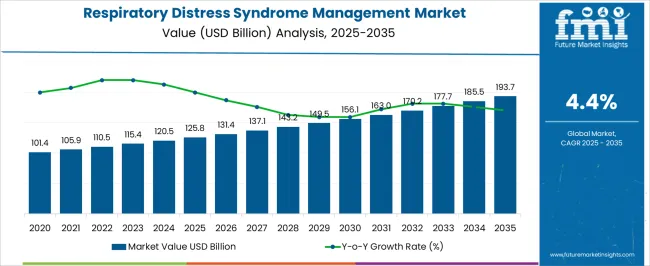

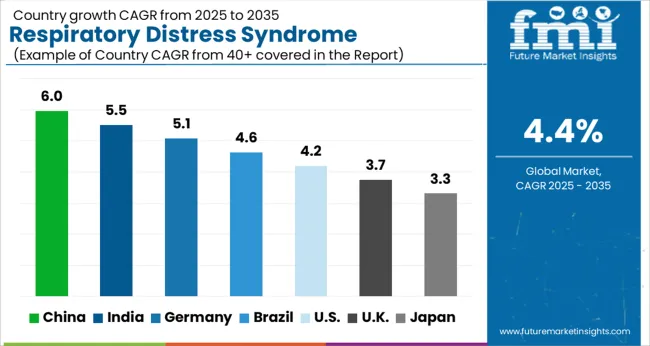

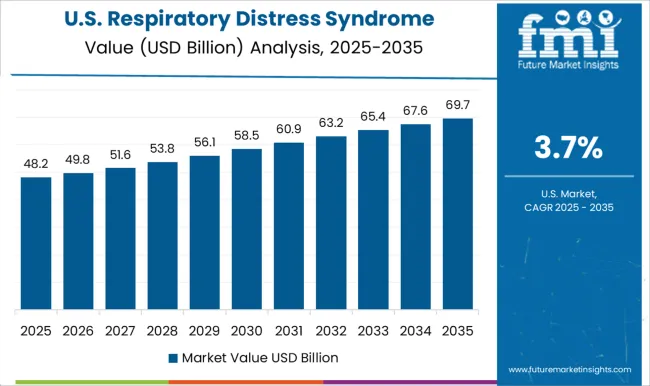

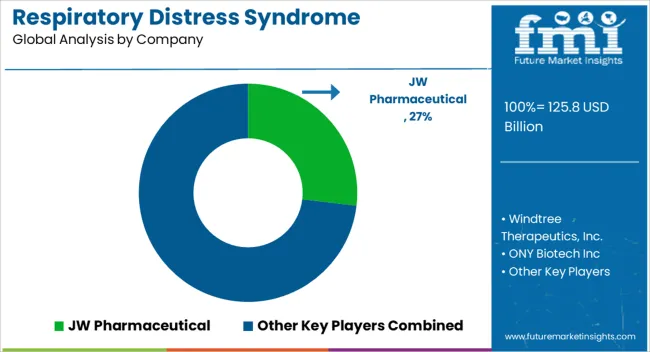

The Respiratory Distress Syndrome Management Market is estimated to be valued at USD 125.8 billion in 2025 and is projected to reach USD 193.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Respiratory Distress Syndrome Management Market Estimated Value in (2025 E) | USD 125.8 billion |

| Respiratory Distress Syndrome Management Market Forecast Value in (2035 F) | USD 193.7 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The respiratory distress syndrome management market is expanding steadily due to the rising prevalence of respiratory disorders, increased neonatal cases, and higher demand for advanced therapeutic interventions. Growth is being further supported by innovations in drug formulations, improved critical care facilities, and greater awareness among healthcare providers regarding timely intervention.

Regulatory authorities and healthcare organizations are emphasizing effective treatment strategies, particularly in neonatal intensive care units and among adult populations with comorbidities. Advancements in delivery systems and the availability of multiple drug classes have contributed to better patient compliance and outcomes.

The market outlook remains favorable as investments in hospital infrastructure and pharmaceutical R&D continue to accelerate, ensuring the availability of targeted therapies and diverse administration routes to improve survival rates and patient recovery.

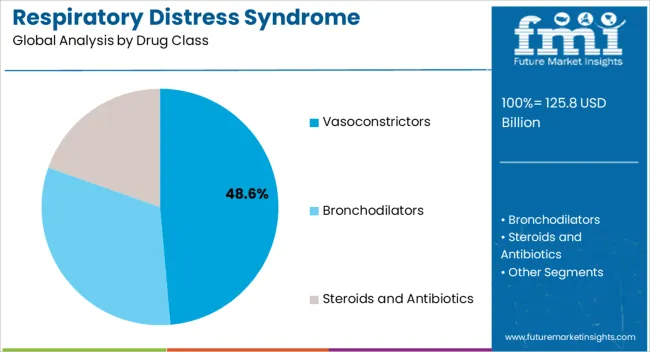

The vasoconstrictors segment is projected to account for 48.60% of the total revenue by 2025, positioning it as the leading drug class. This dominance is attributed to its effectiveness in stabilizing blood pressure, improving oxygenation, and reducing pulmonary complications associated with respiratory distress syndrome.

The ability of vasoconstrictors to enhance hemodynamic stability and manage acute conditions has increased their use in critical care settings. With ongoing improvements in formulation safety and clinical protocols, adoption rates have continued to rise.

Their proven efficacy in reducing the severity of respiratory complications has reinforced their role as the primary therapeutic option within this market segment.

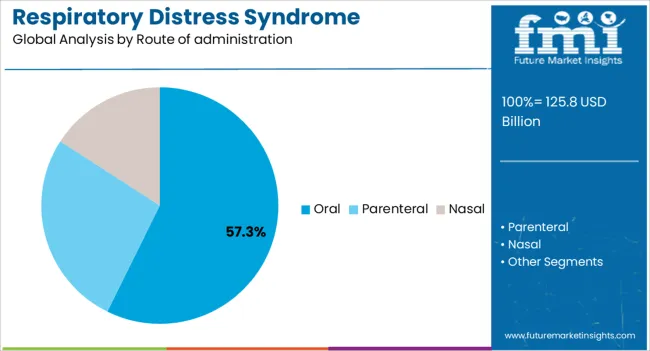

The oral route of administration is expected to represent 57.30% of overall revenue by 2025, making it the most widely used method. This preference is driven by the convenience of administration, patient compliance, and cost effectiveness compared to invasive methods.

Oral drugs are increasingly favored in both acute care follow up and long term management, as they reduce the need for specialized staff and minimize hospital resource strain. Pharmaceutical companies have been investing in developing oral formulations that provide targeted action while ensuring improved bioavailability.

The widespread accessibility and ease of use have solidified the dominance of the oral route of administration in this market.

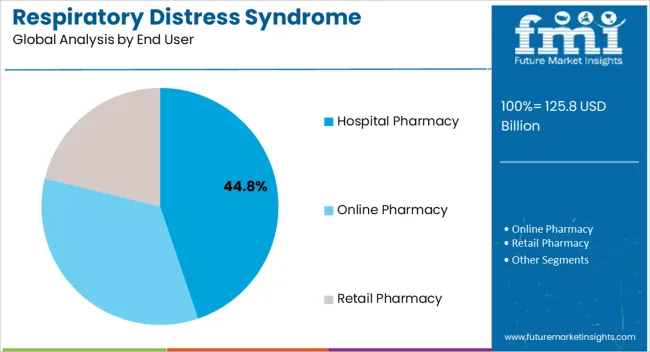

The hospital pharmacy segment is anticipated to contribute 44.80% of the total revenue by 2025, making it the largest end user category. This leadership position is supported by the central role hospitals play in managing severe respiratory distress cases, where immediate access to a broad range of medications is critical.

Hospital pharmacies are key providers for both emergency and intensive care units, ensuring uninterrupted availability of vasoconstrictors and other essential drugs. The increasing incidence of neonatal and adult respiratory distress cases has heightened dependency on hospital-based dispensing.

Continuous upgrades in hospital infrastructure and the prioritization of specialized critical care have reinforced hospital pharmacies as the primary end user segment in this market.

The global respiratory distress syndrome management market grew at a CAGR of 4.24% from 2020 to 2025, as per Future Market Insights, a provider of market research and competitive intelligence.

Historically, the focus of mechanical ventilation in respiratory failure has been to maintain adequate oxygenation and carbon dioxide elimination where several preclinical studies indicated that the common clinical practice of using relatively high tidal volumes and elevated airway pressures for ARDS patients might exacerbate the degree of lung injury.

In the year 2000, investigators supported by the US National Heart Lung and Blood Institute ARDS Network completed a randomized phase III clinical trial in which a tidal volume of 6 ml per kg PBW, compared with the more common higher tidal volume of 12 ml per kg PBW, improved survival, shortened duration of mechanical ventilation, attenuated systemic inflammation and accelerated recovery of extra-pulmonary organ failures, and the biologic findings were reported in other studies. Thus, with the discovery of the major role that mechanical forces play in the pathogenesis of lung injury, optimizing ventilator support to minimize VALI has become central to the clinical management of ARDS, leading to the concept of lung-protective ventilation.

The recently developed Radiographic Assessment of Lung Edema (RALE) score may be a novel tool to predict severity, outcomes, and response to therapy in ARDS. In the derivation cohort of this study, the RALE score was correlated with lung weight from excised lungs in deceased organ donors 3. Before the widespread use of this score, extensive validation is required. The use of lung ultrasound for the diagnosis of ARDS may be a promising tool but needs further study. Sensitive and specific biomarkers of ARDS, if available, may aid in earlier and more accurate diagnosis. Also, Future investigations should refine clinical, radiographic, physiological, molecular, and genetic differences in phenotypes to better understand the pathobiology of ARDS and develop novel therapies.

The rising incidence of clinical trials is driving growth

Increasing research and development and clinical trials and usage of therapeutics for the respiratory distress syndrome management market will eventually propel the growth of the market. Government initiatives taken to the reduction in mortality rate will also be a major factor that will help in the contribution of the growth of the market.

Increasing prevalence and incidence of acute lung injury

The increasing alcohol consumption, irrespective of age, leads to syndrome-like ARDS. Other risk factors like dyspnoea, hypertension, diabetes, and more lead to ARDS development. Thereby, this wide range of risk factors associated with acute respiratory distress syndrome increases the possibility of developing the clinical condition, simultaneously raising the cases of the disease. These affirmative risk factors are anticipated to boost the growth of the market.

The rising rate of air pollution and lifestyle-related diseases

The World Health Organization, air pollution is one of the greatest environmental risks to health by increasing the burden of diseases like heart diseases and lung and respiratory infections at both acute and chronic levels. Hence, the rising air pollution rate in developed and developing countries increases the chances of people getting syndromes like acute respiratory distress syndrome. Thus, the factor is expected to drive the growth of the market.

Increasing accident rates and trauma causing ARDS

The inhalation of smoke releases materials like fibrin, neutrophils, mucus, and epithelial cell debris that occlude the airway lumen, causing changes in ventilation. This condition leads to hypoxemia which is a primary significant reason for ARDS. They also reported that increased mortality rates in burn patients were due to ARDS. Thereby, the rising number of accidents and trauma injuries in the lungs is expected to drive the growth of the market.

Complications associated with treatments

There are treatments for ARDS helping people survive, but the complications associated with treatments and post-treatment are still a burden for patients. Most potential and lasting effects include breathing problems, depression, problems with memory and thinking, tiredness and muscle weakness, and more.

These complications associated with and post-treatment of acute respiratory distress syndrome are expected to hamper the market growth during our forecast period.

High cost of device and treatments

The high cost of ventilation treatment per day is not affordable if the therapy has to proceed for many days. Hence patients prefer taking ventilators for home care. However, the price of ventilators is yet quite expensive. Therefore, the high cost of treatment and ventilators is very challenging for people to afford any reliable remedy for the long term until the patient completely recovers. This is anticipated to hamper the growth of the market.

The hospital segment in North America is expected to grow with the highest growth rate

The countries covered in the acute respiratory distress syndrome (ARDS) market report are USA., Canada, and Mexico. In the forecast period of 2025 to 2035 because of increasing government and organizational support.

The hospital segment in Canada is second dominating the market owing to increasing cases of chronic respiratory diseases and high adoption of proper diagnosis. Mexico is third leading the growth of the market and the hospital segment is dominating in this country due to the increasing number of new hospital infrastructures being opened due to the emergence of COVID-19.

Increasing technological advancement in the country

The parenteral segment in Japan is expected to grow with the highest growth rate in the forecast period of 2025 to 2035 because of increasing technological advancement in the country.

The parenteral segment in China is second dominating the market owing to increasing cases of chronic respiratory diseases and high adoption of proper diagnosis. South Korea is third leading the growth of the Asia-Pacific market and the parenteral segment is dominating in this country due to the increasing number of biotechnologies centers and research activities.

The nasal segment will gain the dominant market share

Advancements in neonatal care have been driving growth as the survival rate of premature infants with RDS has increased due to improved diagnostic methods and treatments thus fuelling demand. Various leading companies like Smiths Medical offers neonatal care products, including neonatal ventilators and respiratory support devices.

Also, babies have survived longer and with less lung damage due to the introduction of volume-targeted ventilators as they require support for shorter periods leading to a low risk of developing pneumothorax.

The demand for hospital pharmacies will be more during the forecast period.

According to a report by Future Market Insights, the hospital pharmacies would grow within the anticipated time frame. This market sector is expected to hold a greater share of the worldwide market from 2025 to 2035.

Due to the rise in population and advancement in technologies, a growing number of people are more prone to visiting hospitals for advice on respiratory distress syndrome management market treatment-related, where they will be provided not only with proper care but also with the new and advanced level of instruments at each interval of time. As a result, individuals more pertain towards their health and well-being. Thus, the majority of consumers are expected to only buy medications from hospital pharmacies.

The start-ups in this sector aim to use several techniques, such as the launch of new products and acquisitions, to improve their market positions internationally.

Some of the prominent players in the global market for RDS treatment are

Some of the important developments of the key players in the market are

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.41% from 2025 to 2035 |

| Market value in 2025 | USD 125.8 billion |

| Market value in 2035 | USD 193.7 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for Value and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Drug class, Route of Administration, End-user, Region |

| Regions Covered |

North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled |

United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, India, Malaysia, Singapore, Thailand, China, Japan, South Korea, Australia, New Zealand, GCC countries, South Africa, Israel |

| Key Companies Profiled |

JW Pharmaceutical; Windtree Therapeutics, Inc.; ONY Biotech Inc; AbbVie Inc.; Teva Pharmaceutical Industries Ltd.; Takeda Pharmaceutical Company Limited; GlaxoSmithKline plc.; Pfizer Inc.; Gilead Sciences, Inc.; Hoffmann-La |

| Customisation Scope | Available on Request |

The global respiratory distress syndrome management market is estimated to be valued at USD 125.8 billion in 2025.

The market size for the respiratory distress syndrome management market is projected to reach USD 193.7 billion by 2035.

The respiratory distress syndrome management market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in respiratory distress syndrome management market are vasoconstrictors, bronchodilators and steroids and antibiotics.

In terms of route of administration, oral segment to command 57.3% share in the respiratory distress syndrome management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

WHIM Syndrome Management Market Insights and Analysis for 2025 to 2035

Marfan Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Triple X Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Carcinoid Syndrome Management Market

Central Pain Syndrome Management Market – Size, Share & Growth 2025 to 2035

Severe Acute Respiratory Syndrome Treatment Market

Carcinoid Tumor Syndrome Management Market Forecast & Analysis for 2025 to 2035

Cytokine Release Syndrome Management Market - Trends & Future Outlook 2025 to 2035

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Analysers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Respiratory Pathogen Testing Kits Market Insights - Growth & Forecast 2025 to 2035

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Respiratory Gating Market Analysis – Size, Share & Forecast 2025-2035

Respiratory Device Market Insights – Growth & Forecast 2024-2034

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA