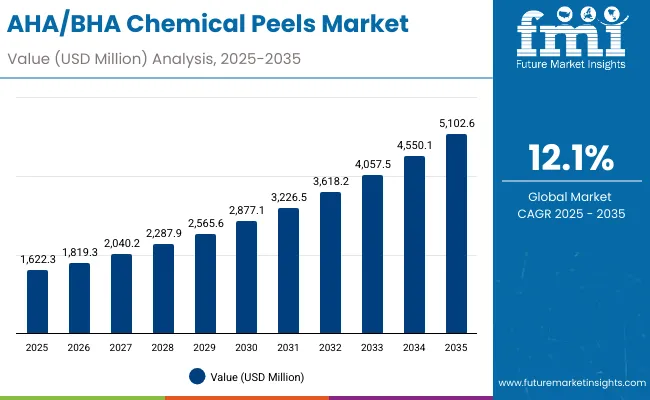

A valuation of USD 1,622.3 million has been projected for the AHA/BHA Chemical Peels Market in 2025, which is anticipated to expand to USD 5,102.6 million by 2035. This rise of nearly USD 3,480 million translates into more than a threefold increase over the decade. The expected growth trajectory reflects a compound annual growth rate of 12.1% between 2025 and 2035.

AHA/BHA Chemical Peels Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,622.3 Million |

| Market Forecast Value in (2035F) | USD 5,102.6 Million |

| Forecast CAGR (2025 to 2035) | 12.10% |

During the first half of the decade, the market is set to advance from USD 1,622.3 million in 2025 to USD 2,877.1 million in 2030, adding over USD 1,254 million and accounting for approximately 36% of the total decade expansion. This period will be shaped by consistent demand for exfoliation-led products and the growing clinical-grade adoption that reinforces consumer trust in safe and effective skincare solutions.

Between 2030 and 2035, the market is forecasted to grow further from USD 2,877.1 million to USD 5,102.6 million, contributing nearly USD 2,225 million or around 64% of the total decade growth. This acceleration will be supported by rising consumer preference for clean-label and dermatology-backed peels, increased acceptance in emerging economies, and deeper penetration through e-commerce and specialty beauty stores. By the end of the forecast period, clinical credibility and natural formulations are expected to play a pivotal role in sustaining adoption, positioning the category for long-term resilience and continued premiumization.

From 2020 to 2024, the AHA/BHA Chemical Peels Market expanded consistently, fueled by consumer adoption of exfoliation-based routines and dermatologist-endorsed formulations. During this period, the competitive landscape was shaped by affordable science-led brands like The Ordinary, which captured strong loyalty through transparency and accessibility. Clinical-grade players maintained presence through premium dermatology channels, reinforcing credibility.

By 2025, the market is anticipated to reach USD 1,622.3 million, with a clear shift toward hybrid formulations combining clean-label and clinical validation. E-commerce is expected to dominate access, while dermatology clinics sustain professional trust. Competitive dynamics are projected to intensify, as niche vegan, natural/organic entrants challenge established players. The competitive edge is moving away from price alone toward credibility, digital engagement, and hybrid positioning that aligns clinical safety with ethical claims.

Growth in the AHA/BHA Chemical Peels Market is being driven by the rising consumer inclination toward professional-grade exfoliation and acne treatments that deliver visible results with minimal invasiveness. The adoption of clinical-grade formulations has been reinforced by dermatologist endorsements, enhancing trust in safe and effective outcomes. Expanding demand for clean-label, vegan, and natural/organic claims has accelerated adoption among health-conscious consumers, while the e-commerce boom has widened access to advanced skincare products across global markets.

Increased awareness of preventive skincare and anti-aging benefits is supporting steady uptake, particularly in premium segments. Emerging economies such as China and India are contributing significantly to overall growth due to heightened disposable incomes and expanding beauty retail infrastructure. Digital platforms and social media are amplifying consumer education, creating stronger demand for active-based solutions. Continued innovation in product formats and distribution strategies is expected to sustain market momentum throughout the forecast period.

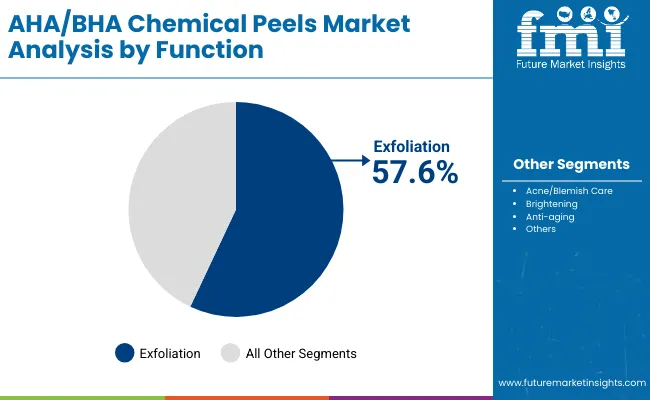

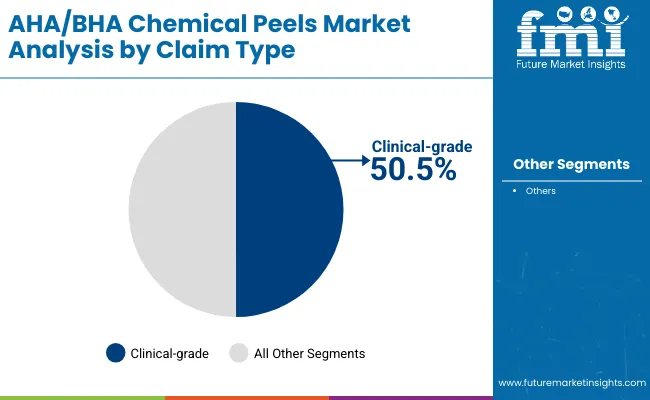

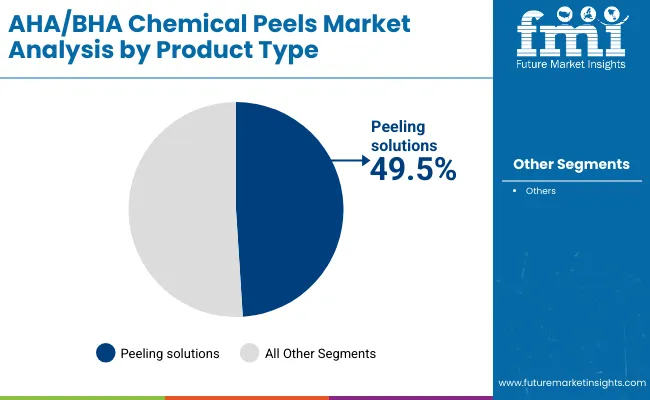

The AHA/BHA Chemical Peels Market is segmented across key dimensions including function, claim, and product type, each reflecting distinct consumer priorities and brand strategies. These segments highlight how performance-driven attributes, clinical validation, and product formats are shaping competitive dynamics. By 2025, exfoliation is expected to dominate functional demand, clinical-grade credibility will drive claims, and product type adoption will reflect a near balance between peeling solutions and other formats. This segmentation underscores the interplay between consumer trust in science-backed skincare and the broader demand for convenience, efficacy, and innovation. Insights into these segments provide a forward-looking view of how growth momentum is likely to be sustained over the forecast horizon.

| Segment | Market Value Share, 2025 |

|---|---|

| Exfoliation | 57.6% |

| Others | 42.4% |

Exfoliation is projected to command 57.6% of the AHA/BHA Chemical Peels Market in 2025, valued at USD 921.2 million. This leadership highlights the strong consumer reliance on exfoliation for acne management, blemish reduction, and anti-aging benefits. The segment’s growth has been reinforced by dermatologist endorsements and increased awareness of skin renewal practices. With preventive skincare gaining traction, exfoliation is expected to remain integral to both premium and mass-market adoption. Rising preference for products offering visible, quick outcomes will sustain demand, while innovations in clinical-grade and at-home formulations will expand accessibility. Exfoliation is anticipated to maintain dominance throughout the forecast horizon, supported by its versatility and credibility as the core function within chemical peels.

| Segment | Market Value Share, 2025 |

|---|---|

| Clinical-grade | 50.5% |

| Others | 49.5% |

Clinical-grade claims are estimated to hold 50.5% of the AHA/BHA Chemical Peels Market in 2025, equivalent to USD 808.1 million. This dominance is underpinned by growing consumer trust in evidence-backed and dermatologist-validated skincare. Rising concerns around product safety and long-term efficacy have reinforced the preference for clinical-grade formulations. Demand has been amplified by professional endorsements and digital platforms spreading dermatology-driven education. While other claims such as clean-label and natural/organic remain competitive, clinical-grade products are expected to maintain their edge due to superior validation and consistent outcomes. Over the next decade, the segment is likely to strengthen further as personalized dermatology and advanced science-based formulations become central to skincare adoption.

| Segment | Market Value Share, 2025 |

|---|---|

| Peeling solutions | 49.5% |

| Others | 50.5% |

Other product types are projected to lead slightly with 50.5% share in 2025, amounting to USD 819.34 million, while peeling solutions will capture 49.5% share worth USD 791.9 million. Despite this narrow difference, peeling solutions remain closely tied to consumer perceptions of chemical peels and continue to represent the most recognized format. Their adaptability across clinical and at-home usage reinforces growth, supported by innovations in safe, user-friendly concentrations. Expansion of e-commerce and rising consumer education on actives are expected to strengthen their presence in emerging economies. While other formats maintain a marginal lead, peeling solutions are likely to witness consistent adoption, positioning the segment as a stable growth engine over the forecast horizon.

The AHA/BHA Chemical Peels Market is being influenced by evolving consumer priorities, scientific innovation, and clinical validation, while cost barriers and regulatory complexities shape adoption dynamics. Growth is increasingly linked to credibility, digital engagement, and sustainable formulations aligned with future skincare demand.

Integration of Dermatology-backed Digital Ecosystems

A significant driver is the integration of dermatologist-led digital ecosystems that connect clinical credibility with consumer access. Skincare consultations through tele-dermatology platforms are enabling stronger product trust and higher adoption, particularly in emerging regions where access to specialists has been limited. By embedding chemical peel products into digital health ecosystems, consumers are guided toward validated usage, reducing misuse concerns. This alignment of clinical guidance and retail access is expected to reinforce adoption across both premium and mass-market channels. Future growth will be further supported as AI-driven skin diagnostics personalize chemical peel recommendations, enhancing safety outcomes while strengthening consumer loyalty.

Clean-Clinical Hybrid Positioning

A defining trend is the emergence of clean-clinical hybrids that blend dermatologist validation with sustainable, ethical claims. Consumers are no longer satisfied with formulations that are only natural or only clinical; a merging of both narratives is shaping future preferences. Products positioned as clinically tested yet vegan, cruelty-free, and free from harsh chemicals are being perceived as higher-value solutions, particularly among younger demographics. This hybrid positioning is driving competitive differentiation, compelling brands to innovate with transparent ingredient sourcing and environmentally responsible packaging. Over the next decade, this trend is expected to shift industry baselines, making hybridization of clean and clinical features not an option, but an essential competitive standard.

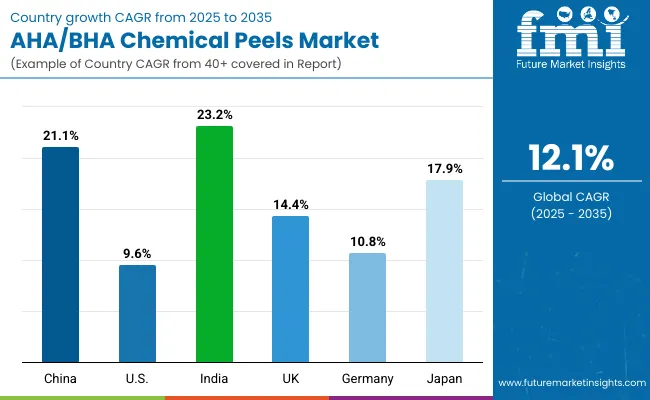

| Countries | CAGR |

|---|---|

| China | 21.1% |

| USA | 9.6% |

| India | 23.2% |

| UK | 14.4% |

| Germany | 10.8% |

| Japan | 17.9% |

The AHA/BHA Chemical Peels Market demonstrates significant geographic variation, shaped by dermatology infrastructure, consumer sophistication, and the pace of digital adoption. Asia is expected to emerge as the fastest-expanding region, led by India at a projected CAGR of 23.2% and China at 21.1%. Growth across these countries will be reinforced by expanding middle-class populations, rising disposable incomes, and heightened consumer awareness of advanced skincare solutions. Adoption will also be supported by the proliferation of e-commerce and social media-driven beauty ecosystems, which are set to accelerate penetration beyond urban centers.

Japan, with an estimated CAGR of 17.9%, is expected to strengthen its position as a premium skincare hub, with demand influenced by high standards for safety, clinical efficacy, and innovation-driven formulations. In Europe, the UK (14.4% CAGR) and Germany (10.8% CAGR) are projected to benefit from consumer trust in dermatology-led brands and strict quality regulations, reinforcing steady but measured expansion.

The USA, with a moderate CAGR of 9.6%, reflects a mature yet competitive skincare market, where innovation will continue to be driven by clinical credibility and product diversification. Across regions, the interplay between dermatology expertise and lifestyle-oriented claims will define market dynamics over the forecast period.

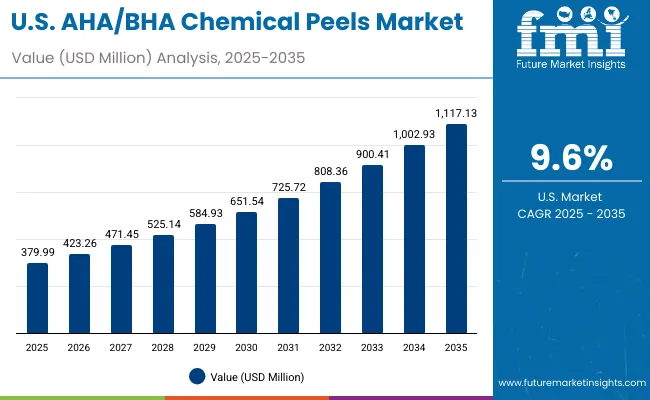

| Year | USA AHA/BHA Chemical Peels Market (USD Million) |

|---|---|

| 2025 | 379.99 |

| 2026 | 423.26 |

| 2027 | 471.45 |

| 2028 | 525.14 |

| 2029 | 584.93 |

| 2030 | 651.54 |

| 2031 | 725.72 |

| 2032 | 808.36 |

| 2033 | 900.41 |

| 2034 | 1,002.93 |

| 2035 | 1,117.13 |

The AHA/BHA Chemical Peels Market in the United States is projected to expand at a CAGR of 9.6% between 2025 and 2035, rising from USD 379.99 million in 2025 to USD 1,117.13 million by 2035. This progression highlights steady but significant expansion in a mature skincare ecosystem where consumer reliance on dermatology-led treatments remains high. Growth is expected to be influenced by the widespread availability of professional skincare clinics, increasing demand for anti-aging treatments, and rising adoption of at-home formulations. The role of e-commerce in reshaping distribution will also be central, as digital platforms amplify access and consumer education.

By the end of the forecast period, the United States is anticipated to remain one of the largest contributors globally, balancing scientific rigor with lifestyle-driven demand.

The AHA/BHA Chemical Peels Market in the United Kingdom is forecasted to grow at a CAGR of 14.4% from 2025 to 2035, supported by strong dermatology infrastructure and heightened consumer focus on professional skincare. Market expansion is expected to be reinforced by the presence of trusted European brands that emphasize both efficacy and safety. E-commerce penetration is broadening access to niche clinical-grade and vegan formulations, while younger demographics are showing higher interest in preventive skincare. Regulatory alignment with EU safety standards is anticipated to sustain consumer confidence, positioning the UK as a resilient and competitive market.

UK Market Key Insights

The AHA/BHA Chemical Peels Market in India is projected to grow at the highest CAGR of 23.2% during 2025-2035, driven by rising middle-class consumption and rapid digital retail expansion. Market adoption is expected to accelerate as dermatology services expand beyond metropolitan hubs, supported by heightened consumer education through social media. Increased preference for both affordable and clinically validated formulations will create opportunities for domestic and international brands. E-commerce marketplaces are anticipated to play a central role in extending product reach to tier-2 and tier-3 cities.

India Market Key Insights

The AHA/BHA Chemical Peels Market in China is projected to expand at a CAGR of 21.1% between 2025 and 2035, reflecting one of the fastest global growth rates. Consumer appetite for advanced skincare is expected to be reinforced by strong digital retail ecosystems and high social media engagement. Clinical-grade and premium clean-label products are anticipated to gain significant traction, particularly among urban consumers. Regulatory emphasis on product safety and transparency is also expected to favor established brands while challenging smaller entrants.

China Market Key Insights

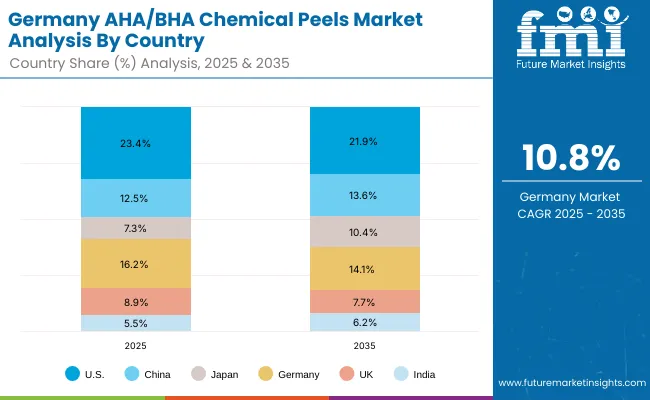

| Countries | 2025 |

|---|---|

| USA | 23.4% |

| China | 12.5% |

| Japan | 7.3% |

| Germany | 16.2% |

| UK | 8.9% |

| India | 5.5% |

| Countries | 2035 |

|---|---|

| USA | 21.9% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 6.2% |

The AHA/BHA Chemical Peels Market in Germany is expected to grow at a CAGR of 10.8% from 2025 to 2035, anchored by consumer trust in dermatology-led products and strong regulatory oversight. German consumers are highly receptive to clinical validation, which is projected to reinforce demand for professional-grade solutions. Sustainability concerns and preferences for vegan and clean-label offerings are anticipated to further influence purchasing behavior. Premium positioning is expected to dominate as established brands continue to leverage Germany’s reputation for quality and safety.

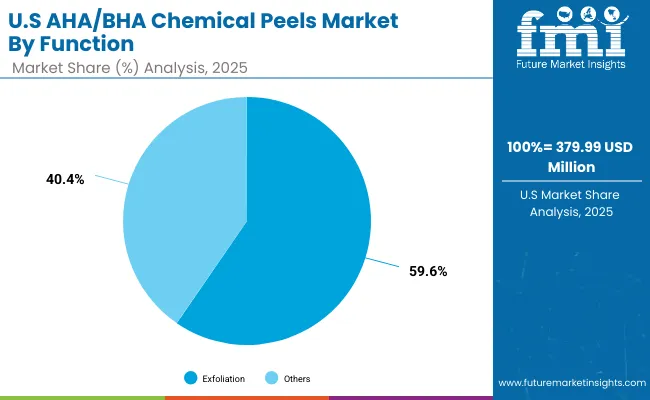

| Segment | Market Value Share, 2025 |

|---|---|

| Exfoliation | 59.6% |

| Others | 40.4% |

The AHA/BHA Chemical Peels Market in the United States is projected at USD 379.99 million in 2025. Exfoliation contributes 59.6%, while other functional claims hold 40.4%, showing a clear preference for visible renewal and acne-oriented treatments. This dominance reflects the role of exfoliation as the foundation of dermatology-led skincare, offering results that align with both clinical and at-home applications. Increased consumer awareness of preventive skincare and anti-aging routines is further expected to sustain its leadership.

Other functions continue to hold significant relevance, particularly in brightening and soothing formulations, which provide opportunities for differentiation in a competitive market. Their growth is anticipated to be supported by innovation in multi-functional products that combine exfoliation with broader benefits such as hydration and skin tone correction. As USA consumers seek products validated by dermatologists and reinforced by lifestyle-driven claims, the interplay between exfoliation and complementary functions will define competitive positioning over the next decade.

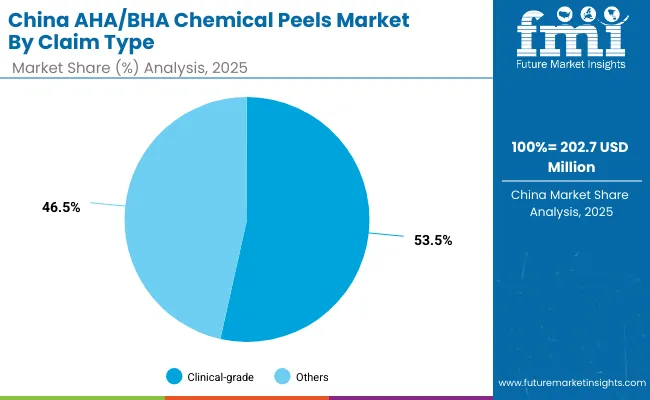

| Segment | Market Value Share, 2025 |

|---|---|

| Clinical-grade | 53.5% |

| Others | 46.5% |

The AHA/BHA Chemical Peels Market in China is estimated at USD 202.7 million in 2025. Clinical-grade products contribute 53.5%, while other functional claims account for 46.5%, showing a near-balanced but clinically skewed preference. This dominance highlights the rising trust in dermatologist-backed and evidence-based skincare, supported by regulatory tightening around product safety and quality. As consumers seek reassurance in product efficacy, clinical-grade formulations are anticipated to sustain their leadership in driving adoption.

Other claims, including natural and clean-label products, maintain significant importance in shaping consumer behavior. These formats appeal strongly to younger demographics, who increasingly demand ethical and sustainable formulations. Digital-first ecosystems and social media-driven education are expected to amplify awareness of these alternatives, providing opportunities for niche and emerging brands. Over the next decade, China’s market is projected to evolve into a dual-growth pathway, with clinical-grade products anchoring credibility and clean-label offerings reinforcing lifestyle alignment.

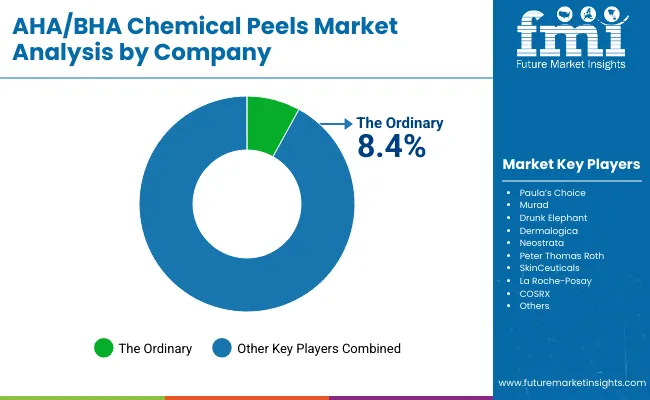

The AHA/BHA Chemical Peels Market is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing for share across diverse consumer and professional segments. Global leaders such as The Ordinary hold a significant position, capturing 8.4% of global market value in 2025, making it the most dominant brand in this category. The company’s leadership is anchored in affordability, wide accessibility through e-commerce, and strong consumer trust in minimalist, ingredient-focused formulations. Its model of transparency and clinical validation is projected to sustain loyalty, particularly among younger demographics.

Other established players, including Paula’s Choice, Murad, Drunk Elephant, Dermalogica, Neostrata, SkinCeuticals, La Roche-Posay, Peter Thomas Roth, and COSRX, are actively shaping the market through premium positioning, professional endorsements, and advanced clinical-grade formulations. These brands emphasize dermatologist credibility and premium claims, driving competitive differentiation.

Niche-focused brands are increasingly carving opportunities through vegan, natural/organic, and clean-label products. Their strategies rely on sustainability, ethical sourcing, and alignment with lifestyle-oriented consumer values, enabling them to compete effectively despite smaller global footprints.

Competitive differentiation is shifting away from traditional formulation features toward integrated value propositions digital engagement, personalized skin diagnostics, and hybrid clinical-clean positioning. Over the next decade, the ability to blend clinical validation with sustainable and consumer-friendly claims is expected to define long-term leadership.

Key Developments in AHA/BHA Chemical Peels Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,622.3 Million in 2025; USD 5,102.6 Million in 2035 (CAGR 12.1%) |

| Function | Exfoliation (59.6%), Acne/Blemish Care, Brightening, Anti-aging, Others |

| Claim | Clinical-grade (50.5%), Others (49.5%) |

| Product Type | Peeling Solutions (49.5%), Others (50.5%) |

| Channel | E-commerce, Dermatology Clinics, Pharmacies, Specialty Beauty Stores |

| End-use Consumer Base | Individual Consumers, Dermatology Professionals, Specialty Beauty Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea, Indonesia, Australia, Mexico, Thailand |

| Key Companies Profiled | The Ordinary, Paula’s Choice, Murad, Drunk Elephant, Dermalogica, Neostrata, Peter Thomas Roth, SkinCeuticals, La Roche-Posay, COSRX |

| Additional Attributes | Dollar sales by function, product type, and claim; rapid adoption of clinical-grade and clean-label peels; e-commerce as dominant channel; strong dermatology clinic influence; regional growth led by Asia; innovations in hybrid clean-clinical formulations; brand competition driven by affordability, science validation, and digital engagement. |

The global AHA/BHA Chemical Peels Market is estimated to be valued at USD 1,622.3 million in 2025.

The market size for the AHA/BHA Chemical Peels Market is projected to reach USD 5,102.6 million by 2035.

The AHA/BHA Chemical Peels Market is expected to grow at a CAGR of 12.1% between 2025 and 2035.

The key product types in the AHA/BHA Chemical Peels Market are peeling solutions and other product formats, both contributing almost equally to market share in 2025.

In terms of function, exfoliation is projected to command 57.6% share in the AHA/BHA Chemical Peels Market in 2025, valued at USD 921.2 million.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chemical Vapor Deposition Market Size and Share Forecast Outlook 2025 to 2035

Chemical Recycling Service Market Forecast Outlook 2025 to 2035

Chemical Dosing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Chemical Filling System Market Size and Share Forecast Outlook 2025 to 2035

Chemical Absorbent Pads Market Size and Share Forecast Outlook 2025 to 2035

Chemical Indicator Inks Market Size and Share Forecast Outlook 2025 to 2035

Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Chemical Protective Gloves Market Size and Share Forecast Outlook 2025 to 2035

Chemical Injection Pump Market Size and Share Forecast Outlook 2025 to 2035

Chemical Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Chemical Sensors Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant EVA Film Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistant Coating Market Size and Share Forecast Outlook 2025 to 2035

Chemical Distribution Market Size and Share Forecast Outlook 2025 to 2035

Chemical & Petrochemical IECS Market Size and Share Forecast Outlook 2025 to 2035

Chemical Air Separation Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA