The C-Arms devices market is experiencing sustained growth, fueled by rising surgical procedure volumes and increasing demand for real-time imaging in minimally invasive interventions. Medical equipment manufacturers have reported strong year-over-year demand for C-Arms, particularly in high-throughput clinical environments such as orthopaedics, trauma centers, and cardiovascular operating suites.

Hospital procurement trends have favored systems that provide superior imaging clarity, reduced radiation dose, and compatibility with modern operating room workflows. Additionally, the global expansion of ambulatory surgical centers and specialty clinics has further accelerated market adoption.

Advancements in flat-panel detectors, 3D imaging capability, and digital connectivity have enhanced procedural precision and patient outcomes, reinforcing the importance of C-Arms in image-guided surgeries. Clinical guidelines have increasingly recommended the integration of mobile imaging solutions in orthopaedic and trauma care settings to improve intraoperative decision-making. Looking ahead, the market is expected to benefit from growing adoption of mobile C-Arms in emerging economies, innovations in AI-based image processing, and rising demand for outpatient surgical care across key regions.

| Metric | Value |

|---|---|

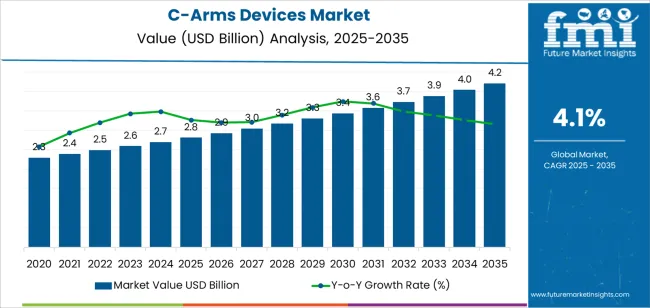

| C-Arms Devices Market Estimated Value in (2025 E) | USD 2.8 billion |

| C-Arms Devices Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

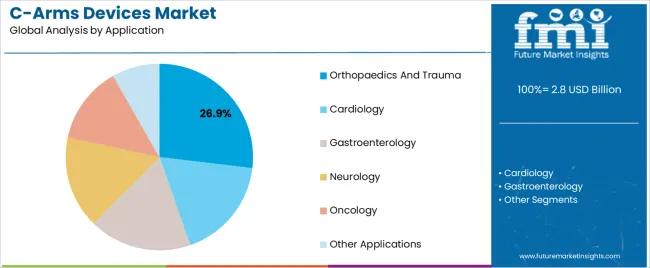

The market is segmented by Type and Application and region. By Type, the market is divided into Mobile C-Arms and Fixed C-Arms. In terms of Application, the market is classified into Orthopaedics And Trauma, Cardiology, Gastroenterology, Neurology, Oncology, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

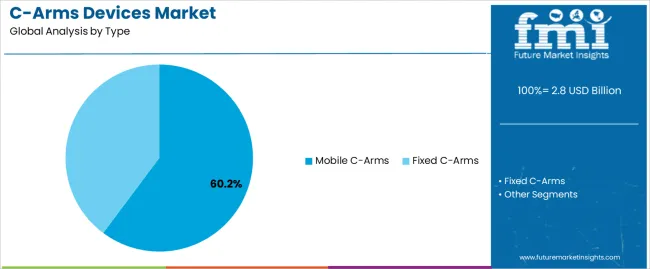

The Mobile C-Arms segment is projected to account for 60.20% of the C-Arms devices market revenue in 2025, maintaining its leadership in the device type category. Growth in this segment has been driven by the flexibility, portability, and broad clinical utility offered by mobile systems in operating rooms and outpatient care environments.

Medical equipment manufacturers have enhanced mobile C-Arm designs to deliver high-resolution imaging with compact footprints, supporting procedures in constrained clinical spaces. Additionally, mobile C-Arms have enabled rapid deployment in trauma, emergency, and interventional settings without the need for fixed imaging infrastructure.

Hospitals and surgical centers have preferred mobile units for their ability to support a wide range of procedures, including orthopaedics, urology, pain management, and cardiovascular interventions. Continuous upgrades in software integration, radiation dose optimization, and flat-panel detector technology have further increased their clinical value. With the growing shift toward minimally invasive and day-care procedures, the Mobile C-Arms segment is expected to remain the primary driver of market expansion.

The Orthopaedics and Trauma segment is projected to contribute 26.9% of the C-Arms devices market revenue in 2025, holding the largest share among application areas. This growth has been supported by the increasing global burden of musculoskeletal injuries, age-related fractures, and the rising number of orthopedic surgeries.

Clinical best practices have emphasized the use of intraoperative imaging to ensure alignment accuracy during fracture fixation, joint replacement, and spinal surgeries. Surgeons have relied on C-Arms to visualize bone structures in real time, improving procedural outcomes and reducing post-surgical complications.

Additionally, trauma centers and emergency departments have integrated C-Arms to manage acute injuries requiring immediate imaging support. Equipment procurement data from hospitals has reflected consistent demand for systems optimized for orthopaedic workflows, with features such as enhanced bone contrast and navigation compatibility. As the incidence of road traffic accidents and sports-related injuries continues to rise, the Orthopaedics and Trauma segment is expected to sustain its leading position in driving C-Arms device utilization.

The above table presents the expected CAGR for the global C-arm devices market over numerous semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the industry is predicted to surge at a CAGR of 4.7%, followed by a slightly drop in growth rate of 4.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 4.7% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

| H1 | 4.3% (2025 to 2035) |

| H2 | 3.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.3% in the first half and remain relatively low at 3.9% in the second half.

Technological Innovations in C-Arm Devices is likely to Accelerate Market Growth

Continuous innovations in C-Arm technology have helped to drive market growth. Manufacturers are continually inventing to improve image quality, increase functionality, and add new features.

C-Arms systems have seen significant technological improvements. The incorporation of 3D imaging capabilities allows for volumetric reconstruction of anatomical structures, facilitating precise visualization and spatial assessment.

The development of cone beam CT technology provides real time 3D imaging, which is very useful in interventional radiology and orthopedics. Improved image guided navigation, dosage optimization features, and interaction with other imaging modalities all contribute to the improvement of C-arm systems, transforming numerous medical specializations and improving patient outcomes.

High Expenses related to C-Arms Imaging Equipment to Stifle Market Growth

The high cost of C-Arms imaging equipment is a key impediment to their industry adoption. C-Arm equipment is expensive to create, maintain, and upgrade, representing a considerable commitment for healthcare organizations. The high cost may restrict adoption, especially in underdeveloped countries with limited healthcare budgets.

C-Arm systems are complex and require specific training to function properly. Healthcare providers may have difficulties in educating their employees or hiring personnel with the appropriate skills to operate and interpret C-Arm pictures. The intricacy of the technology can impede wider acceptance and use.

C-Arm systems create real time pictures using Xrays, exposing patients and healthcare staff to radiation. Although contemporary C-Arm devices are intended to reduce radiation exposure, worries concerning radiation dangers remain. The considerations may impact the adoption of C-Arm systems and prompt healthcare practitioners to make careful decisions.

C-Arm technology is not standardized among manufacturers. This can lead to compatibility concerns, interoperability issues, and difficulty in connecting C-Arm systems with other medical devices or healthcare information systems. The absence of standards might hamper seamless workflow integration, restraining the market size.

Global C-Arms Devices demand increased at a CAGR of 5.1% from 2020 to 2025. For the next ten years (2025 to 2035), projections are that expenditure on C-Arms Devices will reach a CAGR of 4.1%.

During the historical period, the market grew owing to advances in imaging technology and a rising number of minimally invasive operations. C-Arms, which provide real time, high resolution imaging, have proven crucial in a variety of medical specialties, including orthopedics, cardiology, and neurosurgery.

As per C-arms devices market forecast, the industry growth is anticipated to slow down driven by continuous technical progress in C-Arms, such as the incorporation of 3D imaging and digital flat-panel detectors, improves their diagnostic and therapeutic capacities. The advances ensure that C-Arms remain essential equipment in current surgical operations.

The rising frequency of chronic disorders, notably cardiovascular and orthopedic ailments, is predicted to keep demand stable. The aging global population, which is prone to age related health concerns that necessitate diagnostic imaging and surgical intervention, fuels the global industry size.

As healthcare systems throughout the world adjust to the demographic shifts, investment in sophisticated imaging is anticipated to propel the global C-arms devices market size.

Increasing healthcare infrastructure in emerging economies promotes global C-arms devices market size. Governments and corporate entities in the regions are investing in advanced medical equipment to improve healthcare delivery, opening up new C-arms devices market opportunity.

The global C-arms devices market size is likely to slow significantly due to cost cutting initiatives in healthcare spending and the significant initial investment required for new imaging technology.

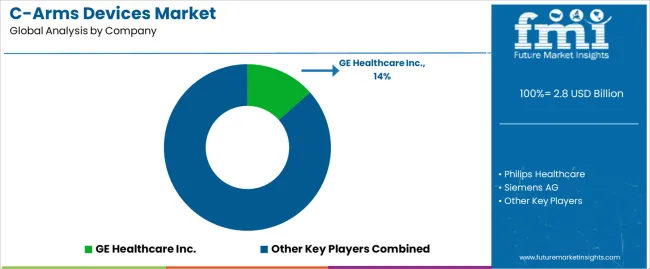

In the dynamic environment of the C-arms devices market, market concentration among competitors is a key factor in determining the market destiny. Over the projection period of 2025 to 2035, the industry is expected to consolidate significantly, with Tier 1 and Tier 2 companies accounting for a sizable percentage of the total revenue of USD 2213.2 million.

Tier 1 businesses are likely to dominate the industry, with a significant 67% share of total income. The industry leaders have vast resources, significant technological skills, and a strong worldwide presence, which allows them to maintain a competitive advantage in the industry.

Tier 1 firms are well positioned to capitalize on new possibilities and maintain industry leadership by prioritizing innovation, strategic alliances, and effective marketing strategies.

Tier 2 players, on the other hand, play an important role, accounting for 23% of total income despite their lesser industry share. The Tier 2 companies frequently specialize in niche markets or locations, providing unique solutions suited to specific consumer requirements.

Despite constraints such as limited resources and fierce competition, Tier 2 firms use their adaptability, and customer centric attitude to strengthen their position in the industry.

The concentration of industry share among Tier 1 and Tier 2 competitors emphasizes the competitive dynamics and the significance of strategic positioning in the C-arms device market.

As industry consolidation proceeds, firms at all levels must stay nimble, adaptive, and customer centric in order to flourish in an increasingly competitive environment. Industry participants may influence the future success of the C-arms devices market by utilizing their strengths, responding to changing client expectations, and embracing innovation.

The section below covers the industry analysis for the C-Arms devices market for different countries. Industry demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

Canada is anticipated to remain at the forefront in North America, with a value share of 4% through 2035. In Asia Pacific, China is projected to witness a CAGR of 5.8% by 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 5.8% |

| India | 5.2% |

| Italy | 3.9% |

| France | 3.7% |

| The United States | 3.4% |

China is predicted to augment at a CAGR of 5.8% during the projected period. The C-arms devices market in China is expanding rapidly due to rising demand for minimally invasive treatments.

As healthcare in China moves toward more modern and patient friendly treatment choices, there is a rising demand for operations that result in shorter recovery periods, fewer problems, and better patient outcomes. C-arms devices let surgeons do minimally invasive operations by giving real time image guidance throughout the process.

The development in chronic illnesses, such as cardiovascular ailments and orthopedic issues, along with an aging population, is pushing the need for diagnostic and interventional treatments aided by C-Arm equipment. Favorable government efforts and healthcare reforms in China that encourage the use of innovative medical technology drive the regional C-arms market size and growth.

Italy is expected to thrive at a CAGR of 3.9% during the assessment period. In Italy, favorable reimbursement policies are fueling the growing demand for medical equipment. With a strong healthcare system that prioritizes patient access to novel therapies, Italy has adopted payment rules that encourage the use of modern medical technology, such as C-arm devices.

The laws give financial incentives for healthcare professionals to use cutting-edge imaging technology, allowing for faster diagnosis, more effective treatment, and better patient outcomes.

The reimbursement regulations provide an atmosphere that encourages healthcare institutions to invest in cutting edge medical technology, hence boosting industry growth.

The United States is projected to ascend at a CAGR of 3.4% during the forecast period. Technological innovations are a key factor driving the growth of the C-Arms Devices industry in the United States.

Continuous advances in imaging technology, such as the incorporation of digital imaging, and 3D imaging capabilities, have transformed medical imaging and surgical procedures. The developments have greatly improved the accuracy, resolution, and efficiency of C-Arms devices, making them essential instruments in a variety of medical disciplines.

In the United States, healthcare facilities are progressively implementing C-Arms devices with cutting edge capabilities to increase diagnostic accuracy, optimize treatment planning, and improve intraoperative vision.

Advanced C-Arms devices are in great demand in disciplines such as orthopedics, cardiology, neurosurgery, and interventional radiology, where real time imaging is important for guiding complex treatments and delivering the best possible patient results.

Technological improvements have resulted in the creation of hybrid operating rooms, in which C-Arms devices are combined with other imaging modalities and surgical equipment, increasing their utility and boosting industry growth in the United States.

The section contains information about the leading segments in the industry. By application, the cardiology segment is held an industry share of 36.3% throughout 2025. The Mobile C-Arms segment held an industry share of 60.2% in 2025.

| Application | Cardiology |

|---|---|

| Value Share (2025) | 36.3% |

The cardiology category is expected to lead the C-arms devices market by 2025, accounting for 36.3%. This growth is due to the increasing importance of improved imaging technology in cardiovascular surgeries.

C-Arms, with their real time imaging capabilities, are critical in detecting and directing treatments for a wide range of cardiovascular disorders, including coronary artery disease and structural heart abnormalities.

The increased frequency of cardiac conditions, along with the growing need for minimally invasive operations, is boosting the use of C-Arms devices in cardiology.

Continuous technical improvements, such as the incorporation of 3D imaging and image guided navigation systems, increase the utility and adaptability of C-Arms devices for complicated cardiac treatments. As a result, the cardiology segment is expected to drive the global C-arms devices market size.

| Product | Mobile C-Arms |

|---|---|

| Value Share (2025) | 60.2% |

In 2025, the Mobile C-Arms segment is predicted to lead the C-arms devices market, with an industry share of 60.2%. This growth is a reflection of the increasing popularity of mobile C-arm systems due to their mobility, portability, and enhanced imaging capabilities.

Mobile C-arms provide versatility in a variety of medical environments, such as operating rooms, emergency departments, and outpatient clinics, allowing for real time imaging during surgical operations and minimally invasive treatments.

Advances in software integration and connection capabilities improve workflow efficiency and picture quality, accelerating acceptance among healthcare providers. The Mobile C-Arms segment is predicted to lead the application segment further propelling the global C-arms devices market size.

The C-arms devices market is extremely competitive, driven by technological improvements, growing healthcare spending, and the rising frequency of chronic conditions that need diagnostic imaging. The industry is dominated by leading companies who use their vast product portfolios and global distribution networks to stay ahead of the competition.

Innovation is a key competitive aspect, with businesses investing heavily in research and development to produce updated C-arm systems with higher picture quality, lower radiation doses, and more flexibility. The use of artificial intelligence and machine learning into imaging systems is an emerging trend, which improves diagnostic accuracy and efficiency.

Emerging firms and startups are also making significant progress, frequently focusing on specialized niches or offering cost effective solutions customized to emerging markets. Companies frequently get into strategic alliances, mergers, and acquisitions in order to grow their industry presence and technical capabilities.

Recent Developments

The C-Arms devices industry is classified into Fixed C-Arms and Mobile C-Arms.

The C-Arms devices industry is classified into cardiology, gastroenterology, neurology, orthopaedics and trauma, oncology and other applications.

Analysis of the C-Arms devices industry has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe and Middle East & Africa.

The global c-arms devices market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the c-arms devices market is projected to reach USD 4.2 billion by 2035.

The c-arms devices market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in c-arms devices market are mobile c-arms and fixed c-arms.

In terms of application, orthopaedics and trauma segment to command 26.9% share in the c-arms devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Sleep Aid Devices Market Growth – Industry Insights & Forecast 2022-2032

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA