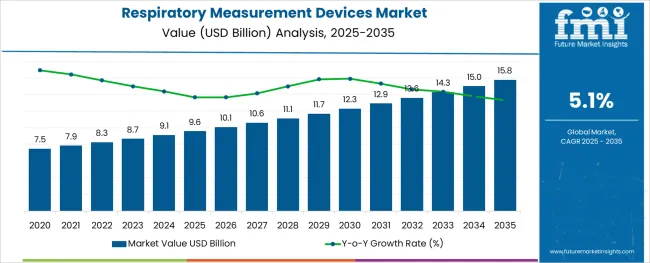

The Respiratory Measurement Devices Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The respiratory measurement devices market is being propelled by a surge in respiratory disorders such as asthma, chronic obstructive pulmonary disease, and sleep apnea across both developed and emerging economies. Technological innovations in monitoring have made devices smarter, smaller, and more patient friendly through integration with AI, cloud connectivity, and wearables.

Portable pulse oximeters have become especially prominent following the COVID-19 pandemic due to their role in detecting oxygen desaturation. Simultaneously, homecare adoption has increased as patients seek convenient remote monitoring options supported by reimbursement policies.

Regulatory emphasis on accuracy, equity, and traceability has driven continued product refinement. The market outlook remains robust with expected double digit growth as allied healthcare adoption expands and remote patient monitoring models mature.

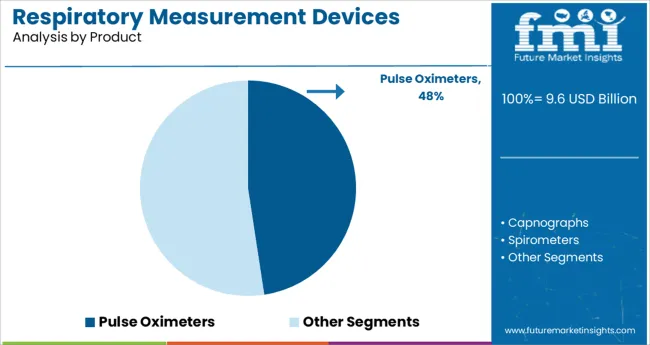

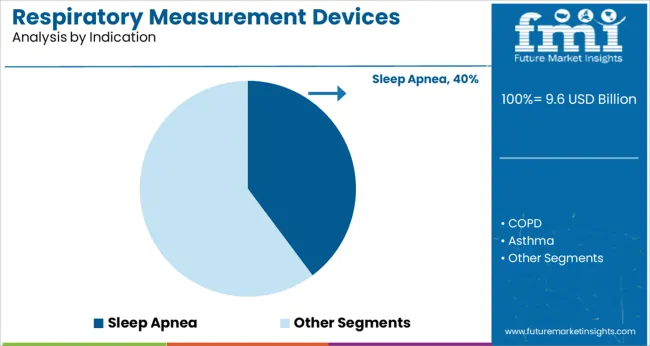

The market is segmented by Product, Indication, and End User and region. By Product, the market is divided into Pulse Oximeters, Capnographs, Spirometers, Polysomnographs (PSG), Peak Flow Meters, Gas Analyzers, and Others. In terms of Indication, the market is classified into Sleep Apnea, COPD, Asthma, and Infectious Disease. Based on End User, the market is segmented into Home Care, Hospitals, Ambulatory Surgical Centers, and Specialty Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is acknowledged that the pulse oximeters segment accounts for 47.60% share of the global respiratory measurement devices market. This dominance is explained by their noninvasive simplicity portability and utility in both clinical and homecare environments.

Their rapid adoption during the COVID 19 pandemic enhanced recognition among consumers and healthcare providers. Technological advances such as Bluetooth enabled fingertip designs and integration with mobile platforms have further broadened usability and facilitated continuous physiological monitoring.

Additionally regulatory scrutiny surrounding racial accuracy biases has driven manufacturers to improve measurement precision. These features have resulted in widespread deployment across point of care settings forming a strong foundation for future innovation.

It is observed that the sleep apnea indication segment holds 39.80% market share. This substantial positioning is rooted in rising diagnostic rates treatment adoption and increased awareness of sleep disorders.

Home sleep apnea testing using pulse oximetry and other remote monitoring tools has simplified screening processes reducing dependency on clinical polysomnography. Insurance coverage and favourable reimbursement frameworks have further supported home based monitoring.

Moreover integration of noncontact sensors and AI assisted analytics is boosting diagnostic accuracy and patient acceptance. As both consumer and provider demand for convenient sleep monitoring rises innovation in device accuracy connectivity and affordability is expected to solidify this segment’s leadership position.

An increase in the prevalence of sleep apnea and respiratory diseases boosted the demand for respiratory monitoring devices. Furthermore, the rising geriatric population propelling the demand of the market. In older populations age causes a person's immune system to deteriorate.

Therefore, the risk of developing diseases in this age group increases due to the surge in the geriatric population. The risk of developing and contracting respiratory diseases increases with the age.

The market for respiratory monitoring devices is constantly developing new products that will be rising monitoring accuracy and enhancing patient comfort. Research and Development on novel systems by key manufacturers have been seen as a lucrative growth opportunity in the forecasted period.

The demand for novel products such as wearables, cordless devices, smartphones, and integrated devices, caused by the rapid advancement of technology is being accepted more quickly, propelling the market's expansion.

In comparison to other regions, North America has the greatest market for respiratory measurement device sales and makes the most contribution. Due to the existence of well-established key players that provide respiratory measurement devices and approval from the Food and Drug Administration (FDA) for the products.

Due to the increased emphasis on respiratory care management in homecare settings, Europe is predicted to have the fastest-growing demand for respiratory measurement devices. Due to the region's increasingly aging population, rising consumer awareness, and growing medical tourism in developing nations like China, South Asia is forecasting strong development for the respiratory monitoring devices market.

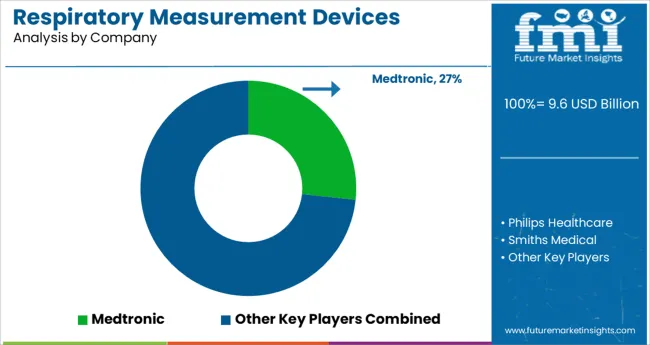

Medtronic, Philips Healthcare, Smiths Medical, Drgerwerk AG Co. KGaA, GE Healthcare, Welch Allyn, Inc., Masimo, MGC Diagnostics Corporation, Vyaire Medical, Inc., Nihon Kohden Corporation, Novelda AS, Welch Allyn, Inc., Masimo, Getinge Inc., Resmed, Siemens Healthcare.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 5.1% 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2012 to 2024 |

| Forecast Period | 2025 to 2035 |

| Qualitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segment Covered | Product, Indication, End User, Region |

| Region Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East Africa (MEA) |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Players | Medtronic; Philips Healthcare; Smiths Medical; Drgerwerk AG Co. KGaA; GE Healthcare; Welch Allyn, Inc.; Masimo; MGC Diagnostics Corporation; Vyaire Medical, Inc.; Nihon Kohden Corporation; Novelda AS; Welch Allyn, Inc.; Masimo, Getinge Inc.; Resmed; Siemens Healthcare. |

| Customization | Available Upon Request |

The global respiratory measurement devices market is estimated to be valued at USD 9.6 billion in 2025.

It is projected to reach USD 15.8 billion by 2035.

The market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types are pulse oximeters, capnographs, spirometers, polysomnographs (psg), peak flow meters, gas analyzers and others.

sleep apnea segment is expected to dominate with a 39.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Analysers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Respiratory Pathogen Testing Kits Market Insights - Growth & Forecast 2025 to 2035

Respiratory Gating Market Analysis – Size, Share & Forecast 2025-2035

Respiratory Device Market Insights – Growth & Forecast 2024-2034

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Upper Respiratory Tract Infection Treatment Market

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Chronic Respiratory Diseases Treatment Market

Germany Respiratory Inhaler Devices Market Insights – Demand, Trends & Outlook 2025-2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Unit-Dose Respiratory Medications Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA