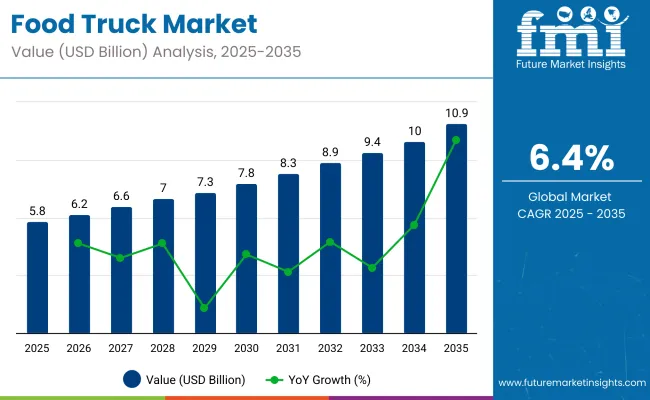

The food truck market is expected to reach USD 5.8 billion by 2025, expanding at a CAGR of 6.4%. Extending this growth rate, the market is projected to reach USD 10.9 billion by 2035. Growth drivers include increasing consumer demand for convenient and varied meal options, a rise in urban population density, and evolving dining habits. Lower barriers to entry compared to traditional restaurants encourage more entrepreneurs to launch food truck businesses. The steady CAGR of 6.4% reflects continuous market interest and gradual adoption across multiple regions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.8 billion |

| Industry Value (2035F) | USD 10.9 billion |

| CAGR (2025 to 2035) | 6.4% |

Examining growth patterns over time shows the market’s adaptability to shifting trends, such as the use of social media for promotion and the popularity of unique culinary offerings. A growing focus on health-conscious menus and customization expands the customer base. Regions like North America and Asia Pacific demonstrate notable market expansion due to urban development and rising disposable incomes supporting new food service concepts. The rolling CAGR points to consistent progress, with some fluctuations resulting from economic or regulatory changes. The food truck industry is positioned to sustain positive growth by aligning with changing consumer preferences and increasing opportunities for operators and suppliers through 2035.

The food truck market holds distinct shares across its parent markets, reflecting its specialized role. Within the mobile food services market, food trucks represent approximately 5-7%. In the broader food service industry, the share is around 3-5%. Their presence is more significant in the street food market, accounting for about 20-25%, and within the quick service restaurant (QSR) market, the share is estimated at 3-5%. In the broader commercial vehicles market, food trucks comprise roughly 1-2%, highlighting their specialized nature.

These percentages underscore the unique position of food trucks in the culinary landscape.Recent trends in the food truck industry focus on sustainability through eco-friendly packaging and locally sourced ingredients, responding to changing consumer values. Technological adoption has accelerated, with mobile ordering platforms and data analytics enhancing operational efficiency and customer experience. Menus increasingly feature plant-based and health-conscious options, broadening appeal. Key players are forming partnerships with breweries and event organizers to boost visibility and market reach. Some cities are creating dedicated food truck parks to support growth and community engagement. These strategies demonstrate how the industry adapts to evolving preferences while optimizing efficiency and expanding its customer base.

The market is expanding, driven by increasing consumer preference for convenient and diverse food options. The global market value reached approximately USD 2.5 billion in 2023, supported by urban population growth and rising disposable incomes. Food trucks offer cost-efficient entry for small entrepreneurs compared to traditional restaurants, with startup costs ranging from USD 50,000 to USD 150,000. Challenges include strict regulatory compliance and seasonal fluctuations affecting sales. Growth opportunities lie in mobile kitchens adopting eco-friendly equipment and digital ordering technologies.

Consumer lifestyles are shifting towards on-the-go eating, boosting food truck demand. Urbanization increases foot traffic in areas suited for mobile food vendors. Millennials and Gen Z, who account for over 50% of food truck customers, favor novel and ethnic cuisines. Lower investment requirements, typically between USD 50,000 and USD 150,000, make food trucks attractive to startups. Social media platforms generate word-of-mouth marketing, enhancing visibility. Festivals, events, and food parks offer frequent opportunities for sales growth. Increasing health awareness encourages offerings of organic and vegan menu options, broadening customer bases.

Food truck operators face complex licensing and zoning laws, with compliance costs often exceeding USD 2,000 annually. Health and safety regulations impose rigorous inspection schedules, adding operational strain. Weather and seasonal factors influence foot traffic, causing sales volatility in colder months or rainy periods. Limited parking spaces and competition for prime locations constrain growth potential. Variability in municipal policies creates inconsistent market conditions, especially across smaller cities. Operator experience and food quality also impact repeat customer rates. These factors create barriers that can slow expansion despite increasing consumer demand.

Adoption of energy-efficient cooking equipment and solar-powered vehicles helps reduce operating costs and environmental impact. Electric food trucks, though currently a small market segment, are gaining attention for lower emissions and noise. Digital ordering and delivery platforms enhance convenience, attracting tech-savvy consumers. Virtual food truck festivals and collaborations with food delivery apps broaden customer access beyond physical locations. Customizable menus targeting dietary trends like keto and gluten-free open new customer segments. Partnerships with local suppliers improve freshness and appeal to sustainability-conscious buyers.

Food trucks increasingly leverage Instagram, TikTok, and Facebook for brand building and event promotion, generating viral buzz and loyal followings. Collaborations between food trucks and brick-and-mortar restaurants create hybrid concepts that blend mobility with established culinary brands. Focus on authentic ethnic cuisines and fusion menus attracts diverse demographics. Mobile food courts and curated food truck parks provide stable locations with shared amenities, reducing logistical challenges. Technology integration like contactless payments and app-based loyalty programs improves customer experience. Growth of late-night and specialty dessert trucks meets demand for niche markets.

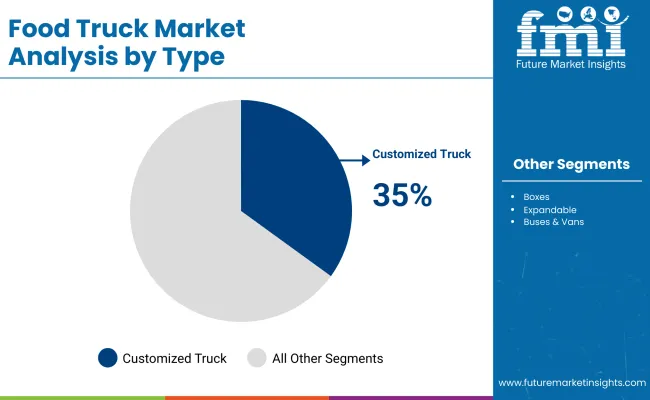

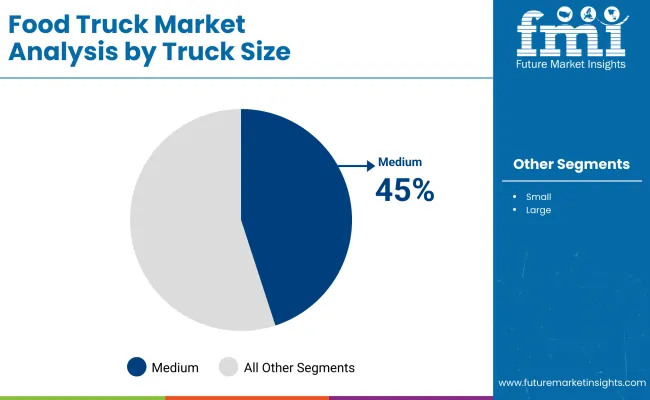

In 2025, customized trucks lead the food truck market with 35% share, driven by demand for tailored kitchen configurations that support diverse culinary concepts. Medium-sized trucks dominate at 45%, balancing kitchen capacity and urban maneuverability. Fast food accounts for 30%, reflecting consumer preference for quick service options. Boxes hold 25%, favored for their compact, efficient design, while expandable trucks at 15% offer adaptability for growing businesses. Barbecue and snacks capture 25%, appealing to customers seeking flavorful street fare.

Customized trucks hold 35% of the type segment due to their ability to meet specific operational needs, such as equipment layout and storage optimization. Vendors benefit from tailored ventilation systems supporting high-heat cooking, increasing equipment lifespan by up to 15%. These trucks enable operators to optimize kitchen workflows, potentially improving service speed by 20%. Custom truck design facilitates brand visibility through unique exterior wraps and signage, helping vendors attract 25% more-foot traffic in competitive markets. The modularity of customized trucks supports scaling business operations into new geographic areas without extensive retrofitting costs.

Medium-sized trucks capture 45% market share by size, favored for combining adequate kitchen space with urban drivability. These trucks typically provide 10-15% greater storage capacity than small trucks, supporting longer operational hours without restocking. Improved fuel efficiency designs reduce consumption by an estimated 8% compared to large trucks, lowering operating costs. Medium trucks’ dimensions allow access to 85% of urban routes, compared to 65% for larger trucks, enhancing route flexibility. Their balance of size and capacity makes them the preferred choice for vendors expanding into high-density metropolitan areas.

Fast food commands 30% of the food segment, driven by consumer demand for convenience and affordability. Trucks focusing on fast food serve up to 30-40 orders per hour during peak times, maximizing daily revenue potential. Streamlined menus reduce ingredient inventory needs by approximately 20%, minimizing waste and cost. The segment’s success relies on high-turnover locations such as office districts, where foot traffic can increase sales volume by 35% compared to event-based sales. Operators optimize cooking equipment for rapid heating, cutting average preparation time per item by nearly 25%, improving customer throughput.

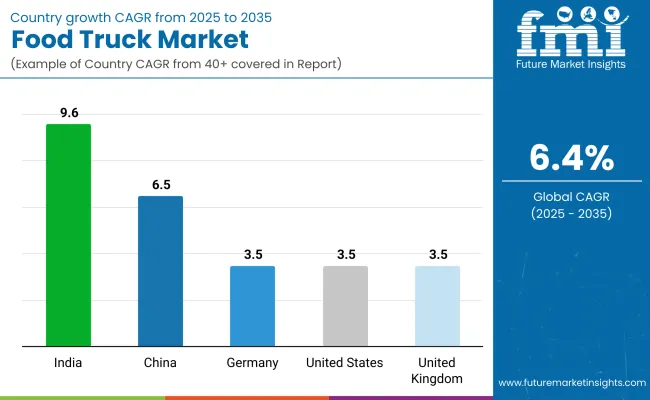

The global food truck market is projected to grow at a CAGR of 6.4% from 2025 to 2035. India leads with a CAGR of 9.6%, followed by China at 6.5%. Germany, the United States, and the United Kingdom each record growth of 3.5%. India’s growth exceeds the global average by +50%, while China aligns closely with the baseline at +2%. Germany, the United States, and the United Kingdom fall below the global CAGR by –45%.

Growth is driven by increasing urban food demand and entrepreneurial activity in BRICS nations, with OECD countries focusing on innovation in food services and regulatory improvements. ASEAN markets, although not listed, show rising interest linked to evolving consumer preferences. These trends illustrate distinct growth dynamics across emerging and developed economies within the food truck sector.

The demand food truck in India is projected to grow at a CAGR of 9.6%, fueled by increasing consumer preference for diverse and affordable street food options. Rising young population and growing interest in experiential dining contribute to demand. Entrepreneurs favour compact and fuel-efficient food trucks that can navigate congested urban areas. Regulatory frameworks around health and safety are becoming more structured, helping improve consumer trust.

Digital ordering and cashless payments have accelerated adoption among tech-savvy customers. Growing presence of branded food trucks and food festivals also supports market expansion across metropolitan and tier 2 cities.

The food truck marketin China is expected to grow at a CAGR of 6.5%, driven by expanding urban populations and growing interest in fast, casual dining. The market includes a mix of traditional and innovative cuisines offered through modern, hygienic mobile kitchens. Government initiatives supporting small business development and street vending encourage market participation. Rapid expansion of food truck parks in major cities offers centralized locations for operators. Online delivery integration allows trucks to reach a wider customer base beyond physical locations.

The food truck market in Germany is forecast to grow at a CAGR of 3.5%, supported by a strong culture of outdoor events and street food festivals. Operators focus on high-quality ingredients and specialty cuisines to attract discerning customers. Stringent hygiene and safety regulations ensure consumer confidence but raise operational costs. Electric and hybrid trucks are gaining traction to reduce noise and emissions in urban areas. Partnerships with event organizers provide stable revenue streams during peak seasons. Seasonal menu adaptations also help maximize sales throughout the year.

The United States food truck market is projected to grow at a CAGR of 3.5%, sustained by consumer demand for diverse and convenient food options. Innovations in menu design and food preparation technology enhance customer experience. Leasing and rental options reduce barriers to entry for aspiring food truck entrepreneurs. Social media marketing plays a critical role in customer acquisition and brand building. Regulatory environments vary by state but generally favour mobile food businesses. Demand for healthier and gourmet offerings is rising, expanding market segmentation.

The United Kingdom food truck market is expected to grow at a CAGR of 3.5%, supported by rising popularity of street food culture and outdoor dining. Operators favour compact, energy-efficient vehicles for urban environments. Government incentives for small businesses and local sourcing encourage market entry and sustainable practices. Events and food markets remain key platforms for exposure and sales growth. Increasing consumer preference for ethnic and fusion cuisine diversifies the market. Digital ordering and cashless payments are becoming standard.

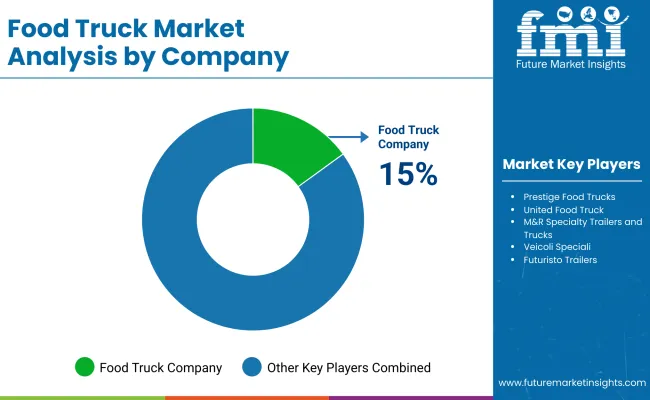

The market features a mix of established manufacturers and emerging suppliers focusing on product innovation, customization, and market expansion. Fud Trailer continues to introduce modular trailers designed for quick setup and versatile use, targeting both new entrepreneurs and seasoned operators. Food Truck Company emphasizes customization options, allowing clients to tailor interiors and equipment to specific cuisine types, helping it expand in competitive markets. Prestige Food Trucks recently launched a new line of lightweight models with improved insulation and energy-efficient power systems to support longer operating hours.

United Food Truck and M&R Specialty Trailers and Trucks focus on durable build quality and incorporating flexible layouts that cater to diverse foodservice needs. VeicoliSpeciali has increased its export activities by partnering with distributors across Europe, offering trailers with advanced ergonomic designs for operator comfort. Futuristo Trailers emphasizes high-quality materials and stylish aesthetics, appealing to clients seeking both function and visual appeal.

MSM Catering Trucks MFG. Inc. continues to refine its manufacturing processes to reduce lead times and improve customization. Bostonian Body, Inc. supports its customers through comprehensive aftersales service and training programs, ensuring operators maximize vehicle performance. Emerging players in the market concentrate on offering cost-effective, tailored solutions and developing local manufacturing capabilities to meet regional demands efficiently.

Recent industry News

| Report Attributes | Details |

| Market Size (2025) | USD 5.8 billion |

| Projected Market Size (2035) | Nearly USD 10.9 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and relevant units for volume |

| Types Analyzed (Segment 1) | Expandable, Boxes, Buses & Vans, Customized Trucks, Others |

| Truck Sizes Analyzed (Segment 2) | Small, Medium, Large |

| Food Categories Analyzed (Segment 3) | Barbecue & Snacks, Fast Food, Desserts & Confectionary, Bakery, Vegan & Meat Plant, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, China, India, UAE, South Africa |

| Key Players Influencing the Market | The Fud Trailer, Food Truck Company, Prestige Food Trucks, United Food Truck, M&R Specialty Trailers and Trucks, Veicoli Speciali , Futuristo Trailers, MSM Catering Trucks MFG. Inc., Bostonian Body, Inc. |

| Additional Attributes | Dollar sales by truck type and cuisine, demand trends across events, urban areas, and corporate catering, regional adoption in North America, Europe, Asia-Pacific, innovation in mobile kitchens, digital payments, sustainable fuels, environmental impact of waste and energy, and new uses in pop-ups and delivery. |

The market is expected to reach nearly USD 10.9 billion by 2035.

The market is growing at a CAGR of 6.4% during this period.

Customized trucks lead with 35% market share in 2025.

Medium-sized trucks capture 45% of the market by size.

Food Truck Company holds a leading 15% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA