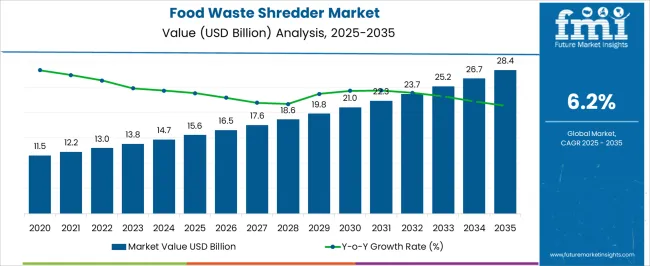

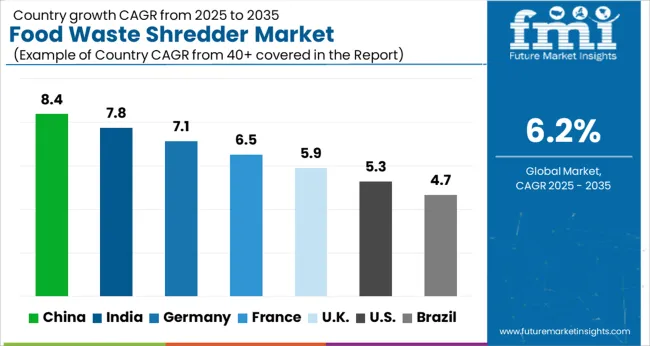

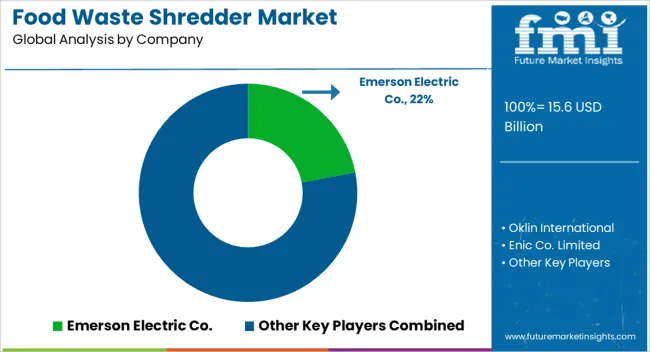

The Food Waste Shredder Market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 28.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

| Metric | Value |

|---|---|

| Food Waste Shredder Market Estimated Value in (2025 E) | USD 15.6 billion |

| Food Waste Shredder Market Forecast Value in (2035 F) | USD 28.4 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The Food Waste Shredder market is experiencing consistent growth due to the rising emphasis on sustainable waste management practices and the growing implementation of food disposal regulations across commercial and industrial sectors. Increased awareness around food waste's environmental impact has led to stronger policy initiatives and investment in waste-processing infrastructure. Companies are adopting shredding systems to comply with waste segregation mandates and reduce landfill contributions.

According to corporate sustainability reports and environmental news sources, food processing units, hotels, and large kitchens are prioritizing shredders as part of their operational upgrades to align with circular economy goals. In addition, product innovations in shredding efficiency and automation are enabling higher throughput and reduced operational costs.

The future outlook remains positive as urban waste generation increases, particularly in emerging economies, prompting greater adoption of scalable and automated waste management systems Technological integration with sorting and composting units is further improving the return on investment, making food waste shredders essential across multiple industries.

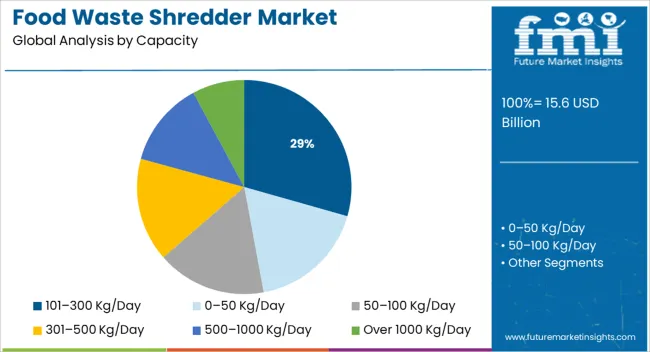

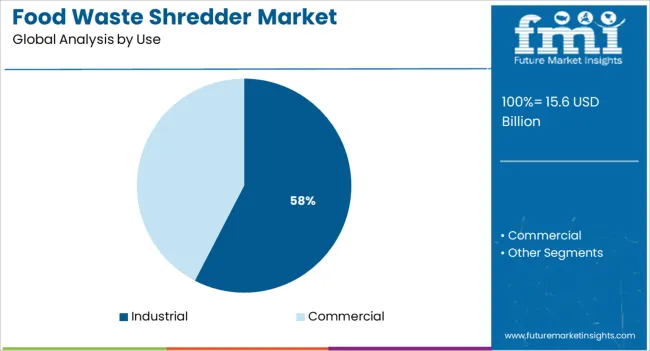

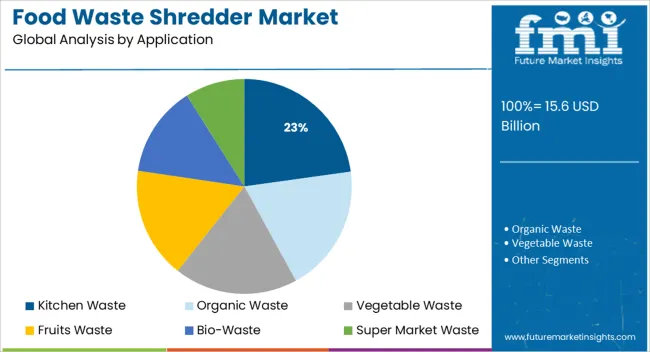

The market is segmented by Capacity, Use, and Application and region. By Capacity, the market is divided into 101–300 Kg/Day, 0–50 Kg/Day, 50–100 Kg/Day, 301–500 Kg/Day, 500–1000 Kg/Day, and Over 1000 Kg/Day. In terms of Use, the market is classified into Industrial and Commercial. Based on Application, the market is segmented into Kitchen Waste, Organic Waste, Vegetable Waste, Fruits Waste, Bio-Waste, and Super Market Waste. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 101 to 300 Kg per day capacity segment is expected to account for 29.4% of the Food Waste Shredder market revenue share in 2025, making it the leading capacity segment. This dominance is being attributed to the segment’s suitability for medium-scale commercial kitchens, food courts, and institutional cafeterias, where daily food waste generation falls within this range. As reported in equipment catalogs and facility management updates, this capacity range is preferred due to its balance of operational efficiency and compact installation footprint.

The segment has gained traction among food businesses and mid-size waste processors seeking cost-effective shredding solutions that can handle variable loads without overcapacity issues. Additionally, the adoption has been supported by initiatives that promote on-site food waste processing to avoid transportation and dumping costs.

These units have been widely deployed due to their low maintenance requirements and compatibility with downstream composting or biogas systems Their increasing adoption is helping facilities align with environmental compliance standards while optimizing space and operational costs.

The industrial segment is projected to dominate the Food Waste Shredder market by holding 57.6% of the revenue share in 2025. This leadership is being driven by high-volume food waste generation in processing plants, large manufacturing units, and bulk food production facilities. Industrial users are integrating shredders to meet environmental regulations, reduce waste handling costs, and streamline downstream waste processing.

As highlighted in corporate waste management strategies and manufacturing sustainability disclosures, these shredders are enabling better throughput and minimal downtime, which are critical in high-capacity operations. Moreover, the ability of industrial-grade shredders to process mixed organic waste efficiently has led to their broader adoption across multi-line food production units.

The segment’s continued expansion is also being supported by government policies that require bulk generators to implement on-site waste treatment mechanisms With increasing investments in waste-to-energy conversion systems, industrial users are prioritizing shredders to ensure consistent feedstock quality and reduce operational bottlenecks in their waste recycling pipelines.

The kitchen waste application segment is expected to hold 22.8% of the Food Waste Shredder market revenue share in 2025, highlighting its rising significance in food service and residential sectors. The segment’s growth is being fueled by increasing food preparation waste in hotels, catering services, and institutional kitchens. Kitchen waste shredders have become a critical component of on-site waste management strategies, enabling facilities to reduce odor, improve hygiene, and comply with disposal regulations.

Technical product announcements and sustainability initiatives across hospitality chains indicate that these shredders are helping reduce volume and prepare waste for composting or anaerobic digestion. The growing trend of decentralized waste processing in urban areas is further contributing to adoption.

Their compact size, energy-efficient operation, and compatibility with small to mid-sized waste processing units make them suitable for kitchen environments These factors, along with the need to minimize environmental impact and meet local municipal waste norms, are strengthening the segment’s role in the market.

During the historical period between 2020 to 2025, the global food waste shredder market showcased considerable growth at a CAGR of 4.1%. Growth is mainly attributed to the generation of large quantities of food waste, including food service providers, wholesalers, retailers, and food processing facilities.

These end-use industries are required to report the waste disposal methods, origin, and volume of waste to the respective governments. These would further help policymakers to remain informed about the sources and volume of food waste in addition to enabling businesses to evaluate the cost of their waste.

As per the Food and Agriculture Organization of the United Nations (FAO), the global volume of food wastage is projected at 1.6 billion tons of primary product equivalents. The total food wastage for the edible part of this accounts for nearly 1.3 billion tons.

Also, 1.4 billion hectares of land, or about 28% of the world's agricultural area is annually used for producing food that is either wasted or lost. Thus, food waste management is becoming crucial nowadays to protect the environment and increase sustainability, which would push the global food waste shredder market in the forecast period.

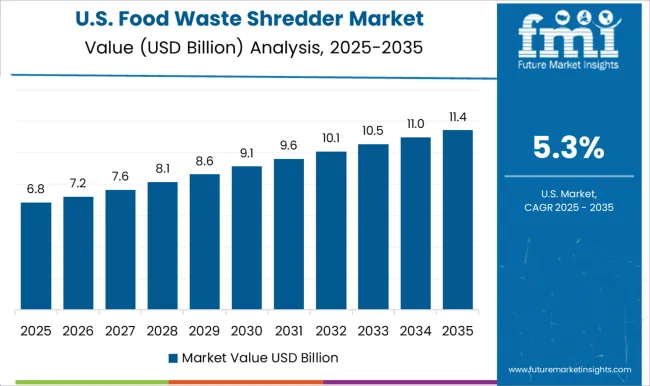

Initiatives to Reduce Food Waste in the USA to Push Sales of Organic Waste Shredders

The amount of food thrown out by Americans each year is growing at a fast pace. According to the Environmental Protection Agency (EPA), around 11.5 million tons of wasted food were produced in the commercial, residential, and institutional sectors in 2020, with animal feed, composting, biochemical/bio-based materials processing, land application, anaerobic digestion/digestion, donation, and wastewater/sewer treatment accounting for about 32%. An increasing number of attempts to reduce food waste, as well as the need to divert the waste away from landfills and incinerators, would also spur the USA food waste shredder market in the next ten years.

Domestic and Industrial Applications of Food Waste Shredder Machines to Grow in Australia

Australia has established a goal to cut food waste in half by 2035, in line with the United Nations' Sustainable Development Goal. The National Food Waste Strategy, Roadmap, and the National Waste Policy Action Plan lay out the steps that must be performed to reduce food waste in the country. As a result, the use of food waste shredders is likely to increase in domestic and industrial applications across Australia.

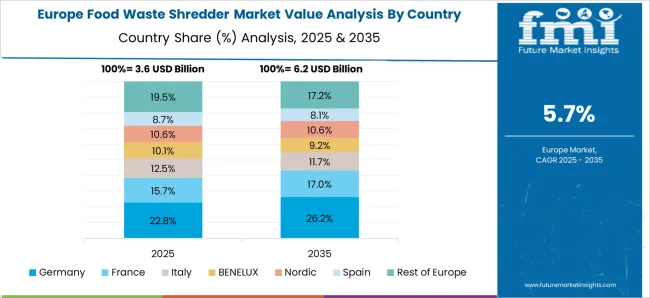

Urgent Need to Conserve Resources in Germany to Propel the Demand for Food Waste Recycling Machines

Food waste is generated in Germany at a rate of roughly 11.5 million tons per year (as of 2020). As per an expert’s opinion from the Federal Ministry of Food and Agriculture (BMEL) scientific advisory boards on agricultural, food, and forest policies, if food waste in domestic households was reduced by 50%, gas emissions in Germany would be decreased by six million tons of CO2. Anyone who contributes to the conservation of resources and climate stewardship by decreasing food waste is doing so actively. The market for food waste shredders is expected to grow at a rapid pace in Germany during the forecast period owing to the above-mentioned factors.

Demand for Vegetable Waste Crusher Machines to Surge by the End of 2035

Based on application, the vegetable waste segment is projected to remain at the forefront in the global food waste shredder market. An increasing number of restaurants and fast-food chains is expected to drive the demand for food waste shredders in the next decade across the globe.

Governments of various countries across the globe are also implementing numerous food waste management initiatives such as the Stop Wasting Food movement in Denmark and Love Food Hate Waste in the UK Besides, a global partnership between Messe Düsseldorf, FAO, and the United Nations Environment Program (UNEP) named Think Eat Save in support of the UN Secretary-General’s Zero Hunger Challenge is expected to spur awareness about food waste management. Such initiatives are projected to augur well for the segment.

The global food waste shredder market is highly fragmented with the presence of a large number of local and regional players. Mergers & acquisitions, collaborations, expansions, and partnerships are some of the marketing tactics that are being used by significant companies. In addition, leading corporations are investing huge sums in research and development activities to expand their geographic presence.

For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 15.6 billion |

| Projected Market Valuation (2035) | USD 28.4 billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The US, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Capacity, ProductC, Use, Application, Region |

| Key Companies Profiled | Emerson Electric Co.; Oklin International; Enic Co. Limited; Hungry Giant Recycling; Bhor Engineering Company; Weimar Biotech; IMC WasteStation; Amey Engineers; Bin Crusher; Ridan Composting Ltd.; Apollo Kitchen Equipment; WasteCare Corporation; MEIKO Clean Solutions (India) Pvt. Ltd.; Komptech Americas, LLC |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global food waste shredder market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the food waste shredder market is projected to reach USD 28.4 billion by 2035.

The food waste shredder market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in food waste shredder market are 101–300 kg/day, 0–50 kg/day, 50–100 kg/day, 301–500 kg/day, 500–1000 kg/day and over 1000 kg/day.

In terms of use, industrial segment to command 57.6% share in the food waste shredder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Waste Disposal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Composting Machine Market Size and Share Forecast Outlook 2025 to 2035

Food Waste-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Food Waste Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Demand for Food Waste Management in EU Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Demand for Products From Food Waste in Western Europe - Size, Share and Forecast Outlook 2025 to 2035

Waste Heat Power Generation Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Waste Wood Recycling Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA