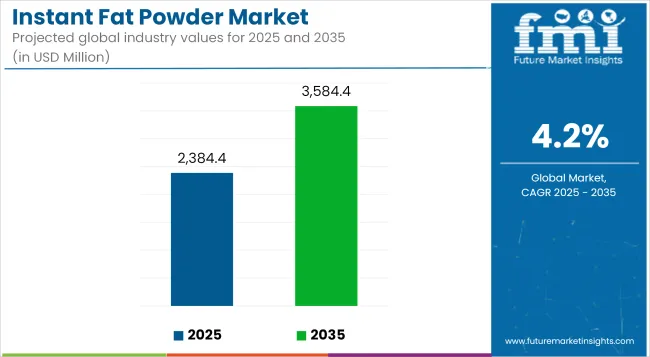

The Instant Fat Powder market is forecast to exhibit consistent growth, advancing from USD 2,384.4 million in 2025 to approximately USD 3,584.4 million by 2035, with an annual growth rate of 4.2%.

A steady rise in demand for functional food ingredients and instantized formats has shaped the market's trajectory. The instant fat powder category is gaining traction due to its ease of dispersion in cold and hot liquids, superior mouthfeel, and longer shelf stability. Demand across confectionery, beverages, and bakery mixes has intensified as manufacturers increasingly rely on powder-based fats to simplify formulation processes and enhance product quality.

However, fluctuating dairy fat prices and a growing shift toward non-fat or low-fat formulations in certain consumer groups have created friction in broader adoption. Still, clean-label preferences and enhanced solubility standards have influenced product innovations. Companies have pivoted toward offering fortified and allergen-free variants while optimizing spray drying and agglomeration techniques to retain functional attributes across food matrices.

| Attributes | Description |

|---|---|

| Estimated Global Instant Fat powder Industry Size (2025E) | USD 2,384.4 million |

| Projected Global Instant Fat Powder Industry Value (2035F) | USD 3,584.4 million |

| Value CAGR | 4.2% |

Over the next decade, the industry is expected to witness demand acceleration across foodservice and B2B segments, particularly in Asia Pacific and Latin America. By 2025, dairy-based instant fat powders are expected to retain dominance with nearly 59% value share, as manufacturers prioritize taste, stability, and ease of blending.

By 2035, value-added instant powders-enriched with vitamins, proteins, or emulsifiers-will gain relevance, especially in health-positioned meal solutions and fortified mixes. Market expansion will likely be supported by improved drying technologies and increasing R&D investments into low-trans fat and lactose-free formulations. The sector’s future will be driven by performance-oriented attributes, evolving processing standards, and higher consumer acceptance of instantized dairy and non-dairy fats in convenience-driven food innovation pipelines.

Holding an estimated 14.7% market share in 2025, the infant nutrition segment for instant fat powders is strategically positioned to gain relevance through 2035. This segment is evolving beyond energy contribution, with formulators now leveraging instant fat powders for lipid structuring, improved absorption, and brain development functionalities.

DHA- and ARA-compatible fat powders have seen increased uptake, especially those enriched via microencapsulation or enzymatic interesterification. Manufacturers such as FrieslandCampina Ingredients and Fonterra continue investing in lipid matrix enhancements tailored for early-life formulas, compliant with Codex Alimentarius and EU infant nutrition regulations (Commission Delegated Regulation (EU) 2016/127).

Rising demand for hypoallergenic and lactose-free solutions further strengthens the case for instantized non-dairy fat powders-especially in Asian and Middle Eastern markets where goat milk and soy-based formulas are gaining traction. The growth trajectory is underpinned by the convenience of instant powders in blending with proteins and carbohydrates without altering viscosity or digestibility.

The trend toward premium infant offerings fortified with functional lipids, probiotics, and plant-derived emulsifiers supports adoption in e-commerce and specialty pharmacy channels. With continuous regulatory oversight and ingredient scrutiny in this space, performance-oriented fat powder systems with superior reconstitution behavior are expected to outperform conventional oils in reconstitution-dependent infant formula systems.

Accounting for an estimated 11.2% market share in 2025, the bakery emulsions and non-dairy toppings segment is undergoing a substantial shift as formulators adopt instant fat powders to replace traditional shortenings and hydrogenated fats. Non-dairy instant fat powders derived from coconut, palm kernel, or high-oleic sunflower oils are increasingly being used for laminated doughs, whipped fillings, and spray-dried bakery premixes.

Leading processors such as Kerry Group and AAK are driving innovation in non-hydrogenated, palm-free, and allergen-free fat powder systems tailored for clean-label bakery mixes across North America and Western Europe. These powders offer functional parity with conventional fats, including aeration, moisture retention, and crumb softness, while improving declaration compliance for retail and foodservice bakery SKUs.

The shift is particularly supported by the FDA’s PHO (partially hydrogenated oil) ban and regional front-of-pack labeling mandates, especially in the EU and Canada. Spray drying and agglomeration methods have enabled superior dispersibility in cold batters and frozen doughs, driving preference in industrial-scale bakery operations.

As gluten-free, vegan, and allergen-friendly baked goods become mainstream, non-dairy instant fat powders are emerging as critical enablers of formulation flexibility. Their role is likely to deepen as bakery manufacturers align with evolving consumer expectations and regulatory labeling thresholds.

Demand For the Health Focused Product

Manufacturers should develop goods which respond to health needs by creating low-fat or cholesterol-free instant fat powders targeted at health-oriented consumers.

The product range at Dairygold Co-Operative Society Ltd. features dairy items that fulfill health-related consumer requirements. The company produces Dairygold Light Butter as a butter substitute that contains lower amounts of fat for customers seeking healthier options.

Dairygold maintains existing product lines focused on creating reduced-fat dairy options although the company does not market instant fat powder as a specific brand. The company can enter the instant fat powder Industry through its production specialization in nutritious high-quality dairy products.

Koninklijke FrieslandCampina NV operates as a worldwide dairy company that prioritizes health and wellness for its customers. FrieslandCampina Professional Fat Powder represents one of their healthy product offerings for food applications. FrieslandCampina demonstrates strong nutritional expertise that establishes it for developing both low-fat and cholesterol-free fat powder production.

Growth In Dairy and Bakery Industries

Market demand for instant fat powders increases based on the dairy and bakery industries' continuous growth. These powders find widespread use in dairy and baking-derived products such as milk, cakes and cookies.

The portfolio of high-quality dairy ingredients at Vreugdenhil Dairy Foods includes Vreugdenhil Milk Powder that serves the dairy industry and bakery manufacturers. Since their milk powders and dairy-based ingredients suit baking applications they establish Vreugdenhil as a strong supplier for instant fat powder requirements in the dairy and bakery industries.

Frontera Group, Inc. stands as a prominent dairy company that distributes Frontera Dairy Ingredients to both dairy and bakery sectors. Their established knowledge in dairy ingredient supply allows them to deliver exceptional instant fat powders that serve dairy and bakery sectors through cheese products along with cake production and cookies and additional baked goods.

Increasing Consumer demand For Convenience Foods

Busy lifestyles ensure that consumers continue to seek ready to use ingredients such as instant fat powder to be used in their variety of food productsKoninklijke FrieslandCampina NV offers dairy products suitable to the convenience food sector; FrieslandCampina Dairy Creamer and FrieslandCampina Instant Full Cream Milk Powder.

FrieslandCampina is a strong supplier of ingredients for convenience food production, such as ready to eat meals, beverages and sauces, using these products in the preparation.

A number of dairy based products are offered by Hoogwegt International B.V., including milk powders, whey powders and cream powders for application in sauces, beverages and ready to eat meals. Hoogwegt is a strong contender in the convenience food sector and in supplying instant fat powders because the high quality, ready to use ingredients.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.2% |

| H2(2024 to 2034) | 5.2% |

| H1(2025 to 2035) | 5.1% |

| H2(2025 to 2035) | 6.0% |

The Instant Food Market is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 4.2%, while H2 is slightly higher at 5.2%. Moving to the 2025 to 2035 period, H1 is projected to grow at 5.1%, indicating a positive trend. In H2 growth for the same period is slightly higher at 6.0%.

The Instant Fat Powder Market is quite intense, with a join of worldwide buttery cooperatives, specific suppliers, and alcove performers contributing to the industry’s development. The market is separate into three profit levels based on party intensity and retail influence.

Tier 1 players, that hold nearly 30% of stock exchange share, include Koninklijke FrieslandCampina NV, Frontera Group, Inc., and Vreugdenhil Dairy Foods. These associations are all-encompassing creamery giants accompanying powerful supply chain networks, progressive processing sciences, and a meaningful client base across miscellaneous food and liquor requests.

Their supremacy is driven by extreme result volume, strategic alliances, and unending money in product change.

The Tier 2 sector, reconciling 50% of the market, exists of Dairygold Co-Operative Society Ltd., Glenstal Foods Ltd., Hoogwegt International B.V., and Solarec. These associations have a forceful demeanor in regional and worldwide markets, fixating above-quality buttery elements and practice formulations.

Meanwhile, Tier 3 players, property held the surplus 20% of stock exchange, include Imeko Dairy Products B.V., Vitusa Global, and Polindus. These parties generally pamper niche segment, contribution specific crop accompanying competitive reducing.

While they have a tinier advertise share, they contribute to the industry’s variety and determine alternative sourcing alternatives for manufacturers. Overall, the instant fat powder industry remnants ambitious, accompanying innovation, sustainability, and supply chain effectiveness forceful future progress.

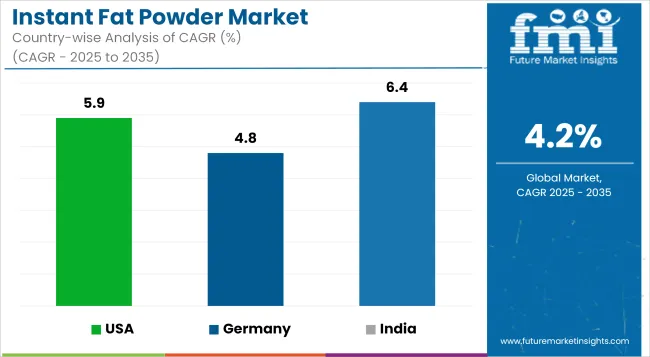

The following table shows the estimated growth rates of the top three territories. USA, Germany and India are few attractive countries to look upon.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.9% |

| Germany | 4.8% |

| India | 6.4% |

The USA instant fat powder retail is planed to evolve at a CAGR of 5.9% from 2025 to 2035, driven by allure comprehensive useful life of product, smooth depository, and versatility in uses in the way that cooking business where baked goods are produced, buttery, bakery, and beverages.

The growing enactment of plant-located and creamery options is further fueling demand, as shoppers inquire more healthful and tolerable meat options. Manufacturers favor instant fat powders on account of their support and cost-influence distinguished to liquid grease, making them ideal for big cooking result.

Advancements in drink refine technology and the growing demand for enduring, superior additives further support advertise expansion. However, challenges to a degree supply chain disruptions and financial doubts, containing potential cost changes, may impact tumor. Despite these hurdles, the changeability of instant fat powders across differing commerces positions the USA display for steady growth in the coming age.

The Germany instant fat powder display is experience stable tumor, compelled by climbing demand in the cooking business where baked goods are produced, creamery, and bakery corporations, with grow at a CAGR of 4.8% from 2025 to 2035.Germany traditional feed transform subdivision and growing services priority for first-rate, enduring elements enhance advertise growth.

The shift toward plant-located and creamery options is too inciting demand, as manufacturers expand creative formulations to pamper developing digestive advantages. Additionally, the country's forceful importance on bread security and status flags helps the use of instant fat powders, that offer lengthened useful life of product and economical depository distinguished to liquid grease.

However, challenges to a degree changing natural resources prices and supply chain disruptions can impact development. Despite these determinants, the Germany instant fat powder display proper to witness constant growth in the coming age, situated mechanics progresses and a increasing devote effort to something tenable drink resolutions.

The India instant fat powder display is increasing rapidly, accompanying a planed CAGR of 6.4%, driven apiece growing demand for economical and shelf-constant buttery alternatives in areas like bakery, bakery, and digestive fruit. The rise of buying and modern sell channels has pushed accessibility, admitting two together city and rural shoppers to select instant fat powders for various cuisine requests.

Additionally, the growing flow of plant-located diets and defended food merchandise is bright manufacturers to develop creative formulations helping to energy-conscious buyers. Government actions supporting the meal alter sector and grants in buttery substitutes further accelerate advertise progress. However, price volatility of natural resources and kind concerns in disorderly sectors wait challenges.

Despite this, unending advancements in foodstuff science and the demand for lengthier shelf-history factors position India’s instant fat powder market for maintained growth.

The instant fat powder display should increasingly aggressive, compelled by rising demand in baby food, dairy opportunities, and working food areas. Leading associations like FrieslandCampina, Fonterra, Kerry Group, and Cargill dominate the scope accompanying strong commodity cases catering to various uses.

These companies devote effort to something novelty, particularly in plant-located and clean-label fat powders, to join accompanying evolving services choices. Additionally, the market sees gifts from provincial players contribution economical solutions, making it quite splintered with a join of worldwide and local competitors.

To stay before, guests are emphasizing brand distinction through specialized formulations to a degree Medium-Chain Triglyceride (MCT) powders for sports food and keto diets. Expanding production efficiencies and calculated partnerships accompanying cooking manufacturers are more key growth blueprints.

Sustainability is another main focus, with brands spending in environmental packaging and sourcing means to entice environmentally conscious purchasers. As demand for instantized and working fat powders grows, the cutthroat countryside is expected to severe, promoting continuous change in the manufacturing.

The global industry is estimated at a value of USD 2,384.4 million in 2025.

The global demand for Instant Fat Powder Market is forecasted to surpass USD 3,584.4 million by the year 2035.

The industry is projected to grow at a forecast CAGR 4.2% from 2025 to 2035.

The China Acetic Acid Esters Industry will grow at 6.4% CAGR between 2025 and 2035.

Glenstal Foods Ltd., Dairygold Co-Operative Society Limited, Koninklijke FrieslandCampina NV, Imeko Dairy Products B.V., Vitusa Global, Frontera Group, Inc., Vreugdenhil Dairy Foods, Polindus, Hoogwegt International B.V., and Solarec are some of the leading players in the prominent instant fat powder market.

The USA, India, China, the United Kingdom, and Germany, Thailand, Australia are the prominent countries driving the demand for Instant Fat Powder Industry.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Instant Dry Yeast Market Size and Share Forecast Outlook 2025 to 2035

Instant Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Instant Payments Market Size and Share Forecast Outlook 2025 to 2035

Instant Protein Beverages Market Analysis by Type, End-Use Packaging, Form, Source and Region Through 2035

Key Companies & Market Share in the Instant Dry Yeast Sector

Instant Cereals Market Growth & Demand Forecast 2025-2035

Instant Tea Premixes Market Analysis - Size, Share & Forecast 2024-2034

Instant Wine Chillers & Refreshers Market

Instant Cake Gel Market

Instant Cake Emulsifier Market

Australia Instant Dry Yeast Market Trends – Growth, Demand & Forecast 2025-2035

Fatigue Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fat Soluble Vitamins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA