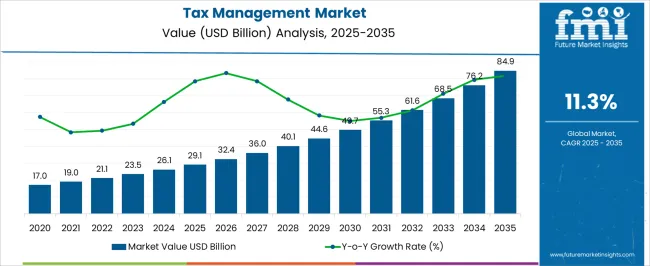

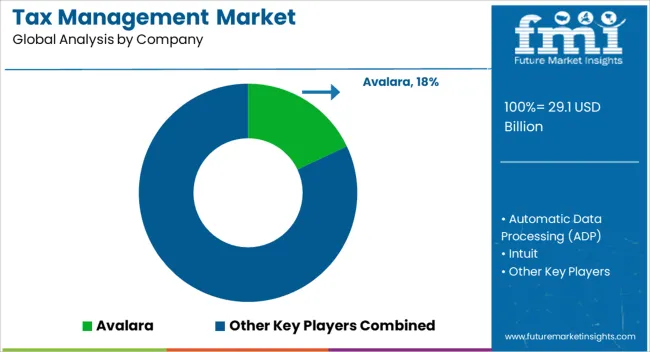

The Tax Management Market is estimated to be valued at USD 29.1 billion in 2025 and is projected to reach USD 84.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

| Metric | Value |

|---|---|

| Tax Management Market Estimated Value in (2025 E) | USD 29.1 billion |

| Tax Management Market Forecast Value in (2035 F) | USD 84.9 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The tax management market is evolving rapidly amid growing regulatory complexity, cross-border tax challenges, and increasing digitalization of financial workflows. Enterprises are prioritizing solutions that ensure compliance with local and international tax codes while also enhancing reporting accuracy and operational efficiency.

Heightened scrutiny from tax authorities and the global push for real-time reporting have compelled organizations to invest in technologies that automate filings, manage liabilities, and minimize audit risks. Additionally, advancements in AI, machine learning, and cloud-based platforms are enabling seamless integration with ERP and accounting systems, reducing manual errors and improving transparency.

The market is expected to further benefit from shifting tax regimes, mandates for e-invoicing, and demand for data-driven tax strategy optimization across industries and geographies.

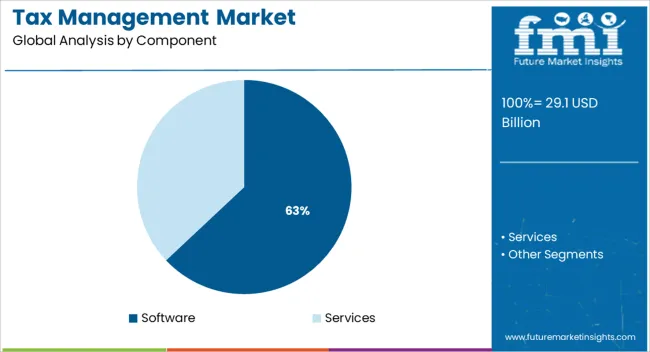

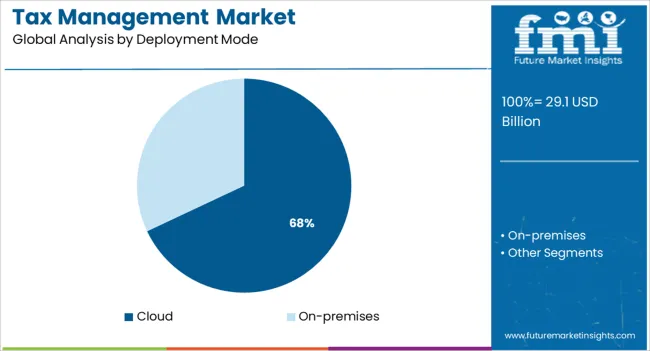

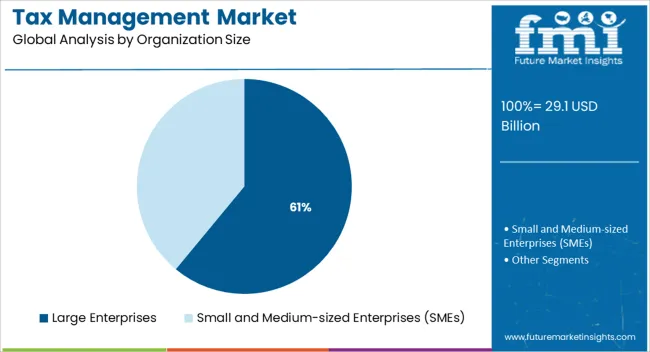

The market is segmented by Component, Deployment Mode, Organization Size, Tax Type, and Vertical and region. By Component, the market is divided into Software and Services. In terms of Deployment Mode, the market is classified into Cloud and On-premises. Based on Organization Size, the market is segmented into Large Enterprises and Small and Medium-sized Enterprises (SMEs). By Tax Type, the market is divided into Indirect Tax and Direct Tax. By Vertical, the market is segmented into Banking, Financial Services and Insurance (BFSI), Information Technology (IT) and Telecom, Manufacturing, Energy and Utilities, Retail, Healthcare and Life Sciences, Media and Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Software is projected to dominate the tax management market with 63.0% revenue share in 2025. This lead is being driven by the growing need for integrated digital solutions capable of handling complex tax computations, jurisdictional variations, and compliance reporting in real time.

Enterprises are moving away from manual and spreadsheet-based processes, seeking scalable and configurable platforms that automate tasks and offer decision-support analytics. Regulatory requirements for digital tax submissions and audit trails have further enhanced reliance on software-based tax management systems.

The ability to centralize tax operations, gain real-time insights, and facilitate error-free reporting has positioned software as the core component of enterprise tax infrastructure.

Cloud deployment is expected to contribute 68.0% of overall revenue in 2025, establishing it as the dominant deployment mode in the tax management market. This growth is being fueled by the flexibility, scalability, and cost-efficiency cloud platforms offer, especially for geographically distributed organizations.

Businesses are increasingly adopting cloud-based tax management systems for their ability to handle large volumes of data, ensure secure remote access, and deliver automatic software updates that comply with the latest tax regulations. Cloud infrastructure also enables seamless integration with other financial and ERP systems, improving workflow continuity and reducing system silos.

As remote work models and global operations expand, cloud-native platforms are becoming essential for real-time tax visibility and responsiveness.

Large enterprises are projected to account for 61.0% of the total market revenue in 2025, making them the largest contributor by organization size. This dominance is being attributed to the scale and complexity of tax obligations faced by large businesses operating across multiple jurisdictions.

The requirement for robust compliance mechanisms, audit-readiness, and high-volume transaction processing has made advanced tax management platforms a strategic necessity. Large enterprises also possess the financial and IT resources to implement and maintain enterprise-grade tax solutions that offer predictive analytics, risk management, and centralized oversight.

As multinational operations and M&A activities grow, large organizations continue to lead the adoption of automated, regulatory-aligned tax management frameworks.

A law amendment is an act of adding, altering or omitting a particular part of a law in an attempt to make it more effective. It is expected that the amendment of tax laws will pose a challenge to solution providers because they will need to consult tax experts and update their existing users'/subscribers' software as well.

This will increase the price of the solution and decrease the company's revenue. In such cases, the solution providers had to make certain changes in their offerings to be able to serve these customers. Consequently, solution providers face several challenges after every amendment made by governments all over the world.

Several industries use blockchain technology, which stores information about health and property, bank transactions, and supply chain. It is used in aviation, automotive, agriculture, manufacturing, and banking.

Blockchain technology has several major advantages such as improved accuracy, decentralization, security, and transparency. The application of blockchain technology for tax compliance will add a shared blockchain technology between taxpayers and tax administrators. As a result, the current method of exchanging tax information occasionally will be replaced by a real-time method.

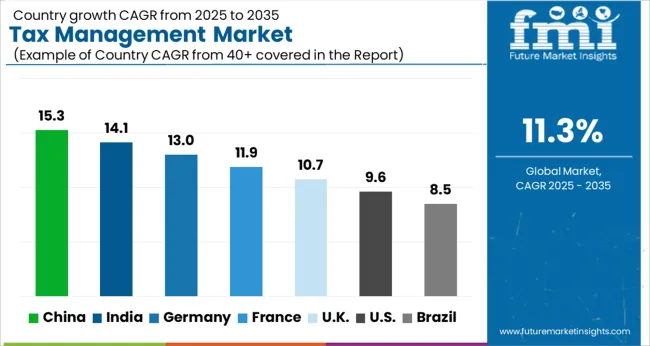

Due to the increasing level of tax enforcement in the region, as well as the increasing use of tax management software, Asia Pacific is predicted to record significant growth in terms of revenue during the forecast period.

It is expected that the growth in the BFSI sector and the frequent regulatory changes in developing countries like India and China in the region will drive the growth in the tax management market in the region.

As an example, the Indian government began charging Goods and Services Tax in July 2020 at five different rates: 0%, 5%, 12%, 18%, and 28%. The GST tax calculation is quite complex, so there has been an increase in the adoption of tax management software to automate tax calculations, which is expected to augment the growth of the tax management market in the Asia Pacific since GST tax calculation is quite complicated.

With the acquisition of Transaction Tax Resources, Inc. in October 2024, Avalara, Inc. will be able to integrate the leading technology behind tax returns with trustworthy tax data, thus enabling Avalara to expand its existing product line, introduce new capabilities, and expand its reach to new markets.

As per the Tax Management Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the Tax Management Market increased at around 13% CAGR.

The rising amount of financial transactions over different verticals due to digitization, the complexity of the existing tax system, and heightened surveillance of tax administrators are the key factors driving the expansion of the tax management industry. Furthermore, the usage of blockchain technology is projected to generate several prospects for tax management companies.

Technological advancements have boosted information interchange and cut transaction costs, which has increased transaction volume. Due to the increased usage of mobile phones and tablets, it has become feasible for everyone to conduct financial transactions using their smartphones or tablets.

Furthermore, the increased usage of web-based e-commerce and banking services and solutions increases the volume of online transactions internationally. This rise in web-based transactions is expected to fuel demand for different tax administration systems for sales tax, GST, and service tax, which will drive market expansion globally.

Market growth for even more cost-effective tax filing solutions is also predicted to boost the global tax management industry's revenue growth in the coming years. According to Income Tax Department guidelines, a taxpayer, whether an individual or a corporation, must use the stated format when providing data of uncontested accounts.

Income-tax return submitting software may handle the pre-defined procedures by assessing the tax number. This strategy eliminates the need for taxpayers to consider mistakes or discrepancies.

Additionally, growing demands for solutions for easier tax record keeping is likely to fuel revenue growth of the tax management market. When it relates to preserving important tax documents, most firms rely on record keeping, which may be simplified by adopting tax software.

Businesses may also utilize cloud-based tax software to securely save tax data from prior years on the cloud. Using such services, businesses may also have fast access to critical tax information for any fiscal year. Growing demands for tax computation software with high precision and fewer mistakes are likely to drive revenue growth in the global tax management market in the upcoming years.

During the projected period, North America held the largest share in the global Tax Management Market with a market size of around USD 25 Billion. Due to the constant changes and restrictions in the local taxation system, the North American market has seen remarkable development in the use of tax software.

The region's taxation system's complexity, along with disparities in tax and employment legislation, is offering significant potential for software application developers and key suppliers to participate in the tax management software industry.

Regional software suppliers have begun collaborating with third-party developers to create API-based products to improve the taxes system. As a result, firms in North America are adopting innovative technology and channels to stay competitive and update at an exponential rate.

The United States is expected to account for the largest market share of USD 84.9 Billion by the end of 84.932 with an expected CAGR of 10.6% by the end of 84.932.

The constantly changing taxation climate has also made it critical for tax authorities and taxpayers in the USA to remain updated on variables impacting the company's tax responsibilities. The United States Tax Forum has evolved into the ideal platform for tax software suppliers to develop their user base in the area.

Many countries' development in this region has slowed, making it more important for tax proposals to appeal to businesses. However, tax administrations are projected to conduct more frequent and aggressive fiscal audits to generate more substantial revenues; hence, the need for different technologies is predicted to rise in the region throughout the projection period.

Businesses are focusing on organic growth strategies such as product approvals and non-disclosure agreements. Acquisitions, partnerships, and collaborations are among the inorganic growth procedures seen in the company.

With increased demand in the worldwide industry, market players in the Tax Management industry are expected to benefit from growth prospects in the future. Some of the recent developments in the Tax Management market include:

Similarly, recent developments related to companies in Tax Management Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global tax management market is estimated to be valued at USD 29.1 billion in 2025.

The market size for the tax management market is projected to reach USD 84.9 billion by 2035.

The tax management market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in tax management market are software and services.

In terms of deployment mode, cloud segment to command 68.0% share in the tax management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Indirect Tax Management Market Growth - Trends & Forecast 2025 to 2035

Astaxanthin Market Analysis - Size, Share, and Forecast 2025 to 2035

In-Taxi Digital Signage Market Size and Share Forecast Outlook 2025 to 2035

Robotaxi Market Size and Share Forecast Outlook 2025 to 2035

Air Taxi Market Size and Share Forecast Outlook 2025 to 2035

Crypto Tax Software Market Size and Share Forecast Outlook 2025 to 2035

Demand for Astaxanthin in EU Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA