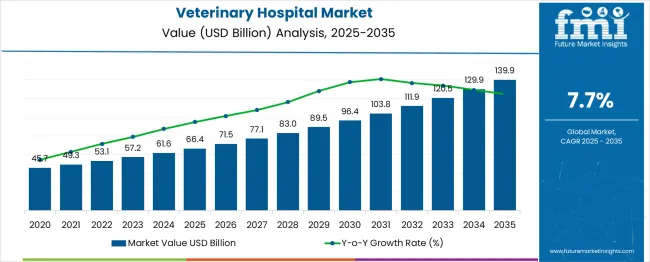

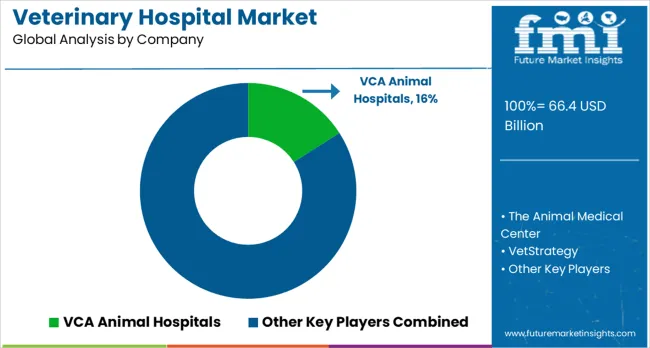

The global veterinary hospital market is likely to reach from USD 66.4 billion in 2025 to approximately USD 139.9 billion by 2035, recording an absolute increase of USD 73.5 billion over the forecast period. This translates into a total growth of 110.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8% between 2025 and 2035. The market size is expected to grow by nearly 2.1X during the same period, supported by increasing pet ownership, rising awareness about animal health, growing demand for advanced veterinary treatments, and expanding veterinary infrastructure globally.

Quick Stats for Veterinary Hospital Market

Between 2025 and 2030, the veterinary hospital market is projected to expand from USD 66.4 billion to USD 97.7 billion, resulting in a value increase of USD 31.3 billion, which represents 42.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising pet humanization trends, increasing expenditure on pet healthcare, growing demand for specialized veterinary services, and expanding veterinary education programs in emerging markets.

| Metric | Value |

| Estimated Value in (2025E) | USD 66.4 billion |

| Forecast Value in (2035F) | USD 139.9 billion |

| Forecast CAGR (2025 to 2035) | 8 % |

From 2030 to 2035, the market is forecast to grow from USD 97.7 billion to USD 139.9 billion, adding another USD 42.2 billion, which constitutes 57.4% of the ten-year expansion. This period is expected to be characterized by the expansion of telemedicine in veterinary care, the integration of advanced diagnostic technologies, and the development of personalized treatment solutions for animals. The growing adoption of preventive healthcare for pets and livestock will drive demand for comprehensive veterinary hospital services with enhanced treatment capabilities and specialized care options.

Between 2020 and 2025, the veterinary hospital market experienced robust expansion, driven by increasing pet ownership rates globally and growing awareness of animal welfare. The market developed as veterinary professionals recognized the need for advanced medical facilities to provide comprehensive healthcare for companion animals and livestock. Social media influence and veterinarian recommendations began prioritizing the importance of regular veterinary care in maintaining animal health and preventing diseases.

Market expansion is being supported by the increasing humanization of pets and the corresponding demand for high-quality veterinary care services. Modern pet owners are increasingly willing to invest in premium healthcare services for their animals, including advanced diagnostic procedures, specialized treatments, and emergency care. The growing awareness of zoonotic diseases and the importance of animal health in public health has made veterinary services a critical component of healthcare infrastructure.

The rising global population of companion animals, particularly dogs and cats, is driving demand for accessible and comprehensive veterinary services. Consumer preference for specialized veterinary services that combine medical expertise with compassionate care is creating opportunities for innovative service models. The increasing integration of technology in veterinary practice, including digital health records and telemedicine capabilities, is also contributing to improved service delivery and patient outcomes across different animal species and demographics.

The market is segmented by animal type, service type, sector, and region. By animal type, the market is divided into companion animals, farm animals, and others. Based on service type, the market is categorized into medicine, surgery, and consultation. In terms of sector, the market is segmented into private and public. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The companion animals segment is projected to account for 63% of the veterinary hospital market in 2025, reaffirming its position as the category's dominant segment. Pet owners increasingly consider their companion animals as family members, leading to higher willingness to spend on quality veterinary care. The emotional bond between humans and their pets drives demand for comprehensive healthcare services, including preventive care, emergency treatments, and specialized medical procedures.

This segment forms the foundation of most veterinary hospital revenue, as it represents the most consistent and lucrative patient base. The growing trend of pet humanization and increasing disposable income in developed and emerging markets continue to strengthen demand for premium veterinary services. With urban lifestyles leading to increased pet adoption and longer pet lifespans requiring ongoing medical care, companion animals ensure steady market dominance, making them the central growth driver of veterinary hospital demand.

Medicine services are projected to represent 46% of veterinary hospital demand in 2025, underscoring their role as the core offering for comprehensive animal healthcare. Veterinary medicine encompasses diagnostic services, treatment protocols, and medication management that form the basis of most veterinary consultations. Pet owners and livestock managers increasingly seek evidence-based medical treatments that ensure optimal health outcomes for their animals.

The segment is supported by the rising complexity of animal health conditions and the need for specialized medical interventions. The integration of advanced diagnostic tools and treatment methodologies is enhancing the effectiveness of veterinary medicine services. As animal health awareness grows and owners prioritize preventive and therapeutic care, veterinary medicine services will continue to dominate demand, reinforcing their essential positioning within the animal healthcare ecosystem.

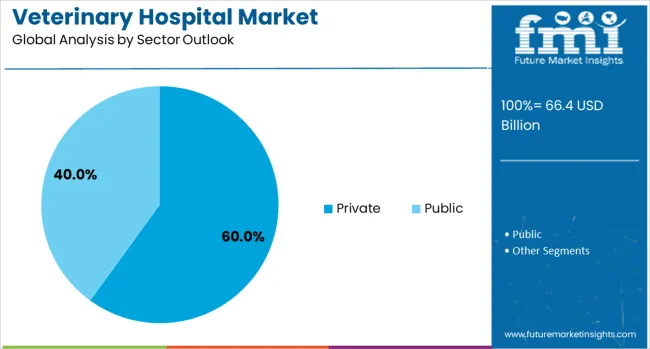

The private sector is forecasted to contribute 60% of the veterinary hospital market in 2025, reflecting the growing preference for specialized and personalized veterinary care services. Private veterinary hospitals typically offer more comprehensive services, advanced equipment, and flexible scheduling options compared to public facilities. This aligns with pet owners' desire for convenient, high-quality healthcare that can accommodate their specific needs and preferences.

Private veterinary practices benefit from their ability to invest in cutting-edge technology and specialized treatment capabilities. The segment also benefits from consumer willingness to pay premium prices for superior service quality and personalized attention for their animals. With increasing competition driving innovation and service excellence, private veterinary hospitals serve as the preferred choice for discerning pet owners, making them a critical driver of market growth and service advancement in the veterinary healthcare category.

The veterinary hospital market is advancing rapidly due to increasing pet humanization trends and growing demand for comprehensive animal healthcare services. The market faces challenges, including a veterinarian shortage, high operational costs, and regulatory compliance requirements. Innovation in telemedicine solutions and specialized treatment capabilities continues to influence service development and market expansion patterns.

The growing adoption of telemedicine platforms is enabling veterinarians to provide remote consultations and follow-up care for animal patients. Digital health solutions offer convenience, cost-effectiveness, and improved access to veterinary expertise, particularly in underserved rural areas. Technology integration is driving efficiency improvements and enabling better patient monitoring and treatment compliance.

Modern veterinary hospitals are incorporating advanced diagnostic equipment such as MRI machines, CT scanners, and digital radiography systems to enhance diagnostic capabilities. These technologies improve treatment accuracy while providing better patient outcomes and enabling more complex procedures. Advanced equipment also enables veterinary hospitals to offer specialized services that differentiate them from basic veterinary clinics.

The global veterinary eye care market is expected to increase from USD 5.3 billion in 2025 to USD 9.9 billion by 2035, advancing at a CAGR of 6%. China, growing at 8.6%, leads BRICS with rising pet ownership, urban clinic expansion, and government policies favoring companion animal health. India follows at 8.0%, supported by expanding middle-class spending, demand for specialized veterinary services, and the influence of emerging ASEAN trade in pet pharmaceuticals. Germany, with 7.3%, reflects OECD-driven regulation and innovation, where strong veterinary networks adopt advanced ophthalmic diagnostics. France grows at 6.7%, underpinned by rising awareness of animal welfare and state-backed pet insurance. The United Kingdom, at 6.1%, benefits from advanced veterinary practices and strong R&D in animal health. The United States, with 5.4%, remains a mature OECD market, yet continued pet insurance coverage sustains growth. Brazil, at 4.8%, sees slower BRICS expansion due to cost sensitivity, though urban centers drive demand.

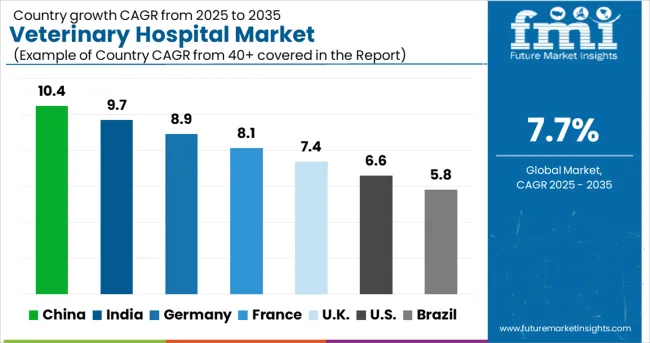

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 10.4% |

| India | 9.7% |

| Germany | 8.9% |

| France | 8.1% |

| U.K. | 7.4% |

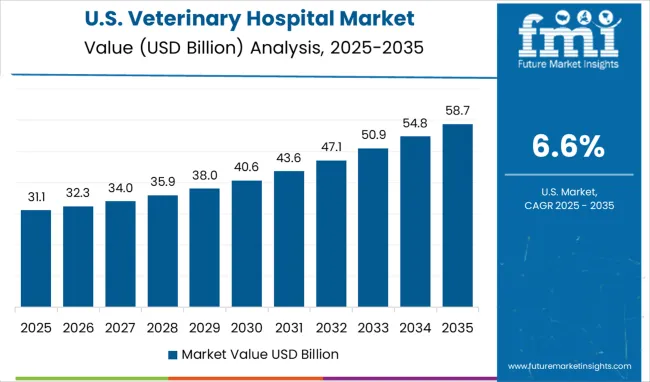

| U.S. | 6.6% |

China is anticipated to grow at a CAGR of 8.6%, fueled by rising pet ownership and increased attention to animal health. Veterinary clinics are adopting advanced diagnostic equipment, including tonometers, slit lamps, and retinal imaging devices, to detect and manage ocular disorders in small animals and livestock. The growth of veterinary pharmacy networks is enhancing the accessibility of ophthalmic medications. Government-led animal welfare initiatives and urban pet population expansion support adoption of preventive eye care services. Domestic and international companies are investing in research and development of innovative veterinary eye care products. Telemedicine platforms are facilitating remote consultations for eye conditions, improving treatment coverage in both urban and regional areas. Analysts predict that China will continue to dominate the Asian market due to investments in veterinary infrastructure, technology-driven eye care solutions, and the rising trend of specialty ophthalmic services across large-scale clinics.

India is growing at a CAGR of 8.0%, with strong adoption driven by increasing pet ownership and awareness of eye health in both companion animals and livestock. Veterinary clinics in metropolitan and tier 2 cities are equipping themselves with advanced diagnostic and surgical tools for ophthalmology. Cost-effective ophthalmic medications are being introduced by domestic and international pharmaceutical companies, improving access to treatments. Partnerships between global manufacturers and Indian veterinary providers are expanding hybrid distribution channels. Preventive care for livestock eye health is gaining traction, particularly in dairy and poultry sectors. Analysts anticipate that growth will be supported by rising veterinary education initiatives, tele-veterinary services, and specialized eye care training programs. Expansion of veterinary insurance coverage is also enhancing affordability and driving the demand for routine eye check-ups and surgical interventions.

Germany is advancing at a CAGR of 7.3%, supported by advanced veterinary infrastructure and increasing specialization in eye care services. Clinics and hospitals are integrating diagnostic imaging, surgical interventions, and targeted topical treatments for conditions like cataracts, glaucoma, and retinal disorders. Pharmaceutical research and collaborations with universities drive the introduction of innovative ophthalmic solutions. Insurance coverage for veterinary care improves accessibility of eye treatments, supporting growth across small and large animal segments. Analysts expect Germany to maintain steady expansion due to the high standard of clinical care, growing adoption of AI-assisted ophthalmic diagnostics, and investments in training veterinary professionals. The market is characterized by a strong focus on preventive care and early detection of ocular conditions, while digital platforms for remote monitoring and consultation continue to increase service efficiency and patient outcomes.

France is advancing at a CAGR of 6.7%, supported by rising pet ownership and the modernization of veterinary services. Hospitals and clinics integrate advanced diagnostic devices and therapeutic solutions to manage glaucoma, cataracts, and other ocular disorders. Domestic and international pharmaceutical collaborations enhance the availability of ophthalmic drugs. Telemedicine adoption improves accessibility in rural regions, supporting preventive care programs.

Analysts forecast that market growth will continue as pet owners demand higher-quality treatment and routine eye care services. Investments in training programs and specialized ophthalmic clinics strengthen service offerings. Veterinary associations are promoting awareness campaigns on ocular health, further driving demand. Market expansion is particularly strong in urban centers, while mid-sized towns are gradually increasing adoption of integrated eye care platforms.

The UK is growing at a CAGR of 6.1%, driven by specialty veterinary clinics and increasing awareness of companion animal eye health. Advanced diagnostic and surgical tools, including slit lamps and fundus cameras, are being deployed for early detection and treatment. Veterinary pharmaceutical companies are introducing innovative ophthalmic formulations in collaboration with global partners. Telehealth and subscription-based services are expanding access to preventive and therapeutic eye care. Analysts anticipate continued growth as pet insurance adoption rises, supporting the affordability of eye care services. Training programs for veterinary professionals are increasingly specializing in ophthalmology. Rural adoption of tele-veterinary eye care solutions is improving accessibility, while urban clinics continue to expand service offerings with integrated imaging and treatment platforms.

The US is growing at a CAGR of 5.4%, driven by widespread pet ownership and strong adoption of specialty eye care services. Veterinary hospitals deploy imaging technologies, surgical interventions, and AI-assisted diagnostic tools to manage ocular disorders. Tele-veterinary platforms allow remote consultations and follow-up care. Analysts expect growth to continue as preventive eye care adoption increases and demand rises for innovative ophthalmic pharmaceuticals. Investment in training, workflow integration, and technology upgrades supports service expansion. Veterinary clinics are standardizing protocols for early detection of conditions such as cataracts, glaucoma, and corneal injuries. Large-scale adoption of hybrid cloud platforms enables efficient management of imaging data and patient records.

Brazil is expanding at a CAGR of 4.8%, driven by increasing pet population in urban centers and the modernization of veterinary infrastructure. Clinics are gradually integrating diagnostic and surgical eye care solutions for pets, while pharmaceutical companies expand availability of ophthalmic drugs. Analysts expect steady growth as awareness of preventive care increases. Telemedicine services improve accessibility in rural regions, facilitating consultations for ocular conditions. Urban adoption is stronger due to higher income levels and clinic density, while rural adoption is rising gradually. Growth is also supported by collaborations between international vendors and local providers to introduce advanced veterinary eye care solutions tailored to local needs.

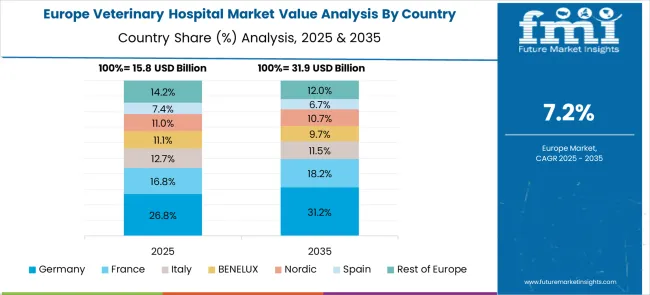

The veterinary hospital market in Europe demonstrates mature development across major economies with Germany showing strong presence through its well-established veterinary education system and consumer commitment to high-quality animal healthcare, supported by veterinary institutions leveraging scientific research to develop effective treatment protocols that address complex animal health conditions and preventive care needs.

France represents a significant market driven by its strong veterinary tradition and sophisticated understanding of animal medicine, with institutions like École Nationale Vétérinaire d'Alfort leading the development of advanced veterinary techniques and comprehensive animal healthcare solutions. The UK exhibits considerable growth through its focus on evidence-based veterinary practice and animal welfare standards, with institutions like the Royal Veterinary College contributing to veterinary education and research advancement.

Italy and Spain show expanding interest in specialized veterinary services, particularly in companion animal care and equine medicine. BENELUX countries contribute through their focus on innovative veterinary technologies and steady animal healthcare practices, while Eastern Europe and Nordic regions display growing potential driven by increasing pet ownership and expanding access to quality veterinary services across diverse healthcare delivery channels.

The veterinary hospital market is characterized by competition among established veterinary service chains, independent veterinary practices, and emerging telemedicine providers. Companies are investing in advanced medical equipment, specialized treatment capabilities, staff training programs, and digital health solutions to deliver comprehensive, effective, and accessible veterinary healthcare services. Service quality, technology adoption, and geographic coverage are central to strengthening market presence and patient satisfaction.

VCA Animal Hospitals, U.S.-based, leads the market with 16.0 percent global value share, offering comprehensive veterinary services with a focus on specialty care and emergency medicine across multiple locations. The Animal Medical Center, U.S., provides advanced medical and surgical services with focus on specialized treatments and clinical research. VetStrategy (IVC Evidensia) operates veterinary practices with focus on efficient service delivery and client satisfaction. Royal Veterinary College (RVC), U.K., combines veterinary education with clinical services, providing advanced treatments and research-based care.

Beijing Xintiandi International Animal Hospital and MaxPetZ focus on companion animal care with modern facilities and comprehensive service offerings. SASH Vets provides specialized veterinary services with focus on emergency care and advanced treatments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 66.4 Billion |

| Animal Outlook | Companion Animals, Farm Animals, Others |

| Type Outlook | Medicine, Surgery, Consultation |

| ector Outlook | Private, Public |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | VCA Animal Hospitals, The Animal Medical Center, VetStrategy, Royal Veterinary College (RVC), École Nationale Vétérinaire d'Alfort (ENVA), Tierärztliche Hochschule Hannover (TiHo), Beijing Xintiandi International Animal Hospital, MaxPetZ, Daktari Animal Hospital, and SASH Vets |

| Additional Attributes | Revenue analysis by service type and specialization level, regional demand trends, competitive landscape, consumer preferences for private versus public services, integration with telemedicine and digital health solutions, innovations in diagnostic equipment, treatment protocols, and veterinary education programs |

The global veterinary hospital market is estimated to be valued at USD 66.4 billion in 2025.

The market size for the veterinary hospital market is projected to reach USD 139.9 billion by 2035.

The veterinary hospital market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in veterinary hospital market are companion animals and farm animals.

In terms of type outlook , medicine segment to command 46.0% share in the veterinary hospital market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Hospitals Revenue Analysis Growth – Trends & Forecast 2024-2034

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA