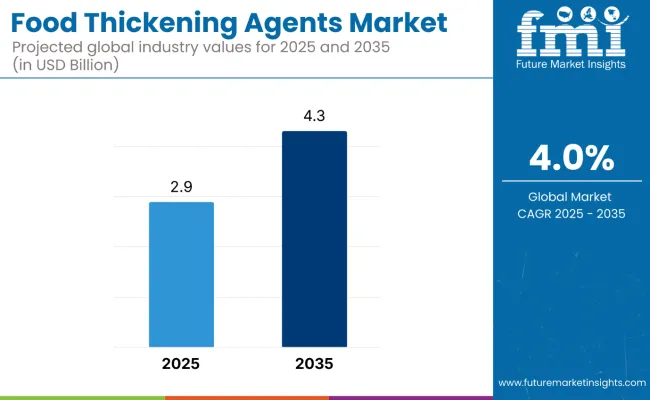

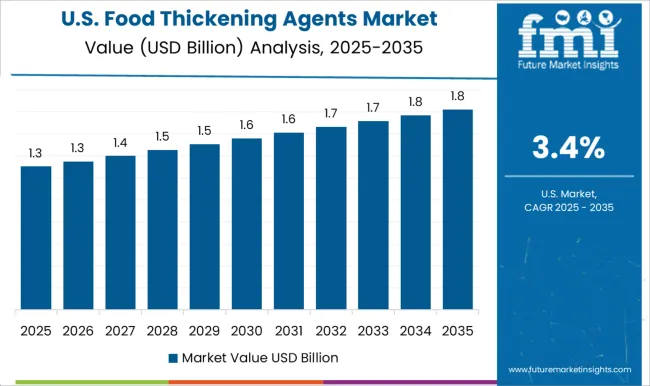

The food thickening agents market is estimated to be valued at USD 2.9 billion in 2025. It is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% during the forecast period. The market is expected to add an absolute dollar opportunity of USD 1.40 billion from 2025 to 2035. This reflects a 1.48 times growth across the decade. Expansion will be shaped by rising demand for texture-modified foods, increasing consumption of processed and convenience foods, and growing applications in the bakery, dairy, and beverage sectors.

By 2030, the market is projected to reach USD 3.53 billion, adding USD 0.63 billion in the first half of the decade. The remaining USD 0.77 billion is expected to be added during the second half, indicating a balanced growth trajectory supported by product innovation, plant-based adoption, and expansion in clean-label offerings.

Companies such as Cargill Inc., DuPont de Nemours Inc., and Ingredion Incorporated are strengthening their competitive positions through investments in plant-derived ingredients, microbial innovation, and synthetic blends that enhance food stability and mouthfeel. Marketing strategies highlighting clean-label attributes, functional benefits, and natural sourcing are supporting wider adoption in bakery, confectionery, and dairy products.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.9 billion |

| Projected Value (2035F) | USD 4.3 billion |

| CAGR (2025 to 2035) | 4.0% |

The market represents a specialized yet significant segment of the broader food and beverage industry. Within the food additives market, thickening agents account for nearly 12-15%, given their essential role in texture modification and stability. In the specialty ingredients space, they represent around 8-10%, driven by rising demand for clean-label and plant-based formulations. Their contribution to the processed and packaged foods sector is about 6-8%, reflecting widespread use in soups, sauces, and ready meals. Within dairy and bakery ingredients, thickeners command 10-12%, while in the functional foods and nutraceuticals category, they hold roughly 5-7%.

The market is gaining momentum due to rising demand for processed and convenience foods, where thickeners enhance texture, stability, and shelf life. Consumer inclination toward natural and plant-based ingredients has driven the use of starches and hydrocolloids from plants and seaweed. In bakery and confectionery, these agents support moisture retention, volume, and consistency, while dairy applications benefit from improved creaminess and reduced syneresis. Beverages use thickeners for viscosity adjustment and better mouthfeel, aligning with clean-label and low-fat trends. Advances in microbial fermentation and synthetic blends further expand their applications, with strong growth in emerging economies.

The food thickening agents market is witnessing robust growth due to rising demand for processed and convenience foods, where thickeners enhance texture, stability, and shelf life. Consumer preference for natural and plant-based ingredients has further accelerated the adoption of starches, hydrocolloids, and other plant- and seaweed-derived thickeners. In bakery and confectionery, these agents are used extensively for moisture retention, volume enhancement, and consistent product quality. At the same time, dairy applications benefit from improved creaminess and reduced syneresis in yogurts, cheese, and frozen desserts.

Innovation in microbial fermentation and synthetic blends is expanding the functional range of food thickeners, enabling their use in gluten-free, vegan, and low-fat formulations. Beverages are increasingly incorporating thickeners for viscosity adjustment and mouthfeel enhancement, aligning with clean-label and health-focused trends. The growing penetration of emerging markets, supported by urbanization and the expansion of food service industries, is further accelerating demand. Continuous product innovation and sustainability-driven developments are expected to drive market growth through 2035.

The market is segmented by source, application, and region. By source, the market is segmented into plant (guar gum, gum arabic, locust bean gum, pectin, starches, and others), seaweed (carrageenan, agar, alginate), microbial (gellan gum, curdlan, xanthan gum), synthetic (carboxy methyl cellulose and methyl cellulose), and animal (gelatine). Based on application, the market is divided into bakery & confectionery, meat & poultry, sauces, beverages, dairy products, and other applications. Regionally, the market spans over North America, Latin America, Europe, Asia Pacific, and MEA.

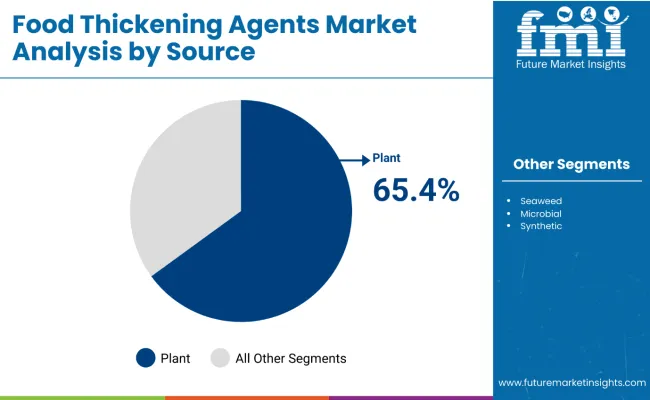

Plant-based food thickening agents represent the leading source segment, holding 65.4% of the market share in 2025. The dominance of this segment is attributed to the rising demand for natural and sustainable ingredients.

Seaweed-derived thickeners, including carrageenan and alginates, are gaining attention for their gelling and stabilizing properties, while microbial and synthetic sources are primarily used in niche functional food applications.

Plant-based thickeners, such as starches, pectins, and guar gum, are widely used across bakery, confectionery, and dairy industries to enhance texture, consistency, and mouthfeel. Growing adoption of plant-based diets globally is expected to reinforce reliance on these thickeners throughout the forecast period.

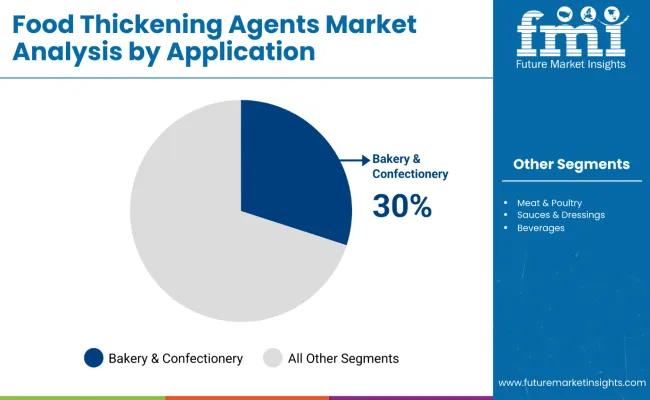

Bakery and confectionery represent the leading application segment, holding 30.0% of the market share in 2025. The dominance of this segment is driven by the use of thickeners for volume enhancement, texture improvement, and moisture retention in cakes, breads, pastries, and candies.

In confectionery, thickeners are critical for controlling viscosity and ensuring product stability during storage. Dairy products also benefit from thickeners, which improve creaminess and prevent syneresis, while beverages rely on them for viscosity adjustment and enhanced mouthfeel.

Sauces and dressings depend heavily on thickeners to maintain uniform texture and stability. Rising demand for convenience foods and ready-to-eat products is expected to sustain growth in this segment throughout the forecast period.

In 2025, global food thickening agent consumption is projected to rise by nearly 16% year-on-year, with bakery and confectionery capturing a 40% share, followed by dairy, beverages, and sauces. Applications range from viscosity control and moisture retention to texture enhancement and product stabilization. Manufacturers are diversifying portfolios with starch-based, seaweed-derived, microbial, and synthetic thickeners to cater to varied dietary requirements. Gluten-free, low-fat, and vegan formulations are driving innovation, while convenience in processed and ready-to-eat foods continues to expand usage. Expansion of quick-service restaurants and packaged food segments worldwide is accelerating demand, with Asia-Pacific accounting for over 35% of total consumption.

Plant-Based, Clean-Label, and Functional Nutrition Accelerate Adoption

Shifting consumer preference toward natural, plant-derived thickening agents is the strongest demand driver. Starches, pectins, guar gum, and seaweed hydrocolloids are increasingly selected for their functional properties and compatibility with clean-label formulations. Health-conscious consumers are avoiding synthetic additives, making plant-based thickeners essential in reformulated bakery, dairy, and beverage products. Microbial fermentation methods are also producing new blends that deliver enhanced viscosity, controlled gelling, and longer shelf life. By 2025, adoption in functional beverages and dairy-alternative categories is estimated to rise by 31%, with oat-based and soy-derived thickeners leading innovations. The ability of these agents to improve mouthfeel and maintain product consistency across diverse storage conditions explains why adoption surged 28% in nutraceutical applications last year.

Supply Chain Variability, Compliance Pressures, and Processing Complexity Limit Expansion

Market expansion is restrained by fluctuations in raw material costs, regulatory compliance, and sourcing complexities. Prices for guar gum and seaweed derivatives fluctuate between USD 1,100 and USD 1,600 per metric ton depending on seasonal yields and maritime supply conditions, creating procurement challenges. Food safety regulations, including allergen disclosures and regional labeling requirements, add delays of 6 to 8 weeks in new product launches. Processing complexities such as achieving consistent hydration, solubility, and blending compatibility elevate operational costs by 12-18% compared to synthetic counterparts. Cold-chain and packaging requirements for certain natural hydrocolloids add distribution costs, while limited processing hubs in emerging regions restrict scalability. These constraints hinder broader adoption, particularly in price-sensitive food categories, despite rising demand for plant-based functional additives.

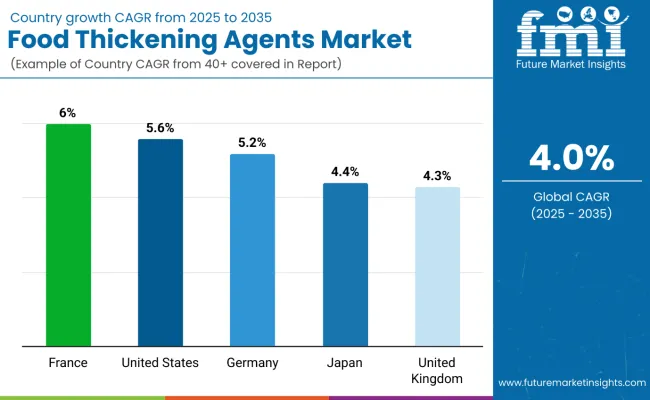

| Country | CAGR (2025 to 2035) |

| France | 6.0% |

| USA | 5.6% |

| Germany | 5.2% |

| Japan | 4.4% |

| UK | 4.3% |

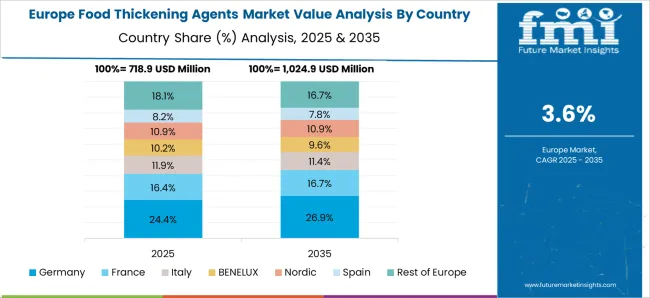

The food thickening agents market is witnessing varied growth across key countries between 2025 and 2035. France leads with a CAGR of 6.0%, driven by strong demand for premium bakery and dairy products and increasing consumer preference for natural thickeners. The USA follows at 5.6%, supported by high adoption in convenience foods, sauces, and beverages. Germany is projected at 5.2%, reflecting rising clean-label initiatives in bakery and confectionery. Japan and the UK show moderate growth at 4.4% and 4.3%, respectively, fueled by expanding applications in beverages, sauces, and plant-based foods. This reflects regional differences in consumption patterns and innovation adoption.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The food thickening agents market in France is estimated to grow at a CAGR of 6.0% from 2025 to 2035, the highest among major countries. Growth is driven by strong demand for premium bakery and dairy products, particularly in Paris, Lyon, and Marseille. Manufacturers focus on plant-based thickeners such as starches, pectins, and guar gum to cater to clean-label and natural ingredient trends. Supermarkets and specialty stores play a key role in distribution, enabling consumer access. Innovation in texture, moisture retention, and product consistency further supports expansion.

Key Statistics:

Revenue from food thickening agents in the USA is anticipated to increase at a CAGR of 5.6% from 2025 to 2035, driven by adoption in sauces, beverages, and convenience foods. New York, Los Angeles, and Chicago are major consumption hubs. Companies focus on plant- and seaweed-based thickeners to improve viscosity, texture, and shelf life in processed foods. Online retail and supermarket channels provide accessibility, while R&D investments in functional thickeners enhance product differentiation and meet health-focused demand.

Key Statistics:

Sales of food thickening agents in Germany are projected to grow at a CAGR of 5.2% from 2025 to 2035. Growth is supported by consumer preference for clean-label bakery and confectionery products, particularly in Berlin, Hamburg, and Munich. Manufacturers emphasize plant-based and hydrocolloid thickeners to improve texture, moisture retention, and stability. Retail and foodservice channels are crucial in reaching health-conscious consumers. Ongoing innovation in natural thickeners improves quality, enabling German manufacturers to maintain competitiveness in domestic and export markets.

Key Statistics:

Demand for food thickening agents in Japan is projected to rise at a CAGR of 4.4% from 2025 to 2035, supported by premium dairy products and beverages. Tokyo, Osaka, and Nagoya lead consumption, with manufacturers focusing on plant- and seaweed-based thickeners to enhance mouthfeel and stability. Rising health awareness and preference for clean-label ingredients further support growth. Convenience stores and supermarkets are key distribution channels, while innovation in functional thickeners strengthens product differentiation in the Japanese market.

Key Statistics:

The food thickening agents market in the UK is expected to expand at a CAGR of 4.3% from 2025 to 2035, supported by innovations in sauces, dressings, and plant-based foods. London, Manchester, and Birmingham are primary consumption hubs. Manufacturers focus on improving texture, viscosity, and stability in processed and ready-to-eat foods using plant-based thickeners. Supermarkets, hypermarkets, and online retail provide wide distribution. Rising demand for natural and functional ingredients drives adoption, while R&D and product innovation strengthen competitive positions.

Key Statistics:

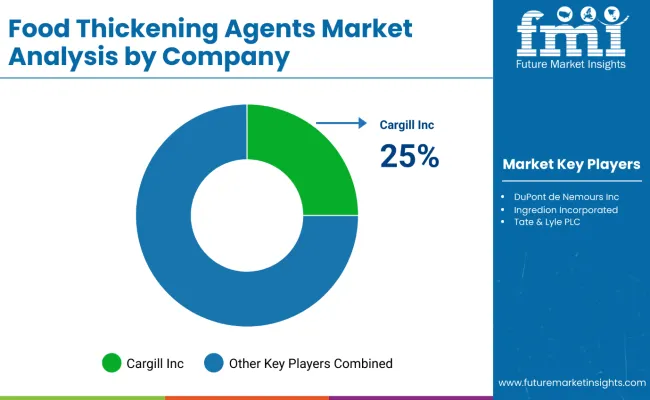

The food thickening agents market is moderately consolidated, comprising global ingredient leaders, specialized texturizer providers, and emerging regional players. Major companies such as Cargill Inc., DuPont de Nemours Inc., and Ingredion Incorporated dominate the market, leveraging extensive R&D, integrated supply chains, and diverse portfolios of plant-based, microbial, and synthetic thickeners to meet growing demand across bakery, dairy, and beverage applications. Strategic partnerships and co-development with food manufacturers help these leaders enhance product performance and adoption.

Specialized players like Tate & Lyle PLC and CP Kelco focus on sustainable and clean-label solutions, differentiating through innovative hydrocolloids, starches, and texturizers. These companies cater to niche applications in dairy, beverages, and convenience foods, aligning with rising consumer preference for natural, plant-based, and functional ingredients. Their targeted formulations and emphasis on health benefits support traction in premium and specialty food segments.

Competitive dynamics are shaped by sustainability initiatives, functional innovation, and emerging market expansion. Companies are prioritizing natural sourcing, product versatility, and regulatory compliance to maintain market leadership. Additionally, marketing strategies highlighting clean-label, health-focused, and multifunctional applications, combined with distribution through modern retail and B2B channels, reinforce adoption and support continual growth within the food thickening agents industry.

| Items | Values |

| Quantitative Units (2025) | USD 2.9 Billion |

| Source | Plant (Guar Gum, Gum Arabic, Locust Bean Gum, Pectin, Starches, Other Plant Sources), Seaweed (Carrageenan, Agar, Alginate), Microbial (Gellan Gum, Curdlan, Xanthan Gum), Animal (Gelatine), Synthetic (Carboxy Methyl Cellulose, Methyl Cellulose) |

| Application | Bakery & Confectionery, Meat & Poultry, Sauces, Beverages, Dairy Products, Other Applications |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, MEA |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Cargill Inc., Ingredion Incorporated, Archer Daniels Midland Company, Kerry Group plc, DuPont de Nemours Inc., Tate & Lyle PLC, TIC Gum Inc., CP Kelco USA Inc., Medline Industries Inc., Fuerst Day Lawson Limited |

| Additional Attributes | Dollar sales by application and purity grade, regional demand trends, competitive landscape, consumer preferences for natural versus synthetic alternatives, integration with sustainable sourcing practices, innovations in extraction technology and quality standardization for diverse industrial applications |

The global food thickening agents market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the food thickening agents market is projected to reach USD 4.3 billion by 2035.

The food thickening agents market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in food thickening agents market are plant, _guar gum, _gum arabic, _locust bean gum, _pectin, _starches, _other plant sources, seaweed, _carrageenan, _agar, _alginate, microbial, _gellan gum, _curdlan, _xanthan gum, animal (gelatine), synthetic, _carboxy methyl cellulose and _methyl cellulose.

In terms of application, bakery & confectionery segment to command 47.6% share in the food thickening agents market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA