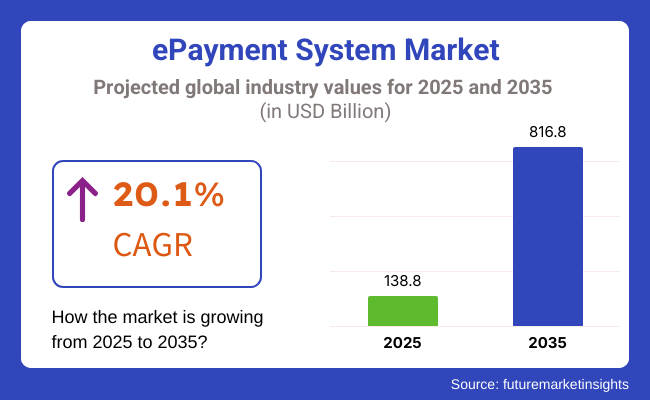

The ePayment system market is projected to reach USD 138.8 billion in 2025 and expand to USD 816.8 billion by 2035, driven by a compound annual growth rate (CAGR) of 20.1%. This rapid expansion is fueled by advancements in mobile technology, the proliferation of e-commerce platforms, and the increasing shift toward cashless and contactless transactions across developed and emerging economies.

Key growth drivers include rising consumer demand for secure, fast, and convenient digital payment options, the integration of biometric authentication, and the widespread adoption of digital wallets and mobile payment apps. Financial institutions and fintech companies are accelerating innovation in e-payment platforms to meet evolving user expectations and regulatory standards.

Challenges include cybersecurity risks, regulatory compliance complexities, and limited digital infrastructure in some regions, which may slow adoption. However, increasing internet penetration, government initiatives promoting digital payments, and innovations such as blockchain-based systems and AI-driven fraud detection present substantial opportunities for industry expansion.

Emerging trends include the rise of real-time payment systems, embedded finance, and cross-border ePayment solutions, transforming the global payments landscape and enhancing financial inclusion.

Between 2020 and 2024, sales grew rapidly, fueled by the use of digital payment solutions, increasing financial inclusion, and increased cybersecurity. The COVID-19 pandemic further spurred the transition to cashless transactions, and digital payments became the go-to choice for businesses and consumers.

Mobile payments via platforms such as Apple Pay, Google Pay, and PayPal skyrocketed, with contactless payment methods like NFC cards and QR code scanning becoming the norm. Blockchain and cryptocurrency adoption picked up pace, with Visa and Mastercard embracing crypto payments and governments looking into Central Bank Digital Currencies (CBDCs).

AI-based fraud prevention, biometric verification, and multi-factor authentication enhanced payment security, while regulatory environments matured to deal with inconsistencies and better protect consumers. Issues like cybersecurity attacks, regulatory loopholes, and the digital divide remained, but in 2024, there were global standards for interoperability and security. Throughout 2025 to 2035, the ePayment sector will be influenced by AI automation, decentralized finance (DeFi), and biometric technology.

During 2025 to 2035, artificial intelligence-based financial assistants will automate payments, anticipate expenditure habits, and optimize personal finance planning. Blockchain-based DeFi platforms and smart contracts will lower fees, allow real-time cross-border settlement, and automate payment contracts.

Biometric and voice payments through facial recognition, palm vein scanning, and voice biometrics will be convenient and secure. Blockchain and AI will enable low-cost real-time cross-border payment, and IoT-enabled devices will power automated smart home and vehicle payments. Green digital payment infrastructure, such as carbon-free data centers and energy-efficient processing, will be the standard. Quantum computing and quantum-resistant cryptography will secure payments, offering fraud detection at higher speed and verifiable, secure proof of transactions, changing the future of payments.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| PSD2, GDPR, and regional regulatory compliance | Global standardization of digital payment policies, AI-driven compliance enforcement |

| AI-driven fraud detection, contactless payments | Decentralized finance (DeFi), biometric authentication, and voice-activated payments |

| Mobile wallets, e-commerce payment integration | IoT-based payments, cross-border real-time settlements |

| NFC-based payments, blockchain integration | Quantum computing-driven security, AI-driven predictive financial automation |

| Reduction of paper transactions, digital-first banking | Carbon-neutral digital payment infrastructure, sustainable blockchain solutions |

| AI-powered fraud prevention, real-time transaction tracking | Self-learning AI payment optimization, automated smart contracts |

| Supply chain disruptions, cybersecurity concerns | Scalable AI-driven payment processing, interoperability between global financial networks |

| Digital transformation, COVID-19-driven cashless adoption | Scaling of AI automation, end-to-end decentralized worldwide payment systems |

The industry is going through a very fast evolution because of the growing global trend of cashless payment forms like digital wallets and contactless payments. Businesses operating in the retail and e-commerce space are looking for a payment method that is not only fast and secure but also user-friendly to the customer to enrich the customer experience.

The BFSI sector faces the requirements of high security, fraud prevention, and regulatory compliance, which are issues that arise due to the nature of financial transactions. Healthcare providers are asking for secure and HIPAA-compliant payment processing schemes for applications such as medical billing and patient transactions.

Government entities' key issues are regulatory adherence, fraud protection, and integration with other infrastructure. The travel and hospitality sectors are concentrating on a multi-currency-friendly interface with international payment processing that is fast and easy. Some of the major trends include blockchain-based payments, AI-imposed fraud detection, biometric authentication, and cross-border transactions in real-time that form the digital payment future.

Contract & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Visa | Approximately USD 80 - 90 |

| Mastercard | Approximately USD 70 - 80 |

| PayPal | Approximately USD 60 - 70 |

| Square | Approximately USD 50 - 60 |

| Stripe | Approximately USD 90 - 100 |

In 2024 and early 2025, there was robust growth driven by the increasing shift towards digital and contactless transactions. Leading companies such as Visa, Mastercard, PayPal, Square, and Stripe have secured significant contracts and strategic partnerships to enhance security, reliability, and innovation in payment processing. These developments reflect the industry's commitment to digital transformation, ensuring seamless and secure transactions across diverse markets.

The ePayment industry is vulnerable to cyber threats like data breaches, phishing emails, and fraud. When digital transactions increase, cybercriminals get interested in the payment gateways, aiming at financial losses and negative publicity. Minimizing these threats is through strong encryption, multi-factor authentication, and real-time fraud detection systems.

Regulatory compliance challenges are the main hurdles for the industry. Governments are monitoring data security laws like GDPR, PCI DSS, and PSD2 in their strict formality to protect user data. The company's failure to obey may lead to high penalties and lawsuits. Regular updates of the system and compliance audits are the two things that businesses operating in various regions must perfor.m

Operational disruptions can result from system downtimes, network failures, or technical glitches. Companies that rely on online payments are greatly affected even by the smallest detours, as they can lead to significant revenue losses. Measures like operational efficiency, redundancy steps, and contingency strategies will help lower the risks.

The absence of consumer trust and adoption barriers is the major drawback to growth. Customers may have concerns about security issues, hidden fees for some transactions, and difficulty in using new payment methods that they have never used before. Successful communication, strong security frameworks, and easy-to-use interfaces are the key factors that lead to getting consumers' trust and increasing the adoption rate.

| Segment | Value Share (2025) |

|---|---|

| Solution | 65.8% |

The solution segment is expected to lead the ePayment Systems market during the forecast period, owing to the advancement in technology; it is anticipated that the solution segment is estimated to represent ~65.8% of the total ePayment Systems market share in 2025. This growth is fueled by the increasing use of digital wallets, artificial intelligence fraud detection tools, blockchain transactions, and real-time payment processing.

Successful companies and financial institutions are using advanced payment software for better security, efficiency, and user experience. Major players like PayPal, Stripe, and Square are expanding their solution portfolios, while banks and fintech organizations are increasingly embracing tailored payment platforms to address changing customer needs.

The services segment is expected to dominate in 2025, accounting for a share of 34.2%, driven by rising demand for payment integrations, consulting, and managed services. With companies moving towards a smooth omnichannel payment experience, service providers play a major role in deploying systems, cybersecurity, regulations compliance, and cloud-based infrastructure/facility management. Increasing focus on fraud prevention, AI-based analytics, and secure transaction frameworks is additionally propelling the demand for professional services.

Cloud-based and AI-enhanced solutions would fuel innovation as the digital payments landscape continues to evolve. Now, the confluence of IoT and payment processing infrastructure will open the door to SMEs across industries, and contactless payment will become the backbone of the ePayment domain while improving efficiency, security, and convenience for both merchants and consumers.

| Segment | Value Share (2025) |

|---|---|

| Cloud-based | 75.4% |

The global ePayment Systems market is rapidly transitioning towards cloud-based deployment, which will dominate 58.3% of the overall share by the year 2025. The rising deployment of cloud-native payment platforms, AI-based fraud detection, and scalable payment infrastructures drive this growth. Emerging payment technologies like blockchain, real-time payments, IoT-based transactions, etc., have made operations flexible, economical, and palatable over the cloud. AWS (Amazon Web Services), founded in 2006, powers the cloud infrastructure for most of the banks globally and enables cloud adoption in financial services, offering banks, fintech, and e-commerce companies an optimized payment processing journey while securing it.

The on-premises deployment segment is estimated to account for 41.7% of the share in 2025, owing to industries that demand higher data control, compliance with stricter regulations, and improvement in security measures. Some of the larger enterprises, such as those in banking, financial services, and government sectors, would prefer on-premises payment solutions due to concerns about data privacy, latency, and integration with on-premises legacy systems. For such enterprises, leading key participants such as FIS, ACI Worldwide, and Fiserv are providing in-depth on-premises payment gateways and AI in fraud management systems.

Due to that very cost-effective, real-time, globally accessible option, the cloud segment is meant to witness faster adoption as digital transformation accelerates. Nonetheless, there will always be a need for on-premises solutions in cases where businesses require a customized and high-security payment processing environment, making both deployment models relevant in the ever-evolving ePayment industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 11.2% |

| The UK | 10.5% |

| France | 9.8% |

| Germany | 9.5% |

| Italy | 8.9% |

| South Korea | 12.0% |

| Japan | 10.2% |

| China | 13.5% |

| Australia | 9.3% |

| New Zealand | 8.5% |

2025 to 2035 CAGR is expected to be 11.2%, driven by high fintech adoption, changing regulatory landscapes, and digital wallet growth. PayPal, Apple Pay, and Stripe are leading the industry and indicate robust local growth as BNPL products gain traction. Enhanced security features and government support for open banking will drive growth. Contactless and QR-code payments are being adopted by major retailers as well as small businesses, which is fueling the growth in the USA

Growing demand for borderless payments stimulates innovation as banks embrace blockchain technology. Tech players continue to dominate, with Google Pay and Square picking up growing traction. Mergers and acquisitions by fintech participants drive scalability and efficiency.

Pioneers like Revolut, Monzo, and Barclays are at the forefront, setting the stage for instant payments and cryptocurrency-based transactions. Contactless payment is almost everywhere, indicating widespread customer adoption and making the UK industry robust.

Government policies encouraging open banking force fintech startups, resulting in a highly competitive landscape, cross-border commerce, especially in the EU, forces frictionless cross-border payments. High smartphone penetration guarantees that mobile wallets and P2P transactions will expand further.

9.8% is the CAGR between 2025 and 2035, as rigorous regulation renders it a secure digital payments platform. Industry growth is fueled by French incumbents such as Worldline and BNP Paribas, while new entrants offer AI-driven fraud prevention. Mobile payments are increasingly gaining traction among young people who value convenience and speed. Strong government support and tech-led solutions provide backing to the industry in France.

E-Commerce expansion, facilitated by Cdiscount and others, highlights end-to-end payment solutions. Pressure from the French government for a cashless future propels uptake, especially in cities. With the development of the digital euro ongoing, the Central Bank Digital Currency (CBDC) may transform the future.

2025 to 2035 CAGR is predicted at 9.5%, with digitalization gaining momentum in the largest European economy. Cash is still the choice of some consumers, but companies such as Wirecard (before the scandal) and N26 encourage contactless payments and mobile banking. Conventional banks offer instant payment processing to hold onto market share, propelling sales in Germany.

E-commerce growth prompts a heightened need for online secure payment, and Klarna and Paydirekt lead the way. Wider promotion by the government, backed by regulatory powers, secures solid momentum for growth. The detection of fraud using artificial intelligence is of new importance with growing transaction volumes.

2025 to 2035 CAGR is 8.9% and is driven by the growth of mobile banking as well as fintech firms. Although Italy has never been a leader in digital, firms such as Nexi and Satispay are spearheading the charge towards cardless and mobile payments. Smartphone penetration at high levels is driving eWallet and QR-code payments, thereby driving the industry in Italy.

The pandemic caused augmented contactless utilization, and nowadays, businesses emphasize frictionless payment tools. The reward of cashless transactions by the government incentivizes SME digitization, while the tourism and retail industry employs advanced ePayment technology to address foreign buyers.

CAGR from 2025 to 2035 is 12.0% and places South Korea as a leader in digital payments. Brand dominance by the likes of Kakao Pay, Naver Pay, and Samsung Pay also reflects the technology-savvy consumers. Super apps are complemented by bundled financial services so that transactions can be smooth across platforms.

Government encouragement of blockchain-driven payment systems heightens security and efficiency. Highly developed internet networks in South Korea facilitate real-time mobile payments, while AI-aided prevention of fraud limits risk. Payment adoption by the e-commerce and gaming sectors further rises.

CAGR of 2025 to 2035 is projected to be 10.2%, driven by the rising adoption of cashless technologies. Rakuten Pay, PayPay, and Line Pay are dominant brands driving cash-to-digital wallet adoption. Government-led campaigns are supporting QR-code payments.

Tourism is another key factor, with shops making provisions to handle foreign payment methods. Japan's aging population is an issue and a challenge as companies create accessible ePayment systems for senior citizens.

2025 to 2035 CAGR is estimated at 13.5%, with China being the most lucrative industry. WeChat Pay and Alipay are the undisputed champions, handling billions of transactions daily. The central bank is also launching a CBDC.

E-commerce behemoths such as Alibaba and JD.com are driving demand for frictionless payments. Super apps bring together social, banking, and payments in an interdependent digital economy. AI-powered fraud detection makes transactions safer, further enhancing consumer trust in digital payments.

2025 to 2035 has a forecasted CAGR of 9.3%, driven by fintech advancement and smartphone penetration. Digital lead growth is driven by brands such as Afterpay and Commonwealth Bank, while stability is provided through regulatory environments. Tap-and-go payment technology is the standard now, and even small businesses have embraced contactless payment strategies, driving the industry in Australia.

The expansion of BNPL services influences consumers' consumption patterns, particularly in retail. Cross-border transactions with the Asia-Pacific region gain prominence, leading to increased demand for multi-currency payment facilities. Real-time payment systems, backed by the Reserve Bank of Australia, also make transactions more convenient.

8.5% CAGR from 2025 to 2035 is anticipated, representing consistent growth in digital payments. Laybuy and ASB Bank are some of the businesses that advocate cashless payment, and government-supported fintech projects allow for speedy innovation. QR-code payments and mobile wallets are becoming popular, especially in city-based locations.

Small firms adopt ePayment platforms to accommodate digitally born customers. Post-pandemic recovery of travel and tourism boosts international payment compatibility needs. Business houses make investments in sophisticated fraud detection and encryption technology since security concerns come to the forefront, increasing customer confidence.

The payment systems market is growing fast, creating advantages in doing business across global commerce and financial systems with digital transactions. This mobile commerce, contactless payments, and regulatory policies that promote cashless economies drive companies to refine their specifications on real-time payment processing, AI-enabled fraud detection, and security applications on the blockchain.

Key players in this business are PayPal, Visa, Mastercard, Square, Stripe, and all the other players that are offering secure, scalable, and integrated solutions for payment transactions and consumers taking on businesses. The promise of established players to be

Emerging trends include biometric authentication, innovations in cross-border payments, and the development of central bank digital currencies (CBDCs), which together will represent a major force in shaping transaction infrastructures. With these, businesses expect seamless API-driven integrations, omnichannel payment acceptance, and data-driven financial insight into digital commerce optimization.

Some key strategic factors include adherence to the regulatory framework governing global financial transactions, the resilience of cybersecurity, and improvement in user experience. As digital payments increasingly become the norm, competition impels change in instant settlement networks and tokenization of transactions, and advances AI-powered personalization to reshape the future of payments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PayPal Holdings Inc. | 20-25% |

| Visa Inc. | 15-20% |

| Mastercard Inc. | 12-16% |

| Square (Block, Inc.) | 10-14% |

| Stripe | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| PayPal Holdings Inc. | Ensures safe online transactions, person-to-person money transfers, and worldwide e-commerce solutions. |

| Visa Inc. | We specialize in digital card-based transactions, contactless payments, and instant review of fraud. |

| Mastercard Inc. | Engines of disruption may be established in AI-based risk evaluation and tokenized payment security. |

| Square (Block, Inc.) | Mobile payment, business solutions for SMEs, and blockchain financial services. |

| Stripe | Provides developer-friendly APIs for e-commerce, subscription billing, and global payment processing. |

Key Company Insights

PayPal Holdings Inc. (20-25%)

PayPal leads the ePayment market with an extensive range of online and mobile payment solutions, with seamless cross-border transactions and AI-powered fraud protection.

Visa Inc. (15-20%)

Visa is a pioneer of secure digital payments with contactless and tokenized payment options that increase user convenience and security.

Mastercard Inc. (12-16%)

Mastercard is leading digital payments by deploying AI for fraud detection, real-time authentication, and an expanding network of secure global partnerships.

Square (Block, Inc.) (10-14%)

Square enhances accessibility in mobile payment solutions, point-of-sale innovation and facilitation, and cryptocurrency payment integration for businesses and consumers.

Stripe (6-10%)

Stripe is transforming e-commerce payments as it creates developer-friendly application programming interfaces, a seamless pathway to worldwide payment processing, and subscription revenue mechanisms.

Other Key Players (30-40% Combined)

The segmentation is into solutions (payment gateway, payment processing, payment wallet, payment security, and fraud management, and point of sale (POS)) and services (consulting & advisory, integration & implementation, support & maintenance, and managed services).

The segmentation is into on-premises and cloud.

The segmentation is into small and medium enterprises (SMEs) as well as large enterprises.

The segmentation is into BFSI, retail, healthcare, media & entertainment, IT & telecom, transportation & logistics, and others.

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

The overall market size for the ePayment System Market was USD 138.8 billion in 2025.

The ePayment System Market is expected to reach USD 816.8 billion in 2035.

The demand will grow due to increasing digital transactions, rising adoption of contactless payments, and government initiatives promoting cashless economies.

The top 5 countries driving the ePayment System Market are the USA, China, India, Germany, and the UK.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Enterprise Size, 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 23: Global Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 24: Global Market Attractiveness by Industry, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 46: North America Market Attractiveness by Component, 2023 to 2033

Figure 47: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 48: North America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 49: North America Market Attractiveness by Industry, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Component, 2023 to 2033

Figure 97: Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 98: Europe Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 99: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 124: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Deployment, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Deployment, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 174: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Enterprise Size, 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Enterprise Size, 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Enterprise Size, 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size, 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 196: MEA Market Attractiveness by Component, 2023 to 2033

Figure 197: MEA Market Attractiveness by Deployment, 2023 to 2033

Figure 198: MEA Market Attractiveness by Enterprise Size, 2023 to 2033

Figure 199: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Atomic System Clocks Market Forecast and Outlook 2025 to 2035

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA