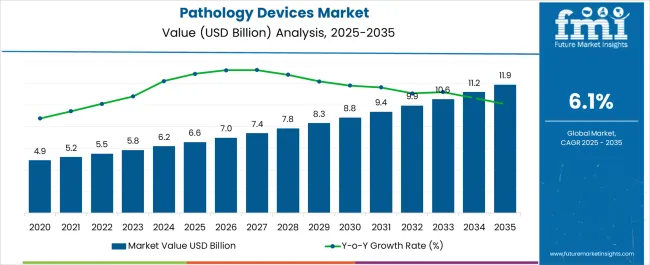

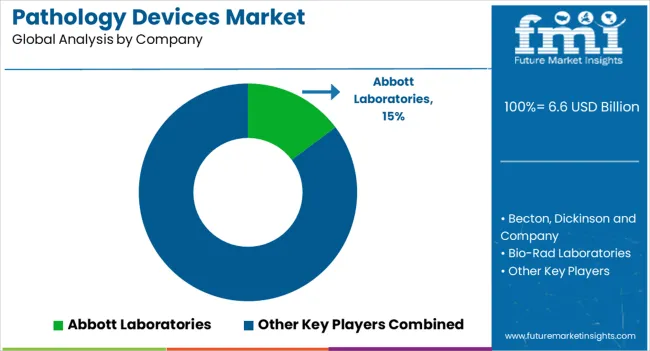

The Pathology Devices Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 11.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Pathology Devices Market Estimated Value in (2025 E) | USD 6.6 billion |

| Pathology Devices Market Forecast Value in (2035 F) | USD 11.9 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The pathology devices market is witnessing steady growth, driven by the increasing prevalence of chronic and infectious diseases and the rising need for accurate diagnostic solutions. The role of pathology devices in enabling early disease detection and guiding treatment decisions is reinforcing their adoption across healthcare ecosystems. Continuous advancements in diagnostic technologies, including automation, digital pathology, and integration of artificial intelligence, are enhancing accuracy, efficiency, and scalability in laboratory operations.

Growing awareness about preventive healthcare and regular screening programs in both developed and emerging markets is further stimulating demand. In addition, expanding healthcare infrastructure and rising government investments in modernizing diagnostic capabilities are providing a strong foundation for future growth.

The market is also benefiting from the trend toward personalized medicine, where pathology devices play a central role in identifying patient-specific disease markers and tailoring treatment strategies As healthcare systems worldwide prioritize precision diagnostics and rapid turnaround times, pathology devices are positioned to remain indispensable, with significant opportunities emerging from ongoing technological innovation and global health initiatives.

The pathology devices market is segmented by technology, application, end users, and geographic regions. By technology, pathology devices market is divided into Immunoassays technology, ELISA, Fluorescence, Colorimetric, Chemiluminescence, Rapid Test, Western Blot, Clinical chemistry, Hematology, Microbiology, Molecular diagnostics, Polymerase Chain Reaction (PCR), Nucleic Acid Amplification Technology (NAAT), Microarrays, Molecular Hybridization, and DNA Sequencing. In terms of application, pathology devices market is classified into Disease diagnostics, Drug discovery and development, and Forensic diagnostics. Based on end users, pathology devices market is segmented into Diagnostics laboratories, Forensic laboratories, Academic institutes, Contract research organizations, and Pharmaceutical and biotechnology companies. Regionally, the pathology devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The immunoassays technology segment is projected to hold 17.2% of the pathology devices market revenue share in 2025, positioning it as a significant contributor within the technology category. This growth is being reinforced by the increasing demand for reliable and sensitive methods for detecting specific biomarkers, proteins, and pathogens. Immunoassays are widely recognized for their accuracy, scalability, and ability to deliver rapid results, making them highly suitable for both routine diagnostics and advanced clinical investigations.

Their adaptability to automated platforms and compatibility with high-throughput laboratory systems are supporting large-scale deployment in disease screening and monitoring. The segment is also benefiting from ongoing innovations in assay design and reagent development, which are improving sensitivity and reducing the risk of false results.

The growing burden of infectious diseases and cancer has further strengthened reliance on immunoassays as they enable early diagnosis and timely intervention With healthcare systems increasingly emphasizing cost efficiency, precision, and patient safety, the immunoassays technology segment is expected to retain its importance in the evolving pathology devices market.

The disease diagnostics application segment is anticipated to account for 46.8% of the pathology devices market revenue share in 2025, making it the leading application area. Its dominance is being driven by the rising prevalence of chronic conditions such as cancer, cardiovascular disorders, and infectious diseases that require accurate and timely detection. Pathology devices are central to disease diagnostics as they enable the identification of disease-specific markers, facilitating effective treatment planning and monitoring.

Growing investments in screening programs, supported by government initiatives and healthcare organizations, are contributing to the expansion of this segment. Technological advancements, including digital pathology, automated imaging, and molecular diagnostics, are further enhancing diagnostic precision and efficiency.

The increasing demand for personalized healthcare is also reinforcing the segment’s leadership, as pathology devices are integral to tailoring therapies based on individual disease profiles With global health systems emphasizing early intervention and improved patient outcomes, disease diagnostics will continue to drive the largest share of demand for pathology devices.

The diagnostics laboratories segment is expected to represent 29.7% of the pathology devices market revenue share in 2025, making it the leading end-user category. This dominance is being explained by the rising demand for centralized, high-volume diagnostic services that require advanced equipment for efficient processing and analysis. Diagnostics laboratories are increasingly investing in automation and digital solutions to handle the growing volume of tests while maintaining high accuracy and quick turnaround times.

Their role as primary providers of clinical testing services for hospitals, clinics, and public health programs has reinforced their importance within the healthcare ecosystem. The segment is also benefiting from expanding laboratory networks in emerging economies, where rising healthcare access and infrastructure development are driving adoption of advanced pathology devices.

Furthermore, the integration of artificial intelligence and machine learning into laboratory workflows is enabling enhanced interpretation of results and optimized operations With the growing emphasis on precision, scalability, and cost efficiency, diagnostics laboratories are expected to remain the dominant end users of pathology devices.

Pathology is the field in healthcare which provides accurate information regarding the progression of disease conditions. This information helps physicians to monitor and manage the therapies. Increasing advances in the diagnostic techniques such as PCR, biopsies, and other assays have catered to the needs of pathology services across various domains of healthcare industry.

Biomarker technology is one the diagnostic tool which would get prominent potential in next five years. Such advances in technologies has largely helped physicians to measure and monitor the progression life style diseases such as stroke, diabetes and cancer. Other technologies such as immunoassays, clinical chemistry are also framing the demand for pathology devices to next level.

These technologies are prominently used across developed regions owing to lower cost and easy availability. However, the substandard quality and marginal efficiency would pose a threat for these technologies. Pathology devices used in diagnosing infectious diseases, cancer and other prevalent diseases have high demand across globe. Moreover, devices used during clinical trials, drug discovery and development are gaining pace owing to increasing pharmaceutical research and development.

Increasing prevalence of chronic diseases, growing number of geriatric population and active initiatives from the government to regulate preventive measures of infectious diseases has triggered growth of pathology devices market, globally. The rising incidence of sexually transmitted diseases and lifestyle diseases is increasing the demand for anatomical and clinical chemistry pathologies.

However, prevalent conditions such as autoimmune diseases, chromosomal diseases are elevating a need for more advanced molecular diagnostic devices. However, limited awareness across developing regions, lack of skill work force and high cost of devices are hindering the growth of pathology devices market.

By technology, immunoassays and clinical chemistry are two leading segments, owing to its higher adoption in developing regions. However, molecular diagnostic is expected to gain pace during the forecast period. This is due to its superior quality over conventional pathology techniques such as immunoassays and clinical chemistry.

By application, the disease diagnostic was the leading application segment in pathology devices market. However, drug discovery and drug development is anticipated to grow at a healthy CAGR during the forecast period. By end users, diagnostic laboratories was the highest revenue generating segment in 2025. However, pharmaceutical and biotechnology companies and contract research organizations are expected to be the fastest growing segment during the forecast period.

By region, North America was the most dominating region in pathology devices market in 2025, followed by Europe. Favorable government regulations and high affordability are the prominent factors responsible for the growth of Nprth America & Europe pathology devices market. Moreover, the growing demand for door step diagnostic services and advancement in technologies are promoting the growth of pathology devices market in North America and Europe region.

In October 2025, Roche Diagnostics has received US FDA approval for the cobas HBV and cobas HCV viral load test. This test provide rapid result with highest throughput in hepatitis B or hepatitis C conditions. Such commercialization of novel diagnostic tools provides promising growth opportunities for pathology devices market.

Some of the leading players operating in pathology device market are Becton, Dickson and Company, Ortho-Clinical Diagnostics, Roche Diagnostics, Abbott Laboratories, Inc., Johnson and Johnson, Danaher Corporation, Ventana Medical Systems, Hamamatsu Photonics K.K., Mikroscan Technologies, Definiens AG, Visiopharm, Thermo Fisher Scientific, Inc., Siemens Healthcare, Bio-Rad Laboratories, Inc., Sysmex Corporation, bioMérieux, 3DHistech, Quest Diagnostics and LabCorp. Receiving commercial approvals from the respective government authorities plays a crucial role in novel product launch in the global pathology devices market. Moreover, these companies are majorly focusing on the research and development area to introduce more economic pathology devices for developing regions.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

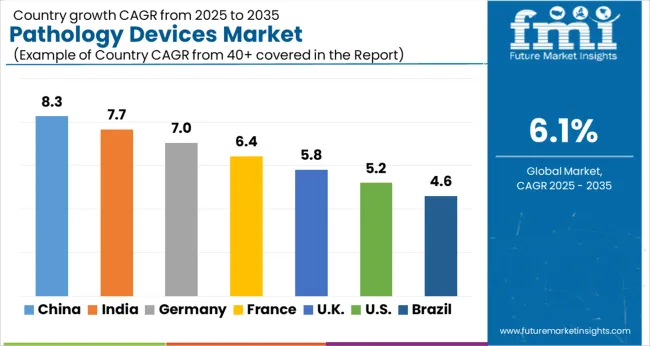

| Country | CAGR |

|---|---|

| China | 8.3% |

| India | 7.7% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The Pathology Devices Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.3%, followed by India at 7.7%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Pathology Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Pathology Devices Market is estimated to be valued at USD 2.3 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 5.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 341.0 million and USD 228.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Technology | Immunoassays technology, ELISA, Fluorescence, Colorimetric, Chemiluminescence, Rapid Test, Western Blot, Clinical chemistry, Hematology, Microbiology, Molecular diagnostics, Polymerase Chain Reaction (PCR), Nucleic Acid Amplification Technology (NAAT), Microarrays, Molecular Hybridization, and DNA Sequencing |

| Application | Disease diagnostics, Drug discovery and development, and Forensic diagnostics |

| End Users | Diagnostics laboratories, Forensic laboratories, Academic institutes, Contract research organizations, and Pharmaceutical and biotechnology companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abbott Laboratories, Becton, Dickinson and Company, Bio-Rad Laboratories, Beckman Coulter Inc., Definiens, Hamamatsu Photonics, Mikroscan Technologies, Ortho-Clinical Diagnostics, F. Hoffmann-La Roche AG, Thermo Fisher Scientific, Danaher Corporation, and Siemens Healthineers |

The global pathology devices market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the pathology devices market is projected to reach USD 11.9 billion by 2035.

The pathology devices market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in pathology devices market are immunoassays technology, elisa, fluorescence, colorimetric, chemiluminescence, rapid test, western blot, clinical chemistry, hematology, microbiology, molecular diagnostics, polymerase chain reaction (pcr), nucleic acid amplification technology (naat), microarrays, molecular hybridization and dna sequencing.

In terms of application, disease diagnostics segment to command 46.8% share in the pathology devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pathology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Displays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Digital Pathology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Anatomic Pathology Track and Trace Solution Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Anatomic Pathology Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA