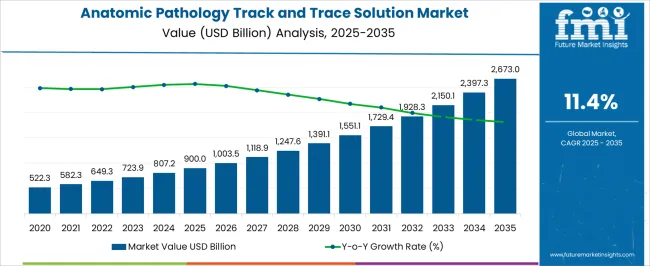

The Anatomic Pathology Track and Trace Solution Market is estimated to be valued at USD 900.0 billion in 2025 and is projected to reach USD 2673.0 billion by 2035, registering a compound annual growth rate (CAGR) of 11.4% over the forecast period.

| Metric | Value |

|---|---|

| Anatomic Pathology Track and Trace Solution Market Estimated Value in (2025 E) | USD 900.0 billion |

| Anatomic Pathology Track and Trace Solution Market Forecast Value in (2035 F) | USD 2673.0 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The anatomic pathology track and trace solution market is growing steadily, driven by the rising demand for accurate, efficient, and compliant sample management systems in diagnostic laboratories. Increasing test volumes, the need to minimize diagnostic errors, and regulatory emphasis on patient safety have accelerated adoption.

Digital transformation initiatives in healthcare are also contributing to market growth, with laboratories adopting advanced software solutions and automation tools to improve operational efficiency. The market benefits from increasing investments in healthcare infrastructure and the integration of barcode and RFID technologies to streamline workflows.

Future growth is expected to be supported by the expansion of precision medicine, greater adoption of laboratory information management systems, and the rising importance of interoperability in diagnostic processes.

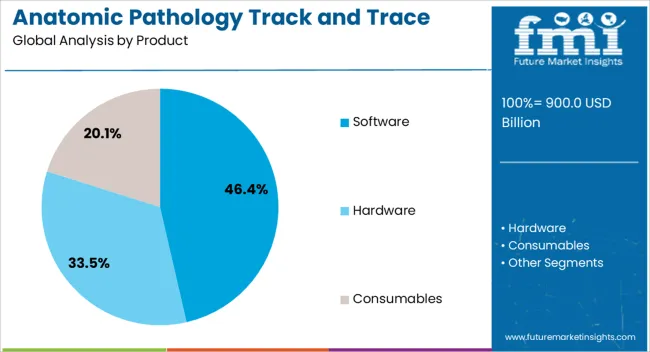

The software segment leads the product category with approximately 46.4% share, supported by its critical role in managing data, ensuring accuracy, and enhancing laboratory workflow efficiency. The adoption of software solutions has been reinforced by their ability to integrate with laboratory information systems and provide real-time tracking capabilities.

Cloud-based platforms and AI-driven analytics are further enhancing functionality, enabling predictive maintenance and error reduction.

With laboratories prioritizing digitization and scalability, the software segment is expected to maintain its dominant position in the market.

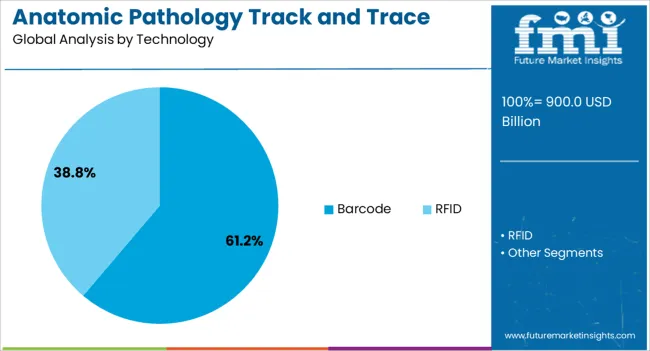

The barcode segment dominates the technology category with approximately 61.2% share, owing to its cost-effectiveness, simplicity, and reliability in specimen identification and tracking. Barcode systems provide laboratories with scalable and efficient solutions to minimize errors and improve traceability.

Their compatibility with existing laboratory workflows and equipment ensures widespread adoption. The segment benefits from well-established infrastructure, making it the preferred choice over more costly technologies like RFID in many regions.

With continuous improvements in printing and scanning accuracy, the barcode segment is expected to sustain its leadership in the foreseeable future.

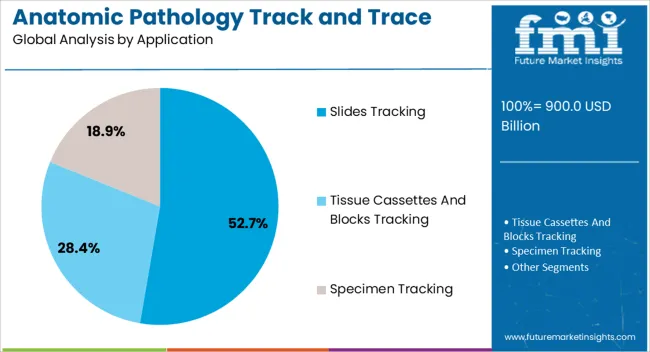

The slides tracking segment accounts for approximately 52.7% share of the application category, highlighting its importance in ensuring specimen integrity and traceability in diagnostic procedures. Slides are critical components in pathology workflows, requiring meticulous management to avoid misidentification and diagnostic delays.

The segment’s growth is reinforced by the increasing volume of diagnostic tests and the adoption of digital pathology practices. Integration of barcode systems and advanced imaging platforms has further streamlined tracking processes.

With rising emphasis on patient safety and operational efficiency, the slides tracking segment is projected to remain the leading application area in the anatomic pathology track and trace solution market.

Rise of Mobile Solutions and Point-of-Care Testing Surges Investments in the Market

The development of pathology point-of-care testing technologies and mobile applications is driving the implementation of real-time specimen tracking. This trend enhances patient care and satisfaction by addressing the need for timely outcomes.

Companies that invest in mobile solutions are strategically positioned to address changing consumer needs and capitalize on the expanding market for accessible healthcare services.

Demand for Cross-Platform Compatibility and Integration Surges in the Market

A market requirement for interoperability is evident in the growing demand for track and trace solutions that seamlessly integrate with various laboratory information systems (LIS) and electronic health record (EHR) platforms.Businesses that offer cross-platform compatible solutions respond to the industry's demand for seamless system integration and data interchange.

Businesses can potentially be positioned as enablers of efficient procedures and participants in the smooth exchange of data throughout the whole healthcare ecosystem by strategically emphasizing interoperability.

Artificial intelligence Incorporation in Pathology Diagnostics Unlocks New Opportunities

More opportunities for better diagnoses arise from using artificial intelligence in track and trace systems. Businesses should look at chances to create AI algorithms that improve specimen identification, automate data processing, and help create more precise and effective diagnostic procedures.

By placing companies at the forefront of technical innovation, this calculated action gives them a competitive advantage in the quickly developing field of pathology.

| Trends |

|

|---|---|

| Opportunities |

|

| Challenges |

|

| Segment | Software (Product) |

|---|---|

| Value CAGR (2025 to 2035) | 11.4% |

Based on product, the software segment is projected to rise at an 11.4% CAGR through 2035.

| Segment | Barcode (Technology) |

|---|---|

| Value CAGR (2025 to 2035) | 11.2% |

Based on technology, the barcode segment is anticipated to thrive at an 11.2% CAGR through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| The United States | 11.6% |

| The United Kingdom | 12.1% |

| China | 11.9% |

| Japan | 12.0% |

| South Korea | 13.6% |

The demand for anatomic pathology track and trace solutions in the United States is projected to rise at an 11.6% CAGR through 2035.

The anatomic pathology track and trace solution market size in the United Kingdom is anticipated to expand at a 12.1% CAGR through 2035.

The demand for anatomic pathology track and trace solutions in China is expected to surge at an 11.9% CAGR through 2035.

The anatomic pathology track and trace solution market growth in Japan is estimated at a 12.0% CAGR through 2035.

The sales of anatomic pathology track and trace solutions in South Korea are predicted to rise at a 13.6% CAGR through 2035.

Anatomic pathology track and trace solution market competition is defined by the dynamic interaction of leading businesses fighting for dominance in a quickly developing healthcare technology industry.

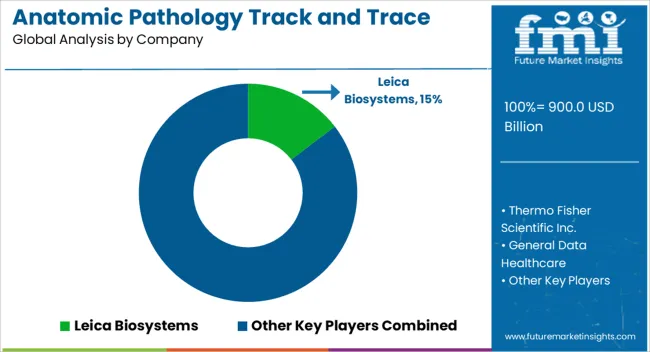

Leica Biosystems and Thermo Fisher Scientific, two well-known industry giants, control a huge portion of the market due to their broad product portfolios and long-standing connections with healthcare facilities.

These businesses promote themselves as all-inclusive solution suppliers, providing complete track and trace services, including specimen gathering, processing, and diagnosis.

Recent Developments

The global anatomic pathology track and trace solution market is estimated to be valued at USD 900.0 billion in 2025.

The market size for the anatomic pathology track and trace solution market is projected to reach USD 2,673.0 billion by 2035.

The anatomic pathology track and trace solution market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in anatomic pathology track and trace solution market are software, hardware, _printers and labeling systems, _barcode scanners and rfid readers, _mobile computing systems, consumables, _barcode labels and rfid tags, _slides, _specimen containers, tissue cassettes, and blocks and _transport bags.

In terms of technology, barcode segment to command 61.2% share in the anatomic pathology track and trace solution market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anatomic Pathology Market Size and Share Forecast Outlook 2025 to 2035

Human Anatomical Models Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Pathology Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Quantitative Pathology Imaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Veterinary Digital Pathology Market Size and Share Forecast Outlook 2025 to 2035

Solution Styrene Butadiene Rubber (S-SBR) Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

5PL Solutions Market

High-Resolution Anoscopy Market Size and Share Forecast Outlook 2025 to 2035

mHealth Solutions Market Size and Share Forecast Outlook 2025 to 2035

Super Resolution Microscope Market Insights - Size, Share & Forecast 2025 to 2035

G-3 PLC Solution Market – Smart Grids & Connectivity

Docketing Solution Market Size and Share Forecast Outlook 2025 to 2035

Long Haul Solutions Market Size and Share Forecast Outlook 2025 to 2035

E-tailing Solutions Market Growth – Trends & Forecast 2020-2030

Connected Solutions for Oil & Gas Market Insights – Trends & Forecast 2020-2030

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA