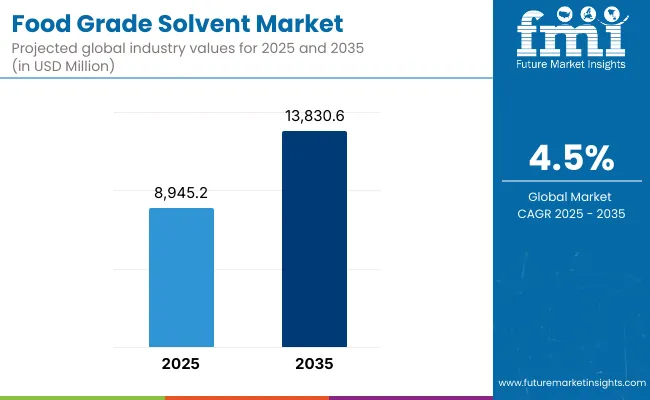

The Food Grade Solvent Market is expected to record a valuation of USD 8,945.2 million in 2025, reaching USD 13,830.6 million by 2035, reflecting a 4.5% CAGR over the decade. Growth during the first half of the forecast period (2025-2030) will be supported by the rising adoption of ethanol-based formulations, which remain integral to food processing, flavor extraction, and beverage applications. During this phase, the market is projected to gain nearly USD 2,022 million, underpinned by increased consumption in North America and steady expansion across Europe.

Food Grade Solvent Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025 E ) | USD 8,945.2 Million |

| Market Forecast Value In (2035f) | USD 13,830.6 Million |

| Forecast CAGR (2025 to 2035) | 4.5% |

From 2030 to 2035, the pace of growth will accelerate in Asia-Pacific, where solvent usage in bakery, dairy, and processed foods is expanding in response to consumer demand for convenience products. This period will add approximately USD 2,863 million to the market, reflecting the role of industrial modernization in South Asia and East Asia. Strong policy encouragement for clean-label and bio-based inputs will reinforce the shift toward natural solvents, which are forecast to grow at 6.1% CAGR, significantly outpacing synthetics at 3.9% CAGR.

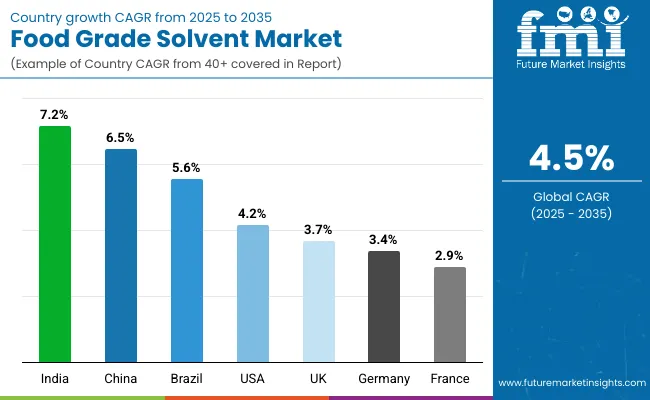

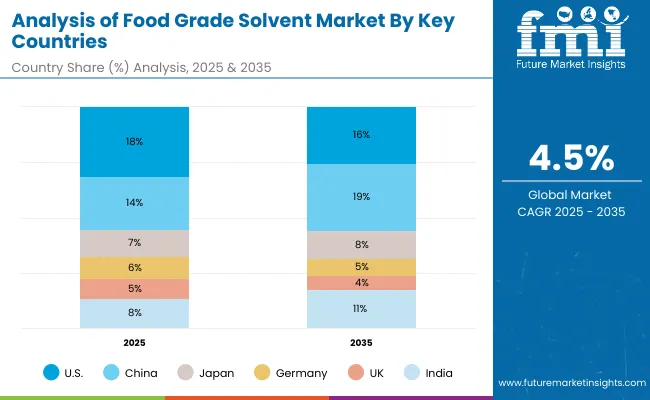

Regional momentum will be most pronounced in China and India, which are expected to record CAGRs of 6.5% and 7.2% respectively, supported by rapid urbanization and modernization of food supply chains. While the United States retains leadership, its share is forecast to fall from 18% in 2025 to 16% by 2035, reflecting faster expansion in Asia-Pacific.

From 2020 to 2024, the Food Grade Solvent Market expanded steadily, driven by the rising need for safe and high-purity processing solutions. In 2025, the market is valued at USD 8,945.2 Million, supported by ethanol’s leadership across beverages and bakery applications. By 2035, it is forecasted to reach USD 13,830.6 Million, with growth momentum shifting toward natural/bio-based solvents, reflecting sustainability commitments and consumer demand for clean-label products. Competitive advantage is expected to evolve beyond cost leadership toward ecosystem strength, including regulatory compliance, supply chain integration, and digital solvent management.

The Food Grade Solvent Market is expanding due to technological advancement, industry modernization, and evolving consumer preferences. Precision in food processing and analytical testing has been enhanced through improved solvent purification, which ensures safety and compliance in sensitive applications. Bio-based innovation is another driver, supported by fermentation technologies that lower production costs of ethanol and glycerol, enabling wider substitution for petrochemical derivatives.

Growing reliance on portable devices and digital testing platforms has also increased demand for high-purity solvents, particularly in chromatography. In parallel, the food and beverage industry is experiencing heightened demand for functional, natural, and convenience products, which require solvents in flavor extraction, preservation, and formulation. Regulatory frameworks across Europe, North America, and Asia-Pacific are reinforcing this trend by promoting sustainable practices and clean-label product adoption. Together, these factors are ensuring consistent growth, while natural solvents emerge as the most transformative category within the decade ahead.

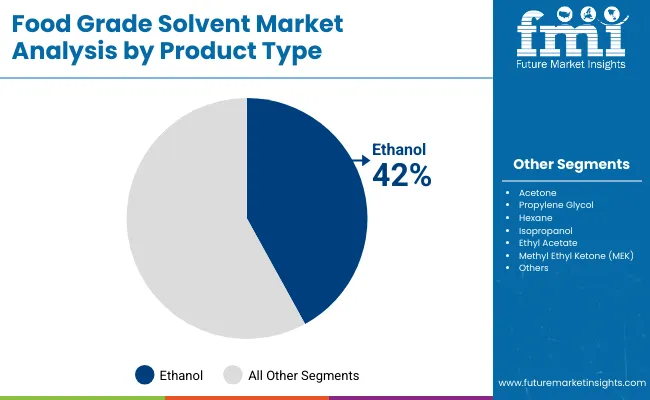

The Food Grade Solvent Market is segmented across product type, source, and application, each contributing unique growth dynamics. These categories are defining competitive positioning, shaping technological innovation, and guiding investment priorities for manufacturers. Product type segmentation emphasizes ethanol’s leadership, supported by its wide applicability in flavor extraction and beverage processing, while highlighting fast-growing categories such as ethyl acetate.

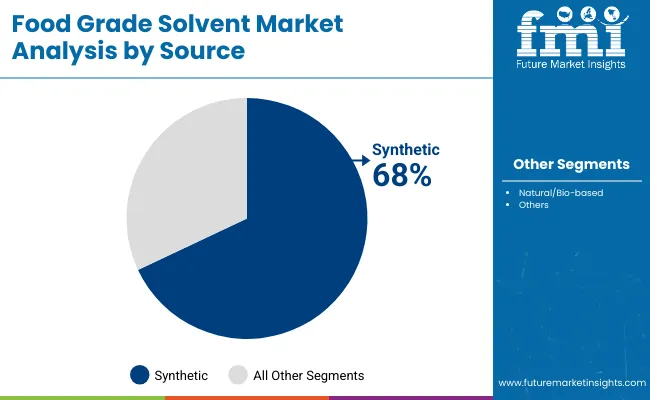

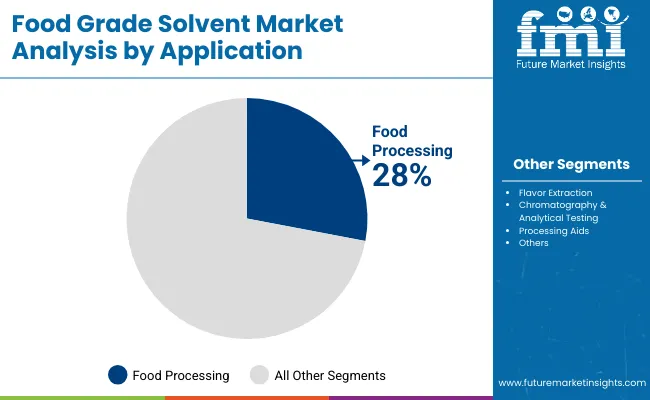

Source analysis illustrates the accelerating adoption of bio-based solvents, driven by sustainability mandates and consumer preference for clean-label food products. Application trends underscore the central role of food processing as the largest demand driver, while flavor extraction emerges as the fastest-growing segment, reflecting the rising importance of natural formulations. Each of these dimensions is expected to undergo transformative shifts over the decade, supported by regulatory alignment, advances in biotechnology, and evolving consumer demand for high-quality and sustainable ingredients.

| Product Type | Market Value Share, 2025 |

|---|---|

| Ethanol | 42.0% |

| Others | 58.0% |

Ethanol dominates the Food Grade Solvent Market with 42.0% share in 2025, expanding at 5.2% CAGR. Its wide applicability across beverages, bakery, and flavor extraction sustains its leadership. Ethyl acetate, with the fastest growth at 5.5% CAGR, is expected to gain relevance, though it remains smaller in scale compared to ethanol. Isopropanol also reflects strong utility in food-grade cleaning and analytical testing, while glycerol and propylene glycol provide formulation stability. Despite this diversity, ethanol remains unrivaled in scale, serving as the cornerstone of demand. Over the forecast period, ethanol’s balance of volume dominance and adaptability across multiple industries ensures its continued leadership, even as specialized bio-based solvents attract attention for sustainability-driven opportunities.

| Source | Market Value Share, 2025 |

|---|---|

| Synthetic | 68.0% |

| Others | 32.0% |

Synthetic solvents account for the majority of consumption, with 68.0% share in 2025, reflecting their entrenched use in preservation and bulk food production. Growth, however, is restrained at 3.9% CAGR due to sustainability pressures and rising consumer preference for natural alternatives. Bio-based solvents, though smaller at 32.0% share, are projected to expand fastest at 6.1% CAGR, supported by bioethanol and glycerol scaling through fermentation and biorefinery investments. This structural shift highlights an industry realignment, where bio-based inputs progressively capture share in premium and functional applications. By 2035, natural solvents are expected to hold a significantly larger role, reshaping competitive strategies and offering manufacturers opportunities to differentiate through sustainability-led innovation.

| Application | Market Value Share, 2025 |

|---|---|

| Food Processing | 28.00% |

| Others | 72.00% |

Food processing leads with 28.0% share in 2025, growing steadily at 4.2% CAGR. Solvents are indispensable in ingredient refinement, preservation, and consistency across large-scale production, making this segment the backbone of demand. Flavor extraction is forecast as the fastest-growing application, reflecting a 5.6% CAGR supported by global appetite for natural and functional flavors. Chromatography and testing applications also strengthen, driven by food safety mandates and analytical precision requirements. While other categories grow at varying rates, food processing continues to command the largest absolute value, sustaining its influence across the decade. Its integration into bakery, dairy, and packaged food supply chains ensures stability, while innovation in natural formulations enhances its forward-looking role.

Growth of the Food Grade Solvent Market is influenced by structural demand drivers, regulatory challenges, and transformative industry trends. These forces collectively determine adoption trajectories, technological priorities, and sustainability pathways, shaping both regional opportunities and global competitiveness across the forecast horizon.

Driver: Expansion of Bio-Based Solvents

The strongest driver shaping the Food Grade Solvent Market is the accelerated adoption of bio-based solvents, which are forecast to expand at a 6.1% CAGR, significantly outpacing synthetics. This shift is being encouraged by stringent regulatory frameworks across Europe, the USA, and Asia-Pacific, where policymakers promote eco-friendly solutions in food processing and packaging. Fermentation-based ethanol and glycerol are serving as the foundation of this transformation, supported by cost reductions achieved through biotechnology and biorefinery innovations. Consumer preference for clean-label, natural, and sustainable ingredients has reinforced the attractiveness of bio-based solvents, especially in flavor extraction and dairy applications where product purity is critical.

Multinational food companies are responding by integrating bio-based solvents into their formulations to align with sustainability goals and enhance brand differentiation. Investment flows into fermentation and renewable feedstock facilities further demonstrate the scalability of bio-based production. Over the coming decade, this expansion is expected to transition bio-based solvents from niche adoption into mainstream applications, creating long-term structural changes within the market. This trend not only reflects regulatory and consumer alignment but also positions manufacturers that embrace bio-based portfolios as industry leaders in sustainability-driven innovation.

Restraint: Regulatory and Compliance Barriers

A key restraint facing the Food Grade Solvent Market is the increasing stringency of regulatory and compliance requirements, which limit the flexibility of manufacturers and slow the pace of product commercialization. Food safety agencies such as the USA Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) impose rigorous standards on solvent purity, permissible residue levels, and sourcing transparency. These measures, while critical for consumer protection, increase compliance costs for manufacturers, particularly those dependent on synthetic solvents that face stricter scrutiny. Smaller firms encounter challenges in meeting these requirements due to resource constraints, leading to slower adoption of advanced solvent formulations.

Additionally, differences in compliance frameworks between regions create complexity for global producers, necessitating multiple parallel validation processes. Regulatory restrictions on certain petrochemical derivatives, such as hexane and acetone, have further constrained their market growth, despite their established industrial utility. The push toward bio-based alternatives also requires certification and traceability mechanisms, adding layers of compliance. Although these regulations foster market credibility and ensure safety, they create a restraint by raising entry barriers and increasing operational costs. Consequently, only manufacturers with robust compliance capabilities and sustained investment in quality assurance can effectively navigate this restrictive environment.

| Countries | CAGR |

|---|---|

| China | 6.5% |

| India | 7.2% |

| Germany | 3.4% |

| France | 2.9% |

| UK | 3.7% |

| USA | 4.2% |

| Brazil | 5.6% |

Adoption of food grade solvents is evolving unevenly across regions, with Asia-Pacific, Europe, and North America representing the most influential markets. In Asia-Pacific, strong growth is forecast as industrial modernization and rising packaged food consumption fuel solvent usage in bakery, dairy, and flavor extraction. China is expected to record a 6.5% CAGR, increasing its global share from 14% in 2025 to 19% in 2035, while India, expanding at 7.2% CAGR, is positioned as the fastest-growing national market. These countries are benefiting from both consumer demand and government-led policies encouraging sustainable food production.

Europe demonstrates a more compliance-driven profile, with solvent adoption shaped by strict regulations on purity, residue limits, and sustainability standards. Germany and France, recording slower CAGRs of 3.4% and 2.9% respectively, reflect market maturity but remain important hubs for innovation in bio-based formulations under EU green directives. The UK, growing at 3.7% CAGR, shows consistent reliance on solvents within beverages and bakery processing.

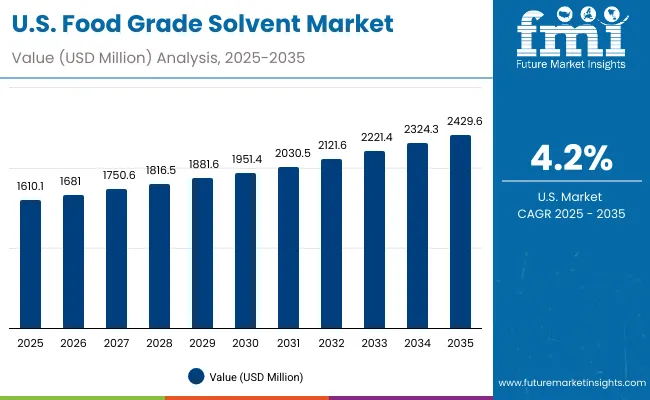

In North America, the United States remains a leader, holding 18% of global share in 2025, though this is expected to decline to 16% by 2035 as Asia gains prominence. With a 4.2% CAGR, USA growth remains tied to food processing modernization and sustainability transitions.

| Year | USA Food Grade Solvent Market (USD Million) |

|---|---|

| 2025 | 1,610.1 |

| 2026 | 1,681.0 |

| 2027 | 1,750.6 |

| 2028 | 1,816.5 |

| 2029 | 1,881.6 |

| 2030 | 1,951.4 |

| 2031 | 2,030.5 |

| 2032 | 2,121.6 |

| 2033 | 2,221.4 |

| 2034 | 2,324.3 |

| 2035 | 2,429.6 |

A CAGR of 4.2% has been projected for the United States, reflecting steady growth in a mature but compliance-driven market. Market value is expected to increase from USD 1,610.1 million in 2025 to USD 2,429.6 million by 2035, supported by strong adoption across beverages, dairy, and bakery sectors. Stringent FDA regulations ensure high safety and purity standards, reinforcing demand for ethanol, isopropanol, and ethyl acetate in food processing and testing applications. Innovation in chromatography and analytical workflows is enhancing the role of solvents in quality assurance, while sustainability transitions are encouraging substitution with bio-based ethanol and glycerol. Despite a relative decline in global share from 18% in 2025 to 16% in 2035, the USA will remain a cornerstone market for premium, compliant, and innovation-driven adoption.

| Countries / Subregion | 2025 Market Share (%) |

|---|---|

| USA | 18% |

| China | 14% |

| Japan | 7% |

| Germany | 6% |

| UK | 5% |

| India | 8% |

| Countries / Subregion | 2035 Market Share (%) |

|---|---|

| USA | 16% |

| China | 19% |

| Japan | 8% |

| Germany | 5% |

| UK | 4% |

| India | 11% |

A CAGR of 3.7% has been projected for the United Kingdom, reflecting moderate but stable growth in a mature European market. Market share is expected to decline from 5% in 2025 to 4% by 2035, as faster expansion in Asia-Pacific shifts global balances. Ethanol remains the primary solvent in beverages and bakery processing, while ethyl acetate and isopropanol support preservation and formulation functions.

Regulatory alignment with EU standards ensures strict monitoring of purity, sustainability, and residue levels, creating a compliance-led adoption framework. Growth in flavor extraction highlights consumer preference for clean-label and natural products, while demand from premium bakery and beverage categories underpins steady consumption. Despite limited volume growth, the UK retains importance through innovation-driven adoption, regulatory credibility, and consumer focus on premium quality.

A CAGR of 3.4% has been projected for Germany, reflecting modest expansion in a mature but regulation-heavy market. Market share is expected to decline from 6% in 2025 to 5% in 2035, as faster-growing Asian markets capture global momentum. Ethanol and ethyl acetate are widely used across bakery, dairy, and confectionery industries, while glycerol supports specialized formulations. Adoption is strongly shaped by EU regulations emphasizing safety, sustainability, and traceability, which reinforce demand for bio-based solvents despite higher compliance costs.

Innovation in green chemistry and circular economy initiatives is strengthening Germany’s role as a hub for sustainable formulation research, even as volume growth remains constrained. The country’s solvent market is expected to retain influence through its alignment with eco-conscious standards and its reputation for high-quality, precision-driven food processing.

A CAGR of 6.5% has been projected for China, positioning it as one of the fastest-expanding national markets globally. Market share is forecast to rise from 14% in 2025 to 19% in 2035, overtaking the United States as the largest contributor. Ethanol, isopropanol, and ethyl acetate are widely adopted in beverages, packaged foods, and flavor extraction, supported by rapid industrial modernization. Strong government policies promoting sustainable food production and bio-based innovation are further reinforcing demand. Expanding middle-class consumption, coupled with growth in convenience foods and dairy products, underpins solvent uptake across applications. With increased investment in fermentation technologies and domestic production capacity, China is expected to serve as both a key demand center and a global supplier of food grade solvents.

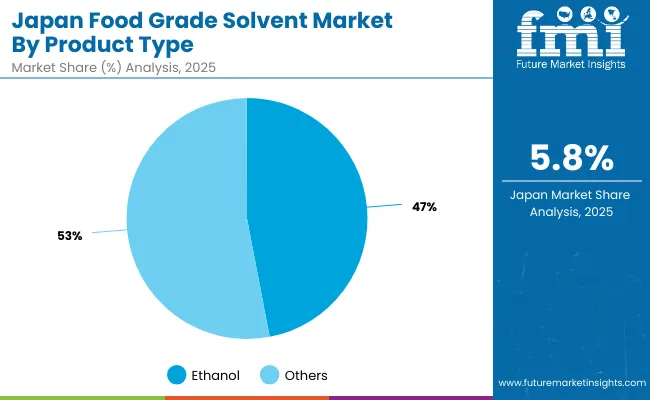

| Product Type | Market Value Share, 2025 |

|---|---|

| Ethanol | 47% |

| Others | 53% |

A CAGR of around 4.0-5.0% has been projected for Japan, supported by mature but innovation-driven adoption in beverages, bakery, and dairy industries. Ethanol dominates consumption with 47% share in 2025, growing at 5.8% CAGR, supported by demand for flavor extraction and beverage preservation. Ethyl acetate and isopropanol are also gaining traction in flavor stabilization and food-grade cleaning.

Japan’s strong regulatory alignment with carbon neutrality targets is stimulating bio-based solvent substitution, particularly in high-value applications such as functional foods and cosmetics. Chromatography and analytical testing are also growing steadily, reinforcing the importance of precision-driven solvent adoption. By 2035, Japan is expected to retain its reputation as a premium, high-quality market, underpinned by its innovation-led approach to sustainability and digital testing infrastructure.

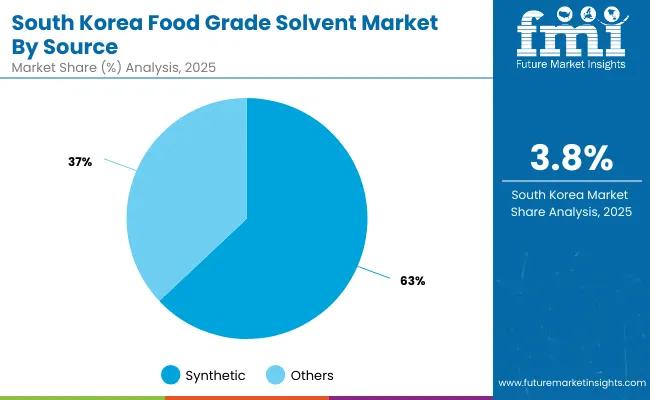

| Source | Market Value Share, 2025 |

|---|---|

| Synthetic | 63% |

| Others | 37% |

A CAGR of around 4.5-5.0% has been projected for South Korea, supported by strong sustainability transitions and advanced laboratory integration. In 2025, synthetic solvents dominate with 63% share, though growth is restrained at 3.8% CAGR. Natural/bio-based solvents, representing 37% share, expand at a faster 6.4% CAGR, highlighting the country’s commitment to green technology adoption. Ethanol and isopropanol dominate applications across beverages and dairy, while ethyl acetate and propylene glycol gain importance in sauces, bakery, and confectionery. With government-led carbon neutrality goals and Industry 4.0 adoption in processing plants, South Korea is well-positioned to lead the East Asian market in sustainability-driven solvent usage by 2035.

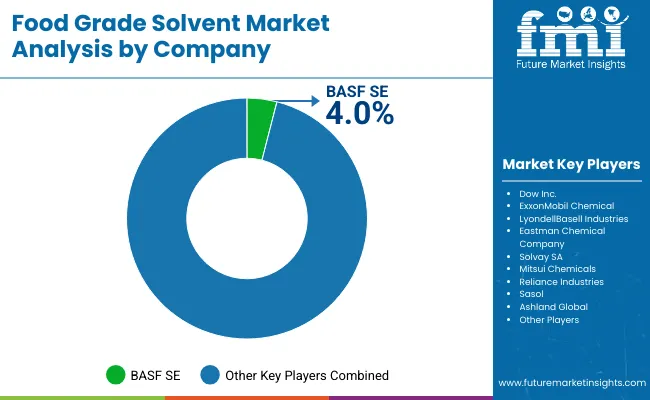

The Food Grade Solvent Market is characterized by the presence of global chemical leaders, regional producers, and specialized innovators. Established multinational companies such as BASF SE, Dow Inc., ExxonMobil Chemical, and LyondellBasell Industries dominate through integrated portfolios that include ethanol, isopropanol, and ethyl acetate. Collectively, these players account for an estimated 12-14% of global market share in 2024, highlighting a moderately consolidated structure. Their competitive advantage is reinforced by large-scale production capacities, global distribution networks, and long-standing partnerships with food and beverage manufacturers.

In parallel, regional producers in Asia-Pacific, including firms in China and India, are expanding rapidly, leveraging fermentation and biorefinery technologies to scale bio-based ethanol and glycerol production. This is reshaping competition by aligning solvent portfolios with sustainability goals and regulatory compliance. Mid-sized innovators are differentiating through product purity, specialty formulations, and integration of solvents with digital laboratory testing platforms.

The future competitive edge is expected to be defined not only by chemical innovation but also by ecosystem integration. Strategies such as bundling solvents with digital monitoring tools, adopting subscription-based supply models, and expanding bio-based production capacity will play decisive roles. Companies that adapt portfolios toward sustainability while maintaining cost competitiveness are forecast to lead the decade ahead.

Key Developments in Food Grade Solvent Market

| Item | Value |

|---|---|

| Market Size, 2025 | USD 8,945.2 Million |

| Market Size, 2035 | USD 13,830.6 Million |

| Absolute Growth (2025-2035) | USD 4,885.4 Million |

| CAGR (2025-2035) | 4.50% |

| Value Added 2025-2030 | USD 2,022.0 Million |

| Value Added 2030-2035 | USD 2,863.4 Million |

| Applications (2025) | Food Processing: USD 2,504.7 Million (28.0%); Others: USD 6,440.5 Million (72.0%) |

| Product Type (2025) | Ethanol: USD 3,757.0 Million (42.0%); Others: USD 5,188.2 Million (58.0%) |

| Source (2025) | Synthetic: USD 6,083.7 Million (68.0%); Bio-based: USD 2,861.5 Million (32.0%) |

| End-Use Hotspots (2025) | Beverages: 27.0% share; Bakery & Confectionery: 18.0% share |

| Growth Hotspots (CAGR) | India 7.2%; China 6.5%; South Asia & Pacific 6.2%; East Asia 5.7% |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, China, India, Japan, South Korea, Brazil |

| Key Companies Profiled | BASF SE, Dow Inc., ExxonMobil Chemical, LyondellBasell Industries, Eastman Chemical Company, Solvay SA, Mitsui Chemicals, Reliance Industries, Sasol, Ashland Global |

| Additional Attributes | Bio-based adoption, fermentation-derived ethanol scale-up, AI-enabled solvent testing, and Industry 4.0 compliance integration are shaping competitive advantage. |

The market is valued at USD 8,945.2 million in 2025, led by ethanol, which accounts for the largest share.

The market is expected to reach USD 13,830.6 million by 2035, reflecting consistent growth over the decade.

The market is projected to expand at a 4.5% CAGR during 2025-2035

Ethanol dominates with 42.0% market share in 2025, driven by strong usage across beverages, bakery, and flavor extraction.

The Natural/Bio-based solvents category, holding 32.0% share in 2025, is growing at a 6.1% CAGR, outpacing synthetic solvents due to sustainability initiatives.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA