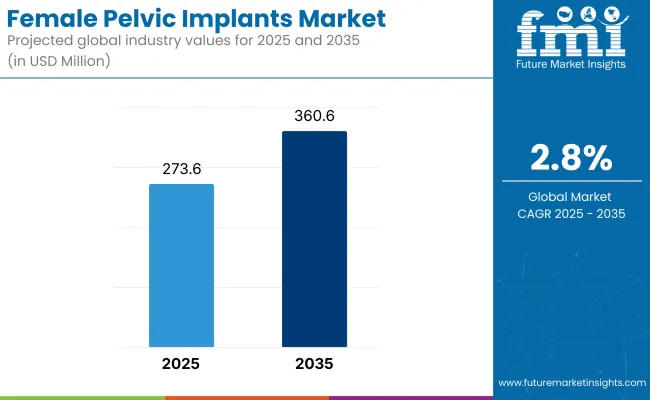

The female pelvic implants market is expected to reach USD 273.6 Million by 2025 and is expected to steadily grow at a CAGR of 2.8% to reach USD 360.6 Million by 2035. In 2024, the female pelvic implants market generated roughly USD 266.2 million in revenues.

Pelvic prostheses are intended prosthetics that help to support pelvic organ prolapse (POP) of females and stress urinary incontinence (SUI) clinically. These are synthetic mesh or biologic graft luteal implants that assist in restoring a functional pelvic mechanism. The increasing incidence of pelvic diseases, mostly in elderly and postmenopausal women, is the major cause that has increased patient demand for available and effective treatments.

Additionally, increased health coverage in many countries and generous reimbursement policies have made pelvic implants more affordable for patients and thereby induced adoption in the market.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 273.6 Million |

| Industry Value (2035F) | USD 360.6 Million |

| CAGR (2025 to 2035) | 2.8% |

The period from 2020 to 2024 saw various historical events that were responsible for the uptake of female pelvic implants. The COVID-19 pandemic (2020-2021) first delayed elective surgery, including pelvic procedures. But as healthcare systems started to recover, there was an influx of delayed treatments, with increasing patients coming for pelvic implants.

Greater awareness campaigns on pelvic health by medical societies and patient groups caused an increase in treatment-seeking behavior on the part of women. In addition, the increase in approvals and reimbursements in some countries, such as North America and Europe, has increased availability. The increased incidence of pelvic disorders among the aging population is further propelling the growth of the market in the near future.

Increasing incidence of pelvic disorders, specifically pelvic organ prolapse(POP) and stress urinary incontinence (SUI), has significantly increased demand for efficient treatment alternatives among aging women. Introduction of better implant technology, including biocompatible materials and absorbable mesh, has increased safety and decreased complications as implants become more acceptable.

Moreover, the introduction of attractive reimbursement policies and much wider insurance coverage has made implants affordable. Growing awareness and education campaigns by medical institutions and patient advocacy groups have also paved the way for increased usage across the region.

The mounting incidence of pelvic floor disorders, namely pelvic organ prolapse (POP), stress urinary incontinence (SUI), and increasingly postmenopausal women and aging, has continued to energize the demand. Increasing safety and diminishing complication rates have improved with the biocompatible and resorbable implant material, which has increased its acceptance.

Furthermore, the more recent procedures, like those carried out robotically or through laparoscopy, contribute to adopting this solution, as they produce little recovery time. In addition to improvements in most European nations' health care infrastructure and private and government-funded reimbursement plans, increased availability of treatment is seen in many countries.

Additionally, awareness and campaign initiatives towards patient education led by medical associations are driving pelvic implants into increased use in the region.

Advancements in the healthcare infrastructure and surging investments in medical technologies have opened up avenues to surgery. Increasing awareness of pelvic health, coupled with the option of minimally invasive procedures that pose a reduction in recovery periods, has encouraged more women to opt for implantation.

Increased demand has also come from flourishing medical tourism destinations such as India, Thailand, and South Korea. Also boosting sales across the region is the increasing presence of both local and foreign manufacturers providing cheap implant solutions.

Safety Concerns Associated with Female Pelvic Implants Hinders its Adoption in the Market

An eminent issue with female pelvic implants is the regulatory and safety issues in its deployment. Mesh erosion, pain, and, later, infection have prompted scrutiny of the procedure by various parties, particularly the FDA and the EMA, in the past few years. Distrust of litigation and recalls has halted important market expansions, in some cases.

Enhanced clinical trial standards and post-market surveillance have prohibited costs and timelines to gain project approval, thus blocking the way manufacturers introduce new implants. Unhelpful disparity in regulatory practices among countries constitutes another complication preventing standardization of the product, restricting access to new markets, and thereby further denying the acceptance of the products.

Introduction of Advanced Biocompatible Materials poses a significant opportunity for female pelvic implants

Synthetic and biological meshes are thought to have increased the safety of implantation surgical processes because of reduced risk of erosion and rejection. New generation implants, including 3D-printed and tissue-engineered implants, provide individualized treatment, catering to better outcomes for the patients.

Minimally invasive technologies such as robotic-assisted and laparoscopic surgery gain more and more ground for these objectives because of less recovery time and risk. Increased consistent support from medical device companies and university institutions will take the whole issue forward.

An environmental atmosphere that augurs well in terms of awareness in these new markets and protection of increased health care facilities will forecast an increase in demand for superior and safer pelvic implants, thereby leading to opportunities for manufacturers and health care service providers.

Rising Focus on Minimally Invasive Procedures Surges the Growth of the Market

The latter have seen extensive embracement by laparoscopic and robotically assisted surgical procedures owing to the many advantages that have endeared the techniques to gynecologists, such as minimal recovery periods, fewer postoperative complications, and better satisfaction from patients. As the number of surgeons who have been trained in minimal intervention procedures continues to rise, use of pelvic implants will, in turn, increase, pushing the growth of the industry even further.

Emphasis on the Development of Biocompatible and Absorbable Materials Anticipates the Market Growth.

The new material approach greatly enhances the safety and effectiveness of the female pelvic implant. Conventional mesh implants always present the problem of due to regulation and erosion concerns. New-generation implants are manufactured from biodegradable biomaterials to wither away over time, and the long-term risks could be alleviated.

Manufacturers are intensifying their research into synthetic and bioengineered scaffolds that promote tissue integration and healing. The focus of regulatory authorities has shifted to long-term clinical data requirements; thus, innovation is expected to move toward safer implant materials.

Adoption of 3D-Printed and Bioengineered Implants is an Ongoing Trend in the Market.

Bioengineered implants, which are made from biodegradable or tissue engineering-based materials, modify themselves with the surrounding tissue, thereby avoiding rejection and any risk of complications. While researchers further their aims in regenerative medicine, industry players are investing in second-generation pelvic implants for stimulating endogenous tissue growth.

The establishment of these high-tech solutions would ensure improved long-term success rates and propel future development of female pelvic implants.

Growing Demand in Emerging Markets

Factors that drive market growth include increasing healthcare spending, better medical facility access, and improved awareness of conditions affecting pelvic health. Governments in those countries spend a lot of money on women's healthcare, which increases the adoption of surgery in cases of pelvic organ prolapse and incontinence.

In addition, health tourism in countries such as Thailand and India contributes to increased demand for advanced pelvic surgery, as patients want high-quality yet cheaper treatments. As regulation systems and infrastructures in these countries improve, emerging markets begin to paint a rosy foreground in terms of growth prospects for manufacturers.

The awareness raising with the help of advanced technology concerning certain female pelvic implants has been brought on by dwindling incidences, in use, of techniques involving invasive procedures. Such improvement makes it possible to offer better treatment to cater to the increasing incidence of pelvic floor disorders.

Another noteworthy triggering reason was the current COVID-19 pandemic that intensified the emphasis on better treatment options; it created further demand for these implants in urogynecology and reconstructive pelvic surgery.

Great future development may come between 2025 and 2035 because progress in technology, as well as regulations and the development of the healthcare infrastructure, will be accomplished. Investment amounts in the field of bioengineering will increase and better patient outcomes with the help of AI-aided surgery will continue leading.

In addition, smart implant technologies will merge with the next generation of biodegradable implants, which are likely to influence the future of female pelvic implants.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Further approvals by the FDA and EMA for newly introduced implants and increasing scrutiny for safety, owing to mesh problems and recalls |

| Technological Advancements | Launch of advanced biomaterials, 3D printing technologies for personalized implants, and the latest in minimally invasive surgical procedures. |

| Consumer Demand | Growing acceptance as the knowledge of pelvic disorders increases, with the growth of the elderly population and pregnancy complications. |

| Market Growth Drivers | More funding in R&D, more health care spending, and sophisticated implant design are driving acceptance. |

| Sustainability | A shift toward biodegradable and biologically derived implants for risk mitigation. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations, long-term clinical trials as a requirement, and embracing biocompatible non-mesh alternatives. |

| Technological Advancements | Increased bioengineered regenerative implants, sensor-enabled smart implants, and robotic-assisted surgeries. |

| Consumer Demand | Shift towards non-mesh alternatives, customized implants, and minimally invasive procedures for quicker recovery. |

| Market Growth Drivers | Increased healthcare access, integration of regenerative medicine, and increased emphasis on women's health. |

| Sustainability | Creation of fully biodegradable implants and environmentally friendly biomaterials for sustainable healthcare. |

The USA market is thriving with a heightened number of urogynecological interventions, sophisticated medical technology, and a developed reimbursement system. Patient exposure to, as well as availability and access of, minimally invasive therapy, fuels demand. Stricter FDA regulation preserves product safety while expanding investments in biomaterials and 3D printed implants stimulate market expansion.

Market Growth Factors

Market Forecast

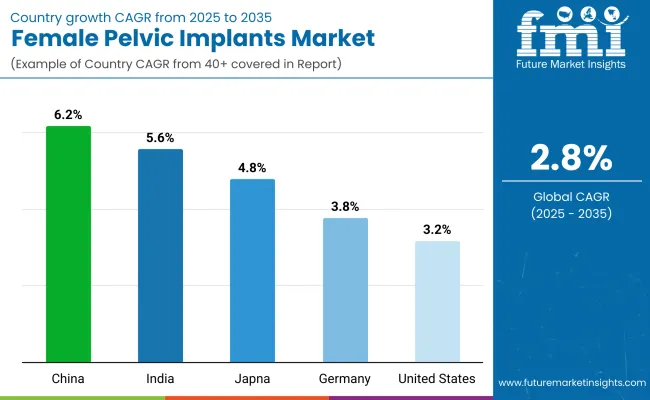

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

Market Outlook

The market for female pelvic implants in Germany is strong, driven by a well-developed healthcare system, elderly population, and high level of acceptance of innovative surgical methods. The availability of worldwide leading producers of medical devices, combined with well-enforced regulatory systems, guarantees product quality; there is high awareness of pelvic disorders, which, coupled with the existence of insurance coverage, drives the growth of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

A growing aging population, a growing incidence of pelvic organ prolapse, and an enhanced healthcare infrastructure are the drivers contributing to the growth of this market in India. Medical tourism and government efforts to enhance the quality of women's health services have also contributed to the demand. Affordability and availability for the rural market, however, are still concerns, hence the opportunity for cost-effective solutions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

China's market is fueled by fast urbanization, high growth in healthcare spending, and increased awareness of pelvic health. The government supports the utilization of high-tech medical devices and encourages their development, bolstered by the expansion of private healthcare centers. The local industry is enhancing its production capabilities, hence fueling competitive pricing and broader availability.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Japan's market is dominated by an aging population, a preference for minimally invasive surgery, and stringent healthcare standards. New technologies like bioengineered implants and robot-assisted procedures are extensively used. Government-funded healthcare programs promoting research into regenerative medicine also drive market adoption of superior female pelvic implant solutions.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Vaginal mesh implants dominate the female pelvic implants market due to their high efficacy in treating pelvic organ prolapse (POP)

Vaginal mesh implants have occupied the best position in the market for female pelvic implants because they are better efficient than other devices in the treatment of stress urinary incontinence (SUI) and pelvic organ prolapse (POP).

Longevity, capability to provide long-term support, and low recurrence rates make them the first pick among surgeons. Although regulation is focused in markets like the US and Europe, the global acceptance being adopted in developing markets continues to boost the segment's dominance.

The vaginal sling segment holds a substantial market share due to its minimally invasive nature.

The vaginal sling segment captures the dominant share of the market since it is minimally invasive and guarantees high success rates in curing stress urinary incontinence (SUI). These slings cause fewer and smaller incisions than those of any conventional mesh and lead to faster recovery with fewer complications.

The increasing number of women suffering from SUI after pregnancy, menopause, or old age has mainly driven the demand upward. The clinical fact that both biologic and synthetic slings are being made available will greatly assist patients looking for options in personalized treatment.

Coupled with clinical support and regulatory clearances in favor of mid-urethral slings in leading healthcare markets such as Europe and the United States, these factors enhance their market presence greatly.

The Hospitals segment dominates the market due to advanced infrastructure and experienced surgical teams.

The Hospitals segment leads in the female pelvic implants market due to advanced infrastructure, skilled teams of surgical experts, and special medical equipment required for complicated pelvic procedures. Hospitals deal with more serious pelvic floor disorders, including pelvic organ prolapse (POP) and stress urinary incontinence (SUI), for which surgical implants are requisite.

Insurance coverage and reimbursement policies for treatment conducted in hospitals also make this option more suitable for patients. The postoperative care offered and multidisciplinary skills further enhance the outcome and solidify the hospital segment's lead in the market.

The Ambulatory Surgical Centers (ASCs) segment is growing significantly due to cost efficiency, and shorter hospital stays

The Ambulatory Surgical Centers (ASCs) segment is growing tremendously with cost-effectiveness, short hospital stays, and minimal invasiveness in surgical procedures. A great variety of pelvic implant surgeries like sling implantations and vaginal mesh repairs are being carried out in ASCs with lower complications and high recovery rates.

Demand for outpatient surgeries, improved access to healthcare, and advancements in surgical technology all add to this trend. ASCs further help reduce the costs of hospital care while offering specialized, efficient, and streamlined care for patients requiring pelvic implant services, thus becoming the preferred option for the healthcare provider as well as for the patients.

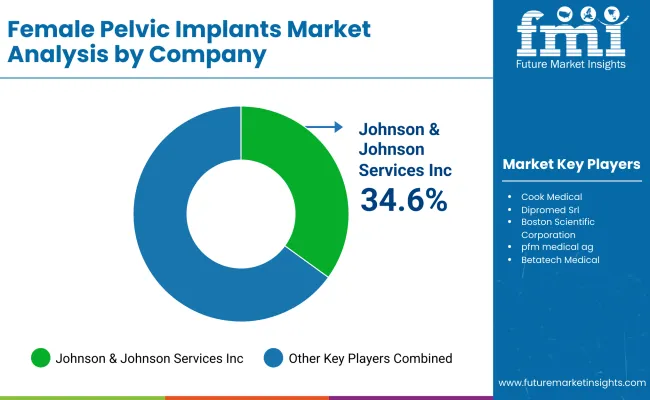

The regulatory agencies, such as the FDA and EMA, have imposed regulatory safety, efficacy, and post-market monitoring requirements on conditions in the market. Leading players have product innovation, partnerships with hospitals and surgical centers, and penetration of the international market. Investment in research and development of biocompatible materials and minimally invasive implants to improve patient outcomes is included in these companies.

Most affordable alternatives in developing markets benefit from local developers competing with worldwide giants on price, and price competition and affordability further increase. Local mergers and acquisitions are raising competition within this constantly changing market environment, also including expansion locally.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson & Johnson Services, Inc. | 34.6% to 38.5% |

| Cook Medical | 20.4% to 22.6% |

| Dipromed Srl | 15.1% to 17.2% |

| Boston Scientific Corporation | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson Services, Inc. | Johnson and Johnson has an Ethicon line that markets vaginal mesh slings and implants with biocompatibility in mind while trying to avoid more invasive interventions; the emphasis is improvement in safety and future-generation implant research. |

| Cook Medical | The focus is on urological and gynecological implants that can optimize biodegradable and synthetic biologics in order to reduce complications. The company does patient-specialized products. |

| Dipromed Srl | A maker of low-cost vaginal grafts and slings that favor ergonomic, biocompatible materials for treating POP or SUI and targets both European and worldwide markets. |

| Boston Scientific Corporation | The leader in mesh, graft, and sling solutions, touching on minimally invasive therapies and more safety, with continuing R&D toward ensuring competitiveness. |

Other Key Players

Vaginal Mesh Implants, Vaginal Sling and Vaginal Graft Implants

Pelvic Organ Prolapse and Stress Urinary Incontinence

Hospitals, Ambulatory Surgical Centres and Speciality Clinics

The overall market size for female pelvic implants market was USD 273.6 Million in 2025.

The female pelvic implants market is expected to reach USD 360.6 Million in 2035.

Growing technological advancement by development and introduction of new materials in female pelvic implants anticipates the growth of the female pelvic implants market.

The top key players that drives the development of female pelvic implants market are Johnson & Johnson Services, Inc., Cook Medical, Dipromed Srl, Boston Scientific Corporation and Coloplast A/S

Vaginal mesh implants segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: Middle East & Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East & Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: Middle East & Africa Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 32: Middle East & Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Indication, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Indication, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Indication, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Indication, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 139: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East & Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: Middle East & Africa Market Value (US$ Million) by Indication, 2023 to 2033

Figure 143: Middle East & Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: Middle East & Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East & Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East & Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 149: Middle East & Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: Middle East & Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: Middle East & Africa Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 152: Middle East & Africa Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 153: Middle East & Africa Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 154: Middle East & Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: Middle East & Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: Middle East & Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: Middle East & Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 158: Middle East & Africa Market Attractiveness by Indication, 2023 to 2033

Figure 159: Middle East & Africa Market Attractiveness by End User, 2023 to 2033

Figure 160: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Female Stress Urinary Incontinence Treatment Device Market Size and Share Forecast Outlook 2025 to 2035

Pelvic Cancer Induced Hemorrhegic Cystitis Market Size and Share Forecast Outlook 2025 to 2035

Pelvic Floor Diagnostics Market - Demand & Forecast 2025 to 2035

Pelvic Reconstruction Market - Growth & Demand 2025 to 2035

Pelvic Floor Stimulators Market – Trends & Forecast 2025 to 2035

Pelvic Inflammatory Disease Therapeutics Market

Pelvic Floor Diagnostic Testing Market

Bio-Implants Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Gel Implants Market Analysis - Trends, Share & Forecast 2025 to 2035

Smart Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Cheek Implants Market

Spinal Implants and Devices Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Ocular Implants Market

Facial Implants Market

Struts Implants Market

Medical Implants Precision Machining Service Market Size and Share Forecast Outlook 2025 to 2035

Steroid Implants Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Humeral Implants Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA