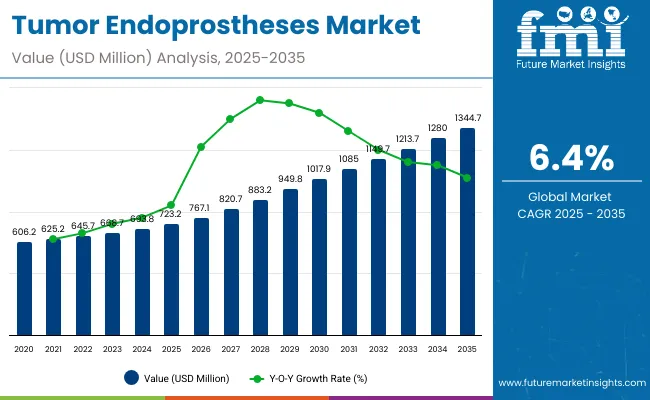

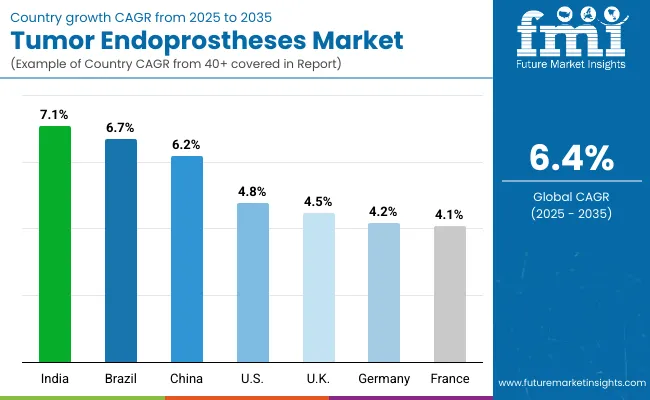

The global Tumor Endoprostheses Market is projected to reach a valuation of USD 723.2 million by 2025 and USD 1,344.7 million by 2035. This indicates a decade-long increase of USD 621.5 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 6.4%, representing a 1.86X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 723.2 million |

| Industry Value (2035F) | USD 1,344.7 million |

| CAGR (2025 to 2035) | 6.4% |

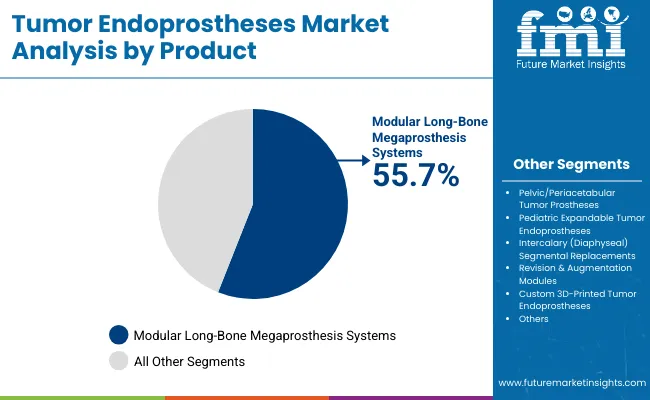

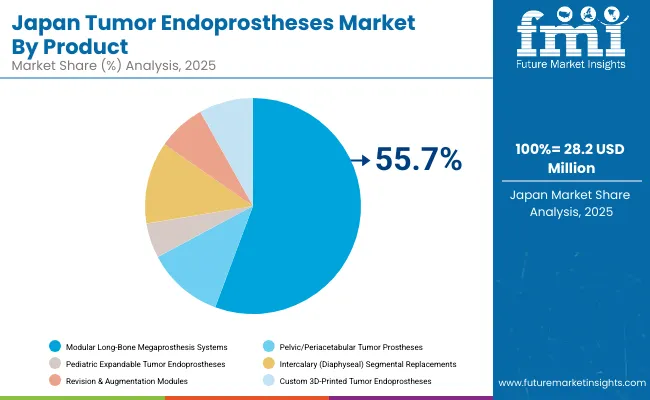

During the first five-year period from 2025 to 2030, the total market value is projected to expand from USD 723.2 million to USD 1,017.9million, adding USD 294.7 million which contributes to 47.4% of the total decade growth. Modular Long-Bone Megaprosthesis Systems will remain dominant holding around 55.0% share of the category by 2030 due to their modularity, intraoperative flexibility, and high clinical adoption. The Intercalary (Diaphyseal) Segmental Replacements segment will remain stable at ~13.0% share by 2030, while Pelvic/Periacetabular Tumor Prostheses will continue to account for over 11% of total share.

The second half from 2030 to 2035 contributes USD 326.8 million which is equal to 52.6% of the total growth as the market jumps from USD 1017.9 million to USD 1,344.7 million. This acceleration is powered by widespread adoption of limb-salvage surgeries and increasing penetration in emerging markets. Modular Long-Bone Megaprostheses and Pelvic/Periacetabular Prostheses together capture a large share of above 66.0% by the end of the decade. Pediatric Expandable Tumor Endoprostheses will hold around 9%, while Custom 3D-Printed Prostheses and Revision & Augmentation Modules together contribute nearly 16% share, surpassing many conventional fixed designs.

From 2020 to 2024, the overall Tumor Endoprostheses Market grew from USD 606.2 million to USD 693.8 million. Leading manufacturers such as Stryker, Zimmer Biomet, and DePuySynthes together account for nearly 52.5% of global revenue through modular limb-salvage systems and oncology-focused reconstruction implants. Key strategies deployed by these players include the development of modular megaprosthesis platforms, silver-coated infection-resistant technologies, and collaborations with cancer research institutes to expand clinical adoption.

In 2025, the Tumor Endoprostheses Market is expected to reach a value of approximately USD 723.2 million, driven by a shift from conventional limb amputation to advanced limb-salvage reconstructions. Growth will be propelled by rising incidence of bone tumors, improved surgical techniques, and expanding reimbursement for oncology prosthetics. Hospitals and cancer research institutes are increasingly adopting modular megaprostheses, expandable pediatric implants, and 3D-printed custom solutions to enhance patient survival, restore mobility, and improve quality of life outcomes.

The Tumor Endoprostheses Market is seeing strong growth because healthcare systems worldwide are prioritizing limb-salvage surgeries over amputations, aiming to preserve function and improve long-term patient outcomes. Major drivers include rising incidence of primary and metastatic bone tumors, advancements in modular megaprosthesis designs, and increasing surgeon preference for reconstructive solutions backed by favorable survival rates. Innovations such as silver-coated infection-resistant implants, non-invasive expandable pediatric prostheses, and patient-specific 3D-printed reconstructions are improving durability, reducing revision rates, and restoring quality of life for oncology patients.

The pandemic further highlighted the need for advanced reconstructive procedures as cancer treatments resumed, accelerating adoption of reliable tumor prostheses. As hospitals, cancer institutes, and specialty orthopedic centers prioritize functional recovery and evidence-based oncology care, manufacturers delivering infection-resistant surfaces, modular intraoperative flexibility, and personalized implant solutions are capturing robust demand. In rapidly growing healthcare markets such as Asia Pacific and Latin America, expanding oncology infrastructure and government investment in advanced surgical care are further boosting adoption.

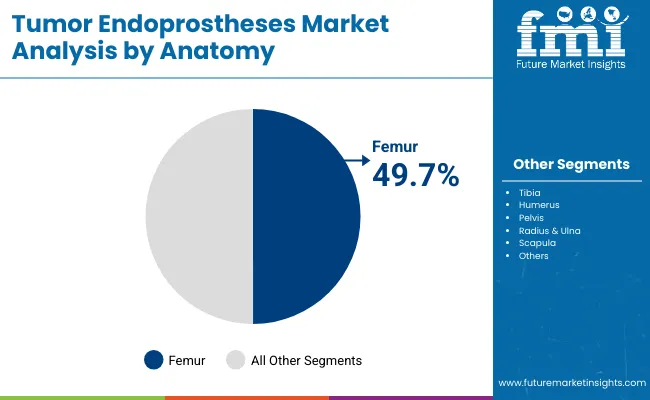

The market is segmented by product, anatomy, procedure, and end-user. Product categories include Modular Long-Bone Megaprosthesis Systems, Pelvic/Periacetabular Tumor Prostheses, Pediatric Expandable Tumor Endoprostheses, Intercalary (Diaphyseal) Segmental Replacements, Revision & Augmentation Modules, and Custom 3D-Printed Tumor Endoprostheses, highlighting the diverse reconstruction solutions driving adoption. Anatomy classification covers Femur, Tibia, Humerus, Pelvis, Radius & Ulna, and Scapula, reflecting the most common tumor-affected skeletal sites requiring prosthetic intervention.

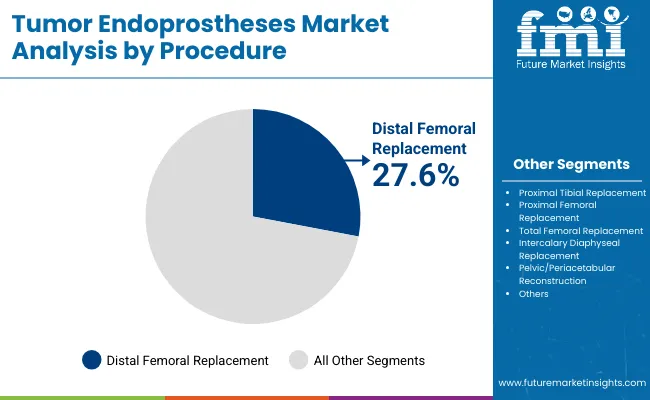

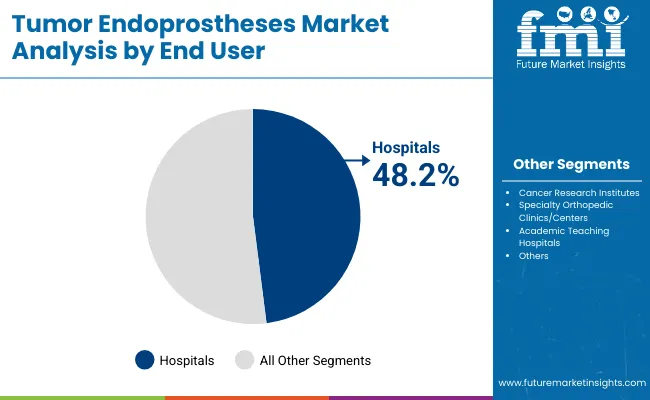

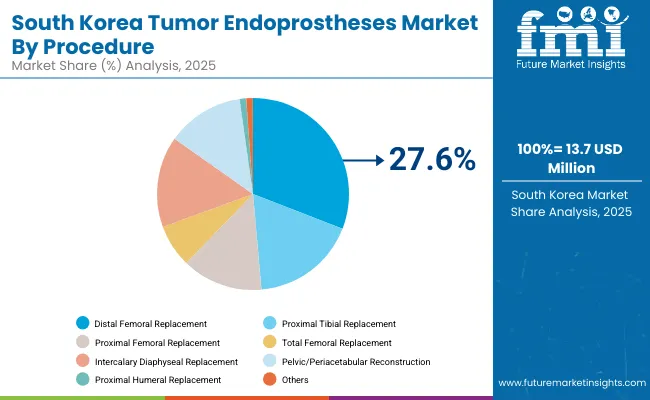

By procedure, segmentation includes Distal Femoral Replacement, Proximal Tibial Replacement, Proximal Femoral Replacement, Total Femoral Replacement, Intercalary Diaphyseal Replacement, Pelvic/Periacetabular Reconstruction, Proximal Humeral Replacement, and Others, each representing critical limb-salvage techniques in oncology practice. Based on end user, the segmentation spans Hospitals, Cancer Research Institutes, Specialty Orthopedic Clinics/Centers, and Academic Teaching Hospitals, underscoring the clinical settings where tumor endoprostheses are widely utilized.

| Product | Market Share (%) |

|---|---|

| Modular Long-Bone Megaprosthesis Systems | 55.7% |

| Pelvic/ Periacetabular Tumor Prostheses | 11.5% |

| Pediatric Expandable Tumor Endoprostheses | 5.2% |

| Intercalary (Diaphyseal) Segmental Replacements | 12.3% |

| Revision & Augmentation Modules | 7.2% |

| Custom 3D-Printed Tumor Endoprostheses | 8.1% |

Modular Long-Bone Megaprosthesis Systems are expected to retain a dominant position and are projected to contribute 55.7% in 2025, owing to their versatility in replacing large bone segments and providing intraoperative flexibility. Their adoption has been driven by the rising global emphasis on limb-salvage surgery for bone tumors and the proven clinical outcomes of modular reconstruction platforms. Preference has been increasingly shown for these systems due to their ability to allow rapid assembly, adaptability to different anatomies, and reduced surgical time compared to traditional grafting methods.

Product uptake has also been supported by surgeon training programs and oncology center protocols recommending modular systems for complex tumor resections. These factors have collectively contributed to the sustained demand for modular long-bone solutions over conventional graft-based reconstructions in high-volume hospitals and cancer research institutes.

| By Anatomy | Market Share (%) |

|---|---|

| Femur | 49.7% |

| Tibia | 18.6% |

| Humerus | 11.9% |

| Pelvis | 12.8% |

| Radius & Ulna | 2.8% |

| Scapula | 4.2% |

Femur reconstructions have emerged as the leading anatomical site and are projected to hold around 49.7% share in 2025 due to the high incidence of osteosarcoma and metastatic tumors affecting the distal and proximal femur. Clinical evidence highlights that femoral involvement accounts for nearly half of all long-bone tumor cases, making endoprosthetic replacement a critical surgical intervention.

Hospitals and cancer research institutes increasingly favor femoral megaprostheses because they provide immediate stability, restore load-bearing function, and reduce recovery time compared to biological grafting. Additionally, advances in modular distal and proximal femoral replacement systems, along with improvements in fixation methods, have supported their sustained adoption. These factors collectively reinforce the dominance of femoral reconstructions over tibial, humeral, and pelvic tumor sites in global oncology practices.

| By Procedure | Market Share (%) |

|---|---|

| Distal Femoral Replacement | 27.6% |

| Proximal Tibial Replacement | 15.8% |

| Proximal Femoral Replacement | 12.2% |

| Total Femoral Replacement | 6.4% |

| Intercalary Diaphyseal Replacement | 13.7% |

| Pelvic/ Periacetabular Reconstruction | 11.6% |

Distal Femoral Replacement is expected to remain the leading procedure, contributing around 27.6% in 2025 due to the high prevalence of osteosarcoma and metastatic lesions in the distal femur. Most limb-salvage surgeries involving the femur are concentrated at this site, making distal replacements the standard approach in oncology-focused orthopedic practice. Demand has been reinforced by modular megaprosthesis platforms that allow intraoperative flexibility, faster surgical time, and predictable long-term outcomes.

Investments in hospital oncology units and cancer research centers have supported widespread use of distal femoral implants, particularly in tertiary care facilities. Adoption is also driven by favorable clinical evidence showing better functional recovery and reduced complication rates compared to biological reconstruction techniques. These factors collectively ensure that distal femoral replacement will continue to dominate over other procedures such as proximal tibial, pelvic, and humeral reconstructions in high-volume cancer care settings.

| By End User | Market Share (%) |

|---|---|

| Hospitals | 48.20% |

| Cancer Research Institutes | 27.90% |

| Specialty Orthopedic Clinics/Centers | 11.90% |

| Academic Teaching Hospitals | 12.00% |

Hospitals are expected to remain the largest end user segment, contributing around 48.2% in 2025, driven by their role as the primary centers for oncology surgeries and limb-salvage interventions. Most complex tumor resections and high-risk reconstructive procedures are concentrated in hospital settings, necessitating access to modular megaprostheses, revision systems, and custom 3D-printed implants. Demand has been reinforced by hospital-based multidisciplinary cancer units and orthopedic oncology teams that prioritize advanced prosthetic solutions to improve survival and functional outcomes.

Investments in hospital infrastructure, particularly in oncology surgical departments and specialized orthopedic divisions, have further supported the widespread adoption of tumor endoprostheses. Procurement decisions are also influenced by reimbursement frameworks and public health policies that encourage the integration of high-value surgical implants in tertiary and academic hospitals, reinforcing their leadership as the largest end user base in this market.

Rising Preference for Limb-Salvage Over Amputation Driving Adoption

A key driver in the Tumor Endoprostheses Market is the accelerating clinical and institutional shift toward limb-salvage surgeries in place of traditional amputations. With osteosarcoma and metastatic bone tumors often affecting the femur, tibia, and humerus, surgeons increasingly rely on modular megaprostheses to restore structural integrity and preserve mobility.

Advances such as silver-coated prostheses, non-invasive lengthening pediatric implants, and modular fixation technologies have enhanced long-term survivorship and minimized infection rates, making prosthetic reconstruction more favorable than biological grafting. The rising adoption of multidisciplinary oncology protocols in hospitals and cancer research institutes further strengthens demand for durable, revision-friendly implant systems. As patient survival improves due to better chemotherapy regimens, the need for advanced prosthetic reconstructions to maintain quality of life is becoming a major growth catalyst.

High Cost and Limited Accessibility in Emerging Markets

A significant barrier for this market is the high cost and infrastructure dependency of advanced tumor endoprostheses. Premium megaprosthesis platforms with modular or silver-coated components can cost substantially more than conventional implants, limiting accessibility in mid-tier hospitals across emerging economies.

Additionally, successful outcomes require specialized surgical expertise and advanced oncology centers, creating disparities between developed and developing regions. The burden of revision surgeries further elevates lifetime treatment costs. This combination of affordability constraints and uneven clinical infrastructure slows adoption, particularly outside large tertiary hospitals.

Expansion of Custom 3D-Printed Endoprostheses as a Key Trend

One of the most prominent trends is the rapid expansion of 3D-printed, patient-specific endoprostheses for anatomically complex reconstructions. Traditional modular systems are limited in addressing pelvic, scapular, or irregular diaphyseal resections. With additive manufacturing, implants can be tailored to match exact patient anatomy, improving implant fit, reducing surgical time, and enhancing post-operative function.

Hospitals are increasingly collaborating with implant manufacturers and engineering firms to integrate CAD/CAM workflows directly into surgical planning. This transition from standard modules to personalized 3D-printed designs positions digital manufacturing as a strategic frontier in the market. As more clinical data validates improved outcomes and lower revision rates, adoption of custom 3D-printed tumor prostheses is expected to accelerate, making them a key differentiator for vendors competing in high-complexity cases.

Asia Pacific is emerging as the fastest-growing region in the Tumor Endoprostheses Market, projected to expand at a CAGR of 7.8% in China and 8.2% in India between 2025 and 2035. India’s growth is fueled by the rapid expansion of tertiary cancer hospitals, the adoption of limb-salvage surgery protocols, and government-backed oncology care initiatives.

China’s market is supported by large-scale public sector investment in oncology infrastructure, rising surgical volumes for bone tumors, and local manufacturing by companies such as AK Medical and Beijing Chunlizhengda. Regional growth is further reinforced by expanding healthcare infrastructure in Tier 1 and Tier 2 cities, as well as government-funded modernization of cancer treatment centers, which are prioritizing advanced reconstructive implants.

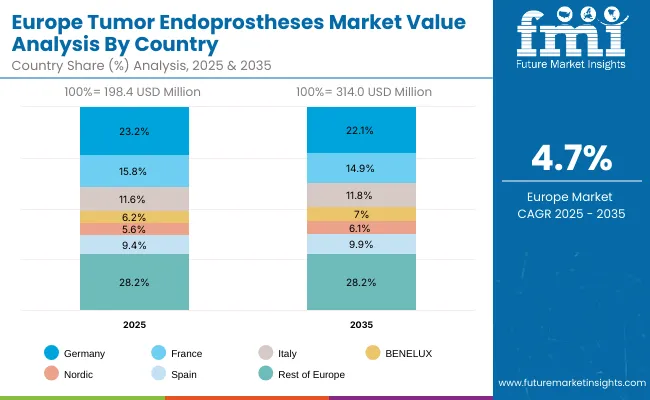

Europe is expected to grow steadily at a CAGR of 6.0% through 2035. Germany, the largest market, is forecast at 5.5% CAGR, supported by adoption of silver-coated megaprostheses to reduce infection risk. France, growing at 6.2% CAGR, benefits from public hospital oncology reforms, while the UK at 5.0% CAGR continues to expand through NHS-funded modernization of bone cancer treatment facilities. Markets such as Italy and Spain are also showing increased adoption of modular femoral and tibial prostheses. Harmonized oncology protocols, expanding training in orthopedic oncology, and access to EU reimbursement frameworks are strengthening Europe’s demand.

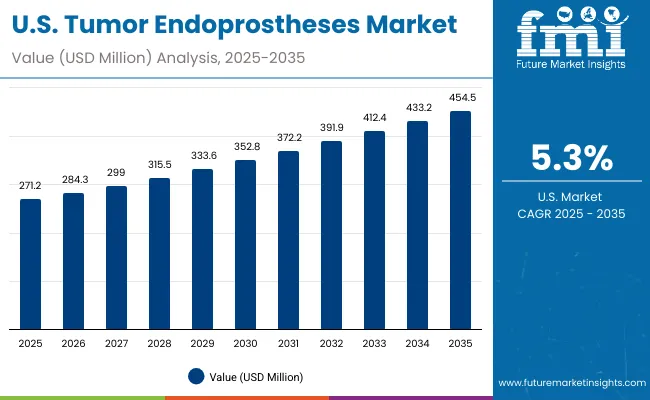

North America remains a mature but innovation-driven market, with the USA projected to grow at 5.3% CAGR between 2025 and 2035. Growth is driven by the replacement of older generation implants with advanced modular tumor systems, integration of silver-coated prostheses, and the availability of non-invasive pediatric expandable implants. Rising cancer survival rates, along with an increase in surgical volume at tertiary hospitals and academic centers, are accelerating adoption. Federal and private investments in oncology infrastructure, combined with clinical preference for limb-salvage over amputation, are reinforcing the USA as the largest global market for tumor endoprostheses.

The USA market is forecasted to grow at a 5.3% CAGR, primarily driven by the rising incidence of osteosarcoma and metastatic bone lesions, which require advanced limb-salvage solutions. Hospitals are replacing legacy implants with modular megaprosthesis systems and adopting silver-coated designs to minimize infection risk. Growth is further fueled by the adoption of pediatric expandable prostheses and increased procedural volumes in specialized cancer centers. Multidisciplinary oncology teams in tertiary hospitals are reinforcing the use of tumor endoprostheses as the standard of care for bone tumor reconstruction.

The UK market is projected to grow at a 5.0% CAGR through 2035, supported by NHS-funded investments in oncology treatment infrastructure. Expansion of the “New Hospital Programme” and national cancer strategies are catalyzing modernization of limb-salvage care. Rising volumes of bone tumor surgeries and pressure to reduce amputation rates are increasing adoption of modular megaprostheses. NHS trusts are increasingly prioritizing cost-efficient procurement of standardized prosthetic systems, with emphasis on modular designs that can be adapted intraoperatively.

The German market is expected to grow at a 5.5% CAGR, driven by increased automation and strong reimbursement frameworks for orthopedic oncology. Under Germany’s Krankenhauszukunftsgesetz (Hospital Future Act), investments are directed toward advanced oncology care, including modular and silver-coated megaprostheses. German hospitals, known for high surgical volumes and stringent infection control, are accelerating adoption of revision-ready modular platforms and expanding use of distal femoral and proximal tibial replacements, which dominate clinical demand. Additionally, the focus on ergonomic surgical protocols and long-term survivorship data is shaping procurement strategies.

The Tumor Endoprostheses Market in India is projected to grow at a CAGR of 8.2%, making it one of the fastest-growing markets globally between 2025 and 2035. Growth is being fueled by rapid expansion of tertiary cancer hospitals, oncology departments in medical colleges, and private orthopedic oncology centers across Tier 1 and Tier 2 cities.

Rising incidence of bone cancers, along with improved access to chemotherapy and imaging, is creating greater demand for limb-salvage reconstructions. Indian hospital groups are increasingly adopting modular long-bone prostheses and expanding access to pediatric expandable implants to improve survival outcomes. Local suppliers are entering the market with cost-effective options, while global companies are supplying modular and revision-ready systems tailored for India’s diverse clinical settings.

The China market is forecast to grow at a CAGR of 7.8% through 2035, supported by aggressive oncology infrastructure investment under the Healthy China 2030 policy. Rising surgical volumes, improved early cancer detection, and government procurement programs are accelerating adoption of distal femoral and proximal tibial replacements in Class A hospitals.

Urban tertiary hospitals are increasingly incorporating silver-coated prostheses and custom 3D-printed pelvic implants for complex resections. Domestic players such as AK Medical and Beijing Chunlizhengda are scaling manufacturing to meet demand, while joint ventures with international companies are supplying advanced modular platforms.

The Japan market is projected to reach USD 28.2 million in 2025 and grow at a CAGR of 4.4% through 2035. Modular Long-Bone Megaprostheses dominate with 55.5% share, reflecting surgeon preference for standardized modular systems that allow intraoperative flexibility. Japan’s aging population and growing incidence of metastatic bone tumors are key drivers, alongside strong emphasis on functional recovery. The Ministry of Health, Labour and Welfare has reinforced oncology care funding, supporting adoption of expandable pediatric prostheses and custom 3D-printed designs in specialized cancer centers.

The South Korea market is estimated at USD 13.7 million in 2025, projected to grow at a CAGR of 5.6%. Distal Femoral Replacement leads with 28.5% share, followed by Proximal Tibial Replacement at 15.8% and Total Femoral Replacement at 12.2%. Growth is supported by Ministry of Health and Welfare initiatives to strengthen oncology surgery capabilities and improve access to limb-salvage solutions. South Korea’s leading cancer centers are deploying revision-ready modular implants and trialing custom pelvic prostheses for complex resections.

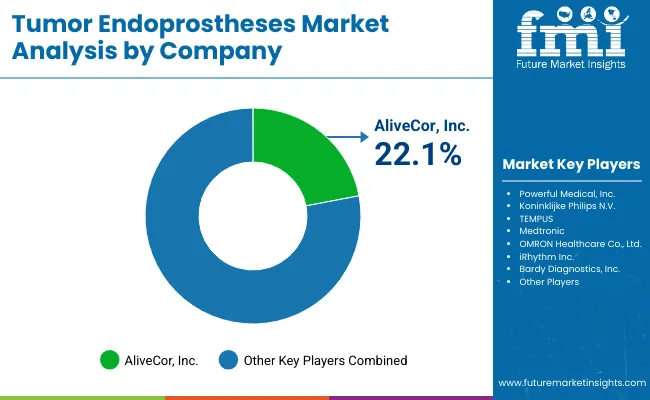

The Tumor Endoprostheses Market is moderately consolidated, with global leaders, established European firms, and strong regional manufacturers competing across oncology-driven limb-salvage and reconstructive procedures. Stryker leads with an estimated 22.4% share, driven by its extensive modular tumor reconstruction portfolio, including femoral, tibial, and pediatric expandable systems. The company leverages its oncology-focused R&D and strong presence in orthopedic oncology centers across North America and Europe to maintain leadership.

Zimmer Biomet and DePuySynthes are close contenders, offering broad tumor reconstruction platforms integrated into their revision arthroplasty ecosystems. Their strategies emphasize modularity, revision readiness, and silver-coated prostheses to reduce infection risks. Onkos Surgical is strengthening its presence in the USA market with oncology-specific platforms and partnerships with cancer research institutes, targeting niche but high-growth patient segments.

Established European players such as Waldemar Link GmbH & Co. KG and implantcast GmbH specialize in modular megaprostheses with customizable solutions, strong adoption in Germany and broader European markets, and long-term clinical validation. Their innovations in infection-resistant coatings and modular expandability make them competitive in high-complexity reconstructions.

Regional leaders including United Orthopedic Corporation (Taiwan), Kyocera (Japan), Beijing Chunlizhengda, and AK Medical (China) play a critical role in Asia-Pacific expansion. These companies leverage cost competitiveness, strong local distribution, and increasing investment in 3D-printed tumor endoprostheses to gain share in fast-growing emerging markets.

As the market evolves, competitive differentiation is shifting from basic modular systems toward silver-coated implants, 3D-printed anatomically precise designs, and pediatric expandable platforms, positioning innovation and surgeon partnerships as key success factors.

Key Developments:

| Item | Value |

|---|---|

| Market value (2025) | USD 723.2 million |

| Product type | Modular Long-Bone Megaprosthesis Systems, Pelvic/ Periacetabular Tumor Prostheses, Pediatric Expandable Tumor Endoprostheses, Intercalary (Diaphyseal) Segmental Replacements, Revision & Augmentation Modules, and Custom 3D-Printed Tumor Endoprostheses |

| Anatomy | Femur, Tibia, Humerus, Pelvis, Radius & Ulna, and Scapula |

| Procedure | Distal Femoral Replacement, Proximal Tibial Replacement, Proximal Femoral Replacement, Total Femoral Replacement, Intercalary Diaphyseal Replacement, Pelvic/ Periacetabular Reconstruction, Proximal Humeral Replacement, and Others |

| end user | Hospitals, Cancer Research Institutes, Specialty Orthopedic Clinics/Centers, and Academic Teaching Hospitals |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Stryker, Zimmer Biomet, DePuy Synthes, Onkos Surgical, Waldemar Link GmbH & Co. KG, implantcast GmbH, United Orthopedic Corporation, Kyocera, Beijing Chunlizhengda, AK Medical |

| Additional Attributes | Dollar sales by application and regions, Adoption trends of Modular and Custom Endoprostheses, Rising demand in Cancer Research Institutes, Growing demand across Specialty Orthopedic Clinics and Academic Hospitals |

The global Tumor Endoprostheses market is estimated to be valued at USD 723.2 million in 2025.

The market size for Tumor Endoprostheses is projected to reach USD 1,344.7 million by 2035.

The Tumor Endoprostheses market is expected to grow at a CAGR of 6.4% during this period.

Key product types include Modular Long-Bone Megaprosthesis Systems, Pelvic/Periacetabular Tumor Prostheses, Pediatric Expandable Tumor Endoprostheses, Intercalary (Diaphyseal) Segmental Replacements, Revision & Augmentation Modules, and Custom 3D-Printed Tumor Endoprostheses.

The Femur segment is projected to command 49.7% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Tumor Profiling

Tumor Tracking Systems Market

Tumor-sequencing Blood Testing Market

Tumor Embolization Market

Intratumoral Cancer Therapies Market Size and Share Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Wilms Tumor Treatment Market

Carcinoid Tumor Syndrome Management Market Forecast & Analysis for 2025 to 2035

Mast Cell Tumor Treatment Market Trends – Analysis & Forecast 2024-2034

Germ Cell Tumors Market

Metastatic Bone Tumor Treatment Market

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

NTRK Fusion Gene Positive Advanced Solid Tumors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA