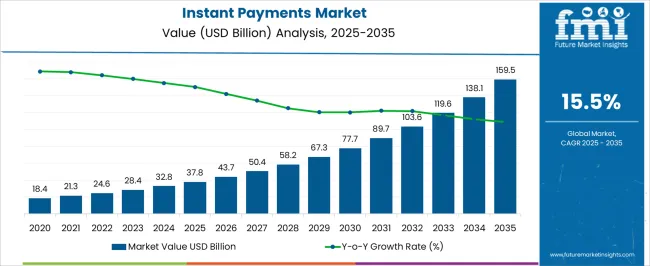

The Instant Payments Market is estimated to be valued at USD 37.8 billion in 2025 and is projected to reach USD 159.5 billion by 2035, registering a compound annual growth rate (CAGR) of 15.5% over the forecast period.

| Metric | Value |

|---|---|

| Instant Payments Market Estimated Value in (2025 E) | USD 37.8 billion |

| Instant Payments Market Forecast Value in (2035 F) | USD 159.5 billion |

| Forecast CAGR (2025 to 2035) | 15.5% |

The instant payments market is experiencing accelerated adoption as financial institutions, businesses, and consumers increasingly prioritize speed, transparency, and efficiency in transactions. The rising demand for real time payment systems is being fueled by advancements in digital infrastructure, smartphone penetration, and regulatory frameworks supporting faster payment settlements.

Enhanced interoperability across domestic and cross border systems is enabling greater participation from banks and fintechs, while security improvements are building user confidence. The adoption of instant payments is also being reinforced by the shift toward cashless economies and the integration of advanced analytics for fraud prevention and risk management.

The market outlook remains strong as enterprises and individuals continue to embrace solutions that deliver cost effectiveness, improved liquidity management, and seamless user experiences.

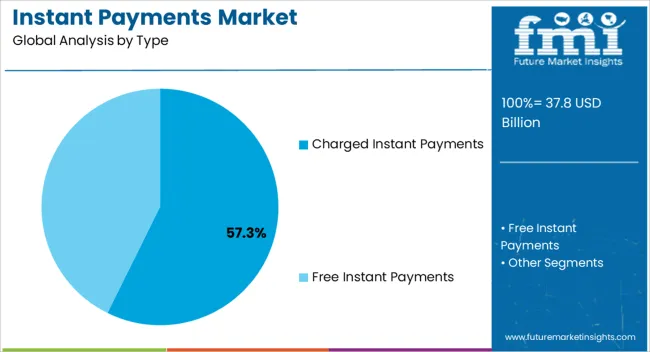

The charged instant payments segment is projected to hold 57.30% of market revenue by 2025, establishing itself as the leading type. This dominance is attributed to the revenue generating potential it offers to financial service providers and the enhanced value added services packaged with these transactions.

Banks and payment providers have prioritized this model to cover infrastructure costs while ensuring system scalability and security. Additionally, the adoption of charged models has been supported by business users who value guaranteed transaction speed, fraud prevention measures, and round the clock service availability.

The ability to sustain investments in advanced payment rails and fraud detection systems has further solidified the prominence of charged instant payments in the overall market.

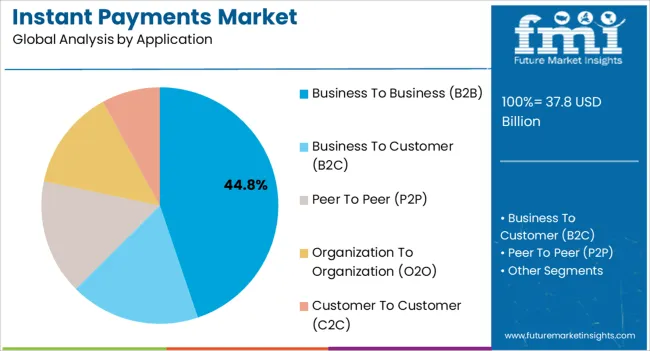

The business to business segment is expected to account for 44.80% of total market revenue by 2025, making it the most significant application category. This growth is being driven by corporate demand for improved cash flow visibility, real time settlement of invoices, and reduced dependency on credit cycles.

Enterprises have recognized the efficiency gains from eliminating delays associated with traditional payment channels, especially in global supply chains. Adoption has also been encouraged by the need for greater transparency in financial transactions and compliance with evolving regulatory standards.

The scalability of instant payments for high volume transactions, combined with integration into enterprise resource planning systems, has reinforced the leadership of business to business applications in the market.

The digitization, government initiatives, and rapid adoption of real-time payment platforms in almost every industry such as retail, e-commerce, healthcare, education, and FMCG have fueled the growth of the instant payment market.

The shift to cashless and contactless payments, high capital investment by governments, and the spreading of awareness about alternative payment methods are the driving factors for the growth of the instant payment market. Through the advent of the coronavirus, the need for instant payment solutions has increased.

New players are coming into the market with significant schemes. Countries like India and China have started shifting toward a cashless economy. Steps like demonetization and enhanced online cash transfer platforms have pushed people to use instant payment gateways and tools, fueling the sales of the instant payment market.

High penetration of 4G or 5G internet and smartphones has made payments easy and fast. Further, the adoption of cloud-based payment solutions that are developed through various financial institutes and their integration with research and development programs are also pushing enterprises to adopt these platforms.

The incorporation of cutting-edge technology like artificial intelligence and machine learning integrating with these platforms provides an enhanced customer experience. For instance, AI helps these platforms in verifying multiple QR codes and helps when the payment is stuck. AI also works as the first line of support that troubleshoots when there is an error. Machine learning helps these platforms by introducing new advanced payment methods to ease and smoothen cash transfers.

The future growth prospects look notable for the instant payment market due to the rollout of 5G networks in multiple developed and developing countries. This might further make the payment process fast and easy. Another factor that drives the market’s growth is big tech and consulting giants using online payment options to transfer huge amounts. For instance,

JP Morgan Chase & Co. has introduced the request to pay that enables their multiple clients to send payment requests to over 57 million retail clients just through their app and website.

Digitization has also risen with the advent of covid-19 as it barred corporates from functioning physically. For instance, Japan initiated the Cashless Japan program to aware its citizen about cashless and contactless payments.

The key restraint that challenges the market is slow internet speed in certain regions, lack of awareness, and an incompetent workforce that needs to get trained for multiple payment operations. This restricts the instant payment market slightly.

The overall valuation of the market was surveyed to be USD 13,143.1 million in the year 2020. During the years between 2020 and 2025, the adoption of instant payment services expanded by a CAGR of 23.2%.

Pandemic years also speeded up the transformation process, including the shift from a cash economy to a cashless economy. This is a factor behind the excessive growth of the market, with an extremely high CAGR of 23.2% between 2020 and 2025.

Another factor behind the high adoption of instant payment options is the rapid digitization of multiple corporations, industries, and retail outlets, fueling the sales of the instant payment market.

The market is categorized by Type and Application. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a stronghold in multiple regions.

| Category | By Type |

|---|---|

| Top Segment | Free Instant Payments |

| Market Share in Percentage | 67.5% |

| Category | By Application |

|---|---|

| Top Segment | Business to Consumer (B2C) |

| Market Share in Percentage | 43.5% |

By platform type, the FMI study finds that the charge type of platform has a high sales potential through 2035. The adoption of software systems is likely to expand at a CAGR of 17.9% during the forecast period. Consumer demand for charge systems is attributed to their characteristics like an easy-to-use interface, many services, and verticals, and better customer support and security.

In the future, sales of charge-based instant payment systems are estimated to grow excessively to provide better end-user experience, security, and fast payments. This pushes the sales of instant payment systems in the new regions.

By application, Peer-to-peer money transfer is the big segment in the market and is expected to hold a significant portion in the forecast period. The segment is thriving at a strong CAGR of 17.4% between 2025 and 2035. The factors behind the growth of this segment are its high consumption of it in small and medium enterprises and by the general public.

Peer-to-peer transfer is used in transferring money from one’s bank account to other people like family, friends, or any retail outlet. This helps the market expand its distribution channel because of its general use if it in P2P transfers, fueling the sales of instant payment platforms.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| North America | 26.9% |

| Europe | 22% |

There are a few factors pushing demand for instant payments platforms in the region including:

The leading and notably growing market is the United States of America, thriving at a CAGR of 17.8% between 2025 and 2035. The region is expected to hold a market revenue of nearly USD 47,000 million by the end of 2035.

The United States of America holds a dominant revenue share due to the huge investments through government and private sectors for the transformation of the payment processes, and increased online transactions in the region.

| Regional Market Comparison | Global Market Share in Percentage |

|---|---|

| The United States | 16.5% |

| Germany | 7.6% |

| Japan | 5.1% |

| Australia | 3.6% |

China region is growing at a promising growth rate and might hold nearly USD 9,000 million by the end of 2035 as it thrives on a strong CAGR of 17.5% between 2025 and 2035. Japan is also growing along with China with a forecasted value of nearly USD 8,000 million (2035) registering a CAGR of 16.4% between 2025 and 2035. The United Kingdom is forecasted to hold a revenue of nearly USD 6,000 million by 2035 registering a CAGR of 15.9%.

| Regions | CAGR (2025 to 2035) |

|---|---|

| The United Kingdom | 15.9% |

| India | 21.2% |

| China | 15.4% |

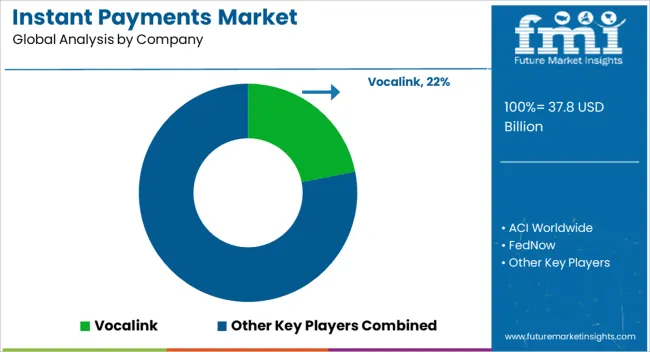

The competitive landscape of Instant payments is diversified and makes the market exclusive for new players. Vendors are trying to make their platform flexible for the latest technological advancements while working on fast transfers. The vendor companies also focus on mergers and collaborations to expand their distribution channels in new regions.

Key Players Working in the Market

Recent Developments in the Instant Payments Market

The global instant payments market is estimated to be valued at USD 37.8 billion in 2025.

The market size for the instant payments market is projected to reach USD 159.5 billion by 2035.

The instant payments market is expected to grow at a 15.5% CAGR between 2025 and 2035.

The key product types in instant payments market are charged instant payments and free instant payments.

In terms of application, business to business (b2b) segment to command 44.8% share in the instant payments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Instant Dry Yeast Market Size and Share Forecast Outlook 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Instant Fat Powder Market Size, Growth, and Forecast for 2025 to 2035

Instant Protein Beverages Market Analysis by Type, End-Use Packaging, Form, Source and Region Through 2035

Key Companies & Market Share in the Instant Dry Yeast Sector

Instant Cereals Market Growth & Demand Forecast 2025-2035

Instant Tea Premixes Market Analysis - Size, Share & Forecast 2024-2034

Instant Wine Chillers & Refreshers Market

Instant Cake Gel Market

Instant Cake Emulsifier Market

B2B Payments Platform Market

Australia Instant Dry Yeast Market Trends – Growth, Demand & Forecast 2025-2035

Smart Home Payments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA