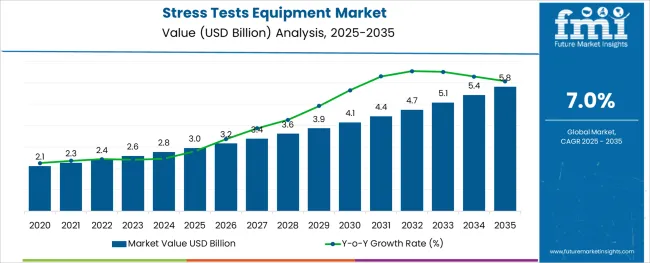

The Stress Tests Equipment Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The stress tests equipment market is undergoing a notable expansion as healthcare providers emphasize preventive cardiology, early detection, and improved patient outcomes. Advances in diagnostic protocols and the rising incidence of cardiovascular diseases are creating sustained demand for precise and reliable stress testing solutions.

Hospitals and diagnostic centers are increasingly prioritizing the acquisition of technologically advanced equipment that integrates imaging, data analytics, and real-time monitoring. Growth in this market is being supported by improved reimbursement frameworks, a growing geriatric population, and greater awareness among patients about proactive cardiac assessments.

Future opportunities are expected to emerge from the integration of AI powered diagnostics, portable testing solutions, and enhanced patient comfort features, all contributing to a more efficient and patient centric testing experience. Strategic investments in training, workflow optimization, and cross disciplinary collaborations are further paving the path for continued adoption and innovation in this segment.

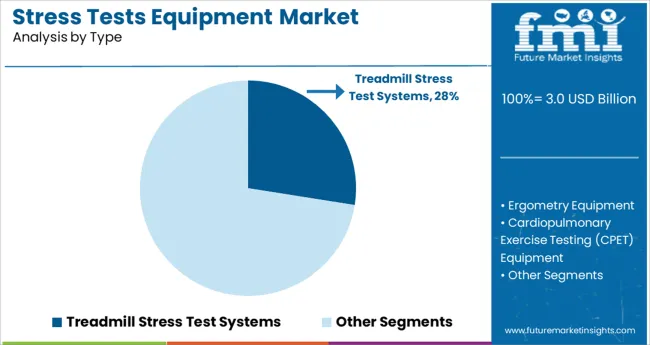

The market is segmented by Type and End-Use and region. By Type, the market is divided into Treadmill Stress Test Systems, Ergometry Equipment, Cardiopulmonary Exercise Testing (CPET) Equipment, Exercise ECG Systems, Echocardiogram, and Supplies & Accessories.

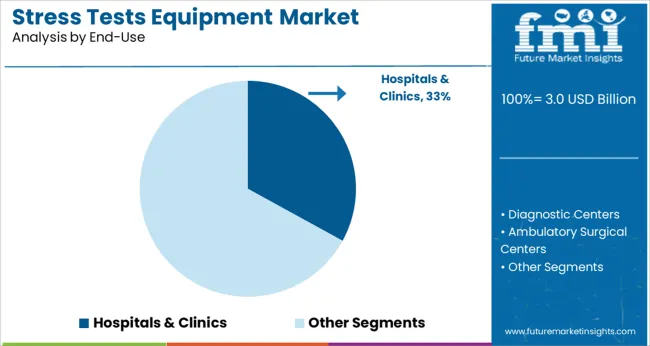

In terms of End-Use, the market is classified into Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type the treadmill stress test systems segment is projected to hold 27.5% of the total market revenue in 2025 maintaining its position as the leading type segment. This leadership is being driven by the widespread acceptance of treadmill based protocols which are regarded as standard in cardiovascular diagnostics for their reliability and accessibility.

The design of these systems enables controlled workload increments which allow clinicians to evaluate cardiac response under progressively challenging conditions. Their integration with advanced monitoring equipment has enhanced diagnostic accuracy and patient safety which has further encouraged their use in diverse clinical settings.

The durability and adaptability of treadmill systems to accommodate a wide range of patient profiles and test protocols have reinforced their dominance. Additionally the familiarity of healthcare professionals with treadmill operation and maintenance has contributed to its continued preference over alternative modalities.

When segmented by end use hospitals and clinics are anticipated to account for 33.0% of the market revenue in 2025 establishing themselves as the dominant end use segment. This prominence is being supported by the central role hospitals and clinics play in delivering comprehensive cardiac care and their ability to house integrated diagnostic facilities.

The presence of trained cardiologists and multidisciplinary teams within these institutions has ensured proper utilization and interpretation of stress test results. Investments in infrastructure modernization and the prioritization of preventive health programs have further accelerated adoption within this segment.

The ability to provide immediate intervention based on test outcomes and the convenience for patients to undergo testing in a familiar healthcare setting have strengthened the position of hospitals and clinics. Moreover institutional procurement power and adherence to standardized testing guidelines have solidified their leadership in the deployment of stress tests equipment.

Recent developments in artificial intelligence and wearable technologies offer exceptional prospects to expand the use of these tests and simplify their interpretation.

The market will grow as a result of the presence of several exercise testing systems by significant key companies with numerous benefits and improvements. For instance, MGC Diagnostics Corporation offers the Ergocard CPX exercise testing system, which includes bronchial provocation testing software, diagnostic functions, full program control, and complete basic spirometry measurement.

It also has quality control automated software, diagnostic functions, and full program control. The availability of such cutting-edge items will enable the segment to considerably contribute to market expansion.

Due to the precision and short running times of these devices, the exercise testing systems claim a considerable market share. Yet another factor in the rise in adoption of these systems, which is boosting the market's expansion, is the rising preference among doctors and patients due to their affordability and the variety of applications for these devices.

The most used cardiac screening test is Exercise Cardiac Stress testing (EST). The speed and height of the treadmill are gradually increased while the patient exercises on one in accordance with a set routine. The patient's ECG, heart rate, heart rhythm, and blood pressure are continually analyzsed throughout the exercise cardiac stress test (EST).

‘Stress’ is a word heard all too much in the fast paced, hectic lives that we all lead today. But what exactly is stress? In simple terms, it’s just a way for the body to respond to any kind of threat, either real or perceived. Stress hormones like adrenalin and cortisol are released by the nervous system, which prepare the body to either fight or take flight! A moderate amount of stress is actually good, contradictory as that may seem.

It keeps you alert at work, focused on winning a game or even motivates you to study when a crucial exam is approaching! However, when a person’s physical and mental well-being is threatened by their high stress levels, medication of some sort is required.

That’s where the stress test equipment market comes into picture. A stress test helps find out if a person has arrhythmia, if breathing problems faced are heart-related, how much they should exercise, or even to see if heart disease treatments are working. It is done by making a person walk on a treadmill to measure the heart rate, breathing, BP and the electrocardiogram

‘Prevention is better than cure’ is one of the most famous proverbs that cannot be more apt anywhere but in the drivers of the stress test equipment market. An aging population in the developed world, increasing prevalence of cardiac and breathing disorders due to rising pollution levels in the developing world all contribute to the growth of the stress test equipment market.

Even new hospitals constructed would definitely be responsible for increase in the demand. In 2014, more than a third of all deaths worldwide could be linked to cardiovascular diseases as per an estimate by the American Heart Association. Increasing awareness by the general public and also various government initiatives to educate people about various treatments available is expected to only grow the demand for this product and the whole market.

It would seem that all factors point to an increasing level of stress and thus an ever-growing market to check or control it. However, the stress test equipment market also has a few restraints challenging its growth which must be mentioned. Acts such as the Affordable Care Act, encourages the healthcare sector to provide cost-effective treatment to their patients.

This also makes them seriously reconsider investing in expensive stress test equipment. This becomes a much larger problem in the developing world, since the funds available with hospitals or the private sector there is much lower.

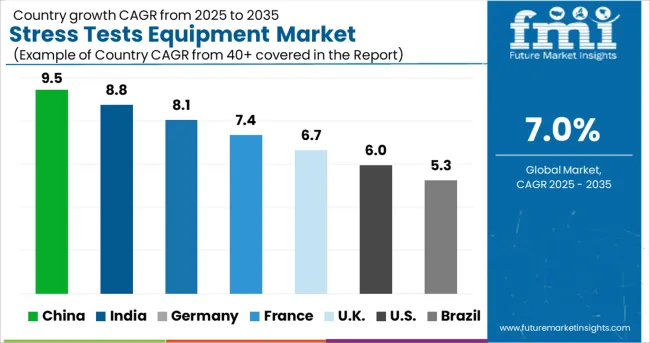

The Stress Tests Equipment market key regions correspond to the various geographic divisions i.e. North America, Europe, Asia- Pacific, Latin America, Middle East and North Africa (MENA) and the rest of the world (RoW). North America is currently the largest market because they have the most medical professionals and also some of the highest stress levels (hence greater awareness of the tests).

However, Asia- Pacific and in particular China is fast catching up in this category. Rising levels of air pollution have increased the occurrence of both respiratory and cardiovascular issues in this fast growing region, fuelling the long-term growth prospects of the stress test equipment market.

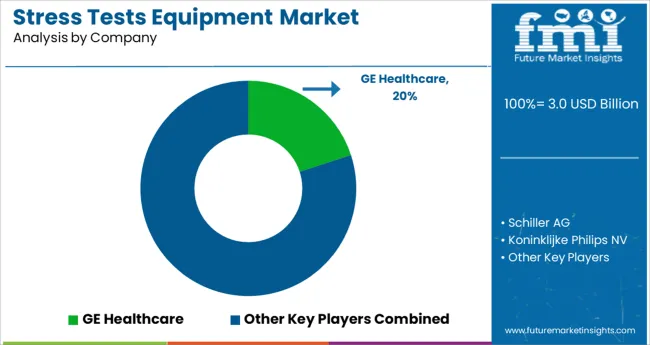

Thermo Fisher Scientific Ltd., Philips healthcare, Cardinal Health, Care Medical Ltd., Cosmed Medical, Cardiac Science Corporation and GE Healthcare are some of the stress tests equipment market key market players. Most of the companies are based in North America, since it is currently the largest stress test equipment market.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to market segments such as geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global stress tests equipment market is estimated to be valued at USD 3.0 USD billion in 2025.

It is projected to reach USD 5.8 USD billion by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are treadmill stress test systems, ergometry equipment, cardiopulmonary exercise testing (cpet) equipment, exercise ecg systems, echocardiogram and supplies & accessories.

hospitals & clinics segment is expected to dominate with a 33.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stress-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Stress Relief Supplement Market Analysis by Source, Form, Category and Distribution Channel Through 2035

Stress Tracking Devices Market - Demand & Forecast 2025 to 2035

Prestressed Concrete Wire and Strand Market Growth – Trends & Forecast 2024-2034

Pre-Stressed Concrete Market Size and Share Forecast Outlook 2025 to 2035

Anti-Stress / Relaxing Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Stress Monitor Market Analysis by Product, Application, Offering, Life Form, Technology, Sensor Type, and Region Forecast Through 2035

Anti-Stress Feed Supplements Market – Growth, Demand & Livestock Health

Heat Stress Meter Market

Female Stress Urinary Incontinence Treatment Device Market Size and Share Forecast Outlook 2025 to 2035

Creep and Stress Rupture Testers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Post-Traumatic Stress Disorder (PTSD) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Hematocrit Tests Market

Veterinary Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Trichomonas Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

IgE Allergy Blood Tests Market Size, Growth, and Forecast 2025 to 2035

Xylose Absorption Tests Market

Special Coagulation Tests Market Size and Share Forecast Outlook 2025 to 2035

The Hepatitis B Diagnostic Tests Market is segmented by product type & end user from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA