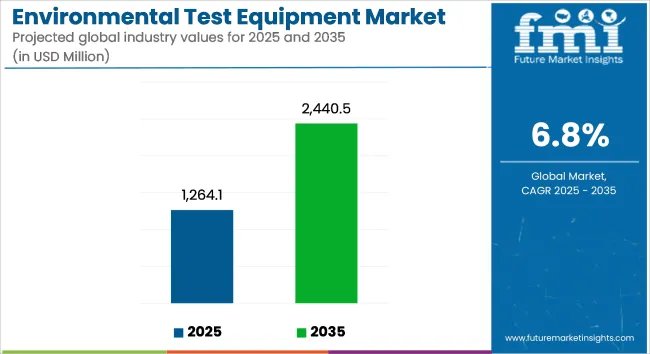

The global environmental test equipment market is estimated at USD 1,264.1 million in 2025 and is further projected to reach USD 2,440.5 million by 2035, registering a CAGR of 6.8% over the forecast period. Growth is being driven by increasing regulatory scrutiny, stricter product validation requirements, and expanding use of environmental simulation in aerospace, automotive, and electronics sectors.

In March 2025, the Naval Air Systems Command (NAVAIR) introduced advanced proof-loading equipment at its Environmental Test Lab to support high-fidelity performance assessments. The system was designed to simulate real-world mechanical stress and environmental conditions for military components. According to NAVAIR’s official release, this investment was made to "enhance system readiness and test fidelity under operationally realistic loads".

Thermotron, a manufacturer of environmental test chambers, has continued to expand its portfolio with temperature and humidity testing systems equipped with touchscreen controls, multi-zone programming, and improved data logging features. These systems are being deployed in R&D labs to accelerate product qualification across automotive battery packs, avionics modules, and consumer electronics.

In another 2024 update, Presto Stantest launched an advanced environmental test chamber capable of achieving ±0.2% temperature accuracy and relative humidity control for accelerated aging and reliability testing. As stated in a report on MSN, the system was introduced to meet evolving demands in materials and packaging validation, especially in pharmaceutical and food processing sectors.

Demand is also being supported by the increasing integration of test data into digital quality assurance systems. Test benches are now being equipped with IoT-based sensors to allow real-time monitoring and remote diagnostics. Environmental chambers with multi-point calibration and predictive maintenance alerts are being prioritized by manufacturers aiming to reduce test cycle failures and downtime.

As product life cycle testing becomes central to regulatory compliance and product safety validation, the environmental test equipment market is expected to maintain steady growth through 2035, supported by cross-industry digitalization and hardware innovation.

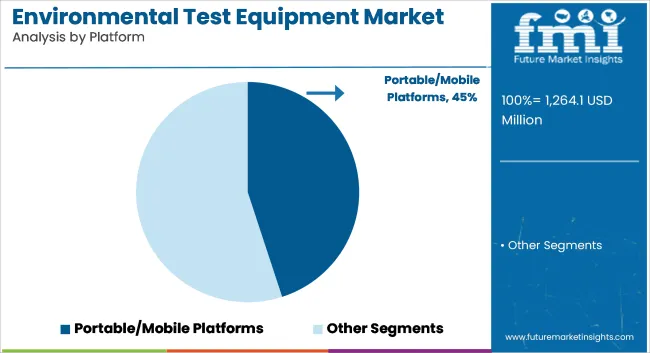

Portable and mobile platforms accounted for 45% of the global market in 2025 and are projected to grow at a CAGR of 7.2% through 2035. Adoption was supported by the growing need for on-site, real-time environmental assessment in both regulated and remote areas.

In 2025, environmental test agencies, utility companies, and industrial safety teams expanded use of portable units for air, water, and soil quality testing. These platforms offered a balance between analytical capability and field operability, reducing the reliance on laboratory-based analysis.

Product configurations were optimized for battery life, data logging, and wireless connectivity, enabling integration with environmental data platforms and compliance systems. Regional deployments in Southeast Asia, Latin America, and Eastern Europe targeted emissions tracking, industrial discharge monitoring, and emergency response scenarios, where portability and rapid deployment were essential.

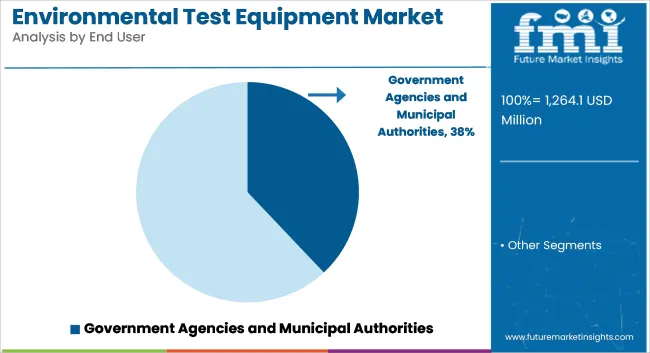

Government agencies and municipal authorities contributed 38% of total market demand in 2025 and are forecast to grow at a CAGR of 7.0% through 2035. Procurement was driven by regulatory mandates tied to air and water quality monitoring, waste management oversight, and infrastructure safety assessments.

In 2025, smart city initiatives and public health surveillance programs expanded investments in environmental monitoring platforms, particularly in urban and industrial belts. Fixed and mobile systems were installed to measure particulate matter, chemical contaminants, and greenhouse gas levels.

Authorities in countries such as the United States, Germany, India, and China implemented district-level monitoring systems that integrated portable and benchtop platforms with cloud-based reporting dashboards. Equipment deployment was also supported by international funding mechanisms for environmental compliance and pollution reduction in low- and middle-income regions.

Challenges

High Costs and Stringent Regulatory Compliance

The high cost of procuring and maintaining precision environmental testing instruments hampers the growth of the environmental test equipment market. Furthermore, adherence to stringent environmental regulations like the EPA, ISO 14001, and RoHS adds another layer of complexity for manufacturers. The absence of standardization across different markets and limited knowledge of advanced testing technologies in emerging economies compounds this.

Opportunity

Growth in IoT-Enabled, AI-Powered, and Sustainable Testing Solutions

The increasing focus on climate change, air quality monitoring, water contamination analysis, and industrial emissions control will fuel the demand for the advanced environmental test equipment market. Revolutionary advancements in IoT-enabled real-time monitoring, AI-powered predictive analytics, and cloud integration are augmenting accuracy, automation, and efficiency.

The rising use of smart sensors, nanotechnology, and portable environmental test devices is making on-site and remote testing accessible for localized sectors, including healthcare, manufacturing, automotive, and energy, helping to restrict and eliminate them.

Demand for pollution control and precision instruments and increasing number of environmental testing & monitoring service providers are also augmenting the market growth through 2030. Rising adoption of environmental testing is a common necessity across numerous application industries like automotive, aerospace and electronics is driving market growth.

The presence of leading equipment manufacturers and research institutes, coupled with robust government support for environmental protection policies like the Clean Air Act and Safe Drinking Water Act, is also boosting market growth. Furthermore, rising traction towards climate change mitigation and sustainable industry practices is anticipated to propel the demand for advanced environmental test equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

Environmental sustainability efforts in the United Kingdom, combined with strict regulatory policies regarding pollution control, emissions monitoring, and climate change adaptation, are fostering the growth of the UK Environmental Test Equipment market. The market is driven by an increasing demand for real-time environmental tests in sectors such as energy, pharmaceuticals, and construction.

Government efforts to reduce carbon emissions and increase air and water quality are largely influencing investments in environmental test equipment. Moreover, the burgeoning research and development in climate science and environmental monitoring is also helping the market grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.6% |

The European Union (EU) environmental test equipment market‘s growth is driven by the rising need for advanced environmental monitoring solutions in sectors like manufacturing, agriculture, and energy generation.

Germany, France, and Italy have key markets in the sector, focusing on green research as well as extensive investments to meet EU-wide pollution control measures. An increased focus on sustainable industrial processes and renewable energy projects is further driving demand for environmental test equipment.

Moreover, the European Union’s interest in smart cities and real-time environmental information collection is driving the deployment of advanced testing capabilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.5% |

The rising emphasis on sustainability, pollution management, and climate resilience in Japan, coupled with the country's proactive approach to environmental monitoring, drives its Environmental Test Equipment market. - The use of environmental test equipment is booming in industries like automotive, electronics, and renewable energy.

Investments in advanced testing technologies are driving the Japanese Government’s focus on clean energy, emission reduction policies, and disaster preparedness. The growing adoption of AI-enabled and automated environmental monitoring systems is also shaping market trends.

Japan’s stringent industrial regulations and dedication to decreasing environmental effects further drive the demand for precise air, water, and soil testing business equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

The South Korean environmental test equipment market is projected to grow steadily over the next few years as the nation strives to invest more in environmental sustainability and green technologies. Demand for advanced testing equipment is rising as the government takes steps to reduce industrial pollution, improve air quality, and increase clean energy projects.

The growth of the semiconductor, automotive, and electronics industries is also accelerating the growth of the environmental testing market since these industries require environmental testing for quality control and regulatory compliance purposes. Moreover, the increasing emphasis on smart environmental monitoring and IoT-enabled test equipment is further shaping the future of the market.

In South Korea, the increasing number of research institutions and environmental testing laboratories is anticipated to further drive the growth of the high-precision environmental test equipment market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

The global environmental test equipment market is projected to witness rapid growth due to the rising need for product reliability testing, regulatory compliance, and environmental monitoring. Key industries, including automotive, aerospace, electronics, healthcare, and energy, are embracing advanced environmental test equipment to validate product resilience under extreme conditions.

Stringent environmental regulations, increasing R&D investments, and technological advancements in testing equipment, such as automation, AI, and IoT integration, are driving the market.

Thermatron Industries (18-22%)

Thermatron leads the environmental test equipment market with high-performance thermal, humidity, and vibration test systems for automotive, aerospace, and electronics industries. The company integrates automation and remote monitoring into its solutions.

ESPEC Corporation (14-18%)

ESPEC specializes in climate and reliability test chambers, offering high-precision temperature and humidity control solutions for electronics, medical devices, and industrial applications.

Weiss Technik (Schunk Group) (12-16%)

Weiss Technik provides state-of-the-art environmental test chambers, catering to high-precision industrial testing needs in defense, automotive, and semiconductor industries.

Votsch Industrietechnik GmbH (10-14%)

Votsch focuses on customized environmental test systems, including thermal shock and corrosion test chambers, with energy-efficient and AI-driven monitoring features.

Cincinnati Sub-Zero (CSZ) (8-12%)

CSZ manufactures high-performance environmental test chambers, including thermal and altitude test systems, used in automotive, military, and electronics sectors.

Other Key Players (26-32% Combined)

Several emerging and regional players are strengthening the environmental test equipment market with affordable and specialized solutions, including:

The overall market size for environmental test equipment market was USD 1,264.1 million in 2025.

The environmental test equipment market is expected to reach USD 2,440.5 million in 2035.

Stringent environmental regulations, increasing industrial quality control needs, and rising demand for reliable testing solutions in aerospace, automotive, and electronics will fuel market growth.

The top 5 countries which drives the development of environmental test equipment market are USA, European Union, Japan, South Korea and UK.

Air quality test equipment command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 21: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Asia Pacific Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 23: Asia Pacific Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 24: Asia Pacific Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by End User, 2017 to 2033

Table 26: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 27: Middle East and Africa Market Value (US$ Million) Forecast by Platform, 2017 to 2033

Table 28: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Platform, 2023 to 2033

Figure 22: Global Market Attractiveness by Product, 2023 to 2033

Figure 23: Global Market Attractiveness by Application , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Platform, 2023 to 2033

Figure 47: North America Market Attractiveness by Product, 2023 to 2033

Figure 48: North America Market Attractiveness by Application , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Platform, 2023 to 2033

Figure 97: Europe Market Attractiveness by Product, 2023 to 2033

Figure 98: Europe Market Attractiveness by Application , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) by Platform, 2023 to 2033

Figure 102: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 103: Asia Pacific Market Value (US$ Million) by Application , 2023 to 2033

Figure 104: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 110: Asia Pacific Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 111: Asia Pacific Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 112: Asia Pacific Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 113: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 114: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 115: Asia Pacific Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 116: Asia Pacific Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 117: Asia Pacific Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 118: Asia Pacific Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 119: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Asia Pacific Market Attractiveness by Platform, 2023 to 2033

Figure 122: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 123: Asia Pacific Market Attractiveness by Application , 2023 to 2033

Figure 124: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 125: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 126: Middle East and Africa Market Value (US$ Million) by Platform, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application , 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Platform, 2017 to 2033

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 138: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 139: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 140: Middle East and Africa Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 141: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 142: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2017 to 2033

Figure 144: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Middle East and Africa Market Attractiveness by Platform, 2023 to 2033

Figure 147: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 148: Middle East and Africa Market Attractiveness by Application , 2023 to 2033

Figure 149: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 150: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wi-Fi Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Equipment Market

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Shear Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blood Testing Equipment Market Growth - Trends & Forecast 2025 to 2035

Motor Testing Equipment Market - Growth & Demand 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mortar Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fabric Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA