolia's work in the West of Europe for the capping of old municipal landfills and groundwater treatment for environmental protection.

Both segments are sustained by stringent environmental regulations that make these solutions a necessity in the eyes of industrial players and municipalities through increasing public awareness of ecological concerns. Common to both sectors is a further drive for demand for remediation technologies by sustainable land reuse and resource recovery development.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK | 4.3% |

| France | 4% |

| Germany | 4.5% |

| Italy | 3.8% |

| South Korea | 4.7% |

| Japan | 3.9% |

| China | 6.1% |

| Australia | 4.1% |

| New Zealand | 3.5% |

The USA industry will expand at a CAGR of 5.2% during the period from 2025 to 2035, driven by increasing regulatory needs and federal spending on reducing pollution and redevelopment of brownfields. The technologies used are bioremediation, soil vapor extraction, and in-situ chemical oxidation, which are widely practiced in industrial and Superfund facilities.

Large remediation project stakeholders like AECOM, Bechtel Corporation, and Tetra Tech offer integrated engineering and environmental solutions. The EPA's support and creativity in treatment technologies also boost the growth of the industry. Climate resilience and sustainable site restoration enhance the use of advanced remediation methods across the nation.

The UK industry will grow at a 4.3% CAGR from 2025 to 2035 due to stringent environmental regulations and ongoing land reuse campaigns. Significant demand arises from the cleanup of polluted historic industrial sites and groundwater treatment. Phytoremediation and advanced filtration technologies have gained immense popularity.

Engaged in providing turnkey remediation services on infrastructure and redevelopment projects, major players like WSP UK, ERM, and Geosyntec Consultants also support ongoing investment in cleanup technologies that are made possible through government programs enabling brownfield regeneration and net-zero goals. Industry development is further boosted through cross-sector cooperation between environmental consultants, developers, and regulatory authorities.

France is forecast to experience a CAGR of 4% in the industry over the next decade. The industry is largely influenced by compliance with European Union directives targeting soil and water pollution control. Urban redevelopment, chemical site decontamination, and agricultural runoff treatment are major drivers of demand.

Major players include Veolia Environnement, Suez SA, and Arcadis, all being specialized remediation service providers in industrial and municipal industries. Circular economy and eco-design principles are the emphasis of France's policy, encouraging innovation in remediation methodology. Innovation in new technologies such as nano remediation and hybrid systems is being invested in to facilitate sustainable environmental rehabilitation.

Germany is anticipated to advance at a CAGR of 4.5% over the 2025 to 2035 period with the aid of strict environmental measures, industrial rehabilitation initiatives, and enhanced application in post-mining land reclamation. Low-impact, energy-saving solutions like electrokinetic remediation, in-situ chemical remediation, and permeable reactive barriers are of utmost significance to the industry.

Reputable firms such as Siemens AG, Bilfinger SE, and HPC AG dominate the remediation industry in Germany, carrying out both private and public environmental work. Efficiency and cost reduction have been achieved with the introduction of smart monitoring equipment and digital modeling gear. Governmental programs offering incentives to stimulate soil revival and water protection further enhance strength in long-term industry stability.

Italy's industry is set to grow at a CAGR of 3.8% during the period 2025 to 2035. The industry is fueled by growing public consciousness of industrial pollution, particularly along the coasts and the north of the country. Priority programs include groundwater remediation, landfill rehabilitation, and treatment of heritage industrial sites.

Key players such as Eni Rewind, Italferr, and Saipem are involved in providing tailored technologies for complex contamination scenarios. EU-compatible environmental compatibility regulations are leading private and public capital into the remediation plants. Budgetary constraints pose challenges, but incremental upgrading of waste and water management systems facilitates incremental industry progression.

South Korea is likely to record a CAGR of 4.7% over the forecast period, driven by an ambitious national policy for pollution control and urban regeneration. High-density city centers and former military sites are high-priority targets for cleanup initiatives employing thermal desorption, washing of soil, and in-situ biological treatment methods.

Key industry players include Sambo Engineering, Hyundai Engineering, and Korea Engineering Consultants Corp. Projects like the National Soil Environment Management Plan and investment in green infrastructure development are key drivers. The use of real-time monitoring and AI-based diagnostic capabilities is enhancing project accuracy and environmental footprint.

Japan's industry is estimated to grow with a CAGR of 3.9% over the 2025 to 2035 period. The industry is primarily dominated by legacy site decontamination, radioactive waste management, and post-industrial land rehabilitation. Advanced oxidation processes and microbial remediation technologies stand out in domestic applications.

Large core companies such as JESCO, Obayashi Corporation, and Shimizu Corporation participate in heavily regulated remediation work across the archipelago. Government efforts in reconstruction and risk reduction during disasters represent large demand generators. Continuation of innovation within sensor-fitted systems and treatment module units will stretch the technical boundaries of remediation solutions.

China will lead the industry with a CAGR of 6.1% over 2025 to 2035. Rapid industrialization on a large scale, widespread soil contamination, and stringent domestic pollution control regulations are driving rapid industry growth. The government's commitment to the "Beautiful China" initiative drives enormous-scale environmental restoration activities.

Key industry players in this sector include China Energy Conservation and Environmental Protection Group, Huaneng Clean Energy Research Institute, and Beijing GeoEnviron Engineering & Technology. The investments in the remediation of mining sites, chemical spills, and municipal landfills are massive. Emphasis on technology localization and strategic alliance with foreign companies facilitates capacity building and diversification of services.

Australia's industry for the environment is anticipated to grow at a CAGR of 4.1% during the forecast period. Mining legacy impacts, industrial and urban pollution, and urbanization are key drivers for demand for remediation services. Soil vapor extraction, immobilization practices, and ecological restoration techniques are being actively implemented in high-priority locations.

Some of the industry leaders include GHD Group, AECOM Australia, and Environmental Earth Sciences. Public-private partnerships are critical to addressing contamination in coastal regions, brownfields, and remote communities. Forward-thinking environmental legislation and commitment to the restoration of biodiversity underpin the growing adoption of remediation technologies across sectors.

New Zealand will likely have a CAGR of 3.5% in the period 2025 to 2035 in the industry for environmental remediation technology. The principal driving forces of the industry include mainly agricultural runoff treatment, redevelopment of urban brownfield sites, and restoration activities on native land. Nature-based approaches and sustainable land management strategies are being practiced more and more.

Such players as Beca Group, Tonkin + Taylor, and Aurecon New Zealand provide environmental engineering and consultancy services that are in line with national needs. Emphasis on ecological balance, soil health, and water quality is in line with more integrated policy initiatives such as the Essential Freshwater reforms. Low-impact remediation techniques will tend to expand in rural and urban areas.

The industry consists of a blend of global engineering firms with some specialized service providers and a number of emerging technology-driven players. By providing integrated remediation solutions, including soil and groundwater decontamination, hazardous waste management, and bioremediation services, large firms such as Clean Harbors, Golder Associates, and MWH Global command the industry. This enhances their competitive edge through a wide network of services, proficiency in regulatory compliance and cutting-edge treatment technologies.

Competitive mid-size players such as Newterra Ltd. and GEO Inc. provide specialized and effective solutions like modular water treatment systems and in-situ remediation techniques. Such firms brought in low-cost scalable technologies aimed at industrial, municipal, and military cleanup projects. They strongly establish a hub and scope for tailored environmental remediation services in niche markets.

Companies like Bristol Industries, Sequoia Environmental Remediation, and ERSI focus primarily on site-specific remediation techniques, which could comprise chemical oxidation, soil vapor extraction, and phytoremediation. They have partnerships with government and private industries, working to create sustainable environmental recovery programs. Moreover, the demand for remediation of PFAS (per- and poly-fluoroalkyl substances) and other such emerging pollutants has strengthened possibilities for innovativeness in this segment.

Advances in AI-driven site assessment, real-time contamination monitoring, and green remediations further propel forward that competition. Companies are increasingly integrating these new technologies with predictive modeling to make remediation efforts more cost-effective and optimized while enhancing long-term environmental sustainability.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Clean Harbors, Inc. | 14-18% |

| Golder Associates Corporation | 12-16% |

| MWH Global, Inc. | 10-14% |

| Newterra Ltd. | 8-12% |

| GEO Inc. | 6-10% |

| Others (combined) | 40-50% |

| Company Name | Key Offering and Activities |

|---|---|

| Clean Harbors, Inc. | Provides hazardous waste disposal, soil remediation, and emergency spill response services. |

| Golder Associates Corporation | Specializes in environmental consulting and site restoration projects for contaminated land. |

| MWH Global, Inc. | Offers water and wastewater treatment solutions with a focus on large-scale remediation. |

| Newterra Ltd. | Develops modular water treatment systems for industrial and municipal remediation projects. |

| GEO Inc. | Focuses on in-situ remediation and soil vapor extraction technologies. |

Key Company Insights

Clean Harbors, Inc. (14-18%)

A leader in hazardous waste management and industrial remediation, leveraging AI-driven site assessments to enhance efficiency and regulatory compliance.

Golder Associates Corporation (12-16%)

Expands its presence in global remediation projects, focusing on contaminated site restoration and hydrogeological assessments.

MWH Global, Inc. (10-14%)

Strengthens its water remediation capabilities with innovative treatment technologies for PFAS and emerging contaminants.

Newterra Ltd. (8-12%)

Develops cutting-edge modular water treatment systems, catering to decentralized and remote remediation projects.

GEO Inc. (6-10%)

Specializes in cost-effective in-situ remediation technologies, including chemical oxidation and bioremediation solutions.

Other Key Players

By technology type, the industry is segmented into thermal desorption, excavation or dredging, surfactant enhanced aquifer remediation (SEAR), pump and treat, solidification and stabilization, in situ oxidation, soil vapor extraction, bioremediation, and nanoremediation.

By application, the industry caters to various end-use sectors including oil and gas, mining and forestry, waste disposal sites, agriculture, automotive, and others.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The global industry is estimated to be worth USD 142.6 billion in 2025.

Sales are projected to grow significantly, reaching USD 308.5 billion by 2035.

China is expected to experience a CAGR of 6.1%.

Thermal desorption is leading, owing to its effectiveness in removing hazardous contaminants from soil and sediment.

Key players in the industry include Bristol Industries, LLC, MWH Global, Inc., Tarmac International, Inc., Sequoia Environmental Remediation Inc., Environmental Remediation Resources Pty Ltd., Entact LLC, GEO Inc., ERSI, Newterra Ltd., Golder Associates Corporation, and Clean Harbors, Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Technology Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Technology Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Technology Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Technology Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Technology Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Technology Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Technology Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Technology Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Technology Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Technology Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Patch and Remediation Software Market Size and Share Forecast Outlook 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA