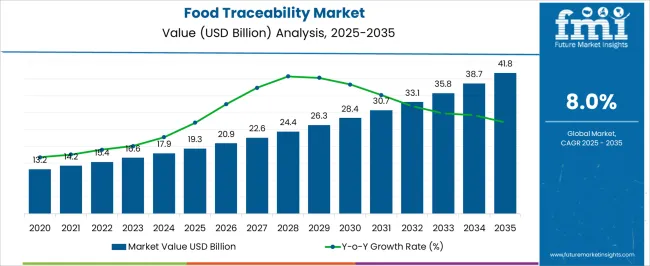

The food traceability market is expected to grow from an estimated USD 19.3 billion in 2025 to USD 41.8 billion by 2035, reflecting a compound annual growth rate of 8.0%. Regulatory frameworks and compliance mandates play a significant role in shaping market dynamics and influencing growth patterns across regions. Governments and international agencies are increasingly enforcing stringent food safety standards, requiring comprehensive traceability systems across the supply chain.

These regulations ensure that all stages of production, processing, and distribution are monitored, documented, and verifiable, thereby reducing risks of contamination, fraud, and recalls. Regulatory compliance drives demand for advanced traceability technologies, including blockchain-enabled tracking, RFID tagging, IoT-enabled monitoring, and centralized database systems.

The annual incremental market growth, rising from USD 19.3 billion in 2025 to USD 41.8 billion in 2035, mirrors increasing adoption prompted by compliance pressures, particularly in regions with strict food safety legislation.

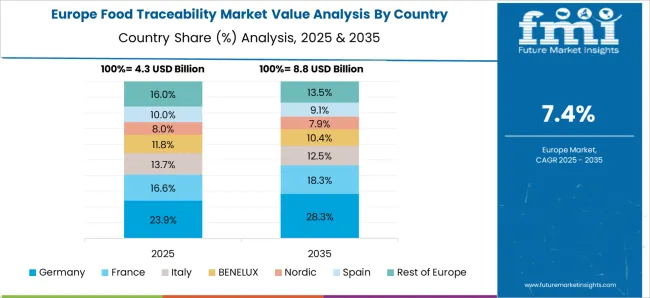

Manufacturers, processors, and retailers are compelled to integrate traceability solutions to meet labeling requirements, allergen disclosures, and real-time reporting mandates, thereby influencing investment in technology infrastructure. Regional variations in regulations create market imbalances, with Asia-Pacific and Europe often leading due to rigorous food safety standards, while North America emphasizes both federal and state-level compliance. The regulatory forces are a primary growth driver, shaping the Food Traceability Market by mandating operational transparency, enhancing food safety, and encouraging adoption of innovative tracking and monitoring technologies throughout the global supply chain.

The food traceability market represents a specialized segment within the global food safety and supply chain management industry, emphasizing transparency, compliance, and quality assurance. Within the overall food safety solutions market, it accounts for about 6.5%, driven by demand from regulatory compliance and consumer awareness. In the food supply chain management segment, it holds nearly 5.8%, reflecting the adoption of tracking systems from farm to fork. Across the packaged and processed foods sector, the market captures 4.3%, supporting recall management and product authentication.

Within the cold chain and logistics solutions category, it represents 3.9%, highlighting the need for monitoring perishable goods. In the smart agriculture and digital farming technologies sector, it secures 2.7%, demonstrating integration with traceable sourcing and quality control initiatives. Recent developments in this market have focused on digital technologies, blockchain, and real-time monitoring. Innovations include cloud-based traceability platforms, RFID and IoT-enabled sensors, and blockchain for secure and tamper-proof food records. Key players are partnering with food processors, retailers, and logistics providers to enhance end-to-end visibility.

AI-driven analytics are being applied to optimize supply chains, detect contamination risks, and improve recall efficiency. Regulatory initiatives across regions are accelerating adoption, particularly in North America and Europe. The consumer demand for transparency and authenticity is driving the implementation of QR code-based verification and smart labeling. These advancements demonstrate how technology, compliance, and consumer focus are shaping the food traceability market.

| Metric | Value |

|---|---|

| Food Traceability Market Estimated Value in (2025 E) | USD 19.3 billion |

| Food Traceability Market Forecast Value in (2035 F) | USD 41.8 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The food traceability market is witnessing accelerated adoption as global food safety regulations become more stringent and consumer awareness regarding product origin and authenticity rises. Demand is being supported by the need for transparent supply chains, risk mitigation against contamination events, and compliance with evolving international trade requirements. Industry participants are increasingly investing in integrated solutions combining hardware, software, and advanced analytics to enhance real-time monitoring and reporting capabilities.

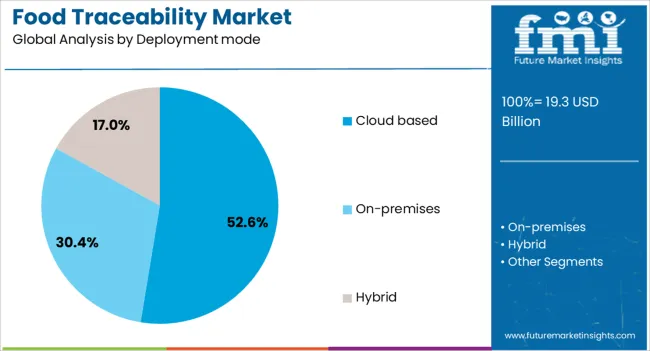

Cloud deployment models are gaining traction for their scalability, cost-efficiency, and accessibility across diverse geographic locations, enabling seamless collaboration among supply chain stakeholders. Technological advancements such as RFID, blockchain, and IoT are driving operational efficiency, reducing errors, and improving data accuracy.

Future market expansion is expected to be fueled by government initiatives promoting digital transformation in agriculture and food logistics, along with the increasing pressure on producers and distributors to meet traceability standards for premium market access. The market outlook remains robust, supported by regulatory enforcement, digital innovation, and heightened supply chain transparency demands.

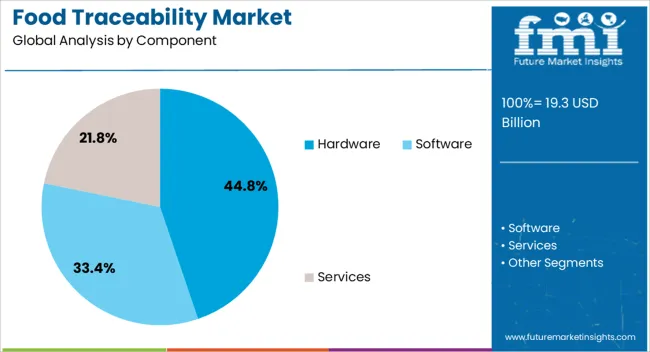

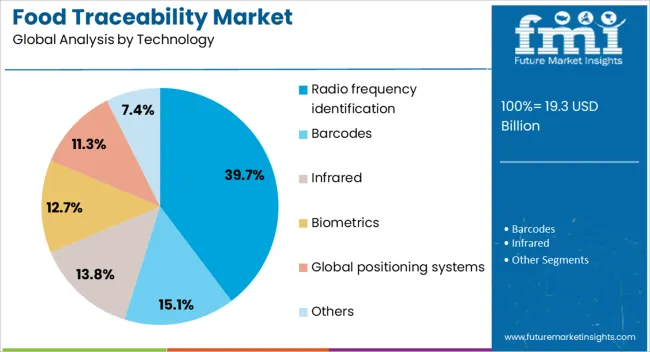

The food traceability market is segmented by component, deployment mode, technology, software, application, and geographic regions. By component, the food traceability market is divided into Hardware, Software, and Services. In terms of deployment mode, the food traceability market is classified into Cloud-based, On-premises, and Hybrid. Based on technology, the food traceability market is segmented into Radio frequency identification, Barcodes, Infrared, Biometrics, Global positioning systems, and Others.

By software, the food traceability market is segmented into Supply Chain Management (SCM), Enterprise Resources Planning (ERP), Friction welding, Laboratory information systems, and Warehouse software. By application, the food traceability market is segmented into Fish, meat, and seafood, fruits and vegetables, Fruit pulp & concentrates, Dairy products, processed food, bakery and confectionery, and Others. Regionally, the food traceability industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, representing 44.80% of the component category, has maintained its leadership due to its critical role in enabling physical data capture, tracking, and monitoring within food supply chains. Devices such as RFID readers, barcode scanners, GPS trackers, and sensors form the backbone of traceability infrastructure, providing real-time data acquisition for storage, processing, and transportation stages.

Adoption has been driven by the reliability and durability of hardware in varied environmental conditions, ensuring operational continuity in both indoor and outdoor facilities. The segment benefits from ongoing improvements in device connectivity, energy efficiency, and integration with cloud-based platforms, which enhance accuracy and usability.

Supply chain participants continue to invest in advanced hardware solutions to comply with food safety regulations and minimize recall costs. With rising demand for automated and contactless systems, the hardware category is positioned for sustained growth, supported by long-term capital investments and the global shift toward digitalized food safety monitoring systems.

The cloud-based segment, holding 52.60% of the deployment mode category, has emerged as the preferred choice due to its scalability, cost efficiency, and remote accessibility. Cloud platforms enable real-time data sharing across geographically dispersed supply chain stakeholders, facilitating faster decision-making and improving operational transparency. Implementation in food traceability has been accelerated by the growing need for flexible solutions that can adapt to dynamic regulatory frameworks and market requirements.

Cloud-based systems allow integration with IoT sensors, RFID devices, and mobile applications, ensuring seamless data synchronization and enhanced traceability reporting. The reduced need for extensive on-premise infrastructure has made cloud adoption attractive for both large enterprises and small-to-medium food processors.

Enhanced security protocols and disaster recovery capabilities have further strengthened confidence in cloud solutions. As digital transformation initiatives in the food industry expand, cloud deployment is expected to remain dominant, driving efficiency gains and broadening adoption across developed and emerging markets.

The radio frequency identification (RFID) segment, accounting for 39.70% of the technology category, has secured its lead position by enabling precise, automated, and high-speed data capture in food traceability systems. RFID technology offers advantages over traditional barcoding by eliminating the need for line-of-sight scanning and enabling simultaneous tracking of multiple items. Its application across production, packaging, storage, and distribution has enhanced accuracy in inventory management and reduced human error.

Adoption has been supported by falling RFID tag costs, improved read ranges, and compatibility with cloud and IoT-based traceability platforms. The technology’s ability to provide real-time visibility into product movement and environmental conditions has been critical in preventing spoilage and ensuring regulatory compliance.

With increasing emphasis on end-to-end supply chain transparency, RFID integration is expected to expand, especially in high-value and perishable food categories. Ongoing innovation in tag miniaturization and sensor-enabled RFID will further strengthen its market penetration over the forecast period.

The market has grown significantly as consumer demand for food safety, transparency, and quality assurance continues to rise globally. Traceability systems allow the tracking of food products across the entire supply chain, from farm to fork, ensuring authenticity, reducing contamination risks, and facilitating quick recalls in case of safety issues. Technological advancements such as blockchain, RFID, IoT sensors, and cloud-based platforms have enabled real-time monitoring and data management, enhancing supply chain visibility. Regulatory frameworks and industry standards mandating traceability for meat, seafood, dairy, and processed foods have further accelerated adoption.

Rising consumer awareness regarding food safety, nutrition, and origin has been a primary driver for traceability solutions. Modern consumers demand transparency in product sourcing, ingredient authenticity, and manufacturing practices. Simultaneously, governments and regulatory authorities have implemented strict food safety standards and traceability requirements, particularly for meat, dairy, seafood, and packaged food products. These regulations require producers and distributors to maintain detailed records of production, storage, and transportation conditions. Retailers and e-commerce platforms increasingly use traceability systems to assure customers of food quality and safety. Together, consumer expectations and regulatory compliance have created strong incentives for the adoption of food traceability solutions across the supply chain.

The integration of technologies such as blockchain, IoT sensors, RFID tags, QR codes, and cloud computing has enhanced the efficiency, reliability, and transparency of food traceability systems. Blockchain provides immutable records for product origin and handling, improving trust between suppliers, retailers, and consumers. IoT sensors monitor temperature, humidity, and storage conditions in real time, ensuring compliance with safety standards. RFID and QR codes facilitate easy tracking during transportation and retail distribution. Advanced analytics allow predictive insights on supply chain disruptions and contamination risks. These technological improvements streamline operations, reduce losses, and improve accountability, making traceability an essential tool for modern food supply chains.

Food traceability systems have been widely adopted to improve supply chain efficiency, reduce waste, and enhance inventory management. By tracking products at every stage, from farm and processing facility to warehouse and retail store, companies can identify inefficiencies, optimize logistics, and maintain product quality. Integration with enterprise resource planning (ERP) systems and automated reporting ensures compliance and operational transparency. Emerging markets with expanding retail networks, cold chain infrastructure, and modern food processing facilities have shown high adoption potential. Additionally, multinational food companies have standardized traceability protocols to streamline cross-border operations, improving market competitiveness and ensuring consistent quality across regions.

Sustainability trends and demand for ethically sourced and high-quality food products have provided new growth avenues for traceability solutions. Traceability enables verification of organic certifications, fair-trade claims, and environmentally responsible sourcing, aligning with corporate social responsibility initiatives.

Food recalls, contamination incidents, and fraud detection can be managed more efficiently, reducing health risks and reputational damage. Companies using traceability systems gain consumer trust and a competitive advantage by demonstrating accountability and compliance with environmental and safety standards. Expansion of organic, clean-label, and specialty food products further drives the need for advanced traceability solutions across agricultural, processing, and retail sectors globally.

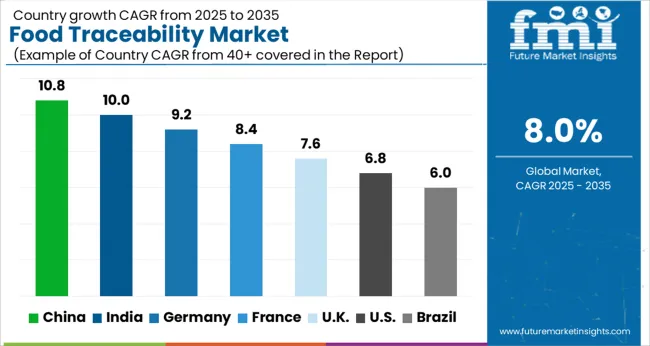

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The market is projected to expand steadily, driven by rising consumer demand for safety, regulatory compliance, and digital supply chain solutions. China leads with a forecast growth rate of 10.8%, supported by extensive adoption of blockchain and IoT technologies in food logistics. India follows at 10.0%, scaling through government initiatives and increasing investments in cold chain and traceability systems. Germany grows at 9.2%, leveraging advanced food safety standards and smart tracking solutions. The United Kingdom records 7.6%, innovating through digital monitoring and certification platforms. The United States reaches 6.8%, driven by adoption across large-scale food producers and distributors. Together, these countries influence global development, technology deployment, and adoption in the food traceability sector. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 10.8%, driven by increasing regulatory requirements and consumer demand for food safety. The rise in processed food consumption and complex supply chains has necessitated the adoption of traceability technologies. Blockchain-based solutions, IoT-enabled sensors, and cloud platforms are increasingly implemented to track food from farm to fork. Manufacturers, retailers, and logistics providers are investing in software solutions for real-time monitoring, quality assurance, and recall management. Urbanization and growing awareness of foodborne illnesses are further accelerating adoption across domestic and export-oriented food industries. Collaborative efforts between technology providers and government authorities are enhancing market reach.

India’s food traceability sector is projected to grow at a CAGR of 10%, supported by rising food safety regulations and the modernization of the food supply chain. Growing awareness among consumers regarding nutritional quality and product authenticity is boosting adoption of tracking technologies. Food manufacturers and retailers are increasingly integrating cloud-based systems, barcoding, RFID, and IoT solutions to enhance transparency and reduce contamination risks. Government initiatives promoting safe and hygienic food processing further accelerate implementation. Export-oriented food producers are also leveraging traceability to meet international standards. The technological collaborations with startups and solution providers are strengthening capabilities for quality control and recall management.

Germany is expected to expand at a CAGR of 9.2%, driven by stringent food safety regulations and increasing consumer preference for quality-assured products. The adoption of digital technologies such as blockchain, IoT-enabled sensors, and cloud-based management systems ensures accurate tracking across complex supply chains. Food processors, retailers, and logistics providers are investing in software and hardware solutions to improve traceability, enhance recall efficiency, and reduce wastage. Sustainability concerns and demand for organic and high-quality products further promote market growth. Partnerships between technology vendors and food businesses are also increasing deployment. The regulatory environment, combined with consumer vigilance, ensures ongoing demand for traceability solutions.

The UK food traceability market is projected to grow at a CAGR of 7.6%, supported by rising regulatory pressure and consumer interest in food safety. Adoption of IoT devices, cloud platforms, and blockchain systems enables efficient monitoring from production to consumption. Retailers and food service providers are increasingly implementing digital solutions to track origin, quality, and expiry dates. Strategic collaborations between technology firms and food producers strengthen system integration and data management. Export-oriented companies leverage traceability for compliance with international standards. Continuous awareness campaigns and adoption of advanced technologies are expected to maintain steady market expansion.

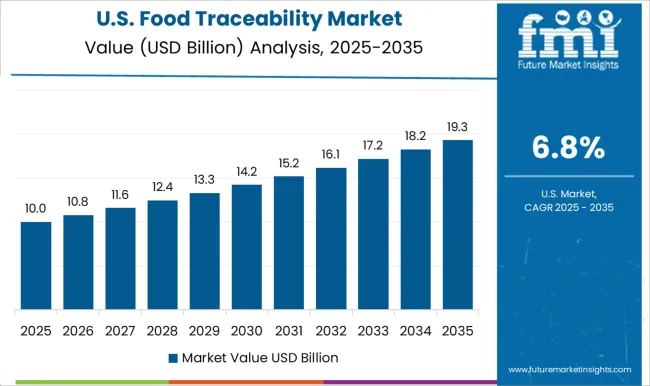

The United States market is expected to grow at a CAGR of 6.8%, driven by federal and state regulations, consumer expectations, and technology advancements. IoT-enabled sensors, RFID, cloud computing, and blockchain technologies are increasingly used to monitor product quality, enhance supply chain transparency, and manage recalls efficiently. Large food manufacturers and retailers are investing in digital solutions to improve traceability and ensure compliance with stringent food safety standards. Growing interest in organic and natural foods encourages adoption, while collaboration with technology vendors and startups facilitates the development of scalable solutions. The market continues to benefit from innovation and rising awareness among stakeholders.

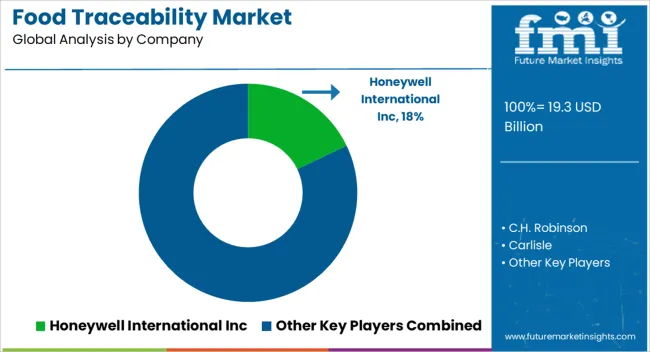

The market is witnessing robust growth driven by regulatory requirements, consumer demand for transparency, and the need to enhance food safety across the supply chain. Honeywell International Inc. offers comprehensive traceability solutions integrating barcode scanning, IoT sensors, and data analytics to monitor products from farm to fork. C.H. Robinson provides logistics-focused traceability platforms that ensure real-time visibility and accurate tracking of perishable goods during transportation. Carlisle delivers specialized labeling and traceability technologies that support compliance with food safety standards and improve operational efficiency.

Cognex emphasizes machine vision and automated inspection solutions, enabling precise identification and tracking of food products across processing and packaging stages. Merit-Trax offers software platforms for supply chain transparency, enabling traceability of raw materials and finished goods. SGS SA provides certification, testing, and auditing services that reinforce food traceability frameworks globally. Zebra Technologies focuses on integrated hardware and software solutions for barcode scanning, RFID, and data management to strengthen traceability and operational monitoring.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.3 Billion |

| Component | Hardware, Software, and Services |

| Deployment mode | Cloud based, On-premises, and Hybrid |

| Technology | Radio frequency identification, Barcodes, Infrared, Biometrics, Global positioning systems, and Others |

| Software | Supply Chain Management (SCM), Enterprise Resources Planning (ERP), Friction welding, Laboratory information systems, and Warehouse software |

| Application | Fish, meat, and seafood, Fruits & vegetables, Fruit pulp & concentrates, Dairy products, Processed food, Bakery & confectionary, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc, C.H. Robinson, Carlisle, Cognex, Merit-Trax, SGS SA, and Zebra Technologies |

| Additional Attributes | Dollar sales by solution type and application, demand dynamics across retail, foodservice, and manufacturing sectors, regional trends in traceability technology adoption, innovation in blockchain, IoT, and data analytics, environmental impact of supply chain efficiency and waste reduction, and emerging use cases in food safety, quality assurance, and regulatory compliance. |

The global food traceability market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the food traceability market is projected to reach USD 41.8 billion by 2035.

The food traceability market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in food traceability market are hardware, software and services.

In terms of deployment mode, cloud based segment to command 52.6% share in the food traceability market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blockchain Food Traceability Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA