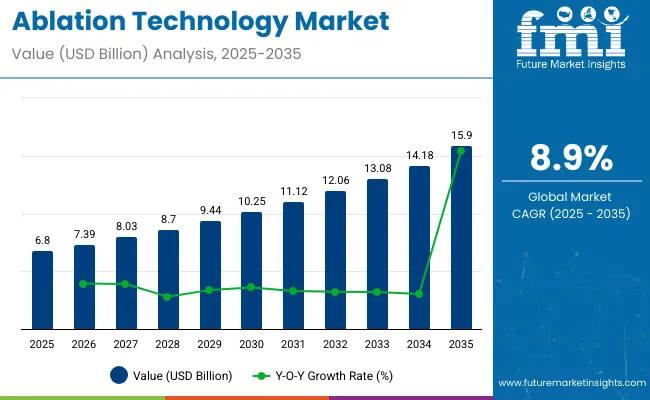

The ablation technology market is expected to be valued at USD 6.8 billion in 2025 and projected to reach USD 15.9 billion by 2035, expanding at a CAGR of 8.9% during the forecast period. This growth is being driven by rising demand for minimally invasive surgical procedures and increased global incidence of cardiac arrhythmias, cancers, and chronic pain conditions.

Technologies such as radiofrequency, cryoablation, microwave, and laser ablation have been increasingly adopted across hospital settings and ambulatory surgical centers. With higher procedural accuracy and reduced recovery time, ablation therapies are being prioritized by healthcare providers. Strong clinical success rates have been documented, and patients are being increasingly offered ablation as a first-line or adjunct therapy for targeted tissue destruction across multiple disease categories.

Substantial market momentum is being experienced due to advances in imaging integration, catheter-based ablation systems, and the adoption of energy-based modalities. Growth in demand for image-guided ablation procedures has been supported by improved accuracy in lesion formation, real-time visualization, and reduced procedural risks.

Market expansion is further being aided by investments in AI-based mapping systems and robotic-assisted ablation tools. Innovation pipelines of companies are being shaped by clinician input and regulatory collaboration to enhance both safety and procedural efficacy. Adoption is being accelerated by the development of outpatient care frameworks and value-based care models. Strategic partnerships, particularly in Europe, Japan, and the United States, are being pursued to facilitate device approvals and streamline global access to next-generation ablation solutions.

According to Geoff Martha, Chairman and CEO of Medtronic, “Sensing and closed-loop technology is becoming foundational for the neuromod space,” as noted in a verified Medtronic leadership update. This statement reflects a strategic alignment of ablation systems with intelligent feedback platforms, especially in neuroablation and electrophysiology. The market is being reshaped by such integrations, where real-time data allows for enhanced procedural control and optimized therapeutic outcomes.

Future product development is being guided by demand for compact, durable, and interoperable systems that combine ablation energy delivery with diagnostic precision. With expanding indications and favorable reimbursement environments, ablation is expected to continue as a cornerstone technology within interventional and therapeutic disciplines.

| Attributes | Details |

|---|---|

| Market Value (2025) | USD 6.8 billion |

| Market Value (2035) | USD 15.9 billion |

| CAGR (2025 to 2035) | 8.9% |

The ablation technology market is rapidly evolving with the integration of smart technologies aimed at improving precision, safety, and procedural efficiency. These include robotic navigation systems, AI-assisted mapping, real-time feedback mechanisms, and energy delivery innovations. With increasing demand for minimally invasive solutions across cardiac, oncology, and neurological applications, companies are investing in intelligent systems that enhance clinician control and patient outcomes.

The ablation technology market is governed by strict regulatory frameworks to ensure the safety, efficacy, and quality of medical devices used in treatment. Regulatory bodies worldwide enforce comprehensive guidelines covering device approval, manufacturing practices, clinical trials, and post-market surveillance.

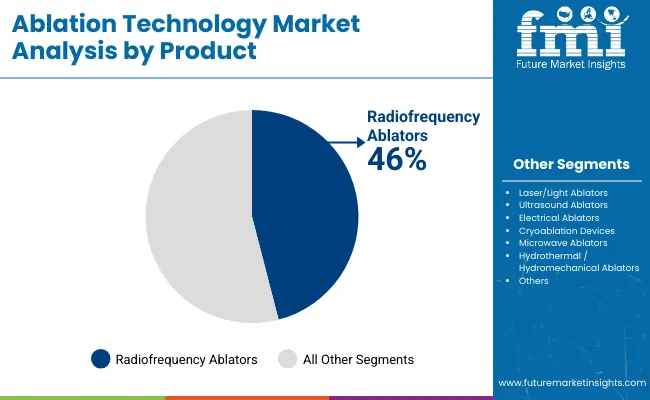

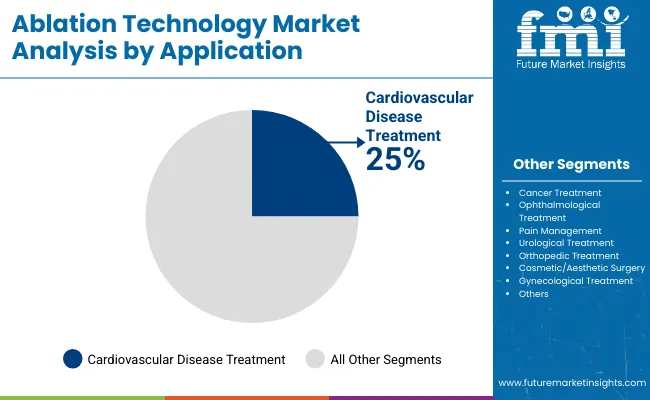

Significant capital inflows are being witnessed in the ablation technology market, especially in product innovations and high-impact application areas. Among these, radiofrequency ablators and cardiovascular disease treatments have been identified as the top investment-worthy segments. Technological advancements, clinical success, and market scalability are considered key factors supporting their pivotal role in market growth through 2035.

The ablation technology product segment is expected to be dominated by radiofrequency ablators, which are projected to grow at a CAGR of 10.7% from 2025 to 2035. Due to their consistent clinical efficacy, minimally invasive nature, and favorable safety profile, these devices have been widely adopted. Procedural outcomes have been enhanced through technological improvements such as precise temperature regulation, reduced collateral damage, and automated energy delivery.

Next-generation RF ablation systems are being developed actively by major players including Medtronic, Boston Scientific, and Abbott Laboratories for cardiovascular and oncology applications. Volume growth is further driven by increased availability in outpatient settings and expanded adoption across Asia-Pacific and North America.

The cost-effectiveness and integration capabilities of radiofrequency ablators have made them preferred choices in treating arrhythmias and certain solid tumors. Sustained investment in R&D continues to attract investor confidence, positioning this segment as a leader in product category revenues throughout the forecast period.

The leading application area in the ablation technology market is expected to be cardiovascular disease treatment, which is forecasted to grow at a CAGR of 10.5% between 2025 and 2035. Demand has been escalated by the rising incidence of atrial fibrillation, ventricular tachycardia, and ischemic disorders, requiring effective, minimally invasive treatment options.

Ablation therapies have been increasingly adopted due to their ability to offer rapid recovery, reduced complications, and improved long-term outcomes. R&D efforts in cardiac ablation platforms, integrating AI and real-time mapping systems to improve accuracy, are being intensified by companies such as Biosense Webster (J&J), AtriCure, and CardioFocus.

Procedure adoption has been facilitated by healthcare reforms, favorable reimbursement policies, and growing clinician awareness in hospitals and specialty clinics. Long-term investments are being attracted by the shift toward value-based cardiac care and preventive health interventions, ensuring this segment’s continued dominance in the clinical usage of ablation technologies worldwide.

The market developed significantly from 2020 to 2024, propelled by technological improvements and a rise in the adoption of ablation technology in different medical settings.

The increased demand for medical procedures and technical advancements fostered a strong market expansion of ablation technology. Research and development experienced an upsurge in the ablation technology industry, creating a competitive environment with a wide range of healthcare applications.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 3.7 billion |

| Market Value for 2024 | USD 5.7 billion |

| Market CAGR from 2020 to 2024 | 10.9% |

Ablation technology is set to become more integral to medical interventions due to anticipated developments in the field. Improved accuracy, more applications, and greater interaction with other medical technologies are expected to drive market growth. The growing awareness and regulatory support ought to maintain market momentum.

Ablation technology is anticipated to transform into a key element of minimally invasive operations in the long run, helping to change how medical interventions are thought of. A revolutionary influence on healthcare practices is stimulated by ongoing technological innovation and enhanced accessibility, accelerating market penetration.

Age-related health problems are more likely to arise due to the aging population, which encourages demand for ablation technology. Interventions are frequently needed to control and treat various medical issues in older adults.

Ongoing developments aid market expansion in ablation technologies, such as new approaches to procedures, imaging modalities, and energy sources. These developments draw patients and healthcare professionals alike by improving ablation treatments' accuracy, security, and effectiveness.

Market expansion of ablation technology is facilitated by rising patient and healthcare professional knowledge of the advantages of ablation treatments. Programs for education and training are essential for increasing the body of knowledge and promoting the adoption of ablation technologies.

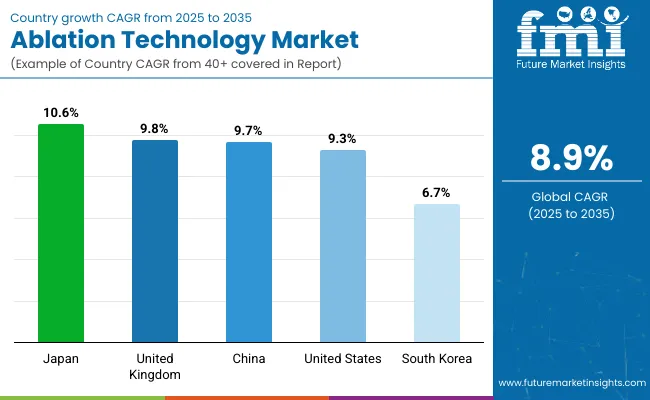

The market analysis of ablation technology is portrayed in the following tables, which highlight the significant economies of Asia Pacific, Europe, and North America.

An in-depth evaluation shows a lot of potential in Japan due to the presence of several manufacturers of ablation technology. Resilient ablation technology suppliers highlight Japan's market potential and promote the nation as a lucrative hub for developments and expansion in the ablation technology field.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.6% |

| United Kingdom | 9.8% |

| China | 9.7% |

| United States | 9.3% |

| South Korea | 6.7% |

The demand for ablation technology is driven by an aging population and a high frequency of chronic diseases, making Japan an important player in the Asia Pacific market. The demand for ablation technology in Japan exhibited an HCAGR of 13.4% from 2020 to 2024.

Japan's ablation technology market is rising because of the country's growing inclination for less intrusive procedures and innovative medical technologies. The ablation technology market is growing due to strategic partnerships between Japanese businesses and global companies that enable the sharing of technological expertise.

In the United Kingdom, the demand for ablation technology has steadily increased due to rising chronic illness incidences and a proactive attitude toward healthcare innovations. The United Kingdom market developed at a CAGR of 13.3% through 2024.

A well-established healthcare system and high levels of technological adoption have created an advanced market for ablation technology in the United Kingdom. The United Kingdom's reimbursement practices and regulatory frameworks provide patients access to advanced medical treatments by creating a stable environment for the growth of ablation technology.

Due to rising healthcare expenditures and a growing middle class, China is leading globally in ablation technology market growth. Sales of ablation technology evolved at an CAGR of 12.4% from 2020 to 2024.

An aging population and an increase in the prevalence of cardiovascular illnesses are pushing demand for ablation technology, making China a major player in the ablation technology industry. Initiatives for localized research and development help to innovate and tailor ablation technology to China's unique medical demands.

The United States ablation technology market surged at an HCAGR of 11.6% from 2020 to 2024. Due to its robust healthcare infrastructure and significant healthcare expenditures, the United States is a leader in the adoption of ablation technology.

The United States ablation technology industry is growing due to rising chronic illness prevalence and proactive regulations. The ablation technology industry in the United States is constantly expanding due to generous reimbursement guidelines and a strong emphasis on technology developments.

Sales of ablation technology in South Korea thrusted at a strong HCAGR of 18.4% during the historical period. The adoption of ablation technology continues to grow in South Korea due to a greater understanding of the advantages of minimally invasive procedures.

The market growth for ablation technology in South Korea is centered on government programs that support the development of healthcare infrastructure and the acceptance of new technologies. In South Korea, an emphasis on teaching medical practitioners how to use ablation technology improves its acceptance and application across various specializations.

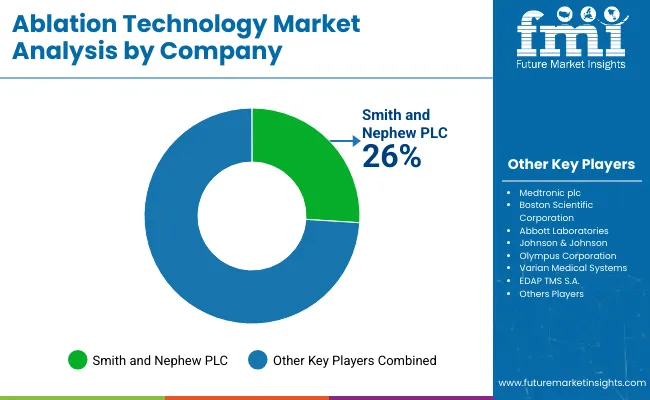

Prominent Ablation Technology ManufacturersThe market is competitive, with a wide selection of ablation technology vendors providing innovative solutions. Major ablation technology providers concentrate on research and development, tactical alliances, and technology breakthroughs to obtain a competitive edge.

The rising incidence of chronic diseases and the growing desire for minimally invasive procedures stimulate market growth for ablation technology.

The leaders in the field promote innovation and direct the development of ablation technology. Manufacturers of ablation technology at the forefront include Boston Scientific Corporation and Medtronic Plc., while Abbott Laboratories and Johnson & Johnson offer distinctive strengths. Olympus Corporation, Varian Medical Systems Inc., and EDAP TMS S.A. provide various solutions and play crucial roles. The participants continuously mold the market's evolution by advancing the boundaries of ablation technology.

| Company | Details |

|---|---|

| Medtronic | For patients with atrial fibrillation, Medtronic finished recruiting subjects for a pivotal trial that assessed a revolutionary pulsed field ablation catheter in December 2022. |

| Medtronic | To foster quick innovation in stroke treatment, Medtronic announced the launch of the Medtronic Neurovascular Co-LabTM Platform in October 2022. |

| Olympus Corporation | In October 2022, EU-ME3, an endoscopic ultrasound processor, was launched by Olympus Corporation, a global MedTech company committed to improving people's lives through health, safety, and fulfillment. This device was created to satisfy the demands of medical professionals seeking clear, high-quality images when performing endoscopic ultrasound procedures. Europe, the Middle East, Africa, Asia, and Oceania are likely to have access to EU-ME3 during this fiscal year. EU-ME3 is displayed from October 8 to October 11 at the 30th United European Gastroenterology Week. |

| PENTAX Medical | The C2 CryoBalloon Ablation System was released in Canada in October 2022 to treat Barrett's esophagus. PENTAX Medical, a producer of endoscopic instruments for therapeutic and diagnostic uses, carried this out. |

| Quantum Surgical | In March 2022, the United States Food and Drug Administration approved Quantum Surgical's 510(k) for their Epione robot, which can design, perform, and confirm tumor ablation as a cancer treatment. |

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.8 billion |

| Projected Market Size (2035) | USD 15.9 billion |

| CAGR (2025 to 2035) | 8.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for procedure volume (where applicable) |

| Product Types Analyzed (Segment 1) | Radiofrequency Ablators, Cryoablation Systems, Microwave Ablation, Laser Ablation |

| Application Segments Analyzed (Segment 2) | Cardiovascular Disease Treatment, Oncology, Chronic Pain Management, Others |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, United Kingdom, Germany, France, Japan, China, South Korea, India, Australia/New Zealand (ANZ), GCC Countries, South Africa |

| Key Players influencing the Ablation Technology Market | Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Johnson & Johnson, Olympus Corporation, Varian Medical Systems, EDAP TMS S.A. |

| Additional Attributes | Dollar sales by product type (radiofrequency vs others), Dollar sales by application (cardiovascular, oncology, chronic pain), Trends in AI-based mapping and robotic-assisted ablation, Adoption of minimally invasive procedures, Investments in imaging integration and energy modalities, Regional patterns of regulatory approvals and reimbursement policies, Strategic partnerships and innovation pipelines |

The ablation technology market is estimated to secure a valuation of USD 6.8 billion in 2025.

The ablation technique market is estimated to reach USD 15.9 billion by 2035.

The ablation technology industry is anticipated to develop at an 8.9% CAGR through 2035.

The radiofrequency ablators segment is anticipated to dominate the market, exhibiting a CAGR of 8.6% from 2024 to 2034.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

4K Technology Market Size and Share Forecast Outlook 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

8K Technology Market

Nanotechnology Photocatalysis Surface Coating Industry Analysis in AMEA Size and Share Forecast Outlook 2025 to 2035

Nanotechnology Packaging Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in GDS Technology Market

GDS Technology Market Insights - Growth & Forecast 2025 to 2035

Nanotechnology for food packaging Market

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Smart-Technology Anti-Wrinkle Peptides Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Green Technology And Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Tumour Ablation Devices Market Size and Share Forecast Outlook 2025 to 2035

Camera Technology Market Analysis – Trends & Forecast 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Airline Technology Integration Market Size and Share Forecast Outlook 2025 to 2035

Food Biotechnology Market Size and Share Forecast Outlook 2025 to 2035

IO-Link technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA