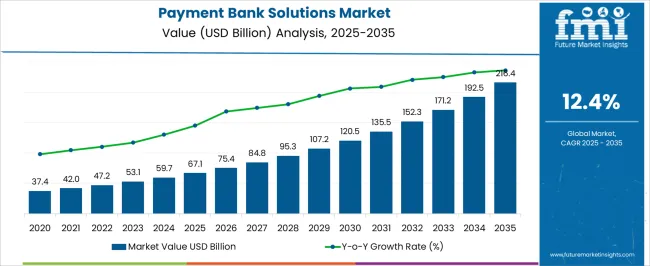

The Payment Bank Solutions Market is estimated to be valued at USD 67.1 billion in 2025 and is projected to reach USD 216.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period.

| Metric | Value |

|---|---|

| Payment Bank Solutions Market Estimated Value in (2025 E) | USD 67.1 billion |

| Payment Bank Solutions Market Forecast Value in (2035 F) | USD 216.4 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

The payment bank solutions market is advancing steadily, driven by the increasing digitalization of banking services, rising demand for financial inclusion, and the growing adoption of secure transaction platforms. Financial institution reports and technology provider updates have emphasized the critical role of payment banks in bridging the gap between unbanked populations and formal financial systems. The expansion of mobile banking, digital wallets, and government-led initiatives promoting cashless economies have accelerated the adoption of advanced payment infrastructures.

Investments in robust security frameworks, biometric authentication, and integrated payment systems are reshaping the market landscape. Furthermore, strategic collaborations between financial service providers and technology firms have supported innovation in real-time payment processing and customer service delivery.

Looking ahead, market growth is expected to be fueled by the continued rollout of secure hardware, scalable software solutions, and regulatory frameworks that promote transparent and accessible financial services across emerging and developed economies.

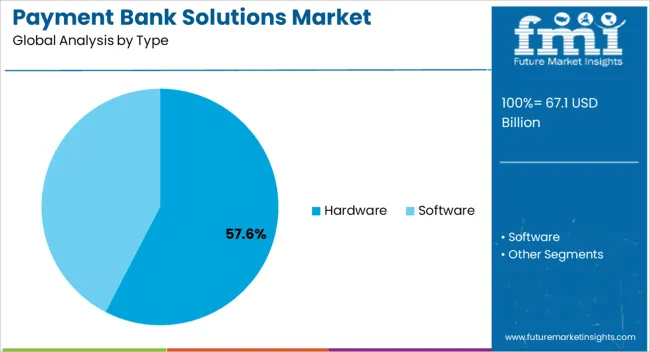

The Hardware segment is projected to account for 57.60% of the payment bank solutions market revenue in 2025, maintaining its position as the leading type category. Growth of this segment has been driven by the increasing reliance on physical infrastructure such as point-of-sale (POS) terminals, biometric devices, and secure transaction modules that ensure safe and efficient customer interactions.

Banks and payment service providers have prioritized investment in hardware solutions to support expanding digital payment ecosystems, particularly in rural and semi-urban areas where financial access infrastructure is still developing. Hardware systems have been critical in enabling secure customer verification, cashless transactions, and reliable connectivity for financial services.

Additionally, hardware upgrades driven by the need for enhanced encryption standards and compliance with regulatory norms have sustained demand. As financial institutions continue to strengthen their physical banking infrastructure alongside digital innovations, the Hardware segment is expected to retain its dominant market share, supported by ongoing deployment and modernization of secure banking devices.

The major factor driving the adoption of payment bank solutions is the rising usage of mobile technology among individuals. The concept of payment bank solution is also being adopted by individuals due to internet facilities and easy to understand concept, positively influencing the payment bank solutions market outlook.

The market growth is expected to take a dip due to the lack of knowledge payment banking solutions. RBI has issued licenses to 11 entities to launch payment banks due to which only these 11 companies are offering solutions to areas where they already exist and this concept is in the introductory stage due to which it takes time for individuals to adopt.

Merchants have been forced to choose options for payment management as a result of the growing consumer demand for online purchases, in turn, auguring well for payment bank solutions market future trends. Merchants can lower the risk of fraudulent purchases and enhance the customer experience by using payment bank solutions.

These solutions can be successfully combined with POS systems to support business growth.

The payment banks solutions market statistics are likely to spike as banks and financial institutions are straying from conventional service offering modules in an effort to gain a competitive edge in the market.

They are implementing business and customer-based models that focus on contextual and specialized offerings, ultimately expanding the payment bank solutions market share.

Banks can adapt to a more strategic role and create new revenue streams for both themselves and their clients owing these value-added services.

Banks create a conducive environment for the payment bank solutions market trends to thrive as they can improve their payment technology & offer an effective cash forecasting model based on prior transactions by utilizing data analytics.

Banks can offer treasury as a service to both small and large businesses and can smooth out automated decision-making processes by utilizing artificial intelligence (AI), boosting the adoption of payment bank solutions.

The adoption of cutting-edge technologies has allowed banks and Fintech companies to manage liquidity operations, offer end-to-end services, and automate crucial accounting operations.

North America is projected to dominate the market with a share of 40% in 2025 as a result of the greater acceptance of digital payments in the region. An annual slight but advantageous increase in net interest margins on the current account balance has been made possible by a stronger interstate economic structure.

The e-commerce boom & the ongoing shift away from cash and checks have caused the growth rate of electronic payment transactions to almost double that of the GDP, thereby fostering the payment bank solutions market trends and forecasts.

Europe is likely to hold a payment bank solutions market share of 23% in 2025 due to very high card penetration in the UK and the fact that credit cards are one of the most widely used payment methods for online purchases.

The market in the region is likely to thrive through payment bank solutions, multinational corporations like Maestro, MasterCard, American Express, and Visa Guarantee, and discover a secure payment process between vendors and issuing banks.

The presence of significant players in the area and the growing use of online channels by retail customers are some other factors expected to improve payment bank solutions market key trends & opportunities.

Business-to-business (B2B) and business-to-consumer (B2C) markets in e-commerce, fintech, and manufacturing among others, can use the white-label banking-as-a-service platform provided by Brazilian start-up Dock.

Dock gives non-banking businesses the tools they need to launch their own banking product through an exclusive application programming interface (API).

For financial products to get started, the start-up also provides branded cards, and mobile, or web applications. A full lending-as-a-service solution, developed by US-based Kuber Financial, consists of a portfolio management suite, high-end analytics, and an end-to-end lending back-office engine.

The setup and development costs for lending services can be reduced by businesses thanks to Kuber Financial.

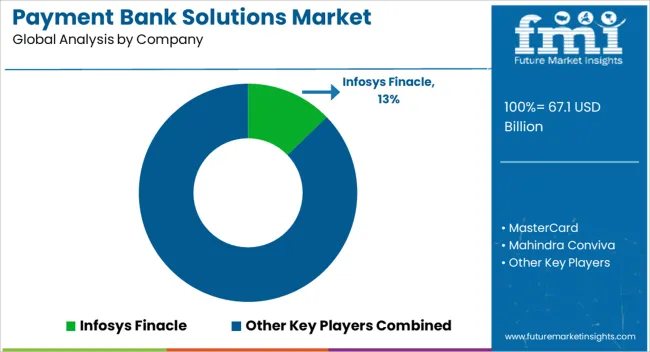

In the payment bank solutions market, some of the key players include Infosys Finacle, MasterCard, Mahindra Conviva, and others.

Recent developments in payment bank solutions market are as follows:

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 12.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Payment Bank Solutions Market Value (2025) | USD 52,545 million |

| Payment Bank Solutions Market Anticipated Forecast Value (2035) | USD 178,367.5 million |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Infosys Finacle; MasterCard; Mahindra Conviva; Gemalto; EdgeVerve Systems; BPC; ACI Worldwide; IBM |

| Customization & Pricing | Available Upon Request |

The global payment bank solutions market is estimated to be valued at USD 67.1 billion in 2025.

The market size for the payment bank solutions market is projected to reach USD 216.4 billion by 2035.

The payment bank solutions market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in payment bank solutions market are hardware, _atm cards, _debit cards, _forex cards, software, _platforms and _mobile apps.

In terms of , segment to command 0.0% share in the payment bank solutions market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Payment Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Bank Regulatory & Governance Consulting Market Size and Share Forecast Outlook 2025 to 2035

Payment Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Banking as a Service (BaaS) Platform Market Size and Share Forecast Outlook 2025 to 2035

Open Banking & BaaS – Revolutionizing European FinTech

ePayment System Market Analysis by Component, Deployment, Enterprise Size, Industry, and Region through 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

B2B Payments Platform Market

5PL Solutions Market

Open Banking Market Analysis - Size, Share, and Forecast 2025 to 2035

Core Banking Solution Market Report – Growth & Forecast 2017-2027

Blood Bank Reagent Market Size and Share Forecast Outlook 2025 to 2035

Japan Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Blood Banking Equipment Market Analysis – Size, Share & Forecast 2024-2034

Mobile Payment Transaction Market Analysis – Growth, Applications & Outlook 2025 to 2035

Crypto Payment Gateways Market Insights - Trends & Growth 2025 to 2035

Mobile Payment Data Protection Market Trends – Growth & Demand 2024-2034

Mobile Payment Security Market Insights – Growth & Demand 2024-2034

Secure & Seamless Digital Payments – AI-Powered Payment Gateways

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA