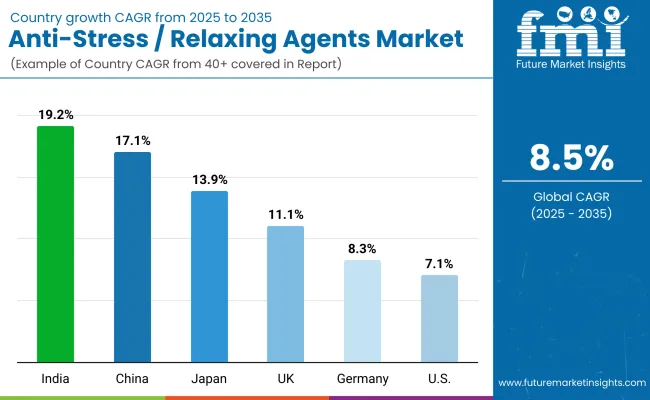

The Anti-Stress / Relaxing Agents Market is anticipated to reach USD 1,103.2 million in 2025, advancing to USD 2,502.1 million by 2035. This expansion reflects an overall rise of USD 1,398.9 million across the decade, equivalent to more than doubling in size with a compound annual growth rate of 8.5%. A strong trajectory is indicated as adoption of stress-relief actives broadens across personal care formulations, with ingredient suppliers positioned to capture higher-value opportunities through innovation and clinically substantiated outcomes.

Anti-Stress / Relaxing Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Stress / Relaxing Agents Market Estimated Value in (2025E) | USD 1,103.2 million |

| Anti-Stress / Relaxing Agents Market Forecast Value in (2035F) | USD 2,502.1 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

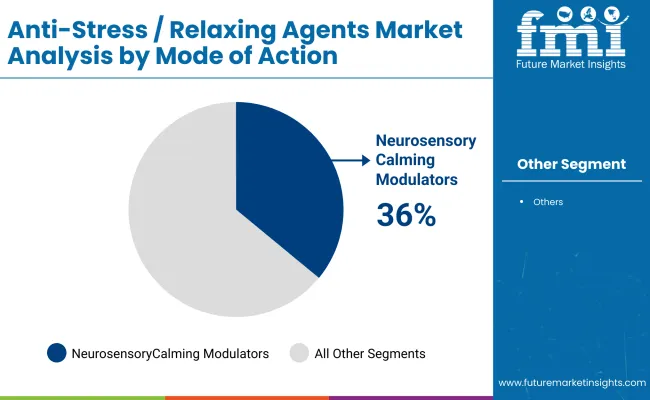

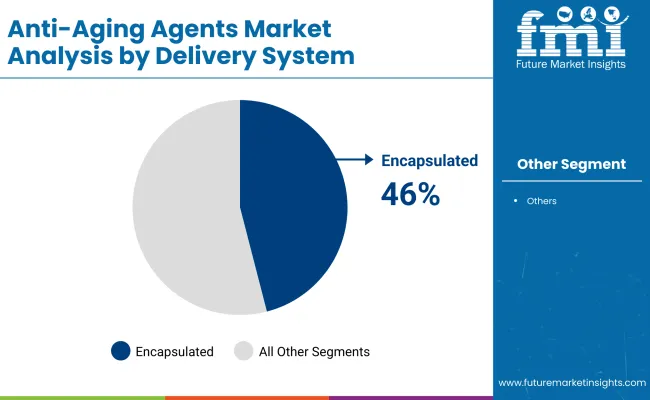

During the initial five-year phase from 2025 to 2030, the market is projected to expand from USD 1,103.2 million to USD 1,661.4 million, representing an addition of USD 558.2 million, or nearly 40% of the total decade growth. This steady gain is expected to be supported by the growing reliance on neurosensory calming modulators, which will dominate with a 36.0% share in 2025, alongside encapsulated delivery systems leading with a 46.0% share. These segments are projected to gain preference as formulators demand stability, improved bioavailability, and superior sensory outcomes.

In the second half of the period, from 2030 to 2035, the market is forecast to accelerate from USD 1,661.4 million to USD 2,502.1 million, adding USD 840.7 million, which accounts for nearly 60% of total decade expansion. Growth in this phase is expected to be reinforced by stronger penetration in high-growth regions such as China and India, both of which exhibit double-digit CAGR. The outlook signals increasing competitive intensity among ingredient suppliers, with biotechnology-derived solutions and advanced encapsulation technologies likely to drive premiumization and long-term revenue gains.

From 2025 to 2030, the market is projected to expand steadily from USD 1,103.2 million to USD 1,661.4 million, supported by the rising demand for neurosensory modulators and encapsulated delivery systems. Natural-origin sourcing is anticipated to maintain importance as formulators prioritize clean-label claims.

Between 2030 and 2035, a sharper acceleration is expected, with value reaching USD 2,502.1 million. Expansion in this phase is projected to be led by strong adoption in China and India, alongside biotechnology-derived ingredients that provide scalability and sustainability. Competitive positioning is expected to rely on clinically validated efficacy, transparent sourcing, and advanced delivery systems, while partnerships and consolidation are anticipated to shape the evolving supplier landscape.

Growth in the Anti-Stress / Relaxing Agents Market is being driven by the increasing integration of wellness-focused ingredients into personal care and body care formulations. Rising consumer awareness of stress management and demand for sensorial experiences have encouraged formulators to adopt neurosensory calming modulators and encapsulated delivery systems. Advances in biotechnology are enabling consistent, scalable production of active compounds, while clean-label and botanical sourcing preferences are reinforcing adoption across global markets. Rapid growth in Asia, particularly in China and India, is being fueled by rising disposable incomes and cultural alignment with natural calming solutions. Premiumization trends in North America and Europe are expected to sustain ingredient demand supported by regulatory validation and clinical substantiation. Expansion into spa and professional channels is reinforcing ingredient uptake, while continuous innovation in microencapsulation and sensory neuroscience is anticipated to unlock new application areas. These factors collectively position the market for steady long-term growth.

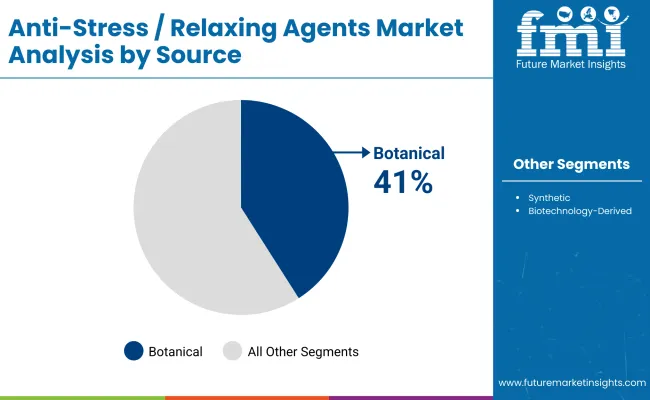

The Anti-Stress / Relaxing Agents Market is segmented by mode of action, source, and delivery system, reflecting the diverse pathways through which calming and relaxing benefits are incorporated into formulations. Neurosensory modulators are shaping innovation in stress-relief actives, while botanical and biotechnology-derived sources are guiding procurement and sustainability strategies. Encapsulation is redefining delivery efficiency, ensuring actives remain stable and release effectively during application. These segmentation layers highlight the evolving priorities of formulators as demand rises for scientifically validated, sensorially engaging, and sustainably sourced raw materials. Each segment offers distinct growth levers, with suppliers expected to tailor portfolios to match clinical validation requirements, regional sourcing preferences, and delivery system compatibility with emerging formulation technologies.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Neurosensory calming modulators | 36.0% |

| Others | 64.0% |

Neurosensory calming modulators are projected to contribute 36.0% of the market value in 2025, equal to USD 397.15 million, positioning them as a leading mode of action. Their growth is being reinforced by rising reliance on neuro-cosmetic science, which allows measurable improvements in mood and sensory perception. These actives are expected to gain wider acceptance as formulators increasingly demand ingredients backed by clinical and instrumental data. The balance of demand is held by other stress-relief actives, representing 64.0% of the market, and these will continue to support breadth in applications where multi-functional performance is valued. Neurosensory modulators are expected to remain central to premium innovation pipelines, securing preference in high-value formulations across skincare and body care.

| Source | Market Value Share, 2025 |

|---|---|

| Botanical | 41% |

| Others | 59.0% |

Botanical ingredients are projected to capture 41.0% of the market in 2025, representing USD 452.31 million, driven by sustained demand for natural-origin solutions. These actives are being favored by formulators responding to consumer preferences for clean-label, plant-based claims and transparent sourcing. Regional sourcing strategies are anticipated to strengthen the appeal of botanicals, particularly in Asia, where traditional remedies align well with stress-relief formulations. Other sources, representing 59.0% of the market at USD 650.89 million, will remain critical for consistency, scalability, and cost efficiency. Biotechnology-derived actives in this category are expected to expand rapidly as supply stability and sustainability credentials become central to procurement decisions. Botanical ingredients are projected to reinforce premium positioning across spa, professional, and personal care channels.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 46% |

| Others | 54.0% |

Encapsulated delivery systems are estimated to account for 46.0% of the market in 2025, equal to USD 507.47 million, underscoring their role in ensuring stability and controlled release of active compounds. Their prominence is being driven by the ability to deliver sensory efficacy while minimizing irritation, making them attractive for both premium skincare and body care formulations. Encapsulation is expected to remain the preferred system where long-lasting performance and improved bioavailability are demanded. Other delivery formats, accounting for 54.0% or USD 595.73 million, will retain relevance in cost-sensitive formulations but are expected to face gradual substitution. As technological advances refine encapsulation, suppliers leveraging these innovations are projected to capture competitive advantage in both established and emerging markets.

Complex regulatory pathways, evolving consumer expectations, and the pursuit of scientific substantiation are shaping the trajectory of the Anti-Stress / Relaxing Agents Market, even as suppliers are presented with opportunities to expand ingredient adoption across diverse formulation categories globally.

Clinical Validation as a Procurement Catalyst

Ingredient demand is being reinforced by the need for validated performance claims, where measurable outcomes on neurosensory modulation and mood enhancement are increasingly expected by formulators. Procurement teams are aligning sourcing with suppliers who provide peer-reviewed studies, instrumental data, and consumer-perception evidence to substantiate efficacy. This shift is not only elevating the credibility of premium raw materials but is also reshaping supplier selection criteria. Investments in clinical testing facilities and partnerships with academic institutions are being deployed to create proof-driven differentiation, positioning suppliers with credible data as long-term partners for leading global brands.

Biotechnology as a Strategic Enabler

Biotechnology-derived solutions are being positioned as strategic growth levers, enabling scalability, consistency, and sustainability in raw material supply. The ability to engineer actives with reduced variability and minimal environmental impact is allowing suppliers to mitigate climate-related sourcing risks. This trend is driving portfolio diversification, with biotech pathways expected to complement botanicals while meeting regulatory and consumer demands for traceability. Integration of fermentation-based production and synthetic biology is anticipated to create novel active profiles tailored for stress-relief functions, opening opportunities for suppliers to engage in co-creation with formulators seeking innovation at the intersection of efficacy and sustainability.

| Country | CAGR |

|---|---|

| China | 17.1% |

| USA | 7.1% |

| India | 19.2% |

| UK | 11.1% |

| Germany | 8.3% |

| Japan | 13.9% |

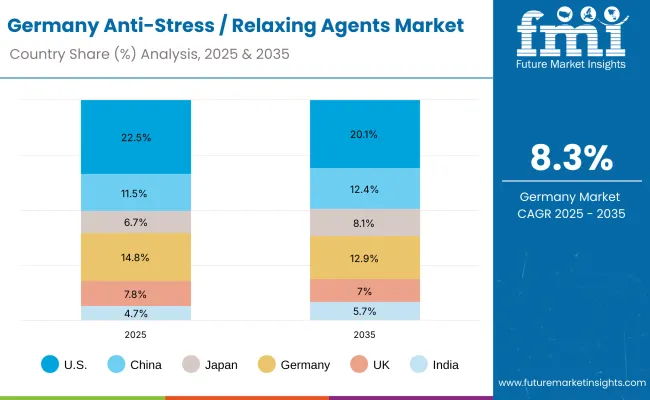

The Anti-Stress / Relaxing Agents Market is projected to advance unevenly across major economies, with adoption patterns shaped by cultural perceptions of wellness, regulatory frameworks, and investment in formulation science. Asia is expected to emerge as the fastest-expanding region, led by India at 19.2% CAGR and China at 17.1% CAGR. India’s trajectory is anticipated to be reinforced by rapid urbanization, rising disposable incomes, and increasing reliance on botanical-based actives aligned with Ayurveda-inspired personal care. China’s acceleration is expected to be driven by strong consumer affinity for mood-enhancing formulations and government support for biotechnology platforms that scale consistent ingredient supply.

In Japan, growth of 13.9% CAGR is expected to reflect premiumization in wellness-linked cosmetics and the adoption of neuro-cosmetic actives by established brands catering to aging populations. Europe demonstrates a steady expansion, with Germany at 8.3% CAGR, the UK at 11.1%, and the broader Europe at 10.3%, supported by stringent quality standards and rising focus on sustainable sourcing. In the USA, growth at 7.1% CAGR indicates maturity, with innovation expected to be more incremental, focusing on encapsulation, biotech-derived actives, and clean-label formulations. Collectively, these dynamics underscore a multipolar growth landscape, where regional strategies tailored to consumer behavior and compliance frameworks will determine long-term supplier competitiveness.

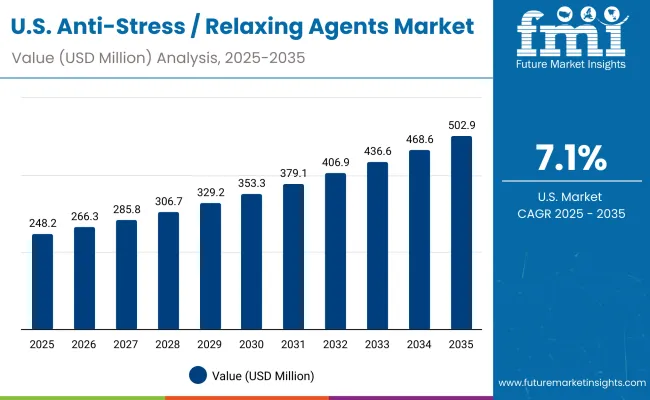

| Year | USA Anti-Stress / Relaxing Agents Market (USD Million) |

|---|---|

| 2025 | 248.22 |

| 2026 | 266.38 |

| 2027 | 285.87 |

| 2028 | 306.79 |

| 2029 | 329.23 |

| 2030 | 353.32 |

| 2031 | 379.17 |

| 2032 | 406.91 |

| 2033 | 436.68 |

| 2034 | 468.63 |

| 2035 | 502.92 |

The Anti-Stress / Relaxing Agents Market in the United States is projected to grow at a CAGR of 7.1% from 2025 to 2035, expanding from USD 248.22 million in 2025 to USD 502.92 million by 2035. Expansion is anticipated to be reinforced by consistent demand for neurosensory calming modulators, clean-label ingredients, and encapsulated delivery systems that align with premium skincare and body care categories. Ingredient procurement strategies are being influenced by rising requirements for clinical validation, regulatory alignment, and sustainability certifications.

Innovation pipelines are being advanced by biotechnology-derived actives that provide supply stability and transparency, ensuring compatibility with evolving formulator expectations. Broader wellness adoption in personal care is being complemented by growing use in spa and professional care applications. Opportunities for suppliers are expected to emerge through collaborations with North American formulators that prioritize encapsulation, bio-based sourcing, and advanced sensorial outcomes.

The Anti-Stress / Relaxing Agents Market in the United Kingdom is projected to grow at a CAGR of 11.1% between 2025 and 2035, supported by rising integration of wellness-driven formulations across premium skincare and body care categories. Growth is expected to be underpinned by strong demand for neurosensory modulators, particularly in products targeting sleep quality and relaxation. Clean-label claims and transparent sourcing are anticipated to dominate procurement decisions, creating opportunities for botanical actives aligned with sustainability narratives. Encapsulation technologies are expected to gain traction as formulators emphasize efficacy and safety in sensitive skin applications. The professional spa sector is projected to serve as a critical adoption channel, reinforcing ingredient visibility in luxury wellness offerings.

The Anti-Stress / Relaxing Agents Market in India is anticipated to expand at a CAGR of 19.2% from 2025 to 2035, making it the fastest-growing global market. Expansion is expected to be fueled by rising disposable incomes, urbanization, and alignment of botanical actives with Ayurveda-inspired formulations. Local formulators are anticipated to prioritize natural-origin ingredients, supported by government focus on promoting traditional medicine systems within modern applications. Encapsulation and micro-delivery systems are expected to provide formulators with opportunities to differentiate offerings in highly competitive segments. Demand from middle-income consumers is anticipated to push volume growth, while premium segments are expected to favor clinically validated actives. India is projected to serve as a pivotal growth hub, attracting international suppliers seeking scalable demand.

The Anti-Stress / Relaxing Agents Market in China is forecast to grow at a CAGR of 17.1% between 2025 and 2035, supported by strong consumer affinity for mood-enhancing and neuro-cosmetic formulations. Biotechnology-derived actives are expected to be prioritized, ensuring stable supply chains and consistency for large-scale formulation needs. Government initiatives promoting biotechnology are anticipated to accelerate commercial adoption, reinforcing the positioning of China as a global leader in advanced ingredient manufacturing. Botanical actives will remain central, particularly where traditional Chinese medicine concepts align with stress-relief benefits. Growth is also expected to be supported by rapid expansion of spa, wellness, and premium skincare categories, which are creating new opportunities for suppliers offering substantiated efficacy.

| Country | 2025 |

|---|---|

| USA | 22.5% |

| China | 11.5% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 7.8% |

| India | 4.7% |

| Country | 2035 |

|---|---|

| USA | 20.1% |

| China | 12.4% |

| Japan | 8.1% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

The Anti-Stress / Relaxing Agents Market in Germany is projected to advance at a CAGR of 8.3% from 2025 to 2035, supported by stringent regulatory frameworks and strong demand for sustainable, clean-label ingredients. Growth is expected to be driven by European compliance standards that favor transparent sourcing, traceability, and eco-certifications. Neurosensory modulators are anticipated to gain traction within high-value formulations as brands seek to link measurable relaxation effects with dermatological efficacy. Biotechnology-derived ingredients are likely to receive preference as supply stability and scalability align with Germany’s advanced manufacturing base. Wellness integration in both professional spa and home-use categories is expected to support steady demand. Germany is projected to remain a core market for suppliers seeking compliance-driven growth and innovation leadership.

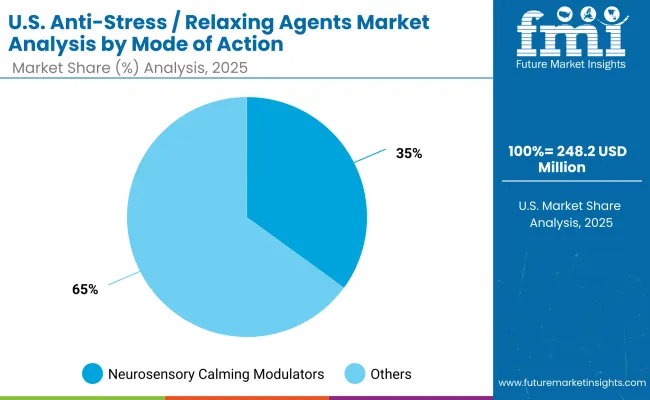

| USA By Mode of Action | Market Value Share, 2025 |

|---|---|

| Neurosensory calming modulators | 35% |

| Others | 64.9% |

The Anti-Stress / Relaxing Agents Market in the USA is projected at USD 248.22 million in 2025. Neurosensory calming modulators contribute 35% (USD 87.13 million), while other mechanisms account for 64.9% (USD 161.09 million), reflecting a diversified approach to ingredient adoption. This segmental balance highlights how neurosensory pathways are becoming central to premium formulations where measurable calming effects are demanded, while broader multifunctional actives continue to support mainstream applications. Growing reliance on encapsulation and biotechnology-derived actives is expected to complement neurosensory solutions by ensuring efficacy, safety, and stability. Professional spa formats and advanced skincare are anticipated to act as catalysts for modulators, while high-volume body care and bath products are projected to sustain the larger “others” category. Over the decade, neurosensory modulators are expected to gradually increase share as substantiated efficacy drives procurement decisions.

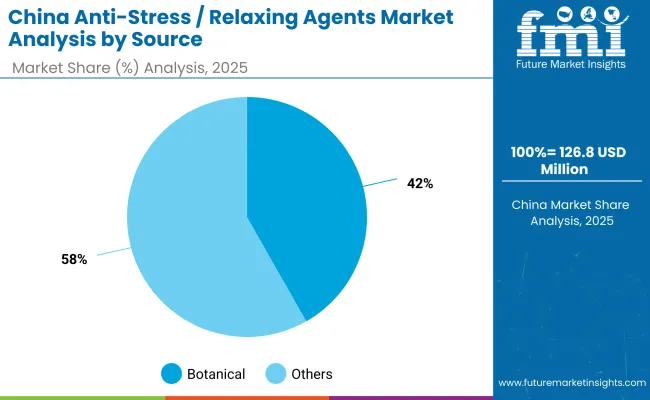

| China By Source | Market Value Share, 2025 |

|---|---|

| Botanical | 42% |

| Others | 58.5% |

The Anti-Stress / Relaxing Agents Market in China is projected at USD 126.87 million in 2025. Botanical ingredients contribute 42% (USD 52.65 million), while other sources, including biotechnology-derived and synthetic actives, account for 58.5% (USD 74.22 million). This distribution underscores the country’s dual reliance on traditional natural ingredients and advanced modern technologies. Botanical inputs are expected to benefit from strong cultural alignment with traditional Chinese medicine practices, reinforcing consumer trust in natural remedies for stress relief. At the same time, biotech-derived actives are anticipated to expand more rapidly, supported by government-backed innovation programs and the need for scalable, consistent supply chains. Sustainability and traceability are projected to become critical factors for procurement decisions as local and global brands integrate advanced sourcing practices. Over the forecast period, China is expected to position itself as both a producer and consumer hub, blending natural heritage with cutting-edge science.

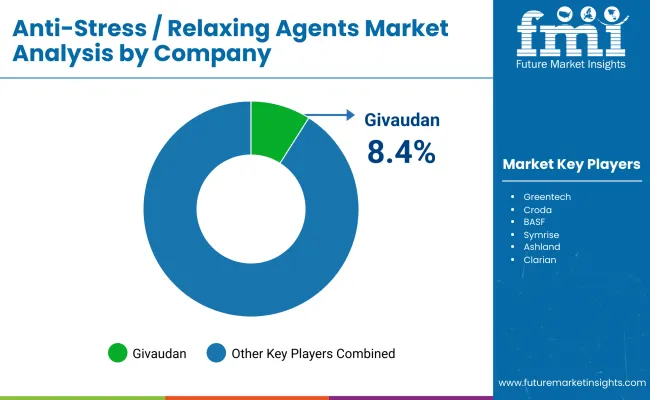

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.4% |

| Others | 91.6% |

The Anti-Stress / Relaxing Agents Market is moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across B2B ingredient use-cases. Global suppliers such as Givaudan, Symrise, Croda, and DSM-Firmenich are understood to command meaningful shares through broad portfolios of neurosensory modulators, biotechnology-derived actives, and advanced encapsulation. Strategies are being oriented toward proof-led differentiation, including clinical substantiation, neuro-sensory instrumentation, and end-to-end technical support for formulators.

Established mid-sized players Ashland, Clariant, Seppic, Mibelle Biochemistry, Rahn, and Greentech are expected to accelerate adoption via botanicals, biotech fermentation routes, and delivery technologies tailored to sensitive-skin and sleep-adjacent applications. Agility in customization, rapid sampling, and clean-label positioning is being used to win briefs with regional brands and professional spa lines.

Specialists focusing on regional botanicals and micro-delivery systems are anticipated to compete through sustainability credentials, traceability, and rapid reformulation support. Competitive differentiation is shifting from single-ingredient claims toward integrated ecosystems that combine verified efficacy, transparent sourcing, and compatibility with encapsulation, enabling premium pricing and reduced irritation risk. Over the forecast, partnerships and selective M&A are expected to consolidate capabilities in biotech production and sensory analytics.

Key Developments in Anti-Stress / Relaxing Agents Market

| Item | Value |

|---|---|

| Market Value & Forecast | USD 1,103.2 million (2025E); USD 2,502.1 million (2035F); 8.5% CAGR (2025-2035) |

| Mode of Action | Neurosensory calming modulators; Others |

| Source | Botanical; Others (biotechnology-derived and synthetic) |

| Delivery System | Encapsulated; Others |

| Physical Form (Type) | Solution/concentrate; Powder; Dispersion/gel |

| Applications / End-use | Leave-on face care; Body care & sleep care; Bath & shower; Facial mists & essences; Spa/professional |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; Japan; Germany; United Kingdom; Europe (aggregate) |

| Key Companies Profiled | Givaudan; Symrise; Croda; DSM-Firmenich; Ashland; Clariant; Seppic; Mibelle Biochemistry; Rahn; Greentech |

| Additional Attributes | 2025 segment splits: Neurosensory modulators 36.0% (USD 397.15 million) vs Others 64.0% (USD 706.05 million); Botanical 41.0% (USD 452.31 million) vs Others 59.0% (USD 650.89 million); Encapsulated 46.0% (USD 507.47 million) vs Others 54.0% (USD 595.73 million). USA trajectory: USD 248.22 million (2025) → USD 502.92 million (2035). Competitive lead: Givaudan 8.4% global share (2025). Sustainability, clinical validation, and advanced encapsulation are expected to drive premiumization and long-term contracts. |

The global Anti-Stress / Relaxing Agents Market is estimated to be valued at USD 1,103.2 million in 2025.

The market size for the Anti-Stress / Relaxing Agents Market is projected to reach USD 2,502.1 million by 2035.

How much will be the Anti-Stress / Relaxing Agents Market growth between 2025 and 2035?

The key product types in the Anti-Stress / Relaxing Agents Market are neurosensory calming modulators, botanical actives, biotechnology-derived ingredients, synthetic sources, and encapsulated delivery systems.

In terms of mode of action, neurosensory calming modulators are projected to command 36.0% share in the Anti-Stress / Relaxing Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Stress Feed Supplements Market – Growth, Demand & Livestock Health

I/O-Link Market Analysis - Size, Share, and Forecast 2025 to 2035

Breaking Down Market Share in the I/O-Link Industry

CMO/CDMO Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

CMO/CDMO Market Analysis - Size, Share, and Forecast 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

IaaS/Hosting Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Stoma/Ostomy Care Market Growth - Trends & Forecast 2025 to 2035

Vacuum/Gas Flushing And Sealing Machine Market

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

802.15.4/ZigBee Market Size and Share Forecast Outlook 2025 to 2035

Starches/Glucose Market

EDM Oils/Fluids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA