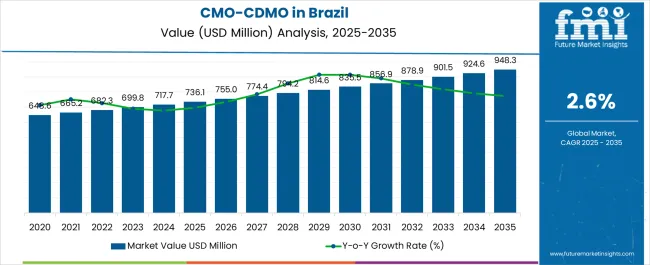

The CMO/CDMO Industry Analysis in Brazil is estimated to be valued at USD 736.1 million in 2025 and is projected to reach USD 948.3 million by 2035, registering a compound annual growth rate (CAGR) of 2.6% over the forecast period.

| Metric | Value |

|---|---|

| CMO/CDMO Industry Analysis in Brazil Estimated Value in (2025 E) | USD 736.1 million |

| CMO/CDMO Industry Analysis in Brazil Forecast Value in (2035 F) | USD 948.3 million |

| Forecast CAGR (2025 to 2035) | 2.6% |

The CMO/CDMO industry in Brazil is experiencing robust growth. Increasing pharmaceutical outsourcing, rising biologics development, and expansion of contract manufacturing capabilities are driving demand. Current dynamics are characterized by the adoption of both small and large molecule production services, regulatory support for biotechnology manufacturing, and strategic partnerships between local and global players.

Investment in state-of-the-art facilities, capacity expansion, and compliance with international quality standards are enhancing operational efficiency. The future outlook is shaped by growing demand for specialized manufacturing services, technological advancements in drug development, and the expansion of biologics pipelines, which are expected to elevate outsourcing requirements.

Growth rationale is anchored on the ability of CMOs/CDMOs to provide flexible, cost-effective, and scalable manufacturing solutions, support regulatory compliance, and accelerate time-to-market for pharmaceutical products Continued focus on high-quality production infrastructure, innovation in process development, and strategic collaborations is expected to sustain market expansion and strengthen Brazil’s position in the global contract manufacturing landscape.

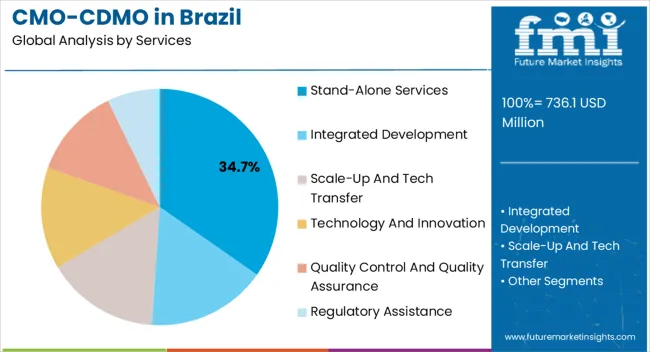

The stand-alone services segment, holding 34.7% of the services category, has been leading due to its ability to provide flexible and specialized manufacturing and development support without long-term integration commitments. Its adoption has been supported by pharmaceutical companies seeking cost-efficient solutions and rapid scale-up capabilities.

Regulatory compliance and high-quality standards have reinforced confidence in these services. The segment has benefited from strategic investments in process development, analytical capabilities, and technology transfer support, ensuring operational efficiency and reliability.

Growth is further driven by increasing outsourcing trends in biologics and complex therapeutics Continued focus on expanding service offerings, improving turnaround times, and enhancing client partnerships is expected to maintain the segment’s market share and reinforce its competitive position in the Brazilian CMO/CDMO landscape.

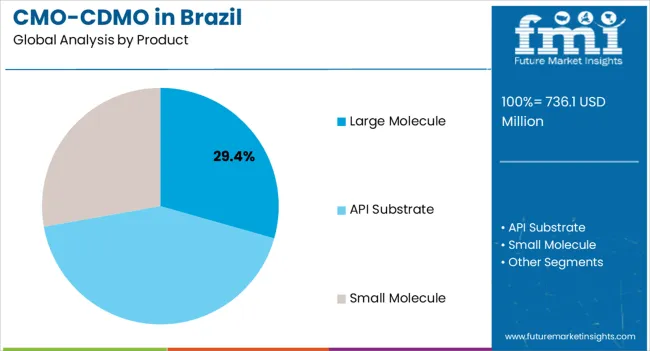

The large molecule segment, representing 29.4% of the product category, has maintained dominance due to increasing biologics development and the need for specialized manufacturing expertise. Its adoption has been supported by demand for monoclonal antibodies, recombinant proteins, and other complex therapeutics.

Advanced production processes, adherence to quality standards, and scalability have reinforced preference among pharmaceutical developers. Technological enhancements in purification, formulation, and analytical testing have improved production efficiency and product consistency.

The segment’s growth is further underpinned by investment in state-of-the-art bioprocessing facilities and regulatory alignment with international standards Continued pipeline expansion for biologics and increased outsourcing of large molecule production are expected to sustain the segment’s market share and drive overall industry growth.

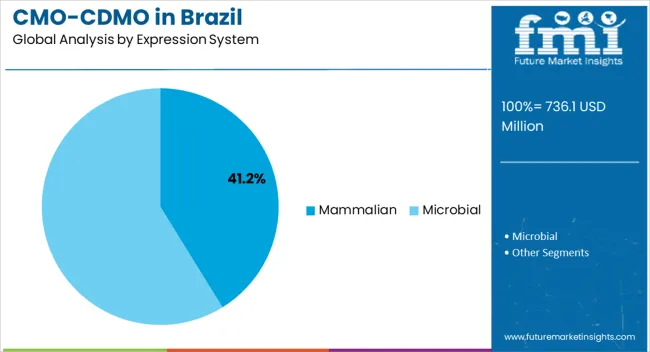

The mammalian expression system segment, holding 41.2% of the expression system category, has emerged as the leading platform due to its capability to produce complex and highly functional proteins with human-compatible post-translational modifications. Adoption has been driven by its relevance in monoclonal antibody production, advanced therapeutics, and regulatory acceptance for biologics.

Process optimization, facility capabilities, and quality control measures have reinforced its market leadership. Investments in cell line development, bioreactor optimization, and analytical testing have enhanced efficiency, yield, and consistency.

Continued innovation in mammalian expression technologies, along with increasing demand for biologics and outsourced manufacturing, is expected to maintain the segment’s dominance and support long-term growth in Brazil’s CMO/CDMO industry.

The Brazil CMO/CDMO business recorded a decent CAGR of 2.0% in the historical period from 2020 to 2025. The value for the CMO/CDMO business in Brazil was around 1.2% of the total USD 56,660.60 million of the global CMO/CDMO business.

The growing pharmaceutical sector is the main factor spurring the Brazil CMO/CDMO business landscape. Increasing approval of manufacturing facilities is set to drive growth.

The total production capacity in Brazil rises as more manufacturing facilities are approved. The increased demand for outsourcing services would enable CMOs and CDMOs to take on additional clients and projects.

The approval of multiple manufacturing facilities, such as those for sterile injectables, biologics, or specialized formulations, can increase the variety of services provided by CMOs and CDMOs. Due to this variety, pharmaceutical companies can select partners who meet their particular requirements.

Manufacturing facilities would become more competitive in the global business landscape as they receive approval. CMOs/CDMOs that can show compliance with international regulatory standards would draw clients from other nations looking for dependable manufacturing partners in addition to Brazil.

The Brazil CMO/CDMO ecosystem has begun to place a lot of emphasis on the manufacturing of biologics and biosimilars. The complexity of these products frequently necessitates specialized production capabilities, and this business category has seen tremendous expansion.

The government of Brazil has also started several programs to encourage expansion in the biotechnology and pharmaceutical sectors. These include tax breaks, research grants, and other forms of assistance to promote industrial investment and innovation.

CMOs and CDMOs in Brazil have started to focus more on research & development services and offering their experience in technological development. They are also aiming to understand analytical testing and process optimization in addition to typical manufacturing services

The table below provides the latest trends observed in the Brazil CMO/CDMO space, growth obstacles, and upcoming opportunities. Business strategies for pushing CMO/CDMO sales in Brazil would enable stakeholders to invest in the right area and gain profit.

| Attributes | Key Factors |

|---|---|

| Latest Trends |

|

| Upcoming Opportunities |

|

| Challenges |

|

The table below shows the share of the top 5 countries for the review period from 2025 to 2035. South and North Brazil are expected to remain dominant by exhibiting CAGRs of 4.5% and 4.9%, respectively. The Central-west and Northeast Brazil are projected to follow with CAGRs of 3.8% and 3.1%, respectively.

Growth Outlook by Key Region

| Regions | Value CAGR |

|---|---|

| Southeast Brazil | 2.3% |

| Northeast Brazil | 3.1% |

| Central-west Brazil | 3.8% |

| South Brazil | 4.5% |

| North Brazil | 4.9% |

Growth in Southeast Brazil’s pharmaceutical sector is expanding steadily. Due to population expansion and improved access to healthcare, there is an increase in local demand for pharmaceuticals and other medical products.

The Southeast area of Brazil is benefiting from initiatives the government has put in place to encourage pharmaceutical business expansion. This includes financial incentives and tax breaks for businesses setting up shop in the region.

Southeast Brazil dominated the CMO/CDMO business and generated a 68.6% share in 2025. It is projected to continue experiencing high growth throughout the forecast period.

The economic center of Brazil is in the southeast, which is home to important cities, such as Sao Paulo and Rio de Janeiro. It is a popular site for CMOs and CDMOs to serve these clients because of its significant industrial base and the large number of pharmaceutical and biotech companies that call it home.

Prestigious universities and research institutions in Southeast Brazil offer a skilled labor pool and chances for collaboration between CMOs/CDMOs and academia on research & development projects. Also, several CMOs/CDMOs based in Southeast Brazil have expanded their operations globally, enabling them to serve clients both domestically and internationally.

A handful of states in Northeast Brazil, such as Pernambuco, have taken special initiatives to draw in investments in the fields of biotechnology and life sciences. This has caused a cluster of biotech businesses to expand, opening doors for CMOs and CDMOs that focus on biologics.

Biotechnology and pharmaceutical research and development have received more attention in the region. This involves the development of formulations, analytical testing, and process optimization, areas in which CMOs and CDMOs can be particularly skilled.

Northeast Brazil dominates the Brazil CMO/CDMO business and held a 19.8% share in 2025. It is projected to continue experiencing high growth throughout the forecast period. Northeast Brazil has special environmental features or natural resources that make biopharmaceutical research and development possible.

Northeast Brazil is also the perfect location for companies focused on biotech and their manufacturing partners backed by these resources. Also, the region is home to eminent research facilities and academic hubs with a focus on biotechnology and pharmaceuticals.

They can promote cooperation between these institutions and CMOs/CDMOs. Such collaborations are frequently necessary to expand research and development initiatives.

Central-west Brazil held about a 5.1% share of the Brazil CMO/CDMO business in 2025. It is projected to increase during the forecast period.

Central-west Brazil's center geographic location offers a logistical advantage, enabling effective pharmaceutical product distribution to multiple regions across Brazil and adjacent nations. For CMOs and CDMOs aiming to serve a large space, this can be a crucial draw.

Investments in infrastructure, including transportation networks and industrial parks, can further enhance the region's attractiveness for pharmaceutical manufacturing and supply chain operations. The government supports domestic medicinal product production.

CMOs and CDMOs in the region would have the chance to serve the home ecosystem and export goods. Several colleges and research facilities in Central-west Brazil offer a pool of qualified workers in fields related to pharmaceutical development and manufacturing. CMOs and CDMOs can benefit from this in terms of hiring new personnel.

The table below signifies leading sub-categories under product, expression, and company size categories in the Brazil CMO/CDMO business. Stand-alone services are expected to dominate the ecosystem for Brazil CMO/CDMO at a CAGR of 3.4% by 2035. Under the company size category, the mid-sized segment is projected to lead the Brazil CMO/CDMO space with a CAGR of 2.3% by 2035.

Growth Outlook by Key Segments

| Segment | Value CAGR |

|---|---|

| Stand-alone Services (Services) | 3.4% |

| API Substrate (Product) | 1.9% |

| Mid-sized (Company Size) | 2.3% |

| Mammalian (Expression System) | 2.7% |

| Commercial (Scale of Operation) | 2.9% |

Stand-alone services under the service category held a share of 42.5% in 2025. It is expected to remain at the forefront over the forecast period.

Stand-alone services focus on specific aspects of drug development and manufacturing, such as formulation development, analytical testing, or sterile manufacturing. This specialization can attract companies seeking expertise in a particular area.

Companies decide to use stand-alone services to cut costs by outsourcing only a portion of the production or development of drugs while maintaining control over the remaining portions. This factor is anticipated to lead the stand-alone service segment in the Brazil CMO/CDMO business.

API substrate under the product category held a considerable share of 41.4% in 2025. The main components of pharmaceutical formulations are APIs.

APIs, often referred to as the dynamic components of medications, underlie their therapeutic effectiveness. The process of crafting APIs holds a pivotal role in the production of pharmaceuticals, marking a critical step in the journey of creating therapeutic solutions.

Pharmaceutical companies find it more affordable to outsource API production. The volume and efficiency of CMOs and CDMOs would allow them to create APIs more cheaply than in-house labs.

For the manufacturing of biologics, such as monoclonal antibodies, recombinant proteins, and vaccines, mammalian expression systems are frequently chosen. Due to their success in treating a wide range of ailments, biologics have grown in terms of popularity in the operating of the pharmaceutical sector.

Mammalian expression systems are set to be necessary for the manufacturing of several advanced and sophisticated medicines, including cell and gene therapies. These treatments are projected to make up a rapidly expanding area for pharmaceuticals. This factor is expected to stimulate the mammalian segment over the forecast timeline.

Geographic expansions are a priority for leading CMO/CDMO companies in Brazil as they work to create new product lines and expand their global consumer base. Expansion and acquisition among key companies or brands is the leading strategy of manufacturers such as Catalent and Fragon.

They aim to enhance their presence in the business landscape and compete with other players during the forecast period. Following are a handful of recent developments:

For instance,

| Attribute | Details |

|---|---|

| Brazil CMO-CDMO Revenue (2025) | USD 736.1 million |

| Projected Brazil CMO-CDMO Revenue (2035) | USD 948.3 million |

| Value-based CAGR (2025 to 2035) | 2.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Business Analysis | Value (USD million) |

| Key Regions Covered | North Brazil; Northeast Brazil; Central-west Brazil; Southeast Brazil; and South Brazil |

| Key Segments Covered | Services, Product, Expression System, Company Size, Scale of Operation, Region |

|

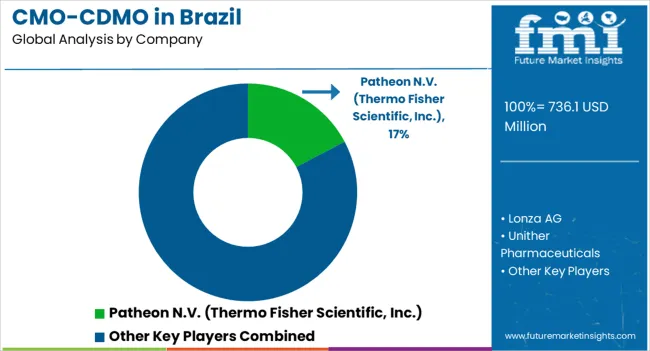

Key Companies Profiled |

Lonza AG; Unither Pharmaceuticals; Catalent Inc.; Fagron; Eurofarma; Pfizer CentreOne; Patheon N.V. (Thermo Fisher Scientific, Inc.); NUVISAN; Societal CDMO; Bio-Manguinhos; Biotimize; Pierre Fabre group; Ajinomoto Co., Inc. |

The global cmo/cdmo industry analysis in Brazil is estimated to be valued at USD 736.1 million in 2025.

The market size for the cmo/cdmo industry analysis in Brazil is projected to reach USD 948.3 million by 2035.

The cmo/cdmo industry analysis in Brazil is expected to grow at a 2.6% CAGR between 2025 and 2035.

The key product types in cmo/cdmo industry analysis in Brazil are stand-alone services, _cell line development, _development and bio manufacturing, _analytical services, _fill finish, _packaging, _clinical supply services, integrated development, scale-up and tech transfer, technology and innovation, quality control and quality assurance and regulatory assistance.

In terms of product, large molecule segment to command 29.4% share in the cmo/cdmo industry analysis in Brazil in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Consumer Packaging Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Brazil Aesthetic Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brazil Safari Tourism Market Growth – Size, Demand & Forecast 2025-2035

Brazil Culinary Tourism Market Insights – Growth & Forecast 2025 to 2035

Brazil Hyaluronic Acid Products Market Outlook – Share, Growth & Forecast 2025-2035

Brazil Faith-Based Tourism Market Trends - Growth & Forecast 2025 to 2035

Industry 4.0 Market

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Brazilian Hemorrhagic Fever (BzHF) Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA