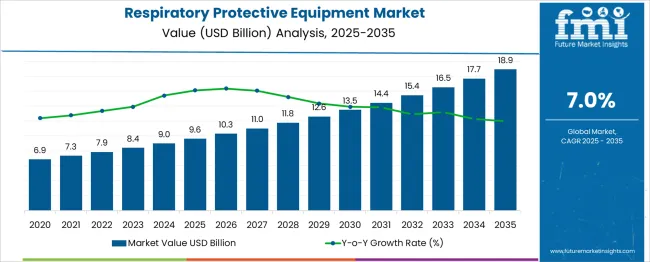

The Respiratory Protective Equipment Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 18.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. This reflects a multiplying factor of 1.97 across the projection timeline. Yearly increases remain steady, ranging from USD 0.7 billion to USD 1.2 billion, which confirms the lack of abrupt shifts or seasonal surges.

No reversals or downturns appear throughout the period. This trend suggests stable procurement cycles driven by regulatory mandates, institutional supply contracts, and workplace safety norms rather than season-based demand triggers that are typical in cyclically influenced markets. The demand curve does not exhibit volatility patterns seen in products tied to calendar cycles, weather changes, or discretionary spending.

Procurement appears evenly distributed throughout each year, aligned with operational requirements rather than seasonal spikes. Moderate acceleration beyond 2030 remains within the expected trend, indicating no systemic shift in purchasing frequency.

These characteristics make the market structurally resilient and suited to year-round inventory management. Long-term supply arrangements, bulk manufacturing schedules, and regional consistency reinforce the stability of this market. As a result, vendors and distributors may plan capacity and logistics without anticipating cyclical constraints during the forecast window.

| Metric | Value |

|---|---|

| Respiratory Protective Equipment Market Estimated Value in (2025 E) | USD 9.6 billion |

| Respiratory Protective Equipment Market Forecast Value in (2035 F) | USD 18.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The respiratory protective equipment (RPE) market is witnessing robust growth, fueled by heightened workplace safety regulations, rising awareness of airborne hazards, and increasing use of personal protective gear in industrial and emergency response environments. The COVID-19 pandemic significantly accelerated global adoption of RPE, and post-pandemic, demand has remained strong due to stricter compliance standards and the rise of occupational health initiatives.

Technological advancements in filtration, material comfort, and wearability are encouraging the use of advanced systems across high-risk sectors. Additionally, investments in infrastructure, mining, and manufacturing are supporting steady RPE procurement, particularly in developing regions where industrial safety norms are tightening.

The integration of smart sensors and compatibility with communication systems is further enhancing the value proposition of next-generation RPE products.

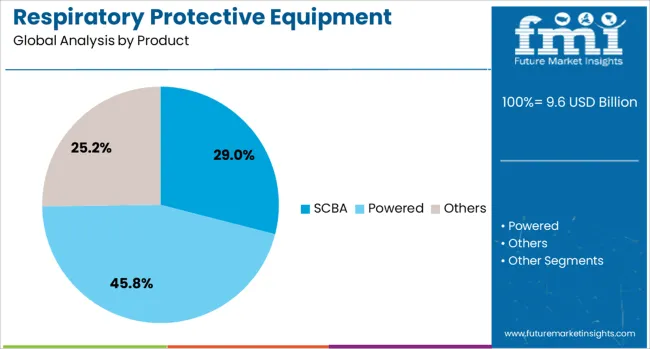

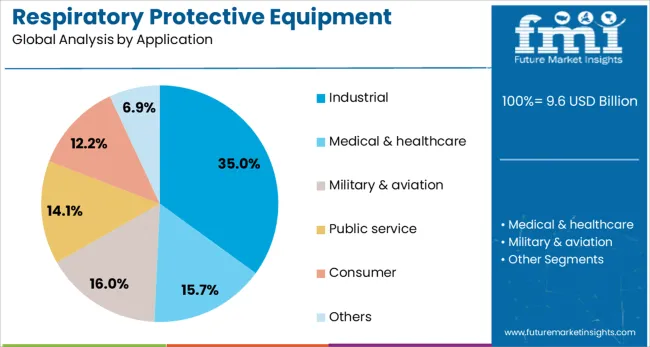

The respiratory protective equipment market is segmented by product, application, and geographic regions. The byproduct of the respiratory protective equipment market is divided into SCBA and Powered Others. In terms of application, the respiratory protective equipment market is classified into Industrial, Medical & healthcare, Military & aviation, Public service, Consumer, and Others.

Regionally, the respiratory protective equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Self-contained breathing apparatus (SCBA) is projected to lead the RPE market with a 29.00% share in 2025. This dominance is primarily driven by its critical role in high-risk environments where clean breathing air must be supplied independently of ambient conditions, such as firefighting, chemical handling, and confined space operations.

SCBAs are engineered to provide full respiratory protection and allow users to operate in toxic, oxygen-deficient, or smoke-filled atmospheres. Regulatory mandates across emergency services and hazardous material sectors have established SCBA as a non-negotiable safety standard.

With advancements in weight reduction, ergonomic harness design, and integrated heads-up displays, SCBAs are evolving to meet the operational efficiency and comfort demands of modern industrial and rescue professionals.

The industrial segment is expected to account for 35.00% of the RPE market by 2025, making it the leading application area. This share is fueled by the increasing adoption of respiratory protection across manufacturing, construction, mining, and oil & gas operations.

Workers in these environments are routinely exposed to dust, vapors, gases, and particulate matter, necessitating compliance with occupational safety regulations such as OSHA and EU directives. As employers focus more on minimizing downtime, improving worker health, and reducing compensation claims, the role of RPE in routine industrial operations is expanding.

The availability of task-specific respirators, combined with rising automation in fit-testing and training, is making industrial RPE implementation more scalable and efficient across large worksites.

The respiratory protective equipment market is expanding steadily due to growing awareness of occupational health and safety in industrial, healthcare, and construction sectors. Demand for advanced filtration technologies and comfortable, reusable designs has increased. Regulatory enforcement on worker safety and rising pollution levels contribute to market growth. Innovations in lightweight materials and smart respirators with real-time monitoring are gaining attention. Adoption is widespread in emerging and developed economies, driven by industrialization, stringent workplace standards, and increasing air quality concerns.

Industrial safety standards and occupational health mandates have accelerated adoption of respiratory protective equipment. Compliance with regulations requires regular updates and certifications, prompting organizations to replace outdated gear with advanced models offering higher filtration efficiency and durability. Healthcare environments are demanding N95 and powered air-purifying respirators to address airborne pathogens. Construction and mining sectors focus on particulate and gas protection in harsh environments. Regulatory bodies across North America, Europe, and Asia-Pacific enforce rigorous compliance, motivating companies to invest in employee protection programs and safer operational practices.

The integration of lightweight, breathable materials and nanofiber filters has improved comfort and protection levels. Innovations include multi-layer filtration media capable of capturing ultrafine particles, gases, and biological contaminants. Reusable respirators with replaceable cartridges reduce total ownership cost and environmental impact. Designs incorporate ergonomic fit, adjustable straps, and compatibility with other personal protective equipment. Smart respirators equipped with sensors monitor air quality and filter status, enhancing user safety. These advancements increase acceptance in various sectors, including pharmaceuticals, manufacturing, and emergency response.

Fluctuations in raw material prices and logistical challenges impact production costs and lead times. The pandemic highlighted vulnerabilities in sourcing specialized filter materials and components. Manufacturing shifts towards regional hubs aim to reduce dependency on global supply chains. Price sensitivity remains high among small and medium enterprises, affecting purchase volumes. Increased demand for certified products with complex features may raise prices. Strategies including localized manufacturing, bulk procurement, and vendor partnerships are being employed to stabilize supply and costs. Economic uncertainties in emerging markets may influence investment cycles and procurement decisions.

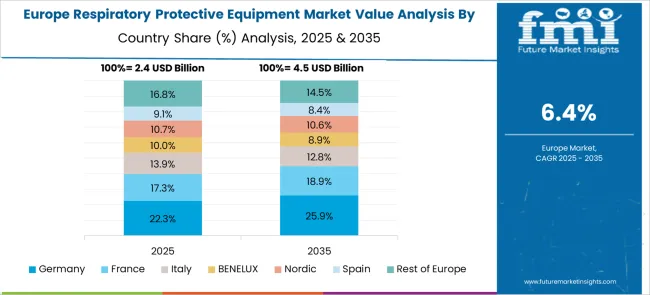

The market shows differentiated growth by geography and end-user sectors. North America and Europe focus on compliance and technological upgrades in healthcare and industrial segments. Asia-Pacific experiences robust demand driven by expanding manufacturing, mining, and construction activities. Latin America and the Middle East/Africa markets are evolving, with increasing safety awareness and infrastructure investments. Industrial manufacturing dominates end-use demand, followed by healthcare, construction, and oil & gas sectors. Increasing government initiatives and industrial expansion in emerging economies are expected to widen the user base and diversify product portfolios in these regions.

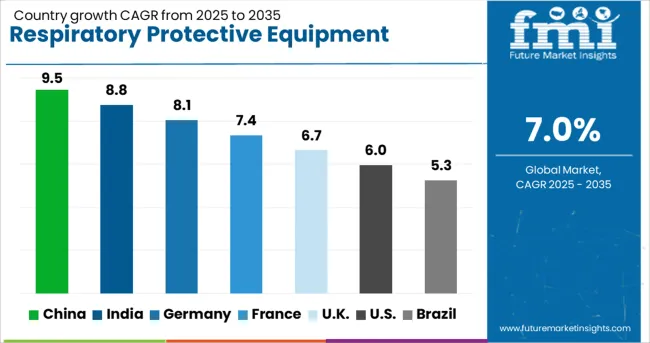

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

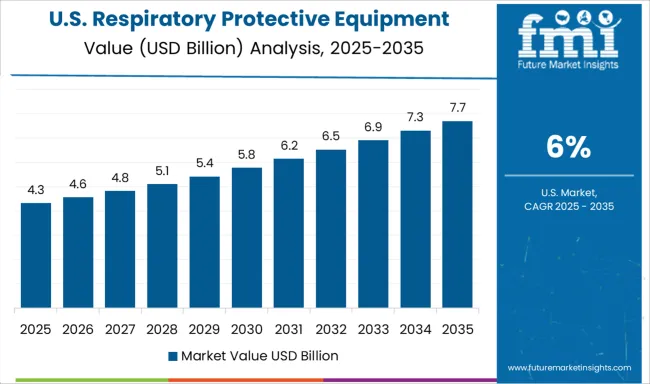

The global respiratory protective equipment market is forecast to grow at a CAGR of 7% from 2025 to 2035. China leads with a growth rate of 9.5%, exceeding the global average by 36%. This growth is attributed to increasing industrial safety regulations and expanding manufacturing activities. India follows with a CAGR of 8.8%, driven by rising awareness of occupational health and industrial compliance. Germany’s market is expected to grow at 8.1%, approximately 16% above the global average, supported by stringent workplace safety policies. The UK and US register lower CAGRs of 6.7% and 6.0% respectively, with mature market conditions and slower industrial expansion. OECD standards heavily influence demand in Germany, the UK, and the US, while ASEAN trade dynamics affect supply chains impacting China and India.

China’s respiratory protective equipment market is projected to expand at a CAGR of 9.5%, significantly above the global rate by 36%. Expansion is propelled by tightening industrial safety laws and growing production in hazardous manufacturing sectors. Increasing investment in infrastructure and mining has intensified demand for advanced respiratory solutions. ASEAN partnerships enhance access to raw materials and component supplies, supporting domestic production. Stringent workplace regulations require upgraded protective gear across multiple industries, particularly in urban and industrial zones.

India’s market is expected to grow at a CAGR of 8.8%, surpassing the global average by 26%. Expansion is fueled by government initiatives to improve workplace safety in mining, construction, and chemical sectors. Increasing awareness of respiratory hazards in urban and rural areas is driving demand for certified equipment. The integration of ASEAN supply chains has improved the availability of cost-effective components. Compliance with new occupational health regulations has resulted in higher adoption of disposable and reusable respiratory masks.

Germany’s market is forecast to grow at a CAGR of 8.1%, exceeding the global average by 16%. Strict enforcement of workplace safety standards under the EU regulatory framework encourages continuous upgrades in respiratory protective equipment. Demand is driven by industrial sectors such as automotive manufacturing, chemicals, and pharmaceuticals. As an OECD member, Germany mandates high-quality certifications, boosting adoption of advanced respirators and filtration technology. Domestic manufacturers have increased output of eco-certified products in response to regulatory pressures.

The UK market is projected to grow at a CAGR of 6.7%, slightly below the global average. Growth is influenced by steady industrial safety compliance and replacement of outdated equipment in manufacturing and healthcare sectors. Limited expansion of hazardous industries and a mature supply chain have constrained rapid growth. As part of the OECD, the UK maintains strong regulatory oversight, with a focus on respiratory protection in healthcare and public service environments. ASEAN trade partnerships provide supplementary components for domestic assembly.

The US market is estimated to expand at a CAGR of 6.0%, below the global average. Growth is restrained by mature industrial sectors and extended equipment replacement cycles. The enforcement of OSHA regulations ensures baseline demand, while new investment in mining and chemical industries provides moderate expansion. As an OECD member, the USA enforces strict certification processes, limiting entry of non-compliant products. ASEAN supply chains supplement domestic production, primarily for low-cost components and filters.

3M remains a dominant player in the respiratory protective equipment market, offering a comprehensive range of disposable and reusable respirators, powered air-purifying respirators (PAPRs), and self-contained breathing apparatus (SCBA). The company has maintained market share through rapid production scalability and innovation in filter technologies.

Honeywell International Inc. delivers competitive solutions across industrial and healthcare applications, backed by integrated safety systems and smart mask development. MSA Safety, known for rugged SCBA units, has focused on expanding its presence in high-risk sectors like firefighting and mining by offering advanced connectivity features.

Delta Plus Group and Alpha Pro Tech have scaled distribution networks across emerging regions, emphasizing compliance with regional safety standards. Bullard and RPB Safety LLC have strengthened niche positions in high-contaminant environments, offering specialized supplied air respirators and hoods for cleanroom and hazardous applications.

The Gerson Company focuses on affordability without compromising on filtration efficiency, targeting bulk procurement for construction and manufacturing industries. Market trends show a continued shift toward reusable and smart respirators, driven by regulatory enforcement and demand from sectors such as oil and gas, pharmaceuticals, and defense. Innovation in comfort design, filtration longevity, and digital monitoring systems is actively being pursued by all major vendors in this market.

In the USA and Europe, manufacturers rolled out smart, reusable respirators equipped with advanced filtration, comfort sensors, and connected capabilities. In Japan, new compact powered-air purifying units emerged for industrial and healthcare users. South Korean firms introduced lightweight air-purifying masks geared toward urban professionals. These innovations reflect elevated safety standards, digital integration, and regional diversification of RPE solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Product | SCBA, Powered, and Others |

| Application | Industrial, Medical & healthcare, Military & aviation, Public service, Consumer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Alpha Pro Tech, Bullard, Delta Plus Group, Honeywell International Inc., Mine Safety Appliances (MSA), RPB Safety LLC, and The Gerson Company |

| Additional Attributes | Dollar sales by product type (air‐purifying respirators, supplied air systems) and end-use segment (healthcare, industrial, oil & gas), demand dynamics driven by regulations and pandemic awareness, regional dominance in North America and rapid growth in Asia Pacific, innovation in smart RPE systems and breathable fan-assisted masks, environmental impact of reusable vs disposable designs, and emerging use cases in CBRN protection, wearable sensor-integrated systems, and frontline defense logistics. |

The global respiratory protective equipment market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the respiratory protective equipment market is projected to reach USD 18.9 billion by 2035.

The respiratory protective equipment market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in respiratory protective equipment market are scba, _apr, _unpowered, powered, _sar, _airline respirator and others.

In terms of application, industrial segment to command 35.0% share in the respiratory protective equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Analysers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Respiratory Pathogen Testing Kits Market Insights - Growth & Forecast 2025 to 2035

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Respiratory Gating Market Analysis – Size, Share & Forecast 2025-2035

Respiratory Device Market Insights – Growth & Forecast 2024-2034

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Home Respiratory Therapy Market – Growth & Forecast 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Human RSV Treatment Market Insights - Innovations & Forecast 2025 to 2035

Upper Respiratory Tract Infection Treatment Market

Germany Respiratory Inhaler Devices Market Insights – Demand, Trends & Outlook 2025-2035

Chronic Respiratory Diseases Treatment Market

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Unit-Dose Respiratory Medications Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA