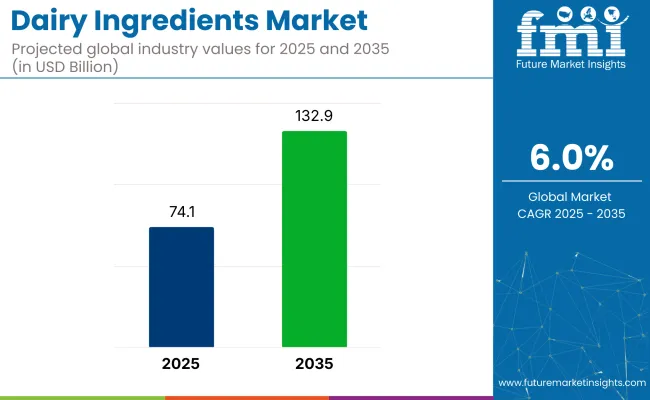

The global dairy ingredients market is forecasted to grow from USD 74.1 billion in 2025 to USD 132.9 billion by 2035, reflecting a CAGR of 6.0%. Expansion is being driven by three converging forces: accelerated protein fortification in mainstream food categories, reformulation momentum across clinical and infant nutrition, and strategic repositioning of dairy byproducts into value-added systems.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 74.1 billion |

| Projected Global Industry Value (2035F) | USD 132.9 billion |

| Value-based CAGR (2025 to 2035) | 6.0% |

Milk proteins, caseinates, and whey fractions are now being redeployed not only as functional inputs but also as delivery vehicles for micronutrients and bioactive compounds in RTE and RTD segments.

Global processors are investing in precision filtration, low-thermal drying, and enzymatic hydrolysis to enable higher purity profiles and application-specific grades. Lactose derivatives are being integrated into pediatric formulations, while MPC and WPC are seeing uptake in sports-recovery and geriatric formulations.

In Asia, reformulated dairy blends are penetrating price-sensitive fortified food categories, while North American brands are layering dairy ingredients into hybrid formats for performance nutrition. Commoditized dairy components are being reoriented to offset volatility in fluid milk sales.

The result is a dual-track dynamic-mass-market dairy powders scaling in foodservice and bakery, and high-margin isolates anchoring growth in clinical and wellness verticals. This bifurcation is expected to define future trade flows and product innovation pipelines.

The dairy ingredients industry holds a significant share in the broader dairy products and food & beverage ingredients industry, reflecting the increasing demand for value-added dairy components in various formulations. Within the dairy product industry, the dairy ingredients segment accounts for approximately 30%, driven by rising demand for milk powder, whey proteins, and casein.

In the food & beverage ingredients industry, its share is around 18%, as dairy ingredients are essential in processing items like baked goods and snacks. Dairy ingredients also play a substantial role in the nutritional supplements and functional foods sectors, contributing roughly 12% and 14%, respectively. Its role in the animal feed industry stands at an estimated 8%.

In March 2025, Arla Foods Ingredients entered a contract manufacturing agreement with South Dakota-based Valley Queen to produce Nutrilac® ProteinBoost, a patented microparticulate whey protein concentrate. The partnership enhances Arla’s capacity to meet growing USA demand for protein-enriched dairy while supporting its North American expansion strategy.

Production is scheduled to begin in winter 2025/2026 at Valley Queen’s Milbank facility following the installation of new specialty equipment. Luis Cubel, Group Vice President and Managing Director at Arla Foods Ingredients, stated that Valley Queen was selected for its shared values and longstanding commitment to quality in dairy and whey production.

The dairy ingredients market has been segmented by product type into proteins, milk powder, milk fat concentrates, casein and caseinates, lactose and its derivatives, whey, and other types. It has been segmented by form type into powder and liquid. It has been segmented by application into bakery and confectionery, dairy products, sports and clinical nutrition, infant formulas including standard infant formula and specialty infant formula, cosmetics, pharmaceuticals, and other applications.

It has been segmented by distribution channel into e-commerce, specialty retailers, supermarket and hypermarket, food service sector, and other distribution channels. It has been segmented by region into North America, Western Europe, Eastern Europe, Russia and Belarus, Balkan and Baltic Countries, Latin America, Central Asia, East Asia, Middle East and Africa, and South Asia and Pacific.

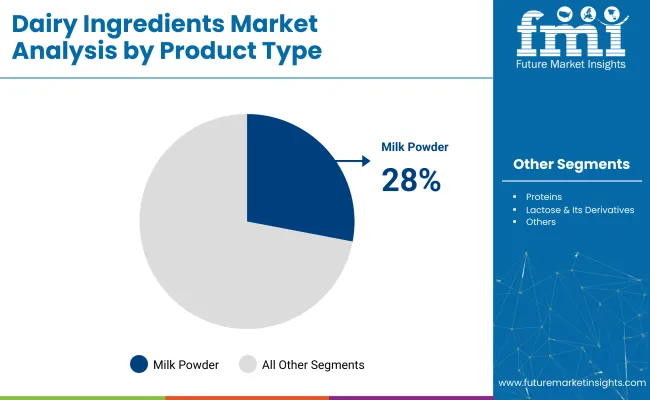

Milk powder is forecast to hold 28% of product-type share in 2025. Solubility, long shelf life, and protein consistency have made it a preferred base for processors across infant nutrition, dairy beverages, and bakery sectors. Friesland Campina, Vinamilk, and Hochwald Foods have scaled powder output by modifying spray-drying lines and integrating flexible packaging formats. Blends have been tailored for varied fat contents and regional fortification standards. Regulatory documentation has been standardised for smooth inter-regional movement, and usage has been reinforced in both low-moisture shelf-stable and high-fat dairy preparations.

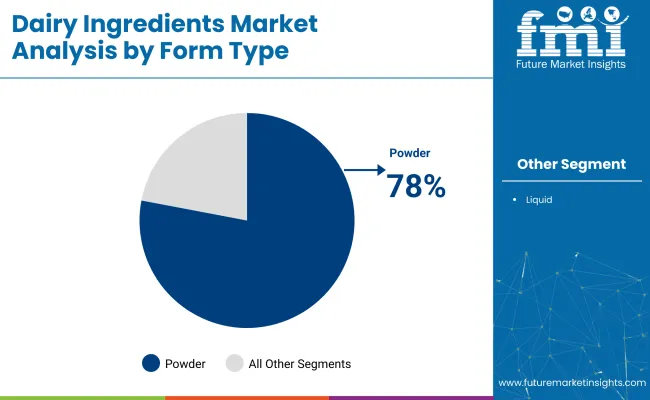

Powdered dairy ingredients are estimated to capture 78% of form-type share in 2025. Transport efficiency, ambient storage, and low spoilage risk have made powder formats ideal for global sourcing. Lactalis Ingredients, Fonterra, and Amul have increased output by streamlining agglomeration and fluid-bed drying operations to deliver improved rehydration performance. Cross-continental shipments have benefited from barrier-laminate packaging that ensures moisture resistance. Procurement from industrial bakeries and beverage facilities has shifted toward powders for precise batch dosing and extended stability.

Dairy products are expected to absorb 38% of ingredient applications in 2025. Yogurt, processed cheese, and ice cream lines have incorporated dairy ingredients to enhance texture, flavor, and shelf life. Danone, Meiji Holdings, and Savencia have deployed tailored ingredients to align with regional taste preferences and fat profile requirements. Heat-stable proteins and functional lactose blends have been introduced in ambient desserts and drinking yogurts. Ingredient traceability protocols have been emphasized, and compatibility with plant-fat systems has increased usage in hybrid product categories.

The foodservice segment is projected to command 20% of distribution share in 2025. Pre-measured powders, cream bases, and dairy concentrates have been adopted to simplify prep and extend shelf life in commercial kitchens. Bidfood (UK), Gruppo VéGé (Italy), and FreshMenu (India) have established sourcing partnerships for high-utility dairy inputs that replace cream, butter, and milk in sauces, soups, and baked goods. Batch consistency, low-waste packaging, and ambient transport have been emphasized to optimize operational efficiency across outlets.

Inventory cycles for dairy ingredients shortened by 26% as powdered formats gained shelf efficiency. Clinical validation of whey isolates is boosting premium SKUs in sports nutrition. Margin pressure emerged from rising milk and freight costs, pushing processors toward ambient powder formats and hedging strategies to offset downstream pricing inflexibility.

Inventory Recirculation & Cold-Chain Rationalization

Retail and foodservice operators have reduced dairy ingredient inventory cycles, cutting days-on-hand from 23 to 17 in H1 2025. Powdered milk protein concentrate (MPC) now turns 1.9× faster than chilled cream bases, driving a 14% reallocation of refrigerated shelf space to high-velocity SKUs.

Shelf productivity for milk protein powders reached USD 385 per linear foot/month, surpassing chilled butterfat by 11%. Discounters cut markdowns by 12% through predictive inventory tied to institutional calendars. DTC platforms reported a 16% spike in first-time purchases when QR-traceable sachets were bundled. Producers responded by trimming buffer stocks 9-10% and shifting to dual-shift spray-drying to meet tighter replenishment cycles.

Clinical Protein Fortification Gains Evidence Support

Studies in 2024 showed hydrolyzed whey isolates restored phosphocreatine 19% faster than casein over 72 hours, validating their use in sports recovery. SKUs dosed at 2.4g leucine per 250ml now command 14% price premiums in specialty retail.

Google searches for “hydrolyzed whey recovery” rose 26% since Jan 2025. Isolate SKUs bearing clinical callouts outperform generic blends by 21% in gym vending data. Heat-stable peptides and BCAA-certified powders are expanding into ready meals, enabling functional crossover beyond beverages.

Margin Pressure from Milk-Price Volatility & Freight Shifts

From Q4 2023 to Q2 2025, skim milk powder export prices rose 9.7%, driven by lower raw milk availability and feed-linked input costs. Spot reefer container rates from Auckland to Shanghai increased 8.1% YoY, with dry freight on Europe-MENA lanes up 6.4%.

FOB whey protein costs rose 7.8%, while downstream contract prices rose just 3.2%, compressing margins by 240 basis points. Large players are hedging through SMP futures and freight caps, while mid-sized processors are shifting toward higher-fat ambient powders, saving up to 13% in shipping costs but requiring reformulation support. Hybrid pricing tied to volume tiers and index-linked clauses is now being deployed to protect profitability.

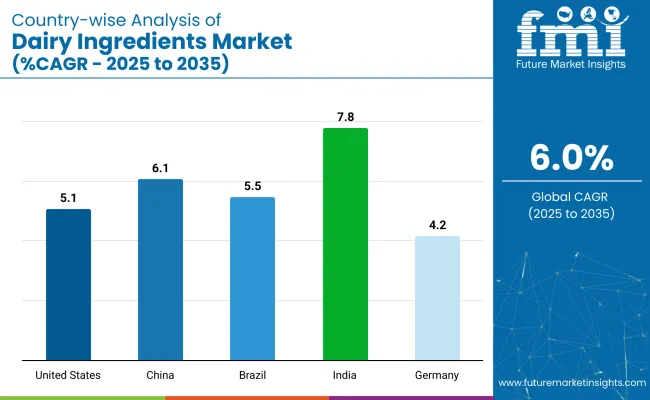

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

| China | 6.1% |

| Brazil | 5.5% |

| United States | 5.1% |

| Germany | 4.2% |

Global dairy-ingredients demand is projected to rise at a 6.0% CAGR from 2025 to 2035. Of the five profiled industries, India leads at 7.8%, followed by China at 6.1%, Brazil at 5.5%, the United States at 5.1%, and Germany at 4.2%. These rates translate to a growth premium of +30% for India and +2% for China versus the baseline, while Brazil, the United States, and Germany trail by -8%, -15%, and -30%, respectively.

Divergence has been shaped by India’s protein-fortification push in nutritional powders, China’s beverage-grade lactose enrichment, Brazil’s sports-nutrition uptake in whey concentrates, mature isolate saturation in the United States, and fat-standard reform constraints in Germany.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for dairy ingredients in the USA is expected to grow at a CAGR of 3.9% between 2025 and 2035. Ingredient demand has been shaped by steady usage in sports nutrition, cheese processing, and fortified milk beverages. Whey and milk protein isolates have been incorporated in value-added dairy and nutritional products.

Formulation demand from private-label brands has been met through standardised ingredient contracts. Ingredient traceability protocols have been strengthened to comply with USDA labeling frameworks, and protein enrichment has been pursued in both traditional and plant-forward formats.

Sales of dairy ingredients in Germany forecast to expand at a CAGR of 4.1% from 2025 to 2035. Functional dairy ingredients have been favoured for inclusion in cheese spreads, yogurt, and bakery systems. Protein-enriched formulations have been promoted through regional clean-label programs. Ingredient contracts have been formalised through dairy co-operatives to supply consistent quality.

Blends with plant fats and milk solids have been used in hybrid spreads, while infant nutrition segments have maintained steady uptake of high-grade dairy proteins. Packaging standards for powdered concentrates have been aligned with EU bulk transit rules.

Demand for dairy ingredients in China is projected to rise at a CAGR of 5.3% during 2025 to 2035. Domestic demand has been driven by rising protein inclusion in reconstituted milk, beverages, and nutritional powders. Import volumes of milk powder and whey protein have been supported by national fortification initiatives.

Ingredient sourcing has been diversified through partnerships with EU and Oceania suppliers. Regulatory clearance for functional dairy imports has been expedited through trade accords. Local reprocessing units have repackaged bulk ingredients into foodservice-ready SKUs for urban distribution.

Sales for dairy ingredient in Japan is expected to record a 4.8% CAGR through 2035. Ingredient applications have been anchored in functional yogurt, processed dairy desserts, and clinical nutrition. Heat-stable whey proteins and low-lactose powders have been adopted by formulators for high-performance requirements.

Domestic manufacturers have relied on imported caseinates and milk solids from Australia and the EU. Cost-per-gram targets have been met through micro-packaging of high-value concentrates for senior nutrition and hospital diets. Food-tech start-ups have also explored dairy blend infusions in protein puddings and ready-to-eat breakfast lines.

Demand for dairy ingredients in India is forecast to expand at a CAGR of 5.8% from 2025 to 2035. Demand has been driven by large-scale use in milk powder reconstitution, bakery fillings, and industrial dairy beverages. Cooperative processors have used dairy concentrates to stabilise cost structures amid regional supply volatility.

Ingredient fortification programs have been undertaken under government nutrition schemes. Plant-dairy blends have been developed to cater to lactose-sensitive consumers, while school milk and nutritional drink brands have prioritised milk solid integration.

Competition in the dairy ingredients industry has been shaped by aggressive expansion, acquisition, and product innovation. Industry share has been maintained by leaders such as Lactalis Group, Arla Foods, FrieslandCampina, and Fonterra through investments in whey proteins, milk powders, and functional dairy components.

Strategic acquisitions have been executed by Glanbia Plc and Kerry Group to strengthen global reach. Distribution networks have been expanded to ensure raw material security and consistent quality. Product portfolios have been diversified by Nestlé S.A. and Saputo. Regional strength has been reinforced by GCMMF (Amul), Yili Group, and Mengniu Dairy as their networks have been leveraged to supply both emerging and developed industries, positioning them competitively within a dynamic global landscape.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 74.1 billion |

| Industry Size (2035) | USD 132.9 billion |

| CAGR (2025 to 2035) | 6.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and metric tons for volume |

| Product Types Analyzed (Segment 1) | Proteins, Milk Powder, Milk Fat Concentrates, Casein and Caseinates, Lactose & Its Derivatives, Whey, Other Types |

| Form Types Analyzed (Segment 2) | Powder, Liquid |

| Applications Analyzed (Segment 3) | Bakery & Confectionery, Dairy Products, Sports and Clinical Nutrition, Infant Formulas (Standard Infant Formula, Specialty Infant Formula), Cosmetics, Pharmaceuticals, Other Applications |

| Distribution Channels Analyzed (Segment 4) | E-Commerce, Specialty Retailers, Supermarket & Hypermarket, Food Service Sector, Other Distribution Channels |

| Regions Covered | North America, Western Europe, Eastern Europe, Russia & Belarus, Balkan & Baltic Countries, Latin America, Central Asia, East Asia, Middle East & Africa, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, Poland, Russia, Belarus, Serbia, Romania, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Lactalis Group, AMCO Proteins, Arla Foods, Cayuga Dairy Ingredients, Dairy Farmers of America, Epi Ingredients, Fonterra Co-operative Group, FrieslandCampina, Glanbia Plc, Gujarat Co-operative Milk Marketing Federation Ltd. (GCMMF), Ingredia SA, Kerry Group, Megmilk Snow Brand Co. Ltd., Meiji Holdings Co. Ltd., China Mengniu Dairy Company Limited, Yili Group, Nestlé S.A., Saputo, Schreiber Foods Inc., Sodiaal Group, Volac International Ltd., Others |

| Additional Attributes | Dollar sales, share by product type and application, expansion in clinical and infant nutrition, growing demand for milk protein isolates, strategic retail and foodservice partnerships, innovation in functional dairy formulations |

The industry has been categorized into Proteins, Milk Powder, Milk Fat Concentrates, Casein and Caseinates, Lactose & Its Derivatives, Whey and Other Types.

The industry has been categorized into Powder and Liquid.

The industry is categorized into Bakery & Confectionery, Dairy Products, Sports and Clinical Nutrition, Infant Formulas (Standard Infant Formula and Specialty Infant Formula), Cosmetics, Pharmaceuticals, Other Applications

The industry has been categorized into E-Commerce, Specialty Retailers, Supermarket & Hypermarket, Food Service Sector and Others Distribution Channels.

Industry analysis has been carried out in key countries of North America, Western Europe, Eastern, Europe, Russia & Belarus, Balkan & Baltic Countries, Latin America, Central Asia, East Asia, Middle East & Africa and South Asia & Pacific.

The global dairy ingredients market is estimated to be valued at USD 74.1 billion in 2025.

The market size for the dairy ingredients market is projected to reach USD 132.7 billion by 2035.

The dairy ingredients market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in dairy ingredients market are milk powder, proteins, milk fat concentrates, casein and caseinates, lactose & its derivatives, whey and other types.

In terms of form type, powder segment to command 78.0% share in the dairy ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cultured Non-Fat Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA