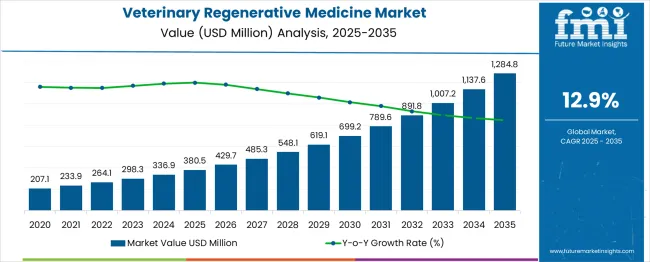

The global veterinary regenerative medicine market is projected to expand from USD 380.5 million in 2025 to USD 1,284.8 million by 2035, reflecting a 13% CAGR and generating an absolute dollar opportunity of USD 904.3 million. Growth is driven by rising demand for advanced therapies in companion animals and livestock, including stem cell treatments, platelet-rich plasma therapies, and tissue engineering applications. Increasing prevalence of orthopedic, musculoskeletal, and chronic conditions in pets, coupled with the willingness of owners to invest in high-value treatments, supports market expansion. Technological advancements and regulatory support for regenerative procedures further enhance adoption globally.

Quick Stats for Veterinary Regenerative Medicine Market

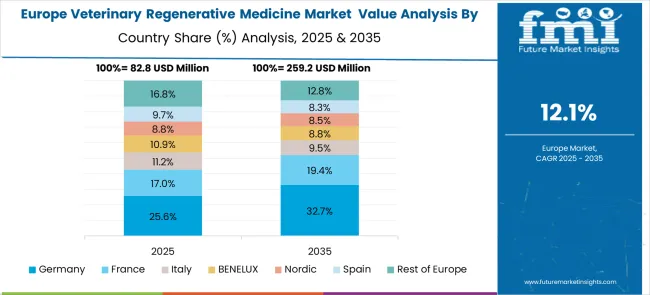

Analysis of contribution from volume versus price growth indicates that early market expansion is primarily volume-driven, with increased adoption of regenerative therapies in veterinary clinics and specialized hospitals across North America and Europe. From 2028 onward, price growth plays a more significant role, driven by the introduction of premium therapies, higher treatment complexity, and specialized service offerings. In emerging regions such as the Asia Pacific and Latin America, volume continues to contribute strongly, supported by rising pet ownership and increasing access to veterinary care.

| Metric | Value |

| Estimated Value in (2025E) | USD 380.5 million |

| Forecast Value in (2035F) | USD 1,284.8 million |

| Forecast CAGR (2025 to 2035) | 13% |

Recent developments in the veterinary regenerative medicine market focus on innovation, safety, and expanded applications. Companies are developing next-generation stem cell therapies, allogenic and autologous treatments, and bioengineered scaffolds to enhance tissue repair and recovery. Advanced delivery systems, minimally invasive procedures, and precision imaging are improving treatment outcomes. Strategic partnerships between biotech firms, veterinary hospitals, and research centers are accelerating commercialization and clinical adoption.

Growing awareness of regenerative therapies, rising companion animal healthcare spending, and demand for specialized treatment options are driving market expansion. These trends are fostering innovation, improving patient outcomes, and increasing adoption globally.

The veterinary regenerative medicine market is driven by five primary parent markets with specific shares. Companion animals lead with 38%, as pet owners increasingly seek stem cell therapies, platelet-rich plasma, and tissue engineering for orthopedic, dermatologic, and ocular conditions. Equine care contributes 25%, using regenerative treatments for tendon, ligament, and joint injuries in racehorses and sport horses. Livestock and farm animal applications account for 15%, supporting recovery from musculoskeletal and reproductive disorders.

Veterinary research and academic institutions represent 12%, advancing therapeutic techniques and clinical trials. Specialty veterinary clinics hold 10%, offering advanced regenerative procedures and customized treatment plans.

Market expansion is being supported by the increasing awareness among pet owners and veterinarians about the benefits of regenerative medicine in treating various animal conditions. Modern veterinary practice is increasingly focused on advanced therapeutic approaches that can address orthopedic injuries, degenerative diseases, and complex medical conditions more effectively than traditional treatments. The proven efficacy of stem cell therapy, platelet-rich plasma, and other regenerative technologies in promoting tissue repair and healing makes them preferred treatment options in progressive veterinary medicine.

The growing focus on animal welfare and quality of life is driving demand for innovative veterinary treatments that can provide better outcomes with reduced invasiveness and faster recovery times. Pet owners' willingness to invest in advanced medical treatments for their animals is creating opportunities for veterinary regenerative medicine applications. The rising influence of veterinary specialization and continuing education about regenerative medicine benefits is also contributing to increased adoption across different animal types and medical conditions.

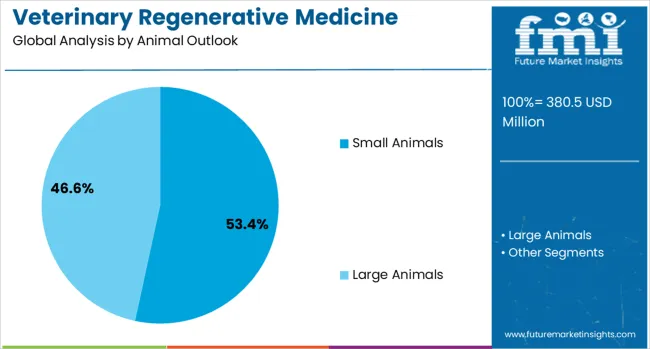

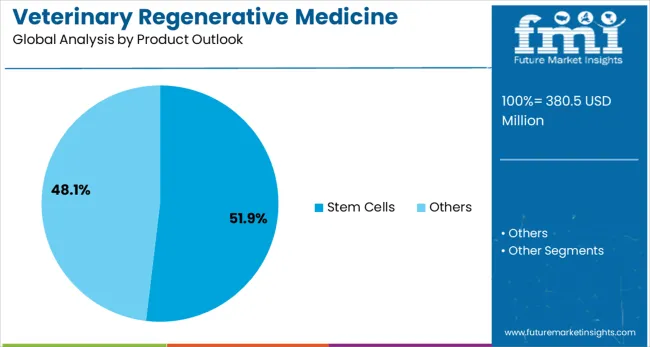

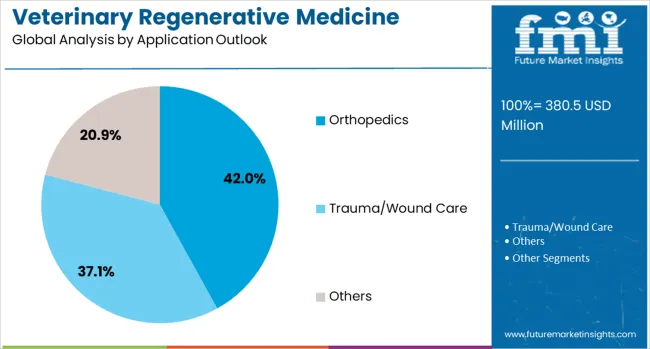

The market is segmented by animal outlook, product outlook, application outlook, and end use outlook. By animal outlook, the market is divided into small animals, large animals, and others. Based on product outlook, the market is categorized into stem cells and others. In terms of application outlook, the market is segmented into orthopedics, trauma/wound care, and others. By end use outlook, the market is classified into veterinary hospitals/clinics, veterinary research institutes, and others.

The small animals segment is projected to account for 53.0% of the veterinary regenerative medicine market in 2025, reaffirming its position as the dominant category. The growing pet population and increasing humanization of companion animals are driving demand for advanced medical treatments that were traditionally reserved for human medicine. Pet owners are increasingly viewing their animals as family members and are willing to invest in sophisticated treatment options to ensure optimal health outcomes and quality of life.

This segment benefits from the higher frequency of veterinary visits for small animals compared to large animals, creating more opportunities for regenerative medicine applications. The well-established veterinary infrastructure for companion animal care, including specialized orthopedic and internal medicine services, supports the adoption of regenerative therapies. The emotional bond between pet owners and their animals creates a strong motivation to pursue advanced treatment options, making small animals the primary market driver for veterinary regenerative medicine growth.

Stem cells are projected to represent 52.0% of veterinary regenerative medicine demand in 2025, highlighting their central role as the leading therapeutic approach in the field. Stem cell therapy offers versatile applications in treating various conditions including orthopedic injuries, degenerative joint disease, and soft tissue injuries. The ability of stem cells to differentiate into multiple cell types and promote natural healing processes makes them particularly valuable for veterinary applications where tissue regeneration is the primary therapeutic goal.

The segment is supported by advancing research demonstrating the safety and efficacy of stem cell treatments in veterinary medicine. Veterinary stem cell therapy has shown promising results in treating conditions that traditionally had limited treatment options, providing new hope for animals with chronic or degenerative conditions. The development of standardized protocols for stem cell collection, processing, and administration is increasing veterinary confidence in these treatments, while ongoing clinical studies continue to expand the approved applications for stem cell therapy in veterinary practice.

The orthopedics application is forecasted to contribute 42.0% of the veterinary regenerative medicine market in 2025, reflecting the significant prevalence of musculoskeletal conditions in both companion and large animals. Orthopedic conditions including arthritis, hip dysplasia, cruciate ligament injuries, and degenerative joint disease represent some of the most common reasons for veterinary visits, creating substantial demand for effective treatment solutions. Regenerative medicine offers promising alternatives to traditional surgical interventions, often providing less invasive treatment options with reduced recovery times.

The segment benefits from the well-documented success of regenerative therapies in promoting cartilage repair, reducing inflammation, and improving joint function in animals. Veterinary orthopedic specialists are increasingly incorporating regenerative medicine techniques into their treatment protocols, recognizing the potential for improved patient outcomes. The growing awareness among pet owners about regenerative therapy options for orthopedic conditions is driving demand for these advanced treatments, particularly for aging animals, where traditional surgical approaches may carry higher risks.

The veterinary hospitals/clinics segment is projected to account for 61.0% of the veterinary regenerative medicine market in 2025, prioritizing the central role of clinical practice settings in delivering regenerative therapies. Veterinary hospitals and clinics serve as the primary point of care for animals requiring regenerative medicine treatments, providing the necessary infrastructure, expertise, and equipment for safe and effective therapy delivery. The segment encompasses both general practice veterinary clinics and specialized referral hospitals that offer advanced regenerative medicine services.

This dominance reflects the practical reality that regenerative medicine treatments require professional veterinary oversight, from initial patient evaluation through therapy administration and follow-up care. Veterinary hospitals and clinics are investing in regenerative medicine capabilities to meet growing client demand and differentiate their services in competitive markets. The segment is supported by continuing education programs that train veterinary professionals in regenerative medicine techniques, expanding the availability of these treatments across different practice settings and geographic regions.

The veterinary regenerative medicine market is advancing rapidly due to increasing awareness of innovative treatment options and growing demand for advanced veterinary care. The market faces challenges including high treatment costs, limited regulatory frameworks, and the need for specialized training among veterinary professionals. Innovation in stem cell technologies and expanded clinical research continue to influence product development and market expansion patterns.

The trend toward treating pets as family members is driving increased spending on advanced veterinary treatments, including regenerative medicine options. Pet owners are increasingly willing to invest in sophisticated medical treatments that can improve their animals' quality of life and extend healthy lifespan. This humanization trend is creating demand for veterinary treatments that parallel advances in human medicine, positioning regenerative therapies as attractive options for pet healthcare.

Ongoing research in veterinary stem cell therapy is expanding the range of treatable conditions and improving treatment protocols. Scientific advances in understanding stem cell biology and therapeutic mechanisms are supporting broader clinical adoption and regulatory approval of regenerative medicine products. These developments are increasing veterinary confidence in regenerative therapies while providing evidence-based support for treatment recommendations to pet owners.

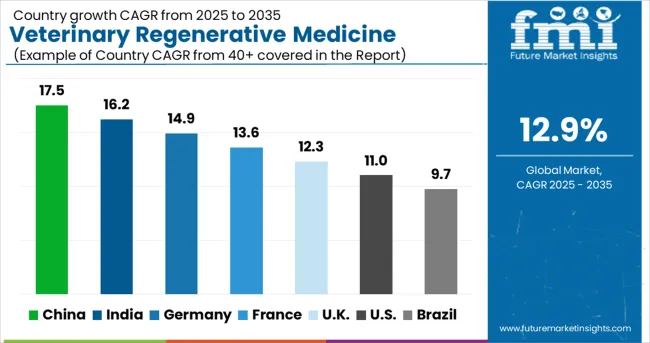

The global veterinary regenerative medicine market is anticipated to expand at a CAGR of 15%, reflecting rising demand for advanced animal health solutions and regenerative therapies. China leads BRICS with 17.5%, driven by increasing pet ownership, government-supported veterinary biotech initiatives, and urban veterinary clinic expansion. India follows at 16.2%, where growing awareness of advanced veterinary treatments, middle-class spending on companion animals, and emerging ASEAN-linked veterinary research foster market growth. Germany, at 14.9%, reflects OECD influence with strong regulatory frameworks, established veterinary networks, and adoption of innovative cell- and tissue-based therapies. France grows at 13.6%, propelled by investment in veterinary biotech and specialized regenerative care. The United Kingdom, at 12.3%, benefits from advanced veterinary R&D and adoption of novel therapies. The United States records 11.0%, showing steady uptake in a mature market with high veterinary infrastructure.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 17.5% |

| India | 16.2% |

| Germany | 14.9% |

| France | 13.6% |

| U.K. | 12.3% |

| U.S. | 11.0% |

China is advancing at a CAGR of 17.5%, supported by rapid adoption of regenerative therapies for companion animals and livestock. Veterinary clinics are integrating stem cell treatments, platelet-rich plasma therapy, and tissue engineering applications to address orthopedic, ophthalmic, and soft tissue disorders. Domestic pharmaceutical companies and international collaborators are expanding R&D efforts for innovative cell-based therapies. Investments in specialized veterinary hospitals and clinical research facilities enhance accessibility of regenerative procedures. Analysts note that the growing pet population and rising demand for advanced therapeutic solutions are fueling adoption. Government initiatives to improve animal healthcare infrastructure further accelerate market expansion. Clinics in tier 1 cities lead the adoption curve, while emerging urban centers are gradually integrating regenerative technologies.

India is expanding at a CAGR of 16.2%, driven by cost-effective adoption of regenerative therapies for both companion animals and livestock. Veterinary hospitals are increasingly providing stem cell injections, tissue engineering solutions, and biologic-based therapies. Partnerships between international biotech companies and Indian clinics enhance accessibility and affordability. Analysts expect that rising awareness of animal health, growth of veterinary specialty centers, and integration of tele-veterinary platforms will further boost market growth. Preventive and post-surgical regenerative therapies are increasingly incorporated into treatment protocols. Government support for veterinary research and biotech development strengthens infrastructure and clinical capabilities. Urban clinics show higher adoption rates, while expansion into semi-urban regions is gradually increasing the market footprint.

Germany is growing at a CAGR of 14.9%, fueled by advanced veterinary infrastructure and focus on high-quality regenerative solutions. Clinics and research institutions are deploying stem cell treatments, platelet-rich plasma therapies, and tissue scaffolding techniques for orthopedic, ophthalmic, and dermatologic applications. Collaborations between biotech companies and veterinary hospitals accelerate development of next-generation regenerative products. Analysts anticipate steady growth due to strong adoption of cutting-edge therapies, insurance coverage for advanced veterinary treatments, and high pet care standards. Regulatory frameworks ensure quality and safety of regenerative procedures. Adoption is concentrated in urban and metropolitan regions, with specialty centers leading the way in innovative therapy implementation.

France is expanding at a CAGR of 13.6%, supported by rising awareness of advanced veterinary treatments and pet healthcare. Clinics are increasingly offering stem cell, PRP, and tissue regeneration therapies for orthopedic and soft tissue disorders. Partnerships between domestic and international biotech companies enhance product availability and innovation. Analysts expect continued growth as veterinary education programs focus regenerative medicine techniques. Telemedicine adoption aids remote consultations and follow-up care, especially in semi-urban and rural regions. Government support for research initiatives and clinical trials strengthens adoption. Urban specialty clinics dominate market uptake, while smaller veterinary centers gradually expand regenerative service offerings.

The UK is growing at a CAGR of 12.3%, driven by specialized veterinary clinics and rising awareness of regenerative therapies for pets. Advanced treatments include stem cell injections, tissue scaffolding, and platelet-rich plasma therapies for musculoskeletal and ophthalmic disorders. Veterinary pharmaceutical companies are collaborating with research institutions to introduce innovative therapies and improve clinical outcomes. Analysts expect growth to continue as tele-veterinary platforms enhance treatment accessibility and insurance coverage expands adoption of advanced therapies. Preventive and post-operative regenerative care are increasingly incorporated into routine treatment protocols.

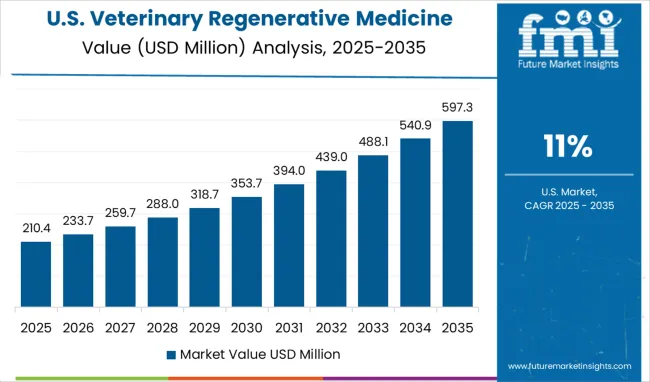

The US is expanding at a CAGR of 11.0%, supported by high pet ownership and demand for advanced regenerative therapies. Veterinary hospitals are deploying stem cell, platelet-rich plasma, and tissue engineering solutions for orthopedic, ophthalmic, and soft tissue conditions. Analysts anticipate sustained growth due to adoption of tele-veterinary services, preventive regenerative treatments, and clinical collaborations. Large animal hospitals and specialty clinics lead therapy adoption, while urban veterinary centers provide advanced surgical applications. The market is characterized by continuous innovation and integration of research-backed regenerative products into routine care, improving clinical outcomes and supporting long-term growth.

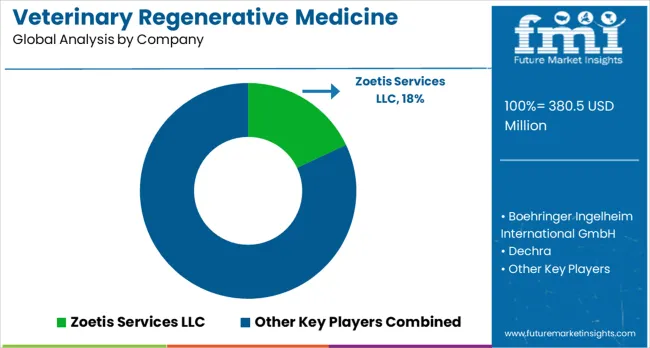

The veterinary regenerative medicine market is characterized by competition among established animal health companies, specialized regenerative medicine providers, and emerging biotechnology firms. Companies are investing in research and development, clinical validation studies, regulatory approvals, and veterinary education programs to deliver effective, safe, and accessible regenerative medicine solutions. Product innovation, clinical evidence generation, and veterinary professional training are central to strengthening market positions and expanding adoption.

Zoetis, Inc., U.S.-based, leads the market with 18.0% global value share, offering comprehensive regenerative medicine products with focus on stem cell therapy and clinical support services. Boehringer Ingelheim International GmbH provides advanced veterinary regenerative medicine solutions with prioritize on research-backed treatments and global distribution networks. Dechra Pharmaceuticals PLC focuses on specialized regenerative medicine products for companion animals and equine applications. VetStem, Inc. provides autologous stem cell therapy services with established clinical protocols and veterinary education initiatives. Ardent, Enso Discoveries, and Animal Cell Therapies, Inc. focus on innovative regenerative medicine technologies and therapeutic development.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 380.5 million |

| Animal Outlook | Small Animals, Large Animals, Others |

| Product Outlook | Stem Cells, Others |

| Application Outlook | Orthopedics, Trauma/Wound Care, Others |

| End Use Outlook | Veterinary Hospitals/Clinics, Veterinary Research Institutes, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Zoetis Inc, Boehringer Ingelheim International GmbH, Dechra Pharmaceuticals PLC, VetStem Inc, Ardent, Enso Discoveries, Animal Cell Therapies Inc |

| Additional Attributes | Dollar sales by therapy type and application area, regional demand trends, competitive landscape, veterinary professional preferences for treatment protocols, integration with traditional veterinary medicine practices, innovations in stem cell processing and delivery systems, and regulatory developments in veterinary regenerative medicine |

Animal Outlook

The global veterinary regenerative medicine market is estimated to be valued at USD 380.5 million in 2025.

The market size for the veterinary regenerative medicine market is projected to reach USD 1,284.8 million by 2035.

The veterinary regenerative medicine market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in veterinary regenerative medicine market are small animals and large animals.

In terms of product outlook, stem cells segment to command 51.9% share in the veterinary regenerative medicine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA