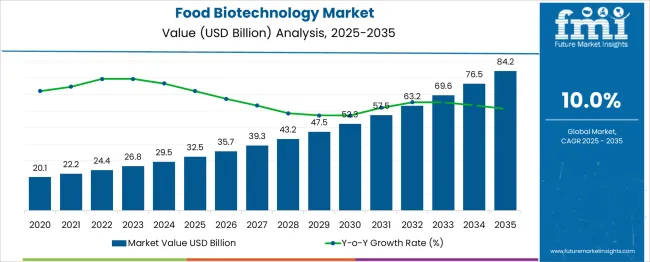

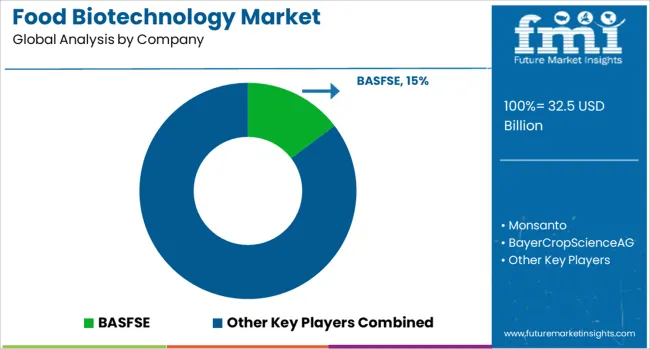

The Food Biotechnology Market is estimated to be valued at USD 32.5 billion in 2025 and is projected to reach USD 84.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The rolling CAGR analysis reveals the consistent expansion of the market across the years, highlighting steady acceleration in market value. Starting at USD 32.5 billion in 2025, the market gradually increases each year with incremental growth rates, reaching USD 35.7 billion in 2026 and USD 39.3 billion in 2027. This steady increase reflects ongoing technological advancements and growing adoption of biotechnological applications in food production and processing.

Midway through the forecast period, the market is expected to reach USD 52.3 billion by 2030, which marks a notable milestone indicating amplified growth. This phase benefits from increased consumer demand for enhanced food quality, safety, and novel bioengineered products, driving further investments and innovations. By 2035, the market’s value climbs to USD 84.2 billion, demonstrating that the growth momentum is sustained throughout the decade. The rolling CAGR underscores a consistent year-on-year growth rate close to the 10% benchmark, confirming the sector’s resilience and expanding footprint. The steady progression in the market’s value reflects a balanced, long-term growth trajectory with incremental gains each year, positioning it as a lucrative sector for stakeholders focused on innovation and sustainability in the food industry.

| Metric | Value |

|---|---|

| Food Biotechnology Market Estimated Value in (2025 E) | USD 32.5 billion |

| Food Biotechnology Market Forecast Value in (2035 F) | USD 84.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The food biotechnology market is experiencing strong growth as global food systems undergo transformation driven by genetic innovation, sustainability mandates, and population growth pressures. Scientific advancements in genome editing, molecular breeding, and microbial applications are redefining how food is cultivated, processed, and preserved.

Regulatory approvals in major economies and growing public-private investment in agri-genomics have supported the development of genetically improved food sources aimed at boosting yield, nutritional value, and resistance to environmental stress. The market is also witnessing increased collaboration between agricultural biotech firms and food producers to accelerate the commercialization of biologically enhanced food products.

As food security and climate-resilient agriculture become central to national policy frameworks, biotechnology is being increasingly positioned as a solution to reduce dependency on synthetic inputs and improve resource efficiency. Over the coming years, integration with precision agriculture, AI-enabled phenotyping, and synthetic biology is expected to drive widespread application of biotech tools across both crop and livestock production systems.

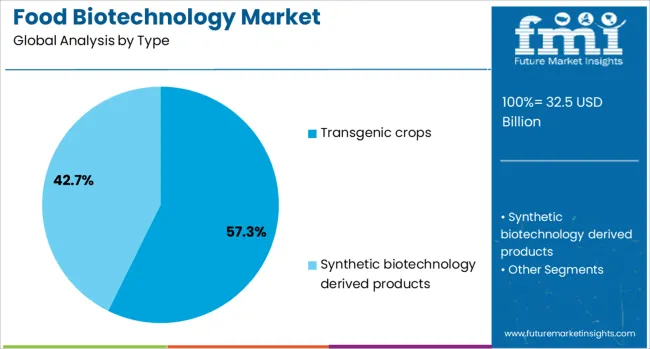

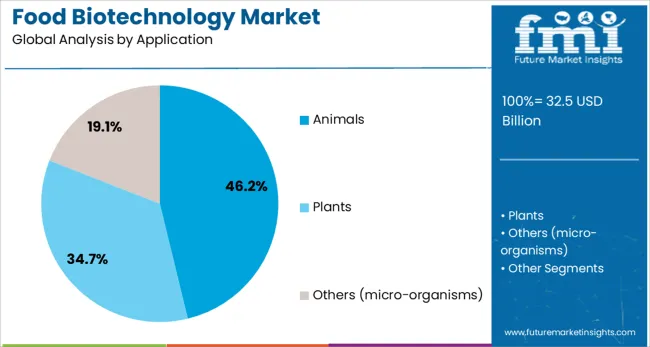

The food biotechnology market is segmented by type, application, and geographic regions. By type, the food biotechnology market is divided into Transgenic crops and synthetic biotechnology-derived products. In terms of application, the food biotechnology market is classified into Animals, Plants, and Others (micro-organisms). Regionally, the food biotechnology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transgenic crops segment is expected to contribute 57.3% of the total revenue share in the food biotechnology market in 2025, making it the leading type segment. This dominance is being driven by the significant improvements in crop traits enabled through recombinant DNA technology, which has allowed enhanced tolerance to pests, herbicides, and environmental stressors.

Transgenic crops have been increasingly cultivated due to their ability to improve yield efficiency and reduce the need for chemical inputs, aligning with sustainable agriculture goals. The widespread adoption of genetically modified soybeans, maize, and cotton in both developed and developing countries has further supported the segment’s expansion.

Advances in gene-editing platforms such as CRISPR and TALEN have enabled faster trait development cycles and more precise genomic alterations, boosting market confidence and regulatory acceptability. The long-standing safety track record and favorable outcomes in field trials have reinforced the demand for transgenic crops as a reliable solution to global food production challenges.

The animals segment is projected to account for 46.2% of the food biotechnology market’s revenue share in 2025, reflecting its growing role in enhancing livestock productivity and health through biotechnological applications. The segment's growth is being influenced by the increasing need to improve feed conversion ratios, accelerate animal growth, and develop disease-resistant breeds through genetic engineering and microbial modulation.

Probiotic feed additives, RNA interference techniques, and gene-edited livestock are being leveraged to improve meat, dairy, and egg production in response to rising global protein demand. Biotech-enabled vaccines and diagnostic tools have further strengthened animal health management, minimizing losses and reducing antibiotic dependency in commercial farming operations.

Regulatory support for biotechnology-based animal health solutions and greater investments in sustainable animal agriculture are expected to bolster segment growth. As consumer demand for traceable and ethically produced animal products increases, biotechnology is playing a crucial role in enhancing transparency, safety, and efficiency across the animal production value chain.

The market has been expanding steadily as biotechnological applications transform food production, processing, and preservation. Genetic modification, enzyme technology, and fermentation have been widely used to enhance crop yield, improve nutritional profiles, and develop functional foods. The market growth has been driven by increasing demand for sustainable food solutions, improved food safety, and extended shelf life. Biotechnological advancements have enabled the creation of biofortified crops, allergen-free products, and bio-preservatives, addressing health-conscious consumer preferences. Regulatory frameworks governing genetically modified organisms and food safety have influenced market developments.

Significant progress in genetic engineering techniques, including CRISPR and recombinant DNA technology, has enhanced crop resistance to pests, diseases, and environmental stresses. These modifications have improved crop productivity and quality, reducing reliance on chemical pesticides and fertilizers. Fermentation technologies have been employed to develop probiotics, enzymes, and bio-preservatives that improve food texture, flavor, and shelf life. Innovations in microbial strain development and fermentation process optimization have expanded applications in dairy, meat substitutes, and beverages. Such technologies have also facilitated the production of alternative proteins and plant-based ingredients aligned with shifting consumer preferences. The integration of bioinformatics and synthetic biology tools has accelerated product development, offering customized solutions for nutritional enhancement and food safety.

The rising consumer interest in health and wellness has driven demand for functional foods enriched with bioactive compounds produced through biotechnology. Probiotics, prebiotics, antioxidants, and vitamins are incorporated to support digestion, immunity, and chronic disease prevention. Biotechnology has enabled the production of these nutraceutical ingredients in scalable and cost-effective ways. Functional foods and dietary supplements developed using biotechnological methods have been gaining market share across global regions. Labeling transparency and scientific substantiation have been emphasized to meet regulatory requirements and consumer trust. This trend is expected to continue as populations age and lifestyle diseases increase, encouraging personalized nutrition and targeted health benefits through biotech-enabled food products.

The market has been influenced by complex regulatory landscapes that vary by region, impacting product approvals and commercialization timelines. Stringent assessments regarding safety, environmental impact, and labeling transparency have been mandated for genetically modified and biotech-derived foods. Consumer acceptance remains a critical challenge due to concerns related to genetic modification ethics, allergenicity, and naturalness perceptions. Educational initiatives and transparent communication have been adopted by industry stakeholders to address misconceptions and build trust. Regulatory harmonization efforts are ongoing to facilitate international trade and innovation. Navigating this regulatory complexity requires robust scientific evidence and compliance, shaping product development and market entry strategies. Overcoming consumer hesitancy is pivotal for wider adoption and market growth.

Biotechnology has been increasingly applied in sustainable agriculture practices to enhance resource efficiency and reduce environmental footprint. Biofertilizers, biopesticides, and genetically enhanced crops contribute to reduced chemical input use and improved soil health. In food processing, enzymes and microbial cultures derived through biotechnology optimize production processes, improve yield, and ensure product consistency. Alternative protein sources such as cultured meat and plant-based analogs have been developed using biotechnological methods, addressing ethical and environmental concerns linked to conventional animal farming. These applications support circular economy principles and climate resilience in food systems. Growing collaboration between biotechnology firms, food manufacturers, and policymakers is expected to drive innovation and expand sustainable solutions, reinforcing the role of food biotechnology in future food security.

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

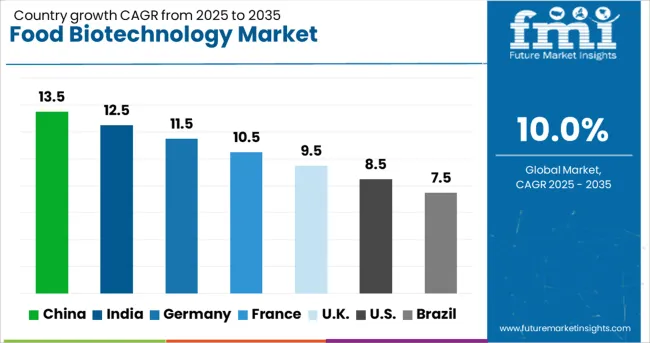

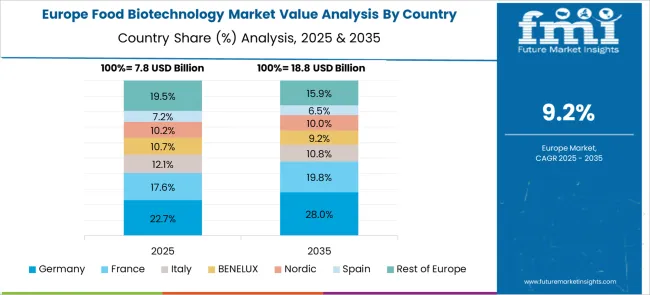

The market is projected to grow at a CAGR of 10.0% between 2025 and 2035, driven by advances in genetic engineering, fermentation technologies, and demand for sustainable food production. China leads with a 13.5% CAGR, supported by government initiatives and rapid biotechnological adoption in food processing. India follows at 12.5%, fueled by growing research investments and biotechnology startups. Germany, at 11.5%, benefits from strong R&D infrastructure and regulatory support. The UK, growing at 9.5%, is driven by innovation in functional foods and alternative proteins. The USA, with an 8.5% CAGR, experiences steady growth due to advanced biotech applications and consumer acceptance. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s industry is expected to grow at a CAGR of 13.5% from 2025 to 2035. The expansion is driven by increased research in genetically enhanced crops and fermentation technologies to improve food safety and nutritional profiles. Major companies such as BGI and Beijing Dabeinong Technology have increased investment in enzyme development and microbial strain innovation. Government initiatives promoting biotech applications in agriculture and food processing support growth. The rising demand for functional foods and protein alternatives accelerates product commercialization, while regulatory frameworks are being refined to encourage innovation and consumer acceptance.

India is anticipated to grow at a CAGR of 12.5% through 2035, led by expanding applications in crop improvement and bio-preservation. Companies like Biocon and Serum Institute focus on microbial biotechnology to enhance food shelf life and safety. Investments in research for probiotics and biofortified foods support consumer health trends. The demand from dairy and processed food industries for biotechnology solutions drives sales growth. Regulatory agencies are working to streamline approvals to enable faster market entry for biotech products.

The industry in Germany is projected to expand at a CAGR of 11.5% during 2025 to 2035. Growth is driven by investments in fermentation technology and enzyme applications for food processing efficiency. Companies such as BASF and Evonik are focusing on sustainable bioproducts and natural preservatives. Consumer preference for clean-label products encourages the use of biotechnology to replace synthetic additives. Collaborative research initiatives between industry and universities support innovation. Strict EU regulations shape market dynamics and product development.

The United Kingdom is forecast to grow at a CAGR of 9.5% from 2025 to 2035, supported by research in bioengineered ingredients and fermentation processes. Companies like Ginkgo Bioworks and Kiran Bio are driving product development in natural flavor enhancers and probiotics. Increasing consumer demand for sustainable protein sources and reduced food waste creates new opportunities. Government funding and regulatory support enhance innovation pipelines. The plant-based food sector is a significant contributor to market expansion.

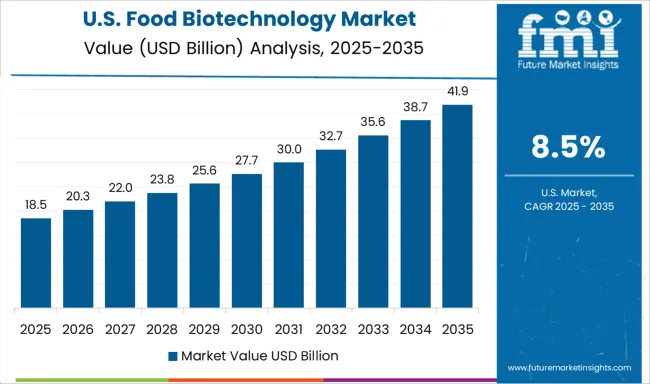

The United States market is expected to grow at a CAGR of 8.5% over the next decade, propelled by advancements in gene editing and fermentation technologies. Leading firms such as DuPont Nutrition and Corteva Agriscience are innovating in bioengineered enzymes and microbial cultures for food processing and preservation. Consumer interest in functional foods and personalized nutrition supports product diversification. Regulatory agencies like the FDA are gradually adapting frameworks to facilitate product approvals. The growth of alternative protein and sustainable ingredient segments reinforces market demand.

Dominant players such as Danisco (part of DuPont), Chr. Hansen, Novozymes, and BASF have established extensive portfolios across enzymes, probiotics, fermentation solutions, and bioactive compounds. Key players, including ADM, Royal DSM, and Kerry Group, focus on regional penetration, specialty formulations, and collaborative research agreements. Emerging companies focus on niche areas such as precision fermentation, plant-based protein enhancement, and microbial-based preservation technologies. The competitive intensity is driven by evolving consumer preferences for functional foods, protein diversification, and clean-label formulations. Strategic moves over the historical period have included mergers, acquisitions, partnerships with startups, licensing of proprietary strains, and investment in pilot-scale production facilities to reduce commercialization cycles.

During the forecast period, companies are expected to prioritize vertical integration, digitalized production monitoring, and co-development agreements with food and beverage brands to accelerate the adoption of these technologies. Players are increasingly leveraging AI-driven fermentation optimization and strain engineering to enhance the yield and functional efficacy of bioingredients. Market entry strategies for new players typically emphasize licensing of technology platforms, strategic collaborations with research institutions, and targeting high-growth geographies, such as the Asia-Pacific and North America. Competitive differentiation is achieved through customized enzyme blends, probiotic formulations tailored for gut health, and proprietary microbial solutions for plant-based and clean-label product lines. Intellectual property protection and regulatory compliance, particularly with the FDA, EFSA, and APAC authorities, remain critical to maintaining first-mover advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 32.5 Billion |

| Type | Transgenic crops and Synthetic biotechnology derived products |

| Application | Animals, Plants, and Others (micro-organisms) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASFSE, Monsanto, BayerCropScienceAG, DowAgroSciencesLLC, ABSGlobal, AquaBountyTechnologies, ArcadiaBiosciences, CamsonBioTechnologiesLtd, and BDFIngredientsZuchem |

| Additional Attributes | Dollar sales by technology type and application segment, demand dynamics across fermentation, enzyme engineering, and genetic modification in food production, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in CRISPR gene editing, synthetic biology, and microbial strain development, environmental impact of resource-efficient processes, reduced food waste, and bio-based product lifecycle, and emerging use cases in alternative protein production, enhanced food preservation, and personalized nutrition solutions. |

The global food biotechnology market is estimated to be valued at USD 32.5 billion in 2025.

The market size for the food biotechnology market is projected to reach USD 84.2 billion by 2035.

The food biotechnology market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in food biotechnology market are transgenic crops and synthetic biotechnology derived products.

In terms of application, animals segment to command 46.2% share in the food biotechnology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA