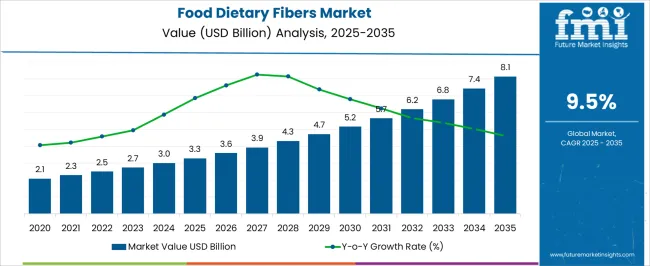

The food dietary fibers market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

The peak-to-trough analysis reveals steady growth with intermittent accelerations. From 2021 to 2025, the market grows from USD 2.1 billion to 3.3 billion, moving through intermediate values of USD 2.3 billion, 2.5 billion, 2.7 billion, and 3.0 billion. This early phase is marked by gradual expansion, as consumer awareness regarding health benefits, including digestive health and weight management, starts to drive the demand for dietary fibers in functional foods, supplements, and beverages. The market shows modest incremental growth, reflecting steady adoption and market penetration. Between 2026 and 2030, the market progresses more significantly, growing from USD 3.3 billion to 5.7 billion, with values passing through USD 3.6 billion, 3.9 billion, 4.3 billion, and 4.7 billion.

This period represents a peak phase, driven by the rising trend of plant-based diets and the increasing incorporation of fiber-rich ingredients in everyday foods. The market sees a faster rate of growth as health-conscious consumers seek natural, high-fiber solutions. From 2031 to 2035, the market continues to expand from USD 5.2 billion to 8.1 billion, passing through values of USD 5.7 billion, 6.2 billion, 6.8 billion, and 7.4 billion.

The food dietary fibers market is driven by five key parent markets that collectively shape its growth, demand, and application across the food and beverage industry. The functional foods and ingredients market contributes the largest share, about 30-35%, as dietary fibers are increasingly used in the formulation of health-promoting food products aimed at improving digestive health, weight management, and overall well-being.

The food and beverage market adds approximately 20-24%, as dietary fibers are integrated into various food products such as snacks, beverages, and dairy alternatives to enhance fiber content and appeal to health-conscious consumers. The health supplements and nutraceuticals market contributes around 15-18%, as dietary fiber is a popular ingredient in dietary supplements, offering benefits such as improved gut health, cholesterol management, and blood sugar control.

The packaged food market accounts for roughly 12-15%, with dietary fibers being used in ready-to-eat meals, cereals, and baked goods to meet the increasing consumer demand for healthy and convenient food options. Finally, the organic food market represents about 8-10%, as there is growing demand for natural and minimally processed sources of dietary fiber in organic food products.

| Metric | Value |

|---|---|

| Food Dietary Fibers Market Estimated Value in (2025 E) | USD 3.3 billion |

| Food Dietary Fibers Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The food dietary fibers market is expanding steadily, supported by increasing consumer awareness of digestive health, weight management, and chronic disease prevention. Scientific publications and nutrition association updates have emphasized the role of dietary fibers in improving gut microbiota balance, regulating blood sugar levels, and lowering cholesterol, driving demand across multiple food categories. Food manufacturers are incorporating fibers into everyday consumables to enhance nutritional profiles without compromising taste or texture.

Product development has also focused on functional fibers that offer added health benefits, aligning with clean-label and wellness trends. Regulatory bodies in various regions have reinforced labeling standards and health claims for dietary fiber content, boosting consumer trust and product transparency.

Additionally, rising demand for fortified bakery products, cereals, beverages, and snacks has created new commercial opportunities. Looking forward, technological advancements in fiber extraction, formulation, and blending are expected to broaden application diversity, with segmental growth led by soluble dietary fibers, cereals & grains as a key source, and bakery as a prominent application category.

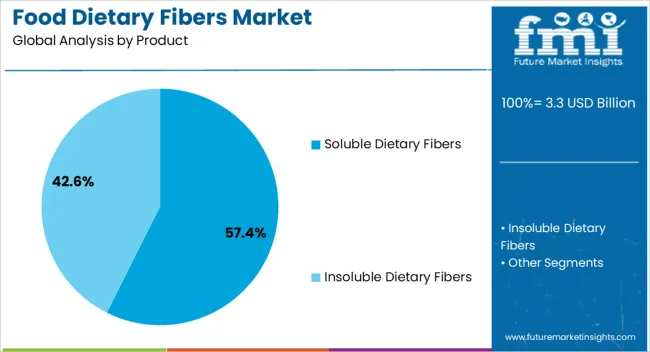

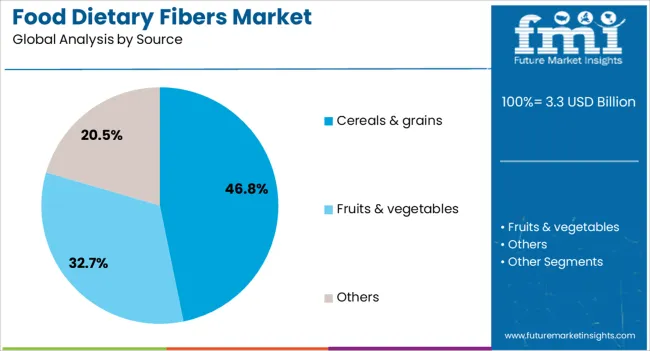

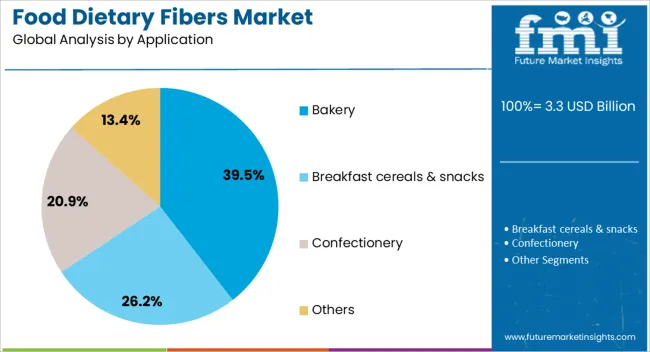

The food dietary fibers market is segmented by product, source, application, and geographic regions. By product, food dietary fibers market is divided into soluble dietary fibers and insoluble dietary fibers. In terms of source, food dietary fibers market is classified into cereals & grains, fruits & vegetables, and others. Based on application, food dietary fibers market is segmented into bakery, breakfast cereals & snacks, confectionery, and others. Regionally, the food dietary fibers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soluble dietary fibers segment is projected to account for 57.4% of the food dietary fibers market revenue in 2025, maintaining its lead due to its functional versatility and scientifically proven health benefits. Soluble fibers dissolve in water to form viscous gels, aiding in cholesterol reduction, blood glucose control, and satiety enhancement.

Ingredient manufacturers have developed advanced soluble fiber variants that are easily incorporated into beverages, dairy, and baked goods without altering sensory qualities. Market adoption has also been supported by research-backed health claims, which have increased consumer confidence and product demand.

Additionally, soluble fibers sourced from natural ingredients such as oats, barley, and psyllium have gained preference in clean-label product lines. As consumer diets increasingly prioritize functional health benefits, the soluble dietary fibers segment is expected to sustain its dominant position, driven by continued innovation and application expansion.

The cereals & grains segment is projected to contribute 46.8% of the food dietary fibers market revenue in 2025, leading the source category due to its nutritional value and wide availability. Cereals and grains, including wheat, oats, barley, and rice, are naturally rich in both soluble and insoluble fibers, making them highly suitable for fiber fortification in food products.

Agricultural supply stability and established milling processes have ensured consistent ingredient quality for manufacturers. Consumer dietary habits, particularly in breakfast and snack categories, have favored cereal-based fiber sources for their taste compatibility and perceived wholesomeness.

Additionally, cereal and grain fibers are often associated with traditional, minimally processed diets, aligning with clean-label and heritage food trends. The segment’s leadership is expected to persist as demand for natural, nutrient-rich fiber sources grows in both developed and emerging markets.

The bakery segment is projected to hold 39.5% of the food dietary fibers market revenue in 2025, leading the application landscape due to the integration of fiber-rich ingredients into breads, pastries, and snacks. Bakery manufacturers have increasingly reformulated products to meet consumer demand for healthier indulgences, incorporating dietary fibers to improve satiety and digestive benefits.

The segment’s growth has been supported by advances in fiber ingredients that maintain dough texture, volume, and taste while enhancing nutritional value. Market trends show strong acceptance of high-fiber bakery products in both retail and foodservice channels, particularly in urban markets where functional foods are gaining popularity.

Additionally, bakery applications serve as a convenient vehicle for delivering daily fiber intake, contributing to their widespread adoption. With ongoing innovation in high-fiber flour blends and prebiotic-enriched formulations, the bakery segment is expected to remain a primary growth driver in the dietary fibers market.

The food dietary fibers market is growing due to rising consumer awareness of the health benefits of fiber, particularly for digestive health, weight management, and cholesterol control. Opportunities lie in plant-based, functional foods, and fiber fortification, with companies offering innovative, health-enhancing ingredients. Trends like prebiotics, soluble fiber, and clean-label products are shaping the market’s future. Manufacturers focusing on fortifying popular food categories like plant-based proteins, dairy alternatives, and snacks with dietary fibers are well-positioned to capture consumer interest.

Dietary fibers, which are found in plant-based foods, play a key role in promoting gut health, preventing constipation, and reducing the risk of digestive disorders. As more consumers adopt health-conscious eating habits, there is a rising demand for fiber-rich foods and dietary supplements. This is particularly evident in developed regions like North America and Europe, where consumers are increasingly seeking products that aid digestion, regulate cholesterol, and support weight management. Leading companies such as ADM, DuPont, and Cargill are investing in innovative dietary fiber solutions, offering functional ingredients that cater to the growing demand for healthier, more balanced diets.

Consumers are becoming more aware of the critical role fiber plays in maintaining overall health, particularly in preventing chronic conditions like heart disease and type 2 diabetes. Additionally, manufacturers are investing in research to innovate new fiber products, including soluble fibers, insoluble fibers, and prebiotics, which offer enhanced digestive and metabolic benefits. However, producers face challenges in meeting regulatory compliance, as dietary fiber ingredients must adhere to food safety standards. The market is also evolving with new regulations on labeling and health claims, requiring manufacturers to provide clear and accurate product information.

As the demand for plant-based diets grows, especially in North America and Europe, dietary fibers derived from vegetables, fruits, and grains are gaining popularity. These fibers are often used to fortify foods such as bakery products, beverages, and snacks, enabling manufacturers to create nutrient-dense options for health-conscious consumers. The rising popularity of functional foods, which offer additional health benefits beyond basic nutrition, is driving demand for fiber-enriched products. Companies that can integrate dietary fibers into popular food categories like plant-based protein, dairy alternatives, and snack foods will be well-positioned to meet consumer demand for functional and health-boosting products.

Prebiotics, which promote the growth of beneficial gut bacteria, are gaining popularity as consumers seek products that enhance gut health and immune function. Soluble fibers, which are known for their ability to lower cholesterol and stabilize blood sugar levels, are also in high demand. Clean labeling, which ensures that food products contain minimal artificial ingredients and preservatives, is another key trend. As consumers increasingly demand transparency in food labeling, manufacturers are focusing on clean-label fiber products that are free from additives, artificial colors, and sweeteners. These trends are driving innovation and shaping the future of the food dietary fibers market.

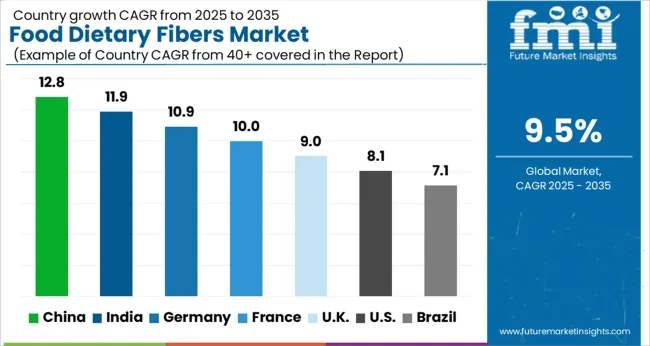

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

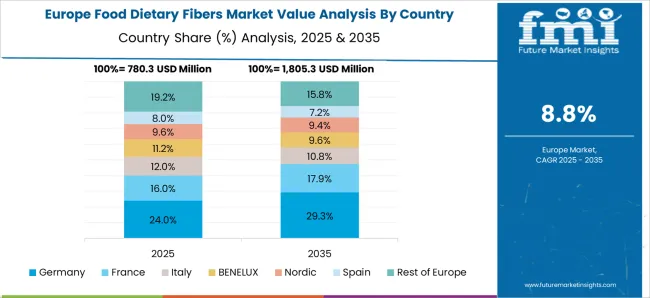

Global Food Dietary Fibers Market is projected to grow at a CAGR of 9.5% from 2025 to 2035. China leads with a CAGR of 12.8%, followed by India at 11.9%. France shows a growth rate of 10.0%, while the UK and the USA are growing at 9.0% and 8.1%, respectively. The strong growth in China and India can be attributed to the increasing awareness of dietary fibers' health benefits, particularly in managing weight and improving digestive health. France is witnessing growing demand in both the food and pharmaceutical sectors, while the UK and the USA show steady growth due to increasing consumption of fiber-rich foods and supplements as part of a healthy lifestyle. Regional factors like rising health-consciousness, the demand for functional foods, and government initiatives to promote healthy diets are key drivers in the market's expansion. The analysis spans over 40+ countries, with the leading markets shown below.

The food dietary fibers market in China is forecasted to grow at a CAGR of 12.8% from 2025 to 2035. The demand for dietary fibers is being driven by a growing awareness of their health benefits, particularly in digestive health and weight management. As the Chinese population becomes increasingly health-conscious, there has been a surge in demand for fiber-rich foods, including fruits, vegetables, whole grains, and processed food products enriched with dietary fibers. The rising prevalence of lifestyle diseases such as obesity, diabetes, and heart disease has prompted consumers to adopt healthier eating habits.Government initiatives promoting balanced diets and healthy lifestyles are supporting this shift. China’s growing urbanization and higher disposable income also play a role in increasing consumer demand for functional foods and dietary supplements. The rapid expansion of the food and beverage industry further boosts the adoption of dietary fibers in processed foods.

The food dietary fibers market in India is projected to grow at a CAGR of 11.9% from 2025 to 2035. The demand for dietary fibers in India is being driven by the growing emphasis on health and wellness, especially in urban areas. With increasing awareness about the benefits of fiber in managing weight, improving digestion, and preventing chronic diseases, consumers are increasingly opting for high-fiber foods and supplements. India’s expanding middle class and rising disposable incomes have led to a shift towards healthier eating habits, with fiber-rich foods becoming an integral part of daily diets. The growing popularity of natural and plant-based foods, as well as the booming demand for organic products, is further driving the market. The surge in lifestyle-related diseases such as diabetes and heart disease has prompted the Indian government to emphasize dietary improvements and promote fiber consumption as part of a balanced diet.

The food dietary fibers market in France is expected to grow at a CAGR of 10.0% from 2025 to 2035. The increasing demand for dietary fibers in France is primarily driven by a rising consumer awareness about healthy diets and wellness. As the demand for functional foods increases, dietary fibers are gaining traction for their role in digestive health, weight management, and overall well-being. The French population’s focus on maintaining a balanced diet is leading to an increased preference for high-fiber products such as cereals, grains, and snacks. The rising trend of plant-based foods is also fueling growth in the market, as dietary fibers are an essential component of plant-based diets. France’s well-established food processing and pharmaceutical industries are contributing to the expansion of fiber-enriched food products and dietary supplements. Government campaigns promoting health-conscious eating habits and efforts to reduce lifestyle diseases further support market growth.

The food dietary fibers market in the UK is expected to expand at a CAGR of 9.0% from 2025 to 2035. In the UK, there is a growing shift toward healthier eating, which is leading to an increased demand for foods rich in dietary fibers. Rising consumer awareness about the health benefits of fiber in managing weight, supporting digestion, and reducing the risk of chronic diseases is driving the market. The rise in the popularity of plant-based diets and the increasing preference for natural and organic products further boost the demand for fiber-rich foods. The growing demand for functional foods, such as high-fiber snacks and fortified cereals, is being supported by the expanding retail sector and e-commerce platforms, making these products more accessible.The UK government’s initiatives to promote healthy eating and combat lifestyle diseases such as obesity and heart disease are expected to further drive the adoption of dietary fibers.

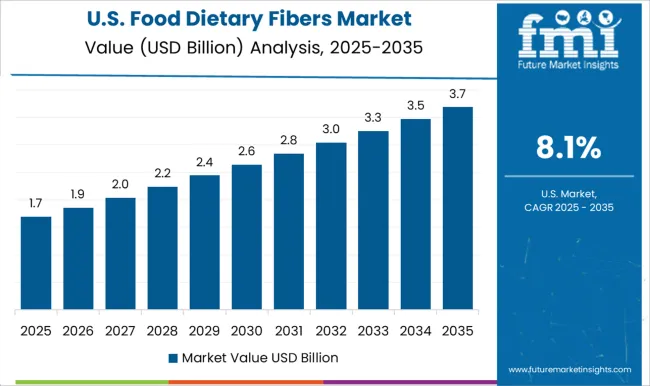

The food dietary fibers market in the USA is forecasted to grow at a CAGR of 8.1% from 2025 to 2035. As the USA continues to focus on health and wellness, the demand for dietary fibers in various food and beverage products is on the rise. The popularity of fiber-rich diets, combined with growing awareness of their role in digestive health, weight management, and disease prevention, is boosting the market. The increased consumption of functional foods and beverages, including fiber-enriched snacks, drinks, and cereals, is driving growth. The growing trend of plant-based eating is also pushing the demand for dietary fibers, as they are essential components of plant-based diets. The USA market is further supported by the expansion of the dietary supplement industry, with many consumers opting for fiber supplements to meet their nutritional needs. The USA food processing industry continues to innovate with fiber-enriched products to cater to the growing demand for healthy, convenient foods.

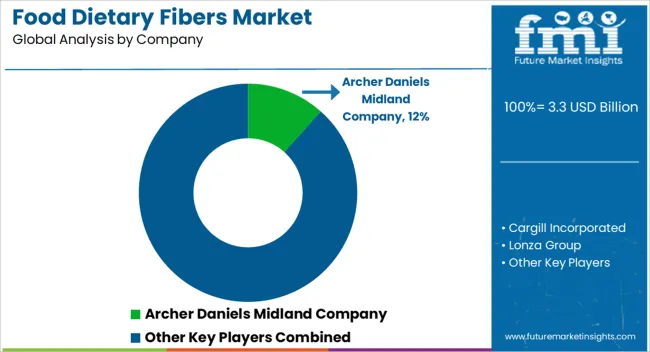

Competition in the food dietary fibers market is driven by product innovation, manufacturing capabilities, and the ability to meet diverse consumer needs across functional foods, beverages, and health supplements. Archer Daniels Midland Company (ADM) leads by offering a range of high-quality dietary fibers derived from natural sources, with brochures emphasizing their versatility in improving digestive health, weight management, and cholesterol control. The company differentiates itself through sustainable sourcing practices and a strong focus on clean-label solutions.

Cargill Incorporated competes by producing both soluble and insoluble fiber products, catering to the needs of food manufacturers seeking affordable and functional fiber ingredients. Their product brochures highlight the versatility of their fibers in a variety of food applications, emphasizing benefits such as improved gut health and consumer-friendly labeling. Lonza Group and Nexira focus on providing specialized fibers with prebiotic properties, targeting the growing demand for digestive health and gut microbiota solutions. Nexira’s brochures highlight the health benefits of its chicory root-based fibers, while Lonza’s product offerings stress the importance of high-performance fibers that support the growing gut health trend. Ingredion Incorporated stands out by focusing on clean-label and non-GMO dietary fiber solutions, with brochures promoting its ability to meet consumer demand for transparency and natural ingredients.

DuPont and Roquette Freres target the premium segment with advanced fiber solutions, emphasizing high bioavailability and superior health benefits. DuPont’s brochures highlight their science-backed approach to developing fibers that support metabolic health, while Roquette Freres focuses on fiber’s versatility in both food and functional applications. Tate & Lyle’s brochures emphasize its fiber-enriched solutions, which are used to reduce sugar and calorie content while maintaining texture and mouthfeel in food products.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 billion |

| Product | Soluble Dietary Fibers and Insoluble Dietary Fibers |

| Source | Cereals & grains, Fruits & vegetables, and Others |

| Application | Bakery, Breakfast cereals & snacks, Confectionery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Cargill Incorporated, Lonza Group, Nexira, Ingredion Incorporated, DuPont, Roquette Freres, Tate & Lyle, Royal DSM, Procter & Gamble, GlaxoSmithKline, Sudzucker, Kerry Group, Ceamsa, SunOpta, Inc., J. Rettenmaier & Söhne GmbH & Co. KG, Interfiber, Solvaira Specialties, and Grain Processing Corporation |

| Additional Attributes | Dollar sales by product type (soluble fibers, insoluble fibers, mixed fibers), application (beverages, bakery products, dietary supplements, dairy, snacks, others), and source (fruits & vegetables, grains, legumes). Demand is driven by the increasing consumer focus on digestive health, weight management, and clean-label products. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by rising health awareness, the growth of functional foods, and increasing consumer preference for natural, plant-based fibers. The market is also influenced by the rising demand for prebiotic fibers that support gut microbiome health. |

The global food dietary fibers market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the food dietary fibers market is projected to reach USD 8.1 billion by 2035.

The food dietary fibers market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in food dietary fibers market are soluble dietary fibers, inulin, pectin, and others.

In terms of source, cereals & grains segment to command 46.8% share in the food dietary fibers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA