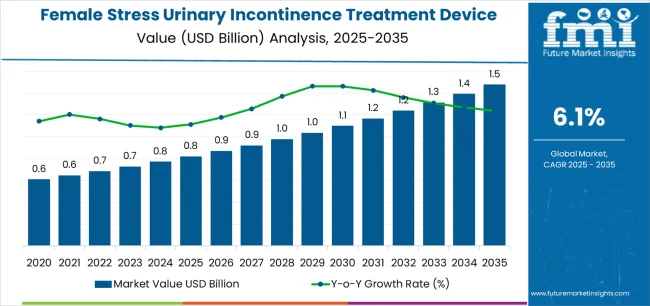

The Female Stress Urinary Incontinence Treatment Device Market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The female stress urinary incontinence treatment device market is experiencing notable growth driven by increasing prevalence of urinary incontinence, rising awareness about women’s health, and growing acceptance of minimally invasive surgical interventions. Market expansion is supported by technological advancements in device design, improved biocompatibility, and the introduction of next-generation materials that enhance patient safety and long-term outcomes.

The current market landscape is characterized by a shift toward outpatient and day-care procedures that reduce recovery time and healthcare costs. Manufacturers are focusing on innovation and strategic collaborations to broaden product portfolios and strengthen distribution networks.

The future outlook remains positive as healthcare infrastructure improves globally and access to specialized gynecological treatments increases Growth rationale is underpinned by the rising demand for effective and durable solutions for incontinence management, coupled with favorable reimbursement policies and supportive clinical guidelines that promote early intervention and higher adoption rates across diverse patient populations.

| Metric | Value |

|---|---|

| Female Stress Urinary Incontinence Treatment Device Market Estimated Value in (2025 E) | USD 0.8 billion |

| Female Stress Urinary Incontinence Treatment Device Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

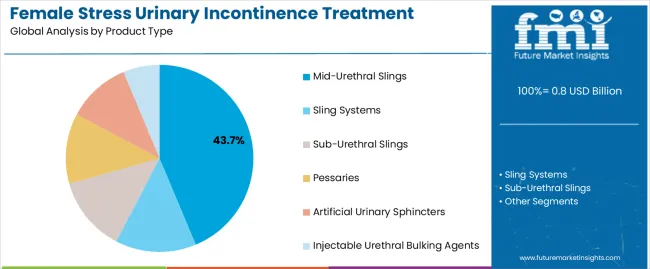

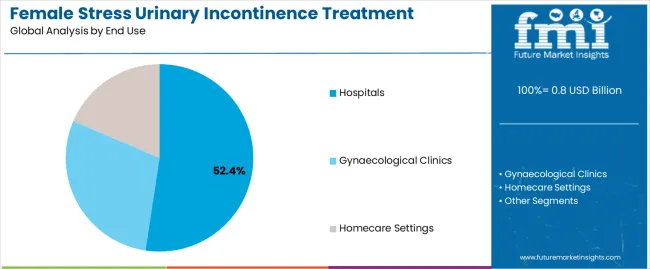

The market is segmented by Product Type and End Use and region. By Product Type, the market is divided into Mid-Urethral Slings, Sling Systems, Sub-Urethral Slings, Pessaries, Artificial Urinary Sphincters, and Injectable Urethral Bulking Agents. In terms of End Use, the market is classified into Hospitals, Gynaecological Clinics, and Homecare Settings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mid-urethral slings segment, holding 43.70% of the product type category, has emerged as the dominant segment due to its proven efficacy, minimally invasive nature, and strong clinical track record in treating stress urinary incontinence. Adoption has been supported by favorable procedural outcomes, shorter hospital stays, and reduced complication rates compared to traditional surgical techniques.

Advances in sling materials and fixation mechanisms have enhanced patient comfort and long-term performance, further strengthening market confidence. Regulatory approvals and continuous clinical research have reinforced the safety and reliability of mid-urethral slings.

Hospitals and specialty clinics are increasingly integrating these devices into standard treatment protocols, driven by consistent success rates and cost efficiency Over the forecast period, growing physician preference, combined with patient awareness and technological refinement, is expected to sustain the segment’s leadership within the market.

The hospitals segment, accounting for 52.40% of the end use category, has maintained its leading position owing to the availability of advanced surgical infrastructure, skilled healthcare professionals, and comprehensive post-operative care. Hospitals remain the primary centers for performing minimally invasive procedures and managing complex incontinence cases that require specialized expertise.

Adoption has been supported by consistent patient inflow, favorable reimbursement coverage, and the presence of multidisciplinary teams ensuring optimal outcomes. Continuous investments in medical technology, sterilization facilities, and staff training have improved procedural precision and patient safety.

Additionally, hospitals serve as hubs for clinical trials and research collaborations, promoting innovation in device development and treatment protocols With ongoing healthcare modernization and expansion of women’s health programs, hospital-based treatment is expected to remain the preferred setting, sustaining its dominant share and driving overall market growth.

Many women prefer non surgical treatment options for stress urinary incontinence due to their minimally invasive nature and shorter recovery times. The preference has LED to a surge in the demand for stress urinary incontinence treatment devices such as vaginal inserts, pessaries, and pelvic floor muscle stimulators.

The scope for female stress urinary incontinence treatment device rose at a 7.2% CAGR between 2020 to 2025. The global market is anticipated to witness a downwards CAGR of 6.4% over the forecast period 2025 to 2035.

There might have been significant advancements in SUI treatment device technology, during the historical period, leading to the development of more effective, minimally invasive, and patient friendly devices. There was a rise in awareness about stress urinary incontinence among both patients and healthcare providers, leading to higher diagnosis rates and increased demand for treatment options.

The aging population demographic trend might have contributed to a higher prevalence of stress urinary incontinence, driving the demand for treatment devices. Changes in regulatory policies and approval processes for medical devices had influenced the market dynamics, affecting product innovation and market entry.

Patients and healthcare providers are expected to continue to prefer minimally invasive treatment options for stress urinary incontinence, driving the demand for advanced devices such as injectable bulking agents, neuromodulation devices, and sling systems.

Continued investments in research and development are expected to drive innovation in stress treatment devices, with companies focusing on addressing unmet clinical needs, enhancing product efficacy, and reducing complications.

There is a growing awareness about female stress urinary incontinence among both patients and healthcare providers. The awareness drives more women to seek treatment options, thereby expanding the market.

Stigma surrounding pelvic floor disorders and urinary incontinence may deter women from seeking medical treatment or discussing their symptoms with healthcare providers, leading to underdiagnosis and undertreatment of stress urinary incontinence.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by the United States and Germany. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 6.7% |

| The United Kingdom | 6.0% |

| Germany | 6.3% |

| France | 5.9% |

| India | 5.7% |

The female stress urinary incontinence treatment device market in the United States expected to expand at a CAGR of 6.7% through 2035. The country has a large population of women affected by stress urinary incontinence. There is a growing demand for effective treatment options, as the population ages and awareness of stress urinary incontinence increases, driving market growth.

Ongoing advancements in medical technology have LED to the development of innovative stress urinary incontinence treatment devices with improved efficacy, safety, and patient comfort. The technological innovations drive market growth by offering patients and healthcare providers more options for managing stress urinary incontinence.

The female stress urinary incontinence treatment device market in the United Kingdom is anticipated to expand at a CAGR of 6.0% through 2035. There is increasing awareness and education about pelvic health and urinary incontinence among women in the United Kingdom.

Greater awareness leads to more women seeking treatment for stress urinary incontinence and advocating for better management options, which in turn drives market growth.

Many women in the United Kingdom prefer non surgical or minimally invasive treatments for stress urinary incontinence due to reduced risks, shorter recovery times, and improved quality of life. The availability of non surgical stress urinary incontinence treatment devices caters to patient preferences and drives market growth.

Female stress urinary incontinence treatment device trends in Germany are taking a turn for the better. A 6.3% CAGR is forecast for the country from 2025 to 2035. Germany has a well established healthcare system with access to specialized urological and gynecological services.

The availability of comprehensive healthcare services supports the adoption and utilization of stress urinary incontinence treatment devices, contributing to market growth.

Germany has stringent regulatory standards for medical devices, ensuring the safety, efficacy, and quality of stress urinary incontinence treatment devices. Regulatory compliance provides confidence to healthcare providers and patients, fostering innovation and market growth.

The female stress urinary incontinence treatment device market in France is poised to expand at a CAGR of 5.9% through 2035. Government support and funding for healthcare initiatives, including research and development in the field of pelvic health, drive innovation and expand treatment options for stress urinary incontinence in France. Public investments in healthcare infrastructure and services contribute to market growth.

France is known for its strong research and development capabilities in the healthcare sector. Leading universities, research institutions, and medical device companies are engaged in developing new stress urinary incontinence treatment devices. Research and development initiatives drive technological advancements and expand the range of treatment options available in the market.

The female stress urinary incontinence treatment device market in India is anticipated to expand at a CAGR of 5.7% through 2035. Increasing female workforce participation in India means that more women are active in professional and social environments.

Women in the workforce are more likely to seek treatment for conditions such as stress urinary incontinence to maintain their quality of life and productivity, driving market growth.

Increased investments in research and development by both domestic and international companies lead to the development of advanced and cost effective treatment devices for stress urinary incontinence. The introduction of new and improved products expands treatment options and drives market growth.

The below table highlights how sling system segment is projected to lead the market in terms of product type, and is expected to account for a share of 54.0% in 2025. Based on end use, the hospitals segment is expected to account for a share of 68.0% in 2025.

| Category | Market Shares in 2025 |

|---|---|

| Sling System | 54.0% |

| Hospitals | 68.0% |

Based on product type, the sling system segment is expected to continue dominating the female stress urinary incontinence treatment device market. Sling systems have demonstrated high efficacy in treating stress urinary incontinence by providing support to the urethra and restoring urinary continence. They offer long term symptom relief and improved quality of life for patients, driving their adoption among healthcare providers and patients.

Sling procedures are minimally invasive compared to traditional surgical approaches for stress urinary incontinence, such as open abdominal surgery. Minimally invasive procedures are associated with shorter recovery times, reduced post operative pain, and lower risk of complications, making sling systems an attractive treatment option for patients.

In terms of end use, the hospitals segment is expected to continue dominating the female stress urinary incontinence treatment device market, attributed to several key factors.

Hospitals typically have advanced diagnostic and treatment facilities, including urology departments equipped with specialized equipment and expertise for the diagnosis and management of female stress urinary incontinence. The facilities attract patients seeking comprehensive care for their condition, driving demand for stress urinary incontinence treatment devices.

Hospitals employ a diverse range of specialized healthcare professionals, including urologists, gynecologists, and pelvic floor specialists, who are trained in the diagnosis and treatment of female stress urinary incontinence. Patients trust hospitals as institutions with access to a multidisciplinary team of experts, enhancing the appeal of seeking treatment in hospital settings.

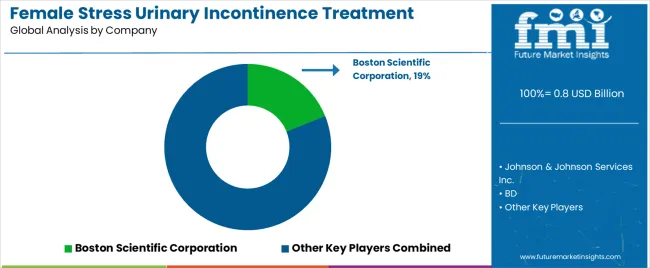

The competitive landscape of the female stress urinary incontinence treatment device market is characterized by a diverse range of players including medical device manufacturers, healthcare providers, research institutions, and regulatory bodies. The entities contribute to the development, production, distribution, and regulation of these treatment devices, shaping the dynamics of the market.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 770.0 million |

| Projected Market Valuation in 2035 | USD 1,432.0 million |

| Value-based CAGR 2025 to 2035 | 6.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Product Type, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Boston Scientific Corporation; Johnson & Johnson Services Inc.; BD;Coloplast A/S; CooperSurgical Inc.; MEDGYN PRODUCTS Inc.; Cousin Biotech; Caldera Medical; Betatech Medical; FEG Textiltechnik mbH; C.R. Bard |

The global female stress urinary incontinence treatment device market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the female stress urinary incontinence treatment device market is projected to reach USD 1.5 billion by 2035.

The female stress urinary incontinence treatment device market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in female stress urinary incontinence treatment device market are mid-urethral slings, sling systems, sub-urethral slings, pessaries, artificial urinary sphincters and injectable urethral bulking agents.

In terms of end use, hospitals segment to command 52.4% share in the female stress urinary incontinence treatment device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Female Pelvic Implants Market Growth – Trends & Forecast 2025 to 2035

Stress-Relief Skincare Market Size and Share Forecast Outlook 2025 to 2035

Stress Tests Equipment Market Size and Share Forecast Outlook 2025 to 2035

Stress Relief Supplement Market Analysis by Source, Form, Category and Distribution Channel Through 2035

Stress Tracking Devices Market - Demand & Forecast 2025 to 2035

Prestressed Concrete Wire and Strand Market Growth – Trends & Forecast 2024-2034

Pre-Stressed Concrete Market Size and Share Forecast Outlook 2025 to 2035

Anti-Stress / Relaxing Agents Market Size and Share Forecast Outlook 2025 to 2035

Heat Stress Monitor Market Analysis by Product, Application, Offering, Life Form, Technology, Sensor Type, and Region Forecast Through 2035

Anti-Stress Feed Supplements Market – Growth, Demand & Livestock Health

Heat Stress Meter Market

Creep and Stress Rupture Testers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Post-Traumatic Stress Disorder (PTSD) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA