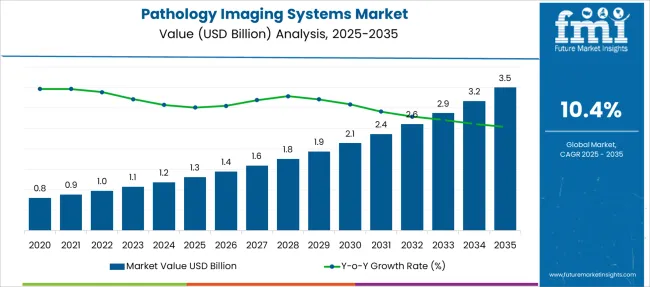

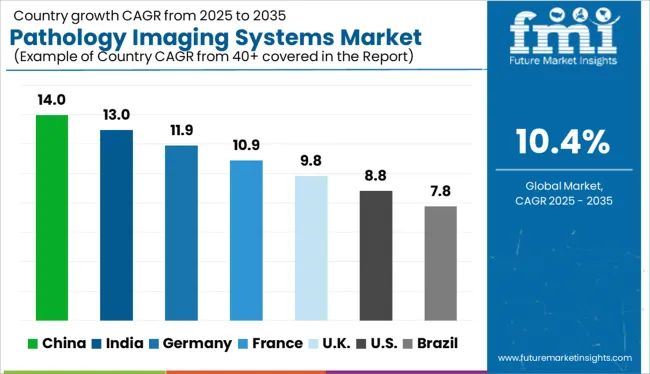

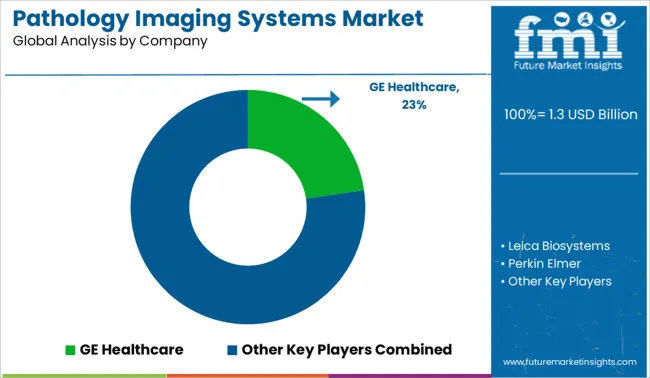

The Pathology Imaging Systems Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

| Metric | Value |

|---|---|

| Pathology Imaging Systems Market Estimated Value in (2025 E) | USD 1.3 billion |

| Pathology Imaging Systems Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The pathology imaging systems market is expanding due to increasing demand for accurate and efficient diagnostic tools in healthcare. Growing prevalence of chronic diseases has emphasized the need for advanced imaging systems to support clinical diagnosis and treatment planning. Technological improvements such as high-resolution imaging and digital pathology workflows have enhanced diagnostic precision and workflow efficiency.

Hospitals and diagnostic laboratories are investing in imaging systems that enable faster turnaround times and integration with electronic health records. Additionally, rising healthcare expenditure and focus on early disease detection have fueled adoption.

The shift toward automated and AI-powered imaging solutions is expected to further accelerate growth. Segmental leadership is anticipated to be driven by imaging systems as the primary product type, clinical diagnosis as the key application, and hospitals as the largest end-user segment.

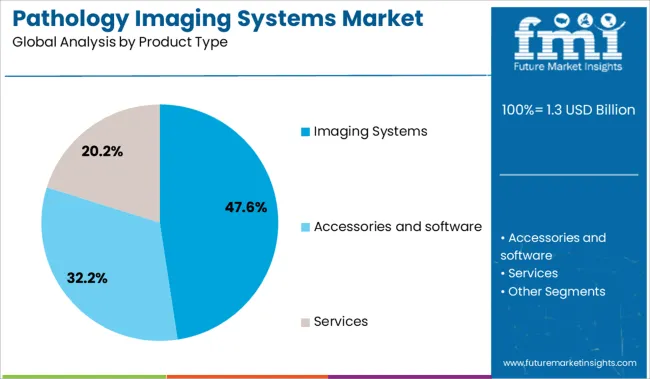

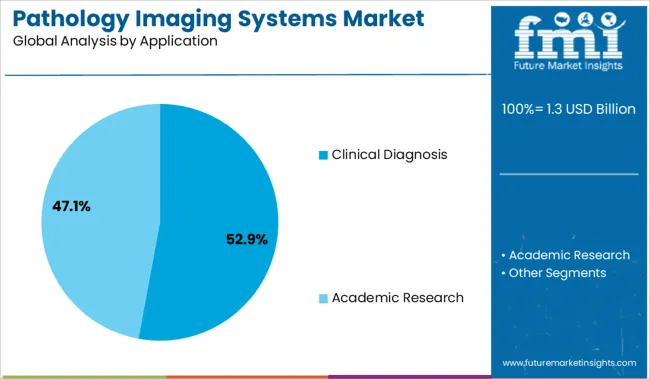

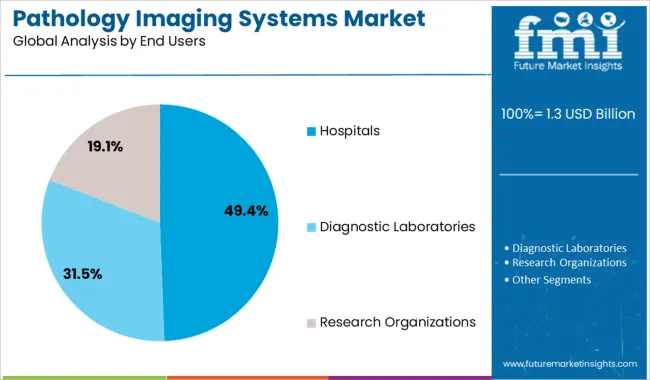

The market is segmented by Product Type, Application, and End Users and region. By Product Type, the market is divided into Imaging Systems, Accessories and software, and Services. In terms of Application, the market is classified into Clinical Diagnosis and Academic Research. Based on End Users, the market is segmented into Hospitals, Diagnostic Laboratories, and Research Organizations. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Imaging Systems segment is expected to contribute 47.6% of the pathology imaging systems market revenue in 2025, maintaining its dominance in product offerings. This segment’s growth is supported by the demand for sophisticated imaging technologies that enable detailed visualization of pathological specimens. Enhanced image quality and digital capabilities have facilitated more accurate diagnoses and have streamlined pathology workflows.

The segment benefits from ongoing innovations such as whole slide imaging and multiplex staining technologies. Healthcare providers increasingly prefer integrated imaging systems that combine multiple functions in a single platform.

As pathology departments continue to upgrade their equipment, the demand for advanced imaging systems is projected to remain strong.

The Clinical Diagnosis segment is projected to hold 52.9% of the market revenue in 2025, leading all applications. The growth of this segment is linked to the essential role pathology imaging plays in disease diagnosis and management. Accurate imaging supports early detection and monitoring of cancers, infectious diseases, and other conditions, improving patient outcomes.

Increased awareness among healthcare professionals about the benefits of digital pathology has driven adoption in clinical settings. The segment also benefits from regulatory encouragement to implement diagnostic technologies that enhance accuracy and efficiency.

As precision medicine gains traction, clinical diagnosis using advanced imaging systems is expected to be a major growth driver.

The Hospitals segment is expected to account for 49.4% of the pathology imaging systems market revenue in 2025, remaining the largest end-user category. Hospitals require robust imaging solutions to support high patient volumes and complex diagnostic needs. Investments in digital pathology and imaging infrastructure have been prioritized to improve diagnostic turnaround times and support multidisciplinary care.

Hospitals benefit from integrating imaging data with electronic health records for better patient management. The need to enhance diagnostic accuracy and comply with healthcare regulations has further accelerated the adoption of imaging systems in hospital settings.

As hospitals continue to modernize and expand diagnostic services, this segment is expected to sustain its leading market share.

The growing awareness among physicians and patients about the benefits of pathology imaging systems will create lucrative pathology imaging systems market opportunities for pathology imaging systems market growth.

The rising number of patients suffering from chronic diseases such as cancer, the rising demand for pathology imaging systems that are improved, the rising levels of investment in the healthcare sector, the rising popularity of the system in hospitals, diagnostic centres, and research organisations, and the rising trends of tele-pathology are some of the major and vital factors that will likely augment the pathology imaging systems market growth in the forecast timeframe.

On the other hand, the increasing number of technological advancements, as well as the rising adoption of pathology imaging systems, will further contribute to the pathology imaging systems market growth over the forecasted timeframe.

Growth in the tele-pathology trend is another factor driving the pathology imaging systems market future trends along with pathology imaging systems key trends and opportunities. Growth is constrained by high maintenance and capital costs. Pathology imaging systems market expansion is also constrained by a shortage of operators with high levels of skill, strict regulatory compliance, and sampling error.

With its high level of technological development and molecular diagnostics research, North America currently dominates the pathology imaging systems market future trends, followed by countries in Western Europe.

Emerging trends in pathology imaging systems market is brought about by high-quality diagnostics, favourable reimbursement conditions; government funding, established players in the pathology imaging systems market, and the availability of trained technicians in these areas accelerate the pathology imaging systems adoption trends.

The Asia Pacific region is anticipated to experience rapid pathology imaging systems market growth over the course of the assessment period. In this region of the world, increased adoption of cutting-edge technologies like digital imaging is anticipated to create new pathology imaging systems market opportunities for the pathology imaging systems market growth.

The next lucrative pathology imaging systems market is anticipated to be Japan. Asia Pacific is leading the pathology imaging systems market in terms of growth rate due to expanding economies, an increase in molecular research activities, an increase in the patient population, and better healthcare opportunities also boosting the pathology imaging systems market trends and forecasts.

How is the Start-up Ecosystem in the Pathology Imaging Systems Market?

The pathology imaging systems market's startup ecosystem is cluttered with new entrants desperately trying to use innovation as a tool for a breakthrough.

December 2024 marks the acquisition of USD 23 million by US-based pathology imaging systems startup Proscia in order to advance Concentriq, a software platform that serves as a basic operating system for digital scanners used to assess tissue biopsies.

There are many established brands and key players in the pathology imaging systems market, which makes it more competitive. Modern technologies are at the forefront of the pathology imaging systems market in this industry.

The pathology imaging systems market growth is also being boosted by strategic alliances and partnerships between businesses and academic institutions. Innovative imaging systems technology was adopted in pathology as a result of significant technological advancements.

GE Healthcare, Leica Biosystems, Perkin Elmer, Siemens, Olympus Corporation, Philips Healthcare, Sakura Finetek, DigiPath, Carl Zeiss Meditec AG, Hamamatsu Photonics, 3D-Histech Ltd., and others are some of the leading companies in the pathology imaging systems market.

Recent Development:

Partnership:

Through Charles River Laboratories International, Inc. and Deciphex Patholytix Preclinical partnership with Deciphex, a pioneer in preclinical digital pathology software-as-a-service, Charles River will optimise Patholytix Preclinical tools in order to use this sector-leading, validated digital peer review process to streamline and hasten the process of guaranteeing the consistency and integrity of studies.

Launch:

FDA approval:

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 10.36% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Product type, end use, material type, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | GE Healthcare; Leica Biosystems; Perkin Elmer; Siemens; Olympus Corporation; Philips Healthcare; Sakura Finetek; DigiPath; Carl Zeiss Meditec AG; Hamamatsu Photonics; 3D-Histech Ltd. |

| Customization scope | Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global pathology imaging systems market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the pathology imaging systems market is projected to reach USD 3.5 billion by 2035.

The pathology imaging systems market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in pathology imaging systems market are imaging systems, accessories and software and services.

In terms of application, clinical diagnosis segment to command 52.9% share in the pathology imaging systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Digital Pathology Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anatomic Pathology Track and Trace Solution Market Size and Share Forecast Outlook 2025 to 2035

Anatomic Pathology Market Size and Share Forecast Outlook 2025 to 2035

Cellular Pathology Market Analysis – Size, Share & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Quantitative Pathology Imaging Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Veterinary Digital Pathology Market Size and Share Forecast Outlook 2025 to 2035

Imaging Markers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Remote Imaging Collaboration Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Aerial Imaging Market Share

Aerial Imaging Market Growth - Trends & Forecast 2025 to 2035

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Spinal Imaging Market Trends – Growth, Demand & Forecast 2022-2032

Hybrid Imaging System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA