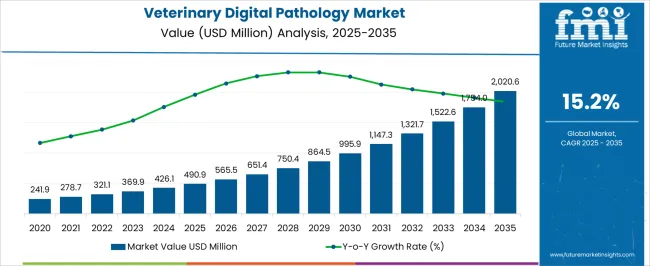

The veterinary digital pathology market is estimated to be valued at USD 490.9 million in 2025 and is projected to reach USD 2020.6 million by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period.

The market follows a distinct technology adoption curve, shaped by rising demand for faster, more accurate diagnostics in animal health across companion animals, livestock, and research applications. From 2020–2024, the market grows from USD 241.9 million to USD 426.1 million, representing the early adoption phase where basic whole-slide imaging and digital scanners dominate, functioning as cost-effective and widely deployed solutions in veterinary laboratories and universities.

AI-assisted pathology platforms begin to emerge in this period, though adoption remains limited compared to conventional microscopy practices. Between 2025–2030, the market enters the scaling phase, expanding from USD 490.9 million to USD 995.9 million, contributing nearly half of the total projected increase. Growth during this stage is driven by higher adoption of cloud-based pathology systems, wider use in veterinary reference labs, and integration of automated image analysis to improve diagnostic accuracy and reduce turnaround times. From 2031–2035, the market transitions into consolidation, advancing from USD 1,147.3 million to USD 2,020.6 million. Growth moderates as the technology matures, with standardized digital workflows becoming the norm and AI-driven solutions gaining specialized use in oncology, infectious disease monitoring, and pharmaceutical research. Overall, the veterinary digital pathology market demonstrates a clear maturity curve, moving from early manual digitization toward full-scale adoption of intelligent, connected systems that transform veterinary diagnostics and research efficiency.

| Metric | Value |

|---|---|

| Veterinary Digital Pathology Market Estimated Value in (2025 E) | USD 490.9 million |

| Veterinary Digital Pathology Market Forecast Value in (2035 F) | USD 2020.6 million |

| Forecast CAGR (2025 to 2035) | 15.2% |

The veterinary digital pathology market holds a specialized yet growing role within the broader animal health and diagnostics ecosystem, with distinct shares across application domains and industry segments. Within the global animal diagnostics industry, veterinary digital pathology contributes approximately 8–10%, driven by its adoption in veterinary hospitals, clinical labs, and research facilities for faster and accurate disease detection. In the broader digital pathology and laboratory informatics sector, its share is estimated around 5–6%, as human healthcare applications remain larger revenue contributors. Within companion animal diagnostics, veterinary digital pathology accounts for nearly 12–14%, reflecting rising demand for precise histopathology, oncology testing, and telepathology services. In livestock and farm animal health monitoring, it contributes about 7–8%, driven by adoption in veterinary research, breeding, and disease management programs.

Within academic and research institutions focused on veterinary science, its share is 9–11%, supported by integration in teaching labs, clinical trials, and pathology research. The relevance is further enhanced in pharmaceutical and biotech applications, where preclinical trials and veterinary drug testing increasingly rely on digital imaging and AI-assisted analysis, contributing a smaller yet consistent 4–5% share. Growth is shaped by increasing awareness of animal health, regulatory compliance, and demand for high-throughput, accurate diagnostics. As telepathology and cloud-based veterinary lab solutions expand across North America, Europe, and Asia-Pacific, veterinary digital pathology is positioned as a central component in modern animal health infrastructure, with scope for higher penetration in emerging veterinary care markets.

The market is undergoing rapid expansion, supported by advancements in imaging technology, increasing demand for accurate diagnostics, and the growing prevalence of chronic and infectious diseases among animals. Veterinary practices and diagnostic laboratories are progressively adopting digital pathology solutions to enhance workflow efficiency, improve diagnostic accuracy, and enable remote consultations. Rising pet ownership and higher spending on animal healthcare have significantly boosted the need for advanced diagnostic tools, particularly in companion animal care.

Whole slide imaging technology, coupled with AI-driven analysis, is reducing diagnostic turnaround times and enabling precise disease detection. Cloud-based data storage and telepathology capabilities are facilitating collaboration between veterinary specialists across regions, further accelerating adoption.

As the market continues to benefit from supportive regulatory frameworks, increased R&D investments, and the integration of digital pathology into veterinary education, long-term growth prospects remain strong The shift toward digital platforms is expected to redefine veterinary diagnostics, making them more accessible, efficient, and data-driven.

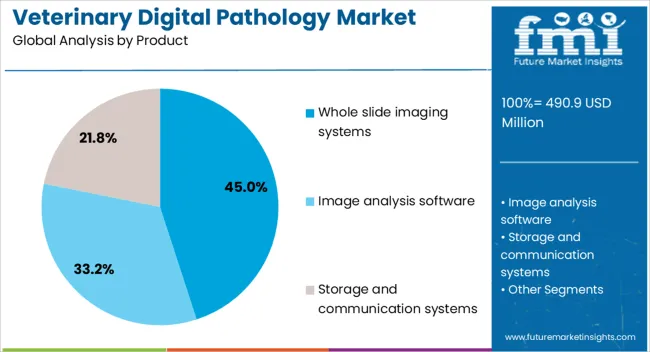

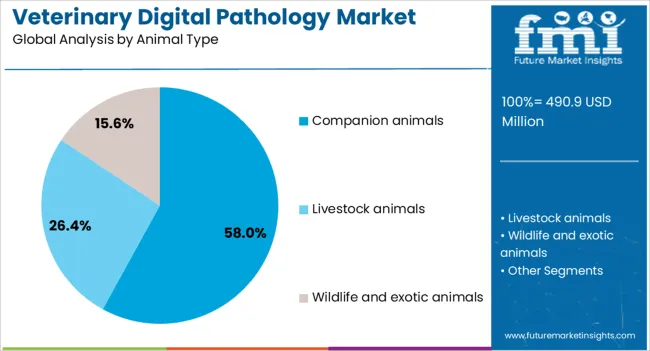

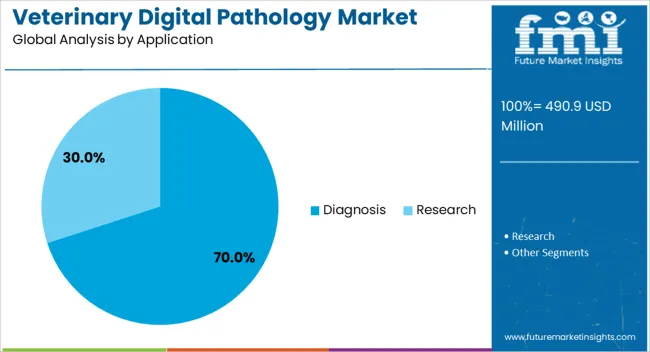

The veterinary digital pathology market is segmented by product, animal type, application, end use, and geographic regions. By product, veterinary digital pathology market is divided into whole slide imaging systems, image analysis software, and storage and communication systems. In terms of animal type, veterinary digital pathology market is classified into companion animals, livestock animals, and wildlife and exotic animals. Based on application, veterinary digital pathology market is segmented into diagnosis and research. By end use, veterinary digital pathology market is segmented into veterinary hospitals and clinics, veterinary diagnostic labs, academic and research institute, and other end use. Regionally, the veterinary digital pathology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The whole slide imaging systems segment is projected to hold 45% of the market revenue share in 2025, making it the leading product category. This dominance is being driven by the ability of whole slide imaging systems to capture high-resolution images of entire tissue samples, enabling detailed analysis and long-term digital archiving. Veterinary laboratories and clinics have favored these systems for their capacity to improve diagnostic precision and facilitate remote consultations. The integration of AI-based image analysis tools has further enhanced the diagnostic capabilities of whole slide imaging, reducing the dependency on physical slide handling and minimizing the risk of sample degradation. These systems have also been valued for their scalability, allowing institutions to process a high volume of cases efficiently As telepathology becomes more widespread, whole slide imaging systems are expected to remain the preferred choice due to their adaptability, accuracy, and potential to streamline veterinary diagnostic workflows.

The companion animals segment is expected to account for 58% of the market revenue share in 2025, positioning it as the dominant animal type. Growth in this segment is being fueled by rising pet ownership, increasing awareness of animal health, and higher expenditure on preventive and diagnostic veterinary services. Digital pathology has been increasingly adopted in companion animal care due to its ability to provide rapid, accurate, and minimally invasive diagnostics. Pet owners are demonstrating a greater willingness to invest in advanced diagnostic procedures to ensure early disease detection and effective treatment. Veterinary clinics specializing in companion animals have been integrating digital pathology solutions to enhance service quality and offer remote consultations with pathology experts The segment's expansion is also being reinforced by the growing role of companion animals in human lives, driving demand for healthcare solutions that match the standards of human medical diagnostics.

The diagnosis segment is projected to command 70% of the market revenue share in 2025, making it the leading application. This leadership position is being supported by the essential role of pathology in identifying diseases, guiding treatment decisions, and monitoring therapeutic outcomes in veterinary practice. Digital diagnostic solutions are enabling veterinarians to detect a wide range of conditions with greater speed and accuracy compared to traditional microscopy. The ability to share digital slides with specialists in real time has improved collaboration and diagnostic confidence. Diagnostic applications have also benefited from AI-powered image recognition, which supports pattern detection and reduces human error. As the prevalence of both chronic and infectious diseases in animals continues to rise, demand for reliable diagnostic tools remains strong The integration of digital pathology into routine veterinary diagnostics is expected to sustain the dominance of the diagnosis segment in the years ahead.

Veterinary digital pathology is gaining adoption in companion animal and livestock diagnostics, research, and preclinical studies. Cloud-based platforms and service providers are strengthening market growth and expanding access to specialized diagnostic workflows.

Veterinary digital pathology has gained traction in companion animal healthcare, particularly in histopathology, oncology, and infectious disease detection. Veterinary hospitals and specialized clinics increasingly rely on digital slides, AI-assisted imaging, and cloud-based platforms to enhance diagnostic accuracy and speed. The shift from traditional microscopy to digital workflows enables faster consultation, remote expert opinions, and improved record management. Growing pet ownership and demand for advanced veterinary care have amplified the adoption of digital pathology solutions in routine diagnostic workflows. Research laboratories and veterinary diagnostic centers are integrating these systems for educational purposes and complex case studies, further supporting broader implementation. Veterinary labs benefit from reduced turnaround times, better image storage, and collaborative platforms for multi-expert consultations, strengthening clinical decision-making across companion animal practices.

Digital pathology adoption in livestock and farm animal diagnostics has expanded, supporting disease surveillance, breeding programs, and preventive care. Veterinary laboratories and agricultural research institutions utilize high-resolution digital slides and automated image analysis to track infections, monitor pathology patterns, and conduct large-scale animal health assessments efficiently. Farms and veterinary networks increasingly implement these solutions to detect diseases early, optimize herd health, and reduce veterinary intervention costs. Veterinary pathologists gain improved workflow management, consistent imaging quality, and access to historical data for trend analysis. The efficiency in reporting and analytical accuracy makes digital pathology essential for veterinary research centers, breeding farms, and government-backed animal health programs, reinforcing its role in sustainable livestock management and productivity enhancement.

Veterinary digital pathology is increasingly critical in preclinical trials, veterinary drug testing, and academic research. Pharmaceutical companies and biotech firms integrate high-resolution imaging and digital slide repositories for analyzing tissue responses in animal studies. Universities and veterinary colleges adopt these systems for teaching, research, and skill development in histopathology and diagnostic techniques. Automation and cloud-enabled platforms allow remote expert reviews and cross-institution collaborations, enhancing study accuracy and efficiency. Data management, reproducibility, and detailed record-keeping are streamlined through digital pathology solutions. The integration of these systems in veterinary R&D ensures precise outcomes, reduces human errors, and provides scalable solutions for both experimental and teaching laboratories, driving the growth of this specialized market segment.

Veterinary digital pathology service providers, including telepathology platforms and laboratory network operators, are expanding their reach to clinics, farms, and research facilities. Cloud-based and subscription models allow smaller veterinary centers to access expert pathology services without investing heavily in equipment. Service providers offer digital scanning, AI-assisted interpretation, and remote consultation, enabling more efficient workflow and accurate diagnosis. Integration of veterinary digital pathology with lab information management systems (LIMS) allows seamless case tracking, reporting, and compliance with regulatory frameworks. Market expansion is also influenced by partnerships between equipment manufacturers and veterinary service companies, creating bundled solutions for diagnostics, training, and preclinical research, further accelerating adoption and market penetration.

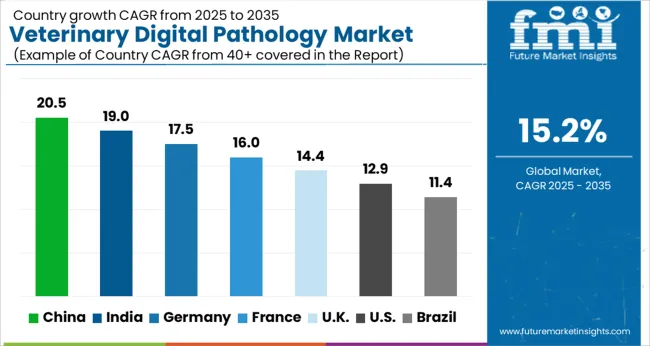

| Country | CAGR |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| France | 16.0% |

| UK | 14.4% |

| USA | 12.9% |

| Brazil | 11.4% |

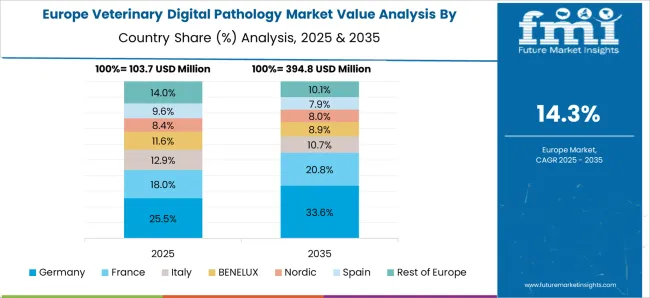

The veterinary digital pathology market is projected to expand globally at a CAGR of 15.2% from 2025 to 2035, fueled by rising adoption in companion animal diagnostics, livestock health monitoring, and preclinical research applications. China leads with a CAGR of 18.3%, supported by large-scale veterinary research investments, government-backed livestock health programs, and increasing digitization of diagnostic laboratories. India follows at 17.1%, where expansion of veterinary hospitals, educational institutions, and telepathology initiatives accelerates adoption. France records 14.4%, aided by advanced veterinary research centers, preclinical trial activities, and integration of digital imaging in diagnostic workflows. The United Kingdom grows at 13.8%, driven by clinical laboratories, academic programs, and rising demand for remote pathology services. The United States posts 12.5%, with adoption guided by veterinary hospitals, research institutes, and pharmaceutical preclinical testing needs. These trends reflect the strategic importance of digital pathology in improving diagnostic accuracy, workflow efficiency, and access to remote expertise across veterinary sectors globally.

The CAGR for the veterinary digital pathology market in the United Kingdom was measured at 11.8% during 2020–2024 and is projected at 14.4% for 2025–2035, slightly below the global average of 15.2%. The earlier period grew at a steady pace as adoption was concentrated in select veterinary teaching hospitals and high-end research laboratories. Expansion improves in the next phase as telepathology services, AI-assisted diagnostics, and cloud-based imaging platforms gain traction across companion animal hospitals and preclinical research facilities. Integration into veterinary chains and pharmaceutical R&D labs further strengthens adoption. Enhanced workflow efficiency and reduced turnaround time drive incremental demand, positioning the UK as a significant contributor to the global veterinary digital pathology landscape.

China’s veterinary digital pathology market posted a CAGR of 17.3% during 2020–2024 and is anticipated at 20.5% for 2025–2035, reflecting strong acceleration. Initial growth was driven by government-supported livestock health programs, veterinary laboratory modernization, and gradual adoption of digital microscopy. In the next phase, expansion of preclinical studies, AI-assisted image analysis, and broader coverage across rural and urban veterinary clinics intensifies adoption. Domestic equipment suppliers and localized production improve availability and reduce costs, enhancing penetration. Large-scale animal health programs and the integration of cloud-based diagnostics consolidate China’s position as the leading market for veterinary digital pathology globally.

India’s veterinary digital pathology market recorded a CAGR of 15.6% during 2020–2024 and is expected to reach 19.0% for 2025–2035. Early adoption was concentrated in academic veterinary hospitals and research centers, with limited penetration in private clinics. Growth intensifies in the later period due to government programs targeting livestock disease surveillance, expansion of companion animal diagnostics, and integration with pharmaceutical preclinical workflows. Networked telepathology services and AI-assisted analysis platforms enhance efficiency, shorten turnaround times, and reduce operational bottlenecks. Rising collaborations between domestic and global suppliers support improved equipment accessibility and training programs, positioning India as one of the high-growth contributors to veterinary digital pathology in the Asia-Pacific region.

France’s veterinary digital pathology market grew at a CAGR of 12.8% during 2020–2024 and is projected at 16.0% for 2025–2035, slightly below the global average of 15.2%. Initial growth stemmed from academic veterinary centers, research institutions, and selective commercial laboratories. Expansion in the next phase is supported by increasing integration of telepathology services, preclinical research digitization, and adoption in companion animal hospitals. Investments in high-resolution scanners, AI-based imaging platforms, and cloud storage systems streamline workflow efficiency. Strategic collaborations between veterinary labs and equipment providers enhance access to digital solutions. France continues to be a critical contributor to Europe’s veterinary digital pathology adoption, reinforcing regional leadership.

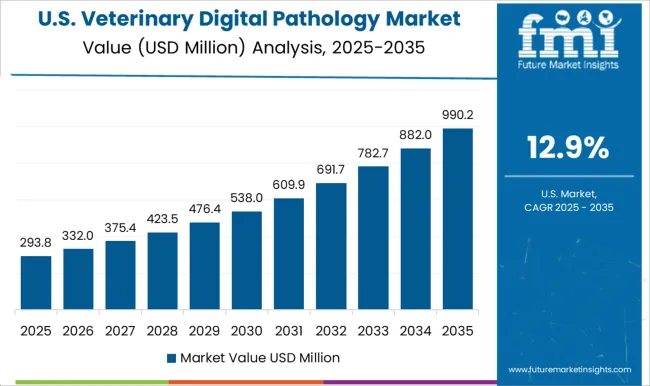

The CAGR for the veterinary digital pathology market in the United States was 11.2% during 2020–2024 and is forecasted at 12.9% from 2025–2035, slightly below the global CAGR of 15.2%. Growth in the earlier period was concentrated in research hospitals, university veterinary programs, and pharmaceutical preclinical labs. Expansion improves in the next phase as networked telepathology services, AI-assisted image analysis, and cloud-based storage systems are increasingly adopted across companion animal hospitals and high-volume veterinary laboratories. Enhanced efficiency, faster diagnostics, and integration with pharmaceutical R&D workflows support consistent growth. The USA maintains steady adoption due to established infrastructure and regulatory support, remaining a mature but critical market for veterinary digital pathology.

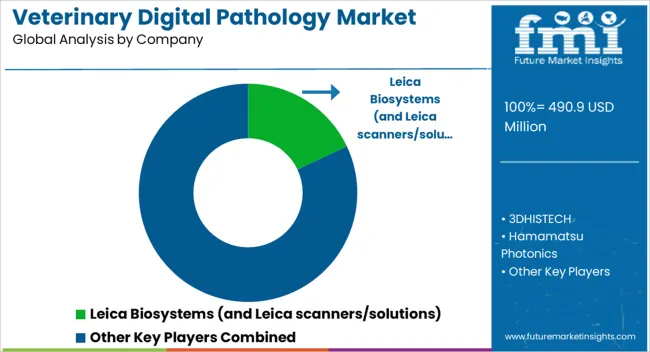

The veterinary digital pathology market is shaped by a combination of global life-science firms, specialized imaging solution providers, and emerging AI-driven analysis vendors. Leica Biosystems holds a strong leadership position with its integrated digital scanners, workflow solutions, and cloud-based telepathology platforms, supporting both companion animal hospitals and preclinical research laboratories. 3DHISTECH emphasizes high-throughput slide scanning and imaging solutions with wide adoption in research institutes and veterinary diagnostic labs. Hamamatsu Photonics contributes with high-resolution digital imaging devices that are well-suited for detailed tissue analysis and laboratory integration. Roche / Ventana leverages its diagnostics expertise to offer end-to-end pathology workflows, integrating scanners, software, and data management for research and clinical applications.

Philips focuses on large-scale digital pathology solutions with advanced image management, analytics, and telepathology capabilities, catering to both academic and private veterinary hospitals. Indica Labs and other image analysis vendors provide AI-powered platforms for quantitative histology, improving diagnostic accuracy and workflow efficiency. Emerging companies such as OptraSCAN, Huron, Proscia, and PathAI offer scalable cloud-enabled solutions and AI-assisted analysis that enhance adoption across smaller veterinary clinics and contract research laboratories. Competitive differentiation in this market is defined by scanner resolution, workflow integration, software intelligence, cloud-based accessibility, and adaptability to veterinary and preclinical workflows. Leading providers focus on combining hardware and software solutions, while newer entrants push innovation in image analysis and AI-driven decision support. The market is further influenced by regional collaborations, preclinical research investments, and the rising need for remote diagnostic capabilities across global veterinary and animal health ecosystems.

| Item | Value |

|---|---|

| Quantitative Units | USD 490.9 million |

| Product | Whole slide imaging systems, Image analysis software, and Storage and communication systems |

| Animal Type | Companion animals, Livestock animals, and Wildlife and exotic animals |

| Application | Diagnosis and Research |

| End Use | Veterinary hospitals and clinics, Veterinary diagnostic labs, Academic and research institute, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Leica Biosystems (and Leica scanners/solutions), 3DHISTECH, Hamamatsu Photonics, Roche / Ventana, Philips, Indica Labs / Image analysis vendors, and Other vendors (OptraSCAN, Huron, Proscia, PathAI, etc.) |

| Additional Attributes | Dollar sales by product type, share by scanner and software segment, regional adoption trends, CAGR by country, competitive landscape, end-user uptake, pricing strategies, and technology integration. |

The global veterinary digital pathology market is estimated to be valued at USD 490.9 million in 2025.

The market size for the veterinary digital pathology market is projected to reach USD 2,020.6 million by 2035.

The veterinary digital pathology market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in veterinary digital pathology market are whole slide imaging systems, image analysis software and storage and communication systems.

In terms of animal type, companion animals segment to command 58.0% share in the veterinary digital pathology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Lasers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Hospital Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA