The global carcinoid tumor syndrome management market is estimated to reach USD 2.18 billion in 2025. It is anticipated to acquire a total valuation of USD 6.14 billion by 2035, registering a CAGR of 10.9% during the forecast period between 2025 and 2035.

In 2024, the worldwide Carcinoid tumor syndrome management industry experienced significant changes in demand and treatment patterns. Progress in diagnostic technology, especially the extensive use of sophisticated imaging modalities such as PET scans, enabled earlier and more precise diagnosis of carcinoid tumors.

This created a growing demand for targeted therapy, especially among high-risk patients. A number of pharmaceutical firms were dedicated to expanding the indications for somatostatin analogs, a pillar therapy for the control of carcinoid syndrome symptoms, with both prescription and patient compliance growth.

Moreover, a wave of new immunotherapies came into clinical trials, promising treatment breakthroughs in the future. Meanwhile, healthcare systems around the world placea high value on integrating multidisciplinary teams for the treatment of carcinoid syndrome, enhancing patient outcomes with more tailored care.

The industry will continue its strong growthin the upcoming decade. The clinical trials underway for next-generation therapies, such as new targeted therapies and combination strategies, will propel strong industry growth. Moreover, the use of minimally invasive surgical methods will decrease recovery times and enhance outcomes.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 2.18 billion |

| Industry Value (2035F) | USD 6.14 billion |

| CAGR (2025 to 2035) | 10.9% |

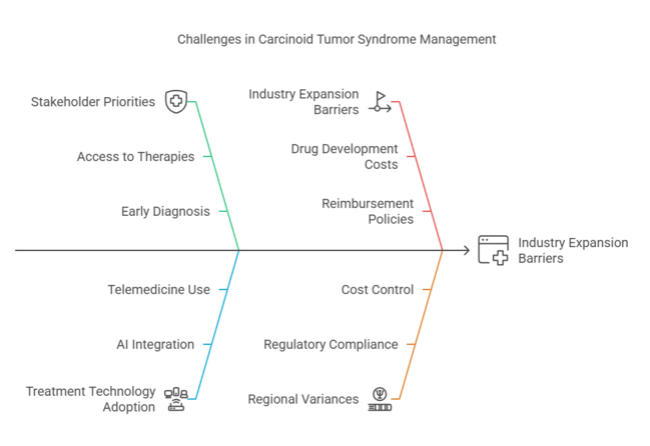

The management industry for Carcinoid Tumor Syndrome is in a solid growth pattern fuelled by progress in early diagnosis, new treatments, and the expanding use of targeted therapies. Prominent drivers include the rising incidence of carcinoid tumors, advancing imaging technologies, and the development of personalized therapy options. Pharma firms, especially those investing in somatostatin analogues and new immunotherapies, will reap the benefits, while healthcare practitioners need to adapt to changing treatment protocols to remain competitive.

Investment in Targeted and Immunotherapies

Prioritize investment in the development of targeted therapies and immunotherapies to respond to increasing demand for effective therapy, riding on the trend towards personalized medicine in the treatment of carcinoid tumors.

Early Detection and Diagnostic Technology Adoption

Emphasize fitting into industry changes by speeding up partnerships or acquisitions in cutting-edge diagnostic technologies, especially imaging devices that facilitate early-stage detection, enhancing treatment effectiveness and patient prognosis.

Enhance Alliances with Multidisciplinary Healthcare Teams

Build strategic alliances with hospitals and healthcare systems to incorporate multidisciplinary care teams for more tailored treatment strategies and investigate mergers and acquisitions to create integrated care offerings in the area of carcinoid tumor care.

| Risk | Probability & Impact |

|---|---|

| Regulatory Changes Impacting Treatment Approval | High Probability, High Impact |

| Disruptions in the Supply Chain for Pharmaceuticals | Medium Probability, High Impact |

| Market Saturation from Increased Competition | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Priority Item 1 | Run feasibility on partnerships with diagnostic tech firms for early-detection solutions. |

| Priority Item 2 | Initiate a feedback loop with pharmaceutical partners to refine targeted therapies. |

| Priority Item 3 | Launch an outreach program for multidisciplinary care teams in key industrie s to expand patient access. |

To stay ahead, companies should prioritize developing partnerships in diagnostic technology to lead the industry, with early tumor detection as a central offering in the pipeline of treatments. Through the coordination of R&D with the industry's need for personalized medicines and the building of stronger collaboration between multidisciplinary care teams, the company can position itself as a pioneer in the emerging Carcinoid tumor syndrome management industry. Regulatory alignment as a priority and planning for supply chain disruptions will be crucial to sustaining a competitive advantage.

| Countries/Region | Policies, Regulations & Certifications Impacting the Industry |

|---|---|

| United States (USA) |

|

| Western Europe (EU) |

|

| United Kingdom (UK) |

|

| Japan |

|

| South Korea |

|

The USA is the most profitable industry for carcinoid tumor syndrome management, driven by sophisticated healthcare infrastructure, strong research spending, and dominant pharmaceutical industry presence. The Food and Drug Administration (FDA) has expedited the approval of new treatments, such as somatostatin analogs and promising immunotherapies, under the Orphan Drug Act, rewarding firms with prolonged sector exclusivity.

However, heavy price controls under Medicare and Medicaid are challenging drug pricing. The increasing use of AI-driven diagnostics and precision medicine is further broadening treatment options. Despite expensive treatments, rising insurance coverage and patient support programs are improving accessibility. The industry will grow steadily, with clinical trials and biopharmaceutical investments being major drivers of growth.

FMI opines that the United States' carcinoid tumor syndrome management sales will grow at nearly 11.3% CAGR through 2025 to 2035.

In the UK, NICE and the NHS dictate the direction of the industry to some extent as they define cost-effectiveness for new drugs before approval. It suggests a good balance between innovation and regulation. The presence of solid research institutes and the growing importance of early diagnosis ensure that demand is building up for advanced imaging and biomarker-guided diagnostics.

Post-Brexit regulatory changes have created additional complexities, with firms needing to obtain MHRA (Medicines and Healthcare Products Regulatory Agency) approval independently of the EU. The UK's Early Access to Medicines Scheme (EAMS) is a welcome change, enabling quicker industry entry for life-saving medicines. Increased awareness and government support for rare diseases also help drive industry growth.

FMI opines that the United Kingdom's carcinoid tumor syndrome management sales will grow at nearly 10.5% CAGR through 2025 to 2035.

France has good growth prospects in the management of carcinoid tumor syndrome on account of its government-funded healthcare system and highly regulated pharmaceutical industry. The French National Authority for Health (HAS) is responsible for setting drug reimbursement, frequently negotiating prices aggressively.

France is at the forefront of precision medicine adoption, with projects such as the France Genomic 2025 Project to advance genomic research for tailored therapies. Drug approvals are overseen by the ANSM (National Agency for the Safety of Medicines and Health Products), which prioritizes patient safety but can retard industry entry for new therapies. Greater investment in AI-based diagnostics and targeted therapies, combined with a robust biopharmaceutical pipeline, is a key driver of industry growth.

FMI opines that France's carcinoid tumor syndrome management sales will grow at nearly 10.8% CAGR through 2025 to 2035.

Germany's industry for managing carcinoid tumor syndrome is forecasted to develop with strong healthcare funding and an established pharmaceutical industry. There is a fast-track approval procedure by the Federal Joint Committee (G-BA), enabling fast access to novel therapies.

Germany is the most active country in Europe in terms of clinical trials and R&D, especially for immunotherapies and somatostatin analogs. The AMNOG (Arzneimittelmarkt-Neuordnungsgesetz) pricing system of drugs provides fair prices but can slow drug industry entry.

Germany also enjoys high rates of adoption of AI-based diagnostics and personalized medicine, contributing to better early detection and treatment outcomes. An aging population and greater awareness of neuroendocrine tumors are increasing the demand for innovative therapies.

FMI opines that the Germany carcinoid tumor syndrome management sales will grow at nearly 11.0% CAGR through 2025 to 2035.

Italy's industry is anticipated to grow under the impact of a blend of public-funded healthcare and high-priced control regulations. Italy has the Italian Medicines Agency (AIFA), which appraises new therapies to be reimbursed, typically extending the industry debut of costly medication.

However, Italy possesses hotspots for the research of neuroendocrine tumors, such as in Milan and Rome, contributing to the improvement of carcinoid tumor management. The nation is spending on genomics and precision medicine, although take-up is behind Germany and France.

Although public healthcare coverage provides wide patient access, regulatory hold-ups and budget limitations could reduce growth. However, the rising prevalence of carcinoid tumors and investments in diagnostic imaging technology will propel long-term industry growth.

FMI opines that the Italy carcinoid tumor syndrome management sales will grow at nearly 10.3% CAGR through 2025 to 2035.

South Korea's carcinoid tumor syndrome management industryis the result of high industry growth spurred by government-sponsored healthcare policies and heavy investment in AI-based diagnostics. Drug approval is regulated by the Ministry of Food and Drug Safety (MFDS), which focuses on expedited approvals for orphan diseases. South Korea is a medical AI technology leader, with hospitals adopting AI-based tumor identification and remote monitoring systems.

But drug price controls by HIRA (Health Insurance Review & Assessment Service) restrict the scope for pharma companies to launch expensive therapies. The Seoul metropolitan region is a biotech research hub, and hence, new treatments are being adopted quickly. Telemedicine services will be expanded further, and more emphasis on precision medicine will fuel growth further.

FMI opines that the South Korea carcinoid tumor syndrome management sales will grow at nearly 11.2% CAGR through 2025 to 2035.

Japan is boosted by its robust universal healthcare system but hindered by government-controlled drug pricing. Japan's Pharmaceuticals and Medical Devices Agency (PMDA) has stringent regulation standards, with localized clinical trials needed for foreign-developed drugs. It slows down new drug approvals but provides patient safety. High demand for AI-powered diagnostics exists in Japan, with growing investments in machine learning-based tumor detection platforms.

However, under price ceilings determined by the National Health Insurance (NHI), pharmaceutical firms need to negotiate price cuts, negatively impacting profitability. Yet, dueto increasing awareness of cancer drives and sophisticated studies on peptide receptor radionuclide therapy (PRRT) treatments, Japan remains a profitable industry for growth over the long term.

FMI opines that Japan’s carcinoid tumor syndrome management sales will grow at nearly 10.6% CAGR through 2025 to 2035.

China is predicted to exhibit the fastest growth in the carcinoid tumor syndrome management industry, spurred by the development of healthcare infrastructure at a fast pace and increasing demand for sophisticated cancer therapies. The National Medical Products Administration (NMPA) has sped up the approval process for new cancer treatments, such as targeted therapy and immunotherapy. China's National Reimbursement Drug List (NRDL) includes a greater number of high-cost medicines, making them more accessible to patients.

The nation is heavily investing in biotech firms and AI-based medical treatments and is becoming a major participant in international clinical trials. There are still challenges that exist, like regional inequities in accessing healthcare and intellectual property issues. Overall,industry projections are very strong.

FMI opines that China’s carcinoid tumor syndrome management sales will grow at nearly 11.5% CAGR through 2025 to 2035.

Australia and New Zealand haveemphasised the early detection of cancer and government-sponsored healthcare initiatives. Australia has its Therapeutic Goods Administration (TGA) that guarantees the rigorous testing of new drugs, while New Zealand's Medsafe takes the same regulatory routes. Both nations provide universal healthcare coverage, which increases patients' access to new treatment. Nevertheless, reimbursement negotiations are long-drawn, slowing the introduction of expensive therapies.

Australia is becoming a clinical trials hub, especially for precision medicine, with government incentives luring biotech companies. The use of genomic sequencing to detect cancer at an early stage is increasing, and the area is becoming a leader in cutting-edge carcinoid tumor syndrome treatment.

FMI opines that the Australia-NZ carcinoid tumor syndrome management sales will grow at nearly 10.7% CAGR through 2025 to 2035.

The treatment of carcinoid tumor syndrome varies depending on whether the small intestine, lungs, rectum, appendix, stomach, liver, or other organs are most affected, and may include surgery, chemotherapy, or radiotherapy. This segment is projected to represent a CAGR of 7.2%, owing to the rising number of implementations of early detection and organ-specific treatment modes.

Still, small intestine tumors are the most common, and the focus on minimally invasive surgical procedures and targeted therapies is increasing. With the rising incidence of lung carcinoid tumors,especially in non-smokers, novel treatment strategies, including biological therapies and immune checkpoint inhibitors, are required for this malignancy.

Rectal and appendiceal carcinoid tumors are rare but have been increasingly diagnosed with advances in endoscopic screening. Demand for combination therapies with radiotherapy and biologics is on the rise, especially in metastatic cases, which often feature liver involvement. As the field of neuroendocrine tumor pathology becomes increasingly sophisticated, treatment strategies are likely to become quite diverse and individualized by all involved organs.

Specific treatment modalities for carcinoid tumor syndrome are chemotherapy, biological and radiotherapy, and all these play a vital role in the management of the disease. The estimated CAGR for this segment is 7.5%, which is in line with the constant innovations of target therapies and combination therapies.

For chemotherapy, which is usually given in the setting of quickly growing and high-stage tumors, the trend is to personalise the dose to decrease side effects while optimizing effectiveness. Biological therapy is emerging rapidly, with somatostatin analogs and targeted inhibitors being first-line agents for the management of tumor progression and hormone-mediated symptoms.

Gamma-based radiotherapy - specifically, peptide receptor radionuclide therapy (PRRT) - is increasingly recognized as an effective surgical tool for metastatic cases, leading to increased survival times with lower incidence of systemic adverse effects. Increasing case for multimodal regimen that may include multiple therapies including pharmaceutical and their combination with existing standards is projected to expand the avenue for new product development driving in the forecast period.

Somatostatin analogues (octreotide and lanreotide) account for the largest the syncope/pectoralis industry,whereas other drugs such as telotristat etiprate are entering the industry. CAGR for this segment is estimated to be 7.8%, attributed to the rise in uptake of biological therapies and next-generation formulations.

Octreotide remains the gold standard for symptomatic control, while long-acting preparations improve compliance. Lanreotide keeps becoming an emerging longer-acting alternative, widely used for its ease of administration. Telotristat etiprate is addressing the unmet need to enable control of over-functional diarrhea. Pipeline drug candidates, inclusive of new somatostatin analogs, combinations regimens, will change the dynamics of the industry further if they continue to be developed and are successful against existing drug treatments.

Oral and injectable routes are still the key routes of administration of carcinoid tumor syndrome treatments that meet distinct patient needs.The CAGR for the segment is anticipated at 6.5%, as growing patient preference for convenience and efficacy to drive demand. Injections, particularly long-acting octreotide and lanreotide,are the most widely used therapies owing to symptom control and long-term compliance.

Technological developments in self-administration devices have made injectables more convenientfor patients and have lessened the reliance on clinical settings. The oral pipeline is booming, with telotristat etiprate potential game-changing symptom control.

Understanding drug delivery systems, like sustained-release oral formulations, will increase bioavailability and improve patient experience, which are attracting investments from pharmaceutical companies. As drug delivery technological advancements continue, oral therapies are anticipated to continue receiving increased adoption, cementing themselves as a competitive alternative to injectable therapies.

The carcinoid tumor syndrome management industry is fragmented, characterized by several pharmaceutical firms competing by means of innovation, strategic alliance, and geographical expansion. Major companies emphasize creating superior therapies, value-for-money pricing, and partnerships to increase their market share.

In October 2024, Teva Pharmaceutical Industries Ltd. introduced the initial generic equivalent of Sandostatin® LAR Depot (octreotide acetate for injectable suspension) in the United States, providing an affordable alternative for the treatment of acromegaly and carcinoid syndrome-related severe diarrhea. Previously, in April 2024, the FDA widened the approval for Lutathera® (lutetium Lu 177 dotatate) to children 12 years and older with somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors, enhancing treatment options in younger patients.

The somatostatin analogue market is currently dominated by Novartis AG, which commands a leading 32% market share. Central to this dominance is its flagship drug, Sandostatin LAR, widely regarded as the gold standard therapy for managing neuroendocrine tumors and acromegaly. Novartis’s long-standing investment in clinical research and physician education has solidified Sandostatin’s position as the default choice across major healthcare markets.

Following closely is Ipsen, holding approximately 25% of the market. Ipsen’s success is largely attributable to the strong clinical performance of Somatuline Depot (lanreotide). Its demonstrated efficacy in controlling symptoms of neuroendocrine tumors, along with an expanding footprint in North America and emerging markets, has made it a serious challenger to Novartis's dominance.

Pfizer accounts for around 18% of the market, propelled by its acquisition of Array BioPharma and its continued focus on developing next-generation targeted therapies. Although Pfizer’s portfolio in somatostatin analogues is smaller compared to Novartis and Ipsen, its aggressive pipeline strategies and integration of Array’s research capabilities are positioning it for future gains.

Lexicon Pharmaceuticals holds about 10% of the market with its innovative product, Xermelo (telotristat ethyl) - notable as the first oral therapy specifically approved for treating carcinoid syndrome diarrhea. This unique niche focus has allowed Lexicon to carve out a defensible segment within a market otherwise dominated by injectable treatments.

Approximately 8% of the market share is attributed to Advanced Accelerator Applications, a subsidiary of Novartis, driven by the success of Lutathera, a radiopharmaceutical therapy targeting gastroenteropancreatic neuroendocrine tumors. Lutathera represents an important evolution in treatment, offering a precision-based therapeutic option beyond traditional somatostatin analogues.

Meanwhile, Sun Pharmaceutical Industries is gradually expanding its presence with a portfolio of generic alternatives to established therapies, capturing roughly 5% of the market. Sun’s low-cost offerings have gained traction particularly in cost-sensitive regions, though they currently lack the clinical prestige of innovator brands.

Finally, smaller biotech firms experimenting with immunotherapies and novel targeted molecular therapies collectively account for the remaining 2% of the market. While their share is modest today, the disruptive potential of their research pipelines could reshape market dynamics over the next decade if they succeed in bringing superior treatments to market.

Chemotherapy, biological therapy, and radiotherapy are commonly used.

Octreotide, lanreotide, and telotristat etiprate are widely used.

North America, Europe, and Asia-Pacific are key regions of growth.

Innovative therapies, like long-acting injections and targeted biologics, enhance symptom control and survival rates.

Companies like Novartis, Ipsen, and Teva are leading in treatment development.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Organ Affected, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Drug , 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Drug , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Organ Affected, 2023 to 2033

Figure 26: Global Market Attractiveness by Therapy Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Drug , 2023 to 2033

Figure 28: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Drug , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 55: North America Market Attractiveness by Organ Affected, 2023 to 2033

Figure 56: North America Market Attractiveness by Therapy Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Drug , 2023 to 2033

Figure 58: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Drug , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Organ Affected, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Therapy Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Drug , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Drug , 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Attractiveness by Organ Affected, 2023 to 2033

Figure 116: Europe Market Attractiveness by Therapy Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Drug , 2023 to 2033

Figure 118: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Drug , 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Organ Affected, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Therapy Type, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Drug , 2023 to 2033

Figure 148: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Drug , 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Organ Affected, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Therapy Type, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Drug , 2023 to 2033

Figure 178: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Drug , 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Organ Affected, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Therapy Type, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Drug , 2023 to 2033

Figure 208: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Organ Affected, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Drug , 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Organ Affected, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Organ Affected, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Organ Affected, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Drug , 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Drug , 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Drug , 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 235: MEA Market Attractiveness by Organ Affected, 2023 to 2033

Figure 236: MEA Market Attractiveness by Therapy Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Drug , 2023 to 2033

Figure 238: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 239: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carcinoid Syndrome Diarrhea Treatment Market

Carcinoid Syndrome Management Market

Tumor Endoprostheses Market Analysis Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Tumor Profiling

Tumor Tracking Systems Market

Tumor-sequencing Blood Testing Market

Tumor Embolization Market

Intratumoral Cancer Therapies Market Size and Share Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Wilms Tumor Treatment Market

Mast Cell Tumor Treatment Market Trends – Analysis & Forecast 2024-2034

Germ Cell Tumors Market

Metastatic Bone Tumor Treatment Market

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

NTRK Fusion Gene Positive Advanced Solid Tumors Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA